- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 27-05-2016.

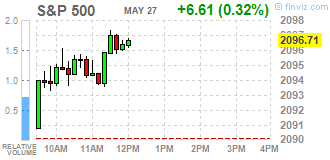

Major U.S. stock-indexes higher in late morning trading on Friday, with the S&P 500 on track for its largest weekly gain since March, helped by gains in consumer discretionary and health stocks and ahead of a speech by Federal Reserve Chair Janet Yellen. Investors are looking for clues on the timing of the next rate hike from Yellen's speech, which comes after comments from several policymakers earlier this week that the U.S. economy has the capacity to absorb a rate hike.

Most of Dow stocks in positive area (21 of 30). Top looser - Wal-Mart Stores Inc. (WMT, -0,51%). Top gainer - UnitedHealth Group Incorporated (UNH, +1,02%).

S&P sectors mixed. Top looser - Basic Materials (-0,3%). Top gainer - Services (+0,6%).

At the moment:

Dow 17845.00 +28.00 +0.16%

S&P 500 2094.25 +4.50 +0.22%

Nasdaq 100 4510.75 +18.50 +0.41%

Oil 49.27 -0.21 -0.42%

Gold 1217.00 -5.70 -0.47%

U.S. 10yr 1.82 -0.05

Stock closed slightly higher ahead a speech by the Fed Chairwoman Janet Yellen later in the day. She will speak at Harvard University. Market participants hope for hints for further interest rate hikes.

Several Fed officials said in the recent days that an interest rate hike in June or in July would be appropriate. These comments added to speculation that the Fed may raise its interest rate in June.

No major economic reports were released in the Eurozone today.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,270.79 +5.14 +0.08 %

DAX 10,286.31 +13.60 +0.13 %

CAC 40 4,514.74 +2.10 +0.05 %

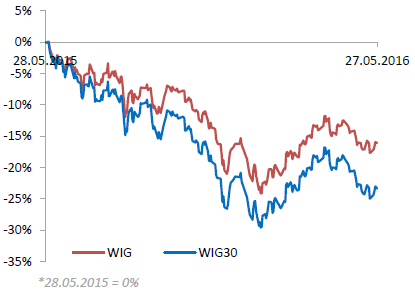

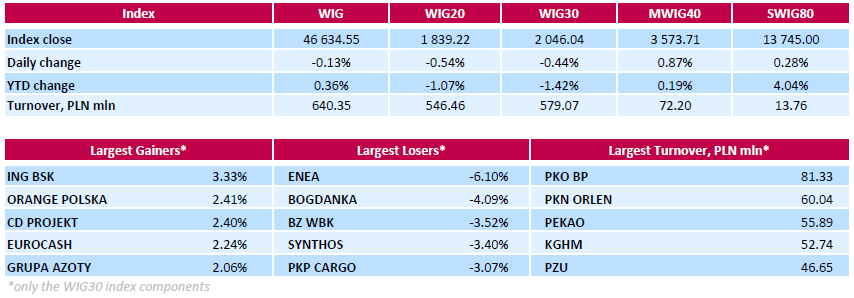

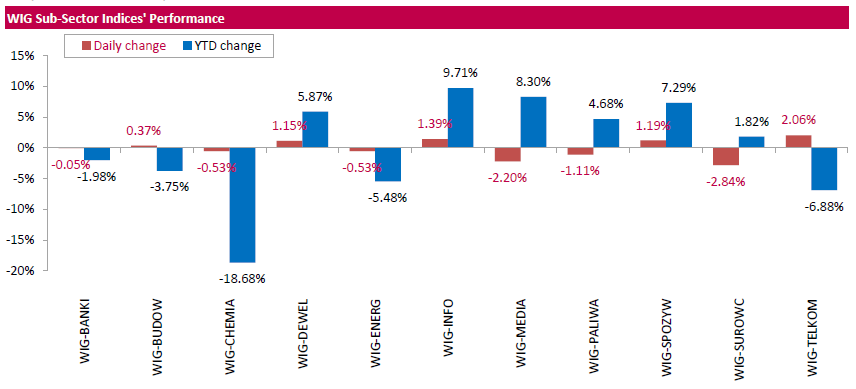

Polish equity market closed lower on Friday. The broad market measure, the WIG index, lost 0.13%. From a sector perspective, telecoms (+2.06%) recorded the biggest gains, while materials (-2.84%) lagged behind.

The large-cap stocks' measure, the WIG30 Index, declined by 0.44%. Within the WIG30 Index components, genco ENEA (WSE: ENA) fared the worst, slumping by 6.1% after the company announced it had no plan to pay out dividend for 2015. It was followed by thermal coal miner BOGDANKA (WSE: LWB), bank BZ WBK (WSE: BZW) and chemical producer SYNTHOS (WSE: SNS), which fell by 4.09%, 3.52% and 3.4% respectively. On the other side of the ledger, bank ING BSK (WSE: ING), telecommunication services provider ORANGE POLSKA (WSE: OPL) and videogame developer CD PROJEKT (WSE: CDR) were the best performers, jumping by 3.33%, 2.41% and 2.4% respectively.

The Thomson Reuters/University of Michigan final consumer sentiment index climbed to 94.7 in May from 89.0 in April, down from the preliminary estimate of 95.8 and missing expectations a rise to 95.4.

"Sespite the meager GDP growth as well as a higher inflation rate, consumers became more optimistic about their financial prospects and anticipated a somewhat lower inflation rate in the years ahead," the Surveys of Consumers chief economist at the University of Michigan Richard Curtin.

"The biggest uncertainty consumers see on the horizon is not whether the Fed will hike interest rates in the next few months, but the outlook for future government economic policies under a new president," he added.

The current economic conditions index increased to 109.9 in May from 106.7 in April, down from the preliminary reading of 108.6.

The index of consumer expectations rose to 84.9 in May from 77.6 in April, down from a preliminary reading of 87.5.

The one-year inflation expectations declined to 2.4% in May from 2.8% in April, down from the preliminary reading of 2.5%.

China's National Bureau of Statistics (NBS) said on Friday that profits of industrial companies in China climbed 4.2% in April from a year earlier, after a 11.1% gain in March.

For the first months of 2016, industrial profits climbed 6.5% from a year earlier.

U.S. stock-index futures were little changed.

Global Stocks:

Nikkei 16,834.84 +62.38 +0.37%

Hang Seng 20,576.77 +179.66 +0.88%

Shanghai Composite 2,821.54 -0.91 -0.03%

FTSE 6,261 -4.65 -0.07%

CAC 4,503.53 -9.11 -0.20%

DAX 10,286.05 +13.34 +0.13%

Crude $48.95 (-1.07%)

Gold $1218.20 (-0.18%)

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 9.54 | 0.03(0.3155%) | 17102 |

| Amazon.com Inc., NASDAQ | AMZN | 715.99 | 1.08(0.1511%) | 7617 |

| American Express Co | AXP | 65.33 | 0.10(0.1533%) | 181 |

| Apple Inc. | AAPL | 99.37 | -1.04(-1.0358%) | 282017 |

| AT&T Inc | T | 38.92 | 0.08(0.206%) | 968 |

| Barrick Gold Corporation, NYSE | ABX | 16.97 | -0.16(-0.934%) | 34266 |

| Boeing Co | BA | 129.07 | -0.24(-0.1856%) | 400 |

| Chevron Corp | CVX | 101.2 | -0.30(-0.2956%) | 2390 |

| Cisco Systems Inc | CSCO | 28.93 | 0.03(0.1038%) | 8055 |

| Citigroup Inc., NYSE | C | 46.25 | 0.14(0.3036%) | 4890 |

| Facebook, Inc. | FB | 119.62 | 0.15(0.1256%) | 34556 |

| Ford Motor Co. | F | 13.49 | 0.03(0.2229%) | 6544 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 11.43 | 0.09(0.7937%) | 88875 |

| General Electric Co | GE | 30.03 | 0.01(0.0333%) | 1272 |

| General Motors Company, NYSE | GM | 31.39 | 0.10(0.3196%) | 2754 |

| Goldman Sachs | GS | 159.05 | 0.48(0.3027%) | 125 |

| Google Inc. | GOOG | 726.91 | 2.79(0.3853%) | 2801 |

| Hewlett-Packard Co. | HPQ | 13.04 | -0.00(-0.00%) | 500 |

| Intel Corp | INTC | 31.58 | 0.09(0.2858%) | 570 |

| JPMorgan Chase and Co | JPM | 65.11 | 0.08(0.123%) | 4138 |

| Microsoft Corp | MSFT | 51.9 | 0.01(0.0193%) | 3033 |

| Pfizer Inc | PFE | 34.35 | -0.08(-0.2324%) | 550 |

| Starbucks Corporation, NASDAQ | SBUX | 55.49 | 0.20(0.3617%) | 2071 |

| Tesla Motors, Inc., NASDAQ | TSLA | 225.79 | 0.67(0.2976%) | 9114 |

| The Coca-Cola Co | KO | 44.71 | 0.02(0.0448%) | 525 |

| Twitter, Inc., NYSE | TWTR | 14.28 | -0.02(-0.1399%) | 20130 |

| Visa | V | 79.15 | 0.15(0.1899%) | 525 |

| Wal-Mart Stores Inc | WMT | 70.8 | -0.05(-0.0706%) | 641 |

| Yahoo! Inc., NASDAQ | YHOO | 36.92 | 0.16(0.4353%) | 7853 |

| Yandex N.V., NASDAQ | YNDX | 19.91 | 0.06(0.3023%) | 1200 |

The U.S. Commerce Department released gross domestic product (GDP) figures on Friday. The U.S. revised GDP climbed 0.8% in the first quarter, up from the preliminary estimate of a 0.5% rise, after a 1.4% in the fourth quarter. Analysts had expected the U.S. economy to expand 0.9% in the first quarter.

The upward revision was partly driven by a downward revision of the trade deficit.

Consumer spending rose by 1.9% in the first quarter, in line with the previous estimate.

Exports fell 2.0% in the first quarter, up from the preliminary estimate of a 2.6% fall, while imports were down 0.2%, down from the preliminary estimate of a 0.2% rise.

The PCE price index increased 0.3% in the first quarter, in line with the preliminary estimate, after a 0.3% rise in the fourth quarter.

The PCE price index excluding food and energy costs increased 2.1% in the first quarter, in line with the preliminary estimate, after a 1.3% rise in the fourth quarter.

The PCE price index is the Fed's preferred gauge for inflation.

Stock indices traded higher ahead a speech by the Fed Chairwoman Janet Yellen later in the day. She will speak at Harvard University. Market participants hope for hints for further interest rate hikes.

Several Fed officials said in the recent days that an interest rate hike in June or in July would be appropriate. These comments added to speculation that the Fed may raise its interest rate in June.

No major economic reports were released in the Eurozone today.

Current figures:

Name Price Change Change %

FTSE 100 6,270.59 +4.94 +0.08 %

DAX 10,277.84 +5.13 +0.05 %

CAC 40 4,512.87 +0.23 +0.01 %

The Italian statistical office Istat released its consumer confidence index for Italy on Wednesday. The Italian consumer confidence index decreased to 112.7 in May from 114.1 in April. April's figure was revised down from 114.2.

The decrease was driven by declines in economic, current and future components.

The business confidence index fell to 102.1 in May from 102.7 in April.

The decline was driven by a less favourable assessment on order books.

Gfk released its consumer confidence index for the U.K. on late Thursday evening. GfK's U.K. consumer confidence index rose to -1 in May from -3 in April.

4 of 5 measures rose in May.

"Despite the tiny uptick this month, our confidence in economic matters, whether we look back or ahead 12 months, remains way below last year," Joe Staton, Head of Market Dynamics at GfK, said.

"Is it because the Brexit gremlins are hard at work? Almost certainly yes," he added.

The Spanish statistical office INE released its retail sales data on Friday. Retail sales in Spain rose at a seasonally adjusted rate of 0.6% in April, after a 0.5% gain in March.

Food sales were up 1.4% in April, while non-food sales increased by 0.8%.

On a yearly basis, retail sales climbed at a seasonally adjusted rate of 4.1% in April, after a 4.4% rise in March.

Sales of non-food products jumped 5.8% in April from a year ago, while food sales rose 1.1%.

French statistical office INSEE released its consumer confidence index for France on Friday. French consumer confidence index climbed to 95 in May from 94 in April. It was the highest level since October 2007.

The index of the outlook on consumers' saving capacity rose to -2 in May from -5 in April.

The index of households' assessment of their financial situation in the past twelve months remained unchanged at -25 in May.

The index of the outlook on consumers' financial situation for next twelve months increased to -9 in May from -14 in April.

The index of the outlook on unemployment rising in coming months dropped to 21 in May from 49 in April.

The index for future inflation expectations remained fell to -39 in May from -36 in April.

Fed Governor Jerome Powell said in a speech on Thursday that the Fed could raise its interest rate soon.

"Depending on the incoming data and the evolving risks, another rate increase may be appropriate fairly soon," he said.

"Several factors suggest that the pace of rate increases should be gradual," Powell added.

Fed governor noted that the referendum on Britain's membership in the European Union could weigh on the Fed's interest rate decision in June.

Powell is a voting member of the Federal Open Market Committee (FOMC).

St. Louis Fed President James Bullard said on Thursday that financial markets had an appropriate view on the Fed's monetary policy in June after the release of the Fed's April monetary policy meeting minutes.

"I think they read the minutes correctly," he said.

Bullard noted that the Fed's interest rate decision in June would depend on the incoming economic data.

According to data from the Bloomberg Consumer Comfort Index, consumers' expectations for U.S. economy declined to 42.0 in in the week ended May 22 from 42.6 the prior week.

The decrease was driven by drops in 2 of 3 sub-indexes. The measure of views of the economy was down to 31.7 from 32.4, the buying climate index remained unchanged at 38.9, while the personal finances index fell to 55.3 from 56.5.

Japan's Ministry of Internal Affairs and Communications released its inflation data on late Thursday evening. Japan's national consumer price index (CPI) declined to an annual rate of -0.3% in April from -0.1% in March, in line with expectations.

Inflation was mainly driven by declines in fuel and communication prices. Fuel prices slid 9.1% year-on-year in April, while communication prices declined 2.5%.

Japan's national CPI excluding fresh food remained unchanged at an annual rate of -0.3% in April, beating expectations for a drop to -0.4%.

The Bank of Japan's inflation target is 2%.

The National Association of Realtors (NAR) released its pending home sales figures for the U.S. on Thursday. Pending home sales in the U.S. increased 5.1% in April, exceeding expectations for a 0.6% gain, after a 1.6% rise in March. March's figure was revised up from a 1.4% gain.

The increase was led by rises in almost all regions. Only pending home sales in the Midwest region declined in April

"The building momentum from the over 14 million jobs created since 2010 and the prospect of facing higher rents and mortgage rates down the road appear to be bringing more interested buyers into the market," the NAR's chief economist Lawrence Yun said.

"Even if rates rise soon, sales have legs for further expansion this summer if housing supply increases enough to give buyers an adequate number of affordable choices during their search," he added.

European stocks logged a modest gain Thursday as energy shares got a brief boost from Brent crude futures, which extended their gains to touch the $50-a-barrel level. Meanwhile, Spanish banks put the pan-European index under pressure as Banco Popular Español SA plunged. Earlier stocks had benefited from a rise in crude but relinquished those gains as crude futures retreated. Still, the Stoxx Europe 600 managed to close at its best level in 5 weeks after a three straight days of gains, FactSet data show.

U.S. stocks closed little changed Thursday after two days of strong gains as crude-oil futures failed to hang on to a move above $50 a barrel and investors brushed off better-than-expected economic reports. Orders for durable goods manufactured in the U.S. jumped in April, fueled by higher demand for new cars, trucks and commercial jets. But a key measure of business investment fell again. Meanwhile, jobless claims declined to a one-month low last week, suggesting the labor market remained robust.

Asian stock markets were mostly higher Friday as investors maintained a cautiously optimistic outlook while they waited for U.S. economic data and remarks by the Fed chief. Investors will be watching to see what Federal Reserve chair Janet Yellen has to say about monetary policy

Based on MarketWatch materials

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.