- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 29-09-2015.

(index / closing price / change items /% change)

Hang Seng 20,556.6 -629.72 -2.97 %

S&P/ASX 200 4,918.43 -195.07 -3.81 %

Shanghai Composite 3,036.77 -63.98 -2.06 %

Topix 1,375.5 2 -63.15 -4.39 %

FTSE 100 5,909.24 -49.62 -0.83 %

CAC 40 4,343.73 -13.32 -0.31 %

Xetra DAX 9,450.4 -33.15 -0.35 %

S&P 500 1,884.09 +2.32 +0.12 %

NASDAQ Composite 4,517.32 -26.65 -0.59 %

Dow Jones 16,049.13 +47.24 +0.30 %

The Standard & Poor's 500 Index trimmed its worst quarterly decline since 2011, as health-care shares rebounded from their longest losing streak in four years.

The S&P 500 Index rose 0.1 percent to 1,884.03, at 4:03 in New York, and is down 4.5 percent in September, following August's 6.3 percent retreat. The Nasdaq Composite Index lost 0.6 percent as Apple Inc. sank 3 percent.

Stocks have been volatile in recent weeks amid confusion over the Federal Reserve's rate-tightening policy while concern lingers that an economic slowdown in Asia will curb demand for commodities and crimp global growth. The S&P 500 is poised for its worst quarter since 2011, down 9 percent. The benchmark is 12 percent below its all-time high set in May.

The turbulence underscores the disparity between investors confident in the U.S. economy and those concerned about sliding commodity prices and slowing Chinese growth. Fed officials insist the recovery has sufficient momentum to cope with higher interest rates. Still, the selloff in U.S. shares has prompted at least two of the bull market's biggest cheerleaders to cut their year-end forecasts for the S&P 500 by as much as 9.7 percent.

Goldman Sachs chief U.S. equity strategist David Kostin also lowered his year-end price target for the equity benchmark. He now estimates a level of 2,000, down from 2,100 earlier, because of slower than anticipated growth from the world's two biggest economies and lower-than-expected oil prices.

A report today showed consumer confidence unexpectedly gained this month as persistent job gains helped Americans shake off the effects of tumbling stock prices. Another report showed home prices in 20 U.S. cities rose 5 percent in July from the same month a year earlier, propelled by improving demand and limited supply.

Traders are split on whether the Fed will raise rates this year. They are pricing in about a 38 percent chance of an increase in December, and a 47 percent probability in January.

Stock indices closed lower after the mixed economic data from the Eurozone. Destatis released its consumer price data for Germany on Tuesday. German preliminary consumer price index fell 0.2% in September, missing expectations for a 0.1% decline, after a flat reading in August.

On a yearly basis, German preliminary consumer price index decreased to 0.0% in September from 0.2% in August, missing expectations for a fall to 0.1%.

The decline was driven by a drop in goods prices, which decreased 1.3% year-on-year in September. Goods prices were driven by a decline in energy prices.

Services prices rose 1.1% year-on-year in September.

The European Commission released its economic sentiment index for the Eurozone on Tuesday. The index increased to 105.6 in September from 104.1 in August. It was the highest level since April 2011.

August's figure was revised down from 104.2.

Analysts had expected the index to remain unchanged at 104.1.

The increase was driven by improvements in the industry, services and retail trade sectors.

The industrial confidence index increased to -2.2 in September from -3.7 in August, beating expectations for a decline to -3.8.

The final consumer confidence index was down to -7.1 in September from -6.9 in August, in line with expectations.

The business climate index climbed to 0.34 in September from 0.2 in August. Analysts had expected the index to remain unchanged at 0.2.

The Bank of England (BoE) released its number of mortgages approvals for the U.K. on Tuesday. The number of mortgages approvals in the U.K. was up to 71,030 in August from 69,010 in July, exceeding expectations for an increase to 70,000. It was the highest reading since May 2008.

Consumer credit in the U.K. rose by £860 million in August, after a rise by £1.163 billion in July.

Net lending to individuals in the U.K. increased by £4.3 billion in August, exceeding expectations for a £4.1 billion, after a £4.0 billion gain in July. July's figure was revised up from a £3.9 billion increase.

Indexes on the close:

Name Price Change Change %

FTSE 100 5,922.73 -36.13 -0.61%

DAX 9,450.4 -33.15 -0.35%

CAC 40 4,343.73 -13.32 -0.31%

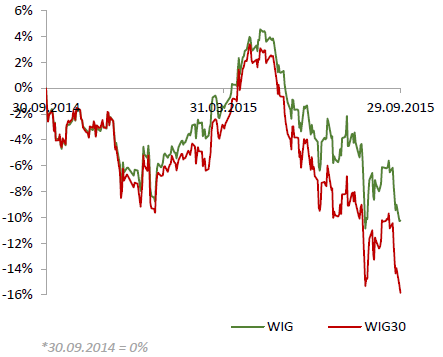

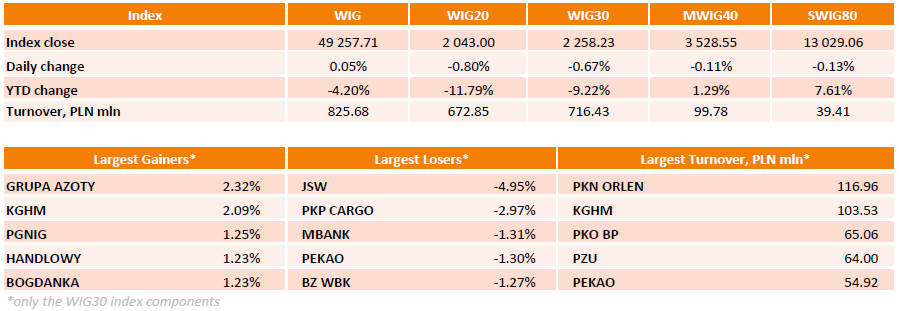

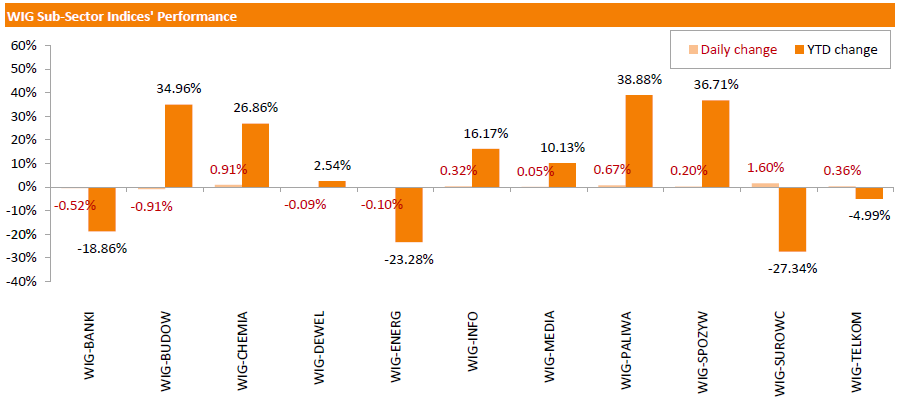

Polish equity market closed flat on Tuesday. The broad market measure, the WIG Index, edged up 0.05%. Sector-wise, materials (+1.60%) fared the best, while constructions (-0.91%) lagged behind.

The large-cap stocks' measure, the WIG30 Index, fell by 0.67%. Within the index components, JSW (WSE: JSW) recorded the biggest drop, down 4.95%. It was followed by PKP CARGO (WSE: PKP), plunging by 2.97%. Elsewhere, banking names BZWBK (WSE: BZW), PEKAO (WSE: PEO) and MBANK (WSE: MBK) lost 1.27%-1.31%. On the other side of the ledger, GRUPA AZOTY (WSE: ATT) and KGHM (WSE: KGH) became the session's best performers, rebounding by 2.32% and 2.09% respectively. Other major advancers were PGNIG (WSE: PGN), BOGDANKA (WSE: LWB) and HANDLOWY (WSE: BHW), gaining 1.23%-1.25%.

Major U.S. stock-indexes higher on Tuesday as shares of health care companies and raw material producers bounced back and data showed consumer confidence was at its highest since January. Commodity prices, which fell after weak Chinese data on Monday and sparked a sharp selloff, edged up but held to their multi-year lows.

Most of all of Dow stocks in positive area (22 of 30). Top looser - The Goldman Sachs Group, Inc. (GS, -1.34%). Top gainer - Johnson & Johnson (JNJ, +1.97%).

Most of S&P index sectors also in positive area. Top looser - Conglomerates (-0.3%). Top gainer - Healthcare (+1,4%).

At the moment:

Dow 15942.00 +33.00 +0.21%

S&P 500 1879.25 +7.25 +0.39%

Nasdaq 100 4116.00 +21.25 +0.52%

10 Year yield 2,08% -0,01

Oil 45.28 +0.85 +1.91%

Gold 1131.00 -0.70 -0.06%

Federal Reserve Bank of Cleveland Loretta Mester said in an interview with The Nikkei on Tuesday that the U.S. economy can handle a small increase in interest rates this year.

"We can handle a small increase in interest rates, because policy will still remain very accommodative," she said.

Mester noted that she thinks that volatility in financial markets has no impact on the U.S. economy.

"In my view, the trajectory of my outlook didn't change much from those risks, but I did mark them down as downside risks to the forecast," she said.

The Conference Board released its consumer confidence index for the U.S. on Tuesday. The index rose to 103.0 in September from 101.3 in August, beating expectations for a rise to 96.1. August's figure was revised down from 101.5.

The increase was mainly driven by the better outlook for current conditions. The present conditions index climbed to 121.1 in September from 115.8 in August. It was the highest level since September 2007.

The Conference Board's consumer expectations index for the next six months decreased to 91.0 in September from 91.6 in August.

"Consumers' more positive assessment of current conditions fuelled this month's increase. Thus, while consumers view current economic conditions more favourably, they do not foresee growth accelerating in the months ahead," the director of economic indicators at The Conference Board, Lynn Franco, said.

The percentage of consumers expecting more jobs in the coming months was up to 25.1% in September from 22.1% in August.

The Spanish statistical office INE released its retail sales data on Tuesday. Retail sales in Spain rose at a seasonally adjusted rate of 0.1% in August, after a 1.2% gain in July.

Food sales were down 0.1% in August, while non-food sales climbed by 0.2%.

On a yearly basis, retail sales climbed at a seasonally adjusted rate of 3.1% in August, after a 4.0% rise in June.

Sales of non-food products jumped 4.3% in August from a year ago, while food sales declined 0.7%.

The Spanish statistical office INE released its preliminary consumer price inflation data on Tuesday. Consumer price inflation in Spain was down 0.3% in September, after a 0.3% drop in August.

On a yearly basis, consumer prices fell by 0.9% in September from a year ago, after a 0.4% decrease in August.

The decline was mainly driven by the decline in the prices of fuels (gas and diesel oil) and electricity.

The S&P/Case-Shiller home price index increased 5.0% in July, missing expectations for a 5.2% rise, after a 4.9% gain in June. June's figure was revised down from a 5.0% increase.

San Francisco, Denver and Dallas were the largest contributors to the rise, where prices climbed by 10.4%, 10.3% and 8.7%, respectively.

"Prices of existing homes and housing overall are seeing strong growth and contributing to recent solid growth for the economy," chairman of the index committee at S&P Dow Jones Indices David Blitzer said.

On a monthly basis, the S&P/Case-Shiller home price index fell by a seasonally adjusted 0.2% rate in July.

The S&P/Case-Shiller home price index measures single-family home prices in 20 U.S. cities.

U.S. index futures rebounded after selloff.

Nikkei 16,930.84 -714.27 -4.05%

Hang Seng 20,556.6 -629.72 -2.97%

Shanghai Composite 3,036.77 -63.98 -2.06%

FTSE 5,940.81 -18.05 -0.30%

CAC 4,368.95 +11.90 +0.27%

DAX 9,502.88 +19.33 +0.20%

Crude oil $45.15 (+1.60%)

Gold $1128.40 (-0.29%)

(company / ticker / price / change, % / volume)

| Yahoo! Inc., NASDAQ | YHOO | 28.60 | 3.62% | 50.9K |

| Tesla Motors, Inc., NASDAQ | TSLA | 252.79 | 1.76% | 9.9K |

| Yandex N.V., NASDAQ | YNDX | 10.45 | 1.46% | 3.9K |

| McDonald's Corp | MCD | 97.30 | 1.40% | 8.3K |

| General Motors Company, NYSE | GM | 28.96 | 1.40% | 1.7K |

| ALCOA INC. | AA | 9.72 | 1.36% | 15.1K |

| Barrick Gold Corporation, NYSE | ABX | 6.33 | 1.12% | 11.9K |

| Johnson & Johnson | JNJ | 92.34 | 1.06% | 7.0K |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 9.00 | 1.01% | 51.9K |

| Chevron Corp | CVX | 76.40 | 0.83% | 0.6K |

| International Paper Company | IP | 37.78 | 0.80% | 0.1K |

| Home Depot Inc | HD | 114.98 | 0.77% | 3.2K |

| Intel Corp | INTC | 28.98 | 0.76% | 2.4K |

| Ford Motor Co. | F | 13.22 | 0.76% | 27.0K |

| Citigroup Inc., NYSE | C | 49.40 | 0.75% | 7.0K |

| Starbucks Corporation, NASDAQ | SBUX | 56.19 | 0.75% | 3.6K |

| Hewlett-Packard Co. | HPQ | 24.75 | 0.73% | 12.5K |

| Caterpillar Inc | CAT | 64.25 | 0.72% | 1K |

| Microsoft Corp | MSFT | 43.60 | 0.72% | 4.1K |

| Amazon.com Inc., NASDAQ | AMZN | 507.69 | 0.72% | 4.1K |

| Twitter, Inc., NYSE | TWTR | 25.44 | 0.71% | 20.8K |

| General Electric Co | GE | 24.48 | 0.70% | 14.1K |

| Exxon Mobil Corp | XOM | 73.10 | 0.69% | 1.4K |

| Cisco Systems Inc | CSCO | 25.82 | 0.62% | 41.4K |

| Nike | NKE | 122.89 | 0.61% | 0.7K |

| Visa | V | 67.60 | 0.60% | 0.4K |

| Walt Disney Co | DIS | 99.08 | 0.60% | 1.9K |

| Boeing Co | BA | 128.88 | 0.59% | 0.7K |

| Apple Inc. | AAPL | 113.10 | 0.59% | 171.2K |

| Pfizer Inc | PFE | 31.00 | 0.58% | 10.4K |

| Goldman Sachs | GS | 174.00 | 0.57% | 0.1K |

| JPMorgan Chase and Co | JPM | 60.30 | 0.53% | 1.3K |

| AT&T Inc | T | 32.05 | 0.47% | 2.1K |

| Procter & Gamble Co | PG | 72.11 | 0.47% | 1.5K |

| Facebook, Inc. | FB | 89.63 | 0.47% | 32.3K |

| Merck & Co Inc | MRK | 48.62 | 0.41% | 0.3K |

| Deere & Company, NYSE | DE | 74.06 | 0.41% | 0.1K |

| Google Inc. | GOOG | 597.16 | 0.38% | 5.4K |

| UnitedHealth Group Inc | UNH | 113.12 | 0.37% | 0.3K |

| International Business Machines Co... | IBM | 143.00 | 0.34% | 0.3K |

| Verizon Communications Inc | VZ | 43.86 | 0.27% | 0.2K |

| AMERICAN INTERNATIONAL GROUP | AIG | 55.80 | 0.25% | 3.5K |

| ALTRIA GROUP INC. | MO | 54.70 | 0.13% | 09K |

| Wal-Mart Stores Inc | WMT | 63.43 | -0.36% | 0.1K |

The Confederation of British Industry (CBI) released its retail sales balance data on Tuesday. The CBI retail sales balance jumped to +49% in September from +24% in August.

The increase was partly driven by a rise in sales in grocery and clothing stores.

Sales expectations for next month were up to +51%.

"Low inflation and the recovery in wage growth are helping to stimulate consumer demand, but the slowdown in the global economy and tight margins mean retailers won't get ahead of themselves as we head into autumn," CBI Director of Economics, Rain Newton-Smith, said.

Destatis released its import prices data for Germany on Tuesday. German import prices declined by 3.1% in August from last year, after a 1.7% fall in July.

The decline was driven by a drop in energy prices, which plunged 29.8%.

Import prices decline since January 2013.

On a monthly base, import prices decreased 1.5% in August, after a 0.7% fall in July.

On a yearly base, import prices excluding crude oil and mineral oil products climbed by 1.6% in August.

Export prices decreased 0.8% year-on-year in August, after a 1.2% increase in July.

On a monthly base, export prices were down 0.5% in August, after a 0.1% rise in July.

Statistics Canada released its industrial product and raw materials price indexes on Tuesday. The Industrial Product Price Index (IPPI) fell 0.3% in August, beating forecasts for a 0.4% drop, after a 0.7% gain in July.

The decrease was driven by lower prices for energy and petroleum products, which slid 4.7% in August.

17 of the 21 commodity groups increased, 2 declined and 2 were unchanged.

The Raw Materials Price Index (RMPI) dropped 6.6% in August, after a 6.0% fall in July. It was the largest fall since January 2015.

The decline was driven by lower prices for crude energy products. Crude energy products plunged 14.8% in August.

2 of the 6 commodity groups rose and 4 decreased.

Upgrades:

Johnson & Johnson (JNJ) upgraded to Buy from Hold at Deutsche Bank

McDonald's (MCD) upgraded to Outperform from Neutral at Credit Suisse; target raised to $112 from $100

Downgrades:

Other:

Apple (AAPL) initiated with a Buy at Sterne Agee CRT

Hewlett-Packard (HPQ) initiated with a Neutral at Sterne Agee CRT

Yahoo! (YHOO) target lowered to $40 from $43 at Mizuho

Destatis released its consumer price data for Germany on Tuesday. German preliminary consumer price index fell 0.2% in September, missing expectations for a 0.1% decline, after a flat reading in August.

On a yearly basis, German preliminary consumer price index decreased to 0.0% in September from 0.2% in August, missing expectations for a fall to 0.1%.

The decline was driven by a drop in goods prices, which decreased 1.3% year-on-year in September. Goods prices were driven by a decline in energy prices.

Services prices rose 1.1% year-on-year in September.

Stock indices traded mixed after the mostly positive economic data from the Eurozone. The European Commission released its economic sentiment index for the Eurozone on Tuesday. The index increased to 105.6 in September from 104.1 in August. It was the highest level since April 2011.

August's figure was revised down from 104.2.

Analysts had expected the index to remain unchanged at 104.1.

The increase was driven by improvements in the industry, services and retail trade sectors.

The industrial confidence index increased to -2.2 in September from -3.7 in August, beating expectations for a decline to -3.8.

The final consumer confidence index was down to -7.1 in September from -6.9 in August, in line with expectations.

The business climate index climbed to 0.34 in September from 0.2 in August. Analysts had expected the index to remain unchanged at 0.2.

The Bank of England (BoE) released its number of mortgages approvals for the U.K. on Tuesday. The number of mortgages approvals in the U.K. was up to 71,030 in August from 69,010 in July, exceeding expectations for an increase to 70,000. It was the highest reading since May 2008.

Consumer credit in the U.K. rose by £860 million in August, after a rise by £1.163 billion in July.

Net lending to individuals in the U.K. increased by £4.3 billion in August, exceeding expectations for a £4.1 billion, after a £4.0 billion gain in July. July's figure was revised up from a £3.9 billion increase.

Current figures:

Name Price Change Change %

FTSE 100 5,929.65 -29.21 -0.49 %

DAX 9,510.6 +27.05 +0.29 %

CAC 40 4,363.72 +6.67 +0.15 %

The European Commission released its economic sentiment index for the Eurozone on Tuesday. The index increased to 105.6 in September from 104.1 in August. It was the highest level since April 2011.

August's figure was revised down from 104.2.

Analysts had expected the index to remain unchanged at 104.1.

The increase was driven by improvements in the industry, services and retail trade sectors.

The industrial confidence index increased to -2.2 in September from -3.7 in August, beating expectations for a decline to -3.8.

The final consumer confidence index was down to -7.1 in September from -6.9 in August, in line with expectations.

The business climate index climbed to 0.34 in September from 0.2 in August. Analysts had expected the index to remain unchanged at 0.2.

The Bank of England (BoE) released its number of mortgages approvals for the U.K. on Tuesday. The number of mortgages approvals in the U.K. was up to 71,030 in August from 69,010 in July, exceeding expectations for an increase to 70,000. It was the highest reading since May 2008.

The BoE introduced tighter rules on mortgage lending last year. Lenders have to make more checks on whether borrowers can afford their loans.

Consumer credit in the U.K. rose by £860 million in August, after a rise by £1.163 billion in July.

Net lending to individuals in the U.K. increased by £4.3 billion in August, exceeding expectations for a £4.1 billion, after a £4.0 billion gain in July. July's figure was revised up from a £3.9 billion increase.

The International Monetary Fund (IMF) released its new World Economic Outlook study on Monday. The IMF said that energy exporting countries could lose about 2.25% of their economic growth through from 2015 to 2017, compared to 2012 to 2014, due to falling oil prices.

Earlier, International Monetary Fund (IMF) Managing Director Christine Lagarde in an interview with Les Echos that the IMF is likely to cut its global growth forecasts due to a slowdown in emerging economies.

Lagarde pointed out that forecasts of 3.3% growth this year and 3.8% next year are no longer realistic. She expect the global economic growth to be above the 3% threshold.

San Francisco Federal Reserve Bank President John Williams said on Monday that he expects the Fed to raise its interest rates "sometime later this year".

"Given the progress we've made and continue to make on our goals, I view the next appropriate step as gradually raising interest rates, most likely starting sometime later this year," he said.

He pointed out that he sees the signs of overheating of the U.S. housing market.

"I am starting to see signs of imbalances emerge in the form of high asset prices, especially in real estate, and that trips the alert system," Williams said.

Chicago Fed President Charles Evans said on Monday that he would not back the interest rate hike until mid-2016.

"Before raising rates, I would like to have more confidence than I do today that inflation is indeed beginning to head higher. I believe that it could well be the middle of next year before the headwinds from lower energy prices and the stronger dollar dissipate enough so that we begin to see some sustained upward movement in core inflation. After lift-off, I think it would be appropriate to raise the target interest rate very gradually," he said.

Evans noted that he does not expect the inflation to rise to the Fed's 2% target until the end of 2018.

The Japan Center for Economic Research released its so-called Li Keqiang index on Tuesday. The index is based on three economic indicators: railway freight, electric power generation and growth in bank lending. The Li Keqiang index showed that the Chinese economy expanded 4.8% to 6.5% in the second quarter, below the official 7% growth.

The Japan Center for Economic Research's data began to differ around summer 2013 and the gap widened.

U.S. stock indices extended declines on Monday amid renewed concerns over China's economic growth and mixed data on the U.S. economy.

The Dow Jones Industrial Average fell 312.78 points, or 1.9%, to 16,001.89. The S&P 500 declined 49.57, or 2.6%, to 1,881.77 (all of its sectors closed down). The Nasdaq Composite Index lost 142.53, or 3%, to 4,543.97.

On Monday investors watched closely speech of FOMC Member Dudley, who said that the central bank is likely to raise rates later this year. He noted that rates can be raised at any meeting, including October. Market participants will pay much attention to employment data due Friday.

US Bureau of Economic analysis reported that personal spending rose in August beating experts' expectations. The latest data suggest that consumers continue supporting the economy despite turmoil in financial markets and slowing growth overseas. Personal spending rose by 0.4% in August compared to the previous month. In July and June spending rose by 0.4% and 0.3% respectively. Meanwhile personal income rose by 0.3% in August. Economists expected a 0.3% rise in spending and a 0.4% rise in income.

This morning in Asia Hong Kong Hang Seng fell 3.30%, or 700.03, to 20,486.29. China Shanghai Composite Index fell 2.05%, or 63.56 points, to 3,037.19. The Nikkei lost 3.71%, or 654.94, to 16,990.17.

Asian stocks fell following declines in U.S. equities. A stronger yen also weighed on stocks of Japanese exporters.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.