- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 31-01-2012.

Resistance 3:1329 (Jan 26 high)

Resistance 2:1317 (session high)

Resistance 1:1309 (intraday low)

Current price: 1306,25

Resistance 1:1300 (50,0 % FIBO 1272-1329)

Resistance 2:1296/94 (Jan 30 low, 61,8 % FIBO 1272-1329)

Resistance 3:1286 (Jan 18 low)

00:01 United Kingdom Gfk Consumer Confidence January -33 -31 -29

00:30 Australia National Australia Bank's Business Confidence December 2 3

00:30 Australia Private Sector Credit, m/m December +0.3% +0.4% +0.3%

00:30 Australia Private Sector Credit, y/y December +3.5% +3.6% +3.5%

05:00 Japan Housing Starts, y/y December -0.3% -1.4% -7.3%

The dollar weakened against most of its major peers after Greek Prime Minister Lucas Papademos said progress had been made in debt-swap talks with bondholders, sapping demand for a refuge from Europe’s fiscal crisis. Papademos said today he’s “strongly committed” to reaching a debt-swap agreement with Greece’s creditors. Representatives of the European Commission, the European Central Bank and the International Monetary Fund want more fiscal tightening and wage cuts from Greece, the Greek prime minister told reporters after a European Union summit in Brussels.

The Australian and New Zealand dollars gained as Asian stocks rallied, boosting the allure of higher-yielding currencies. A confidence index in Australia was at 3 last month from 2 in November, according to a National Australia Bank Ltd. survey of about 400 companies from Jan. 9-13 that was released in Sydney today. That was the highest since May. Traders see a 60 percent chance that the RBA will lower borrowing costs by 25 basis points when policy makers gather next week, cash rate futures show. Australia’s benchmark rate is currently at 4.25 percent after back-to-back reductions at the central bank’s last two meetings.

The yen climbed to a three-month high against the greenback, spurring speculation that Japan’s government may take action to curb the currency’s advance.

EUR/USD: during the Asian session the pair gain up to $1.3200.

GBP/USD: during the Asian session the pair gain showed new week’s high.

USD/JPY: during the Asian session the pair continued decrease.

European data for Tuesday starts at 0700GMT with the German ILO measure of employment along with December and 2011 retail sales data. France data at 0745GMT includes consumer spending, PPI and also housing starts/permits data for December. The main German unemployment data is due at 0855GMT and is expected to see a jobless change of -10k, leaving the unemployment rate unchanged at 6.8%. EMU unemployment data is also due, at 1000GMT. The weekly US ICSC Mall Sales is due at 1145GMT, followed at 1330GMT by the Employment Cost Index. This is followed at 1355GMT by the weekly Redbook Chain Story sales, at 1400GMT by the S&P/Case-Shiller Home Price Index and then at 1445GMT by the Chicago PMI. At 1500GMT, consumer confidence is expected to rise to a reading of 68.0 in January after the solid jump in December to the strongest reading since April.

Asian stocks fell, with a regional benchmark index dropping from a three-month high, ahead of a European summit on the region’s debt crisis and after the U.S. economy expanded less than forecast, hurting the earnings outlook for exporters.

Nikkei 225 8,793 -48.17 -0.54%

Hang Seng 20,230 -271.88 -1.33%

S&P/ASX 200 4,273 -15.63 -0.36%

Shanghai Composite 2,285 -34.08 -1.47%

James Hardie Industries SE (JHX), a building materials supplier that counts the U.S. as its biggest market, fell 1.7 percent in Sydney.

Mitsubishi Electric Corp. slumped 15 percent after Japan barred the electronics maker from bidding on state contracts.

Advantest Corp. jumped 12 percent after the maker of memory-chip testers increased its dividend.

European stocks dropped the most in six weeks as Portuguese bonds sank amid concern a meeting of the region’s leaders will fail to draw a line under the sovereign- debt crisis.

European Union leaders gathered in Brussels for their first summit of 2012 as a deteriorating economy and the struggle to complete a Greek debt write off risk sidetracking efforts to stamp out the financial crisis. EU chiefs are discussing a German-led deficit-control treaty and the statutes of a 500 billion-euro ($661 billion) rescue fund to be set up this year.

The yield on Portugal’s 10-year bonds surged 217 basis points to a euro-era record of 17.39 percent today. Portuguese credit-default swaps also rose to a record, implying a 71 percent chance the government will default.

Euro-area confidence in the economic outlook improved less than forecast in January. An index of executive and consumer sentiment in the 17-nation euro area rose to 93.4 from a revised 92.8 in December, the European Commission said today.

National benchmark indexes fell in every western European market today, except Greece and Iceland. The U.K.’s FTSE 100 lost 1.1 percent, Germany’s DAX slid 1 percent and France’s CAC 40 retreated 1.6 percent.

BNP Paribas tumbled 7.1 percent to 32.18 euros and Societe Generale plunged 6.5 percent to 19.71 euros. The proposed 0.1 percent French transaction tax will apply to share purchases, including high-frequency trading, and CDS transactions, from August. Sarkozy said he expects revenue of 1 billion euros from the tax.

Philips lost 2.2 percent to 15.24 euros as the world’s biggest lightbulb maker reported a 162 million-euro net loss in the fourth quarter. That was wider than analysts’ estimates for a loss of 25.8 million euros.

Hochtief sank 5.8 percent to 48.07 euros after saying it will report a wider loss for 2011 than it had previously anticipated because of additional charges in the fourth quarter at its Australian subsidiary and costs related to the departure of executives. The German builder said the net loss for 2011 will be about 160 million euros, compared with a previous estimate for a loss of about 100 million euros.

ThyssenKrupp AG and Salzgitter AG, Germany’s biggest steelmakers, fell 3.6 percent to 21.11 euros and 5.1 percent to 45.47 euros, respectively.

U.S. stocks fell, sending the Standard & Poor’s 500 Index lower for a third day, as European leaders sparred with Greece over a second rescue program.

Greek Finance Minister Evangelos Venizelos rejected reports of plans to appoint a European Union commissioner to oversee the nation’s budget, citing “national dignity.” French President Nicolas Sarkozy said Greek debt-swap talks with private bondholders are “going in the right direction” and the issue should be settled in the next few days.

Bank of America (ВАС) dropped 3 percent to $7.07 after Goldman Sachs cut its recommendation for the shares to “neutral” from “buy.”

Gannett tumbled 6.9 percent to $14.17. Revenue from the publishing division, the largest unit, declined 5.3 percent as advertising and circulation fell. The newspaper industry overall has continued to lose ad business to Internet companies such as Google Inc. and Facebook Inc.

Staples Inc. declined 4.9 percent to $15.23. The world’s largest office products company was cut to “sell” from “neutral” by Goldman Sachs, which cited a “tough” outlook for the global printing segment.

Measures of telephone and technology companies in the S&P 500 rallied. Apple added 1.3 percent to $453.01. Microsoft (MSFT) gained 1.3 percent to $29.61. Verizon Communications Inc. (VZ) rose 1.1 percent to $37.61.

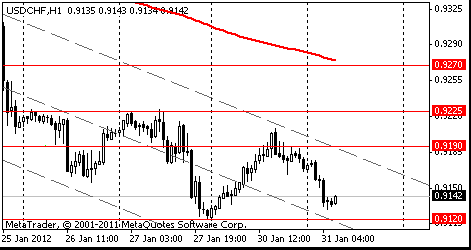

Resistance 3: Chf0.9270 (MA (233) H1)

Resistance 2: Chf0.9225 (Jan 26-27 high)

Resistance 1: Chf0.9190 (resistance line from Jan 17)

The current price: Chf0.9142

Support 1: Chf0.9120 (Jan 30 low)

Support 2: Chf0.9065 (Nov 30 low)

Support 3: Chf0.9020 (Nov 10 low)

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.