- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

European stocks declined, snapping a four-day rally in the benchmark Stoxx Europe 600 Index, as China’s manufacturing contracted in November adding to concern global economic growth is slowing down.

China’s manufacturing recorded the weakest performance since the global recession eased in 2009, underscoring the case for monetary stimulus. A purchasing managers’ index compiled by the China Federation of Logistics and Purchasing slid to 49 in November, lower than all but two of 18 forecasts in a Bloomberg News survey. Readings below 50 signal a contraction.

Spain sold the maximum amount of debt planned at an auction. France sold 4.3 billion euros of securities, compared with a maximum 4.5 billion euros of debt available on offer as 10-year bonds sold were priced to yield 3.18 percent, less than at a previous auction on Nov. 3.

National benchmark equity indexes declined in every western-European market except Switzerland. The U.K.’s FTSE 100 Index dropped 0.3 percent, France’s CAC 40 Index fell 0.8 percent and Germany’s DAX Index fell 0.9 percent.

BNP Paribas SA and Societe Generale SA, the biggest French lenders, declined 2 percent to 28.88 euros and 3.2 percent to 17.50 euros, respectively. Goldman’s Chief Global Equity Strategist Peter Oppenheimer cut the European banking sector to ’underweight’ from ’sell’ as he expects sector to remain under pressure to shore up balance sheets.

Hochtief fell 1.5 percent to 41.78 euros and Vinci SA (DG), Europe’s biggest builder, slipped 2 percent to 32.44 euros. Vinci pulled out of bidding for the purchase of Hochtief’s airport-operating business, Societe Generale said in a research note today, citing Vinci’s chief financial officer.

Norsk Hydro, Europe’s third-largest aluminum maker, fell 2.9 percent to 26.86 kroner after forecasting lower global growth in demand for the metal. Goldman Sachs recommended selling the shares on low returns and near-term weakness.

Burberry Group Plc, the U.K.’s largest luxury-goods maker, rallied 3 percent to 1,308 pence. The company plans to add more stores in Paris after its opening on rue Saint Honore, Les Echos reported, citing Chief Executive Officer Angela Ahrendts.

Frank dramatically weakened on all fronts, falling against the euro and the dollar amid reports that Switzerland is considering the introduction of negative interest rates in order to weaken the currency.

A pair of EUR / CHF for a few minutes gained almost 130 pips, and updated the 2-week high at 1.2388, followed by minor adjustments. Now prices are held in the mark 1.2330, which is 0.5% above the opening price.

USD / CHF, meanwhile, rose sharply from 0.9100 marks and reached the day high at0.9189. At the moment, prices are held above 0.9150.

U.S. stocks fell, after the biggest three-day rally in the Standard & Poor’s 500 Index since 2009, as Massachusetts sued lenders including Bank of America Corp. (BAC) and JPMorgan Chase & Co. (JPM) over foreclosure practices.

More Americans than forecast filed applications for unemployment benefits during Thanksgiving week, signaling limited recovery in the labor market. A purchasing managers’ index compiled by the China Federation of Logistics and Purchasing slid to 49 in November, lower than all but two of 18 forecasts in a Bloomberg News survey. Manufacturing in the U.S. grew in November at the fastest pace in five months.

Spain and France sold 8.1 billion euros ($10.9 billion) of bonds today, sending yields lower across Europe. The European Union may exempt bank debt issued before 2013 from proposals forcing investors to take losses at failing lenders, said a person familiar with the plan. Excluding the debt is designed to prevent lenders’ funding costs from rising, said the person.

Massachusetts Attorney General Martha Coakley said she sued Bank of America, JPMorgan, Citigroup Inc., Ally Financial Inc. and Wells Fargo & Co. for their allegedly “unlawful and deceptive conduct” in foreclosures. Coakley will hold a press conference today in Boston to discuss the lawsuit.

Dow 11,983.02 -62.66 -0.52%, Nasdaq 2,618.98 -1.36 -0.05%, S&P 500 1,241.29 -5.67 -0.45%

Financial stocks had the biggest drop (S5FINL) in the S&P 500 among 10 industries, falling 1.6 percent. Bank of America slumped 1.9 percent to $5.33. JPMorgan retreated 2.6 percent to $30.18. Citigroup slipped 2.7 percent to $26.75. Wells Fargo decreased 1.6 percent to $25.44.

Kohl’s Corp. lost 7.4 percent to $49.82. The retailer said November same-store sales fell 6.2 percent, missing an estimated 2.1 percent increase.

Yahoo! Inc. rallied 3.1 percent to $16.20. Alibaba Group and Softbank Corp. are in advanced talks with Blackstone Group LP (BX) and Bain Capital LLC about making a bid for all of Yahoo, said three people with knowledge of the matter. A bid may value Yahoo at more than $20 a share because of tax savings tied to the Internet company’s stakes in Alibaba and Yahoo Japan, said two of the people, who declined to be identified.

Oil fell as more Americans filed applications for jobless benefits and Chinese manufacturing weakened, bolstering concern that the economies of two biggest crude-consuming countries are slowing.

Futures dropped as much as 1.3 percent after the Labor Department said U.S. unemployment claims rose by 6,000 to 402,000 last week. China’s manufacturing contracted in November for the first time since February 2009, a purchasing managers’ index compiled by the China Federation of Logistics and Purchasing showed.

Crude for January delivery declined to $98.87 a barrel on the New York Mercantile Exchange. Futures climbed 7.7 percent in November and are up 8.6 percent this year.

Brent oil for January settlement fell $1.89, or 1.7 percent, to $108.63 a barrel on the London-based ICE Futures Europe exchange.

U.S. jobless claims were projected to drop to 390,000 last week, according to the median forecast of 43 economists in a Bloomberg News survey.

The U.S. and China were responsible for 32 percent of global oil consumption in 2010, according to BP Plc’s Statistical Review of World Energy released on June 8.

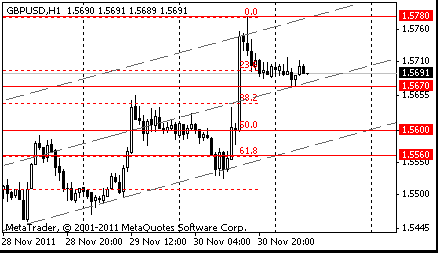

The pair fell to $1.5687, triggering stops on the downward move. Demand seen into $1.5680, ahead of more bids at $1.5665/60 with stops set on a break.

“Nov mfg ISM was healthy and represent remarkable recovery. However, IMS was above 60 early in '11 and that means just modest growth. Also "ISM employment gauge slipped to 51.8, matching the lowest reading in two years."

New orders 56.7 vs 52.4.

Employment 51.8 vs 53.5.

Prices paid 45.0.

Production 56.6 vs 50.1.

EUR/USD $1.3310, $1.3350, $1.3400, $1.3500, $1.3700

USD/JPY Y76.55, Y77.50, Y77.90, Y78.75

AUD/USD $0.9950, $1.0000, $1.0300

EUR/JPY Y103.00

GBP/USD $1.5655, $1.5635, $1.5600, $1.5500, $1.5490

EUR/CHF Chf1.2300

08:45 Italy PMI (November) 44.0

08:50 France PMI (November) 47.3

08:55 Germany PMI (November) seasonally adjusted 47.9

09:00 EU(17) PMI (November) 46.4

09:30 UK CIPS manufacturing index (November) 47.6

The euro strengthened after Spain sold its maximum target of debt today and French yields dropped at an auction.

Spain sold 3.75 billion euros of bonds, the central bank said, meeting the maximum target. The average yield on the five- year notes was 5.544 percent, compared with 4.848 percent when similar-maturity debt were auctioned on Nov. 3. France sold 1.57 billion euros of 10-year bonds at an average yield of 3.18 percent, down from 3.22 percent at the prior offering on Nov. 3.

The Dollar Index fell for a fourth day before U.S. reports forecast to show manufacturing and employment improved, damping demand for safer assets.

The Institute for Supply Management’s factory index, a gauge of U.S. manufacturing, climbed to 51.8 in November from 50.8 the previous month, according to a survey before today’s report. Employers added 125,000 workers last month after hiring 80,000 in October, a separate survey showed before the Labor Department data tomorrow.

EUR/USD: the pair has become stronger in $1.3500 area.

US data at 1330GMT, the weekly initial jobless claims are expected to fall 3,000 to 390,000 in the November 26 week. Also at 1500GMT the ISM manufacturing index is expected to rise to a reading of 52.0 in November after falling slightly in October. The regional data already released suggest only modest growth.

"The timing of these changes likely reflects the deterioration in funding market conditions over the last several weeks and the

announcements were a step in the right direction but the EZ crisis remains severe."

GBP/USD

Offers $1.5830/35, $1.5800, $1.5780, $1.5750

Bids $1.5695/90, $1.5680, $1.5665/60, $1.5600/590

EUR/USD

Offers $1.3600/15, $1.3570

Bids $1.3400, $1.3370/60, $1.3335/25

Resistance 3: Y79.00 (Nov 1 high)

Resistance 2: Y78.30 (Nov 4, 28-29 high)

Resistance 1: Y77.75 (session high)

Current price: Y77.68

Support 1:Y77.60 (support line from Nov 30)

Support 2:Y77.30 (Nov 30 low)

Support 3:Y77.00 (Nov 24 low)

Resistance 2: Chf0.9250 (Nov 29-30 high)

Resistance 3: Chf0.9190 (МА (200) for Н1)

Resistance 1: Chf0.9150 (session high)

Current price: Chf0.9102

Support 1: Chf0.9080 (session low)

Support 2: Chf0.9060 (Nov 30 low)

Support 3: Chf0.9040 (38,2 % FIBO Chf0,8570-Chf0,9330)

Resistance 3: $ 1.5830 (61,8 % FIBO $1,6090-$ 1.5420)

Resistance 2: $ 1.5780 (Nov 30 high)

Resistance 1: $ 1.5745 (session high)

Current price: $1.5706

Support 1 : $1.5670 (support line from Nov 30)

Support 2 : $1.5630 (session low)

Support 3 : $1.5580 (МА (200) for Н1)

Resistance 3: $ 1.3570 (Nov 22 high)

Resistance 2: $ 1.3530 (Nov 30 high)

Resistance 1: $ 1.3500 (area of session high)

Current price: $1.3474

Support 1 : $1.3415 (session low)

Support 2 : $1.3390 (area of МА (200) for Н1 and 50,0 % FIBO of yesterday's falling)

Support 3 : $1.3360 (61,8 % FIBO of yesterday's falling)

- Central Bank swap deals can't solve underlying woes;

- capital buffers can be run down if problems persist;

- this is not time to raise capital ratios;

- shouldn't exaggerate problems facing UK banks;

- spiral is characteristic of systemic crisis.

- Central Bank swap deals can't solve underlying woes;

- capital buffers can be run down if problems persist;

- this is not time to raise capital ratios;

- shouldn't exaggerate problems facing UK banks;

- spiral is characteristic of systemic crisis.

E595mn of 4.25% 2017 OAT;avg yield 2.42%, cover 4.40

E1.571bn of 3.25% 2021 OAT;avg yield 3.18%,cover 3.05.

E1.1bn of 3.50% 2026 OAT;avg yield 3.65%, cover 4.40.

E1.08bn of 4.50% 2041 OAT;avg yield 3.94%, cover 2.26.

Pound At $1.73 In 12 Months

Euro At $1.45 In 12 Months

Brent Oil Price At $130/Bbl In 2013

USD/JPY Y76.55, Y77.50, Y77.90, Y78.75

AUD/USD $0.9950, $1.0000, $1.0300

EUR/JPY Y103.00

GBP/USD $1.5655, $1.5635, $1.5600, $1.5500, $1.5490

EUR/CHF Chf1.2300

Reforms, news govts had little effect on mkts so far

Confident new surveillance will restore confidence

Far reaching Treaty changes should not be discarded

Need long-term vision to restore short-term confidence

ECB monetary policy is guided by price stability

Financial markets have intensified again

Downside risks to economic outlook have increased

Dysfuntional bond markets hamper monetary policy

Impaired monpol transmission mechanism hits credit

Non-standard measures can only be limited

Govts must restore their credibility

Reforms, news govts had little effect on mkts so far

Confident new surveillance will restore confidence

Far reaching Treaty changes should not be discarded

Need long-term vision to restore short-term confidence

ECB monetary policy is guided by price stability

Financial markets have intensified again

Downside risks to economic outlook have increased

Dysfuntional bond markets hamper monetary policy

Impaired monpol transmission mechanism hits credit

Non-standard measures can only be limited

Govts must restore their credibility

Nikkei 225 8,597 +162.77 +1.93%

Hang Seng 19,002 +1,012.91 +5.63%

S&P/ASX 4,229 +108.83 +2.64%

Shanghai Composite 2,387 +53.45 +2.29%

00:30 Australia Building Permits, y/y October -29.8%

00:30 Australia Retail sales (MoM) October +0.2%

00:30 Australia Retail Sales Y/Y October +2.8%

01:00 China Manufacturing PMI November 49.0

02:30 China HSBC Manufacturing PMI November 47.7

05:30 Australia Commodity Prices, Y/Y November +18.1%

Australia’s dollar dropped against all of its peers after the country’s statistics bureau said the number of permits granted to build or renovate houses and apartments fell 10.7 percent in October after dropping a revised 14.2 percent the previous month. Retail sales climbed 0.2 percent from a month earlier, when they rose 0.4 percent. China’s Purchasing Managers’ Index fell to 49.0 in November from 50.4 in October, the China Federation of Logistics and Purchasing said today. The median estimate in a Bloomberg survey of 18 economists was 49.8. A level above 50 indicates expansion.

Gains in the euro were limited before Spain and France sell securities amid concern Europe’s debt crisis will boost borrowing costs for the region’s nations. Spain will sell as much as 3.75 billion euros ($5 billion) of debt today maturing in 2015, 2016 and 2017. France will offer bonds maturing in 2017, 2021, 2026 and 2041 and may auction up to 4.5 billion euros of securities.

The Federal Reserve-led global effort to ease borrowing costs for financial firms shows both the central bank’s power to jolt markets -- and the limits of its ability to alleviate the European debt crisis. Stocks rallied worldwide, commodities rose and yields on most European debt fell after the Fed and five other central banks yesterday cut the cost of emergency dollar loans to banks outside the U.S. At the same time, the action falls short of more-drastic moves that central banks are reluctant to take, including purchases or guarantees of countries’ bonds.

EUR/USD: on Asian session the pair grew, but has fallen later.

GBP/USD: on Asian session the pair decreases.

USD/JPY: on Asian session the pair gain.

European events for Thursday start at 0800GMT when ECB President Mario Draghi is due to present the ECB Annual Report at the

European Parliament Plenary. This morning also sees the release of the manufacturing PMIs from the main European states, including final data from France at 0848GMT, Germany at 0853GMT and leading up to the 0858GMT of the EMU final manufacturing PMI. European data also includes France car registrations at 1100GMT. As well as the BOE Financial Policy Committee note, UK data sees the 0928GMT release of the November Markit/CIPS Manufacturing PMI UK manufacturing is expected to contract in the fourth quarter, with the pace of contraction in November expected to more or less match that in October with a median forecast for today's data of 47. US data at 1330GMT, the weekly initial jobless claims are expected to fall 3,000 to 390,000 in the November 26 week. Also at 1500GMT the ISM manufacturing index is expected to rise to a reading of 52.0 in November after falling slightly in October. The regional data already released suggest only modest growth.

The euro gained the most in a month against the dollar after the Federal Reserve and five other central banks acted to make more funds available to lenders as Europe’s debt crisis threatens global economic growth. The central banks agreed to reduce the interest rate on dollar liquidity swap lines and extend their authorization through Feb. 1, 2013. The rate was cut to the dollar overnight index swap rate plus 50 basis points, or half a percentage point, from 100 basis points, the Fed said in a statement in Washington. The Bank of Canada, Bank of England, Bank of Japan, European Central Bank and Swiss National Bank are part of the coordinated move, the Fed said.

Europe’s shared currency weakened earlier after euro-area finance ministers conceded efforts to expand their bailout fund missed the target and said they would seek a greater role for the International Monetary Fund. All 27 European Union finance ministers meet today with a goal of agreeing on how to temporarily guarantee banks’ bond issuance to improve funding conditions for lending. European heads of government meet on Dec. 9 in Brussels, with Germany pushing for governance changes that would tighten enforcement of budget rules.

The dollar and yen slid earlier today as China cut the amount of cash banks must set aside as reserves to spur growth, damping demand for safer assets. The People’s Bank of China said reserve ratios will decline by 50 basis points effective Dec. 5, the first reduction since 2008.

Canada’s dollar rose after the nation’s economy grew at a 3.5 percent annualized pace in the third quarter, beating the 3 percent expansion forecast in a Bloomberg News survey.

EUR/USD: yesterday the pair has grown on a figure.

GBP/USD: yesterday the pair has grown on a figure.

USD/JPY: yesterday the pair fell updated week’s low.

European events for Thursday start at 0800GMT when ECB President Mario Draghi is due to present the ECB Annual Report at the

European Parliament Plenary. This morning also sees the release of the manufacturing PMIs from the main European states, including final data from France at 0848GMT, Germany at 0853GMT and leading up to the 0858GMT of the EMU final manufacturing PMI. European data also includes France car registrations at 1100GMT. As well as the BOE Financial Policy Committee note, UK data sees the 0928GMT release of the November Markit/CIPS Manufacturing PMI UK manufacturing is expected to contract in the fourth quarter, with the pace of contraction in November expected to more or less match that in October with a median forecast for today's data of 47. US data at 1330GMT, the weekly initial jobless claims are expected to fall 3,000 to 390,000 in the November 26 week. Also at 1500GMT the ISM manufacturing index is expected to rise to a reading of 52.0 in November after falling slightly in October. The regional data already released suggest only modest growth.

Resistance 3: Y79.00 (Nov 1 high)

Resistance 2: Y78.30 (Nov 29 high)

Resistance 1: Y77.95 (middle line from Nov 18)

The current price: Y77.70

Support 1: Y77.45 (support line from Nov 29)

Support 2: Y77.00 (Nov 24 low)

Support 3: Y76.55 (Nov 18 low)

Comments: the pair is on uptrend. In focus resistance Y77.95.

Resistance 3 : $1.5930 (Nov 15 high)

Resistance 2 : $1.5885 (Nov 18 high)

Resistance 1 : $1.5780 (Nov 30 high, resistance line from Nov 25)

The current price: $1.5695

Support 1 : $1.5670 (session low)

Support 2 : $1.5600 (50.0% FIBO $1.5420-$1.5780)

Support 3 : $1.5560 (61.8% FIBO $1.5420-$1.5780)

Comments: the pair is on uptrend. In focus resistance $1.5780.

Resistance 3: $1.3570 (Nov 22 high)

Resistance 2: $1.3530 (resistance line from Nov 25, Nov 30 high)

Resistance 1: $1.3480 (high of the European session on Nov 23)

The current price: $1.3464

Support 1 : $1.3430 (session low)

Support 2 : $1.3395 (50.0% FIBO $1.3530-$1.3255)

Support 3 : $1.3360 (61.8% FIBO $1.3530-$1.3255)

Comments: the pair is on uptrend. In focus resistance $1.3480.

Change % Change Last

Nikkei 225 8,435 -43.21 -0.51%

Hang Seng 17,989 -266.85 -1.46%

S&P/ASX 200 4,120 +17.71 +0.43%

Shanghai Composite 2,333 -78.98 -3.27%

FTSE 100 5,505 +168.42 +3.16%

CAC 40 3,155 +127.86 +4.22%

DAX 6,089 +288.93 +4.98%

Dow 12,045.68 +490.05 +4.24%

Nasdaq 2,620.34 +104.83 +4.17%

S&P 500 1,246.96 +51.77 +4.33%

10 Year Yield 2.07% +0.07 --

Oil $100.23 -0.13 -0.13%

Gold $1,746.80 +1.30 +0.07%

00:30 Australia Building Permits, m/m October -13.6% +3.6%

00:30 Australia Building Permits, y/y October -12.0% -14.4%

00:30 Australia Retail sales (MoM) October +0.4% +0.4%

00:30 Australia Retail Sales Y/Y October +2.4%

01:00 China Manufacturing PMI November 50.4 49.8

02:30 China HSBC Manufacturing PMI November 48.0

05:30 Australia Commodity Prices, Y/Y November +19.4%

06:45 Switzerland Gross Domestic Product (QoQ) Quarter III +0.4% +0.2%

06:45 Switzerland Gross Domestic Product (YoY) Quarter III +2.3% +1.8%

08:00 United Kingdom Halifax house price index November +1.2%

08:00 United Kingdom Halifax house price index 3m Y/Y November -1.8%

08:00 Eurozone ECB President Mario Draghi Speaks 0

08:30 Switzerland SVME PMI November 46.9 46.7

08:50 France Manufacturing PMI November 48.5 47.6

08:55 Germany Purchasing Manager Index Manufacturing November 49.1 47.9

09:00 Eurozone Purchasing Manager Index Manufacturing November 47.1 46.4

09:30 United Kingdom Purchasing Manager Index Manufacturing November 47.4 47.2

13:30 U.S. Initial Jobless Claims неделя по 25 ноября 393 390

15:00 U.S. ISM Manufacturing November 50.8 51.6

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.