- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

Don't see reason for IMF to coordinate with central banks

Consumer spending rose modestly.

Motor vehicle sales increased in a number of Dists, and tourism showed signs of strength.

Business services was flat to higher.

Mfg expanded at a steady pace across the country.

Overall bank lending increased slightly & home refi grew more rapidly.

Changes in credit standards & quality varied.

Res real estate remained sluggish, and comml real est remained lackluster.

Hiring reported as subdued with wages stable.

Overall prices seen as subdued, some price pressures eased.

The euro gained the most in a month against the dollar after the Federal Reserve and five other central banks acted to make more funds available to lenders as Europe’s debt crisis threatens global economic growth. The central banks agreed to reduce the interest rate on dollar liquidity swap lines and extend their authorization through Feb. 1, 2013. The rate was cut to the dollar overnight index swap rate plus 50 basis points, or half a percentage point, from 100 basis points, the Fed said in a statement in Washington. The Bank of Canada, Bank of England, Bank of Japan, European Central Bank and Swiss National Bank are part of the coordinated move, the Fed said.

Europe’s shared currency weakened earlier after euro-area finance ministers conceded efforts to expand their bailout fund missed the target and said they would seek a greater role for the International Monetary Fund. All 27 European Union finance ministers meet today with a goal of agreeing on how to temporarily guarantee banks’ bond issuance to improve funding conditions for lending. European heads of government meet on Dec. 9 in Brussels, with Germany pushing for governance changes that would tighten enforcement of budget rules.

The dollar and yen slid earlier today as China cut the amount of cash banks must set aside as reserves to spur growth, damping demand for safer assets. The People’s Bank of China said reserve ratios will decline by 50 basis points effective Dec. 5, the first reduction since 2008.

Canada’s dollar rose after the nation’s economy grew at a 3.5 percent annualized pace in the third quarter, beating the 3 percent expansion forecast in a Bloomberg News survey.

European stocks jumped, posting their biggest four-day rally since November 2008, as the Federal Reserve and five other central banks lowered the cost of dollar funding and China cut its reserve ratio for banks.

The Fed, Bank of Canada, Bank of England, Bank of Japan, European Central Bank and Swiss National Bank agreed to reduce the interest rate on dollar liquidity swap lines by 50 basis points and extend their authorization through Feb. 1, 2013.

China said it will cut the reserve requirement ratio for banks by 0.5 percentage points from Dec. 5.

Finance ministers of the 27-nation European Union are meeting in Brussels today to seek agreement on how to temporarily guarantee banks’ bond issuance in order to improve funding conditions for lending. EU leaders agreed last month to provide the guarantees to restore investor confidence in banks.

National benchmark equity indexes advanced in every western-European market except Iceland. The U.K.’s FTSE 100 Index increased 3.2 percent, France’s CAC 40 Index jumped 4.2 percent and Germany’s DAX Index surged 5 percent.

A gauge of European banks, which had earlier declined on S&P rating cuts, jumped 4.4 percent. Barclays, Britain’s second- largest lender by assets, surged 6.7 percent to 180.25 pence. Deutsche Bank, Germany’s biggest bank, soared 6.2 percent to 28.62 pence. Lloyds Banking Group Plc jumped 7.1 percent to 24.83 pence.

BHP advanced 6.2 percent to 1,949 pence. Rio Tinto Group, the world’s second-biggest mining company, climbed 6.4 percent to 3,339 pence. Xstrata Plc jumped 6.5 percent to 1,017 pence. A gauge of mining shares rose 6 percent for the best performance in the Stoxx 600.

BP rose 5 percent to 460.75 pence for the largest contribution to the Stoxx 600 index’s advance.

Grifols SA increased 5.4 percent to 12.01 euros for the biggest jump this year. The stock was rated “buy” in new coverage at Deutsche Bank AG.

U.S. stocks rallied, sending benchmark gauges toward their biggest gains since August, as central banks acted to make additional funds available to lenders as Europe’s crisis threatens global economic growth.

Stocks rallied after China cut the amount of cash that banks must set aside as reserves for the first time since 2008. The Fed and five other central banks agreed to reduce the interest rate on dollar liquidity swap lines by 50 basis points and extend their authorization through Feb. 1, 2013.

In the U.S., the number of Americans signing contracts to buy previously owned homes rose more than forecast. Companies added more workers than anticipated in November, according to a private report based on payrolls. The Institute for Supply Management-Chicago Inc. said its business barometer increased to 62.6 in November from 58.4 the prior month.

Dow 11,969.28 +413.65 +3.58%, Nasdaq 2,602.28 +86.77 +3.45%, S&P 500 1,236.24 +41.05 +3.43%

All 10 groups in the S&P 500 rose as gauges of commodity and financial shares added at least 4.3 percent. A measure of homebuilders in S&P indexes increased 5.6 percent. U.S. Steel surged 12 percent to $26.46. Caterpillar gained 6.3 percent to $96.26. D.R. Horton added 6.3 percent to $11.96.

Financial shares tumbled after the close of regular trading as S&P cut credit ratings for lenders including Bank of America and Citigroup Inc. JPMorgan added 6.5 percent, the most in the Dow, to $30.41 today. Bank of America gained 4.7 percent to $5.31 today. Citigroup rose 6.5 percent to $26.88.

American Airlines parent AMR Corp. increased 50 percent to 39 cents. The shares tumbled 84 percent yesterday after the company announced a bankruptcy filing.

Netflix Inc. slumped 2.3 percent to $66.03. The video- streaming and DVD subscription service was cut to “underperform” from “neutral” at Wedbush Securities Inc, citing rising content costs, continued customer losses and concern about the company’s “growth at all costs business model.” Wedbush gave a 12-month price estimate of $45 a share.

Oil rose to a two-week high after the Federal Reserve and five other central banks acted together to boost liquidity and ease the strains of Europe’s debt crisis and as U.S. companies added more workers than projected.

Futures climbed as much as 2 percent as the central banks of the U.S., the euro region, Canada, the U.K., Japan and Switzerland cut the cost of emergency funding for European banks. U.S. companies added 206,000 jobs this month, the most this year, ADP Employer Services said today.

The central banks reduced the cost of providing dollar funding via swap arrangements. The move is aimed at easing strains in markets and boosting their capacity to support the global financial system, according to a Fed statement in Washington.

ADP, based in Roseland, New Jersey, was projected to report an advance of 130,000 jobs, according to the median of responses from economists surveyed by Bloomberg News.

Futures briefly pared gains after the Energy Department reported U.S. oil supplies rose 3.93 million barrels to 334.7 million in the week ended Nov. 25. Inventories were forecast to rise 50,000 barrels, according to the median of 12 analyst estimates in a Bloomberg News survey.

Crude oil for January delivery rose to $101.75 a barrel on the New York Mercantile Exchange before the report. Futures have gained 11 percent this year.

Brent oil for January settlement increased 43 cents, or 0.4 percent, to $111.25 a barrel on the London-based ICE Futures Europe exchange.

Dollar Gold Bullion prices jumped 1.7% in half an hour Wednesday lunchtime in London - hitting $1744 per ounce - following the announcement of coordinated action from the world's major central banks to boost the provision of Dollar liquidity to the global financial system.

The Bank of Canada, the Bank of England, the Bank of Japan, the European Central Bank, the Federal Reserve, and the Swiss National Bank will all lower the price on existing Dollar liquidity swap arrangements by 50 basis points (0.5 percentage points), effective Monday.

As well as strengthening Dollar liquidity provision, the central banks "judge it prudent" to make arrangements to offer enhanced liquidity provision in other currencies " so that liquidity support operations could be put into place quickly should the need arise", a Bank of England statement said.

On the currency markets the Dollar fell sharply following the central banks' announcement.

Today, December gold futures on the Comex in New York rose to 1749.20 doll per troy ounce.

USD/JPY Y77.50, Y77.75, Y77.90, Y77.95, Y78.00, Y78.20, Y78.50

AUD/USD $1.0000, $0.9900

EUR/JPY Y104.00

GBP/USD $1.5945, $1.5950

EUR/USD

Offers $1.3600/15, $1.3570, $1.3540/50

Bids $1.3415/10, $1.3385/80, $1.3355/50, $1.3320, $1.3300, $1.3260/50

They lower pricing on existing US$ swaps by 50 bp.

07:00 Germany Retail sales (October) real adjusted 0.7%

07:00 Germany Retail sales (October) real unadjusted Y/Y -0.4%

08:55 Germany Unemployment (November) seasonally adjusted -20K

08:55 Germany Unemployment (November) seasonally adjusted, mln 2.913

08:55 Germany Unemployment rate (November) seasonally adjusted 6.9%

08:55 Germany Unemployment (November) seasonally unadjusted, mln 2.713

08:55 Germany Unemployment rate (November) seasonally unadjusted 6.4%

10:00 EU(17) Harmonized CPI (November) Y/Y preliminary 3.0%

10:00 EU(17) Unemployment (October) 10.3%

The dollar weakened as China cut the amount of cash that banks must set aside as reserves to spur growth, damping demand for safer assets.

The yen dropped the most versus the Brazilian real and Mexican peso as the People’s Bank of China said reserve ratios will decline by 50 basis points effective Dec. 5, the first reduction since 2008.

The euro earlier approached an eight-week low versus the greenback after euro-area finance ministers meeting yesterday conceded efforts to expand their bailout fund missed the target and said they would seek a greater role for the International Monetary Fund.

S&P lowered the ratings of Goldman Sachs Group Inc. and Bank of America Corp. to A- from A, as part of criteria changes started three years ago. The company also reduced the rankings of Morgan Stanley, Citigroup, Bank of America’s Merrill Lynch unit and JPMorgan Chase & Co.

EUR/USD: the pair has shown low in $1.3260 area, but later rose above $1,3300.

GBP/USD: the pair has shown low in $1.5520 arae. Later the pair rose in area of session high above $1,5600.

USD/JPY: the pair was in Y77.85-Y78,15 range.

US data starts at 1200GMT with the weekly MBA Mortgage Application Index, which is followed at 1230GMT by Challenger Layoffs data, at 1315GMT by the ADP National Employment Report and then at 1330GMT by the ISM-NY Business Index and third quarter productivity, which is expected to be revised down to a 2.6% rate of growth, as GDP was revised down. As a result, unit labor costs are expected to be revised up to a 2.2% rate of decline. US data continues at 1445GMT with the Chicago PMI, which is forecast to rise to a reading of 59.0 in November after falling slightly to 58.4 in October. The Chicago PMI is the one index that appears to consistently indicate expansion. NAR Pending Home Sales and the Help-wanted Online index follow at 1500GMT, while at 1530GMT the weekly EIA Crude Oil Stocks data is due. At 1545GMT, Philly Fed Pres Charles Plosser moderates a panel discussion at the San Francisco Fed's Asia Economic Policy Conference. Later data includes the 1900GMT release of the Fed's Beige Book and the 8GMT release of Agriculture Prices data.

Resistance 3: Y79.50 (Oct 31 high)

Resistance 2: Y79.00 (Nov 1 high)

Resistance 1: Y78.30 (Nov 4, 28-29 highs)

Current price: Y77.97

Support 1:Y77.60 (Nov 29 low)

Support 2:Y77.30 (МА (200) for Н1)

Support 3:Y77.00 (Nov 24 low)

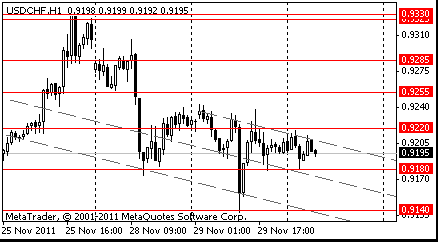

Resistance 2: Chf0.9330 (Nov 25 high)

Resistance 3: Chf0.9300/10 (area of Nov 28 high)

Resistance 1: Chf0.9250 (session high)

Current price: Chf0.9209

Support 1: Chf0.9180 (session low)

Support 2: Chf0.9140 (Nov 29 low)

Support 3: Chf0.9120 (support line from Nov 9)

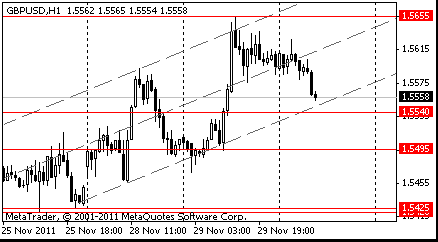

Resistance 3: $ 1.5690/10 (Nov 22 high, 61,8 % FIBO $1,5890-$ 1.5420)

Resistance 2: $ 1.5650 (Nov 29 high, 50,0 % FIBO $1,5890-$ 1.5420)

Resistance 1: $ 1.5630 (session high)

Current price: $1.5621

Support 1 : $1.5590 (МА(200) for Н1)

Support 2 : $1.5520 (resistance line from Nov 14, session low)

Support 3 : $1.5460 (area of Nov 28-29 lows)

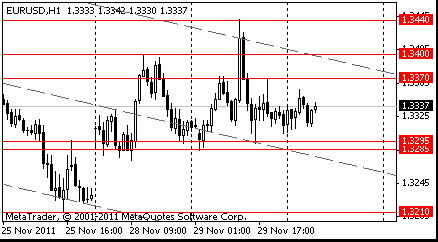

Resistance 3: $ 1.3440 (Nov 29 high)

Resistance 2: $ 1.3400 (МА(200) дл Н1)

Resistance 1: $ 1.3360 (session high)

Current price: $1.3318

Support 1 : $1.3260 (session low)

Support 2 : $1.3210/00 (Nov 25 low, support line from January)

Support 3 : $1.3150 (low of October)

USD/JPY Y77.50, Y77.75, Y77.90, Y77.95, Y78.00, Y78.20, Y78.50

AUD/USD $1.0000, $0.9900

EUR/JPY Y104.00

GBP/USD $1.5945, $1.5950

The yen declined against the majority of its 16 main counterparts after euro-area finance ministers agreed to extend the capacity of a rescue fund for indebted countries, curbing demand for haven assets.

Japan’s currency also weakened after Luxembourg Prime Minister Jean-Claude Juncker said yesterday the finance chiefs of the region’s 17 nations agreed to work on boosting the International Monetary Fund’s resources.

The Australian and New Zealand dollars touched the highest levels in more than a week as euro- area officials agreed to extend the capacity of the region’s bailout fund and leaders worked toward a Dec. 9 summit.

The so-called Aussie maintained four days of gains versus the yen as a government report showed business investment rose by more than economists forecast in the third quarter. New Zealand’s currency, nicknamed the kiwi, held a two-day advance against the greenback after a report showed home-building approvals rose in October for the third time in four months as the nation recovers from earthquakes on the South Island.

EUR/USD: on Asian session the pair fell.

GBP/USD: on Asian session the pair declined.

USD/JPY: on Asian session the pair traded in range Y77.85-Y78.10.

European events for Wednesday start at 0700GMT with the German ILO measure of employment and also retail sales from Germany. This is followed by housing starts/permits and PPI data from France, while at 0855GMT we get the main labour market data from Germany. EMU data at 1000GMT includes the October unemployment rate and the November measure of flash HICP. US data starts at 1200GMT with the weekly MBA Mortgage Application Index, which is followed at 1230GMT by Challenger Layoffs data, at 1315GMT by the ADP National Employment Report and then at 1330GMT by the ISM-NY Business Index and third quarter productivity, which is expected to be revised down to a 2.6% rate of growth, as GDP was revised down. As a result, unit labor costs are expected to be revised up to a 2.2% rate of decline. US data continues at 1445GMT with the Chicago PMI, which is forecast to rise to a reading of 59.0 in November after falling slightly to 58.4 in October. The Chicago PMI is the one index that appears to consistently indicate expansion. NAR Pending Home Sales and the Help-wanted Online index follow at 1500GMT, while at 1530GMT the weekly EIA Crude Oil Stocks data is due. At 1545GMT, Philly Fed Pres Charles Plosser moderates a panel discussion at the San Francisco Fed's Asia Economic Policy Conference. Later data includes the 1900GMT release of the Fed's Beige Book and the 8GMT release of Agriculture Prices data.

Resistance 3: Y79.50 (Oct 31 high)

Resistance 2: Y79.00 (Nov 1 high)

Resistance 1: Y78.25 (Nov 29 high)

The current price: Y77.90

Support 1: Y77.85 (session low)

Support 2: Y77.45 (support line from Nov 18, MA(233) H1)

Support 3: Y77.00 (Nov 24 low)

Comments: the pair is on uptrend. In focus resistance Y78.25.

Resistance 3: Chf0.9385 (76.4% FIBO Chf0.9140-Chf0.9330)

Resistance 2: Chf0.9255 (61.8% FIBO Chf0.9140-Chf0.9330)

Resistance 1: Chf0.9220 (session high)

The current price: Chf0.9194

Support 1: Chf0.9180 (session low)

Support 2: Chf0.9140 (Nov 29 low)

Support 3: Chf0.9105 (Nov 22 low)

Comments: the pair is on downtrend. In focus support Chf0.9180.

Resistance 3 : $1.5765 (high of the European session on Nov 21)

Resistance 2 : $1.5690 (Nov 22 high)

Resistance 1 : $1.5655 (50.0% FIBO $1.5420-$1.5885, Nov 29 high)

The current price: $1.5558

Support 1 : $1.5540 (50.0% FIBO $1.5420-$1.5655)

Support 2 : $1.5495 (low of the European session on Nov 29)

Comments: the pair is on uptrend. In focus resistance $1.5655.

Resistance 3: $1.3440 (Nov 29 high)

Resistance 2: $1.3400 (resistance line from Nov 22)

Resistance 1: $1.3370 (high of the American session on Nov 29)

The current price: $1.3337

Support 1 : $1.3285/95 (area of Nov 29 low)

Support 2 : $1.3210 (Nov 25 low)

Support 3 : $1.3145 (Oct 4 low)

Comments: the pair is on downtrend. In focus support $1.3285/95.

Change % Change Last

Nikkei 225 8,287 +127.48 +1.56%

Hang Seng 18,038 +348.33 +1.97%

S&P/ASX 200 4,058 +73.86 +1.85%

Shanghai Composite 2,383 +2.81 +0.12%

FTSE 100 5,313 +148.11 +2.87%

CAC 40 3,013 +155.96 +5.46%

DAX 5,745 +252.46 +4.60%

Dow 11,523.01 +291.23 +2.59%

Nasdaq 2,527.34 +85.83 +3.52%

S&P 500 1,192.55 +33.88 +2.92%

10 Year Yield 1.96% -0.01 --

Oil $97.79 -0.42 -0.43%

Gold $1,709.20 -1.60 -0.09%

00:01 United Kingdom Gfk Consumer Confidence November -32 -33 -31

00:30 Australia Private Capital Expenditure Quarter III +4.9% +8.2% +12.3%

00:30 Australia Private Sector Credit, m/m October +0.5% +0.4% +0.2%

00:30 Australia Private Sector Credit, y/y October +3.4% +3.6% +3.5%

01:30 Japan Labor Cash Earnings, YoY October 0.0% 0.0% +0.1%

05:00 Japan Housing Starts, y/y October -10.8% -6.1% -5.8%

05:00 Japan Construction Orders, y/y October -9.3% +24.3%

07:00 Germany Retail sales, real adjusted October +0.4% +0.1%

07:00 Germany Retail sales, real unadjusted, y/y October +0.3%

07:45 France Consumer spending October -0.5% +0.1%

07:45 France Consumer spending, y/y October -1.3% -0.2%

08:00 Eurozone ECB President Mario Draghi Speaks 0

08:55 Germany Unemployment Change November 10K -6K

08:55 Germany Unemployment Rate s.a. November 7.0% 7.0%

09:00 Italy Unemployment Rate October 8.3% 8.2%

10:00 Eurozone Harmonized CPI, Y/Y November +3.0% +3.0%

10:00 Eurozone Unemployment Rate October 10.2% 10.2%

10:00 Eurozone ECOFIN Meetings 0

10:30 Switzerland KOF Leading Indicator November 0.80 0.66

13:15 U.S. ADP Employment Report November 110K 131K

13:30 Canada Gross Domestic Product (MoM) September +0.3% +0.2%

13:30 Canada Raw Material Price Index October +1.4% +1.5%

13:30 Canada Industrial product prices, m/m October +0.4% +0.3%

14:45 U.S. Chicago Purchasing Managers' Index November 58.4 58.6

15:00 U.S. Pending Home Sales (MoM) October -4.6% +1.3%

15:30 U.S. EIA Crude Oil Stocks change неделя по 25 ноября -6.2

19:00 U.S. Fed's Beige Book 0

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.