- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

- There Is Minor Momentum In The Economy

- Our Job Is To Refuel The Tanks, We've Done That

- There's Liquidity, Need Fiscal Authorities To Get Act Together

National benchmark indexes retreated in all 18 western European markets, except for Ireland. Germany’s DAX slumped 2.3 percent, France’s CAC 40 declined 1.9 percent and the U.K.’s FTSE 100 lost 1 percent.

FTSE 100 5,076 -52.98 -1.03%, CAC 40 2,927 -55.13 -1.85%, DAX 5,377 -125.32 -2.28%

BHP Billiton Ltd. (BHP) and Rio Tinto Group, the world’s biggest mining companies, declined more than 1.5 percent as copper tumbled to a 14-month low in London. Commerzbank AG (CBK) and Societe Generale SA led losses in banking shares. Bayerische Motoren Werke AG (BMW) sank to a one-year low.

The yen rose against all its major counterparts as Japan’s biggest manufacturers remained below levels seen before a record earthquake in March. The yen climbed against the dollar after the Bank of Japan said today its quarterly Tankan index of sentiment increased to 2 in September from minus 9 in June. The reading was below the reading of 6 in March, encouraging investors to take refuge in Japan’s currency.

Canada’s dollar rose as much as 0.7 percent before trading up 0.2 percent to C$1.0485 per greenback.

The pound fell against all its major counterparts excluding the South Korean won as traders judged a surprise increase in U.K. manufacturing as insufficient to keep the Bank of England from providing further stimulus for the economy. Bank of England policy makers said in minutes of last month’s policy meeting on Sept. 8 that it is becoming “increasingly probable” that another round of government-bond purchases may be needed to boost the economy.

The net long position of bullish minus bearish contracts held by noncommercial - so-called speculative - Gold Futures and options traders on New York's Comex exchange fell by more than 20% in the week ended September 27, according to data published Friday by the US Commodity Futures Trading Commission.

Dow 10,882.66 -30.72 -0.28%, Nasdaq 2,403 -12.51 -0.52%, S&P 500 1,126.06 -5.36 -0.47%

Alcoa Inc. (AA) fell 3.9 percent as Europe’s finance leaders prepared to weigh the risk of a Greek debt default. Las Vegas Sands Corp. slumped 1.3 percent as Macau casino operators tumbled on speculation that slowing China growth and slumping stock markets may damp demand for gambling. Yahoo! Inc. rallied 3.9 percent after Alibaba Group Holding Ltd. Chairman Jack Ma said he’s “very interested” in buying the Web portal.

Futures tumbled as much as 3 percent as European finance ministers met today in Luxembourg to determine whether Greece has done enough to mitigate the default threat. Oil pared earlier declines after an index of U.S. manufacturing unexpectedly increased in September.

Crude for November delivery fell $1.11, or 1.4 percent, to $78.09 a barrel at 10:11 a.m. on the New York Mercantile Exchange. Earlier, it touched $78.09, the lowest price since Aug. 9, when futures reached a 10-month low of $75.71 in intraday trading.

Brent oil for November settlement slid 83 cents, or 0.8 percent, to $101.93 a barrel on the London-based ICE Futures Europe exchange after falling as low as $100.71. A close below $101.32 would represent a decline of more than 20 percent from the April 8 settlement price of $126.65 a barrel, meeting the common definition of a bear market.

U.S. stock futures retreated, following the biggest quarterly slump for the Standard & Poor’s 500 Index since 2008, as Europe’s finance leaders prepared to weigh the risk of a Greek debt default.

Data:

- efficacy of QE is not good - might not create jobs;

- US econ is not robust but not declining.

Resistance 3: Y77.90 (Sep 9 high)

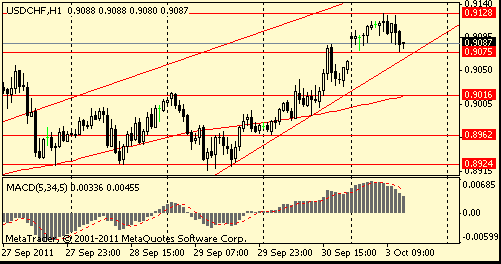

Resistance 3: Chf0.9350 (high of March and April)

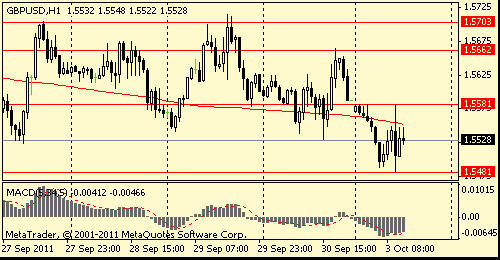

Resistance 3: $ 1.5700/10 (area of Sep 27 and 29 high)

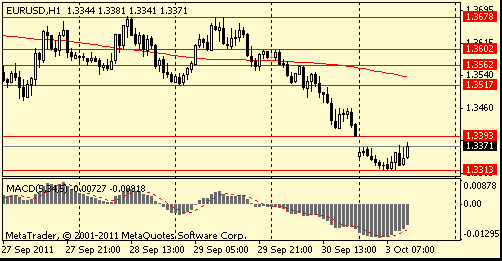

Resistance 3: $ 1.3560 (high of european session on Sep 30)

Start the U.S. session was accompanied by a fall in the major currencies in Europe: the dollar, the pound and the franc, as in the past at the weekend meetings of finance ministers and the IMF, European leaders failed to introduce additional measures to stop the regional debt crisis.

On Tuesday the yen rose against major counterparts before a government report that economists say will show orders for U.S. durable goods decreased, bolstering demand for the Japanese currency as a haven.

The dollar and the yen declined as stocks rallied around the world on optimism European leaders are close to an agreement to contain the region’s debt crisis, damping demand for refuge.

On Wednesday the euro advanced to a one-week high against the dollar after the European Commission refuted reports that euro-area nations are pushing for private Greek bondholders to accept larger writedowns.

German Chancellor Angela Merkel said she’s waiting for a report from a team of officials from the European Union, European Central Bank and International Monetary Fund on Greece’s progress before deciding whether a second financing package for the country agreed on July 21 needs to be revised.

On Thursday the vote in Berlin on changes to the EFSF allows the fund to buy the bonds of distressed member states and offer emergency loans to governments, raising Germany’s guarantees to 211 billion euros from 123 billion euros.

On Friday the dollar and the yen strengthened as growing evidence that the global economy is slowing boosted investor demand for currencies perceived as being the safest. The 17-nation euro headed for its biggest monthly decline against the yen in more than a year after data showed German retail sales fell by more than economists forecast and U.S. consumer spending slowed in August.

- Have to make sure banks in position to lend

- Rejects deficit-funded tax cuts

- US, German, French economies have ground to halt

- To call for bigger EFSF 'firepower'

- Euro zone needs to make decision on Greece now

00:00 China National Day Celebrations 0

01:00 China Non-Manufacturing PMI September 59.3

The euro fell to an eight-month low against the dollar before European finance ministers gather today to weigh the threat of a default in Greece, which is making fresh budget cuts to secure an international bailout.

The 17-nation euro slid for a second day before the meeting, at which officials will discuss how to shield banks from the region’s debt crisis and consider increasing their rescue fund. The dollar touched a two-week high versus the yen after a survey showed that sentiment at Japan’s biggest manufacturers remained below levels seen before a record earthquake struck in March.

The yen maintained losses against the dollar after the Bank of Japan said today its quarterly Tankan index of sentiment was 2 in September from minus 9 in June.

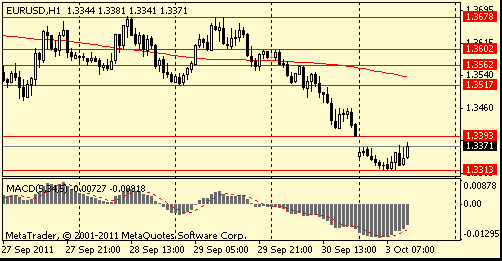

EUR/USD: on asian session the pair fell

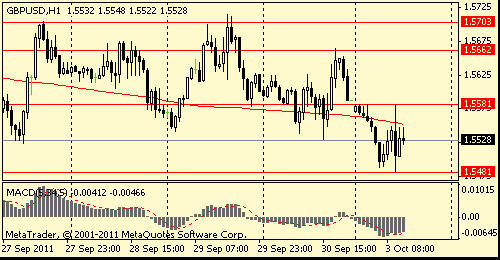

GBP/USD: on asian session the pair fell

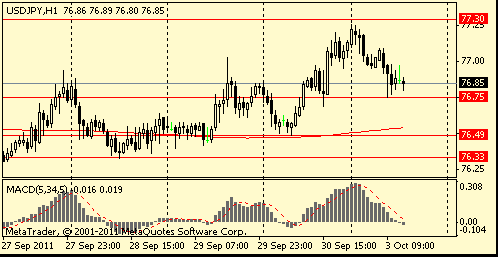

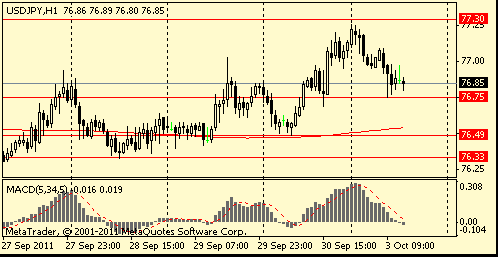

USD/JPY: the pair fell.

Focus today Eurogroup meeting. This morning's data is dominated by the releases of the European manufacturing PMI data. Germany at

0753GMT and the eurozone combined at 0758GMT.

Hong Kong’s Hang Seng Index (HSI) dropped 2.3 percent at the close, extending the quarter’s slump to 21 percent, the worst performance since September 2001. China’s Shanghai Composite Index slid 0.3 percent.

Japan’s Nikkei 225 (NKY) Stock Average, South Korea’s Kospi Index and Australia’s S&P/ASX 200 were little changed, while futures on the Standard & Poor’s 500 Index dropped 1.3 percent.

Japanese stocks edged lower, ending a three-day winning streak on the Topix index, after mixed U.S. economic reports failed to assuage concern the world’s largest economy is slowing.

The Topix fell 10 percent this quarter, its worst performance since the three months through June 2010. Stocks have fallen amid concern sputtering U.S. growth and Europe’s debt crisis will stifle demand in two of Japan’s biggest markets.

Toyota fell 0.5 percent to 2,688 yen. Sony Corp., Japan’s No. 1 exporter of consumer electronics, declined 0.5 percent to 1,507 yen.

Japanese banks fell even after Germany’s lower house voted to expand a European bailout fund. Confidence that the 440 billion euro ($599 billion) facility will be in place by mid- October allows the region’s finance chiefs next week to discuss enacting a permanent rescue fund that provides more capital and tools for managing defaults.

Mitsubishi UFJ Financial Group Inc. (8306), Japan’s biggest lender, fell 0.3 percent to 354 yen. Sumitomo Mitsui Financial slipped 0.6 percent to 2,206 yen.

European stocks posted the largest weekly gain in 14 months, paring a quarterly loss, as German backing for an enhanced euro-area rescue fund eased concern that policy makers will be unable to contain the debt crisis and U.S. jobs and growth data beat forecasts.

National benchmark indexes rose in all of western Europe’s 18 markets. France’s CAC 40 added 6.1 percent, the U.K.’s FTSE 100 climbed 1.2 percent and Germany’s DAX jumped 5.9 percent.

At closing, the major national benchmark indexes in Europe have shown a reduction: FTSE 100 5,128 -68.36 -1.32%, CAC 40 2,982 -45.69 -1.51%, DAX 5,502 -137.56 -2.44%. Negative impact on the dynamics of the indices have published statistics, which recorded decline in retail sales in Germany, rising unemployment in Italy and the rise in consumer prices in the EU as a whole.

Allianz and Axa, Europe’s biggest insurers, rallied 20 percent and 19 percent, respectively, the biggest gains in more than two years. Societe Generale (GLE) SA, France’s second-largest bank, and KBC Groep NV, Belgium’s biggest lender by market value, climbed more than 20 percent. Lundin Petroleum AB soared 44 percent after increasing its estimate of recoverable resources for an oil prospect. Luxury goods makers fell after a survey showed on Sept. 29 that most global investors predict Chinese growth will slow to less than 5 percent by 2016. LVMH Moet Hennessy Louis Vuitton SA (MC), the world’s biggest luxury goods company, slipped 5.5 percent. The company makes 25 percent of its revenue in Asia, according to Bloomberg data. Swatch Group AG (UHR), that watchmaker that makes 51 percent of its sales in Asia, slid 12 percent. A gauge of Chinese manufacturing shrank for a third month in September, the longest contraction since 2009, as measures of new orders and export demand declined. A reading of 49.9 for the purchasing managers’ index, released by HSBC Holdings Plc and Markit Economics yesterday, was unchanged from August and compared with a preliminary figure of 49.4.

U.K. stocks declined, with the S & P500 Index posting its biggest quarterly drop since 2008, after reports on Chinese manufacturing and German retail sales added to evidence that the economy is faltering.

According to the results of today's trading: Dow 10,913.38 -240.60 -2.16%, Nasdaq 2,415.40 -65.36 -2.63%, S & P 500 1,131.42 -28.98 -2.50%.

All sectors of the S & P finished the week in the red zone, dropping more than 1.3%. Maximum drop showed the sector of industrial products and conglomerates (to 3.4%), and the financial sector (-3.5%).

Company, most tied to economic growth, showed the biggest declines among all sectors of the S & P500. Alcoa Inc. fell by 4.9%, while General Electric Co. (GE) lost 4%. Micron Technology Inc (MU) fell 14%, showing the largest decline in the S & P, after reports of sudden loss from weak demand for personal computers. Ingersoll-Rand Plc (IR) has lost 12% after lowering its projected profit.

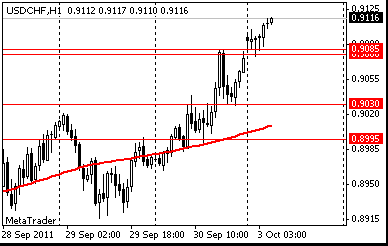

Resistance 2: Chf0.9180 (Sep 22 high)

Resistance 1: Chf0.9140 (Sep 26 high)

The current price: Chf0.9110

Support 1: Chf0.9080/85 (session low)

Support 2: Chf0.9030 (low of American session on Sep 30)

Support 3: Chf0.8995 (Sep 23 low)

Comments: the pair is on an uptrend. In focus support Chf0.9080/85

Resistance 2: Y77.45 (high of American session on Sep 7 )

Resistance 1: Y77.25 (session high)

The current price: Y77.00

Support 1:Y76.95 (session low)

Support 2:Y76.70 (low of American session on Sep 30)

Support 3:Y76.35 (Sep 28 low)

Comments: the pair is on an uptrend. The nearest resistance Y77.25.

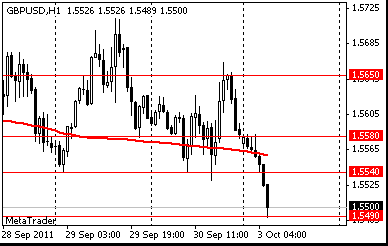

Resistance 2: $ 1.5580 (session high)

Resistance 1: $ 1.5540 (Sep 29-30 low)

The current price: $1.5500

Support 1 : $1.5490 (session high)

Support 2 : $1.5445 ( low of Asian session on Sep 22)

Support 3 : $1.5385 (low of American session on Sep 23)

Comments: the pair is on downtrend. The nearest resistance $1.5490

Resistance 2: $ 1.3410/15 (European session Sep 30 low)

Resistance 1: $ 1.3370 (session high)

The current price: $1.3315

Support 1 : $1.3520 (Jan 17-18 low)

Support 2 : $1.3130 (Jan 5 low)

Support 3 : $1.3020 (Jan 7 high)

Comments: the pair fell. The nearest resistance $1.3370.

00:00 China National Day Celebrations 0

07:15 Switzerland Retail Sales Y/Y August +1,9% +4,5%

07:30 Switzerland SVME PMI September 51,7 50,3

07:55 Germany Purchasing Manager Index Manufacturing September 50,0 50,0

08:00 Eurozone Purchasing Manager Index Manufacturing September 48,4 48,4

08:30 United Kingdom Purchasing Manager Index Manufacturing September 49,0 48,9

14:00 U.S. ISM Manufacturing September 50,6 50,5

14:00 U.S. Construction Spending, m/m September -1,3% -0,1%

21:00 New Zealand NBNZ Business Confidence Quarter III 27

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.