- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

The euro rose from a eight-month low versus the dollar after Federal Reserve Chairman Ben S. Bernanke said he’s ready to take additional steps to boost the economy, increasing bets the central bank may introduce further easing.

The 17-nation currency rose for the first time in three days against the greenback on speculation that the U.S. central bank may implement a third round of quantitative easing, which would debase its currency. The euro extended its gains and higher-yielding currencies rose as U.S. stocks erased losses. The Australian dollar declined to the least in more than a year versus the greenback after the Reserve Bank of Australia held its key rate at 4.75 percent.

The euro appreciated 1 percent to $1.3308 at 12:16 p.m. in New York, from $1.3176, after touching $1.3146, the weakest since Jan. 13. It rose 1.3 percent to 102.26 yen from 100.97 yen yesterday. It touched 100.76, the least since June 2001. The dollar rose 0.3 percent to 76.85 yen.

The euro traded at 27.9 on its 14-day relative strength index against the dollar, falling below 30 for a second day. It was at 29 on a similar index versus the yen. A reading below 30 signals that an asset may be due to reverse direction.

The franc fell against the euro amid speculation that the Swiss National Bank may adjust the cap set last month to further weaken the currency.

European stocks dropped for a third day, the longest losing streak in four weeks, as policy makers signaled they may renegotiate terms of Greece’s bailout, deepening concern about the impact of the debt crisis.

FTSE 100 4,944 -131.06 -2.58%, CAC 40 2,851 -76.28 -2.61% , DAX 5,217 -159.99 -2.98% Dexia SA (DEXB) tumbled to a record low as the board asked Belgium’s biggest bank by assets to solve its “structural problems.” Deutsche Bank AG (DBK) slid 4.3 percent after abandoning its 2011 earnings forecast. National Bank of Greece SA (ETE) sank to the lowest since 1996. Air France-KLM (AF) Group retreated to a 20- year low after the head of the IATA industry association said profit projections may be unsustainable.

Today, gold has shown a sharp decline against the backdrop of growing anxiety about the Greek debt crisis.

December futures traded in New York fell to $ 1613 per ounce and is currently traded at around $ 1624 per troy ounce.

U.S. stocks pared losses as the cheapest valuations for the Standard & Poor’s 500 Index since 2009 lured investors and Federal Reserve Chairman Ben S. Bernanke said he is ready to take more steps to boost growth.

Technology and consumer discretionary companies reversed early losses. Intel Corp. and Sears Holdings Corp. paced advances among the largest companies, rising at least 1.1 percent. AMR Corp. (AMR) surged 17 percent after analysts said the parent of American Airlines is unlikely to file for bankruptcy. Utility and telephone companies dropped more than 1.6 percent for the biggest declines among 10 groups in the S&P 500.

The S&P 500 slid 0.6 percent to 1,092.19 at 11:31 a.m. New York time, after losing as much as 2.2 percent. The Dow Jones Industrial Average fell 149.55 points, or 1.4 percent, to 10,505.75 today.

- 2% infl is essentially price stability, would blame most unemployment on the crisis.

- has no immed plans for QE3 but cant tell about the future.

Oil recovers from early losses today in trading in New York. The November crude oil futures on the New York Mercantile Exchange fell today to $ 74.95 a barrel. Currently, the November futures price is $ 77.67 per barrel.

Are sending messages, not telling govts what to do

- Going back to way it was not an option for banks

- Urges banks to put some of profits into capital

Offers seen at $1.3255/60, stronger at $1.3285/90. Currently the pair at $1.3241.

- ECB balance sheet grew less than half the pace of Fed;

- ECB cannot substitute for governments.

U.S. stock-index futures declined as Europe’s policy makers struggled to reassure investors they can contain the region’s debt crisis.

- expect inflation above 2% through 2011, then lower

- expect very moderate gdp growth in EMU in 2H

- September 3 pct HICP mostly due to oil

Data:

Euro reached an eight-month low versus the dollar before reports tomorrow that economists say will indicate a slowdown in the European economy.

European finance ministers meeting in Luxembourg considered “technical revisions” to a July deal that foresaw investors contributing 50 billion euros to a 159 billion-euro rescue.

The Dollar Index, which IntercontinentalExchange Inc. uses to track the greenback against the currencies of six major U.S. trading partners, reached 79.823 today, the highest level since Jan. 13, before settling at 79.647.

Goldman Sachs cut its global 2012 economic growth forecast, adding it expects a mild recession in Germany and France and a deeper downturn in the euro area’s periphery over the next few quarters.

Resistance 3: Chf0.9500 (Feb 22 high)

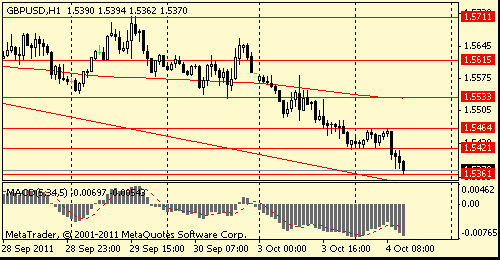

Resistance 3: $ 1.5530/40 (area of Sep 29-30 low and МА(200) for Н1)

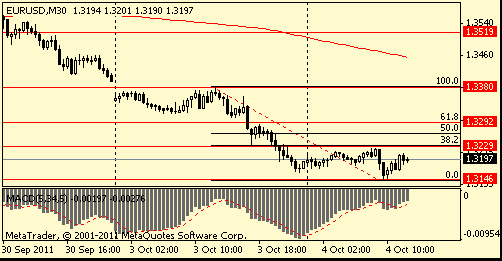

Resistance 3: $ 1.3380 (Oct 3 high)

- Must keep borrowing costs down

- Have had to deal with mountain of inherited debt

- Imagine downside if uk rate forced to rise

- UK deficit like Greece, borrowing costs like Germany

00:30 Australia Building Permits, m/m August 11.4%

00:30 Australia Building Permits, y/y August -5.5%

00:30 Australia Trade Balance August 3.1

01:30 Japan Labor Cash Earnings, YoY August -0.6%

03:30 Australia Announcement of the RBA decision on the discount rate 4,75%

05:30 Australia Commodity Prices, Y/Y September +26,6%

The euro touched the lowest level in more than a decade against the yen before reports that may indicate a slowdown in the European economy, spurring concern the region’s debt crisis is damping prospects of recovery.

The 17-nation currency reached an eight-month low versus the dollar after European governments signaled bondholders may have to take bigger losses on Greek debt.

The Australian dollar dropped to its lowest level in a year and bond yields tumbled as a policy statement by the central bank suggested that an easing of inflation pressures may pave the way for an interest-rate cut.

The so-called Australian dollar slid for a third day against the yen as traders priced in an 82 percent chance the Reserve Bank of Australia will cut interest rates by half a percentage point to 4.25 percent by November.

New Zealand’s currency rose for the first time in five days against Japan’s as trading charts signaled its recent drop has been too rapid and after officials in the Asian nation showed concern about the yen’s strength.

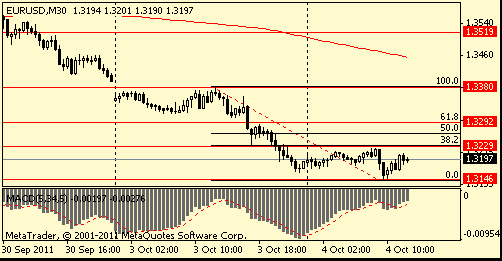

EUR/USD: on asian session the pair fell

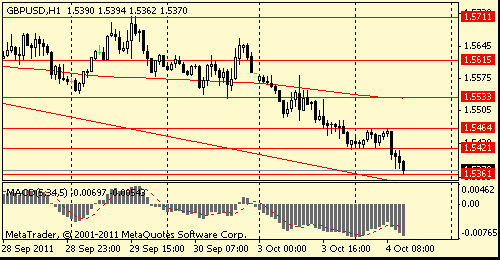

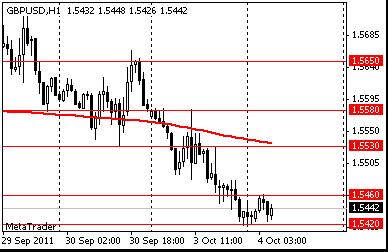

GBP/USD: on asian session the pair fell

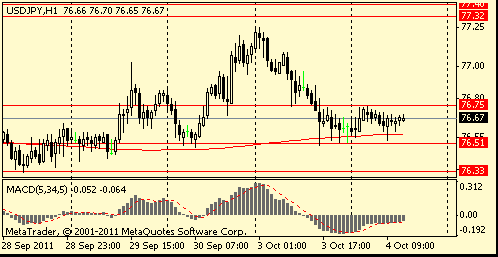

USD/JPY: the pair fell.

Focus today Eurogroup meeting. This morning's data is dominated by the releases of the European manufacturing PMI data. Germany at

0753GMT and the eurozone combined at 0758GMT.

Hang Seng 16,611 -210.77 -1.25%

S&P/ASX 3,872 -24.92 -0.64%

Shanghai Composite closed

The yen rose against all its major counterparts as Japan’s biggest manufacturers remained below levels seen before a record earthquake in March. The yen climbed against the dollar after the Bank of Japan said today its quarterly Tankan index of sentiment increased to 2 in September from minus 9 in June.

The pound fell against all its major counterparts excluding the South Korean won as traders judged a surprise increase in U.K. manufacturing as insufficient to keep the Bank of England from providing further stimulus for the economy.

EUR/USD: the pair decreased on Monday's session and showed new low.

GBP/USD: the pair decreased on Monday's session.

USD/JPY: during Monday's session the pair dropped.

Tuesday's European data calendar kicks off at 0700GMT, with the release of Spanish September unemployment. This is followed at 0800GMT, with the release of Spain's September consumer confidence and German August VDMA new machinery orders. Further European data is expected at 0900GMT, with the release of the EMU August PPI data.

Asian stocks fell, extending the regional benchmark index’s biggest quarterly decline in almost three years, after U.S. consumer spending slowed as incomes unexpectedly dropped, souring the earnings outlook for exporters. The MSCI Asia Pacific Index fell 2.7 percent to 110.10 as of 5:38 p.m. in Mumbai, ahead of a meeting of European finance ministers to weigh the threat of a Greek default. About seven stocks fell for each that rose in the gauge and all 10 industry groups declined. The gauge has dropped 20 percent this year amid concern the global economy is poised for another recession as Europe’s debt crisis worsens and U.S. economic growth slows.

Sony Corp. (6758) plunged as much as 6.2 percent in Tokyo, touching its lowest price in 24 years. Toyota Motor Corp. (7203), the world’s largest carmaker, fell 2 percent. James Hardie Industries SE (JHX), a building-materials supplier that gets almost 70 percent of its sales from the U.S., sank 3.5 percent in Sydney. BHP Billiton Ltd. (BHP), the world’s No. 1 mining company, dropped 2.5 percent after oil and metal prices slid. HSBC Holdings Plc (HSBA), Europe’s biggest lender, led banking stocks lower.

Japan’s Nikkei 225 Stock Average fell 1.8 percent after the Bank of Japan’s quarterly Tankan index showed that sentiment among Japan’s largest manufacturers remains worse than before the March earthquake. Australia’s S&P/ASX 200 slumped 2.8 percent as a gauge of Australian manufacturing fell for a third month in September.

Hong Kong’s Hang Seng Index plunged 4.4 percent, led by Ping An Insurance Group Co., China’s No. 2 insurance company by market value, amid signs China’s economic growth is slowing. Financial markets in China and South Korea are closed for holidays today.European stocks fell for a second day, extending losses from the Stoxx Europe 600 Index’s biggest quarterly drop since 2008, as concern deepened the region’s debt crisis will curb growth.

National benchmark indexes retreated in all 18 western European markets, except for Ireland. Germany’s DAX slumped 2.3 percent, France’s CAC 40 declined 1.9 percent and the U.K.’s FTSE 100 lost 1 percent.

FTSE 100 5,076 -52.98 -1.03%, CAC 40 2,927 -55.13 -1.85%, DAX 5,377 -125.32 -2.28%

BHP Billiton Ltd. (BHP) and Rio Tinto Group, the world’s biggest mining companies, declined more than 1.5 percent as copper tumbled to a 14-month low in London. Commerzbank AG (CBK) and Societe Generale SA led losses in banking shares. Bayerische Motoren Werke AG (BMW) sank to a one-year low.U.S. stocks tumbled, sending the Standard & Poor’s 500 Index to a one-year low, as concern over the Greek debt crisis and Bank of America Corp.’s slump offset a rebound in manufacturing and construction spending.

According to the results of today's trading: Dow 10,653.64 -259.74 -2.38%, Nasdaq 2,335.83 -79.57 -3.29%, S&P 500 1,099.23 -32.19 -2.85%

The S&P 500 lost 2.9 percent to 1,099.23 at 4 p.m. New York time, its lowest close since Sept. 8, 2010. The Dow Jones Industrial Average declined 258.08 points, or 2.4 percent, to 10,655.30, also the lowest level in more than a year. Financial shares had the biggest drop in the S&P 500 as Bank of America fell 9.6 percent to the lowest level since March 2009. Citigroup Inc. (C) slumped 9.8 percent to $23.11. The bank may be penalized by regulators in Japan for the third time since 2004 after its Japanese retail banking unit possibly breached rules by failing to fully explain product risk to customers, two people familiar with the situation said. Alcoa Inc. (AA) fell 7 percent amid concern about slower demand for commodities. American Airlines parent AMR Corp. (AMR) slid 33 percent on concern the U.S. is nearing a return to recession and that the carrier may be forced to seek bankruptcy protection.

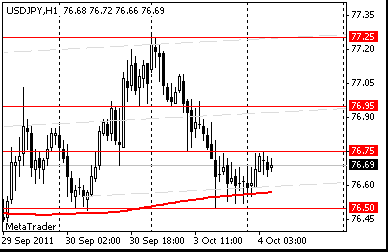

Resistance 2: Y76.95 (Sep 27 high)

Resistance 1: Y76.75 (session high)

The current price: Y76.70

Support 1:Y76.50 (session low)

Support 2:Y76.10/15 (area of Sep 21-22 low)

Support 3: Y75.90 (area of a historical low)

Comments: the pair holds in range Y76.50/75.

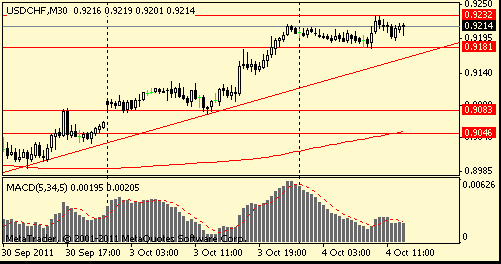

Resistance 2: Chf0.9270 (Mar 30 high)

Resistance 1: Chf0.9215 (session high)

The current price: Chf0.9199

Support 1: Chf0.9185 (session low)

Support 2: Chf0.9140 (Sep 26 high)

Support 3: Chf0.9080/85 (Oct 3 low)

Comments: the pair is on an uptrend. In focus support Chf0.9185.

Resistance 2: $ 1.5530 (MA (200) H1)

Resistance 1: $ 1.5460 (session high)

The current price: $1.5435

Support 1 : $1.5420 (session low)

Support 2 : $1.5385 (area of Sep 23 low)

Support 3 : $1.5330 (Sep 22 low)

Comments: the pair is on an downtrend The nearest resistance $1.5460.

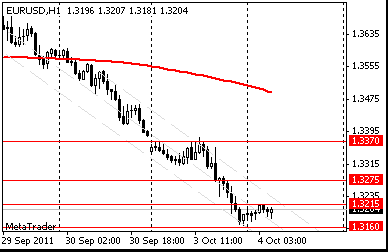

Resistance 2: $ 1.3275 (Dec 28’2010 high)

Resistance 1: $ 1.3215 (session high)

The current price: $1.3185

Support 1 : $1.3160 (session low)

Support 2 : $1.3130 (Jan 5 low)

Support 3 : $1.3020 (Jan 7 high)

Comments: the pair fell. The nearest resistance $1.3215..

Nikkei 225 8,545 -154.81 -1.78%

Hang Seng 16,822 -770.26 -4.38%

S&P/ASX 200 3,897 -111.58 -2.78%

Shanghai Composite 2,359 -6.12 -0.26%

FTSE 100 5,076 -52.98 -1.03%

CAC 40 2,927 -55.13 -1.85%

DAX 5,377 -125.32 -2.28%

Dow 10,653.64 -259.74 -2.38%

Nasdaq 2,335.83 -79.57 -3.29%

S&P 500 1,099.23 -32.19 -2.85%

10 Year Yield 1.79% -0.14 --

Oil $76.50 -1.11 -1.43%

Gold $1,658.50 +0.80 +0.05%

00:30 Australia Building Permits, m/m August +1,0% +1,1%

00:30 Australia Building Permits, y/y August -15,0% -15,1%

00:30 Australia Trade Balance August 1,83 2,14

01:30 Japan Labor Cash Earnings, YoY August -0,1% +0,7%

03:30 Australia Announcement of the RBA decision on the discount rate 0 4,75% 4,75%

05:30 Australia Commodity Prices, Y/Y September +25.2%

07:00 United Kingdom Halifax house price index September -1.2% +0.2%

07:00 United Kingdom Halifax house price index 3m Y/Y September -2.6% -2.1%

08:30 United Kingdom PMI Construction September 52.6 51.7

08:30 United Kingdom MPC Member Miles Speaks 0

09:00 Eurozone ECOFIN Meetings 0

09:00 Eurozone Producer Price Index (YoY) August +0,5% -0,3%

09:00 Eurozone Producer Price Index (YoY) August +6,1% +5,7%

13:00 Eurozone ECB Trichet's Speech 0

13:00 U.S. FOMC Member Raskin Speaks 0

14:00 U.S. Fed Chairman Bernanke Testifies 0

14:00 U.S. Factory Orders August +2,4% +0,2%

22:30 Australia AIG Services Index September 52,1

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.