- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

The U.S. dollar traded mixed to lower against the most major currencies after the mixed U.S. labour market data. The U.S. economy added 142,000 jobs in August, missing expectations for a rise of 222,000 jobs, after a gain of 212,000 jobs in July. July's figure was revised up from a gain of 209,000 jobs.

That was the slowest pace in 2014.

The U.S. unemployment rate declined to 6.1% in August from 6.2% in July, in line with expectations.

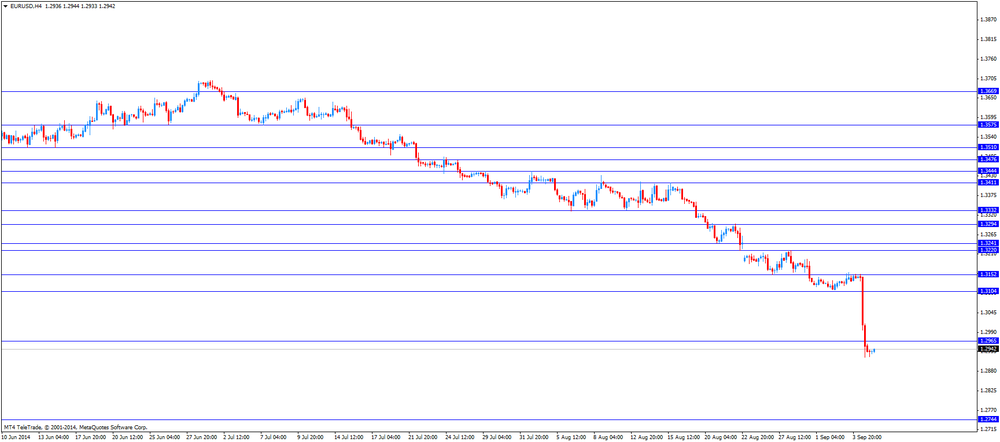

The euro traded mixed against the U.S. dollar. The European Central Bank's (ECB) interest rate cut to 0.05% from 0.15% still weighed on the Euro.

Eurozone's gross domestic product (GDP) was flat in the second quarter, in line with expectations.

On a yearly basis, Eurozone's GDP rose 0.7% in the second quarter, in line with expectations.

German industrial production climbed 1.9% in July, exceeding expectations for a 0.5% gain, after a 0.4% rise in June. June's figure was revised up from a 0.3% increase.

The British pound traded mixed against the U.S. dollar. The Bank of England's interest rate decision weighed on the pound. The Bank of England (BoE) kept its interest rates unchanged at 0.5% and its asset purchase program unchanged at £375 billion.

Consumer inflation expectations for the coming year in the UK climbed to 2.8% from 2.6% in May.

The Canadian dollar traded mixed against the U.S. dollar after the weaker-than-expected Canadian labour market data. Canada's unemployment rate remained unchanged at 7.0% in August, in line with expectations.

Canadian economy lost 11,000 net jobs in August, missing forecasts of an increase of 10,300 jobs, after a rise of 41,700 jobs in July.

Canada's Ivey purchasing managers' index dropped to 50.9 in August from 54.1 in July, missing expectations for an increase to 55.7.

The Swiss franc traded mixed against the U.S. dollar. Foreign currency reserves of the Swiss National Bank increased to 453.799 billion Swiss francs in August from 453.353 billion Swiss francs in July. July's figure was revised down from 453.391 billion Swiss francs.

The New Zealand dollar traded higher against the U.S dollar in the absence of any major economic reports from New Zealand.

New Zealand's Finance Minister Bill English said in an interview today that he expects the kiwi to decline further as the U.S. economy recovers.

The Australian dollar traded higher against the U.S. dollar after the mixed U.S. labour market data.

The AiG Performance of Construction Index rose to 55 in August from 52.6 in July.

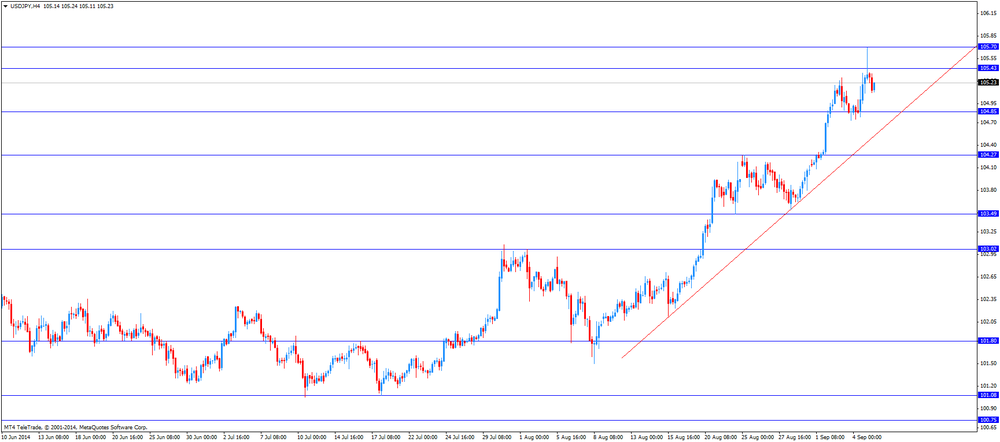

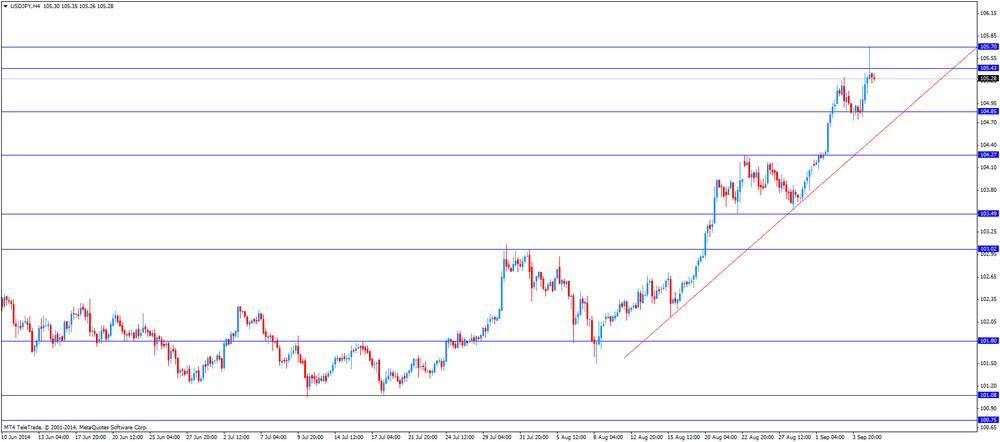

The Japanese yen traded higher against the U.S. dollar. Japan's leading economic index increased to 106.5 in July from 105.5 in June, missing expectations for a rise to 107.2.

Japan's coincident index slightly rose to 109.9 in July from 109.7 in June.

The U.S. Labor Department released the labour market data today. The U.S. economy added 142,000 jobs in August, missing expectations for a rise of 222,000 jobs, after a gain of 212,000 jobs in July. July's figure was revised up from a gain of 209,000 jobs.

That was the slowest pace in 2014.

The U.S. unemployment rate declined to 6.1% in August from 6.2% in July, in line with expectations.

Statistics Canada released the labour market data today. Canada's unemployment rate remained unchanged at 7.0% in August, in line with expectations.

Canadian economy lost 11,000 net jobs in August, missing forecasts of an increase of 10,300 jobs, after a rise of 41,700 jobs in July.

Employment in Canada rose by 81,000 positions compared to a year ago, mostly in part-time job.

Canada's private-sector lost 111,800 jobs in August. That was the largest one-month fall.

EUR/USD $1.3100 (E1bn), $1.3150(E419mn), $1.3185(E257mn), $1.3200(E940mn)

EUR/GBP stg0.7900(E252mn)

USD/JPY Y104.15($565mn), Y104.70($445mn), Y105.50($485mn)

USD/CAD C$1.0825($925mn), C$1.0880($230mn), C$1.0900($731mn), C$1.0940($386mn), C$1.0945($275mn), C$1.0950($245mn)

AUD/USD $0.9350(A$316mn

NZD/USD $0.8350(NZ$150mn)

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:15 U.S. FOMC Member Richard Fisher Speaks

01:00 U.S. FOMC Member Narayana Kocherlakota

05:00 Japan Leading Economic Index July 105.5 107.2 106.5

05:00 Japan Coincident Index July 109.7 109.9

05:00 Japan BoJ monthly economic report

06:00 Germany Industrial Production s.a. (MoM) July +0.3% +0.5% +1.9%

06:00 Germany Industrial Production (YoY) July -0.5% +2.5%

07:00 Switzerland Foreign Currency Reserves August 453.4 453.8

08:30 United Kingdom Consumer Inflation Expectations Quarter III +2.6% +2.8%

09:00 Eurozone GDP (QoQ) (Finally) Quarter II 0.0% 0.0% 0.0%

09:00 Eurozone GDP (YoY) (Finally) Quarter II +0.7% +0.7% +0.7%

The U.S. dollar traded mixed to lower against the most major currencies ahead of the U.S. labour market data. The U.S. unemployment rate is expected to decline to 6.1% in August from 6.2% in July.

U.S. companies are expected to add 222,000 jobs in August.

The euro traded slightly higher against the U.S. dollar. The European Central Bank's (ECB) interest rate cut to 0.05% from 0.15% still weighed on the Euro.

Eurozone's gross domestic product (GDP) was flat in the second quarter, in line with expectations.

On a yearly basis, Eurozone's GDP rose 0.7% in the second quarter, in line with expectations.

German industrial production climbed 1.9% in July, exceeding expectations for a 0.5% gain, after a 0.4% rise in June. June's figure was revised up from a 0.3% increase.

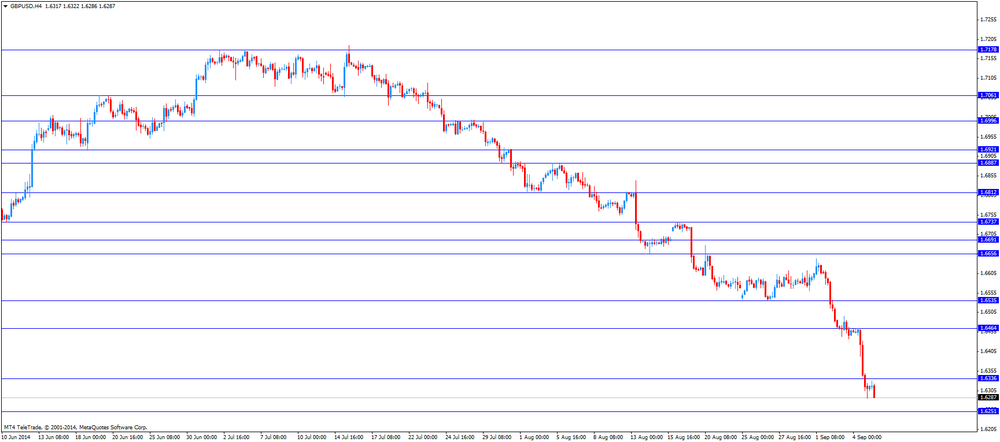

The British pound traded lower against the U.S. dollar. The Bank of England's interest rate decision weighed on the pound. The Bank of England (BoE) kept its interest rates unchanged at 0.5% and its asset purchase program unchanged at £375 billion.

Consumer inflation expectations for the coming year in the UK climbed to 2.8% from 2.6% in May.

The Canadian dollar traded mixed against the U.S. dollar ahead of Canadian labour market data. Canadian unemployment rate is expected to remain unchanged at 7.0% in August.

Canada's economy is expected to add 10,300 jobs in August.

The Swiss franc traded slightly higher against the U.S. dollar. Foreign currency reserves of the Swiss National Bank increased to 453.799 billion Swiss francs in August from 453.353 billion Swiss francs in July. July's figure was revised down from 453.391 billion Swiss francs.

EUR/USD: the currency pair rose to $1.2964

GBP/USD: the currency pair fell to $1.6286

USD/JPY: the currency pair decreased to Y105.10

The most important news that are expected (GMT0):

12:30 Canada Employment August 41.7 10.3

12:30 Canada Unemployment rate August 7.0% 7.0%

12:30 U.S. Average hourly earnings August 0.0% +0.2%

12:30 U.S. Unemployment Rate August 6.2% 6.1%

12:30 U.S. Nonfarm Payrolls August 209 222

14:00 Canada Ivey Purchasing Managers Index August 54.1 55.7

EUR/USD

Offers $1.3220, $1.3200, $1.3160, $1.3090, $1.3000

Bids $1.2900, $1.2810, $1.2750/45

GBP/USD

Offers $1.6535, $1.6500, $1.6465, $1.6400, $1.6380

Bids $1.6280, $1.6250, 1.6220, 1.6200

AUD/USD

Offers $0.9415/20, $0.9400, $0.9390

Bids $0.9330, $0.9300, $0.9260, $0.9250, $0.9235

EUR/JPY

Offers Y138.30, Y138.00, Y137.10

Bids Y135.95, Y135.70, Y135.00

USD/JPY

Offers Y106.00, Y105.70

Bids Y104.70, Y104.30, Y104.00, Y103.80, Y103.50, Y103.20

EUR/GBP

Offers stg0.8035, stg0.8015, stg0.7995

Bids stg0.7890, stg0.7850, stg0.7820, stg0.7800

EUR/USD $1.3100 (E1bn), $1.3150(E419mn), $1.3185(E257mn), $1.3200(E940mn)

EUR/GBP stg0.7900(E252mn)

USD/JPY Y104.15($565mn), Y104.70($445mn), Y105.50($485mn)

USD/CAD C$1.0825($925mn), C$1.0880($230mn), C$1.0900($731mn), C$1.0940($386mn), C$1.0945($275mn), C$1.0950($245mn)

AUD/USD $0.9350(A$316mn

NZD/USD $0.8350(NZ$150mn)

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:15 U.S. FOMC Member Richard Fisher Speaks

01:00 U.S. FOMC Member Narayana Kocherlakota

05:00 Japan Leading Economic Index July 105.5 107.2 106.5

05:00 Japan Coincident Index July 109.7 109.9

05:00 Japan BoJ monthly economic report

06:00 Germany Industrial Production s.a. (MoM) July +0.3% +0.5% +1.9%

06:00 Germany Industrial Production (YoY) July -0.5% +2.5%

07:00 Switzerland Foreign Currency Reserves August 453.4 453.8

08:30 United Kingdom Consumer Inflation Expectations Quarter III +2.6% +2.8%

The U.S. dollar traded mixed against the most major currencies. The greenback climbed yesterday as European Central Bank (ECB) lowered its interest rate. The central bank also cut its deposit facility rate to -0.20% from -0.10% and its marginal lending rate to 0.30% from 0.40%.

The ECB President Mario Draghi said the central bank will start buying asset-backed securities, including covered bonds. Details of the asset-backed securities (ABS) program will be announced later.

The Fed Governor Jerome Powell said the U.S. labour market has "improved substantially".

The New Zealand dollar traded mixed against the U.S dollar in the absence of any major economic reports from New Zealand. The kiwi declined against the U.S dollar yesterday as the European Central Bank cut its interest rate.

New Zealand's Finance Minister Bill English said in an interview today that he expects the kiwi to decline further as the U.S. economy recovers.

The Australian dollar traded mixed against the U.S. dollar. The ECB's interest rate cut weighed on the Aussie.

The AiG Performance of Construction Index rose to 55 in August from 52.6 in July.

The Japanese yen traded mixed against the U.S. dollar. Japan's leading economic index increased to 106.5 in July from 105.5 in June, missing expectations for a rise to 107.2.

Japan's coincident index slightly rose to 109.9 in July from 109.7 in June.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 Canada Employment August 41.7 10.3

12:30 Canada Unemployment rate August 7.0% 7.0%

12:30 U.S. Average hourly earnings August 0.0% +0.2%

12:30 U.S. Unemployment Rate August 6.2% 6.1%

12:30 U.S. Nonfarm Payrolls August 209 222

14:00 Canada Ivey Purchasing Managers Index August 54.1 55.7

EUR / USD

Resistance levels (open interest**, contracts)

$1.3055 (2706)

$1.3012 (1461)

$1.2978 (765)

Price at time of writing this review: $ 1.2932

Support levels (open interest**, contracts):

$1.2910 (1512)

$1.2883 (1813)

$1.2845 (993)

Comments:

- Overall open interest on the CALL options with the expiration date September, 5 is 91348 contracts, with the maximum number of contracts with strike price $1,3200 (11439);

- Overall open interest on the PUT options with the expiration date September, 5 is 61145 contracts, with the maximum number of contracts with strike price $1,3100 (5617);

- The ratio of PUT/CALL was 0.67 versus 0.75 from the previous trading day according to data from September, 4

GBP/USD

Resistance levels (open interest**, contracts)

$1.6600 (1094)

$1.6500 (1016)

$1.6401 (245)

Price at time of writing this review: $1.6308

Support levels (open interest**, contracts):

$1.6200 (395)

$1.6100 (183)

$1.6000 (461)

Comments:

- Overall open interest on the CALL options with the expiration date September, 5 is 33512 contracts, with the maximum number of contracts with strike price $1,7000 (2760);

- Overall open interest on the PUT options with the expiration date September, 5 is 31846 contracts, with the maximum number of contracts with strike price $1,6800 (3478);

- The ratio of PUT/CALL was 0.95 versus 1.07 from the previous trading day according to data from September, 4

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.