- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2939 +0,31%

GBP/USD $1,6104 +0,07%

USD/CHF Chf0,9326 -0,26%

USD/JPY Y106,20 +0,23%

EUR/JPY Y137,42 +0,54%

GBP/JPY Y171,02 +0,30%

AUD/USD $0,9203 -0,81%

NZD/USD $0,8245 -0,39%

USD/CAD C$1,0981 +0,02%

(time / country / index / period / previous value / forecast)

00:30 Australia Westpac Consumer Confidence September +3.8%

02:00 China New Loans August 385 710

05:30 France Non-Farm Payrolls Quarter II +0.1% +0.1%

06:45 France Industrial Production, m/m July +1.3% -0.4%

06:45 France Industrial Production, y/y July -0.4%

13:45 United Kingdom Inflation Report Hearings

14:00 U.S. Wholesale Inventories July +0.3% +0.5%

14:30 U.S. Crude Oil Inventories September -0.9

21:00 New Zealand RBNZ Interest Rate Decision 3.50% 3.50%

21:00 New Zealand RBNZ Rate Statement

21:00 New Zealand RBNZ Press Conference

23:01 United Kingdom RICS House Price Balance August 49% 47%

23:50 Japan BSI Manufacturing Index Quarter III -13.9% -10.3%

The U.S. dollar traded mixed against the most major currencies. The greenback remained supported by yesterday's San Francisco Federal Reserve research report. The report showed that investors were underestimating the start of interest rate hike by the Fed. The Fed could raise its interest rate sooner than expected.

The U.S. Bureau of Labor Statistics released the Job Openings and Labor Turnover Survey (JOLTS) report on Tuesday. Job openings in the U.S. declined to 4.673 million in July from a revised reading of 4.675 million in June, missing expectations for an increase to 4.705 million.

The euro traded higher against the U.S. dollar. The European Central Bank's interest rate cut still weighed on the euro.

France's trade deficit fell to €5.5 billion in July from a deficit of €5.6 billion in June, missing expectations for a decline to a deficit of €5.0 billion. June's figure was revised down from a deficit of €5.4 billion.

The British pound traded mixed against the U.S. dollar after the mixed U.K. economic data. The U.K. trade deficit rose to £10.19 billion in July from £9.41 billion in June. Analysts had expected the trade deficit to decline to £9.10 billion.

The U.K. manufacturing production climbed 0.3% in July, in line with expectations, after a 0.3% rise in June.

The U.K. industrial production rose 0.5% in July, exceeding expectations for a 0.2% rise, after 0.3% gain in June.

The National Institute of Economic and Social Research (NIESR) released its estimated gross domestic product (GDP) today. The estimated UK GDP grew by 0.6% in the three months to August, after a 0.5% growth from May to July, which figure was revised down from a 0.6% rise.

The Bank of England (BoE) Governor Mark Carney said at the TUC's annual meeting that the BoE could start to hike its interest rates next spring.

A weekend Scotland's independence poll still weighed on the pound. The poll showed 47% said "yes" to independence, while 45% said "no", with the rest undecided. That was the first time lead for "yes" campaign.

The Canadian dollar dropped against the U.S. dollar after the weaker-than-expected Canadian housing starts. Housing starts in Canada declined to 192,400 units in August from 199,800 units in July, missing expectations for a drop to 197,000 units.

The New Zealand dollar traded slightly lower against the U.S dollar in the absence of any major economic reports from New Zealand.

The Australian dollar traded lower against the U.S. dollar after the weaker-than-expected economic data from Australia. The National Australia Bank's business confidence index declined to 8 in August from 11 in July.

Home loans in Australia climbed 0.3% in July, missing expectations for a 1.1% rise, after a 0.1% increase. June's figure was revised down from a 0.2% gain.

The Japanese yen traded mixed against the U.S. dollar. Japan's tertiary industry index remained flat in July, beating forecasts for a 0.3% decline. June's figure was revised up from a 0.1% decrease.

Japan's Cabinet Office released its consumer confidence index for Japan. The index fell to 41.2 in August from 41.5 in July, missing expectations for a rise to 42.3.

Preliminary machine tool orders in Japan rose 35.6% in august, after a 37.7% gain July.

The Bank of Japan (BoJ) released its minutes from the August meeting. The BoJ said the Japan's economy has continued its moderate recovery as a trend. Japan's central bank added that "it was important to accurately gauge the underlying trend in prices".

The Bank of England (BoE) Governor Mark Carney said at the TUC's annual meeting that the BoE could start to hike its interest rates next spring. He added that the central bank expects real wages to rise around the middle of next year.

The BoE governor said "the recovery has exceeded all expectations".

Mr. Carney reiterated that the timing of interest rate hike "will depend on the data". But he did not expect interest rate to rise to levels before recession.

EUR/USD: $1.2850(E520mn), $1.2900(E221mn), $1.3000-25(E400mn), $1.3050(E291mn)

USD/JPY: Y105.00($848mn), Y105.15($450mn), Y105.50($570mn)

GBP/USD: $1.6165(stg127mn)

EUR/GBP: stg0.7950(E321mn), stg0.8000(E235mn)

AUD/USD: $0.9275(A$200mn), $0.9290(A$288mn), $0.9300(A$110mn), $0.9325(A$268mn)

NZD/USD: $0.8195(NZ$295mn), $0.8400(NZ$200mn)

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia National Australia Bank's Business Confidence August 11 8

01:30 Australia Home Loans July +0.1% +1.1% +0.3%

05:00 Japan Consumer Confidence August 41.5 42.3 41.2

06:00 Japan Prelim Machine Tool Orders, y/y August +37.7% +35.6%

06:45 France Trade Balance, bln July -5.6 Revised From -5.4 -5.0 -5.5

08:30 United Kingdom Industrial Production (MoM) July +0.3% +0.2% +0.5%

08:30 United Kingdom Industrial Production (YoY) July +1.2% +1.3% +1.7%

08:30 United Kingdom Manufacturing Production (MoM) July +0.3% +0.3% +0.3%

08:30 United Kingdom Manufacturing Production (YoY) July +1.9% +2.2% +2.2%

08:30 United Kingdom Trade in goods July -9.4 -9.1 -10.2

10:45United Kingdom BOE Gov Mark Carney Speaks

The U.S. dollar traded mixed to lower against the most major currencies. The greenback remained supported by yesterday's San Francisco Federal Reserve research report. The report showed that investors were underestimating the start of interest rate hike by the Fed. The Fed could raise its interest rate sooner than expected.

The euro traded mixed against the U.S. dollar. France's trade deficit fell to €5.5 billion in July from a deficit of €5.6 billion in June, missing expectations for a decline to a deficit of €5.0 billion. June's figure was revised down from a deficit of €5.4 billion.

The British pound traded mixed against the U.S. dollar after the mixed U.K. economic data. The U.K. trade deficit rose to £10.19 billion in July from £9.41 billion in June. Analysts had expected the trade deficit to decline to £9.10 billion.

The U.K. manufacturing production climbed 0.3% in July, in line with expectations, after a 0.3% rise in June.

The U.K. industrial production rose 0.5% in July, exceeding expectations for a 0.2% rise, after 0.3% gain in June.

The Bank of England (BoE) Governor Mark Carney said at the TUC's annual meeting that the BoE could start to hike its interest rates next spring.

A weekend Scotland's independence poll still weighed on the pound. The poll showed 47% said "yes" to independence, while 45% said "no", with the rest undecided. That was the first time lead for "yes" campaign.

The Canadian dollar traded slightly higher against the U.S. dollar ahead of Canadian housing starts. Housing starts are expected to increase to 197,000 units in August.

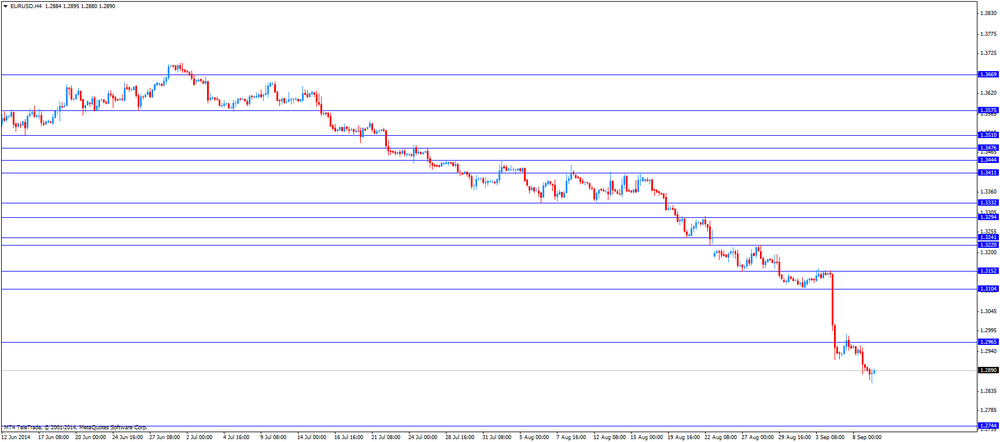

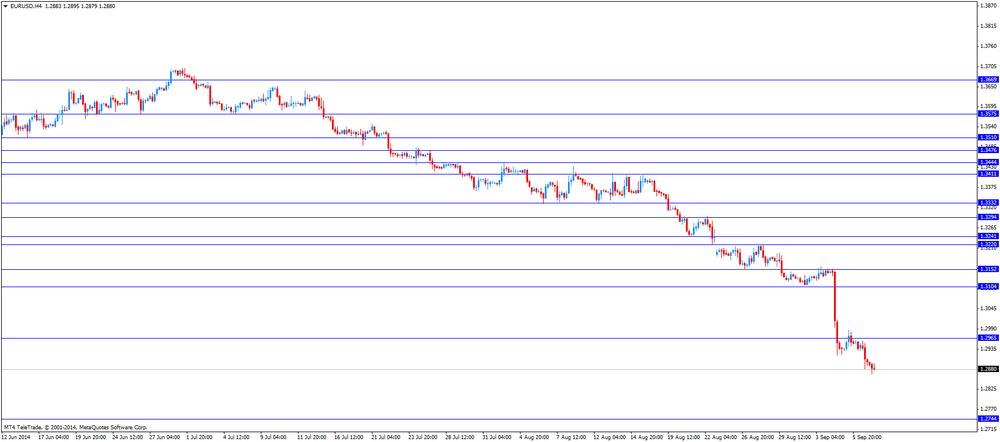

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair traded mixed

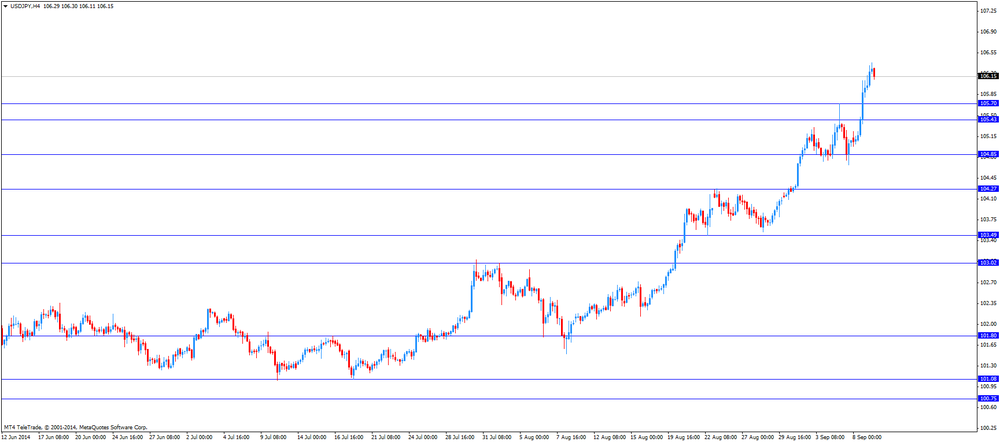

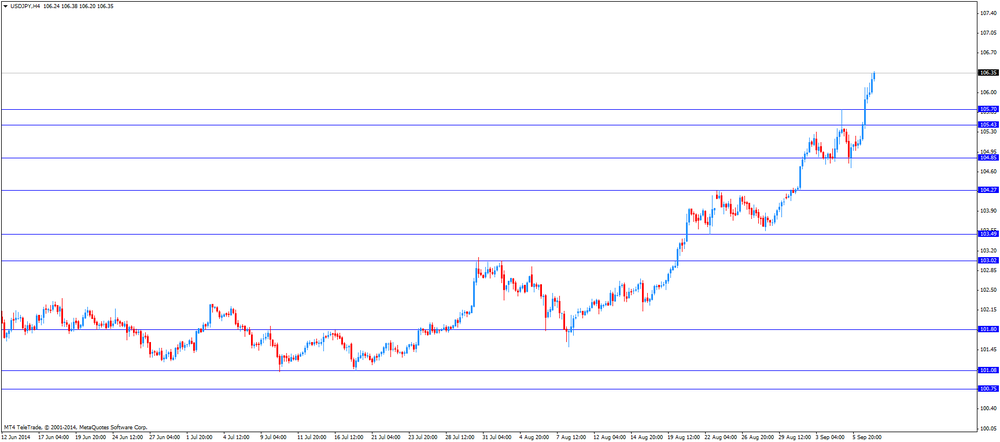

USD/JPY: the currency pair fell to Y106.11

The most important news that are expected (GMT0):

12:15 Canada Housing Starts August 200 197

14:00 United Kingdom NIESR GDP Estimate August +0.6%

14:00 U.S. JOLTs Job Openings July 4.67 4.72

14:00 U.S. FOMC Member Tarullo Speaks

23:50 Japan Core Machinery Orders July +8.8% +4.1%

23:50 Japan Core Machinery Orders, y/y July -3.0% +0.6%

EUR/USD

Offers $1.3050, $1.3000/10, $1.2920/25

Bids $1.2850-40, $1.2800

GBP/USD

Offers $1.6250/55

Bids $1.6050, 1.6000

AUD/USD

Offers $0.9375/80, $0.9350, $0.9300

Bids $0.9255/50, $0.9220/00, $0.9150

EUR/JPY

Offers Y138.25/30, Y138.00, Y137.50, Y137.20

Bids Y136.50, Y136.20, Y136.05/00

USD/JPY

Offers Y108.00, Y107.50, Y107.00, Y106.60/80, Y106.50

Bids Y105.50, Y105.20, Y105.00

EUR/GBP

Offers stg0.8100, stg0.8040

Bids stg0.7900

EUR/USD: $1.2850(E520mn), $1.2900(E221mn), $1.3000-25(E400mn), $1.3050(E291mn)

USD/JPY: Y105.00($848mn), Y105.15($450mn), Y105.50($570mn)

GBP/USD: $1.6165(stg127mn)

EUR/GBP: stg0.7950(E321mn), stg0.8000(E235mn)

AUD/USD: $0.9275(A$200mn), $0.9290(A$288mn), $0.9300(A$110mn), $0.9325(A$268mn)

NZD/USD: $0.8195(NZ$295mn), $0.8400(NZ$200mn)

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia National Australia Bank's Business Confidence August 11 8

01:30 Australia Home Loans July +0.1% +1.1% +0.3%

05:00 Japan Consumer Confidence August 41.5 42.3 41.2

06:00 Japan Prelim Machine Tool Orders, y/y August +37.7% +35.6%

06:45 France Trade Balance, bln July -5.6 Revised From -5.4 -5.0 -5.5

08:30 United Kingdom Industrial Production (MoM) July +0.3% +0.2% +0.5%

08:30 United Kingdom Industrial Production (YoY) July +1.2% +1.3% +1.7%

08:30 United Kingdom Manufacturing Production (MoM) July +0.3% +0.3% +0.3%

08:30 United Kingdom Manufacturing Production (YoY) July +1.9% +2.2% +2.2%

08:30 United Kingdom Trade in goods July -9.4 -9.1 -10.2

The U.S. dollar traded higher against the most major currencies due to yesterday's San Francisco Federal Reserve research report. The report showed that investors were underestimating the start of interest rate hike by the Fed. The Fed could raise its interest rate sooner than expected.

The New Zealand dollar traded lower against the U.S dollar in the absence of any major economic reports from New Zealand.

The Australian dollar fell against the U.S. dollar after the weaker-than-expected economic data from Australia. The National Australia Bank's business confidence index declined to 8 in August from 11 in July.

Home loans in Australia climbed 0.3% in July, missing expectations for a 1.1% rise, after a 0.1% increase. June's figure was revised down from a 0.2% gain.

The Japanese yen dropped against the U.S. dollar after the mixed economic data from Japan and due to the stronger U.S. dollar. Japan's tertiary industry index remained flat in July, beating forecasts for a 0.3% decline. June's figure was revised up from a 0.1% decrease.

Japan's Cabinet Office released its consumer confidence index for Japan. The index fell to 41.2 in August from 41.5 in July, missing expectations for a rise to 42.3.

Preliminary machine tool orders in Japan rose 35.6% in august, after a 37.7% gain July.

The Bank of Japan (BoJ) released its minutes from the August meeting. The BoJ said the Japan's economy has continued its moderate recovery as a trend. Japan's central bank added that "it was important to accurately gauge the underlying trend in prices".

EUR/USD: the currency pair fell to $1.2866

GBP/USD: the currency pair decreased to $1.6063

USD/JPY: the currency pair rose Y106.34

The most important news that are expected (GMT0):

10:45 United Kingdom BOE Gov Mark Carney Speaks

12:15 Canada Housing Starts August 200 197

14:00 United Kingdom NIESR GDP Estimate August +0.6%

14:00 U.S. JOLTs Job Openings July 4.67 4.72

14:00 U.S. FOMC Member Tarullo Speaks

23:50 Japan Core Machinery Orders July +8.8% +4.1%

23:50 Japan Core Machinery Orders, y/y July -3.0% +0.6%

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.