- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

(pare/closed(GMT +2)/change, %)

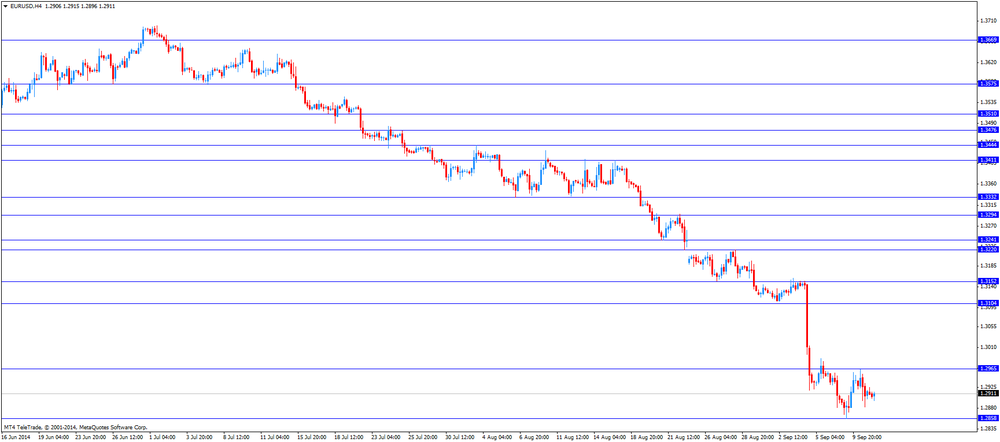

EUR/USD $1,2923 +0,06%

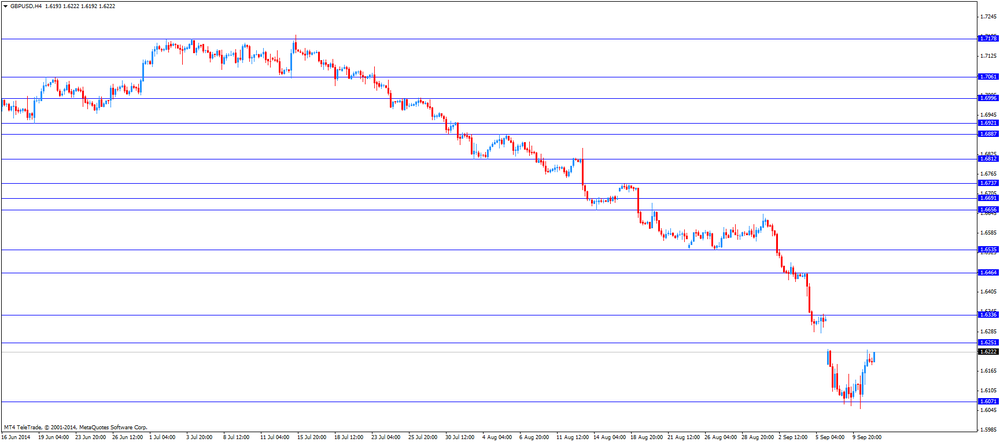

GBP/USD $1,6273 +1,06%

USD/CHF Chf0,9357 -0,10%

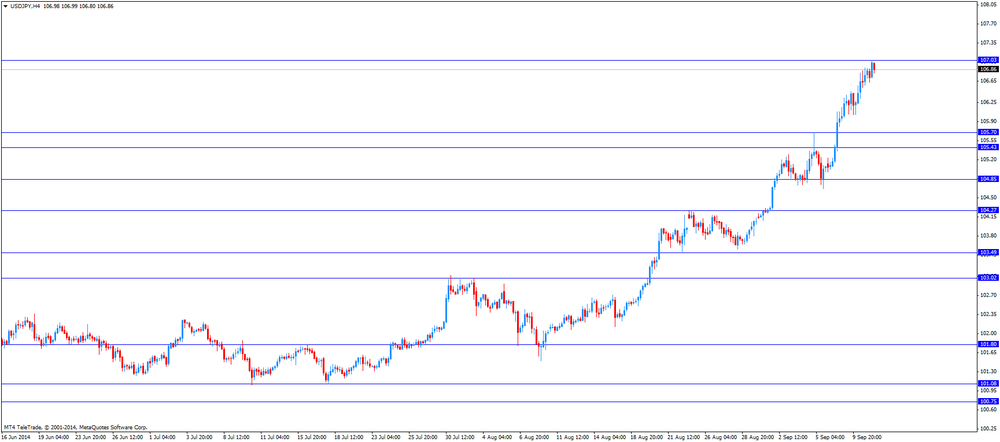

USD/JPY Y107,01 +0,17%

EUR/JPY Y138,29 +0,23%

GBP/JPY Y174,13 +0,61%

AUD/USD $0,9104 -0,58%

NZD/USD $0,8184 -0,17%

USD/CAD C$1,1035 +0,82%

(time / country / index / period / previous value / forecast)

02:00 China New Loans August 385 710

04:30 Japan Industrial Production (MoM) (Finally) July +0.2% +0.2%

04:30 Japan Industrial Production (YoY) (Finally) July -0.9% -0.9%

06:05 Japan BOJ Governor Haruhiko Kuroda Speaks

09:00 Eurozone Industrial production, (MoM) July -0.3% +0.6%

09:00 Eurozone Industrial Production (YoY) July 0.0% +1.3%

09:00 Eurozone Employment Change Quarter II +0.1% +0.1%

09:00 Eurozone ECOFIN Meetings

12:30 U.S. Retail sales August 0.0% +0.3%

12:30 U.S. Retail sales excluding auto August +0.1% +0.2%

12:30 U.S. Import Price Index August -0.2% -0.8%

13:55 U.S. Reuters/Michigan Consumer Sentiment Index (Finally)September 82.5 83.2

14:00 U.S. Business inventories July +0.4% +0.5%

The U.S. dollar traded mixed against the most major currencies ahead of the number of initial jobless claims in the U.S. The number of initial jobless claims in the week ending September 6 rose by 11,000 to 315,000 from 304,000 in the previous week. The previous week's figure was revised from 302,000. Analysts had expected the number of initial jobless claims to increase by 2,000 to 306,000.

The greenback remained supported on speculation the Fed will start to hike its interest rate sooner than expected. The San Francisco Federal Reserve released a research report on Monday. The report showed that investors were underestimating the start of interest rate hike by the Fed.

The euro traded mixed against the U.S. dollar. German consumer price index remained flat in August.

French consumer price index climbed 0.5% in August, exceeding expectations for a 0.4% increase, after a 0.3% decline in July.

The British pound traded slightly lower against the U.S. dollar. The pound retreated as a Wednesday Scotland's independence poll showed 53% said "no" to independence.

Comments by the Bank of England Governor Mark Carney also supported the pound. Mark Carney said on Wednesday that the central bank could start to hike its interest rate in the coming months.

The Canadian dollar fell against the U.S. dollar after the Canadian new housing price index. The Canadian new housing price index was flat in July, missing expectations for a 0.2% gain, after 0.2% increase in June.

The New Zealand dollar traded mixed against the U.S dollar. The Reserve Bank of New Zealand's interest rate decision weighed on the kiwi. The Reserve Bank of New Zealand (RBNZ) kept its interest rate unchanged at 3.50%. This decision was widely expected by analysts.

The RBNZ Governor Graeme Wheeler said the strength of the kiwi is still "unjustified and unsustainable". He added that the central bank expects further significant depreciation.

Mr. Wheeler signalled that he will wait with future interest rates.

The Australian dollar traded lower against the U.S. dollar despite the better-than-expected labour market data from Australia. Australia's economy added 121,000 jobs in August, beating expectations for a gain of 15,200 jobs, after a decline of 4,100 jobs in July. July's figure was revised down from a 300 drop.

Australia's unemployment rate fell to 6.1% in August from 6.4% in July, beating forecasts for a decrease to 6.3%.

The Melbourne Institute's inflation expectations for Australia in the next 12 months climbed to 3.5% in August from 3.1% in July.

The Japanese yen traded mixed against the U.S. dollar. Comments by the Bank of Japan Governor Haruhiko Kuroda weighed on the yen. He said to the Japan's Prime Minister Shinzo Abe that the central bank is ready to expand monetary easing measures to reach 2 percent inflation target.

The BSI manufacturing index climbed to a seasonally adjusted annual rate of 12.7 in the third quarter from a decline of 13.9% in the previous quarter. Analysts had expected the index to increase to -10.3.

EUR/USD: $1.2900(E119mn), $1.2935(E402mn), $1.2940E(400mn), $1.3000-20E(600mn)

USD/JPY: Y105.25($1.7bn), Y106.00($652mn), Y106.50($200mn)

EUR/JPY: Y138.30(E187mn), Y138.75(E100mn)

EUR/GBP: stg0.7950(E601mn)

USD/CHF: Chf0.9180($395mn), Chf0.9200($135mn)

AUD/USD: $0.9050(A$237mn), $0.9100(A$386mn), $0.9130(A$151mn), $0.9240(A$160mn)

NZD/USD: $0.8350(NZ$105mn), $0.8415(NZ$328mn)

USD/CAD: C$1.0925($547mn)

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:00 Australia Consumer Inflation Expectation September +3.1% +3.5%

01:30 Australia Unemployment rate August 6.4% 6.3% 6.1%

01:30 Australia Changing the number of employed August -4.1 +15.2 +121.0

01:30 China PPI y/y August -0.9% -1.1% -1.2%

01:30 China CPI y/y August +2.3% +2.2% +2.0%

02:00 China New Loans August 385 710

06:00 Germany CPI, m/m (Finally) August 0.0% 0.0% 0.0%

06:00 Germany CPI, y/y (Finally) August +0.8% +0.8% +0.8%

06:45 France CPI, m/m August -0.3% +0.4% +0.5%

06:45 France CPI, y/y August +0.5% +0.5% +0.5%

08:00 Eurozone ECB Monthly Report

The U.S. dollar traded mixed against the most major currencies ahead of the number of initial jobless claims in the U.S. The number of initial jobless claims in the U.S. is expected to rise by 4,000 to 306,000.

The greenback remained supported on speculation the Fed will start to hike its interest rate sooner than expected. The San Francisco Federal Reserve released a research report on Monday. The report showed that investors were underestimating the start of interest rate hike by the Fed.

The euro traded higher against the U.S. dollar. German consumer price index remained flat in August.

French consumer price index climbed 0.5% in August, exceeding expectations for a 0.4% increase, after a 0.3% decline in July.

The British pound traded higher against the U.S. dollar as a Wednesday Scotland's independence poll showed 53% said "no" to independence.

Comments by the Bank of England Governor Mark Carney also supported the pound. Mark Carney said on Wednesday that the central bank could start to hike its interest rate in the coming months.

The Canadian dollar traded lower against the U.S. dollar ahead of the Canadian new housing price index. The Canadian new housing price index is expected to increase 0.2% in July.

EUR/USD: the currency pair increased to $1.2939

GBP/USD: the currency pair rose to $1.6263

USD/JPY: the currency pair climbed to Y107.15

The most important news that are expected (GMT0):

12:30 Canada New Housing Price Index July +0.2% +0.2%

12:30 U.S. Initial Jobless Claims September 302 306

22:30 New Zealand Business NZ PMI August 53.0

EUR/USD

Offers $1.3050, $1.3000/10

Bids $1.2880/74, $1.2860/50, $1.2800

GBP/USD

Offers $1.6350, $1.6290-300, $1.6260

Bids $1.6125/15, $1.6050

AUD/USD

Offers $0.9350, $0.9300, $0.9280/90, $0.9250/60, $0.9220

Bids $0.9100, $0.9020, $0.9000

EUR/JPY

Offers Y139.00

Bids Y136.50, Y136.20, Y136.05/00

USD/JPY

Offers Y108.00, Y107.50

Bids Y106.50, Y106.05/95, Y105.50, Y105.20, Y105.00

EUR/GBP

Offers stg0.8100

Bids stg0.7900

The Reserve Bank of New Zealand (RBNZ) released its interest rate decision. The RBNZ kept its interest rate unchanged at 3.50%. This decision was widely expected by analysts.

The RBNZ Governor Graeme Wheeler said the strength of the kiwi is still "unjustified and unsustainable". He added that the central bank expects further significant depreciation.

Mr. Wheeler signalled that he will wait with future interest rates.

The RBNZ expects New Zealand's economy will expand at an annual pace of 3.7% over 2014. The country's economic growth "continues to be supported by increasing construction activity and ongoing strength in consumption and business investment", so the central bank.

New Zealand's central bank said that house price inflation continues to ease.

The Bank of Japan (BoJ) Governor Haruhiko Kuroda said to the Japan's Prime Minister Shinzo Abe today that the central bank is ready to expand monetary easing measures to reach 2 percent inflation target. But he added for now there is no necessity for the central bank to expand stimulus measures. Japan's economy is on track to meet the price stability target, so Kuroda.

The divergence between the monetary policies of the US and those of Japan and Europe weighed on the yen and euro as investors speculate the Fed may raise rates sooner than expected.

EUR/USD: $1.2900(E119mn), $1.2935(E402mn), $1.2940E(400mn), $1.3000-20E(600mn)

USD/JPY: Y105.25($1.7bn), Y106.00($652mn), Y106.50($200mn)

EUR/JPY: Y138.30(E187mn), Y138.75(E100mn)

EUR/GBP: stg0.7950(E601mn)

USD/CHF: Chf0.9180($395mn), Chf0.9200($135mn)

AUD/USD: $0.9050(A$237mn), $0.9100(A$386mn), $0.9130(A$151mn), $0.9240(A$160mn)

NZD/USD: $0.8350(NZ$105mn), $0.8415(NZ$328mn)

USD/CAD: C$1.0925($547mn)

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:00 Australia Consumer Inflation Expectation September +3.1% +3.5%

01:30 Australia Unemployment rate August 6.4% 6.3% 6.1%

01:30 Australia Changing the number of employed August -4.1 +15.2 +121.0

01:30 China PPI y/y August -0.9% -1.1% -1.2%

01:30 China CPI y/y August +2.3% +2.2% +2.0%

02:00 China New Loans August 385 710

06:00 Germany CPI, m/m (Finally) August 0.0% 0.0% 0.0%

06:00 Germany CPI, y/y (Finally) August +0.8% +0.8% +0.8%

06:45 France CPI, m/m August -0.3% +0.4% +0.5%

06:45 France CPI, y/y August +0.5% +0.5% +0.5%

08:00 Eurozone ECB Monthly Report

The U.S. dollar traded mixed to higher against the most major currencies on speculation the Fed will start to hike its interest rate sooner than expected. The San Francisco Federal Reserve released a research report on Monday. The report showed that investors were underestimating the start of interest rate hike by the Fed.

The New Zealand dollar declined against the U.S dollar after the Reserve Bank of New Zealand's interest rate decision. The Reserve Bank of New Zealand (RBNZ) kept its interest rate unchanged at 3.50%. This decision was widely expected by analysts.

The RBNZ Governor Graeme Wheeler said the strength of the kiwi is still "unjustified and unsustainable". He added that the central bank expects further significant depreciation.

Mr. Wheeler signalled that he will wait with future interest rates.

The Australian dollar traded higher against the U.S. dollar after the better-than-expected labour market data from Australia. Australia's economy added 121,000 jobs in August, beating expectations for a gain of 15,200 jobs, after a decline of 4,100 jobs in July. July's figure was revised down from a 300 drop.

Australia's unemployment rate fell to 6.1% in August from 6.4% in July, beating forecasts for a decrease to 6.3%.

The Melbourne Institute's inflation expectations for Australia in the next 12 months climbed to 3.5% in August from 3.1% in July.

The Japanese yen fell against the U.S. dollar as the Bank of Japan (BoJ) Governor Haruhiko Kuroda said to the Japan's Prime Minister Shinzo Abe that the central bank is ready to expand monetary easing measures to reach 2 percent inflation target.

The BSI manufacturing index climbed to a seasonally adjusted annual rate of 12.7 in the third quarter from a decline of 13.9% in the previous quarter. Analysts had expected the index to increase to -10.3.

EUR/USD: the currency pair fell to $1.2901

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair rose Y107.03

NZD/USD: the currency pair declined to $0.8177

The most important news that are expected (GMT0):

12:30 Canada New Housing Price Index July +0.2% +0.2%

12:30 U.S. Initial Jobless Claims September 302 306

22:30 New Zealand Business NZ PMI August 53.0

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.