- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

(pare/closed(GMT +2)/change, %)

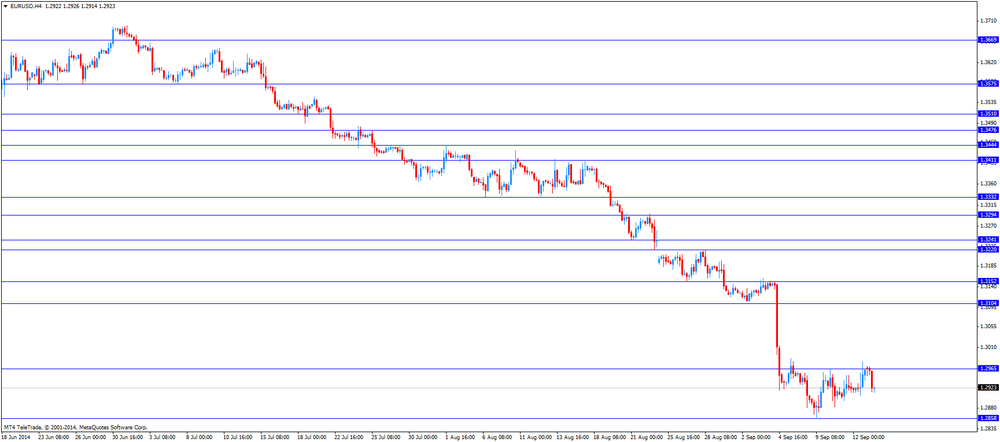

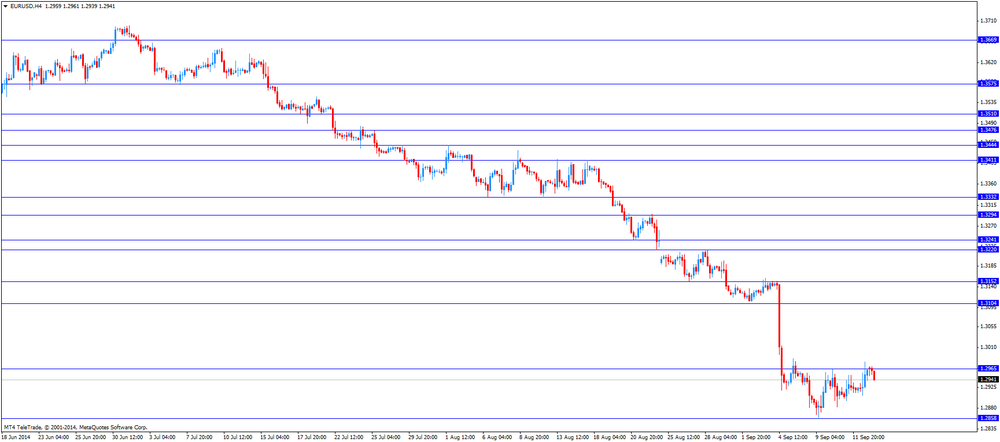

EUR/USD $1,2940 -0,17%

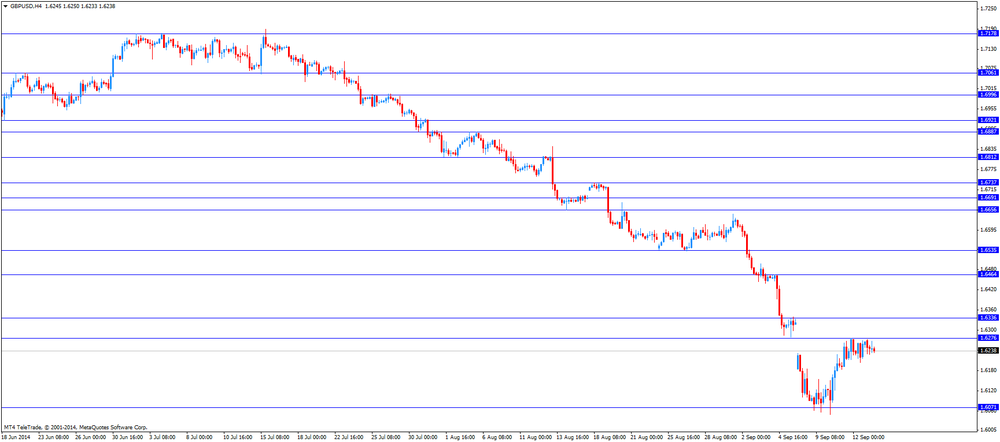

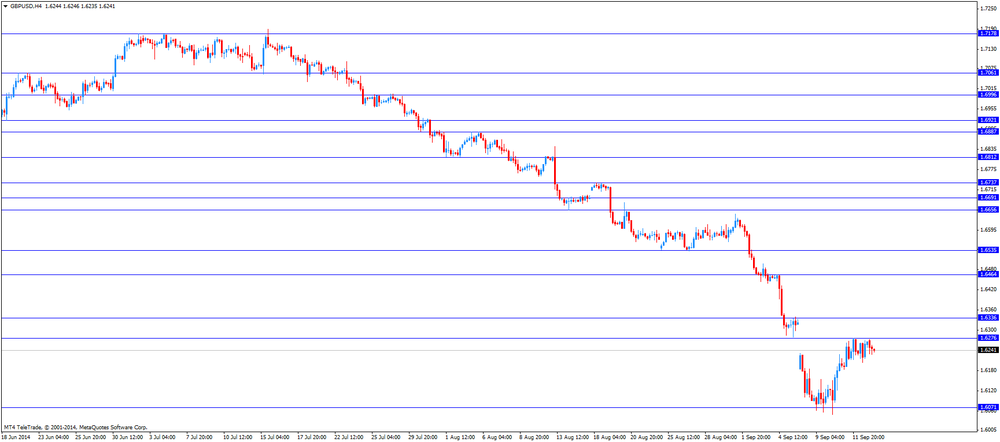

GBP/USD $1,6226 -0,24%

USD/CHF Chf0,9353 +0,24%

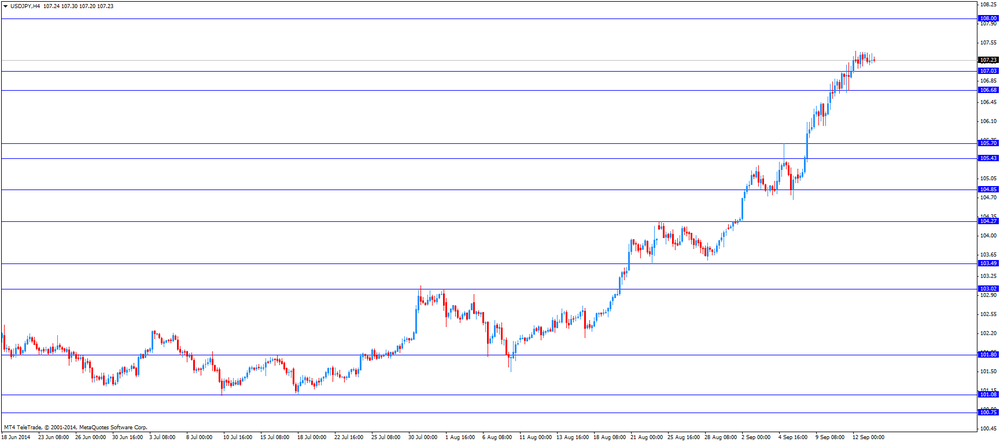

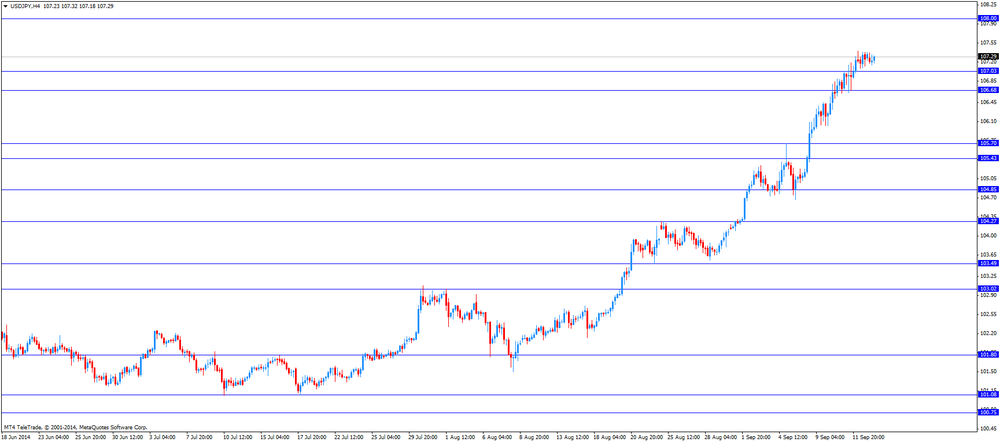

USD/JPY Y107,18 -0,15%

EUR/JPY Y138,70 -0,32%

GBP/JPY Y173,91 -0,38%

AUD/USD $0,9033 -0,03%

NZD/USD $0,8176 +0,37%

USD/CAD C$1,1053 -0,33%

(time / country / index / period / previous value / forecast)

00:00 Australia RBA Assist Gov Kent Speaks

01:30 Australia RBA Meeting's Minutes

05:30 Japan BOJ Governor Haruhiko Kuroda Speaks

08:30 United Kingdom Retail Price Index, m/m August -0.1% +0.5%

08:30 United Kingdom Retail prices, Y/Y August +2.5% +2.5%

08:30 United Kingdom RPI-X, Y/Y August +2.6%

08:30 United Kingdom Producer Price Index - Input (MoM) August -1.6% -0.2%

08:30 United Kingdom Producer Price Index - Input (YoY) August -7.3% -6.6%

08:30 United Kingdom Producer Price Index - Output (MoM) August -0.1% -0.1%

08:30 United Kingdom Producer Price Index - Output (YoY) August +0.9% +0.9%

08:30 United Kingdom HICP, m/m August -0.3% +0.4%

08:30 United Kingdom HICP, Y/Y August +1.6% +1.5%

08:30 United Kingdom HICP ex EFAT, Y/Y August +1.8% +1.8%

09:00 Eurozone ZEW Economic Sentiment September 23.7 21.3

09:00 Germany ZEW Survey - Economic Sentiment September 8.6 5.2

12:30 Canada Manufacturing Shipments (MoM) July +0.6% +1.1%

12:30 U.S. PPI, m/m August +0.1% +0.1%

12:30 U.S. PPI, y/y August +1.7% +1.8%

12:30 U.S. PPI excluding food and energy, m/m August +0.2% +0.1%

12:30 U.S. PPI excluding food and energy, Y/Y August +1.6% +1.7%

13:00 U.S. Net Long-term TIC Flows July -18.7 24.3

13:00 U.S. Total Net TIC Flows July -153.5

16:45 Canada BOC Gov Stephen Poloz Speaks

20:30 U.S. API Crude Oil Inventories September -1.0

22:45 New Zealand Current Account Quarter II 1.41 -1.04

The U.S. dollar traded mixed to lower against the most major currencies after mixed U.S. economic data. The NY Fed Empire State manufacturing index rose to 27.5 in September from 14.7 in August, exceeding expectations for a gain to 15.0. That was the highest level since October 2009.

The U.S. industrial production declined 0.1% in August, missing forecasts for a 0.3% rise, after a 0.2% gain in July. July's figure was revised down from a 0.4% increase.

The U.S. capacity utilization rate decreased to 78.8% in September from 79.1% in August, missing expectations for an increase to 79.3%. August's figure was revised down from 79.2%.

The greenback remained supported on speculation the Fed will start to hike its interest rate sooner than expected. Market participants are awaiting the Fed's interest rate decision on Wednesday. They expect the Fed will cut its asset purchase program by another $10 billion.

The euro traded higher against the U.S. dollar. Eurozone's seasonally adjusted trade surplus declined to 12.2 billion euros in July from 13.8 billion euros in June.

The British pound traded mixed against the U.S. dollar. Scotland's independence referendum on Thursday continued to weigh on the pound.

The Swiss franc traded higher against the U.S. dollar. Switzerland's producer price index (PPI) declined 0.2% in August, after a flat reading in July.

On a yearly basis, Switzerland's PPI fell 1.2% in August, after a 0.8% drop in July.

The New Zealand dollar traded higher against the U.S dollar in the absence of any major economic reports from New Zealand.

The weaker-than expected Chinese economic data weighed on the kiwi and the Australian dollar. China's industrial production rose 6.9% in August, after a 9.0% in July. Analysts had expected an increase of 8.8%.

Fixed-asset investment in China increased 16.5% in August, missing expectations for a 16.9% rise, after a 17.0% gain in July.

Retail sales in China climbed 11.9% in August, missing forecasts of a 12.1% rise, after a 12.2% increase in July.

China is a major trading partner of New Zealand and Australia.

The Australian dollar traded higher against the U.S. dollar. In the overnight trading session, the Aussie fell against the greenback due to the weak economic data from Australia. New motor vehicle sales in Australia fell by 1.8% in August, after a 1.3% decline in July.

On a yearly basis, new motor vehicle sales in Australia dropped by 3.5% in August, after a 0.4% fall in July.

The Japanese yen traded mixed against the U.S. dollar in the absence of any major economic reports from Japan. Markets in Japan were closed for a public holiday.

The yen dropped to the lowest level since September 2008 against the U.S. dollar last week as the Bank of Japan (BoJ) Governor Haruhiko Kuroda said to the Japan's Prime Minister Shinzo Abe on Thursday that the central bank is ready to expand monetary easing measures to reach 2 percent inflation target.

EUR/USD: $1.2945(E120mn), $1.3000-05(E486mn), $1.3050(E484mn), $1.3075(E200mn)

GBP/USD: $1.6250(stg112mn), $1.6300(stg225mn), $1.6320(stg120mn)

EUR/GBP: stg0.7950(E225mn), stg0.7975(E510mn), stg7980(E112mn)

USD/CHF: Chf0.9385($300mn)

AUD/USD: $0.9000(A$621mn), $0.9030(A$219mn), $0.9160(A$349mn)

NZD/USD: $0.8375(NZ$303mn)

AUD/NZD: NZ$1.1250(A$813mn)

USD/CAD: C$1.1000($523mn), C$1.1070-80($336mn), C$1.1100($162mn)

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Japan Bank holiday

01:30 Australia New Motor Vehicle Sales (MoM) August -1.3% -1.8%

01:30 Australia New Motor Vehicle Sales (YoY) August -0.4% -3.5%

07:15 Switzerland Producer & Import Prices, m/m August 0.0% -0.2%

07:15 Switzerland Producer & Import Prices, y/y August -0.8% -1.2%

09:00 Eurozone Trade Balance s.a. July 13.8 12.2

The U.S. dollar traded mixed against the most major currencies ahead of the U.S. economic data. The NY Fed Empire State manufacturing index is expected to climb to 15.0 in September from 14.7 in August.

The U.S. industrial production is expected to rise 0.3% in August, after a 0.4% gain in July.

The greenback remained supported on speculation the Fed will start to hike its interest rate sooner than expected. Market participants are awaiting the Fed's interest rate decision on Wednesday. They expect the Fed will cut its asset purchase program by another $10 billion.

The euro traded lower against the U.S. dollar. Eurozone's seasonally adjusted trade surplus declined to 12.2 billion euros in July from 13.8 billion euros in June.

The British pound traded mixed against the U.S. dollar. Scotland's independence referendum on Thursday continued to weigh on the pound.

The Swiss franc traded lower against the U.S. dollar. Switzerland's producer price index (PPI) declined 0.2% in August, after a flat reading in July.

On a yearly basis, Switzerland's PPI fell 1.2% in August, after a 0.8% drop in July.

EUR/USD: the currency pair fell to $1.2914

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 U.S. NY Fed Empire State manufacturing index September 14.7 15.0

13:15 U.S. Industrial Production (MoM) August +0.4% +0.3%

13:15 U.S. Capacity Utilization September 79.2% 79.3%

EUR/USD

Offers $1.3070, $1.3050, $1.3000/10

Bids $1.2880/74, $1.2860/50, $1.2800

GBP/USD

Offers $1.6350, $1.6290-300

Bids 1.6195/85, $1.6125/20

AUD/USD

Offers $0.9250/60, $0.9220, $0.9110, $0.9100

Bids $0.8900, $0.8800

EUR/JPY

Offers Y140.00, Y139.50, Y139.20

Bids Y138.30, Y138.00, Y138.50

USD/JPY

Offers Y108.00, Y107.40-50

Bids Y106.70/65, Y106.50, Y106.05/95, Y105.50, Y105.20

EUR/GBP

Offers stg0.8100, stg0.8000, stg0.7980

Bids stg0.7940, stg0.7900

EUR/USD: $1.2945(E120mn), $1.3000-05(E486mn), $1.3050(E484mn), $1.3075(E200mn)

GBP/USD: $1.6250(stg112mn), $1.6300(stg225mn), $1.6320(stg120mn)

EUR/GBP: stg0.7950(E225mn), stg0.7975(E510mn), stg7980(E112mn)

USD/CHF: Chf0.9385($300mn)

AUD/USD: $0.9000(A$621mn), $0.9030(A$219mn), $0.9160(A$349mn)

NZD/USD: $0.8375(NZ$303mn)

AUD/NZD: NZ$1.1250(A$813mn)

USD/CAD: C$1.1000($523mn), C$1.1070-80($336mn), C$1.1100($162mn)

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Japan Bank holiday

01:30 Australia New Motor Vehicle Sales (MoM) August -1.3% -1.8%

01:30 Australia New Motor Vehicle Sales (YoY) August -0.4% -3.5%

07:15 Switzerland Producer & Import Prices, m/m August 0.0% -0.2%

07:15 Switzerland Producer & Import Prices, y/y August -0.8% -1.2%

The U.S. dollar traded mixed to higher against the most major currencies on speculation the Fed will start to hike its interest rate sooner than expected. Market participants are awaiting the Fed's interest rate decision on Wednesday.

Market participants expect the Fed will cut its asset purchase program by another $10 billion.

The New Zealand dollar slightly lower against the U.S dollar in the absence of any major economic reports from New Zealand.

The weaker-than expected Chinese economic data weighed on the kiwi and the Australian dollar. China's industrial production rose 6.9% in August, after a 9.0% in July. Analysts had expected an increase of 8.8%.

Fixed-asset investment in China increased 16.5% in August, missing expectations for a 16.9% rise, after a 17.0% gain in July.

Retail sales in China climbed 11.9% in August, missing forecasts of a 12.1% rise, after a 12.2% increase in July.

China is a major trading partner of New Zealand and Australia.

The Australian dollar declined against the U.S. dollar due to the weak economic data from Australia. New motor vehicle sales in Australia fell by 1.8% in August, after a 1.3% decline in July.

On a yearly basis, new motor vehicle sales in Australia dropped by 3.5% in August, after a 0.4% fall in July.

The Japanese yen traded mixed against the U.S. dollar in the absence of any major economic reports from Japan. Markets in Japan were closed for a public holiday.

The yen dropped to the lowest level since September 2008 against the U.S. dollar last week as the Bank of Japan (BoJ) Governor Haruhiko Kuroda said to the Japan's Prime Minister Shinzo Abe on Thursday that the central bank is ready to expand monetary easing measures to reach 2 percent inflation target.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

09:00 Eurozone Trade Balance s.a. July 13.8

12:30 U.S. NY Fed Empire State manufacturing index September 14.7 15.0

13:15 U.S. Industrial Production (MoM) August +0.4% +0.3%

13:15 U.S. Capacity Utilization September 79.2% 79.3%

EUR / USD

Resistance levels (open interest**, contracts)

$1.3077 (4572)

$1.3030 (424)

$1.2998 (162)

Price at time of writing this review: $ 1.2956

Support levels (open interest**, contracts):

$1.2901 (4888)

$1.2881 (7041)

$1.2857 (3933)

Comments:

- Overall open interest on the CALL options with the expiration date October, 3 is 48696 contracts, with the maximum number of contracts with strike price $1,3000 (4572);

- Overall open interest on the PUT options with the expiration date October, 3 is 56882 contracts, with the maximum number of contracts with strike price $1,3000 (7041);

- The ratio of PUT/CALL was 1.17 versus 0.67 from the previous trading day according to data from September, 12

GBP/USD

Resistance levels (open interest**, contracts)

$1.6505 (1917)

$1.6409 (1254)

$1.6314 (1385)

Price at time of writing this review: $1.6236

Support levels (open interest**, contracts):

$1.6185 (1175)

$1.6089 (2785)

$1.5991 (1835)

Comments:

- Overall open interest on the CALL options with the expiration date October, 3 is 25859 contracts, with the maximum number of contracts with strike price $1,6500 (1917);

- Overall open interest on the PUT options with the expiration date October, 3 is 35596 contracts, with the maximum number of contracts with strike price $1,6300 (4509);

- The ratio of PUT/CALL was 1.38 versus 0.95 from the previous trading day according to data from September, 12

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.