- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

In return, PepsiCo will receive a stake of under 10% in the unit with an option to increase it to up to 49%. The deal will enable PepsiCo access to Tingyi's large Chinese distribution platform.

The euro fell versus the yen and dollar as Italian Prime Minister Silvio Berlusconi faces a budget vote amid pressure to resign, stoking concern the region’s third-largest economy will struggle to manage its debt. Yields on Italy’s 10-year bonds jumped to as high as 6.68 percent, approaching the 7 percent level that drove Greece, Ireland and Portugal to seek bailouts. The rise in Italian yields pushed the spread with the German securities to 491 basis points, also a euro-era record.

The shared currency briefly erased losses versus the greenback as the European Investment Bank told European finance ministers it could boost lending to businesses through banks. Italian government bonds dropped, pushing 10-year note yields to a euro-era high. The euro pared losses earlier after Il Foglio reported Berlusconi may step down and push for early elections. The prime minister later denied the report.

The franc fell after Swiss National Bank President Philipp Hildebrand said the central bank expects the currency to weaken further. Swiss inflation unexpectedly slowed to a negative rate in October, data today showed. Consumer prices decreased 0.1 percent from a year earlier after rising 0.5 percent in September, the Federal Statistics Office in Neuchatel said today. Economists forecast prices to rise 0.2 percent.

Sterling approached its strongest level in a month against the euro as investors sought an alternative investment to the 17-nation currency. The pound gained 0.3 percent to 85.74 pence per euro after rising 2 percent last week, the biggest increase since the five days through Jan. 7. It touched 85.59 cents, after reaching 85.48 on Nov. 1, the strongest since Oct. 4.

European stocks dropped, extending last week’s selloff, as Italian Prime Minister Silvio Berlusconi struggled to hold power before a budget vote and Greece worked on plans to form a new government.

In Italy, Berlusconi’s majority is unraveling before a key parliamentary vote tomorrow on the 2010 budget report as contagion from Europe’s sovereign debt crisis pushed the country’s borrowing costs to euro-era records. The yield on Italy’s 10-year bonds surged to as much as 6.68 percent today. Stocks pared losses as Berlusconi’s former spokesman Giuliano Ferrara said the Italian premier is likely to decide on his political future “within hours,” with his formal resignation coming next week after he secures parliamentary approval of austerity and economic-growth measures. Reports of his resignation were “totally unfounded,” Berlusconi said in an interview with newspaper Libero.

The Stoxx 600 dropped 3.7 percent last week after a failed attempt by Greek Prime Minister George Papandreou to hold a referendum on the latest bailout package spurred concern Greece may default. Papandreou yesterday agreed to step down to allow the creation of a new national unity government intended to secure international financing and avert a collapse of the country’s economy.

National benchmark indexes fell in 10 of the 18 western European markets today. The U.K.’s FTSE 100 slipped 0.3 percent while France’s CAC 40 and Germany’s DAX Index lost 0.6 percent.

European retail sales fell more than forecast in September as the debt crisis prompted households to cut spending. Sales in the 17-nation euro region decreased 0.7 percent from August, the European Union’s statistics office said today. Carrefour SA fell 2.6 percent as euro-region retail sales fell and Citigroup Inc. downgraded the shares. Metro AG, Germany’s largest retailer, lost 2.1 percent, while Hennes & Mauritz AB slid 1.1 percent to 209.30 kronor in Stockholm.

PostNL NV slid 7.4 percent as the biggest Dutch postal operator said third-quarter operating profit fell 22 percent as domestic mail deliveries declined.

National Bank of Greece SA and Piraeus Bank SA advanced more than 4 percent in Athens.

We are premanantly watching the situation. If there is need for further action, the SNB will act.

U.S. stocks retreated, following the first weekly decline in the Standard & Poor’s 500 Index since September, as investors weighed prospects for political changes in Europe’s most-indebted countries.

Italian 10-year borrowing costs surged to a euro-era record as the focus shifted from Greece after Prime Minister George Papandreou agreed to step down to create a new unity government. Investors are betting Prime Minister Silvio Berlusconi may be forced to resign if he fails to win majority support in tomorrow’s vote on the 2010 budget report.

Dow 11,888.87 -94.37 -0.79%, Nasdaq 2,651.25 -34.90 -1.30%, S&P 500 1,241.69 -11.54 -0.92%

Bank of America Corp. (BAC), Caterpillar Inc. (CAT) and Alcoa Inc. (AA) fell at least 1.5 percent, for the biggest losses in the Dow Jones Industrial Average.

Jefferies Group Inc., the investment bank that has battled investor concern that it will be hurt by Europe’s debt crisis, increased 1.7 percent after releasing details of its positions in sovereign bonds. The New York-based firm released a document summarizing its exposure to the debt of Italy, Spain, Ireland, Portugal and Greece. It also published a list of sovereign and government-guaranteed bonds from the five indebted nations in which Jefferies International Ltd. holds a position greater than half a million euros.

The world’s largest biotechnology company Amgen Inc. rose 4.7 percent on plans to buy back as much as $5 billion in common stock for $54-$60 per share.

- Swiss Franc policy is domain of SNB

Oil traded near a three-month high in New York as the prospect of new leadership at Europe’s most financially hard-hit countries allayed fears that the region’s debt crisis will damage the economy.

Futures rebounded from a 1.1 percent loss after a former spokesman for Italian Prime Minister Silvio Berlusconi said that the premier may step down within “hours” and push for early elections. Greek Prime Minister George Papandreou agreed to leave office to allow a national unity government to secure outside financing and avert a collapse of the country’s economy.

European finance chiefs were meeting in Brussels today to work on details of a plan to bulk out the region’s bailout fund. Investor concern that Italy will struggle to cut the region’s second-biggest debt load sent the yield on its 10-year bond to about 6.68 percent today. The nation’s parliament votes tomorrow on the 2010 budget report as two Berlusconi allies defected to the opposition last week and a third quit yesterday. Giuliano Ferrara, editor of newspaper Il Foglio and a former Berlusconi spokesman, reported that the premier may step down. Berlusconi later denied the report.

The U.S. is the world’s biggest oil consumer, using 19.1 million barrels a day in 2010, or 21 percent of global consumption, according to BP Plc’s Statistical Review. China is the second-largest, accounting for about 11 percent and the European Union used 16 percent.

Crude for December delivery on the New York Mercantile Exchange was at $95.66 a barrel, after falling as low as $93.23. Oil in New York gained for a fifth week in the five trading days ended Nov. 4, the longest rising streak since the period ended April 3, 2009. Prices are up 3.8 percent this year.

Brent crude for December settlement was $1.34 higher at $113.31 a barrel. The European benchmark contract was at a premium of $18.43 to New York crude, compared with $17.71 on Nov. 4 and a record settlement of $27.88 on Oct. 14.

Need to see more concrete action from ez on firewall

Italy situation shows needs credible debt plan

Gold futures rose to a six-week high as Europe’s escalating sovereign-debt crisis spurred demand for a haven.

Italian Prime Minister Silvio Berlusconi’s allies pressured him to step aside after contagion from the region’s fiscal woes pushed the nation’s borrowing costs to euro-era records. Gold jumped to a record $1,923.70 an ounce on Sept. 6 on demand for an alternative to equities and some currencies.

Berlusconi struggled to keep his allies in line after some lawmakers announced defections before critical parliamentary votes in coming days.

Gold futures for December delivery on the Comex in New York reached $1,784.80, the highest for a most-active contract since Sept. 22. Before today, the commodity climbed 24 percent this year.

Italy must win back market confidence

Next aid tranche for Greece not as urgent as thought

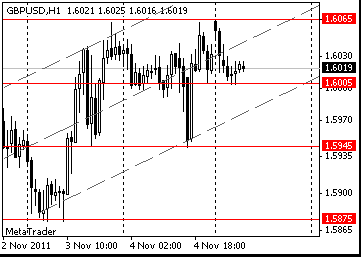

Offers $1,6060-$1,6090 with stops above. Bids start in 1.6030.

USD/JPY Y77.90, Y78.00, Y78.50(large), Y78.95, Y79.00

AUD/USD $1.0300, $1.0350, $1.0420

USD/CHF Chf0.8980

GBP/USD $1.6000, $1.5800

EUR/JPY Y107.50, Y106.00

Data:

08:00 UK Halifax house price index (September) 1.2%

08:00 UK Halifax house price index (September) 3m Y/Y -1.8%

10:00 EU(17) Retail sales (September) adjusted -0.7%

10:00 EU(17) Retail sales (September) adjusted Y/Y -1.5%

11:00 Germany Industrial production (September) seasonally adjusted -2.7%

11:00 Germany Industrial production (September) not seasonally adjusted, workday adjusted Y/Y 5.4%

The euro fell as Italian Prime Minister Silvio Berlusconi faces a budget vote amid pressure to resign, stoking concern the region’s third-largest economy will struggle to manage its debt load.

The euro also weakened as concern mounted that political instability in Italy may push bond yields to levels that will force the region’s second-most indebted nation to seek a rescue.

Greek Prime Minister George Papandreou said he will step down to make way for a coalition government and secure outside financing to avoid a collapse of the nation’s economy.

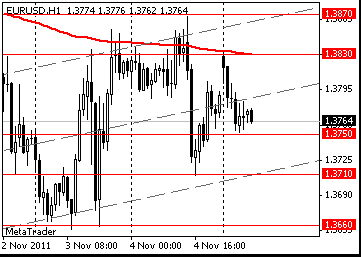

EUR/USD: the pair showed low in $1.3680 area then returned back to area $1,3760.

GBP/USD: the pair showed low in $1.5980 area then returned back above $1.6000.

USD/JPY: the pair decreased in Y78,00 area.

Gold reached a fresh six-week high amid further signals that the European debt crisis is far from improving.

Gold futures rose to $1,774.90 per ounce (+1.1%)

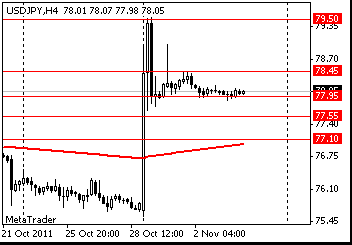

Resistance 3: Y79.00 (Nov 1 high)

Resistance 2: Y78.40 (Nov 2 high)

Resistance 1: Y78.20 (resistance line from Nov 2)

Current price: Y78.05

Support 1:Y77.90 (Nov 3 low)

Support 2:Y77.55 (50.0 % FIBO Y75,55-Y79,55)

Support 3:Y77.10 (61.8 % FIBO Y75,55-Y79,55)

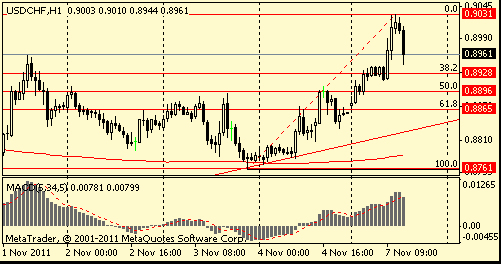

Resistance 3: Chf0.9120 (Oct 11 high)

Resistance 2: Chf0.9080 (Oct 20 high)

Resistance 1: Chf0.9030 (session high)

Current price: Chf0.8860

Support 1: Chf0.8930 (38,2% FIBO Chf0,8760-Chf0,9030)

Support 2: Chf0.8900 (50,0% FIBO Chf0,8760-Chf0,9030)

Support 3: Chf0.8860 (61,8% FIBO Chf0,8760-Chf0,9030, support line from Oct 27)

Resistance 3: $ 1.6165 (Oct 31 high)

Resistance 2: $ 1.6090 (Nov 1 high)

Resistance 1: $ 1.6060 (area of session high and Nov 3 high)

Current price: $1.6047

Support 1 : $1.5980 (session low)

Support 2 : $1.5940 (support line from Oct 12, Nov 4 low)

Support 3 : $1.5890/70 (area of Oct 26, Nov 1 and 3 lows)

Resistance 3: $ 1.3920 (50,0 % FIBO $1,4240-$ 1,3610, МА (200) for Н1)

Resistance 2: $ 1.3850 (38,2 % FIBO $1,4240-$ 1,3610, session high, Nov 3 high)

Resistance 1: $ 1.3780 (area of european session high)

Сurrent price: $1.3770

Support 1 : $1.3680 (session low)

Support 2 : $1.3650 (Nov 3 low)

Support 3 : $1.3610 (Nov 1 low)

USD/JPY Y77.90, Y78.00, Y78.50(large), Y78.95, Y79.00

AUD/USD $1.0300, $1.0350, $1.0420

USD/CHF Chf0.8980

GBP/USD $1.6000, $1.5800

EUR/JPY Y107.50, Y106.00

00:30 Australia ANZ Job Advertisements (MoM) October -0.3%

The franc declined to a two-week low against the euro on speculation the Swiss National Bank will further limit the strength of its currency. Switzerland’s franc fell versus all major peers after SNB President Philipp Hildebrand said the central bank expects it to weaken further, adding to bets the bank will adjust the cap of 1.20 francs per euro set on Sept. 6. Losses in the 17-nation currency were limited after Greek Prime Minister George Papandreou agreed to step down to allow the creation of a national unity government.

Greek Prime Minister George Papandreou agreed to step down to allow the creation of a national unity government intended to secure international financing and avert a collapse of the country’s economy. Papandreou met with Antonis Samaras, leader of the main opposition party, and agreed to form a government to lead Greece “to elections immediately after the implementation of European Council decisions on October 26,” according to an e-mailed statement yesterday from the office of President Karolos Papoulias in Athens. Papandreou already stated he won’t lead the new government, the statement said.

EUR/USD: on Asian session the pair fell.

GBP/USD: on Asian session the pair decreased.

USD/JPY: on Asian session the pair holds in range Y78.05-Y78.20.

On Monday at 05:45 GMT Switzerland will publish data on a rate of unemployment for October (decrease to 0.2 % against 0.3 % the last month is expected). At 06:00 GMT in Britain there will be a price index on habitation from HBOS for October (growth on 0.1 % against falling on 0.5 % the last month is expected). At 07:15 GMT Switzerland will publish data on inflation. At 08:00 GMT the meeting of ministerial council of the finance of the countries of the European Union (ECOFIN) will begin. At 09:00 GMT in an eurozone there will be data on change of retail trade for September. At 10:00 GMT Germany will report on change of industrial production for September. At 23:01 GMT Britain will publish data of the monitor of retails BRC and balance of the prices for habitation from RICS for October. At 23:30 GMT in Australia there will be data on balance of foreign trade for September.

On Monday the yen slumped the most since 2008 against the dollar as Japan stepped in to foreign-exchange markets to weaken the currency for the third time this year after its gain to a postwar record threatened exporters.The dollar rose against all its major peers after MF Global Holdings Ltd. filed for bankruptcy after making bets on European sovereign debt, driving stocks down and boosting refuge demand. The euro fell versus the dollar today after rising 1.8 percent last week as China’s official Xinhua News Agency said the nation can’t play the role of “savior” to Europe.

On Tuesday the euro weakened for a third day against the dollar, touching the lowest in almost three weeks, as concern the currency region’s rescue plan will crumble and the European Central Bank will cut interest rates damped demand.The dollar and yen strengthened as stocks slid around the world and data showed Chinese manufacturing slowed. Australia’s dollar slid against most of its major peers after the Reserve Bank of Australia lowered its cash rate target by 25 basis points to 4.5 percent.On Wednesday the U.S. dollar offset the losses against the euro after the Federal Reserve raised its assessment of the economy. The Central Bank said here that "significant risks" remain, but, still, refrained from taking additional measures to ease monetary policy. The published statistics on the market, employment has also supported the dollar. the euro rose in the first time at this week after the cabinet of Greece supported the call of Prime Minister George Papandreou on the referendum on the plan of salvation of Greece. Greek Prime Minister George Papandreou secured the support of ministers on the issue submitted to referendum, the country assistance plan worth 130 billion euros, but he has to convince the leaders of the eurozone whether the referendum, did not expect such a decision.

On Thursday the euro fell against the dollar, poised for its biggest weekly loss in almost two months, as Group of 20 leaders failed to agree on funding to support European governments’ efforts to contain their debt crisis. The euro pared its declines as commodities reversed a retreat.Canada’s currency tumbled after the nation’s employers unexpectedly eliminated jobs. Employment in Canada fell by 54,000 jobs last month after an increase of 60,900 in September, the nation’s statistics agency reported.The Australian dollar fell for the first time in three days after the Reserve Bank lowered its forecasts for economic growth and inflation forecasts for the next two years as global financial turmoil makes businesses more reluctant to hire.

On Friday the euro rose versus the dollar and yen after Greek Prime Minister George Papandreou signaled he won’t call for a referendum on a bailout package, easing concern voters would reject it and send the nation into default. The dollar dropped as stocks and commodities rallied, damping demand for haven assets.

Resistance 3: Y80.20 (Aug 4 high)

Resistance 2: Y79.50 (Oct 31 high)

Resistance 1: Y78.45 (session high)

The current price: Y78.13

Support 1:Y77.95 (Nov 2 low)

Support 2: Y77.55 (50.0% FIBO Y75.55-Y79.55)

Support 3: Y77.10 (61.8% FIBO Y75.55-Y79.55)

Comments: the pair holds in range.

Resistance 3: Chf0.9080 (Oct 20 high)

Resistance 2: Chf0.9005 (high of American session on Oct 20)

Resistance 1: Chf0.8950/60 (area of Nov 1 high)

The current price: Chf0.8939

Support 1: Chf0.8890 (support line from Nov 4)

Support 2: Chf0.8830 (MA(233) H1)

Support 3: Chf0.8760/70 (area of Nov 3-4 low)

Comments: the pair is on uptrend. In focus resistance Chf0.8950/60.

Resistance 3: $1.6150/60 (area of Oct 28-31 high)

Resistance 2: $1.6095 (Nov 1 high)

Resistance 1: $1.6065 (session high)

The current price: $1.6018

Support 1 : $1.6005 (session low)

Support 2 : $1.5945 (Nov 4 low)

Support 3 : $1.5875 (Nov 3 low)

Comments: the pair is corrected but remains in uptrend. In focus support $1.6005.

Resistance 3: $1.3925 (50.0% FIBO $1.3610-$1.4245)

Resistance 2: $1.3870 (Nov 4 high)

Resistance 1: $1.3830 (session high, MA(233) H1)

The current price: $1.3764

Support 1 : $1.3750 (session low)

Support 2 : $1.3710 (Nov 4 low)

Support 3 : $1.3660 (Nov 3 low)

Comments: the pair is corrected but remains in uptrend. In focus support $1.3750.

00:30 Australia ANZ Job Advertisements (MoM) October -2.1% -0.3%

06:45 Switzerland Unemployment Rate October 3.0% 3.0%

08:00 United Kingdom Halifax house price index October -0.5% +0.1%

08:00 United Kingdom Halifax house price index 3m Y/Y October -2.3.% -2.3%

08:15 Switzerland Consumer Price Index (MoM) October +0.3% +0.2%

08:15 Switzerland Consumer Price Index (YoY) October +0.5% +0.2%

09:30 Eurozone Sentix Investor Confidence November -18.5 -19.5

10:00 Eurozone Retail Sales (MoM) September -0.3% 0.0%

10:00 Eurozone Retail Sales (YoY) September -1.0% -0.5%

11:00 Germany Industrial Production s.a. (MoM) September -1.0% -0.7%

11:00 Germany Industrial Production (YoY) September +7.7% +7.2%

13:40 U.S. FOMC Member Rosengren Speaks

17:45 Switzerland Gov Board Member Jordan Speak

20:00 U.S. Consumer Credit September -9.5 5.2

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.