- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

The euro advanced from a one-month low versus the dollar after Standard & Poor’s clarified that France’s credit rating remains AAA, easing concern that a crisis was imminent in the region’s second-largest economy.

The 17-nation currency advanced earlier versus most major peers after Italy drew double the bids for the amount on offer at a bill sale, damping bets the nation will face a challenge funding itself. Greece chose an interim prime minister. Europe’s shared currency rallied from little-changed as S&P said a message was erroneously sent today to some of its subscribers suggesting France’s top-notch credit rating had been lowered. It affirmed the country’s AAA rating.

The euro gained earlier as Italy sold 5 billion euros ($6.8 billion) of bills to yield 6.087 percent, compared with 3.57 percent the last time it auctioned 12-month securities on Oct. 11, and European Central Bank was said to have bought Italy’s government bonds. Demand at the auction was 1.99 times the amount on offer.

Lucas Papademos, a former vice president of the ECB, was chosen to lead a new Greek unity government, paving the way for a coalition charged with securing additional financing to avert the country’s economic collapse. Papademos, 64, steered the country into the euro region as central bank governor more than a decade ago. He has never held elective office.

The Dollar Index declined 0.5 percent to 77.543 on reduced demand for a refuge after a report showed the number of Americans filing applications for unemployment benefits fell to the lowest level in seven months.

European stocks dropped, erasing earlier gains, as a surge in French borrowing costs added to concern the region’s debt crisis is spreading.

Stocks tumbled yesterday after Italian borrowing costs surged to euro-era records. Italy’s 10-year bond yield yesterday closed at 7.25 percent, near levels that prompted Greece, Ireland and Portugal to seek bailouts.

French 10-year bonds extended their declines today, sending the yield 20 basis points higher to 3.40 percent. Sean Egan, president and founding principal of Egan-Jones Ratings Co., told Bloomberg Radio the nation’s sovereign-debt rating is “probably headed south.”

The difference in yield with similar-maturity benchmark German bunds increased 18 basis points to 166 basis points, the most since the euro was introduced in 1999.

National benchmark indexes declined in 15 of the 18 western European markets today. France’s CAC 40 and the U.K.’s FTSE 100 both slid 0.3 percent, while Germany’s DAX rose 0.7 percent.

Credit Agricole SA slid 2.3 percent after France’s third- largest bank reported a drop in profit. The bank reported a 65 percent drop in third-quarter profit to 258 million euros as writedowns on Greek debt crimped earnings.

Vedanta Resources Plc led a retreat in mining companies, falling 9.5 percent after the largest copper producer in India reported a 92 percent drop in first-half profit to $27.8 million on foreign-exchange losses. The shares also fell as copper tumbled in London.

Air France-KLM lost 5 percent to 4.62 euros after Europe’s biggest airline reported a 31 percent drop in quarterly profit and said it expects to post a full-year loss as fuel costs surge and a sluggish economy weighs on ticket prices.

European Aeronautic Defence and Space Co. paced advancing shares, climbing 5 percent to 20.97 euros after third-quarter profit surged to 312 million euros from 13 million euros and the German government agreed to buy a 7.5 percent stake in the company from Daimler AG. The maker of Mercedes-Benz cars lost 1.2 percent to 33.16 euros.

Fed's doing what it can to get econ on track; econ is still far from where we want it.

U.S. stocks rose, following the biggest decrease in the Standard & Poor’s 500 Index since August, as concern about Europe eased as S&P said it did not downgrade France’s debt and American jobless claims fell. Earlier today, stocks trimmed gains amid investors’ concern that France’s rating would be lowered.

Equities tumbled yesterday on concern that European leaders may be unable to keep the euro zone intact as Italian yields surged to a record. The decline erased the month-to-date advance in the S&P 500. The measure had the biggest monthly gain in 20 years in October on speculation Europe would contain its crisis.

Former vice president of the European Central Bank Lucas Papademos will head a national unity government for Greece, according to the country’s presidency. The ECB bought Italian government bonds today, according to three people familiar with the transactions, who declined to be identified. Italy sold 5 billion euros ($6.8 billion) of one-year bills, the maximum for the auction, and demand rose as the Treasury lured investors with the highest yield in 14 years.

Stocks also rose as data showed the number of Americans filing applications for unemployment benefits fell to the lowest level in seven months, a sign the recovery may be encouraging companies to limit cuts in headcount. The U.S. trade deficit unexpectedly narrowed in September to the lowest level this year as exports surged to a record high, another report showed.

Dow 11,889.74 +108.80 +0.92%, Nasdaq 2,625.69 +4.04 +0.15%, S&P 500 1,238.52 +9.42 +0.77%

Cisco Systems Inc. (CSCO), a maker of networking equipment, climbed 6.3 percent as profit and sales beat estimates. Merck & Co. (MRK) jumped 3 percent after raising its dividend. Apple Inc. slumped 2.4 percent.

Gold futures fell the most in six weeks as demand for a haven eased after Italian bond yields dropped and a new Greek leader was named, reducing concerns that Europe’s sovereign-debt crisis will escalate. Italy sold 5 billion euros ($6.8 billion) of one-year bills, the maximum for the Treasury auction. Lucas Papademos, a former vice president of the European Central Bank, became the head of a national unity government in Greece. Gold jumped to a record $1,923.70 an ounce on Sept. 6 on demand for an alternative to equities and some currencies.

Gold futures for December delivery fell to $1,736.60 on the Comex in New York. A close at the price would mark the biggest gain for a most-active contract since Sept. 23. Before today, the metal climbed 26 percent in the past year.

Oil rose to the highest level in more than three months after a government report showed U.S. jobless claims unexpectedly declined, spurring optimism that a recovering economy will boost fuel demand.

Oil advanced as much as 2.3 percent after the Labor Department said the number of Americans filing applications for unemployment benefits fell by 10,000 to a seven-month low of 390,000 in the week ended Nov. 5. Prices also increased as Italian bond yields retreated from records, tempering concern that Europe’s debt crisis would spiral out of control.

Crude for December delivery climbed to $97.90, the highest intraday level since Aug. 1, on the New York Mercantile Exchange. Prices have risen 6 percent this year.

Brent oil for December settlement gained 41 cents, or 0.4 percent, to $112.72 a barrel on the London-based ICE Futures Europe exchange.

Techs support at $1.5846/49, the 55-day moving average and High 17 Oct.

USD/JPY Y77.25, Y77.50, Y77.70

EUR/PY Y106.55

GBP/USD $1.5890, $1.5900, $1.5965, $1.5995

EUR/GBP stg0.8500

USD/CHF Chf0.9100, Chf0.9035, Chf0.8980

EUR/CHF Chf1.2365, Chf1,2380, Chf1.2400 * Chf1.2300 digital,large

AUD/USD $0.9910, $0.9985, $1.0000, $1.0200, $1.0250

EUR/USD A$1.3450

NZD/USD $0.7535

AUD/NZD NZ$1.3000

USD/CAD C$1.0200-10, C$1.0250

NZD/CAD C$0.8150

Data:

06:30 France CPI (October) unadjusted 0.2%

06:30 France CPI (October) unadjusted Y/Y 2.3%

06:30 France HICP (October) Y/Y 2.5%

07:00 Germany CPI (October) final 0.0%

07:00 Germany CPI (October) final Y/Y 2.5%

07:00 Germany HICP (October) final Y/Y 2.9%

07:00 Germany Wholesale prices (October) -1.0%

07:00 Germany Wholesale prices (October) Y/Y 5.0%

07:45 France Industrial production (September) -1.7%

07:45 France Industrial production (September) Y/Y 3.4%

09:00 Italy Industrial production (September) adjusted -4.8%

09:00 Italy Industrial production (September) Y/Y adjusted -2.7%

12:00 UK BoE meeting announcement 0.50%

The euro rose after Italy drew double the bids for the amount on offer at a bill sale, easing concern the nation is struggling to fund itself.

The euro advanced from a one-month low as the European Central Bank was said to buy Italy’s government bonds.

The country’s 10-year yields climbed yesterday above the 7 percent level that spurred Greece, Ireland and Portugal to request bailouts. The euro remained higher versus the greenback as U.S. initial unemployment claims dropped.

Italy sold 5 billion euros ($6.8 billion) of bills today, with investors bidding for nearly double the amount of securities on offer. The bills were sold to yield 6.087 percent today, compared with 3.57 percent the last time it auctioned 12-month securities on Oct. 11.

The Senate in Italy will vote tomorrow on debt-reduction measures that may lead to the resignation of Prime Minister Silvio Berlusconi within days. The pace of the euro’s decline also encouraged some investors to buy.

EUR/USD: the pair grown above $1.3600.

GBP/USD: the pair fell below $1.5900.

USD/JPY: the pair holds in Y77,55-Y77,90.

EUR/USD:

Offers $1.3720/25, $1.3680/700, $1.3660, $1.3650

Bids $1.3600, $1.3585/80, $1.3555/45, $1.3525/20

New government to be sworn in Friday Nov 11 1200GMT.

Committed to fully implement Oct 27 agreements.

Resistance 3: Y78.40 (Nov 2 high)

Resistance 2: Y78.00 (resistance line from Nov 2)

Resistance 1: Y77.90 (session high)

Current price: Y77.62

Support 1:Y77.55 (Nov 9 low, 50.0 % FIBO Y75,55-Y79,55)

Support 2:Y77.10 (61.8 % FIBO Y75,55-Y79,55)

Support 3:Y76.30 (area of Oct 25-26 highs)

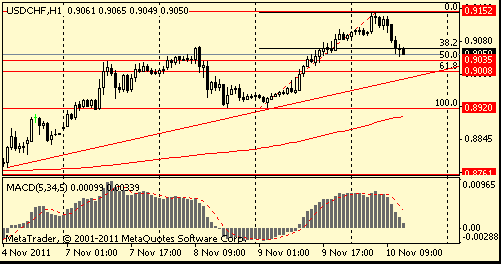

Resistance 3: Chf0.9360 (area of high of March)

Resistance 2: Chf0.9310 (area of high of October)

Resistance 1: Chf0.9150 (session high)

Current price: Chf0.9050

Support 1: Chf0.9030 (50.0 % FIBO Chf0,8920-Chf0,9150, session low)

Support 2: Chf0.9010 (61,8 % FIBO Chf0,8920-Chf0,9150, support line from Nov 3)

Support 3: Chf0.8920 (Nov 8-9 low)

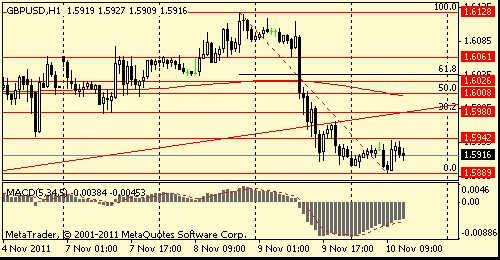

Resistance 3: $ 1.6000/10 (50,0 % FIBO $1,6130-$ 1,5890)

Resistance 2: $ 1.5980 (38,2 % FIBO $1,6130-$ 1,5890, support line from Oct 12)

Resistance 1: $ 1.5940 (area of Nov 4 low and session high)

Current price: $1.5916

Support 1 : $1.5890 (session low)

Support 2 : $1.5875 (Nov 7 low)

Support 3 : $1.5820 (38,2 % FIBO $1,5270-$ 1,6130)

Resistance 3: $ 1.3720 (area of 61,8 % FIBO $1,3850-$ 1,3485, Nov 8 low)

Resistance 2: $ 1.3675 (50,0 % FIBO $1,3850-$ 1,3485)

Resistance 1: $ 1.3630 (38,2 % FIBO $1,3850-$ 1,3485, session high)

Current price: $1.3584

Support 1 : $1.3485 (session low)

Support 2 : $1.3370 (Oct 10 low)

Support 3 : $1.3240 (Oct 6 low)

USD/JPY Y77.25, Y77.50, Y77.70

EUR/PY Y106.55

GBP/USD $1.5890, $1.5900, $1.5965, $1.5995

EUR/GBP stg0.8500

USD/CHF Chf0.9100, Chf0.9035, Chf0.8980

EUR/CHF Chf1.2365, Chf1,2380, Chf1.2400 * Chf1.2300 digital,large

AUD/USD $0.9910, $0.9985, $1.0000, $1.0200, $1.0250

EUR/USD A$1.3450

NZD/USD $0.7535

AUD/NZD NZ$1.3000

USD/CAD C$1.0200-10, C$1.0250

NZD/CAD C$0.8150

- Forecasters See GDP Up 0.8% In 2012 Vs 1.6% In Aug Forecast

- Forecasters See GDP Up 1.6% In 2013 Vs 1.8% In Aug Forecast

- ECB Forecasters Sharply Lower 2012 GDP Growth Forecast

- CPI To Stay Above 2% In Coming Months, Fall Thereafter

- Econ Outlook Subject To High Uncertainty, Intensified Downside Risks

- Some Risks To Econ Outlook Have Been Materializing

- Significant Downward Revision To 2012 GDP Forecast "Very Likely"

- All Euro Area Govts Must Honor Sovereign Signatures

- Forecasters See HICP Up 2.6% In 2011, Same As Aug Forecast

- Forecasters See HICP Up 1.8% In 2012 Vs 2.0% In Aug Forecast

- Forecasters See HICP Up 1.8% In 2013 Vs 1.9% In Aug Forecast

00:30 Australia Changing the number of employed October 10.1K

00:30 Australia Unemployment rate October 5.2%

02:00 China Trade Balance, bln October 17.0

05:00 Japan Consumer Confidence October 38.6

05:00 Japan Consumer Confidence Households October 38.6

06:00 Japan Prelim Machine Tool Orders, y/y October +25.9%

Canada’s dollar dropped to the lowest level in almost three weeks as concern Italy may become the latest European nation in need of a financial bailout drove investors to the safety of the U.S. currrency.

The Canadian currency dropped 1.6 percent, the most this week, extending its losses in the second half of the year to 5.9 percent.

The euro touched the lowest level in a month before Italy sells 5 billion euros ($6.8 billion) of one-year bills today, testing investor appetite after borrowing costs surged to euro-era records.

The 17-nation currency reached a two-week low against the yen after Italian yields yesterday climbed above the 7 percent level that spurred Greece, Ireland and Portugal to seek bailouts. Italy will sell five-year debt on Nov. 14.

EUR/USD: on Asian session the pair fell.

GBP/USD: on Asian session the pair decreased.

USD/JPY: on Asian session the pair fell.

On Wednesday UK data at 0930GMT includes the Trade Balance and also BOE Quoted Rates data. Despite turbulence in the euro zone, the UK's largest export market by far, the August trade data were surprisingly robust, with the global goods, and EU trade, deficits narrowing. US data starts at 1100GMT with the weekly MBA Mortgage Application Index. At 1430GMT, Fed Chairman Ben Bernanke gives welcoming remarks at the Fed's Small Business and Entrepreneurship conference in Washington. US data continues at 1500GMT with Wholesale Inventories and then at 1530GMT with the weekly EIA Crude Oil Stocks data. At 1715GMT, Fed Governor Daniel Tarullo delivers a speech on financial regulation at a Clearing House conference in New York.

The euro slid to a four-week low versus the dollar as Italian bond yields climbed to euro-era records after a firm raised the deposits it demands for clearing the nation’s securities, intensifying Europe’s debt crisis. The shared currency fell to a two-week low versus the yen on concern Italy will join Greece in struggling to form a new regime strong enough to implement austerity measures. LCH Clearnet SA announced the changes to its margin requirements on Italian government-debt on its website.

The 17-nation currency remained lower versus the dollar as Greek Prime Minister George Papandreou said in Athens his country’s two biggest political parties reached agreement on the creation of a national unity government after three days of talks. Papandreou will step down. He didn’t disclose the name of the new prime minister.

The dollar rose as U.S. 10-year note yields declined the most in a week as demand for refuge surged. The Dollar Index, which IntercontinentalExchange Inc. uses to track the greenback against the currencies of six major U.S. trading partners climbed 1.3 percent to 77.630.

The yen strengthened against most of its major peers as traders sought a haven. The Japanese currency and yen- denominated bonds were the most-sought assets, according to Bank of New York Mellon Corp. The yen tends to gain because Japan’s export-reliant economy doesn’t need foreign capital to balance current accounts the broadest measure of trade while the greenback tends to strengthen during periods of financial stress due to its status as the world’s reserve currency.

EUR/USD: the pair fell and has lost three figures.

GBP/USD: the pair has fallen having lost two figures.

USD/JPY: the pair holds near by Y78.70.

A heavy calendar Thursday starts at 0630GMT, with the release of French October inflation data. German HICP data and the October wholesale price data are due for release at 0700GMT. French industrial output data is released at 0745GMT, with Italian output data expected at 0900GMT. At 1215GMT, ECB Executive Board member Juergen Stark speaks on challenges for Germany and Europe, in Berlin. He speaks again at 1330GMT and again at 1800GMT. US data starts at 1330GMT, with the US Sep Intl Trade Balance data. Also at 1330GMT, the November jobless rate is released, along with import/export prices. Initial jobless claims are expected to rise 3,000 to 400,000 in the November 5 week after falling below 400,000 in the previous week. At 1900GMT, the US Oct Treasury Statement is released. The Treasury is expected to post a $104.5 billion budget gap to start the new 2012 fiscal year. October 1 was a Saturday in 2011, shifting transfer payments into September, so outlays for the current month should be smaller than in the previous year.

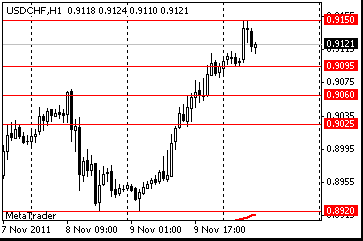

Resistance 3: Chf0.9215 (Oct 3 high)

Resistance 2: Chf0.9180 (Sep 22 high)

Resistance 1: Chf0.9150 (session high)

The current price: Chf0.9121

Support 1: Chf0.9095 (session low)

Support 2: Chf0.9060 (38.2% FIBO Chf0.9150-Chf0.8920)

Support 3: Chf0.9025 (low of the American session on Nov 9)

Comments: the pair is on uptrend. In focus resistance Chf0.9150.

Resistance 3: $1.6015 (50.0% FIBO $1.5900-$1.6130)

Resistance 2: $1.5985 (38.2% FIBO $1.5900-$1.6130)

Resistance 1: $1.5950 (23.6% FIBO $1.5900-$1.6130)

The current price: $1.5919

Support 1 : $1.5900 (session low)

Support 2 : $1.5875 (Nov 3 low)

Support 3 : $1.5840 (Sep 9 low)

Comments: the pair is on downtrend. In focus support $1.5900.

Resistance 3: $1.3685 (50.0% FIBO $1.3515-$1.3860)

Resistance 2: $1.3610 (high of the American session on Nov 9)

Resistance 1: $1.3560 (session high)

The current price: $1.3547

Support 1 : $1.3515 (session low)

Support 2 : $1.3485 (low of the European session on Sep 30)

Support 3 : $1.3415 (low of the American session on Sep 30)

Comments: the pair is on downtrend. In focus support $1.3515.

Change % Change Last

Nikkei 225 8,755 +99.93 +1.15%

Hang Seng 20,014 +335.96 +1.71%

S&P/ASX 200 4,346 +52.22 +1.22%

Shanghai Composite 2,525 +21.08 +0.84%

FTSE 100 5,460 -106.96 -1.92%

CAC 40 3,075 -68.14 -2.17%

DAX 5,830 -131.90 -2.21%

Dow 11,780.94 -389.24 -3.20%

Nasdaq 2,621.65 -105.84 -3.88%

S&P 500 1,229.10 -46.82 -3.67%

10 Year Yield 1.96% -0.11 --

Oil $95.91 +0.17 +0.18%

Gold $1,770.90 -20.70 -1.16%

00:30 Australia Changing the number of employed October 20.4K 10.3K

00:30 Australia Unemployment rate October 5.2% 5.3%

02:00 China Trade Balance, bln October 14.5 26.3

05:00 Japan Consumer Confidence October 38.6 39.3

05:00 Japan Consumer Confidence Households October 38.5

06:00 Japan Prelim Machine Tool Orders, y/y October +20.1%

06:30 France CPI, m/m October -0.1% +0.1%

06:30 France CPI, y/y October +2.2% +2.3%

07:00 Germany CPI (final), m/m September 0.0% 0.0%

07:00 Germany CPI (final), y/y September +2.5% +2.5%

07:45 France Industrial Production, m/m September +0.5% -0.6%

07:45 France Industrial Production, y/y September +4.4% +3.9%

09:00 Eurozone ECB Monthly Report

12:00 United Kingdom BoE Interest Rate Decision 0.50% 0.50%

12:15 Eurozone ECB’s Juergen Stark Speaks

13:30 Canada Trade balance, billions September -0.6 -0.5

13:30 U.S. International trade, bln September -45.6 -46.1

13:30 U.S. Initial Jobless Claims 397 402

15:40 U.S. FOMC Member Charles Evans Speaks

16:45 U.S. Fed Chairman Bernanke Speaks

19:00 U.S. Federal budget October -64.6 -110.3

23:50 Japan Tertiary Industry Index September -0.2% -0.4%

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.