- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

The euro gained the most in two weeks against the dollar as renewed optimism European leaders are taking steps to contain the region’s sovereign-debt crisis spurred appetite for risk.

The 17-nation currency rose as former European Central Bank Vice President Lucas Papademos was sworn in as prime minster of Greece and as Italy’s Senate approved a debt-cutting bill.

The euro rose versus a majority of its 16 most-traded peers as Italy’s 10-year government bond yield declined to as low as 6.43 percent, the least in four days. The rate soared on Nov. 9 to as high as 7.48 percent, exceeding the 7 percent level that led Greece, Ireland and Portugal to seek international bailouts.

Italy’s Chamber of Deputies will give final approval to the austerity legislation tomorrow and Prime Minister Silvio Berlusconi will resign “a minute later,” Chamber Speaker Gianfranco Fini said. The new government may be led by former European Union Competition Commissioner Mario Monti.

Greek Finance Minister Evangelos Venizelos will remain in his post in the new coalition government headed by Papademos, which is charged with the immediate task of securing funds to avert an economic collapse. Venizelos will also be deputy premier, according to an e-mailed statement today from the press ministry in Athens.

The yen reached its highest versus the dollar since Japan intervened last month to weaken it. Finance Minister Jun Azumi of Japan said today he’s on guard against speculative yen trades while declining to comment on whether the nation has been selling the currency this month. Japan sold the yen after it reached a post-World War II high of 75.35 per dollar on Oct. 31. Barclays Plc and Tokyo- based Totan Research Co. estimate the nation sold 8 trillion yen ($103 billion) that day, based on changes in the central bank’s balance sheet.

Updated US bank stress tests to start in two weeks

Length of weak phase depends on solving acute political issues

He sees a risk of deflation in 2012 if there's an economic downturn

Ready to take further measures on the franc

At the moment the pound is trading at 1.6080 zone, 0.9% above the opening price. A pair of fully compensated for losses incurred in the outgoing week. The next resistance levelsare at 1.6100, 1.6130 (week high) and 1.6165 (peak maximum of 31 October), while support is provided to 1.6030, 1.6000 and 1.5950.

EUR/USD $1.3550, $1.3715, $1.3720, $1.3845, $1.3900

GBP/USD $1.6230

AUD/USD $1.0155, $1.0200, $1.0260

EUR/CHF Chf1.2425

AUD/JPY Y79.00

09:30 UK PPI (Output) (October) unadjusted 0.0%

09:30 UK PPI (Output) (October) unadjusted Y/Y 5.7%

09:30 UK PPI Output ex FDT (October)) adjusted -0.1%

09:30 UK PPI Output ex FDT (October) unadjusted Y/Y 3.4%

09:30 UK PPI (Input) (October) adjusted -0.8%

09:30 UK PPI (Input) (October) unadjusted Y/Y 14.1%

The euro extended its advance from a one-month low against the dollar as the Italian Senate approved a budget bill.

The euro rose as former European Central Bank Vice President Lucas Papademos prepared to be sworn in as prime minster while the Italian budget vote paved the way for a new administration that may be led by former European Union Competition Commissioner Mario Monti.

The nation’s 10-year government bond yield soared to as high as 7.48 percent on Nov. 9 and fell to 6.65 percent today. Bond investors charged the nation an interest rate of 6.087 percent yesterday to buy 5 billion euros of one-year bills, the highest in 14 years. Italy plans to sell as much as 3 billion euros of five-year bonds on Nov. 14, testing investor appetite for the nation’s debt.

EUR/USD: the pair grown in $1.3670 area.

GBP/USD: the pair was consolidating in $1.5890-$ 1,5950 area.

USD/JPY: the pair decreased to Y77,30.

The limited US data is released at 1455GMT, with the release of the Nov Consumer Sentiment (UM) numbers. The Michigan Sentiment Index is expected to rise to a reading of 62.0 in early-November.

Resistance 3: Y78.40 (Nov 2 high)

Resistance 2: Y78.00 (resistance line from Nov 2)

Resistance 1: Y77.70 (session high)

Current price: Y77.36

Support 1:Y77.30 (session low)

Support 2:Y77.10 (61.8 % FIBO Y75,55-Y79,55)

Support 3:Y76.30 (area of Oct 25-26 highs)

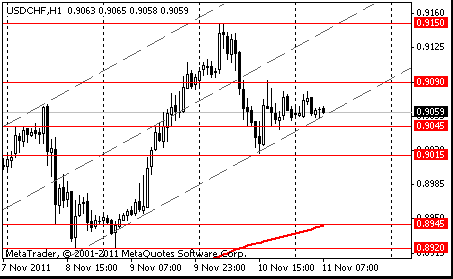

Resistance 3: Chf0.9310 (area of high of October)

Resistance 2: Chf0.9150 (Nov 10 high)

Resistance 1: Chf0.9080 (session high)

Current price: Chf0.9052

Support 1: Chf0.9040/30 (session low, 50.0 % FIBO Chf0,8920-Chf0,9150)

Support 2: Chf0.9010 (61,8 % FIBO Chf0,8920-Chf0,9150, support line from Nov 3)

Support 3: Chf0.8920 (Nov 8-9 low)

Resistance 3: $ 1.6000 (50,0 % FIBO $1,6130-$ 1,5870, support line from Oct 12)

Resistance 2: $ 1.5980 (Nov 10 high)

Resistance 1: $ 1.5950 (session high)

Current price: $1.5915

Support 1 : $1.580 (Nov 10 low)

Support 2 : $1.5875 (Nov 7 low)

Support 3 : $1.5820 (38,2 % FIBO $1,5270-$ 1,6130)

EUR/USD $1.3550, $1.3715, $1.3720, $1.3845, $1.3900

GBP/USD $1.6230

AUD/USD $1.0155, $1.0200, $1.0260

EUR/CHF Chf1.2425

AUD/JPY Y79.00

Resistance 3: $ 1.3750 (support line from Nov 1)

Resistance 2: $ 1.3720 (area of 61,8 % FIBO $1,3850-$ 1,3485, МА (200) for Н1)

Resistance 1: $ 1.3670 (50,0 % FIBO $1,3850-$ 1,3485, session high)

Current price: $1.3636

Support 1 : $1.358 (session low)

Support 2 : $1.3485 (Nov 10 low)

Support 3 : $1.3370 (Oct 10 low)

Demand seen into Y105.30/25 (Y105.25 - 10 Nov intraday low),ahead of strong bids at Y104.75/70 (Y104.77/74 - 26 Oct/10 Nov lows).

Offers seen at Y105.75/80 (Y105.74/79 - Asian/European lows), more at Y105.95/00 (Y105.98 - 10 Nov high).

Being restored from Thursday’s low $1.3484, the pair break $1.3653. Resistance which needs to be broken to the investors putting on growth of euro, is located on $1.3775, but levels of resistance $1.3695 and $1.3730 will resolutely protect this area. Break of a level of closing of the last week $1.3790 it is not expected. Break below low of the Asian session of Friday $1.3580 will change short-term tone of pair on bear and again will aim it at a low of this week $1.3485. Target levels of a dominating 2-week wave of decrease are on $1.3230 and about October 4 low $1.3145.

Nikkei 225 8,514 +13.67 +0.16%

Hang Seng 19,137 +173.28 +0.91%

S&P/ASX 4,297 +52.42 +1.24%

Shanghai Composite 2,481 +1.55 +0.06%

The yen rose to the strongest against the dollar since Japan’s government intervened last month to weaken it as concern Europe’s spreading debt crisis will dent global growth spurred investors to seek haven assets.

The Japanese currency was poised to gain against all 16 major counterparts this week before Italy sells as much as 3 billion euros ($4.1 billion) of five-year bonds on Nov. 14, testing investor appetite for the nation’s debt.

The dollar strengthened against most peers for the period after U.S. Treasury Secretary Timothy F. Geithner said Europe remains the “central challenge” to growth.

EUR/USD: on Asian session the pair grows.

GBP/USD: on Asian session the pair decreased.

USD/JPY: on Asian session the pair continues falling.

On Friday US bond and forex markets closed for the Veterans' Day holiday - although equity markets are open. UK data is up at 0930GMT, with the release of third quarter construction output numbers and October producer price data. The limited US data is released at 1455GMT, with the release of the Nov Consumer Sentiment (UM) numbers. The Michigan Sentiment Index is expected to rise to a reading of 62.0 in early-November.

The euro advanced from a one-month low versus the dollar after Standard & Poor’s clarified that France’s credit rating remains AAA, easing concern that a crisis was imminent in the region’s second-largest economy.

The 17-nation currency advanced earlier versus most major peers after Italy drew double the bids for the amount on offer at a bill sale, damping bets the nation will face a challenge funding itself. Greece chose an interim prime minister. Europe’s shared currency rallied from little-changed as S&P said a message was erroneously sent to some of its subscribers suggesting France’s top-notch credit rating had been lowered. It affirmed the country’s AAA rating.

The euro gained earlier as Italy sold 5 billion euros ($6.8 billion) of bills to yield 6.087 percent, compared with 3.57 percent the last time it auctioned 12-month securities on Oct. 11, and European Central Bank was said to have bought Italy’s government bonds. Demand at the auction was 1.99 times the amount on offer.

Lucas Papademos, a former vice president of the ECB, was chosen to lead a new Greek unity government, paving the way for a coalition charged with securing additional financing to avert the country’s economic collapse. Papademos, 64, steered the country into the euro region as central bank governor more than a decade ago. He has never held elective office.

The Dollar Index declined 0.5 percent to 77.543 on reduced demand for a refuge after a report showed the number of Americans filing applications for unemployment benefits fell to the lowest level in seven months.

EUR/USD: the pair restored and closed day growth on a figure.

GBP/USD: the pair has fallen having lost two figures.

USD/JPY: the pair was under pressure.

On Friday US bond and forex markets closed for the Veterans' Day holiday - although equity markets are open. UK data is up at 0930GMT, with the release of third quarter construction output numbers and October producer price data. The limited US data is released at 1455GMT, with the release of the Nov Consumer Sentiment (UM) numbers. The Michigan Sentiment Index is expected to rise to a reading of 62.0 in early-November.

Resistance 3: Chf0.9215 (Oct 3 high)

Resistance 2: Chf0.9150 (Nov 10 high)

Resistance 1: Chf0.9090 (high of the American session on Nov 10)

The current price: Chf0.9060

Support 1: Chf0.9045 (low of the American session on Nov 10)

Support 2: Chf0.9015 (low on Nov 10)

Support 3: Chf0.8945 (MA(233) H1)

Comments: the pair is on uptrend. In focus resistance Chf0.9090.

Resistance 3: $1.3740 (MA(233) H1)

Resistance 2: $1.3685 (50.0% FIBO $1.3515-$1.3860)

Resistance 1: $1.3635 (session high)

The current price: $1.3624

Support 1 : $1.3575 (session low)

Support 2 : $1.3550 (low of the American session on Nov 10)

Support 3 : $1.3485 (low on Nov 10)

Comments: the pair is corrected after falling on Nov 9. In focus resistance $1.3635.

Change % Change Last

Nikkei 225 8,755 +99.93 +1.15%

Hang Seng 20,014 +335.96 +1.71%

S&P/ASX 200 4,346 +52.22 +1.22%

Shanghai Composite 2,525 +21.08 +0.84%

FTSE 100 5,460 -106.96 -1.92%

CAC 40 3,075 -68.14 -2.17%

DAX 5,830 -131.90 -2.21%

Dow 11,780.94 -389.24 -3.20%

Nasdaq 2,621.65 -105.84 -3.88%

S&P 500 1,229.10 -46.82 -3.67%

10 Year Yield 1.96% -0.11 --

Oil $95.91 +0.17 +0.18%

Gold $1,770.90 -20.70 -1.16%

00:30 Australia Changing the number of employed October 20.4K 10.3K

00:30 Australia Unemployment rate October 5.2% 5.3%

02:00 China Trade Balance, bln October 14.5 26.3

05:00 Japan Consumer Confidence October 38.6 39.3

05:00 Japan Consumer Confidence Households October 38.5

06:00 Japan Prelim Machine Tool Orders, y/y October +20.1%

06:30 France CPI, m/m October -0.1% +0.1%

06:30 France CPI, y/y October +2.2% +2.3%

07:00 Germany CPI (final), m/m September 0.0% 0.0%

07:00 Germany CPI (final), y/y September +2.5% +2.5%

07:45 France Industrial Production, m/m September +0.5% -0.6%

07:45 France Industrial Production, y/y September +4.4% +3.9%

09:00 Eurozone ECB Monthly Report

12:00 United Kingdom BoE Interest Rate Decision 0.50% 0.50%

12:15 Eurozone ECB’s Juergen Stark Speaks

13:30 Canada Trade balance, billions September -0.6 -0.5

13:30 U.S. International trade, bln September -45.6 -46.1

13:30 U.S. Initial Jobless Claims 397 402

15:40 U.S. FOMC Member Charles Evans Speaks

16:45 U.S. Fed Chairman Bernanke Speaks

19:00 U.S. Federal budget October -64.6 -110.3

23:50 Japan Tertiary Industry Index September -0.2% -0.4%

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.