- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

Can meet 2012 deficit goal even with only 0.5% growth

No objection if parliament pushes further fiscal consolidation

The euro fell to a one-month low against the yen as European bond yields surged at auctions and Mario Monti, Italy’s premier-in-waiting, faced resistance to forming a cabinet. The 17-nation currency slid below $1.35 as Italy’s 10-year yields surpassed the 7 percent threshold that prompted other nations to seek bailouts. Italian 10-year yields climbed as high as 7.07 percent after rising to a euro-era record of 7.48 percent on Nov. 9. The extra yield investors demand to hold the 10-year debt of Spain, France, Austria and Belgium instead of German bunds widened to the most since the euro was introduced in 1999. The ZEW Center for European Economic Research said its index of German investor and analyst expectations, which aims to predict developments six months in advance, decreased to minus 55.2 this month, the lowest since October 2008.

The Swiss franc dropped versus the dollar after the central bank’s Vice Chairman Thomas Jordan said the currency remains “very strong.” Hans Hess, president of the country’s industry group Swissmem, told reporters today in Bern that the central bank should raise the ceiling. Fair value, the measure for currencies using prices for similar goods and services in two countries, is 1.35 to 1.40 francs per euro.

The dollar got a boost as Federal Reserve Bank of Dallas President Richard Fisher said he sees decreasing odds the central bank will need to ease policy further on signs the U.S. economy is poised for growth. U.S. retail sales rose in October more than forecast, and manufacturing in the New York region unexpectedly expanded this month, reports showed today.

- Fed has provided certainty, Congress has created uncertainty

European stocks declined as Italy’s premier in waiting Mario Monti struggled to get political parties to help form his new Cabinet and the country’s biggest defense company forecast an unexpected loss. Monti, a former European Union competition commissioner, struggled to get political parties to agree to participate in his so-called technical Cabinet during talks in Rome yesterday and today. A government lacking political representation will find it harder to muster support from the parties in parliament to pass unpopular laws.

The euro area’s inability to contain its sovereign-debt crisis has led to a surge in Italian borrowing costs with yields on the country’s benchmark 10-year bonds climbing above 7 percent today. Monti will try to reassure investors that Italy can cut its 1.9 trillion-euro debt and spur economic growth that has lagged behind the euro-region average for more than a decade.

A report today showed German investor confidence fell to a three-year low in November. The ZEW Center for European Economic Research in Mannheim, Germany, said its index of investor and analyst expectations, which aims to predict developments six months in advance, declined to minus 55.2 from minus 48.3 in October. That’s the lowest since October 2008.

A separate report showed the euro area’s economic expansion failed to accelerate in the third quarter. Gross domestic product increased 0.2 percent from the previous three months, when it rose at the same pace, the European Union’s statistics office in Luxembourg said.

European stocks pared their losses after a U.S. Commerce Department report showed that retail sales climbed more in October than predicted as Americans bought iPhones and cars. A separate report showed manufacturing in the New York region unexpectedly expanded in November. The Federal Reserve Bank of New York’s general economic index rose to 0.6 from minus 8.5 in October.

National benchmark indexes fell in 14 of the 18 western- European markets today. France’s CAC 40 Index lost 1.9 percent, the U.K.’s FTSE 100 Index slipped less than 0.1 percent and Germany’s DAX Index dropped 0.9 percent.

Finmeccanica slumped 20 percent to 3.57 euros, its lowest price in 15 years. The company forecast an adjusted loss before interest, taxes, amortization and restructuring of 200 million euros. The maker of helicopters and plane parts booked writedowns of 753 million euros.

Europe’s banking shares slid 2 percent as a group, extending yesterday’s drop. National Bank of Greece SA retreated 12 percent to 1.86 euros and Alpha Bank SA plummeted 11 percent to 96 euro cents. UniCredit, Italy’s biggest bank, lost 4.5 percent to 73.95 euro cents.

Vienna Insurance Group AG sank 4.5 percent to 26.74 euros. The insurer said third-quarter net income rose 3.9 percent to 98.2 million euros. That missed the average estimate of 102.8 million euros in a Bloomberg survey of six analysts. The insurer wrote down its Italian government bonds by 10 percent.

Cable & Wireless Worldwide plunged 26 percent to 22.31 pence, its largest drop since March 2010 and the biggest retreat on the Stoxx 600. The company, which provides telecommunications services to the U.K. police force, will pay an interim dividend of 0.75 pence per share in January 2012 and then suspend future dividend payments to “improve balance-sheet strength and to enable investment in the business,” it said.

Electrolux AB lost 6.3 percent to 113.40 kronor as the world’s second-biggest appliance maker said it will close factories in Europe and North America to cut costs amid weak demand.

Kabel Deutschland AG slipped 3.2 percent to 40.79 euros as Germany’s largest cable operator predicted sales growth in 2011 at the lower end of its forecast range of 6.25 percent to 6.75 percent.

Can not afford to provoke ratings increased volatility in the markets

Necessary to reduce excessive reliance on ratings

Rating agencies must be accountable for their mistakes

It is necessary to increase the competitiveness of the rating agencies

U.S. stocks declined, sending the Standard & Poor’s 500 Index down for a second straight day, as Italian, Spanish and French credit-default swaps surged to records amid concern Europe’s debt crisis is worsening. Italy’s 10-year yield climbed above 7 percent as prime minister-in-waiting Mario Monti faced resistance on forming a cabinet for his new government. The rate on German two-year notes dropped below 0.3 percent for the first time, while the extra yield investors demand to hold 10-year bonds from France, Belgium, Spain and Austria instead of benchmark bunds all increased to euro-era records.

Earlier today, futures trimmed losses as a Commerce Department report showed U.S. retail sales increased 0.5 percent in October, topping economists’ estimates, and the Federal Reserve Bank of New York’s general economic index unexpectedly rose to 0.6, the first positive reading since May.

Dow 12,052.34 -26.64 -0.22%, Nasdaq 2,660.73 +3.51 +0.13%, S&P 500 1,250.09 -1.69 -0.14%

Financial shares had the biggest decline in the S&P 500 among 10 industries, falling 0.8 percent as a group.

Bank of America Corp. (BAC) rallied 1.8 percent as credit-card writeoffs declined in October.

Wal-Mart Stores Inc. (WMT) retreated 2.6 percent as profit at the world’s largest retailer trailed forecasts. Net income for the quarter ended Oct. 31 declined 2.9 percent to $3.34 billion from $3.44 billion a year earlier. Profit excluding some items was 97 cents a share. Analysts projected 98 cents, on average.

LinkedIn Corp., a professional-networking website, slid 7.1 percent after saying Bain Capital Ventures will sell all of its shares in a secondary stock offering. The company plans to offer as many as 9.2 million shares for as much as $703 million, up from the $500 million sale previously announced. Current holders including Bain expect to sell 6.73 million of those shares. Bain’s stake may be worth as much as $283.2 million in the sale, based on a proposed maximum offering price of $76.44.

Gold declined for a second day in New York as a stronger dollar curbed demand for the metal as an alternative asset.

The euro fell versus the dollar for a second day after Italy’s borrowing costs surged to the highest level since 1997 at a note auction and Mario Monti, the nation’s premier-in- waiting, faced resistance to forming a Cabinet.

Gold for December delivery fell to $1,760.90 an ounce on the Comex in New York. Immediate-delivery gold was 0.6 percent lower at $1,769.88 in London.

Bullion is in the 11th year of a bull market and futures reached a record $1,923.70 an ounce on Sept. 6 as investors sought to diversify away from equities and some currencies. Holdings in gold-backed exchange-traded products reached a record 2,330 metric tons on Aug. 18 and were at 2,312.3 tons yesterday, little changed from Nov. 11.

Oil rose after U.S. retail sales increased more than projected in October, bolstering optimism that the economy of the largest crude-consuming country will expand this quarter.

Futures climbed as much as 1.2 percent after the Commerce Department said sales gained 0.5 percent last month following a 1.1 percent increase in September. The median forecast of 81 economists surveyed by Bloomberg News was a rise of 0.3 percent. Other reports showed wholesale prices dropped in October and manufacturing in the New York region expanded in November.

Crude for December delivery rose to $99.34 a barrel on the New York Mercantile Exchange. The contract dropped to $97.51 earlier today.

The Brent contract for December settlement, which expires today, gained 90 cents, or 0.8 percent, to $112.79 a barrel on the London-based ICE Futures Europe exchange. The January contract climbed 68 cents, or 0.6 percent, to $111.96.

EUR/USD

Offers $1.3640/50, $1.3600/10, $1.3580/85, $1.3560/70

Bids $1.3500, $1.3485/80, $1.3465/60, $1.3440, $1.3410/00

Data:

06:30 France GDP (Q3) preliminary 0.4%

06:30 France GDP (Q3) preliminary Y/Y 1.6%

07:00 Germany GDP (Q3) flash 0.5%

07:00 Germany GDP (Q3) flash Y/Y 2.6%

09:30 UK HICP (October) 0.1%

09:30 UK HICP (October) Y/Y 5.0%

09:30 UK HICP ex EFAT (October) Y/Y 3.4%

09:30 UK Retail prices (October) 0.0%

09:30 UK Retail prices (October) Y/Y 5.4%

09:30 UK RPI-X (October) Y/Y 5.6%

10:00 Germany ZEW economic expectations index (November) -55.2

10:00 EU(17) GDP (Q3) flash 0.2%

10:00 EU(17) GDP (Q3) flash Y/Y 1.4%

10:00 EU(17) Trade balance (September) unadjusted, bln 2.9

10:00 EU(17) Trade balance (September) adjusted, bln 2.1

The euro slumped for a second day as European bond yields surged at auctions and Italy’s premier-in- waiting Mario Monti faced resistance to forming a Cabinet, fueling concern efforts to solve the debt crisis are faltering.

The euro dropped to a one-month low against the yen as Italy’s 10-year yield surpassed the 7 percent threshold that prompted Greece, Ireland and Portugal to seek bailouts.

Spain raised 3.16 billion euros from selling 12- and 18- month bills today, less than its maximum target of 3.5 billion euros. The average yield on the one-year securities climbed to 5.022 percent from 3.608 percent at the previous sale Oct. 18. Greek and Belgian borrowing costs also rose at auctions today.

The ZEW Center for European Economic Research said its index of investor and analyst expectations, which aims to predict developments six months in advance, declined to minus 55.2 this month, the lowest since October 2008.

EUR/USD: the pair fell in $1.3530 area.

GBP/USD: the pair fell in $1.5850 area.

USD/JPY: the pair decreased in Y77,00 area.

- unemployment rate will go down to 6% but slowly;

- inflation rate goal is 2%.

- unemployment rate will go down to 6% but slowly;

- inflation rate goal is 2%.

Resistance 3: Y77.90 (resistance line from Nov 2)

Resistance 2: Y77.70 (Nov 11 high, MA(200) for H1)

Resistance 1: Y77.50 (session high)

Current price: Y76.99

Support 1:Y76.80 (Npv 14 low)

Support 2:Y76.30 (area of Nov 25-26 high)

Support 3:Y75.60 (area of historic low)

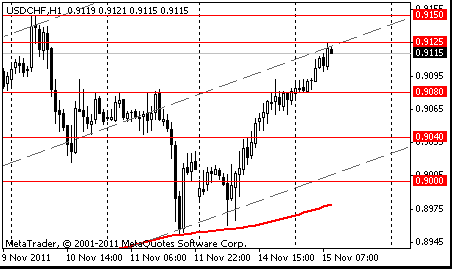

Resistance 3: Chf0.9310 (high of October)

Resistance 2: Chf0.9270 (Oct 10 high)

Resistance 1: Chf0.9175 (session high)

Current price: Chf0.9161

Support 1: Chf0.9150 (Nov 10 high)

Support 2: Chf0.9090 (38,2 % FIBO of growth from Chf0,8960)

Support 3: Chf0.9070 (50,0 % FIBO of growth from Chf0,8960)

Resistance 3: $ 1.6040 (support line from Octo 12)

Resistance 2: $ 1.5990 (МА(200) for Н1)

Resistance 1: $ 1.5930 (session high)

Current price: $1.5880

Support 1 : $1.5820 (session low, 38,2 % FIBO $1,5270-$ 1,6170)

Support 2 : $1.5750 (Oct 21 low)

Support 3 : $1.5720 (50,0 % FIBO $1,5270-$ 1,6170)

Resistance 3: $ 1.3660 (50.0 % FIBO $1,3800-$ 1,3510)

Resistance 2: $ 1.3640 (area of session high)

Resistance 1: $ 1.3620 (38,2 % FIBO $1,3800-$ 1,3510)

Current price: $1.3532

Support 1 : $1.3510 (session low)

Support 2 : $1.3480 (Nov 10 low)

Support 3 : $1.3370 (area of Oct 7-10 lows)

Nikkei 225 8,542 -61.77 -0.72%

Hang Seng 19,356 -152.02 -0.78%

S&P/ASX 4,286 -18.93 -0.44%

Shanghai Composite 2,530 +1.05 +0.04%

Economic Situation Still Relatively Good In Germany

Crisis Risks Could Further Harm German Economy

Econ Expectations Were Last Lower In October

Euro-Zone, US Debt Problems Weigh On Business Activity

The euro declined for a second day before a report forecast to show German investor confidence fell to a three-year low as Europe’s debt crisis threatens to curb economic growth.

The 17-nation currency dropped against 10 of its 16 major counterparts as Spain prepares to sell up to 4 billion euros ($5.4 billion) of bonds on Nov. 17 after Italy’s borrowing costs surged to the highest level since 1997 at a note auction.

The New Zealand and Australian currencies declined for a second day as concern Europe will struggle to contain its sovereign-debt crisis sapped demand for riskier assets.

The so-called kiwi and Aussie dollars weakened versus most of their major counterparts as Asian stocks slid. Losses in Australia’s dollar were limited after the Reserve Bank said in minutes of its Nov. 1 meeting there was a case for keeping interest rates unchanged.

The Canadian currency dropped as crude oil, Canada’s biggest export, fell.

EUR/USD: on Asian session the pair fell.

GBP/USD: on Asian session the pair decreased.

USD/JPY: on Asian session the pair updated a week’s high, however has lost the positions later.

European data for Tuesday sees flash Q3 GDP data including France at 0630GMT, which is expected to come in at 0.4% q/q, while Germany at 0700GMT is expected to rise 0.5%. At 0915GMT, ECB Executive Board member Juergen Stark is due to give a speech entitled "Prospects of monetary policy in the euro area," in Luxembourg. EMU data continues at 1000GMT when the Q3 flash GDP is expected to rise 0.2% q/q. Trade data for September is also due at the same time. Also at 1000GMT, the German ZEW data is due. The current conditions measure is expected to slip to a reading of 32.0, while the economic sentiment measure is also expected to decline to a reading of -52.5. UK data at 0930GMT sees CPI. October was, undoubtedly, another month of very high inflation in the UK with the impact of hikes in domestic energy tariffs still coming through. US events start at 1230GMT when St. Louis Fed President James Bullard is due to deliver a speech on the economy outlook to the CFA Society of St. Louis. US data starts at 1245GMT with the weekly ICSC-Goldman Store Sales data. Also at 1300GMT, Chicago Fed President Charles Evans is due to deliver a speech to the Council on Foreign Relations in New York. US data continues at 1330GMT with Retail & Food Sales, PPI and also the NY Fed Empire State Survey.The weekly Redbook Average is then due at 1355GMT.

The euro dropped more than 1 percent versus the dollar and yen as Italy’s borrowing costs increased at a five-year note sale, stoking concern its new government will struggle to contain debt turmoil. Italy’s Treasury auctioned 3 billion euros ($4.1 billion) of September 2016 notes, the maximum target. The yield was 6.29 percent, up from 5.32 percent at the previous auction and the highest since June 1997. Demand rose to 1.47 times the amount on offer, from 1.34 times last month. Former European Union Competition Commissioner Mario Monti will head a new government as Italy reaches outside the political arena for a leader to restore confidence in its ability to cut the euro region’s second-biggest debt. Italy’s President Giorgio Napolitano offered the position of premier to Monti after the resignation of Silvio Berlusconi.

Yields on Spanish 10-year bonds rose above 6 percent today for the first time since Aug. 5. The European Central Bank was said to resume its purchases of government debt, including buying Spanish and Italian securities, on Aug. 8.

The franc snapped a two-day gain versus the dollar, sliding to 90.86 centimes versus the dollar, after the Federal Statistics Office said producer and import prices decreased 1.8 percent last month from a year earlier. Swiss National Bank President Philipp Hildebrand is proving intervention in foreign-exchange markets can succeed as speculators bow to his decision to cap the franc against the euro as he seeks to stave off the threat of deflation. The currency has depreciated 10 percent against the euro and 13 percent versus the dollar since Sept. 5, the day before the central bank imposed a ceiling at 1.20 per euro.

Sterling fell to $1.5899 after the Chartered Institute of Personnel and Development said its gauge of U.K. hiring fell to minus 3 in the fourth quarter from minus 1 in the previous three months.

EUR/USD: yesterday the pair fell and lost two figures.

GBP/USD: yesterday the pair fell and lost two figures.

USD/JPY: yesterday the pair continued decrease.

European data for Tuesday sees flash Q3 GDP data including France at 0630GMT, which is expected to come in at 0.4% q/q, while Germany at 0700GMT is expected to rise 0.5%. At 0915GMT, ECB Executive Board member Juergen Stark is due to give a speech entitled "Prospects of monetary policy in the euro area," in Luxembourg. EMU data continues at 1000GMT when the Q3 flash GDP is expected to rise 0.2% q/q. Trade data for September is also due at the same time. Also at 1000GMT, the German ZEW data is due. The current conditions measure is expected to slip to a reading of 32.0, while the economic sentiment measure is also expected to decline to a reading of -52.5. UK data at 0930GMT sees CPI. October was, undoubtedly, another month of very high inflation in the UK with the impact of hikes in domestic energy tariffs still coming through. US events start at 1230GMT when St. Louis Fed President James Bullard is due to deliver a speech on the economy outlook to the CFA Society of St. Louis. US data starts at 1245GMT with the weekly ICSC-Goldman Store Sales data. Also at 1300GMT, Chicago Fed President Charles Evans is due to deliver a speech to the Council on Foreign Relations in New York. US data continues at 1330GMT with Retail & Food Sales, PPI and also the NY Fed Empire State Survey.The weekly Redbook Average is then due at 1355GMT.

Resistance 3: Chf0.9235 (resistance line from Nov 4)

Resistance 2: Chf0.9150 (Nov 10 high)

Resistance 1: Chf0.9125 (session high)

The current price: Chf0.9115

Support 1: Chf0.9080 (session low)

Support 2: Chf0.9040 (50.0% FIBO Chf0.9115-Chf0.8960)

Support 3: Chf0.9000 (support line from Nov 4)

Comments: the pair is on uptrend. In focus resistance Chf0.9115.

Resistance 3: $1.3805 (Nov 14 high)

Resistance 2: $1.3720 (MA (233) H1)

Resistance 1: $1.3640 (session high)

The current price: $1.3611

Support 1 : $1.3590 (session low)

Support 2 : $1.3550 (low of the American session on Nov 10)

Support 3 : $1.3485 (Nov 10 low)

Comments: the pair decreases. In focus support $1.3590.

Change % Change Last

Nikkei 225 8,604 +89.23 +1.05%

Hang Seng 19,508 +371.01 +1.94%

S&P/ASX 200 4,305 +8.06 +0.19%

Shanghai Composite 2,529 +47.63 +1.92%

FTSE 100 5,519 -26.34 -0.47%

CAC 40 3,109 -40.43 -1.28%

DAX 5,985 -72.01 -1.19%

Dow 12,078.98 -74.70 -0.61%

Nasdaq 2,657.22 -21.53 -0.80%

S&P 500 1,251.78 -12.07 -0.96%

10 Year Yield 2.04% -0.01 --

Oil $98.23 +0.09 +0.09%

Gold $1,781.20 +2.80 +0.16%

00:01 United Kingdom Nationwide Consumer Confidence October 45

00:30 Australia Australia RBA Meeting's Minutes

06:30 France GDP, q/q Quarter III 0.0% +0.3%

06:30 France GDP, Y/Y Quarter III +1.7% +1.6%

07:00 Germany GDP (QoQ) Quarter III +0.1% +0.5%

07:00 Germany GDP (wda) (YoY) Quarter III +2.8% +2.4%

09:30 United Kingdom HICP, Y/Y October +5.2% +5.1%

09:30 United Kingdom HICP ex EFAT, Y/Y October +3.3% +3.3%

09:30 United Kingdom HICP, m/m October +0.6% +0.2%

10:00 Germany ZEW Survey - Economic Sentiment November -48.3 -51.7

10:00 Eurozone ZEW Economic Sentiment November -51.2 -52.7

10:00 Eurozone GDP (QoQ) Quarter III +0.2% +0.2%

10:00 Eurozone GDP (YoY) Quarter III +1.6% +1.4%

10:00 Eurozone Trade Balance s.a. September -1.0 -0.8

13:00 U.S. FOMC Member Charles Evans Speaks

13:30 Canada Bank of Canada Monetary Policy Report September +1.4% +1.1%

13:30 U.S. Retail sales October +1.1% +0.3%

13:30 U.S. Retail sales excluding auto October +0.6% +0.2%

13:30 U.S. PPI, m/m October +0.8% -0.1%

13:30 U.S. PPI, y/y October +6.9%

13:30 U.S. PPI excluding food and energy, m/m October +0.1% +0.2%

13:30 U.S. PPI excluding food and energy, Y/Y October +2.5%

13:30 U.S. FOMC Member James Bullard Speaks

15:00 U.S. Business inventories September +0.5% +0.2%

17:30 U.S. FOMC Member Richard Fisher Speaks

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.