- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

The euro rose against the majority of its most-traded counterparts as Italian bond yields reversed course and fell, easing concern the region’s third-largest economy will be unable to handle its debt crisis.The 17-nation currency gained from the lowest in five weeks versus the dollar and the yen as two people with knowledge of the trades said the European Central Bank bought more Italian government bonds, following purchases earlier today. The euro fell earlier as Spanish and French borrowing costs rose at auctions.

Italy’s credit rating may be cut to low investment grade should the country lose market access, while the nation’s economy may already be in a recession, Fitch Ratings said. Italy’s new government has a “window of opportunity” to carry out urgent measures together with ECB support to bring down borrowing costs, the ratings company said in a special report.

The euro erased gains versus the yen and euro as stocks and commodities tumbled.

The Dollar Index, which IntercontinentalExchange Inc. uses to track the greenback against the currencies of six major U.S. trading partners, dropped for the first time in four days as builders broke ground on more American homes than forecast in October, an annualized 628,000 . Fewer first-time claims for unemployment insurance payments were filed in the U.S. last week, 388,000, an indication the job market may be gaining traction, Labor Department data showed.

The pound strengthened against the dollar, snapping a three-day decline, after British retail sales unexpectedly rose in October. Sterling gained as much as 0.5 percent to $1.5813 before trading at $1.5751, up 0.1 percent. The currency rose 0.2 percent versus the euro to 85.460 pence.

The Australian dollar reached parity with the greenback for the first time in more than a month as appetite for risk faded.

European stocks fell after Spain’s borrowing costs surged to a euro-era record on waning demand at a bond sale, adding to concern the region’s sovereign debt crisis is deepening.

Spanish bonds sank, driving 10-year yields to as much as 6.78 percent, the highest since before the euro was introduced, as borrowing costs climbed to the most in at least seven years at an auction of securities. The benchmark yield was trading at 6.49 percent at 4:39 p.m.

In France, the extra yield, or spread, investors receive for holding 10-year French debt instead of benchmark German bunds reached 2 percentage points for the first time in the shared currency’s history as the country sold 8.01 billion euros of notes and bonds.

National benchmark indexes fell in all but one of the 18 western-European markets today. France’s CAC 40 slid 1.8 percent, the U.K.’s FTSE 100 dropped 1.6 percent and Germany’s DAX lost 1.1 percent.

A gauge of European banks declined 2.2 percent as the three-month cross-currency basis swap, the rate banks pay to convert euro payments into dollars, reached 131 basis points below the euro interbank offered rate in London, the most expensive since December 2008.

BNP Paribas, France’s largest lender, fell 4.6 percent to 28.49 euros. Societe Generale slid 3.9 percent to 16.95 euros. Credit Agricole SA lost 4.7 percent to 4.43 euros. Deutsche Bank AG, Germany’s largest bank, declined 3.7 percent to 27.29 euros.

Copper tumbled the most in a week in London on concern Europe’s debt crisis may spread to other economies, potentially eroding demand for metals. Antofagasta Plc paced a selloff in mining shares, falling 6.1 percent to 1,103 pence, while Vedanta Resources Plc lost 6.9 percent to 1,014 pence and Xstrata Plc retreated 3.9 percent to 958.8 pence.

Voestalpine AG plunged 9.2 percent to 20.84 euros after Austria’s biggest steelmaker cut its profit outlook for the full year, citing a “difficult economic environment.”

ASML Holding NV, Europe’s biggest semiconductor-equipment maker, dropped 3.2 percent to 28.65 euros after Applied Materials Inc., the world’s largest producer of semiconductor- making equipment, forecast first-quarter earnings that missed analyst estimates.

“We cannot be satisfied with the current state of the economy or the outlook for the next few years. The economy is operating far below its productive potential" - cites 9% unemployment. Fed "could do more in both directions" - eg elaborate on forward commitment to keep rates low (says it'd be desirable to talk abt econ conditions expected before rate hike) - or "we could purchase more longer term financial assets" - "it might make sense to do much of this" in MBS to impact housing and prevent disrupting Tsys mkt. Recognizes poss costs of more ease, but still favors same.”

U.S. stocks fell, sending the Standard & Poor’s 500 Index down a second day, as concern about higher borrowing costs in Europe offset a drop in American jobless claims and higher-than-forecast housing starts.

Stock-market swings may rise as this month’s futures and options on U.S. stocks and indexes expire. Trading at the New York Stock Exchange opened “as usual,” said Ray Pellecchia, spokesman for the NYSE Euronext, as protesters from the Occupy Wall Street movement swarmed Manhattan’s Financial District.

Spanish bonds sank, driving 10-year yields to the highest since the euro was introduced in 1999, as borrowing costs climbed to the most in at least seven years at an auction. The International Monetary Fund won’t release the next tranche of funding for Greece until there is broad political support for the measures attached to the loan, a spokesman said.

In the U.S., the Federal Reserve Bank of Philadelphia’s general economic index slid to 3.6 in November from 8.7 the prior month. Readings greater than zero indicate manufacturing growth in the area covering eastern Pennsylvania, southern New Jersey and Delaware.

Earlier today, futures erased losses as data showed fewer Americans than forecast filed first-time claims for unemployment insurance payments last week, an indication the labor market may be gaining traction. Builders broke ground on more homes than forecast in October and construction permits climbed to the highest level since March 2010.

Sears Holdings slumped 4.2 percent to $65.46. Hedge-fund manager Edward Lampert and new Chief Executive Officer Lou D’Ambrosio are emphasizing smaller stores, online commerce and licensing Sears’s brands to turn around the four-year sales slide. Retailers are having a harder time attracting shoppers, with consumer confidence at the lowest in more than two years.

Applied Materials dropped 6.3 percent to $11.69. Profit before certain costs will be 8 cents to 16 cents a share, the company said. Revenue will decline as much as 15 percent from the prior quarter, Applied said, indicating sales of as little as $1.85 billion. Analysts on average predicted profit of 18 cents on sales of $2.07 billion, according to Bloomberg data.

Jefferies slumped 5.5 percent to $9.75. Shares of the New York-based firm fell yesterday to close at their lowest since March 2009 and its bonds traded with junk-like yields that were double the level of mid-August. Jefferies came under pressure from short sellers after MF Global’s $6.3 billion bet on European debt led to an Oct. 31 bankruptcy and spurred scrutiny of similar stakes at financial firms.

NetApp tumbled 11 percent, the most in the S&P 500, to $36.23. The maker of data-storage products forecast third- quarter adjusted earnings of no more than 60 cents a share, 4 cents less than the average analyst estimate.

Gold futures fell the most in a week as commodities and equities slumped after Fitch Rating said U.S. banks face a “serious risk” from Europe’s debt woes.

The MSCI World Index of equities slumped for a fourth day, and the Standard & Poor’s GSCI index of 24 raw materials fell the most in three weeks. Fitch said yesterday that “the broad credit outlook for the U.S. banking industry could worsen,” unless Europe’s woes are resolved soon. Before today, gold rose 25 percent this year on demand for a store of value.

Average physical gold purchases in the past two weeks in India, the world’s biggest consumer, has been the lowest since mid-June 2010, UBS AG said a report.

The dollar was little changed against a basket of major currencies after a three-day rally.

Gold futures for December delivery fell to $1,733 an ounce on the Comex in New York. A close at that price would mark the biggest drop for a most- active contract since Nov. 10.

Oil fell from the highest level in five months as rising bond yields in Spain and France heightened concern that Europe’s debt crisis is spreading.

Futures dropped as much as 2.5 percent as Spain’s borrowing costs surged to a euro-era record and as French bonds’ spread to Germany’s widened. Oil pared losses earlier after data showed fewer Americans than forecast filed first-time claims for unemployment insurance payments last week.

Crude for December delivery fell to $100.01 a barrel on the New York Mercantile Exchange. Prices settled at $102.59 yesterday, the highest level since May 31, after Enbridge Inc. (ENB) and Enterprise Products Partners LP (EPD) said they will reverse the direction of the Seaway pipeline, adding an outlet to transport oil from the central U.S. and Canada to the coast of the Gulf of Mexico.

Brent oil for January settlement fell $2.23, or 2 percent, to $109.54 a barrel on the London-based ICE Futures Europe exchange. Brent’s premium to West Texas Intermediate, the New York benchmark, narrowed 89 cents to $8.39, down from a record $27.88 on Oct. 14 and from $13.02 on Nov. 15.

USD/JPY Y76.75, Y77.00, Y77.05, Y77.50

AUD/USD $1.0000, $1.0115, $1.0150, $1.0200, $1.0225, $1.0230-35, $1.0275, $1.0300

EUR/CHF Chf1.2500

GBP/USD $1.6000, $1.5750, $1.5500

EUR/JPY Y105.65

Data:

09:30 UK Retail sales (October) 0.6% -0.2% 0.6%

09:30 UK Retail sales (October) Y/Y

The euro approached a five-week low against the yen as Spanish and French borrowing costs rose at auctions, fueling concern the region’s debt crisis is worsening.

The euro earlier reached the weakest since Oct. 10 as Spain sold 3.56 billion euros ($4.8 billion) of a new 10-year bond at an average yield of almost 7 percent, the highest since the euro’s creation.

Spain’s Treasury’s average yield was 6.975 percent, up from 5.433 percent when it auctioned debt maturing in April 2021 last month.

French borrowing costs rose to 2.82 percent at an auction of July 2016 notes, up from 2.31 percent at the previous offer of the securities on Oct. 20.

The Dollar Index snapped three days of gains as economists said a U.S. report today will show first-time jobless claims rose last week.

EUR/USD: the pair lead european session in $1,3440-$ 1,3530 range.

GBP/USD: the pair lead european session in $1,5720-$ 1,5790 range.

USD/JPY: the pair was in Y76,90-Y77.10 area.

US data starts at 1330GMT with the weekly Jobless Claims as well as October's Housing Starts & Building Permits. Initial jobless claims are expected to rise 5,000 to 395,000 in the November 12 employment survey week after falling to 390,000 in the previous week. At 1730GMT, Cleveland Fed President Sandra Pianalto is due to deliver a speech on the economic outlook to Rotary Club of Lexington, while at 1750GMT, New York Fed President William Dudley delivers a speech on the economic outlook at policy at West Point.

- Italy's economic weakness pre-dates financial crisis;

- Measures to focus on debt cuts , growth , social equity.

- Italy's economic weakness pre-dates financial crisis;

- Measures to focus on debt cuts , growth , social equity.

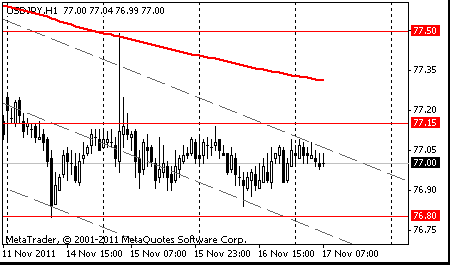

Resistance 3: Y77.80 (resistance line from Nov 2)

Resistance 2: Y77.50 (Nov 15 high)

Resistance 1: Y77.15 (Nov 16 high)

Current price: Y77.00

Support 1:Y76.80 (Nov 14 low)

Support 2:Y76.30 (area of Nov 25-26 low)

Support 3:Y75.60 (area of a historical low)

Resistance 3: Chf0.9310 (high of October)

Resistance 2: Chf0.9270 (Oct 10 high)

Resistance 1: Chf0.9230 (session high)

Current price: Chf0.9211

Support 1: Chf0.9180 (session low)

Support 2: Chf0.9130 (area of 38.2 % FIBO of growth from Chf0,8960 and Nov 16 low)

Support 3: Chf0.9100 (area of 50,0 % FIBO of growth from Chf0,8960)

Resistance 3: $ 1.5875 (38,2 % FIBO $1,6090-$ 1,5690)

Resistance 2: $ 1.5820 (Nov 16 high)

Resistance 1: $ 1.5790 (session high)

Current price: $1.5765

Support 1 : $1.5690 (session low)

Support 2 : $1.5630/10 (61.8 % FIBO $1,5270-$ 1,6170, Oct 18 low)

Support 3 : $1.5540 (Oct 12 low)

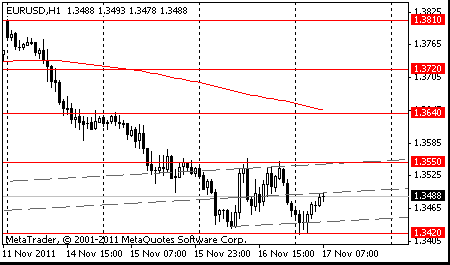

Resistance 3: $ 1.3610 (50.0 % FIBO $1,3800-$ 1,3420)

Resistance 2: $ 1.3560 (Nov 16 high, 38,2 % FIBO $1,3800-$ 1,3420)

Resistance 1: $ 1.3530 (session high)

Current price: $1.3481

Support 1 : $1.3440 (low of european session)

Support 2 : $1.3420 (session low)

Support 3 : $1.3370 (area of Oct 7-10 lows)

AFT sold E6.943bln vs target E6.0-E7.0bln

E950mln of 2.0% Sep 2013 BTAN;avg yield 1.85% , cover 3.87

E1.069bln of 2.00% July 2015 BTAN; avg yield 2.44%, cover 2.40

E1.625bln of 2.25% Feb 2016 BTAN; avg yield 2.71%, cover 2.03

E3.332bln of 2.50% July 2016 BTAN;avg yield 2.82% , cover 1.68

EUR/USD $1.3300, $1.3435, $1.3440, $1.3500, $1.3510, $1.3550-55, $1.3600, $1.3685, $1.3700

USD/JPY Y76.75, Y77.00, Y77.05, Y77.50

AUD/USD $1.0000, $1.0115, $1.0150, $1.0200, $1.0225, $1.0230-35, $1.0275, $1.0300

EUR/CHF Chf1.2500

GBP/USD $1.6000, $1.5750, $1.5500

EUR/JPY Y105.65

Tesoro Publico sold E3.56bn vs target E3.0-E4.0bn releases further auction results. Sold new 5.85% Jan 2022 Obligacion; avg. yield 6.975% vs 5.433% prev. cover 1.54 vs 1.76 prev

The euro touched a five-week low versus the yen and dollar amid bets the European Central Bank will have to buy more European government debt as confidence wanes in the region’s ability to deal with its debt crisis. The 17-nation currency dropped below $1.35 for a second day as Fitch Ratings said U.S. banks face a “serious risk” to their creditworthiness if the European crisis worsens. Spain will auction up to 4 billion euros ($5.4 billion) of bonds tomorrow, the same day France will sell as much as 8.2 billion euros of debt.

The dollar fell against most of its 16 major counterparts before Federal Reserve Bank of New York President William Dudley speaks today amid speculation the U.S. recovery isn’t fast enough to deter further monetary easing.

The Dollar Index slid from a five-week high before government data today expected to show that the number of Americans filing for unemployment benefits rose last week from a seven-month low.

The Australian dollar touched the lowest levels in at least a month on concern the global economy will slow as European leaders struggle to stem the region’s debt crisis. Demand for the South Pacific currencies was limited before Spain and France auction debt today after yields on euro-area bonds soared. New Zealand’s dollar touched a six-week low against the greenback and yen after data showed producer input prices grew at the slowest pace in almost two years.

EUR/USD: on Asian session the pair gain.

GBP/USD: on Asian session the pair advanced.

USD/JPY: on Asian session the pair fell.

A fairly thin calendar of scheduled events in Europe starts at 0800GMT when German Finance Minister Wolfgang Schaeuble delivers a

speech at a insurance industry conference, in Berlin. At 1000GMT, German Chancellor Angela Merkel delivers a speech at the Sueddeutsche Zeitung conference in Berlin. EMU data at 1000GMT sees just EMU construction output for September. US data starts at 1330GMT with the weekly Jobless Claims as well as October's Housing Starts & Building Permits. Initial jobless claims are expected to rise 5,000 to 395,000 in the November 12 employment survey week after falling to 390,000 in the previous week. At 1730GMT, Cleveland Fed President Sandra Pianalto is due to deliver a speech on the economic outlook to Rotary Club of Lexington, while at 1750GMT, New York Fed President William Dudley delivers a speech on the economic outlook at policy at West Point.

The euro against the dollar shows a high volatility. Yesterday, the euro reached a five-week low against the dollar and the yen amid growing fears of investors about the ability of European countries to cope with the debt crisis. Yields on ten-year gosbondam Italy at auction on Wednesday fell by 29 basis points - to 6.79%, the papers in Spain - 9 points - to 6.25%. According to the sources to Bloomberg, most of these papers concern the European countries became the ECB. The pressure on the single currency has also information that a representative of the EU Juncker called the "high" and "an alarming" levels of debt in Germany. A new Greek Prime Papademos said that the crisis has spread from the periphery to the core of the regional economy, and said that the need for a more radical intervention, since the existing EU mechanisms are not adequate.

Over time, the euro rebounded against the dollar, along with an increase in major U.S. stock indices, influenced by favorable macro data and the sharp increase in oil prices. Published in the U.S. statistics reported to investors that consumer prices fell in October by 0.1%, while industrial growth was 0.7%. Net investments of nonresidents in U.S. assets in September was higher than analysts' expectations.

The British pound fell against the dollar after the Bank of England lowered forecasts for economic growth and inflation, as expected, signaling the introduction of a new fiscal stimulus in coming months. As the market was ready for such statements, the pound was able to hold their positions. At the same time in the UK in October, the number of complaints of employment increased by 5.3 million with the expected 21.0 thousand, as a percentage of the number of jobseekers was 5.0%, forecast 5.1%.

EUR/USD: yesterday the pair closed day falling on a floor of figure.

GBP/USD: yesterday the pair decrease.

USD/JPY: yesterday the pair traded nearby Y77.00.

A fairly thin calendar of scheduled events in Europe starts at 0800GMT when German Finance Minister Wolfgang Schaeuble delivers a

speech at a insurance industry conference, in Berlin. At 1000GMT, German Chancellor Angela Merkel delivers a speech at the Sueddeutsche Zeitung conference in Berlin. EMU data at 1000GMT sees just EMU construction output for September. US data starts at 1330GMT with the weekly Jobless Claims as well as October's Housing Starts & Building Permits. Initial jobless claims are expected to rise 5,000 to 395,000 in the November 12 employment survey week after falling to 390,000 in the previous week. At 1730GMT, Cleveland Fed President Sandra Pianalto is due to deliver a speech on the economic outlook to Rotary Club of Lexington, while at 1750GMT, New York Fed President William Dudley delivers a speech on the economic outlook at policy at West Point.

Resistance 3: Y77.80 (resistance line from Nov 2)

Resistance 2: Y77.50 (Nov 15 high)

Resistance 1: Y77.15 (Nov 16 high)

The current price: Y77.00

Support 1:Y76.80 (Nov 14 low)

Support 2:Y76.30 (area of Nov 25-26 low)

Support 3:Y75.60 (area of a historical low)

Comments: the pair is on downtrend. In focus support Y76.80.

Resistance 3: Chf0.9340 (Apr 1 high)

Resistance 2: Chf0.9300 (resistance line from Nov 4)

Resistance 1: Chf0.9230 (session high)

The current price: Chf0.9187

Support 1: Chf0.9140 (Nov 16 low)

Support 2: Chf0.9080 (Nov 15 low)

Support 3: Chf0.9020 (76.4 % FIBO Chf0.9230-Chf0.8950)

Comments: the pair is on uptrend. In focus resistance Chf0.9230.

Resistance 3: $1.3720 (76.4 % FIBO $1.3420-$ 1.3810)

Resistance 2: $1.3640 (Nov 15 high)

Resistance 1: $1.3550 (Nov 16 high)

The current price: $1.3484

Support 1 : $1.3420 (session low)

Support 2 : $1.3360 (Oct 7 low)

Support 3 : $1.3310 (low of the Asian session on Oct 6)

Comments: the pair remains under pressure. In focus support $1.3420.

Change % Change Last

Nikkei 225 8,463 -78.77 -0.92%

Hang Seng 18,961 -387.54 -2.00%

S&P/ASX 200 4,247 -38.24 -0.89%

Shanghai Composite 2,467 -62.80 -2.48%

FTSE 100 5,509 -8.42 -0.15%

CAC 40 3,065 +15.77 +0.52%

DAX 5,913 -19.78 -0.33%

Dow 11,905.59 -190.57 -1.58%

Nasdaq 2,639.61 -46.59 -1.73%

S&P 500 1,236.91 -20.90 -1.66%

10 Year Yield 2.02% -0.03 --

Oil $101.86 -0.73 -0.71%

Gold $1,763.50 -10.80 -0.61%

05:00 Japan BoJ monthly economic report November

09:30 United Kingdom Retail Price Index, m/m October -0.2% +0.6%

09:30 United Kingdom Retail Sales (YoY) October 0.0% +0.6%

13:30 U.S. Initial Jobless Claims неделя по 12 октября 390 402

13:30 U.S. Housing Starts, mln October 0.658 0.610

13:30 U.S. Building Permits, mln October 0.594 0.600

15:00 U.S. Philadelphia Fed Manufacturing Survey November 8.7 9.3

17:50 U.S. FOMC Member Dudley Speak

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.