- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

The euro rose against the dollar, erasing earlier losses, as some stocks advanced and optimism increased that European leaders will be able to agree on measures to help solve the region’s debt crisis.

The euro dropped earlier against most of its counterparts after a German government official said the nation rejects proposals to combine current and permanent euro-area rescue funds.

The European Central Bank is forecast to announce an interest-rate cut tomorrow and European leaders gather for a summit in Brussels during the next two days.

The official’s comments came after the Financial Times reported yesterday that European Union leaders may agree on a package including the existing 440 billion euro ($588 billion) bailout fund and a new 500 billion euro facility.

USD/JPY Y77.00, Y77.05, Y77.50, Y78.00

AUD/USD $1.0300, $1.0250, $1.0175, $1.0535

EUR/JPY Y104.00

Data:

09:30 UK Industrial production (October) -0.7%

09:30 UK Industrial production (October) Y/Y -1.7%

09:30 UK Manufacturing output (October) -0.7%

09:30 UK Manufacturing output (October) Y/Y 0.3%

11:00 Germany Industrial production (October) seasonally adjusted 0.8%

11:00 Germany Industrial production (October) not seasonally adjusted, workday adjusted Y/Y 4.1%

The euro declined after a German government official said the nation rejects proposals to combine current and permanent euro-area rescue funds.

Germany rejects proposals to combine the current and permanent euro-area rescue funds, the government official told reporters in Berlin today on condition of anonymity because the negotiations are private.

The official’s comments came after the Financial Times reported yesterday that EU leaders may agree on a package including the existing 440 billion euro bailout fund and a new 500 billion euro facility.

Economists predict the European Central Bank will cut its benchmark interest rate at a policy meeting tomorrow.

EUR/USD: during european session the pair decreased below $1,3400.

GBP/USD: the pair was in $1.5590-$ 1,5640 area.

USD/JPY: the pair has decreased in Y77.60 area.

EUR/USD

Offers $1.3500/10, $1.3470, $1.3420/25, $1.3400

Bids $1.3360/50, $1.3330, $1.3310/00, $1.3280

Resistance 3: Y79.00 (Nov 1 high)

Resistance 2: Y78.30 (Nov 4 and 29 high)

Resistance 1: Y77.95 (resistance line from Oct 31)

Current price: Y77.72

Support 1:Y77.60 (session low)

Support 2:Y77.30 (Nov 30 low, МА (200) for Н4)

Support 3:Y77.00 (Nov 24 low)

Resistance 3: Chf0.9370 (high of March)

Resistance 2: Chf0.9330/40 (Nov 25 high and high of April)

Resistance 1: Chf0.9300 (area of Dec 6 high)

Current price: Chf0.9272

Support 1: Chf0.9230 (area of session low and support line from Dec 1)

Support 2: Chf0.9160 (Dec 5 low)

Support 3: Chf0.9110/00 (area of Dec 2 low)

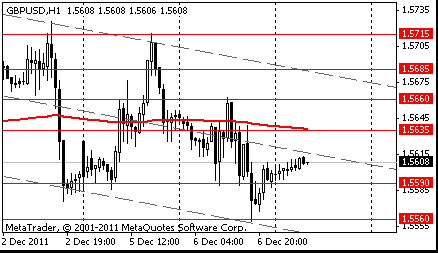

Resistance 3: $ 1.5715 (Dec 5 high)

Resistance 2: $ 1.5660 (Dec 6 high, resistance line from Nov 30)

Resistance 1: $ 1.5640 (session high)

Current price: $1.5612

Support 1 : $1.5590 (session low)

Support 2 : $1.5560 (Dec 6 low)

Support 3 : $1.5520/00 (area of Nov 30 low and the bottom border of the down channel from Nov 30)

Resistance 3: $ 1.3550 (Dec 2 high)

Resistance 2: $ 1.3490/00 (area of Dec 5 high)

Resistance 1: $ 1.3400 (low of asian session)

Current price: $1.3371

Support 1 : $1.3370 (area of session low)

Support 2 : $1.3330 (Dec 6 low, support line from Nov 25)

Support 3 : $1.3260 (Nov 30 low)

USD/JPY Y77.00, Y77.05, Y77.50, Y78.00

AUD/USD $1.0300, $1.0250, $1.0175, $1.0535

EUR/JPY Y104.00

00:30 Australia Gross Domestic Product (QoQ) Quarter III +1.2% +1.2% +1.0%

00:30 Australia Gross Domestic Product (YoY) Quarter III +1.4% +2.3% +2.5%

The euro rose against the majority of its 16 main counterparts amid speculation Europe will expand funds available to the region’s most-indebted nations as leaders prepare to meet in Brussels tomorrow.

The 17-nation euro snapped a three-day decline versus the yen after the Financial Times reported yesterday that Europe may combine temporary and planned permanent rescue facilities to bolster its bailout resources. The European Central Bank is forecast to cut interest rates tomorrow. The euro rose 0.3 percent. U.S. Treasury Secretary Timothy F. Geithner yesterday backed a German-French push for closer European cooperation, urging policy makers to work with central banks to erect a “stronger firewall” to end the crisis.

Losses in the dollar were limited on speculation the euro area will need time to defuse its crisis and Japan will face the risk of a credit-rating downgrade, increasing demand for the greenback as a refuge.

Standard & Poor’s is “closer to a downgrade” of Japan’s AA- rating. Japan-based Rating & Investment Information Inc., which has rated the nation at AAA since 2000, it may cut the ranking by year-end

Australia’s dollar rose against most major peers after a report showed the nation’s economy grew faster than estimated last quarter. The so-called Aussie dollar advanced as signs of resilience in the U.S. and Australian economies supported demand for higher-yielding assets.

EUR/USD: on Asian session the pair rose.

GBP/USD: on Asian session the pair advanced.

USD/JPY: on Asian session the pair traded in range Y77.60-Y77.80.

European data for Wednesday starts at 0745GMT with foreign trade data from France. Germany industrial output data then follows, at 1100GMT. UK data sees the latest Index of Production data, where Industrial Production is expected to come in at -0.3% m/m, -0.7% y/y and Manufacturing Output is expected to come in at -0.2% m/m, +1.5% y/y. US data starts at 1200GMT with the weekly MBA Mortgage Application Index, while at 2000GMT, Treasury Allotments By Class data is due at the same time as Consumer credit usage is expected to rise $7.5 billion in October after see-sawing in the previous two months.

Yesterday the euro fell against yen after Standard & Poor’s warned it may downgrade the European Financial Stability Fund, reinforcing concern that policy makers haven’t contained the region’s debt crisis. The 17-nation euro fluctuated against the dollar as U.S. stocks rose. The euro area’s six AAA rated countries are among those placed on a negative outlook, and their ratings may be cut depending on the result of a summit of European leaders on Dec. 9, S&P said yesterday in a statement. The company said ratings may be cut by one level for Austria, Belgium, Finland, Germany, the Netherlands and Luxembourg, and by up to two levels for the other governments.

The Swiss franc weakened against all its major counterparts after consumer prices dropped in November. S&P added the bailout fund today to the 15 euro nations placed on a negative outlook yesterday before a summit meeting this week.

EUR/USD: yesterday the pair traded nearby $1.3400.

GBP/USD: yesterday the pair fell having lost a floor of a figure.

USD/JPY: yesterday the pair holds in range Y77.65-Y77.85.

European data for Wednesday starts at 0745GMT with foreign trade data from France. Germany industrial output data then follows, at 1100GMT. UK data sees the latest Index of Production data, where Industrial Production is expected to come in at -0.3% m/m, -0.7% y/y and Manufacturing Output is expected to come in at -0.2% m/m, +1.5% y/y. US data starts at 1200GMT with the weekly MBA Mortgage Application Index, while at 2000GMT, Treasury Allotments By Class data is due at the same time as Consumer credit usage is expected to rise $7.5 billion in October after see-sawing in the previous two months.

Resistance 3: Y78.30 (Nov 4 and 29 high)

Resistance 2: Y78.10 (Dec 5 high)

Resistance 1: Y77.85 (Dec 6 high)

The current price: Y77.70

Support 1:Y77.60 (session low)

Support 2:Y77.30 (Nov 30 low)

Support 3:Y77.00 (Nov 24 low)

Comments: the pair is on downtrend. In focus support Y76.10.

Resistance 3 : $1.5685 (resistance line from Dec 1)

Resistance 2 : $1.5660 (Dec 6 high)

Resistance 1 : $1.5635 (MA(233) H1)

The current price: $1.5608

Support 1 : $1.5590 (session low)

Support 2 : $1.5560 (Dec 6 low)

Support 3 : $1.5525 (Nov 30 low)

Comments: the pair is on downtrend. In focus support $1.5590.

Resistance 3: $1.3520 (Dec 1 high)

Resistance 2: $1.3485 (Dec 5 high)

Resistance 1: $1.3460 (high of the European session on Dec 5)

The current price: $1.3435

Support 1 : $1.3400 (session low)

Support 2 : $1.3360 (low of the American session on Dec 6)

Support 3 : $1.3330 (Dec 6 low)

Comments: the pair is corrected in downtrend. In focus resistance $1.3430.

Change % Change Last

Nikkei 225 8,575 -120.82 -1.39%

Hang Seng 18,942 -237.46 -1.24%

S&P/ASX 200 4,262 -59.35 -1.37%

Shanghai Composite 2,326 -7.32 -0.31%

FTSE 100 5,569 +0.76 +0.01%

CAC 40 3,180 -21.65 -0.68%

DAX 6,029 -77.27 -1.27%

Dow 12,150.13 +52.30 +0.43%

Nasdaq 2,649.56 -6.20 -0.23%

S&P 500 1,258.47 +1.39 +0.11%

10 Year Yield 2.09% +0.04 --

Oil $100.97 -0.31 -0.31%

Gold $1,731.90 +0.10 +0.01%

00:30 Australia Gross Domestic Product (QoQ) Quarter III +1.2% +1.2%

00:30 Australia Gross Domestic Product (YoY) Quarter III +1.4% +2.3%

06:45 Switzerland Unemployment Rate November 3.0% 3.1%

09:30 United Kingdom Industrial Production (MoM) October 0.0% -0.3%

09:30 United Kingdom Industrial Production (YoY) October -0.7% -0.7%

09:30 United Kingdom Manufacturing Production (MoM) October +0.2% -0.1%

09:30 United Kingdom Manufacturing Production (YoY) October +2.0% +1.4%

11:00 Germany Industrial Production s.a. (MoM) October -2.7% +0.3%

11:00 Germany Industrial Production (YoY) October +5.4% +3.5%

15:00 United Kingdom NIESR GDP Estimate November +0.5%

15:30 U.S. EIA Crude Oil Stocks change неделя по 2 декабря +3.9

20:00 U.S. Consumer Credit October 7.4 7.0

20:00 New Zealand RBNZ Interest Rate Decision 0 2.50% 2.50%

23:50 Japan Core Machinery Orders October -8.2% +0.8%

23:50 Japan Core Machinery Orders, y/y October +9.8% +9.4%

23:50 Japan Current Account Total, bln October 1584.8 507.2

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.