- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

The euro fell after European Central Bank President Mario Draghi said he didn’t signal stepping up bond purchases to spur growth.

The euro reached the lowest level this month versus the greenback, reversing brief gains, after Draghi’s comments damped speculation that the ECB would expand its bond- buying role to stem the region’s debt crisis.

Draghi said during a press conference in Frankfurt that he was “kind of surprised by the implicit meaning” that was given to his comments last week when he said the ECB could follow faster fiscal union with “other elements.”

Currently the pair is trading in $1,3290 area.

Next suppor - $1,3260 area (Nov 30 low).

USD/JPY Y77.50, Y77.70, Y78.00

AUD/USD $1.0100, $1.0200, $1.0210, $1.0260, $1.0310, $1.0315, $1.0350

EUR/CHF Chf1.2400, Chf1.2500

GBP/USD: $1.5500, $1.6000

USD/CHF: Chf0.9300, Chf0.9320

- ECB sees 2012 HICP 1.5% to 2.5%, Sep fct 1.2% to 2.2%

- ECB sees 2013 HICP 0.8% to 2.2%

- ECB sees 2013 GDP 0.3% to 2.3%

- ECB sees 2011 GDP 1.5% to 1.7%, Sep fcst 1.4% to 1.8%

- ECB sees 2012 GDP -0.4% to 1.0%, Sep fcst 0.4% to 2.2%

- ECB sees 2012 HICP 1.5% to 2.5%, Sep fct 1.2% to 2.2%

- ECB sees 2013 HICP 0.8% to 2.2%

- ECB sees 2013 GDP 0.3% to 2.3%

- ECB sees 2011 GDP 1.5% to 1.7%, Sep fcst 1.4% to 1.8%

- ECB sees 2012 GDP -0.4% to 1.0%, Sep fcst 0.4% to 2.2%

- non-standard measures are by construction temporary.

- non-standard measures are by construction temporary.

- ECB will reduce reserve ratio to 1% from 2%;

- new reserve ratio to take effect Jan 18 2012;

- ECB to conduct two 36-month refi ops.

ECB will reduce reserve ratio to 1% from 2%;

new reserve ratio to take effect Jan 18 2012;

ECB to conduct two 36-month refi ops.

Data:

12:00 UK BoE meeting announcement 0.50%

12:45 EU(17) ECB meeting announcement 1.00%

The euro fell as the European Central Bank lowered its benchmark interest rate in a bid to avoid a recession.

The euro weakened versus major peers as policy makers cut the refinancing rate by a quarter percentage point to 1 percent.

The ECB may loosen collateral criteria to give banks greater access to cash, three euro-area officials with knowledge of the deliberations said yesterday. The Bank of England kept its key rate at a record low 0.5 percent today.

The euro weakened earlier on concern nations such as Germany and France will lose their AAA credit ratings if European leaders fail to agree a plan to curb the debt crisis at a two-day meeting in Brussels starting today.

EUR/USD: after ECB decision the euro grown in area $1,3420, but fell later.

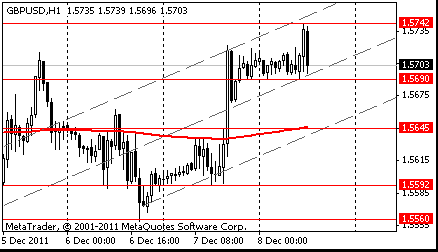

GBP/USD: most part of european session the pair was in $1.5690-$ 1,5740 area.

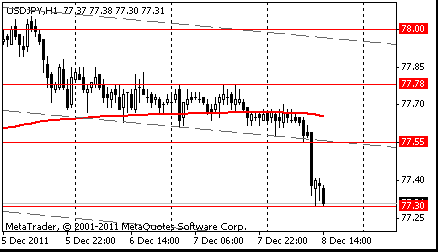

USD/JPY: the pair has decreased in Y77.30 area.

ECB cutting rate by the widely expected 25bp caused rate to

jump up to $1.3425, from around $1.3380. Reaction seen as some had suggested room to cut rate by up to 50bps. Focus now turns to ECB Draghi press conference.

Resistance 3: Y78.00 (resistance line from Nov 29)

Resistance 2: Y77.80 (Dec 7 high)

Resistance 1: Y77.55 (middle line from Nov 29)

The current price: Y77.38

Support 1:Y77.30 (session low, Nov 30 low)

Support 2:Y77.00 (Nov 24 low)

Support 3:Y76.55 (Nov 18 low)

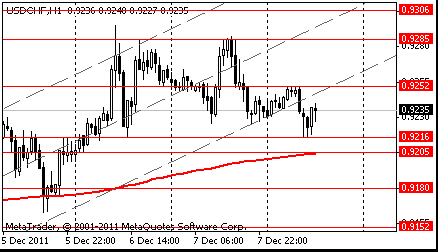

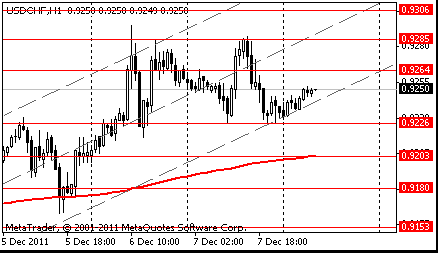

Resistance 3: Chf0.9305 (Nov 28 high)

Resistance 2: Chf0.9285 (Dec 7 high)

Resistance 1: Chf0.9250 (session high)

The current price: Chf0.9235

Support 1: Chf0.9205/15 (session low, MA (233) H1)

Support 2: Chf0.9180 (50.0% FIBO Chf0.9295-Chf0.9065)

Support 3: Chf0.9150 (61.8% FIBO Chf0.9295-Chf0.9065)

Resistance 3 : $1.5800 (Nov 21 high)

Resistance 2 : $1.5780 (Nov 30 high)

Resistance 1 : $1.5740 (session low)

The current price: $1.5703

Support 1 : $1.5690 (session low)

Support 2 : $1.5645 (MA (233) H1)

Support 3 : $1.5590 (Dec 7 low)

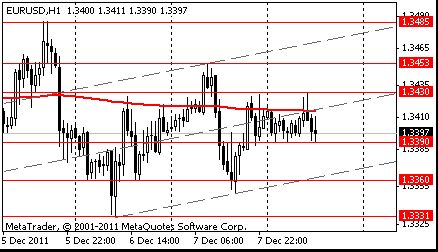

Resistance 3: $1.3485 (Dec 5 high)

Resistance 2: $1.3450 (Dec 7 high)

Resistance 1: $1.3430 (session high)

The current price: $1.3400

Support 1 : $1.3390 (session low)

Support 2 : $1.3360 (support line from Dec 6)

Support 3 : $1.3330 (Dec 6 low)

USD/JPY Y77.50, Y77.70, Y78.00

AUD/USD $1.0100, $1.0200, $1.0210, $1.0260, $1.0310, $1.0315, $1.0350

EUR/CHF Chf1.2400, Chf1.2500

GBP/USD: $1.5500, $1.6000

USD/CHF: Chf0.9300, Chf0.9320

- Need Automatic Trigger For Euro Area Sanctions

- Intervention In National Budgets Has To Be Limited

- UK Mustn't Get Special Rules For Financial Market

- Summit Can Calm Situation If Right Decisions Taken

Juncker Agrees To Most Of Franco-German Proposals In Paper Interview

00:30 Australia Unemployment rate November 5.2% 5.2% 5.3%

00:30 Australia Changing the number of employed November 10.1K 10.6K -6.3%

05:00 Japan Eco Watchers Survey: Current November 45.9 47.1 45.0

05:00 Japan Eco Watchers Survey: Outlook November 45.9 44.7

07:20 Australia RBA's Governor Glenn Stevens Speech

The yen and dollar rose against most major peers as Asian stocks declined amid signs of a slowdown in the region’s economies, boosting demand for refuge currencies.

Australia’s dollar slid against 14 of its 16 most-traded counterparts after a government report showed employers cut jobs for the first time in three months.

The euro snapped a decline against the Swiss franc before a European Central Bank meeting and a summit in Brussels to discuss the region’s problems.

The European Central Bank may announce a range of measures tomorrow to stimulate bank lending, according to three euro-area officials.

Canada’s dollar declined from the strongest level in a month as renewed concern Europe’s sovereign debt crisis will worsen spurred an increase in risk aversion among investors. Canada’s currency has been the fourth-best performer after the U.S. dollar, yen and pound over the past three months against the euro among the most-traded currencies, gaining 2.4 percent, as investors sought refuge from the prospect of a global recession.

EUR/USD: on Asian session the pair holds in range $1.3390-$1.3410.

GBP/USD: on Asian session the pair holds in range $1.5690-$1.5720.

USD/JPY: on Asian session the pair fell.

On Thursday the Bank of England MPC makes it's announcement at 1200GMT but this meeting is expected to be a non-event. Analysts are expecting the BOE to press on with its current round of Stg75 billion of quantitative easing, which is scheduled to be completed ahead of the February MPC meeting. The ECB announces it's rate decision at 1245GMT with the usual press conference following on at 1330GMT. The ECB is likely to cut interest rates and launch further liquidity support measures this Thursday, but it should not be expected to unveil aggressive measures to help control the borrowing costs of Eurozone governments.

Yesterday the euro declined after a German government official said the nation rejects proposals to combine current and permanent euro-area rescue funds. Germany rejects proposals to combine the current and permanent euro-area rescue funds, the government official told reporters in Berlin today on condition of anonymity because the negotiations are private. The official’s comments came after the Financial Times reported yesterday that EU leaders may agree on a package including the existing 440 billion euro bailout fund and a new 500 billion euro facility.

Economists predict the European Central Bank will cut its benchmark interest rate at a policy meeting.

But later the euro rose against the dollar, erasing earlier losses, as some stocks advanced and optimism increased that European leaders will be able to agree on measures to help solve the region’s debt crisis.

EUR/USD: yesterday the pair has lost a floor of a figure, but restored later.

GBP/USD: yesterday the pair has grown on a figure.

USD/JPY: yesterday the pair holds in range Y77.60-Y77.80.

On Thursday the Bank of England MPC makes it's announcement at 1200GMT but this meeting is expected to be a non-event. Analysts are expecting the BOE to press on with its current round of Stg75 billion of quantitative easing, which is scheduled to be completed ahead of the February MPC meeting. The ECB announces it's rate decision at 1245GMT with the usual press conference following on at 1330GMT. The ECB is likely to cut interest rates and launch further liquidity support measures this Thursday, but it should not be expected to unveil aggressive measures to help control the borrowing costs of Eurozone governments.

Resistance 3: Y78.30 (Nov 4 and 29 high)

Resistance 2: Y78.00 (resistance line from Nov 29)

Resistance 1: Y77.80 (Dec 7 high)

The current price: Y77.65

Support 1:Y77.60 (session low)

Support 2:Y77.30 (Nov 30 low)

Support 3:Y77.00 (Nov 24 low)

Comments: the pair is on downtrend. In focus support Y77.60.

Resistance 3: Chf0.9305 (Nov 28 high)

Resistance 2: Chf0.9285 (Dec 7 high)

Resistance 1: Chf0.9265 (high of the Asian session on Dec 7)

The current price: Chf0.9250

Support 1: Chf0.9225 (Dec 7 low)

Support 2: Chf0.9200 (MA (233) H1)

Support 3: Chf0.9180 (50.0% FIBO Chf0.9295-Chf0.9065)

Comments: the pair is on uptrend. In focus resistance Chf0.9265.

Resistance 3: $1.3485 (Dec 5 high)

Resistance 2: $1.3450 (Dec 7 high)

Resistance 1: $ 1.3425 (high of the American session on Dec 7)

The current price: $1.3400

Support 1 : $1.3390 (session low)

Support 2 : $1.3360 (support line from Dec 6)

Support 3 : $1.3330 (Dec 6 low)

Comments: the pair is corrected remains in downtrend. In focus resistance $1.3430.

Change % Change Last

Nikkei 8,722 +147.01 +1.71%

Hang Seng 19,241 +298.35 +1.58%

S&P/ASX 4,292 0.00 0.00%

Shanghai Composite 2,333 +6.82 +0.29%

FTSE 5,547 -21.81 -0.39%

CAC 3,176 -3.65 -0.11%

DAX 5,995 -34.09 -0.57%

Dow 12,196.37 +46.24 +0.38%

Nasdaq 2,649.21 -0.35 -0.01%

S&P 1,261.01 +2.54 +0.20%

10 Year Yield 2.02% -0.08

Oil $100.70 +0.21 +0.21%

Gold $1,746.10 +1.30 +0.07%

00:30 Australia Unemployment rate November 5.2% 5.2% 5.3%

00:30 Australia Changing the number of employed November 10.1K 10.6K -6.3%

05:00 Japan Eco Watchers Survey: Current November 45.9 47.1 45.0

05:00 Japan Eco Watchers Survey: Outlook November 45.9 44.7

07:20 Australia RBA's Governor Glenn Stevens Speech 0

12:00 United Kingdom BoE Interest Rate Decision 0 0.50% 0.50%

12:45 Eurozone ECB Interest Rate Decision 0 1.25% 1.00%

13:15 Canada Housing Starts November 207.6K 203.0K

13:30 Canada New Housing Price Index October +0.2% +0.5%

13:30 Eurozone ECB Press Conference 0

13:30 U.S. Initial Jobless Claims неделя по 3 ноября 402K 397K

15:30 Canada Bank of Canada publishes financial system review 0

23:50 Japan GDP, q/q Quarter III +1.5% +1.3%

23:50 Japan GDP, y/y Quarter III +6.0% +5.1%

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.