- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

No change in rates (FF again targeted 0%-1/4%) with mid-'13 assurance, no mention of IOER or communications. FOMC reiterates will continue to assess in light of incoming info, employ tools incl adjust securities holdings. Says econ expanded 'moderately' since Nov. meeting notwithstanding global slowdown. Data 'point to some improvement in overall labor mkt' but repeats unemp rate elevated. Biz invst increasing less rapidly. Infl will 'settle' to meet mandate. Infl expectatns stable. No explicit mention of EZ. Vote was 9-1, with Chicago Fed's Evans dissenting again, wants more easing.

The euro dropped after Chancellor Angela Merkel told German coalition lawmakers that the 500 billion euro cap on Europe’s planned permanent bailout fund will stay in place.

The dollar declined against the yen before the Federal Reserve holds a meeting today amid speculation officials will maintain their pledge to keep borrowing costs at almost zero.

The European Financial Stability Facility sold 1.97 billion euros of 91-day bills at an average yield of 0.222 percent, the Bundesbank said today. The sale was its first fund-raising since European leaders agree on a closer fiscal accord and additional resources to combat the region’s debt crisis at a summit in Brussels last week.

Euro flushing the reported stops below the figure as confidence in the eurozone wanes and as risk-appetites are pared with US stocks giving back earlier gains. Bids seen around $1.3050.

Offers $1.5775/80, $1.5730/35, $1.5700/10, $1.5610/15

Bids $1.5540/35, $1.5530/25, $1.5470/65

USD/JPY Y77.30, Y77.20, Y77.10, Y76.85

AUD/USD $1.0050, $1.0115, $1.0135, $1.0230, $1.0250, $1.0295, $1.0300

EUR/GBP stg0.8580

GBP/USD $1.5750, $1.5500

EUR/JPY Y104.50

EUR/CHF Chf1.2300

Data:

06:30 France CPI (November) unadjusted 0.3%

06:30 France CPI (November) unadjusted Y/Y 2.5%

06:30 France HICP (November) Y/Y 2.7%

09:30 UK HICP (November) 0.2%

09:30 UK HICP (November) Y/Y 4.8%

09:30 UK HICP ex EFAT (November) Y/Y 3.2%

09:30 UK Retail prices (November) 0.2%

09:30 UK Retail prices (November) Y/Y 5.2%

09:30 UK RPI-X (November) Y/Y 5.3%

10:00 Germany ZEW economic expectations index (December) -53.8

The dollar declined against the yen before the Federal Reserve holds a policy meeting today amid speculation officials will maintain their pledge to keep borrowing costs at almost a record low.

The euro climbed against the greenback after the European bailout fund held its first auction of bills, attracting bids for more than three times the amount of securities that it sold.

The common currency erased earlier losses versus the yen after a German report showed investor confidence unexpectedly increased for the first time in 10 months.

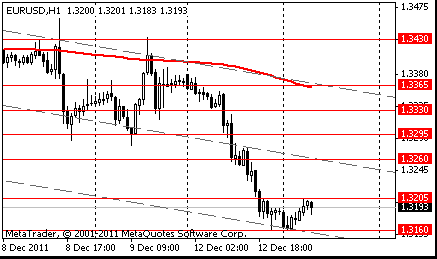

EUR/USD: the pair shown high in $1,3240 area but later returned back to $1.3200 area.

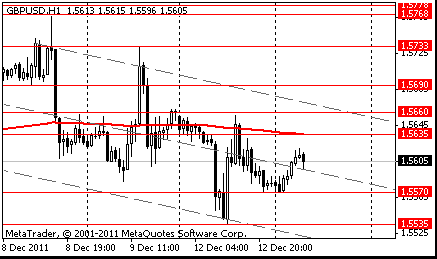

GBP/USD: the pair holds in $1.5560-$ 1.5630.

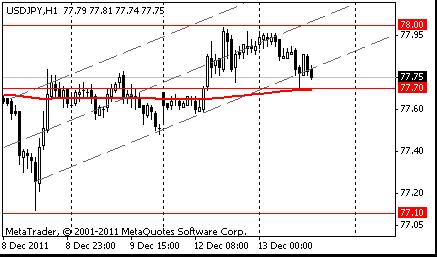

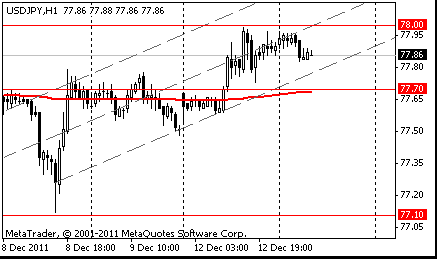

USD/JPY: the pair holds in Y77.70-Y78.00.

EUR/USD

Offers $1.3360/65, $1.3330/35, $1.3300/05, $1.3280, $1.3250

Bids $1.3150/60, $1.3100/10

Resistance 3: Y79.00 (Nov 1 high)

Resistance 2: Y78.30 (Nov 29 high)

Resistance 1: Y78.00 (Dec 12 high)

The current price: Y77.79

Support 1:Y77.70 (MA (233) H1)

Support 2:Y77.10 (Dec 8 low)

Support 3:Y76.60 (Nov 18 low)

Resistance 3: Chf0.9490 (Feb 21 high)

Resistance 2: Chf0.9440 (Feb 2 high)

Resistance 1: Chf0.9385/90 (area of session high)

The current price: Chf0.9350

Support 1: Chf0.9340 (23.6% FIBO Chf0.9390-Chf0.9180)

Support 2: Chf0.9310 (38.2% FIBO Chf0.9390-Chf0.9180)

Support 3: Chf0.9285 (50.0% FIBO Chf0.9390-Chf0.9180)

Resistance 3 : $1.5690 (61.8% FIBO $1.5535-$1.5780)

Resistance 2 : $1.5660 (Dec 12 high)

Resistance 1 : $1.5630 (session high, MA(233) H1)

The current price: $1.5603

Support 1 : $1.5565 (session low)

Support 2 : $1.5535 (Dec 12 low)

Support 3 : $1.5495 (low of the European session on Nov 29)

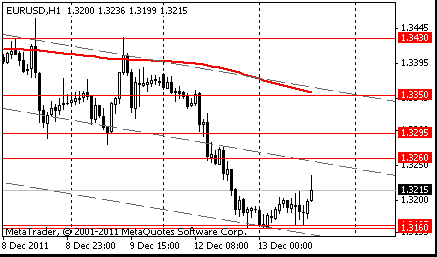

Resistance 3: $1.3350 (MA (233) H1)

Resistance 2: $1.3295 (50.0% FIBO $1.3160-$1.3430)

Resistance 1: $1.3260 (38.2% FIBO $1.3160-$1.3430)

The current price: $1.3215

Support 1 : $1.3160 (session low)

Support 2 : $1.3125 (Jan 5 low)

Support 3 : $1.3085 (Jan 13 low)

- Productivity Slowdown Due To Tight Credit

- No Reason To Think Impact Of QE Will Decline

E3.44 Bn 12-Month T-bills at 4.050%, covered 3.1 times.

E1.50 Bn 18-month T-bills at 4.226%, covered 5.0 times.

USD/JPY Y77.30, Y77.20, Y77.10, Y76.85

AUD/USD $1.0050, $1.0115, $1.0135, $1.0230, $1.0250, $1.0295, $1.0300

EUR/GBP stg0.8580

GBP/USD $1.5750, $1.5500

EUR/JPY Y104.50

EUR/CHF Chf1.2300

00:01 United Kingdom RICS House Price Balance November -24% -25% -17%

00:30 Australia National Australia Bank's Business Confidence November 2 2

00:30 Australia Housing starts Quarter III -4.7% -0.7% -6.8%

The Australian dollar climbed from two-week lows before a report forecast to show retail sales in the U.S. rose in November, adding to signs the world’s largest economy remains resilient. Retail sales in the U.S. probably increased 0.6 percent last month after a 0.5 percent gain in October, a Bloomberg survey of economists showed before the Commerce Department releases the data today.

The dollar reached a two-month high against the euro before three European nations and the region’s bailout fund sell bills amid speculation Standard & Poor’s may cut sovereign credit ratings in the common currency area.

Fitch Ratings and Moody’s Investors Service said yesterday that a European Union summit last week offered little help in ending the region’s debt crisis. The yen touched a two-week high against the euro before a German report today that may show investor confidence in Europe’s largest economy slid to a three- year low.

The pound gain after an index of U.K. house prices climbed in November from a four-month low because of an increase in demand, the Royal Institution of Chartered Surveyors said.

The gauge by London-based RICS rose to minus 17 percentage points from minus 24 points in October, the group said in an e- mailed report today.

EUR/USD: on Asian session the pair fell.

GBP/USD: on Asian session the pair dropped.

USD/JPY: on Asian session the pair holds in range Y77.60-Y77.70.

European data for Tuesday starts at 0630GMT with France HICP data. The IEA monthly oil market report is due at 0900GMT, while at the

same time, the Bank of England's Spencer Dale speaks at an event at Bloomberg. The main core-European release for Tuesday is the german ZEW data at 1000GMT. UK inflation data at 0930GMT is expected to see CPI come in at 0.2% m/m, 4.8% y/y with core-CPI at 3.3% y/y.US data starts at 1245GMT with the weekly ICSC-Goldman Store Sales data, while at 1330GMT, US retail sales are expected to rise 0.5% in November after rising sharply in September and October. At 1730GMT, the FOMC monetary policy announcement is due. The

FOMC's final meeting of 2011 comes amid great uncertainty about the European debt crisis, America's own fiscal mess and the Chinese economy, among other things.

The euro fell to the lowest level in two months versus the dollar as Moody’s Investors Service said it will review the ratings of European Union nations after last week’s summit failed to produce decisive steps to end the debt crisis. Italian bonds slid as the nation sold 7 billion euros ($9.3 billion) of one-year bills to yield 5.95 percent, compared with an average 2.70 percent in the past five years. The securities fell even after the European Central Bank was said to have bought the nation’s debt. Italy has to repay about 53 billion euros in the first quarter, about a third of the region’s maturing bonds. The euro fell 1.5 percent to $1.3235 at 11:55 a.m. in New York, the lowest level since Oct. 4.

The dollar and yen strengthened against a majority of their most-traded counterparts as investors sought safer assets on concern crisis-fighting efforts are failing to stop European borrowing costs from rising.

EUR/USD: yesterday the pair fallen on two figures.

GBP/USD: yesterday the pair decreased.

USD/JPY: yesterday the pair grown.

European data for Tuesday starts at 0630GMT with France HICP data. The IEA monthly oil market report is due at 0900GMT, while at the

same time, the Bank of England's Spencer Dale speaks at an event at Bloomberg. The main core-European release for Tuesday is the german ZEW data at 1000GMT. UK inflation data at 0930GMT is expected to see CPI come in at 0.2% m/m, 4.8% y/y with core-CPI at 3.3% y/y.US data starts at 1245GMT with the weekly ICSC-Goldman Store Sales data, while at 1330GMT, US retail sales are expected to rise 0.5% in November after rising sharply in September and October. At 1730GMT, the FOMC monetary policy announcement is due. The

FOMC's final meeting of 2011 comes amid great uncertainty about the European debt crisis, America's own fiscal mess and the Chinese economy, among other things.

Resistance 3: Y79.00 (Nov 1 high)

Resistance 2: Y78.30 (Nov 29 high)

Resistance 1: Y78.00 (Dec 12 high)

The current price: Y77.87

Support 1:Y77.70 (MA(233) H1)

Support 2:Y77.10 (Dec 8 low)

Support 3:Y76.60 (Nov 18 low)

Comments: the pair is on uptrend. In focus resistance Y78.00.

Resistance 3 : $1.5690 (61.8% FIBO $1.5535-$1.5780)

Resistance 2 : $1.5660 (Dec 12 high)

Resistance 1 : $1.5635 (MA(233) H1)

The current price: $1.5606

Support 1 : $1.5570 (session low)

Support 2 : $1.5535 (Dec 12 low)

Support 3 : $1.5495 (low of the European session on Nov 29)

Comments: the pair is on downtrend. In focus support $1.5570.

- Economic Slowdown Won't Match That In 2008

- Slowdown To Be Mild If EU Crisis Doesn't Worsen

- Lowers 2011 GDP Growth Forecast To 1.8% From 1.9%

- Cuts 2012 GDP Growth Forecast To 0.5% From 0.9%

- Sees Growth Rebounding To 1.9% In 2013

- Cuts 2012 Inflation Prediction To -0.3% From 0.3%

- Sees Inflation At 0.3% In 2013

- Sees 2012 Jobless Rate At 3.6% Vs 3.1% In 2011

Resistance 3: $1.3295 (38.2% FIBO $1.3160-$1.3430)

Resistance 2: $1.3260 (38.2% FIBO $1.3160-$1.3430)

Resistance 1: $1.3205 (session high)

The current price: $1.3189

Support 1 : $1.3160 (session low)

Support 2 : $1.3125 (Jan 5 low)

Support 3 : $1.3085 (Jan 13 low)

Comments: the pair is on downtrend. In focus support $1.3160.

Change % Change Last

Nikkei 8,654 +117.36 +1.37%

Hang Seng 18,576 -10.57 -0.06%

S&P/ASX 4,253 +49.83 +1.19%

Shanghai Composite 2,292 -23.73 -1.02%

FTSE 5,428 -101.35 -1.83%

CAC 3,090 -82.76 -2.61%

DAX 5,785 -201.28 -3.36%

Dow 12,021.54 -162.72 -1.34%

Nasdaq 2,612.26 -34.59 -1.31%

S&P 500 1,236.49 -18.70 -1.49%

10 Year Yield 2.01% -0.04

1 Euro $1.3186 +0.0113 +1.52%

Commodities

Oil $98.01 +0.24 +0.25%

Gold $1,669.10 +0.90 +0.05%

00:01 United Kingdom RICS House Price Balance November -24% -25%

00:30 Australia National Australia Bank's Business Confidence November 2

00:30 Australia Housing starts Quarter III -4.7% -0.7%

06:30 France CPI, m/m November 0.2% 0.2%

06:30 France CPI, y/y November 2.3% 2.4%

06:45 Switzerland SECO Economic Forecasts Quarter I

09:30 United Kingdom HICP, m/m November 0.1% 0.2%

09:30 United Kingdom HICP, Y/Y November 5.0% 4.8%

09:30 United Kingdom HICP ex EFAT, Y/Y November 3.4% 3.3%

09:30 United Kingdom Retail Price Index, m/m November 0.0% 0.2%

09:30 United Kingdom Retail prices, Y/Y November 5.4% 5.1%

09:30 United Kingdom RPI-X, Y/Y November 5.6% 5.3%

10:00 Germany ZEW Survey - Economic Sentiment December -55.2 -55.7

10:00 Eurozone ZEW Economic Sentiment December -59.1 -60.3

13:30 U.S. Retail sales November 0.5% 0.6%

13:30 U.S. Retail sales excluding auto November 0.6% 0.5%

15:00 U.S. Business inventories October 0.0% 0.5%

19:15 U.S. Fed Interest Rate Decision 0 0.00%-0.25% 0.00%-0.25%

23:30 Australia Westpac Consumer Confidence December 103.4

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.