- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

The dollar dropped as U.S. economic data showed a quickening recovery and European funding stress eased, damping demand for the safety of the U.S. currency.

The euro rose from an 11-month low against the dollar as Spain sold more than its maximum target at a debt auction and a report showed European manufacturing and service industries contracted less this month than economists forecast.

The euro rallied after the currency’s 14-day relative strength index against the dollar fell to 29 yesterday, below the 30-level that some traders see as a sign a currency may be poised to reverse direction.

Resistance 2:1244 (Dec 13 high)

Resistance 1:1225 (Dec 14 high, resistance line from Dec 8)

Current price: 1214,35

Support 1 : 1212 (intraday low)

Support 2 : 1200 (area of session low)

Support 3 : 1193 (61,8 % 1147-1267)

EUR/USD $1.2900, $1.2925, $1.3000(large), $1.3050, $1.3100, $1.3200

USD/JPY Y77.00, Y77.75, Y78.00, Y78.30, Y78.80AUD/USD $0.9900, $0.9950, $1.0000, $1.0085 $1.0150

EUR/CHF Chf1.2450, Chf1.2500, Chf1.2650, Chf1.2700, Chf1.3000, Chf1.2300

EUR/JPY Y104.15

GBP/USD $1.5400

Data:

08:30 Swiss SNB press-conference 0.00-0.25%

08:30 Germany PMI (December) flash 48.1

08:30 Germany PMI services (December) flash 52.7

09:00 EU(17) PMI (December) flash 46.9

09:00 EU(17) PMI services (December) flash 48.3

09:00 Italy CPI (November) final -0.1%

09:00 Italy CPI (November) final Y/Y 3.3%

09:00 Italy HICP (November) final Y/Y 3.7%

09:30 UK Retail sales (November) -0.4%

09:30 UK Retail sales (November) Y/Y 0.7%

10:00 EU(17) Harmonized CPI (November) final 0.1%

10:00 EU(17) Harmonized CPI (November) final Y/Y 3.0%

10:00 EU(17) Harmonized CPI ex EFAT (November) Y/Y 1.6%

11:00 UK CBI industrial order books balance (December) -23%

The euro rose after Spain sold more than its maximum target at a debt auction today, easing concern the region’s debt crisis is worsening.

The euro pared losses versus the yen after a report showed European manufacturing and service industries contracted less this month than economists forecast.

The euro rallied earlier today after the currency’s 14-day relative strength index against the dollar fell to 29 yesterday, below the 30-level that some traders see as a sign a currency may be poised to reverse direction.

Gains in the euro were capped today as speculation European leaders aren’t doing enough to resolve the debt crisis damped demand for the region’s currency.

The Swiss franc strengthened against all its major counterparts after the central bank refrained from introducing new measures to weaken the currency at a policy meeting today.

The franc gained the most in eight weeks against the euro after Switzerland’s central bank left its limit on the currency unchanged, resisting pressure from exporters to further curb its strength as officials take time to assess deflation risks.

EUR/USD: the pair has hold in $1,2950-$ 1,3040 area.

GBP/USD: the pair has grown above $1.5500.

USD/JPY: the pair has fallen in Y77.70 area.

Данные по потокам капитала от министерства финансов США станут известны в 14:00 GMT.

Продолжат американскую статистику данные по изменению объема промышленного производства (14:15 GMT). Ожидается, что по итогам ноября показатель вырастет на 3,% после роста на 0.7% в октябре. м/м 3.9% г/г. В 15:00 GMT выйдет производственный индекс ФРС-Филадельфии.

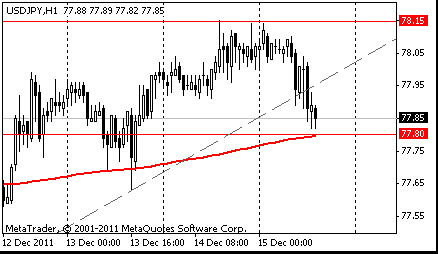

Resistance 3: Y79.00 (Nov 1 high)

Resistance 2: Y78.30/45 (area of Nov 1-4 high)

Resistance 1: Y78.15 (session high)

The current price: Y77.86

Support 1:Y77.80 (MA (233) H1)

Support 2:Y77.50 (Dec 9 low)

Support 3:Y77.10 (Dec 8 low)

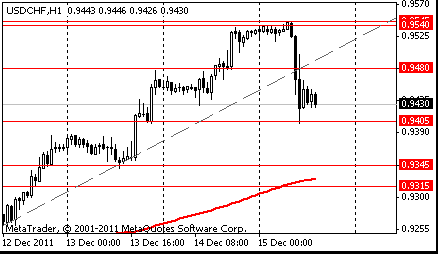

Resistance 3: Chf0.9600 (Feb 17 high)

Resistance 2: Chf0.9440/45 (area of Dec 14-15 high)

Resistance 1: Chf0.9480 (support line from Dec 9)

The current price: Chf0.9429

Support 1: Chf0.9405 (session low)

Support 2: Chf0.9345 (Dec 13 low)

Support 3: Chf0.9315 (161.8% FIBO Chf0.9545-Chf0.9405)

Resistance 3 : $1.5630 (Dec 13 high, 61.8% FIBO $1.5405-$1.5770)

Resistance 2 : $1.5580 (MA (233) H1)

Resistance 1 : $1.5530 (Dec 14 high)

The current price: $1.5505

Support 1 : $1.5435 (session low)

Support 2 : $1.5405 (Dec 14 low)

Support 3 : $1.5340 (Oct 4 low)

Resistance 3: $1.3145 (38.2% FIBO $1.2944-$1.3430)

Resistance 2: $1.3100 (psychological level)

Resistance 1: $1.3065 (Dec 14 high)

The current price: $1.2986

Support 1 : $1.2945 (Dec 14 low)

Support 2 : $1.2910 (Jan 11 low)

Support 3 : $1.2860 (2011 low)

Comments: the pair is on uptrend. In focus support $1.2945.

EUR/USD $1.2900, $1.2925, $1.3000(large), $1.3050, $1.3100, $1.3200

USD/JPY Y77.00, Y77.75, Y78.00, Y78.30, Y78.80AUD/USD $0.9900, $0.9950, $1.0000, $1.0085 $1.0150

EUR/CHF Chf1.2450, Chf1.2500, Chf1.2650, Chf1.2700, Chf1.3000, Chf1.2300

EUR/JPY Y104.15

GBP/USD $1.5400

Sold E2.451bln of 3.15% Jan 2016 Oblig; cover 1.99 vs 2.83 previous

Sold E2.177bln of 4.00% Mar 2020 Oblig; cover 1.52 vs 2.0 previous

Sold E1.40bln of 5.50% Apr 2021 Oblig; cover 2.16 vs 1.76 previous

UK Public Aug 2 Yr Inflation Expectation Was 3.5%

Nov Net Satisfaction Balance With BOE +9%

Aug Net Satisfaction Balance With BOE Was +16%

Nov Net Satisfaction Balance Lowest Since Nov 1999

The euro fell below $1.30 for the first time since January as signs of increased funding stress in Europe damped investor appetite for the shared currency. The euro declined as Italian borrowing costs increased at a debt auction and Spanish banks’ borrowings from the European Central Bank climbed by the most in a year.

The euro’s 14-day relative strength index versus the dollar weakened to 28.8 today, the lowest level since Oct. 3. A reading below 30 signals that an asset may be oversold and due to reverse direction.

The pound was the biggest gainer against the euro among the major currencies as investors sought protection from the crisis.

The pound rose for a third day against the euro as stock declines spurred demand for the perceived safety of the British currency.

The Dollar Index, which IntercontinentalExchange Inc. uses to track the U.S. currency against those of six trading partners, rose to highest since January.

EUR/USD: yesterday the pair fell on half figure.

GBP/USD: yesterday the pair decreased.

USD/JPY: yesterday the pair rose.

On Thursday sees the flash PMI releases from the main European states, which are expected to decline in both France at 0758GMT and

Germany at 0828GMT. The Swiss National Bank reveals it's policy decision at 0830GMT. There has been widespread speculation that the SNB they may hike the Swiss franc trading floor to E1.25 in euro-Swiss. Recent data have pointed up the continuing deflation danger in that country as a result of its still overly mighty currency. The EMU flash PMIs are due at 0858GMT and are expected to edge lower to readings of 46.0 for manufacturing and 47.0 for the services measure. The ECB then publishes the December monthly bulletin at 0900GMT. UK data at 0930GMT includes Retail Sales, the BOE GfK/NOP Inflation Attitudes survey and also SMMT Car Production. EMU Q3 GDP and employment data are due at 1000GMT along with final HICP for November, which is expected to confirm the preliminary reading of 3%. Then, at 1025GMT, ECB President Mario Draghi gives a lecture on "Last Resort ECB? Monetary Policy Leeway In The Social Market Economy," in Berlin. US data at 1330GMT includes the weekly Jobless Claims, Q3 Current Account data, the November PPI and also the latest NY Fed Empire State Survey.US data at 1330GMT includes the weekly Jobless Claims, Q3 Current Account data, the November PPI and also the latest NY Fed Empire State Survey. The weekly Bloomberg Comfort Index follows at 1445GMT, while at 1500GMT, the Philadelphia Fed index is expected to rise to a reading of 5.0 in December after falling to 3.6 in November. Weekly EIA Natural Gas Stocks data is due at 1530GMT. Later data includes the 2000GMT France Insee economic outlook. Later on, at 2130GMT, US M2 Money Supply data is due.

02:30 China HSBC Manufacturing PMI December 47.7 49.0

The euro rose for the first time in four days against the dollar as Spain prepared to sell as much as 3.5 billion euros ($4.55 billion) of government bonds.

Switzerland’s franc appreciated versus all its major counterparts amid speculation its central bank will refrain from boosting its efforts to weaken the currency at a policy meeting today. The euro snapped a three-day decline after the currency’s 14-day relative strength index against the dollar fell to 29 yesterday, below the 30-level that some traders see as a sign an asset may be about to reverse direction.

The Australian dollar fell against most of their 16 major peers on concern Europe’s sovereign-debt crisis will slow global economic growth, sapping demand for riskier assets.

China’s manufacturing may decline for a second month in December as Europe’s debt crisis weighs on exports and home sales slide, preliminary results from a survey indicate. The reading of 49 for a purchasing managers’ index (MXWO) reported by HSBC Holdings Plc and Markit Economics today compares with a final number of 47.7 for November. The Asian nation is Australia’s largest trading partner and New Zealand’s second-biggest export market.

EUR/USD: on Asian session the pair is restored.

GBP/USD: on Asian session the pair has fallen, but was restored later.

USD/JPY: on Asian session the pair decreases.

On Thursday sees the flash PMI releases from the main European states, which are expected to decline in both France at 0758GMT and

Germany at 0828GMT. The Swiss National Bank reveals it's policy decision at 0830GMT. There has been widespread speculation that the SNB they may hike the Swiss franc trading floor to E1.25 in euro-Swiss. Recent data have pointed up the continuing deflation danger in that country as a result of its still overly mighty currency. The EMU flash PMIs are due at 0858GMT and are expected to edge lower to readings of 46.0 for manufacturing and 47.0 for the services measure. The ECB then publishes the December monthly bulletin at 0900GMT. UK data at 0930GMT includes Retail Sales, the BOE GfK/NOP Inflation Attitudes survey and also SMMT Car Production. EMU Q3 GDP and employment data are due at 1000GMT along with final HICP for November, which is expected to confirm the preliminary reading of 3%. Then, at 1025GMT, ECB President Mario Draghi gives a lecture on "Last Resort ECB? Monetary Policy Leeway In The Social Market Economy," in Berlin. US data at 1330GMT includes the weekly Jobless Claims, Q3 Current Account data, the November PPI and also the latest NY Fed Empire State Survey.US data at 1330GMT includes the weekly Jobless Claims, Q3 Current Account data, the November PPI and also the latest NY Fed Empire State Survey. The weekly Bloomberg Comfort Index follows at 1445GMT, while at 1500GMT, the Philadelphia Fed index is expected to rise to a reading of 5.0 in December after falling to 3.6 in November. Weekly EIA Natural Gas Stocks data is due at 1530GMT. Later data includes the 2000GMT France Insee economic outlook. Later on, at 2130GMT, US M2 Money Supply data is due.

- SNB Sees 2011 GDP Growth Of 1.5% To 2.5%

- Swiss Franc Still High At Current Rate

- SNB Sees 2011 Inflation At 0.2%

Asian stocks fell for a second day as the Federal Reserve refrained from taking new measures to spur growth and U.S. retail sales rose at the slowest pace in five months, clouding the earnings outlook for Asian exporters.

The Fed said yesterday that the U.S. economy continues to expand even as global growth slows. The Fed reiterated a warning from its two previous meetings that “strains in global financial markets continue to pose significant downside risks to the economic outlook.”

Li & Fung Ltd., a supplier of toys and clothes to Wal-Mart Stores Inc., sank 3.9%.

Astra, Toyota Motor Corp.’s Indonesian distributor, lost 3.9% as nationwide auto sales dropped.

Sony Corp. , which depends on the U.S. for a fifth of its sales, fell 1.5%.

European stocks declined as the Federal Reserve refrained from taking new action to bolster the world’s largest economy.

Italy sold five-year bonds at an average yield of 6.47 percent, up from 6.29 percent at the last auction on Nov. 14, the Bank of Italy said. Spain will offer debt maturing in 2016, 2020 and 2021 tomorrow.

A report from Eurostat showed that industrial production in the euro area slipped 0.1 percent in October, led by a drop in the output of energy and goods such as steel. Economists had forecast no change, according to a survey.

The Munich-based Ifo institute slashed its 2012 economic growth forecast for Germany to 0.4 percent from a previous prediction of 2.3 percent. Ifo said Europe’s largest economy can avoid a recession unless the region’s debt crisis worsens.

BNP Paribas and Societe Generale SA dropped 7.4% and 8% respectively, as Citigroup Inc. analyst Ronit Ghose said European lenders may drop another 30 percent as the euro area has only begun to deleverage.

Rio Tinto Group and Eurasian Natural Resources Corp. paced a selloff in mining companies, both falling more than 4.5%.

Logica Plc tumbled 16% percent after computer services provider cut its forecast for sales growth this year.

Bayerische Motoren Werke AG (BMW), the biggest maker of luxury cars, and Volkswagen AG fell at least 4.5%.

U.S. stocks fell as growing funding stress in Europe fueled concern the region is struggling to contain its sovereign debt crisis.

U.S. stocks joined a global slump as the cost of insuring against default on European sovereign debt approached a record.

Italy had to pay the most in 14 years to sell five-year bonds. German Chancellor Angela Merkel said there’s no easy solution to the euro-region crisis.

Equities briefly pared losses as the Wall Street Journal reported that S&P has not informed France about an imminent downgrade, citing a French official.

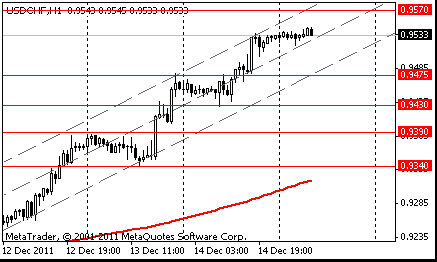

Resistance 3: Chf0.9645 (Feb 8 high)

Resistance 2: Chf0.9600 (Feb 17 high)

Resistance 1: Chf0.9570 (resistance line from Dec 9)

The current price: Chf0.9535

Support 1: Chf0.9475 (support line from Dec 9)

Support 2: Chf0.9430 (Dec 14 low)

Support 3: Chf0.9390 (Dec 12 high)

Comments: the pair is on uptrend. In focus resistance Chf0.9570.

Resistance 3: $1.3145 (38.2% FIBO $1.2944-$1.3430)

Resistance 2: $1.3100 (psychological level)

Resistance 1: $1.3065 (Dec 14 high)

The current price: $1.2982

Support 1 : $1.2945 (Dec 14 low)

Support 2 : $1.2910 (Jan 11 low)

Support 3 : $1.2860 (2011 low)

Comments: the pair is on uptrend. In focus support $1.2945.

Change % Change Last

Nikkei 8,519 -33.68 -0.39%

Hang Seng 18,354 -92.74 -0.50%

S&P/ASX 4,190 -2.90 -0.07%

Shanghai Composite 2,229 -20.06 -0.89%

FTSE 5,367 -123.35 -2.25%

CAC 2,976 -102.55 -3.33%

DAX 5,675 -99.12 -1.72%

Dow 11,823.48 -131.46 -1.10%

Nasdaq 2,539.31 -39.96 -1.55%

S&P 1,211.82 -13.91 -1.13%

10 Year Yield 1.90% -0.06

Oil $94.85 -0.10 -0.11%

Gold $1,577.20 -9.70 -0.61%

02:30 China HSBC Manufacturing PMI December 47.7

08:00 France Services PMI December 49.6 49.2

08:15 Switzerland Industrial Production (QoQ) Quarter III 3.6% -0.7%

08:15 Switzerland Industrial Production (YoY) Quarter III 2.3% 0.0%

08:30 France Manufacturing PMI December 47.3 47.1

08:30 Switzerland SNB Interest Rate Decision 0 0.00%-0.25% 0.00%-0.25%

08:30 Germany Purchasing Manager Index Manufacturing December 47.9 47.6

08:30 Germany Purchasing Manager Index Services December 50.3 50.1

09:00 Eurozone ECB Monthly Report December

09:00 Eurozone Purchasing Manager Index Manufacturing December 46.4 46.1

09:00 Eurozone Purchasing Manager Index Services December 47.5 47.1

09:30 United Kingdom Retail Sales (MoM) November 0.6% -0.2%

09:30 United Kingdom Retail Sales (YoY) November 0.9% 0.4%

10:00 Eurozone Harmonized CPI November 0.3% 0.1%

10:00 Eurozone Harmonized CPI, Y/Y November 3.0% 3.0%

10:00 Eurozone Harmonized CPI ex EFAT, Y/Y November 1.6% 1.7%

11:00 United Kingdom CBI industrial order books balance December -19 -20

11:25 Eurozone ECB President Mario Draghi Speaks 0

13:30 U.S. PPI, m/m November -0.3% 0.3%

13:30 U.S. PPI, y/y November 5.9% 5.9%

13:30 U.S. PPI excluding food and energy, m/m November 0.0% 0.2%

13:30 U.S. PPI excluding food and energy, Y/Y November 2.8% 2.8%

13:30 U.S. Initial Jobless Claims 10/12/2011 381 389

13:30 U.S. Current cccount, bln Quarter III -118 -108

13:30 U.S. NY Fed Empire State manufacturing index December 0.61 3.1

14:00 U.S. Total Net TIC Flows October 68.6 53.4

14:00 U.S. Net Long-term TIC Flows October 57.4

14:15 U.S. Industrial Production (MoM) November 0.7% 0.3%

14:15 U.S. Capacity Utilization November 77.8% 77.9%

15:00 U.S. Philadelphia Fed Manufacturing Survey December 3.6 5.1

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.