- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

The euro rose earlier after Luxembourg’s Jean- Claude Juncker said Europe should meet a deadline for arranging loans with the International Monetary Fund as part of a crisis- fighting package.

USD/JPY Y78.00

AUD/USD $0.9900, $1.0000, $1.0050 $1.0100, $1.0150, $1.0175

EUR/CHF Chf1.2345

GBP/JPY Y122.00

GBP/USD $1.5500, $1.5400

08:30 Eurozone ECB President Mario Draghi Speaks

08:30 United Kingdom BOE Gov King Speaks

10:00 Eurozone Trade Balance s.a. October 2.1 1.3 0.3

The euro headed for the steepest weekly drop versus the greenback in three months as European nations prepare for bill auctions next week amid concern policy makers can’t contain the region’s debt crisis.

France is scheduled to sell as much as 7 billion euros ($9.1 billion) of bills on Dec. 19. Spain and Greece will also offer short-term government securities next week. Gains in the euro were also limited after European Central Bank President Mario Draghi said yesterday there’s no “external savior” for indebted countries that don’t implement structural reforms and the central bank’s program of buying government bonds isn’t limitless.

The Swiss franc fell against higher- yielding currencies as gains in equity markets damped demand for safer assets.

Switzerland’s currency depreciated against 11 of 16 major peers tracked by Bloomberg, falling the most against the New Zealand dollar and the South African rand. It retreated from the strongest level in six weeks against the European single currency, reached yesterday after Swiss National Bank policy makers led by Chairman Philipp Hildebrand kept the franc’s ceiling at 1.20 per euro at a meeting in Zurich.

EUR/USD: the pair holds in range $1.3000-$ 1.3045, but showed new session high later.

GBP/USD: the pair showed new session high at $1.5550.

USD/JPY: the pair holds in range Y77.80-Y77.95.

EUR/USD

Offers $1.3140/50, $1.3080, $1.3064, $1.3050

Bids $1.3000, $1.2985/80, $1.2970, $1.2960/45, $1.2910/00, $1.2875/60

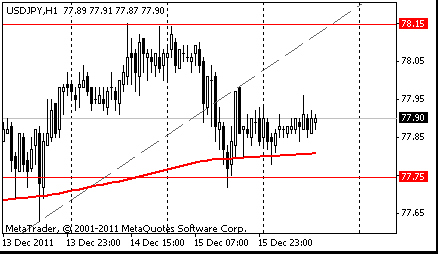

Resistance 3: Y79.00 (Nov 1 high)

Resistance 2: Y78.30/45 (area of Nov 1-4 high)

Resistance 1: Y78.15 (Dec 15 high)

The current price: Y77.90

Support 1:Y77.75 (Dec 15 low)

Support 2:Y77.50 (Dec 9 low)

Support 3:Y77.10 (Dec 8 low)

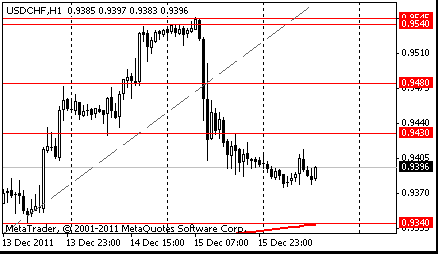

Resistance 3: Chf0.9540/45 (area of Dec 14-15 high)

Resistance 2: Chf0.9480 (Dec 13 high)

Resistance 1: Chf0.9430 (high of the American session on Dec 15)

The current price: Chf0.9386

Support 1: Chf0.9340 (Dec 13 high, MA (233) H1)

Support 2: Chf0.9290 (Dec 8 high)

Support 3: Chf0.9250 (Dec 12 low)

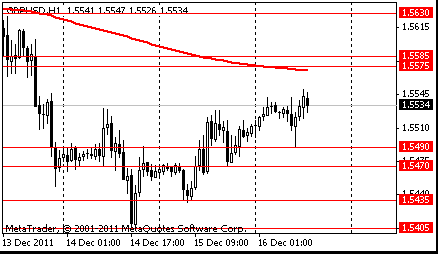

Resistance 3 : $1.5655 (Dec 12 high)

Resistance 2 : $1.5630 (61.8% FIBO $1.5405-$1.5765)

Resistance 1 : $1.5575/85 (MA (233) H1, 50.0% FIBO $1.5405-$1.5765)

The current price: $1.5534

Support 1 : $1.5490 (session low)

Support 2 : $1.5470 (low of the American session on Dec 15)

Support 3 : $1.5435 (Dec 15 low)

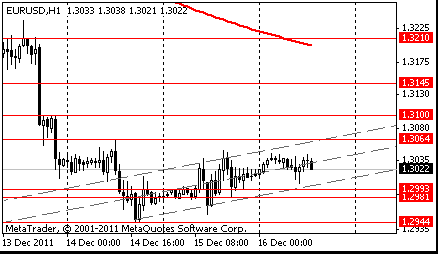

Resistance 3: $1.3145 (38.2% FIBO $1.2944-$1.3430)

Resistance 2: $1.3100 (psychological level)

Resistance 1: $1.3065 (Dec 14 high)

The current price: $1.3029

Support 1 : $1.2980 (low of the American session on Dec 15)

Support 2 : $1.2945 (Dec 14 low)

Support 3 : $1.2910 (Jan 11 low)

USD/JPY Y78.00

AUD/USD $0.9900, $1.0000, $1.0050 $1.0100, $1.0150, $1.0175

EUR/CHF Chf1.2345

GBP/JPY Y122.00

GBP/USD $1.5500, $1.5400

- FIRST FINE-TUNING OP DEC 20, SECOND FEB 28

- 1ST 3-YEAR LTRO SETTLES DEC 22, 2ND SETTLES MAR 1

The dollar and the yen declined against most of their major peers as evidence the U.S. economy is gaining momentum eased demand for havens. U.S. Labor Department figures yesterday showed initial jobless claims decreased by 19,000 to 366,000 last week, the fewest since May 2008. The median forecast of economists surveyed by Bloomberg News was 390,000.

The Australian dollar rebounded from two- week lows as Asian stocks extended gains in equities globally, boosting demand for higher-yielding assets.

The euro headed for the steepest weekly drop versus the greenback in three months as European nations prepare for bill auctions next week amid concern policy makers can’t contain the region’s debt crisis.

France is scheduled to sell as much as 7 billion euros ($9.1 billion) of bills on Dec. 19. Spain and Greece will also offer short-term government securities next week. Gains in the euro were also limited after European Central Bank President Mario Draghi said yesterday there’s no “external savior” for indebted countries that don’t implement structural reforms and the central bank’s program of buying government bonds isn’t limitless.

EUR/USD: on Asian session the pair rose.

GBP/USD: on Asian session the pair rose.

USD/JPY: on Asian session the pair holds in range Y77.80-Y77.90

On Friday at 0830GMT when ECB President Mario Draghi chairs a panel on monetary policy and payment systems, with Bank of England Governor Mervyn King and former Fed vice chairman Donald Kohn. At 0900GMT, ECB Governing Council member Ewald Nowotny gives a press conference on financial stability, in Vienna.EMU data at 1000GMT sees construction output and the trade balance for october as well as Q3 labour costs data.US data starts at 1330, when consumer prices are expected to hold steady in November after falling in October. At 1615GMT, Chicago Federal Reserve Bank President Charles Evans takes part on a panel at the EC2 Conference

on econometric tools for policy making after the crisis, in Florence, Italy, while at 1700GMT, the Dallas Fed President delivers a speech on

the economic outlook at the Austin Chamber of Commerce 2012 Economic Forecast Luncheon in Austin.

Yesterday the euro rose after Spain sold more than its maximum target at a debt auction, easing concern the region’s debt crisis is worsening. The euro pared losses versus the yen after a report showed European manufacturing and service industries contracted less this month than economists forecast.

The euro rallied earlier after the currency’s 14-day relative strength index against the dollar fell to 29 yesterday, below the 30-level that some traders see as a sign a currency may be poised to reverse direction.

Gains in the euro were capped as speculation European leaders aren’t doing enough to resolve the debt crisis damped demand for the region’s currency.

The Swiss franc strengthened against all its major counterparts after the central bank refrained from introducing new measures to weaken the currency at a policy meeting.

The franc gained the most in eight weeks against the euro after Switzerland’s central bank left its limit on the currency unchanged, resisting pressure from exporters to further curb its strength as officials take time to assess deflation risks.

The dollar dropped as U.S. economic data showed a quickening recovery and European funding stress eased, damping demand for the safety of the U.S. currency.

EUR/USD: yesterday the pair was restored.

GBP/USD: yesterday the pair gain on a floor of a figure.

USD/JPY: yesterday the pair fell.

On Friday at 0830GMT when ECB President Mario Draghi chairs a panel on monetary policy and payment systems, with Bank of England Governor Mervyn King and former Fed vice chairman Donald Kohn. At 0900GMT, ECB Governing Council member Ewald Nowotny gives a press conference on financial stability, in Vienna.EMU data at 1000GMT sees construction output and the trade balance for october as well as Q3 labour costs data.US data starts at 1330, when consumer prices are expected to hold steady in November after falling in October. At 1615GMT, Chicago Federal Reserve Bank President Charles Evans takes part on a panel at the EC2 Conference

on econometric tools for policy making after the crisis, in Florence, Italy, while at 1700GMT, the Dallas Fed President delivers a speech on

the economic outlook at the Austin Chamber of Commerce 2012 Economic Forecast Luncheon in Austin.

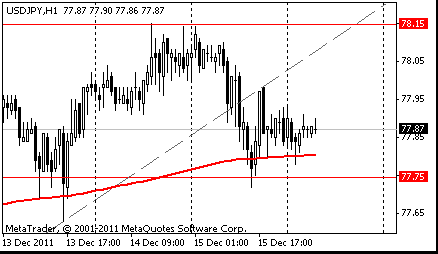

Resistance 3: Y79.00 (Nov 1 high)

Resistance 2: Y78.30/45 (area of Nov 1-4 high)

Resistance 1: Y78.15 (Dec 15 high)

The current price: Y77.86

Support 1:Y77.75 (Dec 15 low)

Support 2:Y77.50 (Dec 9 low)

Support 3:Y77.10 (Dec 8 low)

Comments: the pair is corrected remains in uptrend. In focus support Y77.75.

Resistance 3: Chf0.9540/45 (area of Dec 14-15 high)

Resistance 2: Chf0.9480 (Dec 13 high)

Resistance 1: Chf0.9430 (high of the American session on Dec 15)

The current price: Chf0.9386

Support 1: Chf0.9340 (Dec 13 high, MA (233) H1)

Support 2: Chf0.9290 (Dec 8 high)

Support 3: Chf0.9250 (Dec 12 low)

Comments: the pair decreases. In focus resistance Chf0.9430.

Resistance 3: $1.3145 (38.2% FIBO $1.2944-$1.3430)

Resistance 2: $1.3100 (psychological level)

Resistance 1: $1.3065 (Dec 14 high)

The current price: $1.3025

Support 1 : $1.2980 (low of the American session on Dec 15)

Support 2 : $1.2945 (Dec 14 low)

Support 3 : $1.2910 (Jan 11 low)

Comments: the pair is corrected remains in downtrend. In focus resistance $1.3064.

Change % Change Last

Nikkei 8,377 -141.76 -1.66%

Hang Seng 18,027 -327.59 -1.78%

S&P/ASX 4,140 -50.65 -1.21%

Shanghai Composite 2,181 -47.63 -2.14%

FTSE 5,401 +34.05 +0.63%

CAC 2,999 +22.56 +0.76%

DAX 5,731 +55.48 +0.98%

Dow 11,868.81 +45.33 +0.38%

Nasdaq 2,541.01 +1.70 +0.07%

S&P 500 1,215.76 +3.94 +0.33%

10 Year Yield 1.91% +0.01

Oil $93.65 -0.22 -0.23%

Gold $1,569.70 -7.50 -0.48%

00:01 United Kingdom Nationwide Consumer Confidence November 36 34

08:30 Eurozone ECB President Mario Draghi Speaks 0

08:30 United Kingdom BOE Gov King Speaks 0

10:00 Eurozone Trade Balance s.a. October 2.1 1.3

13:30 U.S. CPI, m/m November -0.1% 0.1%

13:30 U.S. CPI, Y/Y November 3.5% 3.5%

13:30 U.S. CPI excluding food and energy, m/m November 0.1% 0.1%

13:30 U.S. CPI excluding food and energy, Y/Y November 2.1% 2.1%

16:15 U.S. FOMC Member Charles Evans Speaks 0

17:00 U.S. FOMC Member Richard Fisher Speaks 0

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.