- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2711 -0,66%

GBP/USD $1,6115 -0,27%

USD/CHF Chf0,9491 +0,63%

USD/JPY Y107,07 +0,10%

EUR/JPY Y136,10 -0,55%

GBP/JPY Y172,55 -0,15%

AUD/USD $0,8777 -0,01%

NZD/USD $0,7957 -0,10%

USD/CAD C$1,1224 -0,57%

(time / country / index / period / previous value / forecast)

00:30 Australia CPI, q/q Quarter III +0.5% +0.4%

00:30 Australia CPI, y/y Quarter III +3.0% +2.3%

08:30 United Kingdom Bank of England Minutes

12:30 Canada Retail Sales, m/m August -0.1% +0.2%

12:30 Canada Retail Sales ex Autos, m/m August -0.6% +0.3%

12:30 U.S. CPI, m/m September -0.2% 0.0%

12:30 U.S. CPI, Y/Y September +1.7% +1.7%

12:30 U.S. CPI excluding food and energy, m/m September 0.0% +0.2%

12:30 U.S. CPI excluding food and energy, Y/Y September +1.7% +1.7%

14:00 Canada BOC Rate Statement

14:00 Canada Bank of Canada Rate 1.00% 1.00%

14:00 Canada Bank of Canada Monetary Policy Report

14:30 U.S. Crude Oil Inventories October +8.9

15:15 Canada BOC Press Conference

21:00 Australia RBA's Governor Glenn Stevens Speech

21:45 New Zealand CPI, q/q Quarter III +0.3% +0.5%

21:45 New Zealand CPI, y/y Quarter III +1.6%

The U.S. dollar traded mixed to higher against the most major currencies after the better-than-expected existing home sales in the U.S. Existing home sales in the U.S. climbed 2.4% to a seasonally adjusted annual rate of 5.17 million in September from 5.05 million in August. That was the highest level of the year.

Analysts had expected an increase to 5.11 million.

The euro traded lower against the U.S. dollar. The report that the European Central Bank is considering to buy corporate bonds weighed on the euro. Reuters reported today that the European Central Bank (ECB) considering to start buying corporate bonds. The ECB could discuss the possibility of corporate bond buying program at its December meeting.

The British pound traded lower against the U.S. dollar. The U.K. public sector net borrowing climbed to £11.8 billion in September from £10.9 billion in August, missing expectations for a decline to £9.3 billion.

The Swiss franc traded lower against the U.S. dollar. Switzerland's trade surplus widened CHF2.45 billion in September from CHF1.33 billion in August, exceeding expectations for a rise to CHF 2.43 billion. August's figure was revised down from a surplus of CHF1.39 billion.

The New Zealand dollar fell against the U.S. dollar. In the overnight trading session, the kiwi rose against the greenback after the better-than-expected Chinese economic data. China's gross domestic product increased 7.3% in the third quarter, exceeding expectations for a 7.2% rise, after a 7.5% gain in the second quarter.

China's industrial production climbed 8.0% in September, beating forecasts of a 7.5% increase, after a 6.9% gain in August.

International visitor numbers in New Zealand climbed 1.2% in September, after a 3.0% drop in August.

Credit card spending in New Zealand increased 4.4% September, after a 4.2% gain in August.

The Australian dollar decreased against the U.S. dollar. In the overnight trading session, the Aussie climbed against the greenback after the better-than-expected Chinese economic data and the Reserve Bank of Australia's minutes of the monetary policy meeting.

The Reserve Bank of Australia (RBA) said nothing new in its minutes of the monetary policy meeting. The RBA reiterated that the Aussie "remained high by historical standards".

The Japanese yen traded mixed against the U.S. dollar. Japan's all industry activity index decreased 0.1% in August, beating expectations for a 0.3% drop, after 0.4% fall in July. July's figure was revised down from a 0.2% decline.

The Reserve Bank of Australia (RBA) Deputy Governor Philip Lowe said at the Commonwealth Bank of Australia's 7th Annual Australasian Fixed Income Conference on Tuesday that "low rates have boosted asset prices globally", including the housing market in Australia.

He noted the RBA thinks that low interest rates in Australia are appropriate. Lowe pointed out that low interest rates in Australia "are helping boost construction activity and spending".

The RBA deputy governor also said that "very low global interest rates have been with us for some time. And it is likely that they will stay with us for some time yet".

"But the longer it runs on without a pickup in the appetite for real investment, the greater is the potential for new risks to develop", so Lowe.

Lowe noted that it is important to improve the investment climate, and it is the government policy to play the important role.

The National Association of Realtors released existing homes sales figures in the U.S. on Tuesday. Sales of existing homes climbed 2.4% to a seasonally adjusted annual rate of 5.17 million in September from 5.05 million in August. That was the highest level of the year.

Analysts had expected an increase to 5.11 million.

EUR/USD: $1.2600-25(E620mn), $1.2655(E828mn), $1.2685(E400mn), $1.2700(E1.9bn), $1.2750(E794mn), $1.2800(E1.5bn)

USD/JPY: Y107.00($835mn), Y107.50($682mn)

AUD/USD: $0.8650(A$323mn)

NZD/USD: $0.8105(NZ$846mn)

USD/CAD: C$1.1150($335mn), C$1.1250($190mn)

The Reserve Bank of Australia (RBA) released its minutes of the monetary policy meeting on Tuesday. The RBA said nothing new in its minutes of the monetary policy meeting.

The central bank reiterated that the Aussie "remained high by historical standards". The RBA noted that Australia's economy "had grown moderately in the June quarter", and it expects that "moderate growth overall had continued into the September quarter".

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia RBA Monetary Policy Statement

02:00 China Retail Sales y/y September +11.9% +11.8% +11.6%

02:00 China Industrial Production y/y September +6.9% +7.5% +8.0%

02:00 China Fixed Asset Investment September +16.5% +16.2% +16.1%

02:00 China GDP y/y Quarter III +7.5% +7.2% +7.3%

02:00 New Zealand Credit Card Spending September +4.2% 4.4%

04:30 Japan All Industry Activity Index, m/m August -0.4% -0.3% -0.1%

06:00 Switzerland Trade Balance September 1.33 Revised From 1.39 2.43 2.45

08:30 United Kingdom PSNB, bln September 10.9 9.3 11.8

08:55 Australia RBA Assist Gov Lowe Speaks

The U.S. dollar traded mixed to higher against the most major currencies ahead of the existing home sales in the U.S. The existing home sales in the U.S. are expected to increase to 5.11 million units in September from 5.05 million units in August.

The euro dropped against the U.S. dollar as the European Central Bank is considering to buy corporate bonds.

Reuters reported today that the European Central Bank (ECB) considering to start buying corporate bonds. The ECB could discuss the possibility of corporate bond buying program at its December meeting.

The British pound traded lower against the U.S. dollar. The U.K. public sector net borrowing climbed to £11.8 billion in September from £10.9 billion in August, missing expectations for a decline to £9.3 billion.

The Swiss franc fell against the U.S. dollar. Switzerland's trade surplus widened CHF2.45 billion in September from CHF1.33 billion in August, exceeding expectations for a rise to CHF 2.43 billion. August's figure was revised down from a surplus of CHF1.39 billion.

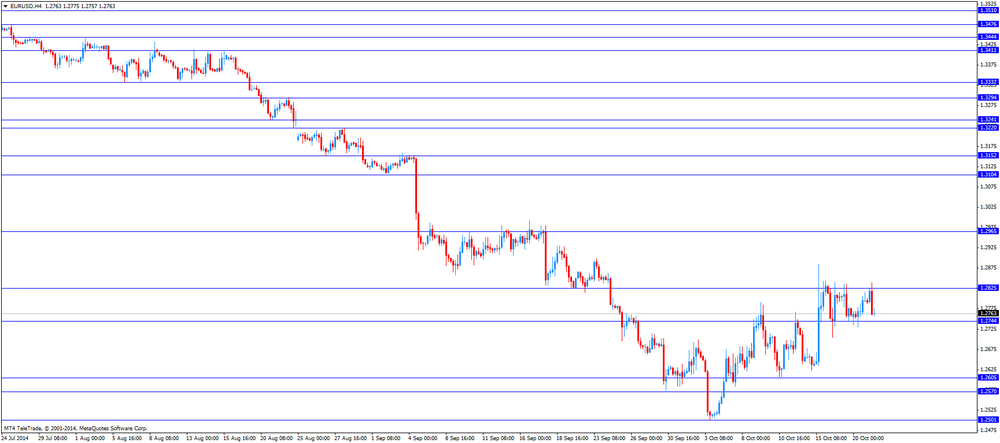

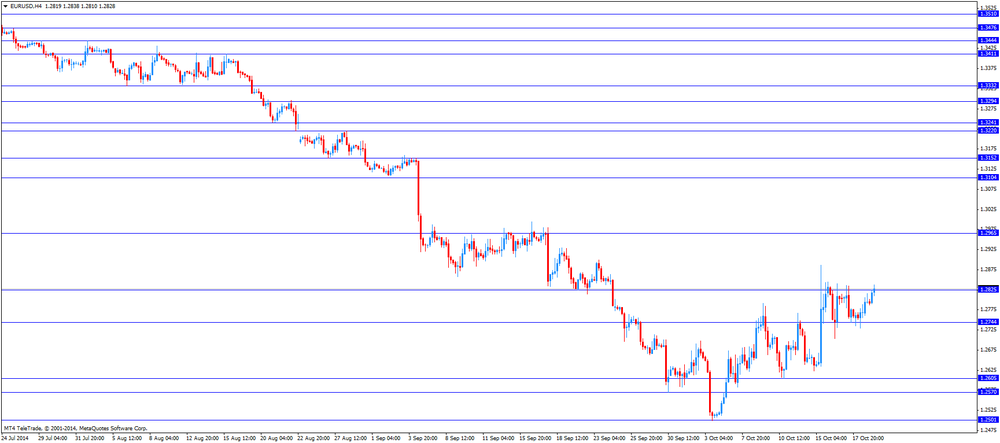

EUR/USD: the currency pair dropped to 1.2760

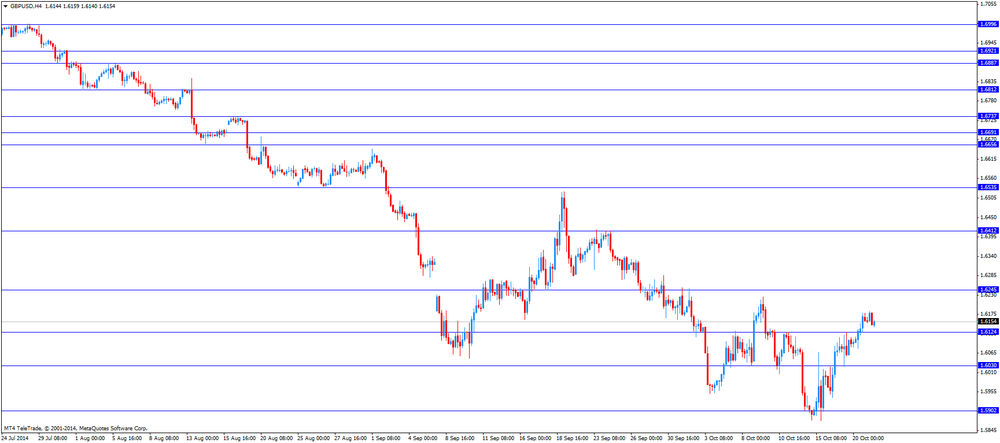

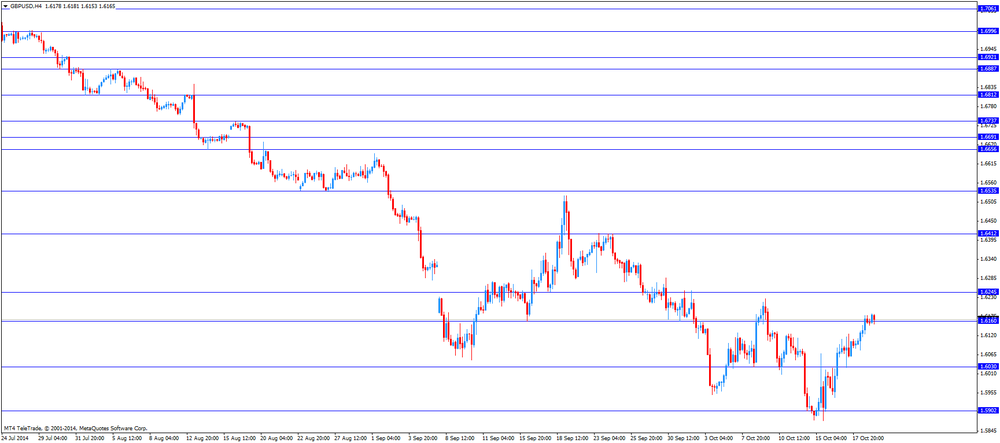

GBP/USD: the currency pair decreased to $1.6140

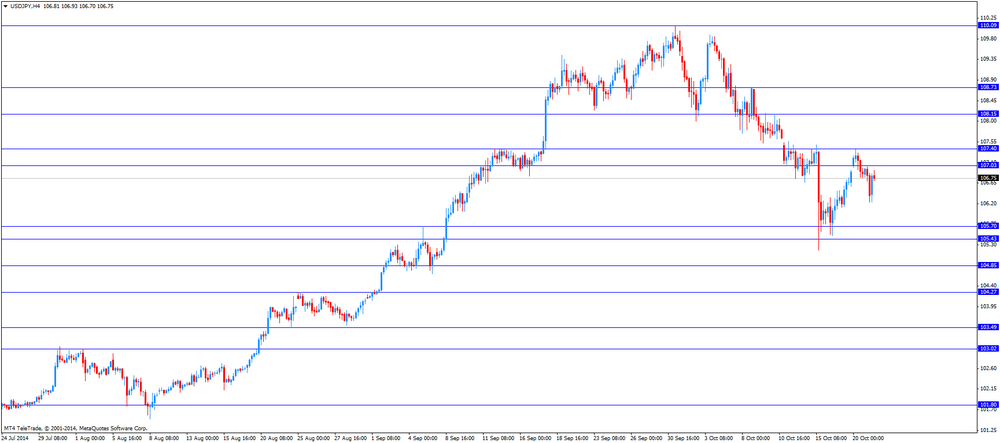

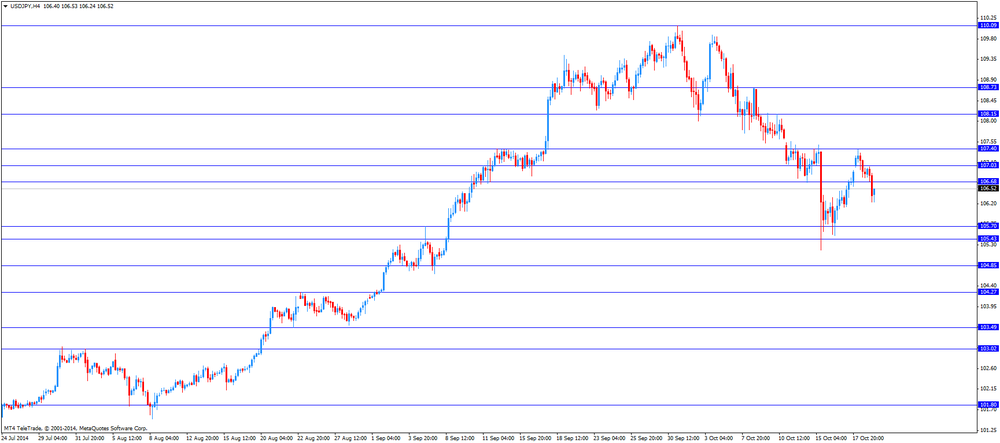

USD/JPY: the currency pair rose to Y106.93

The most important news that are expected (GMT0):

14:00 U.S. Existing Home Sales September 5.05 5.11

23:00 Australia Conference Board Australia Leading Index August +0.5%

23:30 Australia Leading Index September -0.1%

23:50 Japan Adjusted Merchandise Trade Balance, bln September -924.4 -910.0

EUR/USD

Offers $1.2929/30, $1.2900/05, $1.2840/50

Bids $1.2735/30, $1.2700/05, $1.2650

GBP/USD

Offers $1.6320-25, $1.6300, $1.6250, $1.6200

Bids $1.6150

AUD/USD

Offers $0.8950, $0.8900, $0.8840/50

Bids $0.8780, $0.8720/00, $0.8650

EUR/JPY

Offers Y137.50, Y137.20, Y136.80

Bids Y136.10/00, Y135.50, Y135.00

USD/JPY

Offers Y107.80/00, Y107.50, Y107.15/00, Y106.80/85

Bids Y106.10/00, Y105.80, Y105.55/50

EUR/GBP

Offers stg0.8066

Bids stg0.7885/80, stg0.7850

EUR/USD: $1.2600-25(E620mn), $1.2655(E828mn), $1.2685(E400mn), $1.2700(E1.9bn), $1.2750(E794mn), $1.2800(E1.5bn)

USD/JPY: Y107.00($835mn), Y107.50($682mn)

AUD/USD: $0.8650(A$323mn)

NZD/USD: $0.8105(NZ$846mn)

USD/CAD: C$1.1150($335mn), C$1.1250($190mn)

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia RBA Monetary Policy Statement

02:00 China Retail Sales y/y September +11.9% +11.8% +11.6%

02:00 China Industrial Production y/y September +6.9% +7.5% +8.0%

02:00 China Fixed Asset Investment September +16.5% +16.2% +16.1%

02:00 China GDP y/y Quarter III +7.5% +7.2% +7.3%

02:00 New Zealand Credit Card Spending September +4.2% 4.4%

04:30 Japan All Industry Activity Index, m/m August -0.4% -0.3% -0.1%

06:00 Switzerland Trade Balance September 1.33 Revised From 1.39 2.43 2.45

08:30 United Kingdom PSNB, bln September 10.9 9.3 11.8

08:55 Australia RBA Assist Gov Lowe Speaks

The U.S. dollar traded lower against the most major currencies. No major economic reports were released in the U.S. yesterday.

The New Zealand dollar rose against the U.S. dollar after the better-than-expected Chinese economic data. China's gross domestic product increased 7.3% in the third quarter, exceeding expectations for a 7.2% rise, after a 7.5% gain in the second quarter.

China's industrial production climbed 8.0% in September, beating forecasts of a 7.5% increase, after a 6.9% gain in August.

International visitor numbers in New Zealand climbed 1.2% in September, after a 3.0% drop in August.

Credit card spending in New Zealand increased 4.4% September, after a 4.2% gain in August.

The Australian dollar increased against the U.S. dollar after the better-than-expected Chinese economic data and the Reserve Bank of Australia's minutes of the monetary policy meeting.

The Reserve Bank of Australia (RBA) said nothing new in its minutes of the monetary policy meeting. The RBA reiterated that the Aussie "remained high by historical standards".

The Japanese yen rose against the U.S. dollar after Japanese stocks declined.

Japan's all industry activity index decreased 0.1% in August, beating expectations for a 0.3% drop, after 0.4% fall in July. July's figure was revised down from a 0.2% decline.

EUR/USD: the currency pair rose to $1.2824

GBP/USD: the currency pair increased to $1.6183

USD/JPY: the currency pair fell to Y106.24

The most important news that are expected (GMT0):

14:00 U.S. Existing Home Sales September 5.05 5.11

23:00 Australia Conference Board Australia Leading Index August +0.5%

23:30 Australia Leading Index September -0.1%

23:50 Japan Adjusted Merchandise Trade Balance, bln September -924.4 -910.0

EUR / USD

Resistance levels (open interest**, contracts)

$1.2958 (6676)

$1.2903 (3108)

$1.2865 (4206)

Price at time of writing this review: $ 1.2821

Support levels (open interest**, contracts):

$1.2783 (1924)

$1.2755 (3190)

$1.2710 (3107)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 55427 contracts, with the maximum number of contracts with strike pric $1,2900 (6678);

- Overall open interest on the PUT options with the expiration date November, 7 is 57285 contracts, with the maximum number of contracts with strike price $1,2600 (6385);

- The ratio of PUT/CALL was 1.03 versus 1.00 from the previous trading day according to data from October, 20

GBP/USD

Resistance levels (open interest**, contracts)

$1.6403 (1490)

$1.6305 (1652)

$1.6209 (1979)

Price at time of writing this review: $1.6181

Support levels (open interest**, contracts):

$1.6092 (1215)

$1.5995 (2112)

$1.5897 (1317)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 26324 contracts, with the maximum number of contracts with strike price $1,6200 (1979);

- Overall open interest on the PUT options with the expiration date November, 7 is 31775 contracts, with the maximum number of contracts with strike price $1,5400 (2398);

- The ratio of PUT/CALL was 1.21 versus 1.21 from the previous trading day according to data from October, 20

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.