- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

Inflation is likely to remain near the target level of the Fed at 2%

U.S. GDP is likely to grow by 3% this year and next

The unemployment rate should fall to 7.8% by year end

The inflation rate is likely to fall to 7% by the end of 2013

The Fed should follow the approach of "balance" of monetary policy

The Fed can not do much for employment in the long term

The Fed has done much to support the economy

Should carefully weigh the possibility of any further stimulation

Inflation expectations are restrained

Inflation targeting 2% - is not the limit

The threat of rising inflation, it is obvious now reserved

Moderate economic growth for the absence of strong employment growth

European stocks were little changed as company earnings were offset by comments from European Central Bank President Mario Draghi who said policy makers didn’t discuss lowering interest rates this week.

The central bank kept its benchmark interest rate at a record low of 1 percent today as predicted by economists. Stocks erased gains after Draghi, speaking at a press conference in Barcelona, said the central bankers did not talk about cutting rates today.

National benchmark indexes slid in 10 of the 18 western- European markets today. France’s CAC 40 lost 0.1 percent, the U.K.’s FTSE 100 rose 0.2 percent and Germany’s DAX slid 0.2 percent.

Porsche climbing 2.9 percent to 46.99 euros after the company, jointly owned by Volkswagen AG and the Porsche SE holding company, said first-quarter profit jumped 18 percent as deliveries of the revamped 911 and Panamera surged. The preferred shares of Volkswagen added 1.8 percent to 145 euros.

Societe Generale SA, which today reported earnings that topped analyst estimates, lost 4.2 percent to 17.27 euros and Commerzbank AG slid 3.6 percent to 1.54 euros.

Smith & Nephew Plc jumped 4 percent to 629.5 pence. Europe’s biggest maker of artificial hips and knees said first-quarter sales for its wound business added 5 percent to $240 million and revenue from surgical devices rose 3 percent.

The euro strengthened versus the yen after European Central Bank President Mario Draghi said policy makers didn’t discuss cutting interest rates at their meeting this week. The 17-nation currency fluctuated against the dollar after Draghi said at a press conference in Barcelona there has been “significant progress” on the fiscal front. The ECB kept its main refinancing rate at a record low 1 percent, as predicted. While the ECB still expects a gradual economic recovery this year, “downside risks” prevail and the outlook has become “more uncertain,” Draghi said.

The euro fell earlier today as Spanish borrowing costs increased at a note sale. Spain auctioned 765 million euros of notes due in January 2017 at an average yield of 4.75 percent, versus 3.57 percent at a previous sale of five-year securities on Feb. 2. It auctioned three-year debt at an average rate of 4.037 percent, compared with 2.617 percent on March 1.

The yen pared losses against the dollar and euro after the Institute for Supply Management’s index of non-manufacturing industries, which account for almost 90 percent of the U.S. economy, decreased to 53.5 in April from 56 a month earlier. The Tempe, Arizona-based group’s measure was projected to decline to 55.3. Readings above 50 signal expansion. The Japanese currency fell earlier against most major counterparts after the Labor Department said initial claims for unemployment benefits in the U.S. declined by 27,000 to a one- month low of 365,000 in the week ended April 28.

New Zealand’s currency, known as the kiwi, dropped against all of its 16 most-traded counterparts after unemployment exceeded the most pessimistic forecast. The jobless rate climbed to 6.7 percent in the first quarter from a revised 6.4 percent in the previous three months, Statistics New Zealand said.

U.S. stocks retreated, sending the Standard & Poor’s 500 Index lower for a second straight day, after disappointing service industries data overshadowed optimism over a bigger-than-forecast drop in jobless claims.

Equities fell as the Institute for Supply Management’s index of non-manufacturing industries, which account for almost 90 percent of the U.S. economy, decreased to 53.5 in April from 56 a month earlier. Jobless claims fell to 365,000 in the week ended April 28, a one-month low. The median forecast of economists called for 379,000 applications.

Bank of America (ВАС) declined 1.3 percent to $8.06. Hewlett- Packard (HPQ) dropped 1.2 percent to $24.94.

Green Mountain plunged 46 percent, the most ever, to $26.75. The company is seeing more competition from private- label capsules that fit into Keurig machines and from Starbucks Corp., which said it will begin selling its own single-serve brewer later this year. The company has introduced the Vue coffee machine to help combat rivals when the main patents for its K-Cups expire in September.

Target lost 1.9 percent to $56.89 as the earlier Easter holiday pulled sales into March and cooler weather cut mall traffic. Easter, which was April 8 this year after falling on April 24 in 2011, and high-school spring breaks that tend to occur around the same time pulled some shopping into March, Adrienne Tennant, a Washington-based analyst at Janney Montgomery Scott LLC, said in a report before results were announced. Cooler temperatures in the Northeast in late April also were a negative for sales of spring merchandise, she said.

Prudential Financial Inc. dropped 8 percent to $56.09. The second-biggest U.S. life insurer swung to a first-quarter loss as the value of the company’s derivative contracts fell.

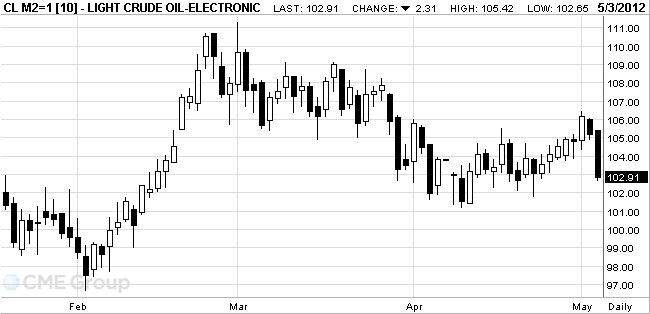

Oil tumbled the most in almost a month as European Central Bank President Mario Draghi said the euro area’s economic outlook has become “more uncertain.”

Prices dropped as much as 2.4 percent as Draghi said the region’s economic forecast is subject to downside risks, though the ECB still expects a gradual recovery this year. The central bank held its benchmark interest rate at a record low of 1 percent. Austerity measures aimed at stemming the debt crisis have pushed economies from the Netherlands to Spain back into recession. The ECB may be unwilling to add to stimulus as it presses governments to enact reforms and take responsibility for the crisis.

Oil’s loss accelerated after data showed U.S. service industries expanded at a slower pace than projected in April.

The Institute for Supply Management’s non-manufacturing index for the U.S. fell to a four-month low of 53.5 in April from 56 in March, the Tempe, Arizona-based group’s data showed today. The median forecast of 74 economists called for a decrease to 55.3. Readings above 50 signal expansion.

Crude for June delivery touched $102.65 in the biggest intraday drop since April 4 on the New York Mercantile Exchange. Prices have fallen 7.4 percent in the past year.

Brent oil for June settlement fell $1.73, or 1.5 percent, to $116.47 a barrel on the London-based ICE Futures Europe exchange.

Gold prices are driven down by the weak Euro against the decision of the European Central Bank on interest rates.

On Thursday the European Central Bank in Barcelona discussed the monetary policy has kept interest rates and the resumption of the program refrained from purchasing bonds.

Meanwhile, Spain sold at an auction of three-and five-year bonds at 2.5 billion euro swith an increase in profitability. It was the first auction after the decline of the country's credit rating agency Standard & Poor's by two points.

Stocks of the largest gold-ETF-funds fell by almost one million ounces, compared with a record level of 70.89 million ounces, registered on March 16.

Physical demand in Asia remains low after short-term price increases to $ 1,670 an ounce earlier in the week, and the weakening of the rupee has a negative impact on consumption in India - the world's largest gold market.

The cost of the June gold futures on the COMEX fell today to $ 1632.7 an ounce.

Resistance 3:1420 (area of high of March)

Resistance 2:1412 (May 1 high)

Resistance 1:1404 (session high, May 2 high)

Current price: 1391,95

Support 1:1390 (Apr 30 and May 1-2 lows, 38,2 % FIBO 1354-1412)

Support 2:1382/80 (area of Apr 26 low, МА (20) and МА (55) for D1, 50.0 % FIBO 1354-1412)

Support 3:1376 (61.8 % FIBO 1354-1412)

business activity 54.6 vs 58.9

prices 53.6 vs 63.9

new orders 53.5 vs 58.8

employment 54.2 vs 56.7

EUR/USD $1.3050, $1.3080, $1.3100, $1.3150, $1.3190

USD/JPY Y80.50, Y80.75, Y81.00

GBP/USD $1.6160, $1.6200, $1.6285

USD/CHF Chf0.9125, Chf0.9150

AUD/USD $1.0275, $1.0350, $1.0400

U.S. stock futures rose as better- than-estimated jobless claims data bolstered optimism in the economy a day before the government’s employment report.

Global Stocks:

Hang Seng 21,249.53 -59.55 -0.28%

Shanghai Composite 2,440.08 +1.64 +0.07%

FTSE 5,784.92 +26.81 +0.47%

CAC 3,244.75 +18.42 +0.57%

DAX 6,738.08 +27.31 +0.41%

Crude oil $104.97 (-0.24%).

Gold $1639.10 (-0.90%).

- global recovery is proceeding

- EMU econ to recover gradually in course of year

- very low int rates,global demand to help emu econ

- further commod price hikes also main downside risk

- global recovery is proceeding

- EMU econ to recover gradually in course of year

- very low int rates,global demand to help emu econ

- further commod price hikes also main downside risk

- stabilization of econ activity at low level

- prevailing uncertainty

- econ activity to recover gradually over 2012

- infl expectations still firmly anchored

- stabilization of econ activity at low level

- prevailing uncertainty

- econ activity to recover gradually over 2012

- infl expectations still firmly anchored

EUR/USD

Offers $1.3230, $1.3200, $1.3170/80

Bids $1.3120, $1.3100, $1.3080, $1.3070, $1.3050

GBP/USD

Offers $1.6330/35, $1.6320, $1.6300/05, $1.6275/85, $1.6240/50, $1.6230, $1.6200, $1.6180/90

Bids $1.6150, $1.6120/00, $1.6085/80, $1.6060/50

AUD/USD

Offers $1.0445/50, $1.0430/35, $1.0390/00, $1.0380, $1.0350/60, $1.0335/40, $1.0320/25

Bids $1.0260, $1.0225, $1.0200

EUR/GBP

Offers stg0.8250, stg0.8220/30, stg0.8200, stg0.8180/85, stg0.8150/65

Bids stg0.8110/00, stg0.8070/65, stg0.8050

USD/JPY

Offers Y81.20/25, Y81.00, Y80.85/90, Y80.70/75, Y80.60/65, Y80.45

Bids Y80.10/00, Y79.80, Y79.60, Y79.50

EUR/JPY

Offers Y106.80/00, Y106.60/70, Y106.50/55, Y106.35/40, Y106.20, Y105.95/00, Y105.85/90

Bids Y105.20/00, Y104.65/60, Y104.50

Resistance 3: Y81.45 (Apr 27 high)

Resistance 2: Y81.00 (resistance line from Mar 21)

Resistance 1: Y80.60 (May 2 high, МА (200) for Н1)

Current price: Y80.31

Support 1: Y80.10 (session low, May 2 low)

Support 2: Y79.60/50 (May 1 low, high of November’2011)

Support 3: Y79.15 (61,8 % FIBO Y76.00-Y84.20)

Resistance 3: Chf0.9210 (Apr 18 high, resistance line from Mar 15)

Resistance 2: Chf0.9170 (Apr 23 high)

Resistance 1: Chf0.9150 (area of session high and May 2 high)

Current price: Chf0.9144

Support 1: Chf0.9120 (area session low and low of american session on May 2)

Support 2: Chf0.9100 (area of Apr 30 and May 1 high, МА (200) for Н1)

Support 3: Chf0.9050 (area of session low and Apr 26-30 lows)

Resistance 3 : $1.6280 (resistance line from April’2011)

Resistance 2 : $1.6240 (May 1-2 high)

Resistance 1 : $1.6200 (session high, the top border of down channel from Apr 30)

Current price: $1.6184

Support 1 : $1.6160/50 (area of session low and Apr 26-27 and May 2 lows)

Support 2 : $1.6120 (the bottom border of down channel from Apr 30)

Support 3 : $1.6080 (area of Apr 23 and 25 lows)

Resistance 3 : $1.3240 (May 2 high)

Resistance 2 : $1.3200 (МА (200) for Н1)

Resistance 1 : $1.3160/70 (area of session high and high of american session on May 2)

Current price: $1.3134

Support 1 : $1.3120/00 (area of session low, May 2 low, Apr 23 low and МА (100) for D1))

Support 2 : $1.3060 (Apr 18 low)

Support 3 : $1.3000 (low of April and March)

EUR/USD $1.3050, $1.3080, $1.3100, $1.3150, $1.3190

USD/JPY Y80.50, Y80.75, Y81.00

GBP/USD $1.6160, $1.6200, $1.6285

USD/CHF Chf0.9125, Chf0.9150

AUD/USD $1.0275, $1.0350, $1.0400

Asian stocks fell, with a regional index heading for its first drop in eight days, as growth in China’s services industries slowed and employment reports from Europe to the U.S. and New Zealand fueled concern the global economy is faltering.

Nikkei 225 Closed

Hang Seng 21,225.33 -83.75 -0.39%

S&P/ASX 200 4,428.96 -6.95 -0.16%

Shanghai Composite 2,440.08 +1.64 +0.07%

Esprit Holdings Ltd., a clothier that counts Europe as its biggest market, slid 2.4 percent.

LG Display Co., the world’s No. 2 maker of liquid-crystal displays, sank 5.4 percent in Seoul after reports prosecutors investigating if it illegally obtained a rival’s technology searched its headquarters.

China Construction Bank Corp. and Bank of China Ltd. fell more than 3 percent in Hong Kong after Temasek Holdings Pte. sold shares in the Chinese lenders at a discount.

E1.085bn of 4.25% 2017 OAT;avg yield 1.89% (1.96%), cover 3.57 (3.27)

- E1.55bn of 3.25% 2021 OAT;avg yield 2.85%, cover 2.90

- E3.323bn of 3.00% 2022 OAT;avg yield 2.96% (2.98%),cover 1.98 (2.56)

- E1.473bn of 6.00% Oct 2025 OAT;avg yield 3.31%, cover 2.50

00:00 Japan Bank holiday -

01:00 China Non-Manufacturing PMI April 58.0 56.1

The euro remained lower following a three-day decline on bets that European Central Bank President Mario Draghi will hint at further stimulus measures to counter the region’s debt crisis after today’s policy meeting. The ECB will keep its benchmark interest rate at a record low 1 percent today, according to all economists surveyed by Bloomberg News. Draghi said on April 25 that inflation will slow next year and risks to the economic outlook remain on the downside. That’s a contrast to the “upside risks” to inflation he warned of three weeks ago.

The 17-nation currency was 0.2 percent from a two-week low versus the yen before Spain auctions debt. Spain will auction three- and five-year notes today amid speculation that the euro area’s fourth-largest economy will follow Greece, Ireland and Portugal in seeking a bailout. The three-year rate was 4.08 percent yesterday, down from a decade high of 6.37 percent in November. Spain’s borrowing costs have been contained after the ECB conducted a three-year loan program, known as the longer-term refinancing operations.

The dollar strengthened against most of its 16 major peers on demand for an investment haven. U.S. private employment increased by 119,000 workers last month, the smallest gain in seven months, ADP Employer Services said yesterday. The Labor Department will report May 4 that U.S. nonfarm payrolls added 160,000 jobs in April, up from 120,000 the previous month, economist estimates compiled by Bloomberg show. The unemployment rate will probably remain unchanged at 8.2 percent.

New Zealand’s currency touched the weakest in three months after data showed the nation’s unemployment rate rose to the highest level since 2010. New Zealand’s dollar, known as the kiwi, dropped to 80.41 U.S. cents, the least since January, before trading at 80.61, 0.6 percent below yesterday’s close. The nation’s jobless rate rose to 6.7 percent in the first quarter, Statistics New Zealand said today. That was higher than the most-pessimistic forecast in a Bloomberg survey of economists and up from 6.4 percent in the last three months of 2011.

EUR/USD: during the Asian session the pair traded in a range $1.3135-$1.3155.

GBP/USD: during the Asian session the pair holds in a range $1.6175-$1.6200.

USD/JPY: during the Asian session the pair rose.

UK data includes the 0600GMT release of the latest Nationwide House Price index and later, the 0830GMT release of the Markit/CIPS services PMI data along with Official Reserves data. US data includes chain store sales but starts with the 1130GMT release of the latest Challenger Layoffs data. US data at 1230GMT sees the weekly initial jobless benefit claims and also non-farm productivity data. At 1400GMT, the ISM non-manufacturing index is due, followed at 1430GMT by EIA natural gas storage data. At 1500GMT, Federal Reserve Bank Presidents Charles Plosser of Philadelphia, Dennis Lockhart of Atlanta and John Williams of San Francisco are among the presenters at the University of California at Santa Barbara Economic Forecast Project 2012.

Yesterday the euro weakened for a third day against the dollar, the longest losing streak in almost a month, after data showed European manufacturing shrank and unemployment rose in Germany, adding to concern the debt crisis will worsen. The euro dropped against most of its 16 major peers as London-based Markit Economics said its purchasing-manager index of euro-region manufacturing shrank for a ninth month, falling to a 34-month low of 45.9 in April from 47.7 in March. A reading below 50 shows contraction. The number of people out of work in Germany increased a seasonally adjusted 19,000 last month to 2.87 million, the Nuremberg-based Federal Labor Agency said. Economists surveyed by Bloomberg forecast a decline of 10,000. Yields on Germany’s two-, five-, 10-, and 30-year bonds dropped to record lows.

The 17-nation currency fell to a two-week low versus the yen on bets European Central Bank President Mario Draghi may hint at further easing at a meeting.

The dollar pared gains against the yen after data showed U.S. firms added fewer workers in April than forecast, fueling speculation the Federal Reserve may keep accommodative monetary policy in place longer. The Dollar Index briefly pared gains after a report showed U.S. companies added fewer jobs than forecast. Private employers’ payrolls increased by 119,000 workers, after a revised 201,000 gain in March, according to Roseland, New Jersey-based ADP Employer Services. The median forecast of economists was for a 170,000 advance. The Labor Department will report May 4 that U.S. nonfarm payrolls added 160,000 jobs in April, up from 120,000 the previous month survey showed.

EUR/USD: yesterday the pair decreased below $1.3200.

GBP/USD: yesterday the pair fell below $1.6200.

USD/JPY: yesterday the pair holds above Y80.00.

UK data includes the 0600GMT release of the latest Nationwide House Price index and later, the 0830GMT release of the Markit/CIPS services PMI data along with Official Reserves data. US data includes chain store sales but starts with the 1130GMT release of the latest Challenger Layoffs data. US data at 1230GMT sees the weekly initial jobless benefit claims and also non-farm productivity data. At 1400GMT, the ISM non-manufacturing index is due, followed at 1430GMT by EIA natural gas storage data. At 1500GMT, Federal Reserve Bank Presidents Charles Plosser of Philadelphia, Dennis Lockhart of Atlanta and John Williams of San Francisco are among the presenters at the University of California at Santa Barbara Economic Forecast Project 2012.

Asian stocks gained as manufacturing in the U.S. and China improved in April, adding to signs the world’s biggest economies are recovering and boosting the outlook for the region’s exporters.

Nikkei 225 9,380.25 +29.30 +0.31%

Hang Seng 21,353.64 +259.43 +1.23%

S&P/ASX 200 4,435.9 +6.39 +0.14%

Shanghai Composite 2,438.44 +42.12 +1.76%

Samsung Electronics Co., the world’s No. 1 mobile-phone maker by sales, climbed 1.4 percent in Seoul.

Japan Tobacco Inc. gained 2.4 percent after Asia’s largest cigarette maker said it will raise its dividend payout.

Idemitsu Kosan Co. jumped 4.6 percent after Japan’s third-biggest oil refiner posted earnings that beat expectations.

Asustek Computer Inc. surged 7 percent in Taipei after the laptop maker reported net income that exceeded analysts’ estimates.

European stocks declined for the second time in three days after reports showed that U.S. employers added fewer payrolls than forecast and euro-area unemployment rose to a 15-year high.

Euro-region unemployment rose to a 15-year high and manufacturing contracted for a ninth month, separate reports showed today. The jobless rate in the 17-nation euro area increased to 10.9 percent in March from 10.8 percent in February, the European Union statistics office in Luxembourg said. That’s the highest since April 1997.

In China, a survey released by HSBC Holdings Plc and Markit Economics indicated that output at small and medium-sized enterprises contracted. That contrasts with a report yesterday that showed Chinese manufacturing expanded last month at the fastest pace in a year.

National benchmark indexes fell in 15 of the 18 western European markets today. France’s CAC 40 rose 0.4 percent, the U.K.’s FTSE 100 slid 0.9 percent and Germany’s DAX (DAX) retreated 0.8 percent. Spain’s IBEX 35 Index dropped 2.6 percent to 6,831.90, its lowest level since March 2009.

A gauge of banks performed the worst of the 19 industry groups on the Stoxx Europe 600 after spreads between German 10- year government bonds and Italian and Spanish securities expanded.

Banco Santander SA and UniCredit SpA, the biggest lenders in Spain and Italy, declined 3.3 percent to 4.56 euros and 5.7 percent to 2.84 euros, respectively.

UBS rose 3.7 percent to 11.75 Swiss francs after the lender attracted more funds from wealthy clients in the first quarter than analysts estimated. UBS said its wealth management units attracted 10.9 billion Swiss francs ($12 billion) in net new funds, more than the 8.8 billion-franc estimate of analysts.

British Sky Broadcasting Group Plc climbed 1.5 percent to 701.5 pence. The U.K.’s biggest pay-TV operator said operating profit in the nine months ended March rose 20 percent. Earnings before interest, taxes, depreciation, and amortization increased to 1.19 billion pounds ($1.9 billion). Sales jumped 5 percent to 5.08 billion pounds.

Vestas, the biggest wind turbine maker, declined 5.6 percent to 48.15 kroner, the lowest closing price since May 28, 2003. The company said its loss widened 91 percent in the quarter as it expects to spend more money on turbine maintenance after uncovering potential faults in 376 machines.

U.S. stocks fell, dragging the Dow Jones Industrial Average down from the highest level since 2007, as data showed companies added fewer jobs than economists projected and euro-region unemployment rose to a 15-year high.

Equities fell as American companies added 119,000 workers in April, the fewest in seven months, according to a private report. Concern about Europe’s economy also helped drive stocks lower today. The jobless rate in the euro area rose to 10.9 percent in March, manufacturing contracted last month and unemployment in Germany unexpectedly increased.

Chesapeake tumbled 15 percent, the most since 2008, to $16.74. The company slashed its full-year 2012 and 2013 operating cash flow estimates by as much as 48 percent, and increased the amount of assets it plans to sell. This year’s cash flow estimate was lowered to $2.7 billion to $3 billion, from a February forecast of $4.5 billion to $5.2 billion.

CVS Caremark Corp. rose 2.7 percent to $45.92. The largest provider of prescription drugs in the U.S. reported first- quarter profit that exceeded analysts’ estimates after grabbing customers from Walgreen Co.

Con-way Inc. advanced 13 percent to $37. The U.S. trucking company said it earned 45 cents a share excluding some items in the first quarter. Analysts, on average, estimated 34 cents.

Resistance 3: Y81.80 (Apr 20 high)

Resistance 2: Y81.45 (Apr 27 high)

Resistance 1: Y80.60 (May 2 high)

The current price: Y80.18

Support 1: Y80.05 (May 2 low)

Support 2: Y79.65 (May 1 low)

Support 3: Y79.35 (Feb 20 low)

Resistance 3: Chf0.9195 (Apr 19 high)

Resistance 2: Chf0.9170 (Apr 23 high)

Resistance 1: Chf0.9155 (May 2 high)

The current price: Chf0.9140

Support 1: Chf0.9125 (low of the American session on May 2)

Support 2: Chf0.9100 (May 1 high)

Support 3: Chf0.9070 (May 2 low)

Resistance 3 : $1.6300 (Apr 30 high)

Resistance 2 : $1.6245 (May 1 high)

Resistance 1 : $1.6205 (high of the American session on May 2)

The current price: $1.6184

Support 1 : $1.6150/60 (Apr 27 low, May 2 low)

Support 2 : $1.6080 (Apr 25 low)

Support 3 : $1.6035 (Apr 20 low)

Resistance 3 : $1.3240 (May 2 high)

Resistance 2 : $1.3205 (May 1 low)

Resistance 1 : $1.3170 (high of the American session on May 2)

The current price: $1.3144

Support 1 : $1.3120 (May 2 low)

Support 2 : $1.3105 (Apr 23 low)

Support 3 : $1.3070 (Apr 19 low)

Change % Change Last

Gold 1,655 -8 -0.46%

Oil 105.45 -0.71 -0.67%

Change % Change Last

Nikkei 225 9,380.25 +29.30 +0.31%

Hang Seng 21,353.64 +259.43 +1.23%

S&P/ASX 200 4,435.9 +6.39 +0.14%

Shanghai Composite 2,438.44 +42.12 +1.76%

FTSE 100 5,758.11 -54.12 -0.93%CAC 40 3,226.33 +13.53 +0.42%

DAX 6,710.77 -50.42 -0.75%

Dow 13,269 -11 -0.08%

Nasdaq 3,060 +9 +0.31%

S&P 500 1,402 -4 -0.25%

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,3153 -0,64%

GBP/USD $1,6196 -0,14%

USD/CHF Chf0,9133 +0,64%

USD/JPY Y80,11 +0,02%

EUR/JPY Y105,38 -0,60%

GBP/JPY Y129,75 -0,10%

AUD/USD $1,0323 -0,08%

NZD/USD $0,8085 -0,79%

USD/CAD C$0,9867 +0,13%

00:00 Japan Bank holiday -

01:00 China Non-Manufacturing PMI April 58.0

06:00 United Kingdom Nationwide house price index April -1.0% +0.6%

06:00 United Kingdom Nationwide house price index, y/y April -0.9% -0.3%

06:45 France Industrial Production, m/m March +0.3% +0.7%

06:45 France Industrial Production, y/y March -1.9%

07:00 United Kingdom Halifax house price index April +2.2% +1.2%

07:00 United Kingdom Halifax house price index 3m Y/Y April -0.6% _0.8%

08:30 United Kingdom Purchasing Manager Index Services April 55.3 54.6

09:00 Eurozone Producer Price Index, MoM March +0.6% +0.6%

09:00 Eurozone Producer Price Index (YoY) March +3.6% +3.4%

11:45 Eurozone ECB Interest Rate Decision - 1.00% 1.00%

12:30 Eurozone ECB Press Conference -

12:30 U.S. Initial Jobless Claims - 388 382

14:00 U.S. ISM Non-Manufacturing April 56.0 55.5

15:00 U.S. FOMC Member Williams Speaks -

17:00 U.S. FOMC Member Dennis Lockhart Speaks -

17:30 U.S. FOMC Member Charles Plosser Speaks -

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.