- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

(raw materials / closing price /% change)

Oil 52.37 +0.23%

Gold 1,191.50 -0.43%

(index / closing price / change items /% change)

Nikkei +63.23 19364.67 +0.33%

TOPIX +8.09 1550.40 +0.52%

Hang Seng +190.50 22935.35 +0.84%

CSI 300 -23.77 3334.50 -0.71%

Euro Stoxx 50 +1.73 3307.94 +0.05%

FTSE 100 +15.02 7290.49 +0.21%

DAX +62.87 11646.17 +0.54%

CAC 40 +0.48 4888.71 +0.01%

DJIA +98.75 19954.28 +0.50%

S&P 500 +6.42 2275.32 +0.28%

NASDAQ +11.83 5563.65 +0.21%

S&P/TSX +65.26 15491.54 +0.42%

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0582 +0,27%

GBP/USD $1,2209 +0,29%

USD/CHF Chf1,0138 -0,29%

USD/JPY Y115,41 -0,29%

EUR/JPY Y122,12 -0,04%

GBP/JPY Y140,89 -0,02%

AUD/USD $0,7439 +0,97%

NZD/USD $0,7052 +0,91%

USD/CAD C$1,3177 -0,40%

05:00 Japan Eco Watchers Survey: Current December 52.5 50.0

05:00 Japan Eco Watchers Survey: Outlook December 53

06:00 Japan Prelim Machine Tool Orders, y/y December -5.6%

10:00 Eurozone Industrial production, (MoM) November -0.1% 0.5%

10:00 Eurozone Industrial Production (YoY) November 0.6% 1.6%

12:30 Eurozone ECB Monetary Policy Meeting Accounts

13:30 Canada New Housing Price Index, MoM November 0.4% 0.3%

13:30 U.S. Continuing Jobless Claims 2112 2118

13:30 U.S. Import Price Index December -0.3% 0.7%

13:30 U.S. Initial Jobless Claims 235 255

13:30 U.S. FOMC Member Charles Evans Speaks

19:00 U.S. Federal budget December -137 -25

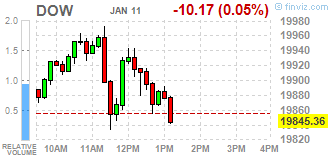

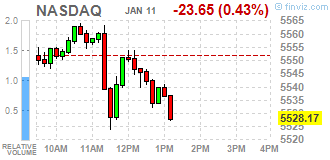

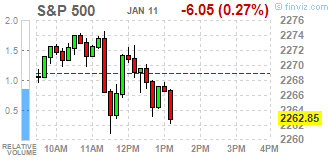

Major U.S. stock-indexes slipped to session lows, before recovering ground, on Wednesday as drug stocks took a beating after Donald Trump's comments on drug pricing in his first formal news conference after his election victory. The President-elect lashed out at pharmaceutical companies, saying they were "getting away with murder" by charging high drug prices. Drug pricing has become a lightning rod for criticism with several drugmakers coming under federal investigation for price gouging.

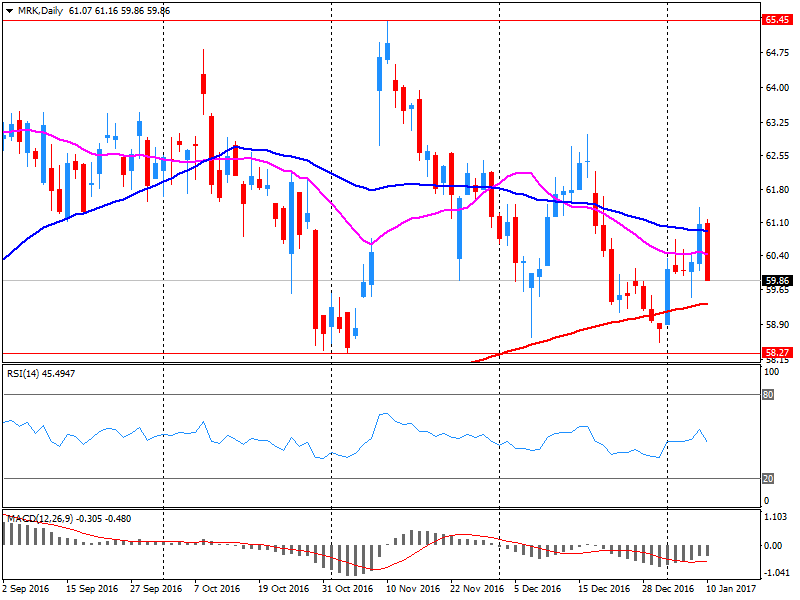

Most of Dow stocks in positive area (18 of 30). Top gainer - Merck & Co., Inc. (MRK, +1.75%). Top loser - Pfizer Inc. (PFE, -2.78%). Most of S&P sectors also in positive area. Top gainer - Basic Materials (+1.0%). Top loser - Healthcare (-1.7%).

At the moment:

Dow 19807.00 +19.00 +0.10%

S&P 500 2261.75 -2.00 -0.09%

Nasdaq 100 5022.50 -8.75 -0.17%

Oil 52.57 +1.75 +3.44%

Gold 1194.20 +8.70 +0.73%

U.S. 10yr 2.34 -0.04

Polish equities continued to grow for the third consecutive day on Wednesday. The broad market measure, the WIG Index, added 0.56%. The WIG sub-sector indices were mainly higher with mining stock gauge (+4.84%) outperforming.

The large-cap stocks' measure, the WIG30 Index, advanced 0.72%. In the index basket, agricultural producer KERNEL (WSE: KER), chemical producer GRUPA AZOTY (WSE: ATT) and copper producer KGHM (WSE: KGH) were the strongest performers, jumping by 6.34%, 5.97% and 5.64%. Other major outperformers were coking coal miner JSW (WSE: JSW), FMCG-wholesaler EUROCASH (WSE: EUR), chemical producers SYNTHOS (WSE: SNS) and videogame developer CD PROJEKT (WSE: CDR), which added between 2.74% and 3.3%. On the other side of the ledger, oil refiner PKN ORLEN (WSE: PKN) fared the worst, tumbling by 3.22%. It was followed by oil and gas producer PGNIG (WSE: PGN), genco ENERGA (WSE: ENG), developing sector name GTC (WSE: GTC) and thermal coal miner BOGDANKA (WSE: LWB), which lost between 1.02% and 1.91%.

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 4.1 million barrels from the previous week. At 483.1 million barrels, U.S. crude oil inventories are at the upper limit of the average range for this time of year.

Total motor gasoline inventories increased by 5.0 million barrels last week, and are at the upper limit of the average range. Both finished gasoline inventories and blending components inventories increased last week.

Distillate fuel inventories increased by 8.4 million barrels last week and are above the upper limit of the average range for this time of year. Propane/propylene inventories fell 4.5 million barrels last week but are in the upper half of the average range. Total commercial petroleum inventories increased by 13.4 million barrels last week.

Monthly estimates of GDP suggest that output grew by 0.5 per cent in the three months ending in December 2016 after growth of 0.5 per cent in the three months ending in November 2016. Our estimates suggest that the economy grew by 2 per cent in 2016, compared with 2.2 per cent in 2015. These figures are close to the UK's long run potential growth rate.

NIESR's latest quarterly forecast (published 2 nd November 2016) projects GDP growth of 2 per cent per annum in 2016 and 1.4 per cent in 2017. CPI inflation is expected to reach 3.8 per cent at the end of 2017.

Wall Street began sessions at neutral levels but the Warsaw WIG20 index fell to daily minima. The distance to the round level of 2,000 points is still safe and may give a chance for a little rest after an excellent start of the year and relatively more powerful than other markets behavior.

An hour before the close of trading the WIG20 index was at the level of 2,015 points (-0,40%).

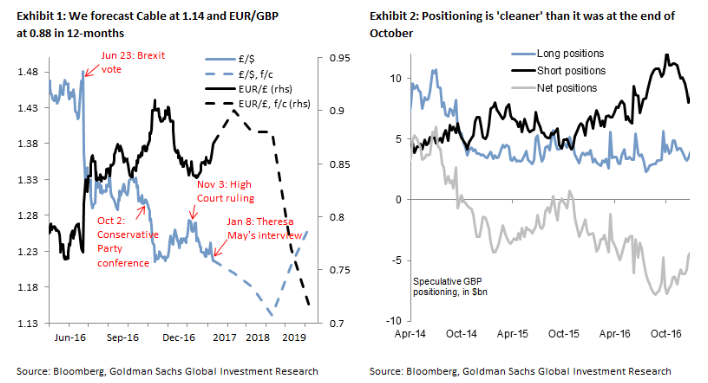

"The UK's High Court decision on November 3 took some pressure off the British Pound. But Prime Minister May's speech on Sunday (8 Jan), which simply restated her plan to trigger Article 50 by March and leave the EU within two years, has been sufficient to pull the currency down to the October lows.

Cable moved from 1.229 on Friday's close to 1.216 today. This is a testament to how vulnerable the Pound is to the repricing of a 'hard Brexit' scenario, as well as, in our view, the extent to which periods of Sterling strength are the result of markets not discounting the new reality appropriately, a reality that we have fully incorporated into our outlook for the currency since the referendum in June and that we have reiterated several times since.

The FX market has not yet re-engaged with selling Sterling. Net shorts have been reduced (Exhibit 2) and GBP has been one of the few G10 currencies not to depreciate substantially against the Dollar since the US elections.

But, in our view, Sterling is 'actionable' and soon set to become even more 'unfashionable', despite the recent move lower, as coming political events will only increase uncertainty on the future relationship between the UK and the EU. The Supreme Court is due to rule in favour of the High Court Decision on the need for a Parliamentary vote to trigger Article 50 by the end of the month. In response, the government will need to prepare a bill for the vote to take place before the end of March. This preparatory work, together with a subsequent parliamentary vote in favour of triggering Article 50, is likely to increase uncertainty even further. The kind of deal the EU and the UK will agree on will remain unclear for some time, with the UK government sticking to PM May's 'red lines' (immigration control and backing away from the European Court of Justice's jurisdiction) and the EU refusing to grant the UK participation in the Single Market under these demands. We expect the main economic consequences to be twofold: (i) an economic slowdown owing to elevated political uncertainty that reduces investment, employment and consumption as a result of higher prices, and (ii) an adjustment to the UK's external balance requiring a substantial decline in the current account deficit".

Copyright © 2017 Goldman Sachs, eFXnews™

U.S. stock-index futures were flat as investors awaited the U.S. President-elect Donald Trump's news conference and the start of earnings season in the U.S.

Global Stocks:

Nikkei 19,364.67 +63.23 +0.33%

Hang Seng 22,935.35 +190.50 +0.84%

Shanghai 3,137.42 -24.25 -0.77%

FTSE 7,294.29 +18.82 +0.26%

CAC 4,891.06 +2.83 +0.06%

DAX 11,616.58 +33.28 +0.29%

Crude $51.12 (+0.59%)

Gold $1,187.80 (+0.19%)

Shares of pharmaceutical company Merck (MRK) show a strong growth in premarket trading. The reason for rise in price of securities, as reported by CNNMoney, is the fact that on Tuesday night, the company reported that the US Food and Drug Administration (US Food and Drug Administration) is considering an accelerated approval of the drug for the treatment of lung cancer, Keytruda.

MRK shares rose to $ 61.65 (+ 2.89%).

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 31 | 0.02(0.0646%) | 117 |

| Amazon.com Inc., NASDAQ | AMZN | 795.3 | -0.60(-0.0754%) | 8394 |

| Apple Inc. | AAPL | 118.82 | -0.29(-0.2435%) | 50704 |

| AT&T Inc | T | 40.6 | -0.21(-0.5146%) | 13549 |

| Barrick Gold Corporation, NYSE | ABX | 16.82 | 0.02(0.119%) | 14508 |

| Boeing Co | BA | 158.45 | -0.62(-0.3898%) | 365 |

| Caterpillar Inc | CAT | 94.01 | 0.18(0.1918%) | 2046 |

| Citigroup Inc., NYSE | C | 59.6 | -0.63(-1.046%) | 62897 |

| Deere & Company, NYSE | DE | 106.19 | 1.30(1.2394%) | 400 |

| Exxon Mobil Corp | XOM | 85.57 | -0.36(-0.4189%) | 23699 |

| FedEx Corporation, NYSE | FDX | 188 | -0.42(-0.2229%) | 158 |

| Ford Motor Co. | F | 12.77 | -0.08(-0.6226%) | 174760 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 15.49 | -0.06(-0.3859%) | 71163 |

| General Electric Co | GE | 31.27 | -0.10(-0.3188%) | 21382 |

| General Motors Company, NYSE | GM | 37.44 | 0.09(0.241%) | 9075 |

| Goldman Sachs | GS | 242.02 | -0.55(-0.2267%) | 2191 |

| Google Inc. | GOOG | 806.06 | 1.27(0.1578%) | 333 |

| Intel Corp | INTC | 36.49 | -0.05(-0.1368%) | 1775 |

| International Paper Company | IP | 54 | 0.22(0.4091%) | 137 |

| JPMorgan Chase and Co | JPM | 86.3 | -0.13(-0.1504%) | 8449 |

| McDonald's Corp | MCD | 120.85 | 0.60(0.499%) | 639 |

| Merck & Co Inc | MRK | 61.84 | 1.92(3.2043%) | 64163 |

| Microsoft Corp | MSFT | 62.78 | 0.16(0.2555%) | 2473 |

| Nike | NKE | 53.2 | 0.09(0.1695%) | 2238 |

| Pfizer Inc | PFE | 33.3 | -0.14(-0.4187%) | 656 |

| Procter & Gamble Co | PG | 83.89 | 0.40(0.4791%) | 447 |

| Tesla Motors, Inc., NASDAQ | TSLA | 228.88 | -0.99(-0.4307%) | 7983 |

| The Coca-Cola Co | KO | 41.08 | 0.04(0.0975%) | 986 |

| Twitter, Inc., NYSE | TWTR | 17.42 | 0.05(0.2879%) | 28653 |

| Verizon Communications Inc | VZ | 52.58 | -0.18(-0.3412%) | 203 |

| Visa | V | 81.46 | 0.15(0.1845%) | 375 |

| Walt Disney Co | DIS | 108.15 | -0.23(-0.2122%) | 3008 |

| Yahoo! Inc., NASDAQ | YHOO | 42.34 | 0.04(0.0946%) | 2877 |

| Yandex N.V., NASDAQ | YNDX | 21.45 | -0.12(-0.5563%) | 3300 |

Upgrades:

Downgrades:

Exxon Mobil (XOM) downgraded to Market Perform from Outperform at Wells Fargo

AT&T (T) downgraded to Hold from Buy at Deutsche Bank

Bank of America (BAC) downgraded to Neutral at UBS

Citigroup (C) downgraded to Sell at UBS

Other:

JPMorgan Chase (JPM) initiated with a Buy at UBS

Microsoft (MSFT) initiated with an Outperform at Wells Fargo

Goldman Sachs (GS) target raised to $225 from $200 at Citigroup; Sell

Bank of America (BAC) target raised to $26 from $19 at Citigroup

Alphabet A (GOOGL) target lowered to $1100 from $1120 at Credit Suisse

Amazon (AMZN) target lowered to $950 from $1000 at Credit Suisse

EUR/USD 1.0400 (EUR 1,104 M) 1.0465-1.0480 (EUR 981 M) 1.0500 (EUR 685 M) 1.0550 (EUR 1,600 M) 1.0600 (EUR 796 M) 1.0625 (EUR 260 M)

GBP/USD 1.2120-1.2125 (GBP 209 M)

EUR/GBP 0.8650 (EUR 248 M)

USD/JPY 114.15-114.20 (USD 410 M) 114.75-114.90 (USD 775 M) 115.20-115.35 (USD 485 M) 115.50 (USD 180 M) 115.70-115.75 (USD 244 M) 116.00 (USD 615 M) 116.50 (USD 360 M) 117.00 (USD 361 M) 117.50 (USD 1,813 M)

AUD/USD 0.7400 (AUD 328 M) 0.7500 (AUD 223 M) 0.7545-0.7550 (AUD 723 M)

USD/CAD 1.3165-1.3171 (USD 450 M)

NZD/USD 0.7020 (NZD 460 M) 0.7040 (NZD 398 M) 0.7065 (NZD 334 M)

EUR/USD

Offers 1.0580 1.0600 1.0620-25 1.0650 1.0680 1.0700 1.0725-30 1.0750

Bids 1.0520 1.0500 1.0480 1.0450 1.0420 1.0400

GBP/USD

Offers 1.2180 1.2200 1.2220 1.2250 1.2280 1.2300

Bids 1.2150 1.2125-30 1.2100 1.2080-85 1.2050 1.2030 1.2000

EUR/GBP

Offers 0.8700 0.8720 0.8750 0.8780 0.8800 0.8830 0.8850

Bids 0.8665 0.8650 0.8620 0.8600 0.8585 0.8550

EUR/JPY

Offers 122.85 123.00 123.30 123.60 123.85 124.00 124.30 124.50

Bids 122.20 122.00 121.75 121.50 121.00 120.80 120.50 120.00

USD/JPY

Offers 116.20-25 116.50 116.80 117.00 117.20 117.50-55 117.80 118.00

Bids 115.75-80 115.50 115.20 115.00 114.80 114.50 114.30 114.00

AUD/USD

Offers 0.7400 0.7420-25 0.7450 0.7475 0.7500

Bids 0.7350-55 0.7330 0.7300 0.7280 0.7250 0.7230 0.7200

The forenoon phase of session brought a favorable for the demand side settlement. The German DAX recovered from earlier losses and is growing by almost 0.3 percent. The Warsaw market took advantage of the atmosphere of the environment and picked up the WIG20 index to area of 2,033 points. The contracts on the S&P500 does not indicate a strong opening in the US, the same into the second half of the session markets are entering market with a slightly less optimism.

At the halfway point of today's quotations the WIG20 index was at the level of 2,027 points (+0,17%), the turnover in the segment of the largest companies was amounted to PLN 360 million.

In November 2016, construction output fell by 0.2% compared with October 2016, largely due to a contraction in non-housing repair and maintenance.

The underlying pattern as suggested by the 3 month on 3 month movement shows a slight contraction of 0.1%.

Repair and maintenance provides the largest downwards pressure to construction output, falling both on the month and year.

The UK's deficit on trade in goods and services was estimated to have been £4.2 billion in November 2016, a widening of £2.6 billion from October 2016, which reflects a £3.3 billion increase in imports, partially offset by a £0.7 billion increase in exports.

The widening of the deficit in November 2016 is attributed to trade in goods in which there were increased imports from both EU and non-EU countries, partially offset by an increase in exports to EU countries.

In November 2016, total production was estimated to have increased by 2.1% compared with October 2016.

The increase in production was due to an increase in mining and quarrying output following the end of a maintenance period in the oil and gas industry and an increase in manufacturing.

The monthly estimate of manufacturing increased by 1.3% in November 2016; the largest contribution came from pharmaceuticals, which increased by 11.4%. Pharmaceuticals can be highly erratic, with significant monthly changes, often due to the delivery of large contracts.

The World Bank improved the forecast for oil prices in 2017 to $ 55 per barrel from the previous forecast of $ 50, which was published in June 2016.

"As soon as the excess oil expected to gradually decline, oil prices are projected to increase to $ 55 per barrel in 2017. It is better than expected in June, when the price of oil for 2017 projected to reach $ 50 per barrel ", -. according to a World Bank report.

WIG20 index opened at 2024.89 points (+0.06%)*

WIG 53515.63 0.20%

WIG30 2337.09 0.23%

mWIG40 4323.10 0.15%

*/ - change to previous close

The Warsaw spot market started the day from increases regardless of the slightly discount behavior in European markets. However the turnover is low and is mainly focused on heavily played yesterday KGHM. Shares of KGHM have more than half of the turnover in the WIG20.

After fifteen minutes of trading the WIG20 index was at the level of 2,027 points (+0,18%).

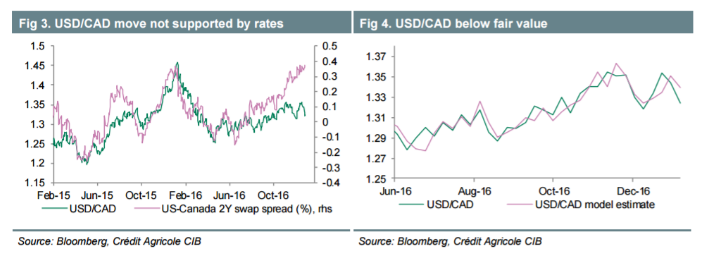

"In Canada, recent strength in building permits should translate into an acceleration in the annual pace of housing starts to 191K. The Bank of Canada business outlook survey released on Monday pointed to an improvement in the outlook for sales, investment and hiring with majority of firms reporting benefits from a stronger US growth outlook although some respondents also highlighted uncertainty about rising protectionism.

Markets have been ignoring risks of US protectionism for the CAD but a potential shift from selective tariffs to a broad border tax could be significant for US-Canada trade and the CAD.

Our fair-value estimates suggest the CAD is expensive. Neither relative rates nor oil prices will provide much support going forward.

We expect the BoC to hold steady next week and with crude oil prices down nearly 4% this week, we believe the dip in USD/CAD will prove unsustainable.

We have added a long USD/CAD exposure to our model portfolio via a 2M 1.37 one-touch option".

Copyright © 2017 Credit Agricole CIB, eFXnews™

The US stock markets ended Tuesday's session with cosmetic change, however, for the Nasdaq Comp. index slight increases were sufficient to establish another record. The Dow Jones Industrial dropped at the closing of 0.16 percent, the S&P 500 remained unchanged and the Nasdaq Composite went up by 0.36 percent . Investors are awaiting Wednesday's conference president-elect Donald Trump and the beginning of the season of quarterly results, which starts on Friday from publishing the results of three banks - JPMorgan Chase & Co., Wells Fargo & Company and Bank of America.

A slight decrease in the valuation of derivatives on US indices may result in revocation at the start of the European markets. The Warsaw market in recent days emphasizes his independence. Breaking by the WIG20 the level of 2,000 points marks the end of consolidation between 2,000 and 1,650 points and the growth potential indicates a level of 2,350 points, hence the optimism with which the market wants to grow despite the relatively weaker behavior of environment.

Japan's leading index strengthened to the highest level in 15 months in November, survey data from the Cabinet Office showed Wednesday, cited by rttnews.

The leading index, which measures the future economic activity, rose to 102.7 in November from 100.8 in October. This was the highest reading since August 2015, when score was 103.4 and slightly above the expected level of 102.6.

The coincident index improved to 115.1, the highest since March 2014, from 113.5 in October. The coincident indicator reflects the current economic activity. The score was slightly below the expected score of 115.

EUR/USD

Resistance levels (open interest**, contracts)

$1.0700 (2296)

$1.0666 (356)

$1.0641 (253)

Price at time of writing this review: $1.0559

Support levels (open interest**, contracts):

$1.0487 (1131)

$1.0443 (2435)

$1.0387 (3193)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 52492 contracts, with the maximum number of contracts with strike price $1,1500 (3225);

- Overall open interest on the PUT options with the expiration date March, 13 is 60611 contracts, with the maximum number of contracts with strike price $1,0000 (5212);

- The ratio of PUT/CALL was 1.15 versus 1.15 from the previous trading day according to data from January, 10

GBP/USD

Resistance levels (open interest**, contracts)

$1.2410 (305)

$1.2314 (148)

$1.2219 (204)

Price at time of writing this review: $1.2154

Support levels (open interest**, contracts):

$1.2083 (517)

$1.1987 (1797)

$1.1890 (2874)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 16200 contracts, with the maximum number of contracts with strike price $1,2800 (2992);

- Overall open interest on the PUT options with the expiration date March, 13 is 20169 contracts, with the maximum number of contracts with strike price $1,1500 (3214);

- The ratio of PUT/CALL was 1.25 versus 1.27 from the previous trading day according to data from January, 10

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

European stocks closed in positive territory Tuesday, shaking off nagging anxieties over the health of Italy's banking system, which gave investors pause for much of the session. A turnaround in bank shares helped to focus a mini turnaround for the European benchmark as shares in lenders cut losses or turned slightly positive late Tuesday.

U.S. stocks ended mixed on Tuesday as Nasdaq closed at a record high for a fourth session while the Dow Jones Industrial Average's push toward 20,000 was again thwarted. Jeffrey Gundlach of DoubleLine Capital earlier told Fox Business that U.S. equities seem very expensive and that stocks are likely to rise moderately from the current level but top off around Donald Trump's inauguration as U.S. president.

Asian shares hit a bump on their 2017 dream run on Tuesday, hurt by doubts over a recent global oil curb deal, and apprehensions ahead of U.S. President-elect Donald Trump's first news conference since his election victory.

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.