- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

(raw materials / closing price /% change)

Oil 53.03 +0.04%

Gold 1,195.10 -0.39%

(index / closing price / change items /% change)

Nikkei -229.97 19134.70 -1.19%

TOPIX -14.99 1535.41 -0.97%

Hang Seng -106.33 22829.02 -0.46%

Euro Stoxx 50 -21.24 3286.70 -0.64%

FTSE 100 +1.88 7292.37 +0.03%

DAX -125.13 11521.04 -1.07%

CAC 40 -24.74 4863.97 -0.51%

DJIA -63.28 19891.00 -0.32%

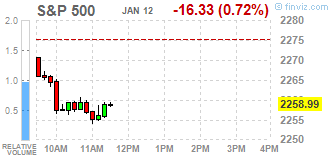

S&P 500 -4.88 2270.44 -0.21%

NASDAQ -16.16 5547.49 -0.29%

S&P/TSX -73.38 15418.16 -0.47%

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0611 +0,27%

GBP/USD $1,2159 -0,41%

USD/CHF Chf1,0108 -0,30%

USD/JPY Y114,70 -0,62%

EUR/JPY Y121,72 -0,33%

GBP/JPY Y139,48 -1,01%

AUD/USD $0,7482 +0,57%

NZD/USD $0,7094 +0,59%

USD/CAD C$1,3143 -0,26%

00:00 U.S. Fed Chairman Janet Yellen Speaks

02:00 China Trade Balance, bln December 44.61 46.5

09:30 United Kingdom MPC Member Saunders Speaks

13:30 U.S. PPI, m/m December 0.4% 0.3%

13:30 U.S. PPI, y/y December 1.3% 1.6%

13:30 U.S. PPI excluding food and energy, m/m December 0.4% 0.1%

13:30 U.S. PPI excluding food and energy, Y/Y December 1.6% 1.5%

13:30 U.S. Retail sales December 0.1% 0.7%

13:30 U.S. Retail Sales YoY December 3.8%

13:30 U.S. Retail sales excluding auto December 0.2% 0.5%

14:30 U.S. FOMC Member Harker Speaks

15:00 U.S. Business inventories November -0.2% 0.5%

15:00 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) January 98.2 98.5

The Polish equity market closed lower on Thursday. The broad-market measure, the WIG Index, fell by 0.11%. Sector performance in the WIG Index was mixed. Clothes sector names (-1.32%) fared the worst, while food stocks (+3.98%) recorded the biggest gains.

The large-cap stocks' measure, the WIG30 Index, lost 0.2%. In the index basket, insurer PZU (WSE: PZU) declined the most, down 2.32%, followed by bank PKO BP (WSE: PKO), footwear retailer CCC (WSE: CCC) and ), FMCG-wholesaler EUROCASH (WSE: EUR), losing 2.31%, 2.07% and 2.04% respectively. At the same time, agricultural producer KERNEL (WSE: KER) continued to extend gains for the second straight day, jumping by another impressive 6.34%. Other major outperformers were railway freight transport operator PKP CARGO (WSE: PKP), copper producer KGHM (WSE: KGH) and two banking sector names MBANK (WSE: MBK) and BZ WBK (WSE: BZW), which added between 2.13% and 3.66%.

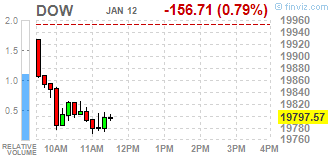

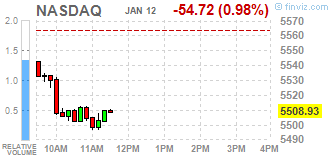

Major U.S. stock-indexes indexes got off to their worst start this year on Thursday after Donald Trump gave little clarity on his promises for economic growth that had powered a record-breaking rally on Wall Street for two months. The U.S. President-elect, in his first news conference on Wednesday, gave no details on tax cuts or infrastructure spending, and instead lashed out at U.S. spy agencies and news agencies over what he called a 'phony' Russia dossier. He also blasted pharmaceutical companies over high drug prices, causing health stocks to snap a six-day winning streak and a wobble in Wall Street.

Most of Dow stocks in negative area (28 of 30). Top gainer - Merck & Co., Inc. (MRK, +1.05%). Top loser - Microsoft Corporation (MSFT, -1.79%).

All S&P sectors in negative area. Top loser - Industrial goods (-1.3%).

At the moment:

Dow 19716.00 -161.00 -0.81%

S&P 500 2252.25 -18.25 -0.80%

Nasdaq 100 5002.50 -44.00 -0.87%

Oil 52.83 +0.58 +1.11%

Gold 1203.00 +6.40 +0.53%

U.S. 10yr 2.31 -0.06

The market in the United States opened with decline of 0.28% (the S&P500 index), which after the first trades is slightly growing. Investors are looking for new impetus to trade and those not. Moreover such arguments for the demand side were not provided by yesterday's press conference of Donald Trump.

An hour before the close of trading the WIG20 index was at the level of 2,036 points (+0,30%).

U.S. stock-index futures as market participants were disappointed with president-elect Donald Trump's first post-election press conference, which provided no clarity on his economic policy. In addition, investors awaited the start of earnings season in the U.S.

Global Stocks:

Nikkei 19,134.70 -229.97 -1.19%

Hang Seng 22,829.02 -106.33 -0.46%

Shanghai 3,119.63 -17.13 -0.55%

FTSE 7,294.73 +4.24 +0.06%

CAC 4,884.49 -4.22 -0.09%

DAX 11,583.51 -62.66 -0.54%

Crude $53.10 (+1.63%)

Gold $1,201.90 (+0.44%)

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 94.39 | -0.26(-0.2747%) | 2856 |

| ALTRIA GROUP INC. | MO | 87.12 | 0.31(0.3571%) | 17281 |

| Amazon.com Inc., NASDAQ | AMZN | 83.85 | 0.10(0.1194%) | 12295 |

| AMERICAN INTERNATIONAL GROUP | AIG | 94.39 | -0.26(-0.2747%) | 2856 |

| Apple Inc. | AAPL | 119.14 | -0.61(-0.5094%) | 275000 |

| Barrick Gold Corporation, NYSE | ABX | 17.07 | 0.39(2.3381%) | 165697 |

| Boeing Co | BA | 158.65 | -0.75(-0.4705%) | 4143 |

| Caterpillar Inc | CAT | 94.39 | -0.26(-0.2747%) | 2856 |

| Citigroup Inc., NYSE | C | 83.85 | 0.10(0.1194%) | 12295 |

| Exxon Mobil Corp | XOM | 87.12 | 0.31(0.3571%) | 17281 |

| Facebook, Inc. | FB | 125.6 | -0.49(-0.3886%) | 95200 |

| Ford Motor Co. | F | 12.7 | 0.03(0.2368%) | 64599 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 15.67 | -0.20(-1.2602%) | 316152 |

| Google Inc. | GOOG | 807.3 | -0.61(-0.0755%) | 1944 |

| Hewlett-Packard Co. | HPQ | 83.85 | 0.10(0.1194%) | 12295 |

| HONEYWELL INTERNATIONAL INC. | HON | 94.39 | -0.26(-0.2747%) | 2856 |

| Intel Corp | INTC | 87.12 | 0.31(0.3571%) | 17281 |

| International Business Machines Co... | IBM | 168.1 | 0.35(0.2086%) | 4695 |

| Johnson & Johnson | JNJ | 114.26 | -0.47(-0.4097%) | 11735 |

| JPMorgan Chase and Co | JPM | 86.7 | -0.38(-0.4364%) | 43226 |

| McDonald's Corp | MCD | 120.69 | -0.19(-0.1572%) | 3473 |

| Merck & Co Inc | MRK | 94.39 | -0.26(-0.2747%) | 2856 |

| Microsoft Corp | MSFT | 87.12 | 0.31(0.3571%) | 17281 |

| Pfizer Inc | PFE | 32.72 | -0.11(-0.3351%) | 26325 |

| Procter & Gamble Co | PG | 83.85 | 0.10(0.1194%) | 12295 |

| Tesla Motors, Inc., NASDAQ | TSLA | 228.75 | -0.98(-0.4266%) | 4971 |

| The Coca-Cola Co | KO | 41.01 | -0.04(-0.0974%) | 26331 |

| UnitedHealth Group Inc | UNH | 94.39 | -0.26(-0.2747%) | 2856 |

| Verizon Communications Inc | VZ | 52.54 | 0.08(0.1525%) | 16278 |

| Visa | V | 81.23 | -0.57(-0.6968%) | 8672 |

| Wal-Mart Stores Inc | WMT | 68.6 | 0.07(0.1021%) | 6180 |

| Walt Disney Co | DIS | 108.15 | -1.29(-1.1787%) | 72495 |

| Yandex N.V., NASDAQ | YNDX | 21.62 | 0.13(0.6049%) | 3239 |

Upgrades:

Merck (MRK) upgraded to Buy from Neutral at Guggenheim

Merck (MRK) upgraded to Overweight from Neutral at Piper Jaffray

Merck (MRK) upgraded to Overweight from Equal-Weight at Morgan Stanley

Downgrades:

Walt Disney (DIS) downgraded to Sell form Hold at Pivotal Research

Twitter (TWTR) downgraded to Hold from Buy at Pivotal Research

Other:

Boeing (BA) initiated with an Underperform at RBC Capital Mkts; target $136

United Tech (UTX) initiated with a Sector Perform at RBC Capital Mkts

EUR/USD 1.0500-1.0511 (EUR 310 M) 1.0525 (EUR 731 M) 1.0750 (EUR 228 M)

GBP/USD 1.2100 (GBP 198 M)

USD/JPY 115.00 (USD 1,200 M) 115.95-116.00 (USD 215 M) 116.10-116.25 (USD 234 M) 117.00 (USD 365 M)

USD/CHF 1.0175 (USD 180 M)

AUD/USD 0.7300-0.7310 (AUD 472 M) 0.7350-0.7355 (AUD 488 M)

USD/CAD 1.3190-1.3200 (USD 281 M)

NZD/USD 0.7000 (NZD 320 M)

The New Housing Price Index (NHPI) rose 0.2% in November compared with the previous month. The advance was largely driven by price increases for new housing in Ontario.

Among the 21 census metropolitan areas (CMAs) surveyed, new housing prices were up in 10, down in 4 and unchanged in 7.

London (+1.3%) and Hamilton (+0.7%) recorded the largest price gains among the CMAs covered by the survey. Builders in both CMAs reported improving market conditions and higher construction costs as reasons for the increases. This was the largest monthly rise in London since March 2010.

Prices also rose in Kitchener-Cambridge-Waterloo (+0.5%), the combined region of Toronto and Oshawa (+0.4%) and Calgary (+0.4%). Builders in Kitchener-Cambridge-Waterloo cited market conditions and higher construction costs as reasons for the gain.

Prices for U.S. imports rose 0.4 percent in December, the U.S. Bureau of Labor Statistics reported today, after a 0.2-percent decline the previous month. The advance in December was primarily driven by higher fuel prices which more than offset lower nonfuel prices. U.S. export prices advanced in December, rising 0.3 percent following a 0.1-percent decrease in November.

In the week ending January 7, the advance figure for seasonally adjusted initial claims was 247,000, an increase of 10,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 235,000 to 237,000. The 4-week moving average was 256,500, a decrease of 1,750 from the previous week's revised average. The previous week's average was revised up by 1,500 from 256,750 to 258,250. There were no special factors impacting this week's initial claims. This marks 97 consecutive weeks of initial claims below 300,000, the longest streak since 1970.

EUR/USD

Offers 1.0680 1.0700 1.0725-30 1.0750 1.0785 1.0800

Bids 1.0620 1.0600 1.0580 1.0550 1.0520 1.0500 1.0480 1.0450

GBP/USD

Offers 1.2325-30 1.2360 1.2380 1.2400 1.2430 1.2450

Bids 1.2250 1.2230 1.2200 1.2180 1.2165 1.2150 1.2125-30 1.2100

EUR/GBP

Offers 0.8685 0.8700 0.8720 0.8750 0.8780 0.8800

Bids 0.8650 0.8620 0.8600 0.8585 0.8550

EUR/JPY

Offers 121.80 122.00 122.50 122.85 123.00 123.30 123.60 123.85 124.00

Bids 121.20 121.00 120.80 120.50 120.00

USD/JPY

Offers 114.60 114.80 115.00 115.20 115.50 115.80 116.00 116.20-25 116.50

Bids 113.80 113.50 113.20-25 113.00 112.85 112.65 112.50

AUD/USD

Offers 0.7530 0.7550 0.7575 0.7600 0.7620 0.7650-60

Bids 0.7480 0.7450 0.7430 0.7400 0.7380 0.7350-55 0.7330 0.7300

-

Fed's Bullard: No Reason to Move Rates `Dramatically'

-

Don't Expect to See Much Impact From Trump Agenda in 2017

-

Markets are Settling Down a Bit Post-Election

-

A Few Policy Makers Opposed Decision to Extend QE

-

ECB Officials Worried in December Underlying Inflation Showed No Convincing Upturn

-

Extended QE to Provide Support During Year From Possible Political Shocks

"Germany does not qualify for an automatic increase in its contribution to the budget of the European Union after Brexit," - said Finance Minister deputy Jens Spahn in an interview with Handelsblatt.

"If the contribution from the UK will disappear, the EU budget will be reduced - said Jens Spahn -. However, there is no automatic mechanism in which Germany and other net contributors should increase the contribution to the EU budget."

Germany, Europe's largest economy, is already making the largest net contribution to the EU budget each year to more than 15 billion euros.

In November 2016 compared with October 2016, seasonally adjusted industrial production rose by 1.5% in the euro area (EA19) and by 1.6% in the EU28, according to estimates from Eurostat, the statistical office of the European Union.

In October 2016 industrial production rose by 0.1% in the euro area, while it fell by 0.1% in the EU28. In November 2016 compared with November 2015, industrial production increased by 3.2% in the euro area and by 3.1% in the EU28.

"The USD/JPY is losing momentum...

As a first correction risk, we are monitoring any unwinding of speculative USD longs driven by the USD/JPY rally. We think the USD/JPY will likely rise quickly to 115-118 level, and estimate that Japanese real-demand traders can be cautious about buying an expensive USD. It is difficult to claim that support for the USD/JPY at the high-110s of firm.

Second, there is still uncertainty concerning the Trump's policies. If Mr. Trump again emphasizes his public commitments including tax cuts at his first press conference today after the election, this will likely be viewed as USD-bullish. His reference to capping USD appreciation might trigger a correction.

Third, we see a risk that a relatively slow economy before Trump can deliver his policies could stall the USD/JPY. The latest market forecast for US economic growth for 4Q to be released on 27 January is 2.0% YoY, but our economist points out that growth may have slowed to around 1%.

Fourth, although there may not be a crisis right now, we need to bear in mind the presence of risk-off factors other than in the US. Economic, market, and political conditions in China, other EMs and Europe, as well as geopolitical risk including in East Asia, are greater factors for concern than in 2016..

We think the USD/JPY uptrend toward 125 will be maintained, and see a prime opportunity to buy on decline. We have seen there could be a correction to 115-110 zone in the first some months of 2017, but we found support at 115 firmer than expected. We think some market participants could start to unwind remaining USD shorts on buying on decline at about 115".

Copyright © 2017 DB, eFXnews™

This morning, the New York futures for Brent rose by 0.89% to $ 55.59 and WTI rose by 0.57% to $ 52.55. Thus, the black gold prices traded higher as refineries in the United States in the first week of January processed record volumes of oil. This indicates strong demand for fuel. In addition, support to the market had news of the reduction of the supply from Saudi Arabia.

-

At 10:30 GMT Britain will place 10-year bonds

-

At 12:30 GMT the ECB to report on monetary policy meeting

-

At 13:30 GMT FOMC member Charles Evans will give a speech

-

At 13:30 GMT FOMC members Patrick T. Harker will deliver a speech

-

At 13:30 GMT FOMC member Dennis Lockhart will give a speech

-

At 18:01 GMT the United States will place 30-year bonds

-

At 18:15 GMT FOMC member James Bullard will give a speech

-

At 18:45 GMT FOMC member Robert Kaplan will deliver a speech

WIG20 index opened at 2029.68 points (-0.05%)*

WIG 53690.48 -0.04%

WIG30 2345.74 -0.12%

mWIG40 4391.99 0.26%

*/ - change to previous close

The cash market opens with slight decrease of 0.05% at a turnover traditionally focused on the shares of KGHM. In Europe the German DAX starts fairly low with decline of approx.. 0.4%. The mood at the beginning is not so the best, but support for the Warsaw Stock Exchange is the weaker dollar, which leads to a peaceful start of the session.

After fifteen minutes of trading the WIG20 index was at the level of 2.028 points (-0,09%).

In December 2016, the Consumer Prices Index (CPI) rose by 0.3% over a month after a stability in the two previous months. Seasonally adjusted, it increased slightly (+0.1%), as in the previous month. Year on year, the CPI accelerated for the second consecutive month (+0.6% after +0.4% in October and +0.5% in November) and have reached its highest increase since May 2014.

The month-on-month increase came from an essentially seasonal rebound in services prices. Energy prices and food prices rose at the same pace as in November. Manufactured product prices were stable after a slight drop in November.

Yesterday's event of the day was the press conference of President-elect Donald Trump. During the conference, the US stock indices fluctuated, but at the end of trading advantage was taken over by shares buyers and as a result Wednesday's session on Wall Street ended with pros. The Dow Jones Industrial rose at the close by 0.50 percent, the S&P 500 by 0.28 percent and the Nasdaq Comp. went up by 0.21 percent.

After two sessions of heavily discount went up crude oil prices. On the stock market in New York this raw material lost on Monday and Tuesday totally 5.9 percent. Both Brent and WTI rallied on Wednesday more than 3 percent despite the fact that crude oil inventories in the US rose last week above expectations. After the conference weakened the dollar.

On the Asian markets this morning is weaker Japanese Nikkei, also China is dominated by the color red. In addition go down contracts in the United States, which in practice reflect the majority of yesterday's positive achievements. Given the above, opening in Europe is not going to be too optimistic.

EUR/USD

Resistance levels (open interest**, contracts)

$1.0756 (2264)

$1.0714 (2215)

$1.0681 (446)

Price at time of writing this review: $1.0630

Support levels (open interest**, contracts):

$1.0555 (2056)

$1.0529 (1104)

$1.0494 (1151)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 52458 contracts, with the maximum number of contracts with strike price $1,1500 (3255);

- Overall open interest on the PUT options with the expiration date March, 13 is 62223 contracts, with the maximum number of contracts with strike price $1,0000 (5469);

- The ratio of PUT/CALL was 1.19 versus 1.15 from the previous trading day according to data from January, 11

GBP/USD

Resistance levels (open interest**, contracts)

$1.2509 (919)

$1.2413 (313)

$1.2317 (421)

Price at time of writing this review: $1.2244

Support levels (open interest**, contracts):

$1.2180 (914)

$1.2085 (444)

$1.1988 (2061)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 16424 contracts, with the maximum number of contracts with strike price $1,2800 (3018);

- Overall open interest on the PUT options with the expiration date March, 13 is 20304 contracts, with the maximum number of contracts with strike price $1,1500 (3212);

- The ratio of PUT/CALL was 1.24 versus 1.25 from the previous trading day according to data from January, 11

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

Japan had a current account surplus of 1.415 trillion yen in November, the Ministry of Finance said on Thursday, cited by rttnews - up 28.0 percent on year.

The headline figure was shy of expectations for a surplus of 1.460 trillion yen and down from 1.719 trillion yen in October.

The trade balance showed surplus of 313.4 billion yen - exceeding forecasts for 254.4 billion yen and down from 587.6 billion yen in the previous month.

The ANZ Commodity Price Index rose 0.7% m/m in December, largely due to the continuing comeback story of dairy prices over the second half of 2016. The December rise in the index was the eighth in a row, driving it 19% higher over the course of 2016.

The NZD Commodity Price Index posted a 2.0% m/m lift in December.This was the fifth month-on-month rise in a row and the fourth monthly gain above 2%. The NZD's continued descent against the USD and GBP in December was the key helping hand. The NZD TWI actually rose 0.1% m/m. however, implying little exporter relief elsewhere.

Non-dairy commodity prices were the disappointment, falling 1.9% m/m. Only 3 of the 12 non-dairy commodities in the index rose in December, with falls centred mainly in the meat and fibre group. However, many sectors saw price improvement throughout the course of 2016 (total non-dairy +7% y/y), though NZD moves continued to weigh on local returns in many cases.

European stocks rose for a second straight day on Wednesday, but with drugmakers capping gains after a late-session selloff following remarks by U.S. President-elect Donald Trump.

The Dow Jones Industrial Average closed less than 50 points from the psychologically-important 20,000 mark on Wednesday following President-elect Donald Trump's first news conference in months. The Nasdaq also extended gains to its fifth straight record close.

Asian equity markets were slightly higher Thursday, after U.S. President-elect Donald Trump largely avoided fresh attacks on global trade in his first news conference in six months. However, Trump on Wednesday also offered little clarity on his economic stimulus plans, sending the U.S. dollar down against major currencies, with the Japanese yen recently up nearly 0.3%, hurting Japanese stocks.

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.