- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

Gold $1,300.00 -22.00 -1.66%

ICE Brent Crude Oil $108.72 -0.35 -0.32%

NYMEX Crude Oil $103.82 +0.56 +0.54%Nikkei 13,996.81 +86.65 +0.62%

Hang Seng 22,671.26 -367.54 -1.60%

Shanghai Composite 2,101.6 -29.94 -1.40%

S&P 1,842.98 +12.37 +0.68%

NASDAQ 4,034.16 +11.47 +0.29%

Dow 16,262.56 +89.32 +0.55%

FTSE 1,306.85 -12.61 -0.96%

CAC 4,345.35 -39.21 -0.89%

DAX 9,173.71 -165.46 -1.77%EUR/USD $1,3812 -0,04%

GBP/USD $1,6727 +0,02%

USD/CHF Chf0,8801 +0,06%

USD/JPY Y101,84 -0,01%

EUR/JPY Y140,67 -0,05%

GBP/JPY Y170,34 +0,01%

AUD/USD $0,9355 -0,64%

NZD/USD $0,8646 -0,39%

USD/CAD C$1,0980 +0,16%00:00 U.S. FOMC Member Narayana Kocherlakota

00:30 Australia Leading Index February -0.1%

02:00 China Retail Sales y/y March +11.8% +11.9%

02:00 China Fixed Asset Investment March +17.9% +18.1%

02:00 China Industrial Production y/y March +8.6% +9.1%

02:00 China GDP y/y Quarter I +7.7% +7.4%

04:30 Japan Industrial Production (MoM) (Finally) February -2.3% -2.3%

04:30 Japan Industrial Production (YoY) February +6.9% +6.9%

06:15 Japan BOJ Governor Haruhiko Kuroda Speaks

08:30 United Kingdom Average earnings ex bonuses, 3 m/y February +1.3% +1.7%

08:30 United Kingdom Average Earnings, 3m/y February +1.4% +1.8%

08:30 United Kingdom Claimant count March -34.6 -30.2

08:30 United Kingdom Claimant Count Rate March 3.5%

08:30 United Kingdom ILO Unemployment Rate February 7.2% 7.2%

09:00 Eurozone Harmonized CPI March +0.3% +1.0%

09:00 Eurozone Harmonized CPI, Y/Y (Finally) March +0.7% +0.5%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y March +1.0% +0.8%

09:00 Switzerland Credit Suisse ZEW Survey (Expectations) April 19.0

12:00 U.S. FOMC Member Jeremy Stein Speaks

12:30 Canada Foreign Securities Purchases February 1.09 4.57

12:30 U.S. Building Permits, mln March 1.018 1.000

12:30 U.S. Housing Starts, mln March 0.907 0.970

13:15 U.S. Industrial Production (MoM) March +0.6% +0.5%

13:15 U.S. Capacity Utilization March 78.8% 78.4%

14:00 Canada Bank of Canada Rate 1.00% 1.00%

14:00 Canada Bank of Canada Monetary Policy Report

14:00 Canada BOC Rate Statement

14:30 U.S. Crude Oil Inventories April +4.0

15:15 Canada BOC Press Conference

16:15 U.S. Fed Chairman Janet Yellen Speaks

17:25 U.S. FOMC Member Richard Fisher Speaks

18:00 U.S. Fed's Beige Book AprilThe euro rose against the dollar after U.S. data on consumer price inflation . A key measure of inflation rose ">Report from the Labor Department showed that the March consumer price index rose a seasonally adjusted 0.2 % compared with 0.1 % the previous month . Many experts predicted an increase in this index is only 0.1 %.

Core CPI , which excludes food and energy , also rose 0.2 % after increasing 0.1 % in February. Expected to grow by 0.1%. Compared to last year consumer price inflation accelerated in March to 1.5% from 1.1 % in February, although it remained below the 2 per cent target Fed .

The data also showed that the drop in energy prices helped to keep inflation pressures subdued in March. Gasoline prices decreased by 1.7 %, which is likely a result of the burst of domestic production of oil and increasing demand . Food prices , on the other hand, rose by 0.4 %, as the drought in some areas of the U.S. and Brazil raised the cost of agricultural products.

The euro exchange rate against the dollar earlier fell against the background of weak data on Germany. Note that confidence among German investors fell again in April , extending this streak to four consecutive months , highlighting risks to recovery in Europe's largest economy . This was stated in the report of the Centre for European Economic Research ZEW.

According to the data , the April index of sentiment in the business environment , which is designed to assess the development of the economic situation in the next six months , declined to 43.2 from 46.6 in March. Economists had forecast a decline to 46.3 . Recall that in December 2013 reached a seven-year maximum sensor - at the level of 62 points . Current situation index rose to 59.5 , its highest level since July 2011 , compared with 51.3 in March. Economists predicted the figure at 51.5 .

The data also showed that the index of economic sentiment in the euro zone fell to 61.2 from 61.5 in March, while the current conditions index rose 6.2 points to -30.5 .

Pound responded decline and then a sharp rise against the dollar on inflation data in Britain. As it became known , at the end of March the British inflation fell to its lowest level in more than four years , retreating further from the target goal of the Bank of England. It became known from the report , which was submitted to the Office for National Statistics.

According to the data , consumer prices rose in March by 1.6 percent per annum , and confirmed the experts' forecasts , but were close to the lowest level since October 2009 . Recall that in February, prices rose 1.7 percent in February. In the ONS said that the greatest pressure on the annual rate of consumer price inflation was the reduction in fuel prices, clothing and furniture . In addition, it was announced that the base rate of inflation , which excludes prices of energy , food, alcohol and tobacco increased by 1.6 percent ( four-year minimum). The data also showed that inflation in selling prices increased by 0.5 percent ( the lowest since October 2009 ), which was slightly higher than economists' forecasts - at the level of 0.3 percent.

European stocks declined, erasing their gains for the year, after a report that Russian troops entered towns in eastern Ukraine, and as German confidence data missed economists’ forecasts.

The Stoxx Europe 600 Index fell 1 percent to 326.58 at the close of trading. The gauge rebounded yesterday amid better-than-estimated U.S. retail sales data and earnings from Citigroup Inc., after last week erasing most of the year’s gains as investors sold technology shares on valuation concerns. The equity benchmark has declined 0.5 percent so far this year.

In Germany, a gauge of investor confidence fell for a fourth month in April. The ZEW Center for European Economic Research in Mannheim said its index of investor and analyst expectations, which aims to predict economic developments six months in advance, slid to 43.2 from 46.6 in March. Economists had forecast a decline to 45.

In the U.S., the Federal Reserve Bank of New York’s so-called Empire State manufacturing index declined to 1.29 this month from 5.61 in March. Economists surveyed by Bloomberg had forecast an increase to 8.

National benchmark indexes retreated in all of the western-European markets except Norway. The U.K.’s FTSE 100 slipped 0.6 percent, Germany’s DAX lost 1.8 percent, while France’s CAC 40 declined 0.9 percent.

SABMiller lost 2.3 percent to 3,052.5 pence. The world’s second-biggest brewer said its 39.6 percent holding in hotel and casino operator Tsogo Sun is not a core part of its operations.

Rio Tinto fell 3.1 percent to 3,302.5 pence. The world’s second-largest mining company said first-quarter iron ore production rose 8 percent to 52.3 million metric tons from 48.3 million tons a year earlier. That missed the 54.7 million-ton median estimate of analysts surveyed by Bloomberg.

Banca Monte dei Paschi di Siena SpA plunged 10 percent to 22.5 euro cents, for its biggest drop since March 2012. Italy’s third-largest bank said it may increase the size of a planned share sale to reimburse part of a 4.1 billion-euro ($5.7 billion) government bailout.

L’Oreal advanced 1.1 percent to 122 euros. The world’s largest cosmetics maker said first-quarter revenue gained 2.8 percent in western Europe, excluding currency shifts and acquisitions, while southern European sales grew for the first time in six years.

Sodexo climbed 3.3 percent to 77.36 euros. Deutsche Bank AG raised its recommendation on the world’s second-largest catering company to buy from hold, citing expected strong earnings growth, increased operational efficiencies and the potential for cash returns.

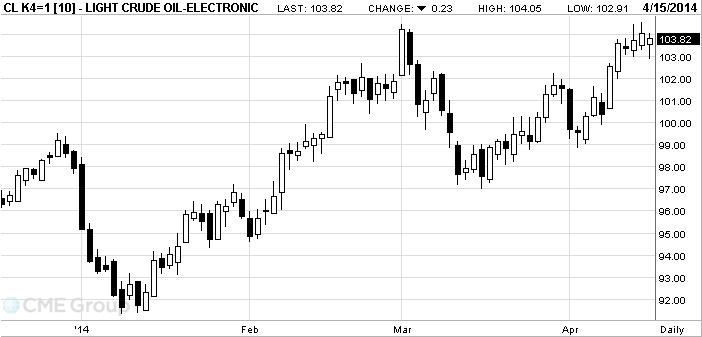

Brent

crude dropped from a five-week high as Libya’s National Oil Corp. prepared to

resume exports from its Hariga terminal. West Texas Intermediate slipped below

$104 on U.S. inventory forecasts.

Brent’s

premium to WTI shrank. A tanker will arrive at the port in eastern Libya today

to load 1 million barrels of crude, according to Libya’s Arabian Gulf Oil. U.S.

supplies probably grew from a four-month high, a Bloomberg survey showed before

an Energy Information Administration report tomorrow. WTI reduced losses as

U.S. stocks advanced.

“It

looks like Libya is getting some oil out and it’s putting some downward

pressure on oil,” said John Kilduff, a partner at Again Capital LLC, a New

York-based hedge fund that focuses on energy. “We are going to see another

build in inventories. The elements are in place for the price to go much

lower.”

Brent

for May settlement decreased 37 cents, or 0.3 percent, to $108.70 a barrel on

the London-based ICE Futures Europe exchange at 10:41 a.m. New York time.

Prices ended the session at $109.07 yesterday, the most since March 4. The May

contract expires today. The more-active June futures slipped 15 cents to

$108.92. The volume of all futures was 7.8 percent above the 100-day average.

WTI for

May delivery slipped 8 cents to $103.97 a barrel on the New York Mercantile

Exchange. The contract climbed to $104.05 yesterday, the highest settlement

since March 3. It’s up 5.6 percent this year. The volume of all futures was 10

percent above the 100-day average.

Gold prices are significantly reduced against the publication of statistics on inflation in the UK and the U.S. and the eurozone torgbalansu .

Investors in the gold market , which has traditionally been regarded as a defensive asset inflation risks , drew attention to the statistical data from the UK. Inflation in the country in March at an annual rate slowed to 1.6% from 1.7 % in February , reaching the minimum rates since October 2009. On a monthly basis , prices rose by 0.2%. Indicators in line with analysts' expectations .

Pressure on the price of the precious metal and have the data from the euro zone , where the trade balance surplus in February rose to 13.6 billion euros. Figure significantly exceeded forecasts : analysts expect it at 10 billion euros .

In the U.S., a key measure of inflation rose >

USD/JPY Y100.50, Y100.95, Y101.00, Y102.00, Y102.25, Y102.40, Y102.75, Y103.50, Y103.75

EUR/USD $1.3750, $1.3800, $1.3855, $1.3900, $1.3960

GBP/USD $1.6500, $1.6665/75, $1.6950

AUD/USD $0.9210, $0.9250, $0.9400

USD/CAD Cad1.0945/55, Cad1.0970/75, Cad1.1015, Cad1.1025, Cad1.1115

USD/CHF Chf0.8800, Chf0.9000, Chf0.9050

AUD/JPY Y95.00, Y96.00

EUR/JPY Y141.60, Y142.00/10, Y142.75

GBP/JPY Y168.50

U.S. stock futures rose as earnings from Johnson & Johnson and Coca-Cola Co. offset data showing a decline in a gauge of New York-area manufacturing.

Global markets:

Nikkei 13,996.81 +86.65 +0.62%

Hang Seng 22,671.26 -367.54 -1.60%

Shanghai Composite 2,101.6 -29.94 -1.40%

FTSE 6,578.33 -5.43 -0.08%

CAC 4,393.87 +9.31 +0.21%

DAX 9,299.05 -40.12 -0.43%

Crude oil $103.10 (-0.89%)

Gold $1292.20 (-2.64%)

Data

01:30 Australia RBA Meeting's Minutes

07:15 Switzerland Producer & Import Prices, m/m March -0.4% +0.3% 0.0%

07:15 Switzerland Producer & Import Prices, y/y March -0.8% -0.9% -0.7%

08:30 United Kingdom Retail Price Index, m/m March +0.6% +0.3% +0.2%

08:30 United Kingdom Retail prices, Y/Y March +2.7% +2.5% +2.5%

08:30 United Kingdom Producer Price Index - Input (MoM) March -0.4% -0.1% -0.6%

08:30 United Kingdom Producer Price Index - Input (YoY) March -5.7% -6.1% -6.5%

08:30 United Kingdom Producer Price Index - Output (MoM) March 0.0% +0.1% +0.2%

08:30 United Kingdom Producer Price Index - Output (YoY) March +0.5% +0.3% +0.5%

08:30 United Kingdom HICP, m/m March +0.5% +0.2% +0.2%

08:30 United Kingdom HICP, Y/Y March +1.7% +1.6% +1.6%

08:30 United Kingdom HICP ex EFAT, Y/Y March +1.7% +1.6% +1.6%

09:00 Eurozone ZEW Economic Sentiment April 61.5 60.7 61.2

09:00 Eurozone Trade Balance s.a. February +15.0

09:00 Germany ZEW Survey - Economic Sentiment April 46.6 46.3 43.2

Euro fell against the dollar amid weak data on Germany. Note that confidence among German investors fell again in April , extending this streak to four consecutive months , highlighting risks to recovery in Europe's largest economy . This was stated in the report of the Centre for European Economic Research ZEW.

According to the data , the April index of sentiment in the business environment , which is designed to assess the development of the economic situation in the next six months , declined to 43.2 from 46.6 in March. Economists had forecast a decline to 46.3 . Recall that in December 2013 reached a seven-year maximum sensor - at the level of 62 points . Current situation index rose to 59.5 , its highest level since July 2011 , compared with 51.3 in March. Economists predicted the figure at 51.5 .

The data also showed that the index of economic sentiment in the euro zone fell to 61.2 from 61.5 in March, while the current conditions index rose 6.2 points to -30.5 .

Pound rebounded from lows against the dollar , reaching levels with today's opening session , which was associated with the release of data on Britain. As it became known , at the end of March the British inflation fell to its lowest level in more than four years , retreating further from the target goal of the Bank of England. It became known from the report , which was submitted to the Office for National Statistics.

According to the data , consumer prices rose in March by 1.6 percent per annum , and confirmed the experts' forecasts , but were close to the lowest level since October 2009 . Recall that in February, prices rose 1.7 percent in February. In the ONS said that the greatest pressure on the annual rate of consumer price inflation was the reduction in fuel prices, clothing and furniture . In addition, it was announced that the base rate of inflation , which excludes prices of energy , food, alcohol and tobacco increased by 1.6 percent ( four-year minimum). The data also showed that inflation in selling prices increased by 0.5 percent ( the lowest since October 2009 ), which was slightly higher than economists' forecasts - at the level of 0.3 percent.

EUR / USD: during the European session after dropped to $ 1.3788

GBP / USD: during the European session, the pair fell to $ 1.6685 , but then recovered to $ 1.6720

USD / JPY: during the European session, the pair traded in the range Y102.00-Y101.70

At 12:30 GMT , Canada announces the change of volume production shipments in February , while the U.S. will release the consumer price index for March and Empire Manufacturing manufacturing index for April. At 13:00 GMT the United States , there are data on the net volume of purchases of long-term U.S. securities by foreign investors and the total net volume of purchases of U.S. securities by foreign investors in February. At 14:00 GMT the United States will present housing market index from the NAHB for April. At 20:30 GMT the United States will declare to the change in stocks of crude oil , according to the API for April. At 22:45 GMT New Zealand's consumer price index will be released in the 1st quarter .

EUR/USD

Offers $1.3970, $1.3950, $1.3930, $1.3905, $1.3850/60

Bids $1.3780/90, $1.3735, $1.3700, $1.3672

GBP/USD

Offers $1.6840/50, $1.6820/25, $1.6785, $1.6750

Bids $1.6660/50, $1.6640, $1.6600, $1.6550

AUD/USD

Offers $0.9500, $0.9480, $0.9435/40, $0.9425

Bids $0.9350/60, $0.9335, $0.9310/00, $0.9250

EUR/JPY

Offers Y142.15/20, Y142.00, Y141.60, Y141.35, Y141.00

Bids Y140.40, Y140.25/20, Y140.00/05

USD/JPY

Offers Y103.00, Y102.50, Y102.20/25, Y102.15

Bids Y101.20/30, Y101.00, Y100.75, Y100.50

EUR/GBP

Offers stg0.8390, stg0.8330/35, stg0.8300/10

Bids stg0.8230, stg0.8200, stg0.8190-80

European stocks declined, after yesterday’s advance, as investors weighed violence in eastern Ukraine and worse-than-forecast German confidence data. U.S. index futures and Asian shares were little changed.

The Stoxx Europe 600 Index slipped 0.5 percent to 328.26 at 10:54 a.m. in London. The gauge rebounded yesterday amid better-than-estimated U.S. retail sales data and earnings from Citigroup Inc., after last week erasing most of the year’s gains as investors sold technology shares on valuation concerns.

“You have this huge uncertainty from the geopolitical front, which is pulling the market in a negative direction,” Witold Bahrke, who helps oversee $55 billion as a senior strategist at PFA Asset Management in Copenhagen, said in a phone interview. “There is a lack of conviction among investors. Sentiment is still tilted to the negative direction after the escalation in Ukraine at the weekend.”

U.S. President Barack Obama and Russian President Vladimir Putin discussed the Ukrainian crisis by telephone yesterday without any substantial breakthrough, according to statements from their offices, as fighting between pro-Russian separatists and government forces highlighted instability in east Ukraine.

In Germany, a gauge of investor confidence fell for a fourth month in April. The ZEW Center for European Economic Research in Mannheim said its index of investor and analyst expectations, which aims to predict economic developments six months in advance, slid to 43.2 from 46.6 in March. Economists had forecast a decline to 45.

SABMiller lost 2.1 percent to 3,058 pence. The world’s second-biggest brewer said its 39.6 percent holding in hotel and casino operator Tsogo Sun is not a core part of its operations.

Banca Monte dei Paschi di Siena SpA slid 8.9 percent to 23 euro cents, for its biggest decline since November. Italy’s third-largest bank said it may increase the size of a planned share sale to reimburse part of a 4.1 billion-euro ($5.7 billion) government bailout.

Siemens AG dropped 1.2 percent to 95.18 euros. The Handelsblatt newspaper cited the chief executive officer of Russian Railways, Vladimir Yakunin, as saying that German, French and Italian businesses, including Europe’s largest engineering company, will be hurt by sanctions against Russia.

L’Oreal (OR) advanced 1.8 percent to 122.90 euros. The world’s largest cosmetics maker said first-quarter revenue gained 2.8 percent in western Europe, excluding currency shifts and acquisitions, while southern European sales grew for the first time in six years.

Roche rose 0.7 percent to 256 Swiss francs. The biggest manufacturer of cancer drugs posted a 17-percent increase in sales of breast-cancer medicines in the first quarter, beating analysts’ forecasts. Total sales fell 0.8 percent to 11.5 billion francs ($13.1 billion), in line with the average of estimates.

Osram Licht AG rose 2.1 percent to 42.67 euros. Citigroup Inc. recommended investors buy shares in the lighting manufacturer that spun off from Siemens. Osram will benefit from expected growth in the global LED lighting market of 20 percent per year through 2020, according to the broker.

FTSE 100 6,561.56 -22.20 -0.34%

CAC 40 4,373.1 -11.46 -0.26%

DAX 9,274.53 -64.64 -0.69%

USD/JPY Y100.50, Y100.95, Y101.00, Y102.00, Y102.25, Y102.40, Y102.75, Y103.50, Y103.75

EUR/USD $1.3750, $1.3800, $1.3855, $1.3900, $1.3960

GBP/USD $1.6500, $1.6665/75, $1.6950

AUD/USD $0.9210, $0.9250, $0.9400

USD/CAD Cad1.0945/55, Cad1.0970/75, Cad1.1015, Cad1.1025, Cad1.1115

USD/CHF Chf0.8800, Chf0.9000, Chf0.9050

AUD/JPY Y95.00, Y96.00

EUR/JPY Y141.60, Y142.00/10, Y142.75

GBP/JPY Y168.50

Asian stocks swung from gains to losses as Chinese equities tumbled after a report showed new credit fell, underscoring risks of a deepening slowdown in the world’s second-biggest economy.

Nikkei 225 13,996.81 +86.65 +0.62%

S&P/ASX 200 5,388.2 +29.25 +0.55%

Shanghai Composite 2,101.6 -29.94 -1.40%

Hong Kong’s benchmark Hang Seng Index headed for its biggest drop in almost a month after central bank data showed aggregate financing in China slid 19 percent in March from a year earlier and money supply grew at the slowest pace since 2001.

Asics Corp. added 3.6 percent in Tokyo after Nomura Holdings Inc. advised buying shares of the sportswear maker.

CapitaMalls Asia Ltd. soared a record 21 percent in Singapore after CapitaLand Ltd., Southeast Asia’s biggest developer, offered to buy the rest of its mall unit for about S$3.06 billion ($2.4 billion).

01:30 Australia RBA Meeting's Minutes

The dollar held an advance versus most of its major peers before a manufacturing gauge that’s forecast to show improvement for a second month. The New York Fed’s gauge of manufacturing in the state probably rose to 8 in April, from 5.61 the previous month, according to the median estimate of economists surveyed by Bloomberg News.

The greenback gained the most in three weeks against the euro yesterday after data showed U.S. retail sales rose in March by the most since September 2012. U.S. retail sales climbed 1.1 percent last month, following a 0.7 percent gain in February that was revised upward, the Commerce Department reported yesterday. The jump exceeded the median projection of a 0.9 percent increase in a Bloomberg survey. Sales excluding receipts at gas stations were the strongest in four years.

The ZEW survey of German investor confidence today may slide to the lowest since August, economists predict. In Germany, the ZEW Center for European Economic Research’s index of investor and analyst expectations, which aims to predict economic developments six months in advance, probably fell to 45 in April, from a seven-month low of 46.6 in March.

Federal Reserve Chair Janet Yellen speaks at a financial conference today.

Australia’s dollar fell from near a five-month high after the Reserve Bank’s minutes of this month’s meeting reiterated interest rates are on hold.

EUR / USD: during the Asian session, the pair traded in the range of $ 1.3810-20

GBP / USD: during the Asian session the pair fell to $ 1.6610

USD / JPY: on Asian session the pair traded in the range of Y101.80-00

Germany releases ZEW data at 0900GMT, with the median forecasts coming in at 51.5 for current conditions and 45.0 in the expectations measure. US data for Tuesday starts at 1130GMT with the NFIB Optimism Index, while the weekly ICSC-Goldman Store Sales data is due at 1145GMT. However, the main data starts at 1230GMT, when CPI is expected to rise 0.7% in March. Analysts expect energy prices to fall after rising falling in February, while food prices are seen higher. AAA reported that unadjusted prices were up sharply in mid-March from a month earlier. The core CPI is expected to rise 0.1%. The NY Fed Empire Index is due at the same time and is expected to rise to 10.0 in April after rising to 5.61 in March. At 1255GMT, the weekly Redbook Average is due, while at 1300GMT, the latest Treasury International Capital System data is released. US data continues at 1400GMT with the April NAHB Index, which has continued to show that while demand is building for housing, the market continues to be held back by a shortage of supply.

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.