- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

Euro recovered previously lost ground against the dollar, while returning to the highs of the day. Experts note that the revival of interest players to risk , coupled with the recent ECB inaction served as the catalyst of the current pulse euros. Meanwhile, the impact on the dynamics of expectations publication next week final inflation data for March, as well as a report on the current account balance for March. These releases will be a kind of test of strength for the single currency.

Meanwhile, adding that today the euro received supports from the German inflation data . EU harmonized methodology inflation in Germany slowed to its lowest level in nearly four years , the final data showed Destatis. Harmonized index of consumer prices ( HICP ) rose 0.9 percent year on year in March, according to preliminary estimates . It was the weakest level since June 2010 . In February, prices rose 1 percent . On a monthly measurement of the HICP increased by 0.3 percent , as originally anticipated by March 28. The consumer price index rose by 1 percent per year in March after the 1.2 percent rise in the previous month . Statistical Office confirmed the preliminary assessment . Last inflation is the lowest since August 2010 . On a monthly basis, consumer prices rose by 0.3 percent, according to a preliminary projection . More info Destatis showed that wholesale prices fell by 1.7 percent in March compared with the corresponding month of the previous year , after declining by 1.8 percent in February and 1.7 percent in January. From February to March , wholesale prices remained unchanged.

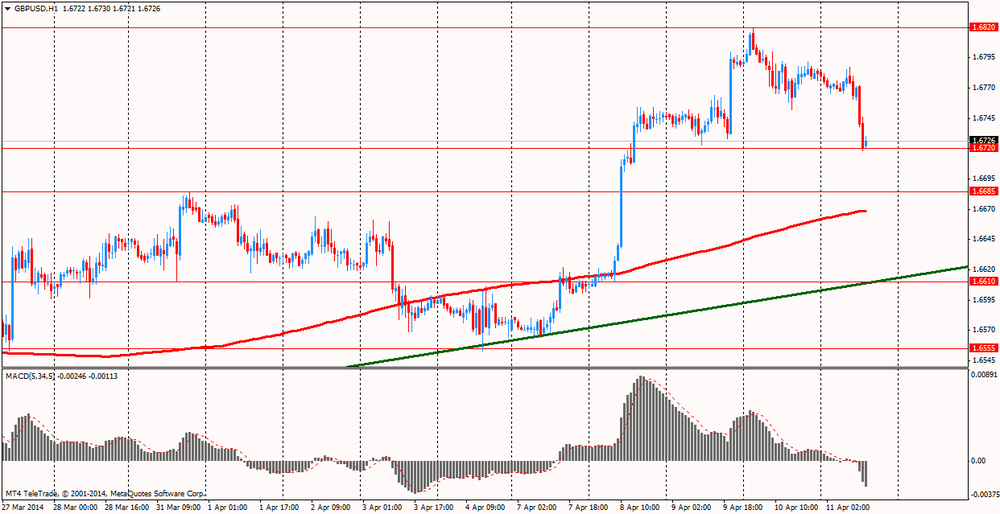

Pound was down against the U.S. dollar , which was associated with the release of data for Britain, which showed that the volume of construction in the UK fell in February at the fastest pace in three months , which was associated with difficult weather conditions. According to the report , the volume of construction fell in February by 2.8 percent after increasing 2.1 percent in January , which was revised upward to 1.8 percent. Last fall was the highest since November, when construction fell by 4.1 percent . Recall that the construction of 6.3 percent of gross domestic product in Britain. We also learned that in February, the total volume of new buildings decreased by 2.6 percent , which stood at the head of the fall in private housing sector - by 6.3 percent . It was the biggest decline in this category since March 2013, when the industry is also affected by the adverse weather conditions. However , annualized private housing sector recorded growth of 15.3 percent, which was associated with an increase in property prices , increase in the number of housing transactions , improved credit conditions and mortgage lending. In annual terms, the volume of construction rose 2.8 percent in February , amid new buildings increase by 3.1 percent , as well as repair and maintenance by 2.3 percent . Within three months ( February) construction output increased by 0.3 percent compared with the previous three months .

European stocks fell for a second day, with the benchmark index posting its biggest weekly drop in almost a month, as investors speculated that equity gains have overshot the earnings outlook.

The Stoxx Europe 600 Index fell 1.4 percent to 328.69 at 4:30 p.m. London. The benchmark gauge posted a weekly retreat of 3.1 percent, its biggest since March 14, amid a selloff in shares with higher-than-average valuations.

Markets seem to be on the back foot this week,” said Espen Furnes, who helps manage about $75 billion at Storebrand Asset Management in Oslo. “Not only are we seeing more volatility, we’re also seeing a certain sector rotation, specifically out of the higher-priced sectors like IT and consumer cyclicals. This could be a signal that investors are becoming more sensitive.”

National benchmark indexes tumbled in all western-European markets.

FTSE 100 6,561.7 -80.27 -1.21% CAC 40 4,365.86 -47.63 -1.08% DAX 9,315.29 -139.25 -1.47%

ARM dropped 4.6 percent to 958 pence and Infineon Technologies AG lost 2.9 percent to 8.14 euros. A gauge of technology stocks posted the second worst performance among the 19 industry groups in the Stoxx 600.

Thales fell 3.8 percent to 46.03 euros. JPMorgan Chase downgraded the French defense-electronics maker to neutral from overweight, meaning investors may no longer buy the stock. The company’s forecasts for sales and cost reduction through 2017-18 are weaker than estimated, the brokerage said.

Mediaset Espana, trading after an hour’s suspension in Madrid, lost 4.9 percent to 7.99 euros. Credit Suisse Group AG sold a 3.7 percent stake in the company for 8.08 euros a share on behalf of Promotora de Informaciones SA.

Firstgroup Plc dropped 3.3 percent to 125 pence after Nomura Holdings Inc. downgraded the bus-and-rail operator to neutral from buy, saying that increased costs and poor weather in the U.S. in the first quarter will hurt earnings.

Givaudan SA declined 2.4 percent to 1,371 Swiss francs. Comparable sales at its flavor division rose 5.8 percent in the first quarter, the world’s biggest maker of flavoring products said. That missed the 6.5 percent increase estimated by analysts. Total comparable sales increased 5.7 percent for the quarter, exceeding the 5.6 percent average analyst forecast.

Bauer AG tumbled 5.1 percent to 18.67 euros, the biggest loss since October. The builder and construction-equipment maker posted a 2013 net loss of 19.4 million euros, compared with a profit of 25.8 million euros a year earlier. The company won’t propose a dividend and is negotiating a syndicated loan with bankers as it could not meet some debt covenants, according to a statement.

Salzgitter advanced 1.5 percent to 30.89 euros after Citigroup upgraded the shares to buy from neutral, saying the German steelmaker will benefit from any increase in construction-related demand in Europe.

Cost of oil futures rose slightly against the publication of the U.S. producer price index and consumer sentiment index . As it became known , consumer sentiment improved in April - sentiment index rose to a maximum of nine months since grown and assessment of current conditions and future expectations . Preliminary index of consumer sentiment from Thomson Reuters and the University of Michigan was at the level of 82.6 , compared with 80.0 in March. Analysts had expected the April index value at 81.2 . Indicator assessment of current economic conditions rose to 97.1 , compared with 95.7 in March. This is above the median estimate of analysts in 96.3 . Consumer expectations index was 73.3 , 70.0 in March. Expectations were at 71.4 . Inflation expectations in the long term than one year decreased from 3.2% to 3.1%. Inflation expectations in the future five years rose from 2.9 % to 3.0%.

On today's dynamics also affected message , the International Energy Agency (IEA) . Experts noted the continuing high risks in the oil market , lowering growth forecast for global demand this year after the Crimea to Russia . In addition, the agency warned that the probability of decline in oil production . Forecast demand for oil in the Russian Federation in 2014 decreased by 55,000 barrels per day to 3.5 million barrels per day. New economic sanctions and pressure on the Russian economy may reduce demand for oil in this country by another 150,000 barrels a day this year , said the IEA . Agency forecast growth in global oil demand this year decreased by 100 thousand barrels per day to 1.3 million barrels per day . In addition, the IEA lowered its forecast for growth in oil supply from countries outside the Organization of Petroleum Exporting Countries (OPEC) in 2014 to 250,000 barrels per day to 1.5 million barrels per day . Meanwhile, today the British newspaper Financial Times reported an increase in exports by China of refined petroleum products , including gasoline and diesel . In the source notes that the March product exports from China amounted to 650 thousand barrels per day , meanwhile quantitative indices of imports equaled 560 thousand barrels. Consequently, on an annualized basis in March 2013 with respect to imports of petroleum products decreased by 25 % and exports increased by 3.4 %. Experts believe that the increase in exports of petroleum products from China will gather pace throughout 2014 and 2015 . It is predicted that this year the refining industry will increase production by 800 thousand barrels per day. In December 2009 and January 2010, the export of oil products in China has exceeded the volume of imports , but experts have expressed the view that the current trend is more long-term plans .

Since the beginning of this week, WTI has risen by 2% on the signals of improvement in the U.S. economy have increased the expectations of growth in demand for energy in the country.

The difference in prices WTI and Brent fell by the results of the previous trading to $ 4.06 per barrel , which was the minimum level since last September.

May futures for U.S. light crude oil WTI (Light Sweet Crude Oil) rose to $ 104.08 per barrel on the New York Mercantile Exchange (NYMEX).

May futures price for North Sea Brent crude oil mixture rose $ 0.36 to $ 107.65 a barrel on the London exchange ICE Futures Europe.

Gold prices fell slightly today, but still continue to be close to a two-week maxim . We also add that the precious metal is sent to its largest weekly gain this month due to lower risk appetite , and increasing expectations that the U.S. Federal Reserve will keep interest rates unchanged until early next year .

We also recall that yesterday reached the highest gold values from 24 March , as minutes of the March Fed meeting showed that officials were not keen on raising interest rates right after the purchase of bonds .

Also reflected in the dynamics of today's U.S. data , which showed that the prices that businesses receive for their goods and services rose in March , despite a long period of restrained inflation in the U.S. economy . Producer Price Index ( PPI) , which measures the change in prices for everything from food and equipment to the warehouse and transport services rose a seasonally adjusted 0.5% in February, the Labor Department said . The index rose 0.6% , excluding the volatile categories of food and energy . Economists had expected the index to rise by a more modest 0.1% , and predicted an increase of 0.2 % excluding food and energy . The index fell 0.1 % in February (not changed compared to the initial estimate of the Ministry of Labour ) . PPI was up 1.4% in March compared with a year earlier , the biggest annual increase since last August . Data showed U.S. producer prices recorded their biggest gain in nine months in March.

Meanwhile, we add that the political tension lowered risk appetite of investors after Russian President Vladimir Putin warned that Europe's gas supplies may be disrupted if Moscow will reduce the flow to Ukraine over unpaid bills.

Price growth was also limited to the continuing outflow of gold funds and weak physical demand in Asia. Add that stocks SPDR Gold Trust, the world's largest gold exchange-traded fund , declined yesterday by 0.26 tons. Fund inflows have not seen since March 24 .

According to analysts, reducing the risks of renewed gold persist despite the factors supporting the growth of gold. To improve the technical prospects precious metal to overcome the resistance of the current $ 1324 , and for the resumption of the upward trend - the level of $ 1343 . Otherwise quotes again test the support at $ 1278 per ounce.

The cost of the June gold futures on the COMEX today dropped to $ 1317.10 per ounce.

USD/JPY Y101.40-50, Y102.00, Y102.50, Y102.75, Y102.90, Y103.00

EUR/JPY Y140.50

EUR/USD $1.3700, $1.3740, $1.3750, $1.3800, $1.3850, $1.389

GBP/USD $1.6900

EUR/GBP stg.0.8175

AUD/USD $0.9200, $0.9300, $0.930, $0.9350, $0.9375, $0.9380, $0.9400

USD/CAD C$1.0800, C$1.0815, C$1.0895, C$1.0955, C$1.1000

U.S. stock futures fell as disappointing results from JPMorgan Chase & Co. fueled concern that corporate earnings will be weak.

Global markets:

Nikkei 13,960.05 -2.38%

Hang Seng 23,003.64 -0.79%

Shanghai Composite 2,130.54 -0.18%

FTSE 6,553.63 -1.33%

CAC 4,349.29 -1.45%

DAX 9,292.82 -1.71%

Crude oil $103.30 (-0.09%)

Gold $1320.60 (+0.01%)

06:00 Germany CPI, m/m (Finally) March +0.3% +0.3% +0.3%

06:00 Germany CPI, y/y (Finally) March +1.0% +1.0% +1.0%

Euro fell against the dollar on German inflation data . EU harmonized methodology inflation in Germany slowed to its lowest level in nearly four years , the final data showed Destatis, published on Friday .

Harmonized index of consumer prices ( HICP ) rose 0.9 percent year on year in March, according to preliminary estimates . It was the weakest level since June 2010 . In February, prices rose 1 percent . On a monthly measurement of the HICP increased by 0.3 percent , as originally anticipated by March 28.

The consumer price index rose by 1 percent per year in March after the 1.2 percent rise in the previous month . Statistical Office confirmed the preliminary assessment . Last inflation is the lowest since August 2010 . On a monthly basis, consumer prices rose by 0.3 percent, according to a preliminary projection.

More info Destatis showed that wholesale prices fell by 1.7 percent in March compared with the corresponding month of the previous year , after declining by 1.8 percent in February and 1.7 percent in January. From February to March , wholesale prices remained unchanged.

Dollar ends week the biggest drop in eight months against most major currencies after the published minutes of the last meeting of the Federal Reserve reduced the likelihood of an early rise in interest rates in the United States . It is learned that after the meeting of Federal Reserve officials moved away from quantitative benchmarks , ie abandoned former promises to increase its benchmark interest rate at a certain level of unemployment. Instead, they said they would consider " a wide range of information," including labor market conditions , inflationary pressures and financial conditions. Recall that during the last meeting of the Central Bank decided to reduce the amount of monthly bond purchases at $ 10 billion to $ 55 billion earlier Fed Chairman Janet Yellen said the bank 's readiness to begin to raise interest rates six months after the after the final collapse of the program asset purchases .

Additional pressure on the U.S. currency may have today's publication of the inflation data in the U.S.. According to the median forecast of economists producer price index is likely to rise in March by 1.0 % compared with the previous period a year earlier. Recall that in February it amounted to 0.9% ( the lowest since November 2010 ) .

EUR / USD: during the European session, the pair fell to $ 1.3871

GBP / USD: during the European session, the pair fell to $ 1.6718

USD / JPY: during the European session, the pair rose to Y101.87 and stepped

In the U.S. at 12:30 GMT will producer price index, producer price index excluding prices for food and energy in March in 13:55 GMT - consumer sentiment index from the University of Michigan in April.

EUR/USD

Offers $1.4000, $1.3970, $1.3950, $1.3930, $1.3910/15

Bids $1.3880, $1.3850/40, $1.3815-00, $1.3780

GBP/USD

Offers $1.6880, $1.6840/50, $1.6825, $1.6795/805

Bids $1.6730/25, $1.6710/00, $1.6685/80, $1.6660/50

AUD/USD

Offers $0.9500, $0.9480, $0.9435/40, $0.9415/20

Bids $0.9350, $0.9310/00, $0.9250

EUR/JPY

Offers Y142.50, Y142.15/20, Y142.00, Y141.30/35

Bids Y140.80, Y140.50, Y140.25/20

USD/JPY

Offers Y103.00, Y102.50, Y102.20/25, Y101.95/00

Bids Y101.20, Y101.00, Y100.50

EUR/GBP

Offers stg0.8330/35, stg0.8300

Bids stg0.8230, stg0.8200, stg0.8190-80

European stocks fell for a second day, with the benchmark index heading for its biggest weekly drop in almost a month, as investors speculated that equity gains have overshot the earnings outlook. U.S. index futures were little changed, while Asian shares slid.

The Stoxx Europe 600 Index fell 1.3 percent to 329.06 at 10:59 a.m. in London. The gauge is heading for a weekly retreat of 3.1 percent, the biggest since March 14, amid a selloff in shares with higher-than-average valuations. Futures on the Standard & Poor’s 500 Index added less than 0.1 percent today, while the MSCI Asia Pacific Index dropped 0.9 percent.

The Stoxx 600 has more than doubled from a low in March 2009, with its valuation rising to 14.4 times estimated earnings compared with a five-year average of 12.3 times.

Thales fell 4.5 percent to 45.70 euros. JPMorgan Chase downgraded the French defense-electronics maker to neutral from overweight, meaning investors may no longer buy the stock. The company’s forecasts for sales and cost reduction through 2017-18 are weaker than estimated, the brokerage said.

Givaudan SA declined 1.9 percent to 1,378 Swiss francs. Comparable sales at its flavor division rose 5.8 percent in the first quarter, the world’s biggest maker of flavoring products said. That missed the 6.5 percent increase estimated by analysts in a Bloomberg survey. Total comparable sales increased 5.7 percent for the quarter, exceeding the 5.6 percent average analyst forecast.

Bauer AG lost 3.8 percent to 18.92 euros after posting a 2013 net loss of 19.4 million euros, compared with a profit of 25.8 million euros a year earlier. The company said it is negotiating a syndicated loan with bankers as it could not meet some debt covenants. Bauer said it won’t propose a dividend.

Salzgitter advanced 1.8 percent to 30.98 euros after Citigroup upgraded the shares to buy from neutral, saying the German steelmaker will benefit from any increase in construction-related demand in Europe.

In the U.S., a preliminary report at 9:55 a.m. New York time may show the University of Michigan’s consumer confidence index rose to 81 in April from 80 a month earlier, according to the median forecast of economists surveyed by Bloomberg.

FTSE 100 6,562.86 -79.11 -1.19%

CAC 40 4,362.47 -51.02 -1.16%

DAX 9,322.29 -132.25 -1.40%

Asia’s benchmark stock index fell from an almost three-month high amid a renewed selloff of technology shares and as a stronger yen dragged Japanese equities toward their worst week since June.

Nikkei 225 13,960.05 -340.07 -2.38%

S&P/ASX 200 5,428.6 -52.15 -0.95%

Shanghai Composite 2,133.97 -0.33 -0.02%

Fast Retailing Co., which comprises 10 percent of Japan’s Nikkei 225 Stock Average, tumbled 8 percent in Tokyo after Asia’s biggest clothing retailer cut its forecast for annual profit.

Tencent Holdings Ltd. slid 4 percent in Hong Kong, with Asia’s No. 1 Internet company following yesterday’s rout in U.S. technology shares.

Hong Kong Exchanges & Clearing Ltd. surged 11 percent, the most in more than five years, after an agreement to link Shanghai and Hong Kong markets.

01:30 China PPI y/y March -2.0% -2.2% -2.3%

01:30 China CPI y/y March +2.0% +2.5% +2.4%

The dollar was set for the biggest weekly slide in eight months against a basket of its major peers as the Federal Reserve’s meeting minutes damped speculation that U.S. interest rates will rise. Fed policy makers cut monthly bond purchases last month by $10 billion to $55 billion. After concluding the two-day policy meeting on March 19, Fed Chair Janet Yellen said the central bank may start to increase interest rates “around six months” after ending its asset-buying program.

The greenback held a four-day decline against the euro before U.S. data that economists say will show inflation pressures are still subdued. U.S. producer prices probably rose 1.1 percent in March from a year earlier, economists forecast in a Bloomberg News survey before the figure is released today. That compares with a 0.9 percent increase in February, which matched the lowest level since at least November 2010.

The Australian and New Zealand dollars dropped as a decline in Asian shares damped demand for higher-yielding currencies.

EUR / USD: during the Asian session, the pair rose to $ 1.3900

GBP / USD: during the Asian session the pair fell to $ 1.6765

USD / JPY: during the Asian session, the pair rose to Y101.75

UK construction data at 0830GMT the morning focus.

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.