- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

Gold $1,320.10 +5.20 +0.40%

ICE Brent Crude Oil $107.46 -0.52 -0.48%

NYMEX Crude Oil $103.33 +0.05 +0.05%Nikkei 14,300.12 +0.43 0.00%

Hang Seng 23,186.96 +343.79 +1.51%

Shanghai Composite 2,134.3 +29.06 +1.38%

S&P 1,833.08 -39.10 -2.09%

NASDAQ 4,054.11 -129.79 -3.10%

Dow 16,170.22 -266.96 -1.62%

FTSE 1,331.04 -7.08 -0.53%

CAC 4,413.49 -29.19 -0.66%

DAX 9,454.54 -51.81 -0.55%(pare/closed(GMT +2)/change, %)

EUR/USD $1,3887 +0,24%

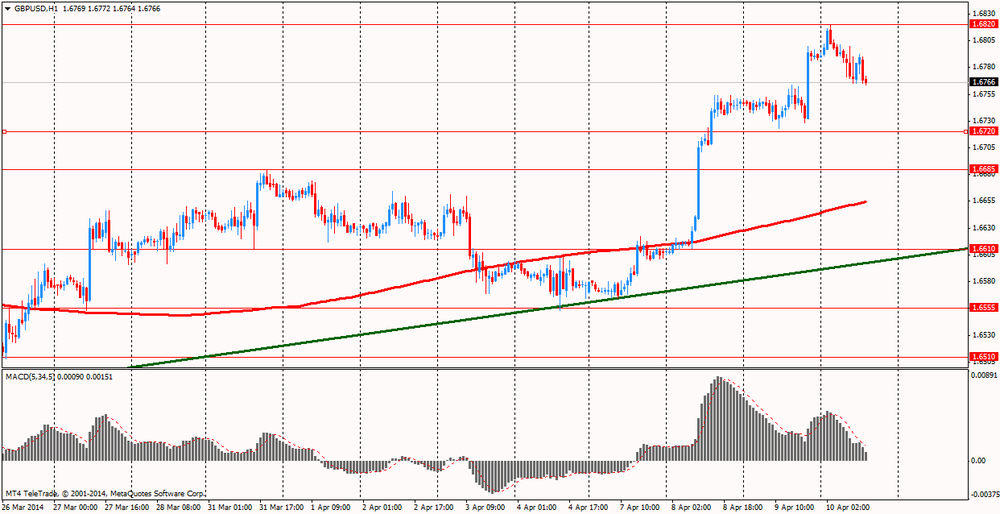

GBP/USD $1,6782 -0,05%

USD/CHF Chf0,8761 -0,39%

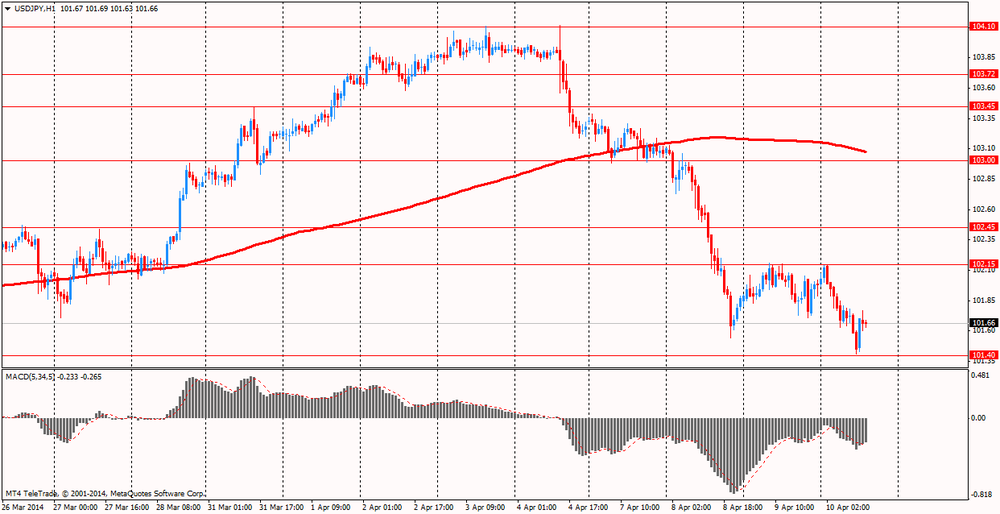

USD/JPY Y101,43 -0,54%

EUR/JPY Y140,86 -0,29%

GBP/JPY Y170,23 -0,58%

AUD/USD $0,9410 +0,31%

NZD/USD $0,8670 -0,47%

USD/CAD C$1,0931 +0,45%

01:30 China PPI y/y March -2.0% -2.2%

01:30 China CPI y/y March +2.0% +2.5%

06:00 Germany CPI, m/m (Finally) March +0.3% +0.3%

06:00 Germany CPI, y/y (Finally) March +1.0% +1.0%

12:30 U.S. PPI, m/m March -0.1% +0.1%

12:30 U.S. PPI, y/y March +0.9% +1.0%

12:30 U.S. PPI excluding food and energy, m/m March -0.2% +0.2%

12:30 U.S. PPI excluding food and energy, Y/Y March +1.1% +1.1%

13:00 G20 Meetings

13:00 IMF IMF Meetings

13:55 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) April 80.0 81.2The euro rose against the U.S. currency against the backdrop of French data on industrial production and inflation. Also helped strengthen the news on Greece. Note that Greece for the first 4 years is selling government bonds to gain for them more than 3 billion euros , which was above the expectations of the government. Government bonds with a maturity of 5 years and a low rate of 4.95 % used in demand : the government received bids worth over 20 billion euros from potential buyers. Last Greek bonds exposed to the market in March 2010 , and since then the country's economy depended on help from the "troika" of international creditors (European Commission, European Central Bank and International Monetary Fund. The fact that the country has again entered the market loans , is a positive signal for the economic situation in Greece.

Important for the euro were comments and ECB chief economist Peter Preta , who said that the central bank has not changed its assessment on the conservation rates at current or lower levels for a long period . Pret assured that " forward-looking statements " had a positive impact on the currency markets . Markets Trust ECB, which comes true in a low inflation environment , the economist said . He also noted that the eurozone economy remains quite vulnerable. The recovery process in the euro area is still " modest flows , uneven pace , but it covers more countries ." Senior economist at the Bank acknowledged that , while confidence indicators have increased markedly , the activity has not increased at a pace that raises questions.

Pound fell against the dollar, almost completely offsetting while yesterday's rise as the Bank of England left policy unchanged . The Bank of England did not bring any surprises , decided to leave its key rate at a record low of 0.5% , which she held for 5 years ( since March 2009 ), and a program of bond purchases in the amount of £ 375 billion is expected , the bank managers will not change policies in the coming months as the UK economy for a long time in a state of stagnation , once again demonstrates the rapid growth in a low inflation environment .

It should be noted that the heads of the Bank of England signaled its intention to continue the policy of "cheap money " as long as the increasing number of Britons do not find a job , and the economy approaches the functioning at full capacity , provided that inflation will remain under control. Dates of the first interest rate hikes are crucial : if the central bank will have to wait too long, inflation could accelerate sharply , as if he would take action too quickly, the economic recovery could stall .

The yen rose against the dollar , which was associated with the release of data on the reduction of Chinese exports , which increased demand for " safe havens ." The strengthening of the Japanese yen helped decrease expected to raise interest rates after the release of the Fed minutes of the meeting FOMC. The report showed that in March, China unexpectedly recorded a reduction in exports by 6.6 % compared with the same month last year , after falling 18.1 % in February, which was the worst since the financial crisis. Analysts expected export growth by 4.8%. While imports fell last month to 11.1% in February after rising to 10.1% , resulting in a trade surplus of $ 7.71 billion , according to the General Administration of Customs of China. Experts predicted import growth of 3.9% and a deficit of $ 0.9 billion, the Customs Administration of China announced that it expects to improve trade performance in the second quarter amid recovery in global demand .

European stocks declined as a report showed Chinese imports unexpectedly slumped last month, outweighing gains by personal- and household-goods companies after LVMH Moet Hennessy Louis Vuitton SA posted results.

The Stoxx Europe 600 Index fell 0.6 percent to 333.23 at 4:30 p.m. in London. The benchmark earlier rose as much as 0.6 percent after the minutes of the Federal Reserve’s last meeting eased concern about when interest rates will increase. European equities have fallen 1.8 percent from a six-year high on April 4 as investors sold the shares with the highest valuations.

National benchmark indexes declined in 15 of the 18 western-European markets today.

FTSE 100 6,633.47 -2.14 -0.03% CAC 40 4,410.77 -31.91 -0.72% DAX 9,448.76 -57.59 -0.61%

In China, the customs administration reported that imports slid 11 percent in March from a year earlier. The median economist estimate had called for a gain of 3.9 percent.

In the U.S., the Federal Open Market Committee said that the revised forecasts for interest rates at its March 18-19 policy meeting did not mean the central bank’s policy would change, according to minutes released after European markets closed yesterday. “Several participants noted that the increase in the median projection overstated the shift in the projections,” the Fed said in the minutes.

Janet Yellen said in the press conference following the meeting that rates might start to rise about six months after the central bank halts its monthly asset purchases.

A Labor Department report showed that the number of people filing jobless claims in the world’s biggest economy fell to 300,000 in the week ended April 5. Economists had forecast a decline to 320,000.

Tryg lost 4 percent to 510.50 Danish kroner. The second-largest Nordic property and casualty insurer reported first-quarter net income of 455 million kroner ($84.7 million), missing the 516 million-krone average estimate of analysts. The company paid out 150 million kroner in large claims, more than it did in the same period a year earlier.

Iberdrola SA decreased 3.4 percent to 4.83 euros, leading a decline in utility companies. Bankia SA sold a 4.9 percent stake in Spain’s largest utility.

Royal Imtech NV tumbled 15 percent to 1.66 euros, its lowest price in 11 years. The technical-services provider said it would review all options to meet a debt-reduction target.

Vienna Insurance Group AG slid 5.8 percent to 35.42 euros as it restated its 2012 earnings following an audit of its BCR Life unit in Romania. Pretax profit fell 4.2 percent to 563.7 million euros, the insurer said in a statement.

LVMH gained 3.2 percent to 140.85 euros after reporting that first-quarter fashion and leather-goods sales climbed 9 percent on an organic basis, the fastest growth since the first quarter of 2012. Analysts had predicted growth of 6 percent.

Hays Plc gained 4.6 percent to 151.4 pence. The recruitment company reported that net fee growth increased in Asia, Europe and the U.K. in the three months through March.

Cost of oil futures fell slightly today , which was associated with the release of economic data for China . Investors have expressed concerns about the demand for oil from one of the world's leading economies . It is learned that China's foreign trade turnover in March 2014 decreased by 9 % yoy to $ 332.52 billion Chinese exports fell in March by 6.6 % compared with the same period in 2013 to $ 170.11 billion Imports China in March fell by 11.3 % to $ 162.41 billion foreign trade surplus amounted to $ 7.71 billion in March in March last year, China had a trade deficit of $ 960 million during the first three months of 2014 foreign trade turnover China's trade fell by 1 % in comparison with I quarter of last year to $ 965.88 billion, China's exports fell by 3.4% to $ 491.31 billion and imports increased by 1.6 % to $ 474.57 billion Recall a week earlier General Administration of Customs informed that in the last month of imports of " black gold" in the country amounted to 23.52 million tons. At night delivered 5.54 million barrels . The March figure is the lowest in the past five months.

The dynamics are also influenced by the news of the Petroleum Exporting Countries (OPEC), which reported that in March the cartel 's oil production fell to its lowest level this year . Last month, OPEC production fell by more than 500,000 barrels a day to 29.6 million barrels a day , according to a monthly report on the oil market . Basically reduction associated with a marked reduction of Iraq's oil production by about 300,000 barrels per day. Although a significant reduction in production last month was also observed in Angola , Libya and Saudi Arabia. Meanwhile, adding that OPEC raised its forecast for growth in aggregate supply of oil produced by countries that are not members of the cartel , at 60,000 barrels per day compared with the previous forecast , to 1.37 million barrels a day . OPEC also lowered its forecast for oil demand this year of the cartel to 100,000 barrels per day to a level of 29.6 million barrels per day. OPEC has also maintained the growth forecast for world oil demand in 2014. According to the forecast , global oil demand in 2014 will grow by 1.14 million barrels per day - up to 91.2 million barrels per day. Countries with OPEC in 2014 will increase the supply of oil to 1.37 million barrels per day.

Dynamics of oil prices also determines the development of the situation in Libya . It seems that the volume of exports from the country is expected to recover

May futures for U.S. light crude oil WTI (Light Sweet Crude Oil) fell to $ 103.29 a barrel on the New York Mercantile Exchange (NYMEX).

May futures price for North Sea Brent crude oil mixture fell $ 0.40 to $ 107.37 a barrel on the London exchange ICE Futures Europe.

Gold prices today rose markedly , reaching a two-week high at the same time as market participants continued to analyze published last minutes of the last meeting of the FOMC. Investors feared that the signs of recovery in the labor market , the regulator may raise interest rates in the near future . At a press conference after the meeting, the head of the previous controller Janet Yellen said the rate may be increased after 6 months after the purchase of assets will be fully collapsed - that is in the middle of 2015 , if the current rate of reduction programs remain. As shown by the protocols , the discussion , the Committee agreed that, subject to economic development within the regulator forecasts on upcoming meetings can be taken the next decision to reduce QEIII. The members of the Committee emphasized that a predetermined volume reduction program does not , it will depend on the current situation of unemployment and inflation .

Slight pressure on the gold had presented data on the U.S. labor market . As it became known , the number of Americans applying for first time unemployment benefits fell last week to the lowest level in the last seven years. This is a sign that the labor market is recovering from the winter slump. The number of initial claims for unemployment benefits , a measure of layoffs, fell by 32,000 to a seasonally adjusted and totaled 300,000 in the week ended April 5. The result showed the greatest decrease in complaints from the end of 2012 , and it has pushed the overall level of the lows that were last seen in May 2007 . Economists had forecast 314,000 new claims last week.

The four-week moving average of applications , which smooths the volatile weekly data , fell by 4,750 to 316,250 . Number of repeated applications for unemployment benefits fell for the week ended March 29, at 62 000 - to 2.776 million ( the lowest level since January 2008 ) .

Meanwhile, adding that prices in China, the world's largest consumer of gold, on Thursday at $ 2 per ounce lower than in London , compared with the ">The outflow of funds in the ETF- Gold also slackened , reflecting the dynamics of prices . Yesterday the first time since the end of March there was no registered net outflows .

The cost of the June gold futures on the COMEX today rose to $ 1320.30 per ounce.

USD/JPY Y102.00, Y102.20, Y102.50, Y102.95, Y103.00, Y103.05, Y103.20-25

EUR/USD $1.3700, $1.3715, $1.3760, $1.3795, $1.3800, $1.3900

GBP/USD $1.6700

EUR/GBP stg.0.8225, stg0.8240, stg0.8315, stg0.8340

USD/CHF Chf0.8930

GBP/CHF Chf1.4600, Chf1.4700

EUR/CHF Chf1.2180, Chf1.2230, Chf1.2240

AUD/USD $0.9300, $0.9350, $0.9455

AUD/JPY Y94.70

USD/CAD C$1.0965, C$1.0970, C$1.0980

U.S. stock futures were little changed as jobless claims fell to the lowest since 2007 and investors awaited earnings reports.

Global markets:

Nikkei 14,300.12 0.00%

Hang Seng 23,186.96 +1.51%

Shanghai Composite 2,134.30 +1.38%

FTSE 6,658.78 +0.35%

CAC 4,446.07 +0.08%

DAX 9,528.75 +0.24%

Crude oil $103.28 (-0.34%)

Gold $1318.90 (+0.99%)

06:45 France Industrial Production, m/m February -0.2% +0.1%

06:45 France Industrial Production, y/y February -0.1% -0.8%

06:45 France CPI, m/m March +0.6% +0.5%

06:45 France CPI, y/y April +0.9% +0.6%

08:00 Eurozone ECB Monthly Report April

11:00 United Kingdom BoE Interest Rate Decision 0.50% 0.50% 0.50%

11:00 United Kingdom Asset Purchase Facility 375 375 375

11:00 United Kingdom MPC Rate Statement

The euro rose against the dollar on French data on industrial production and inflation. Inflation in France, agreed by EU methodology , slowed in March, mainly due to falling oil prices , data showed on Thursday statistical office Insee. Harmonised inflation (HICP) fell more than expected to 0.7 percent in March from 1.1 percent in February. It was expected that inflation will be 0.8 percent.

Annual consumer price inflation fell to 0.6 percent from 0.9 percent the previous month and remained below the expected 0.7 percent.

Food prices fell 0.2 percent, while the prices of petroleum products decreased by 6 percent. Meanwhile, the cost of clothing and footwear increased by 0.6 percent.

On a monthly measurement of consumer prices rose by 0.4 percent after rising 0.6 percent the previous month. At the same time, the HICP rose by 0.5 percent.

Basic consumer prices rose by 0.1 percent compared with the previous month, amounting to an annual increase of 0.4 percent in March.

French industrial production expanded slightly in February , data showed on Thursday Insee. Industrial production in the second -largest eurozone economy grew by 0.1 % in February from January . Analysts had forecast an average increase of 0.2%.

Reduced energy production and release in the oil refining industry restrained overall industrial production, while manufacturing output grew by 0.3%. On an annual basis , industrial production fell by 0.8 % after falling 0.1% the month before.

Support for the single currency had news that Greece has successfully returned to the debt markets . Today, Greece held the first since 2010 auction on sovereign debt , in which were placed 5 - year bonds worth 3 billion euros against 2.5 billion target average yield was 4.95 % against the expected 5-5.25 %. Vice Prime Minister of Greece , said after the auction that the " bond issue said that Greece's debt is acceptable ."

The British pound is trading slightly lower against the dollar after the Bank of England left policy unchanged . The Bank of England did not bring any surprises , decided to leave its key rate at a record low of 0.5% , which she held for 5 years ( since March 2009 ), and a program of bond purchases in the amount of £ 375 billion

CB stated that it intends to keep rates low for at least as long as the b / p drops below 7%, and it is not expected before 2016. However, his representatives have repeatedly said that the mere drop rates b / d less than 7% will not be a direct incentive to improve .

Minutes of the meeting will be published on Wednesday, April 23.

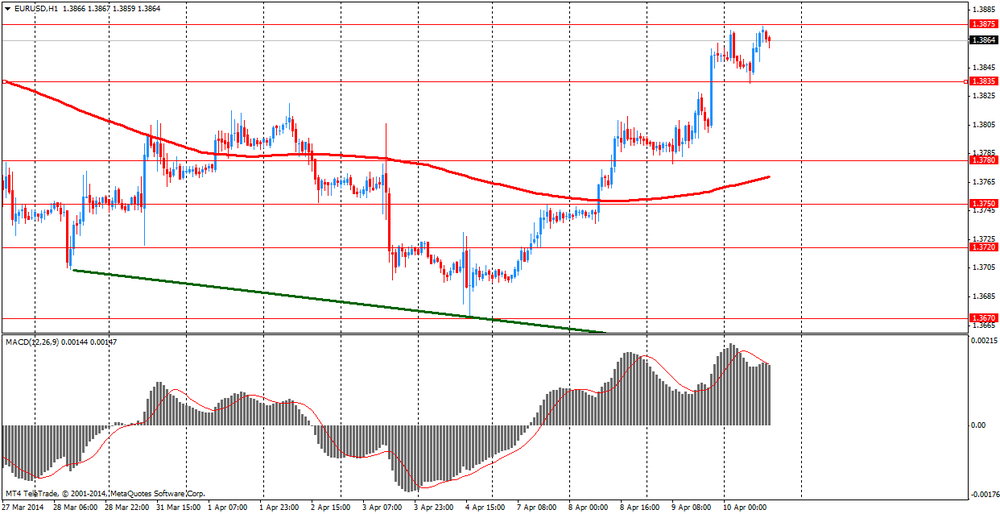

EUR / USD: during the European session, the pair rose to $ 1.3874

GBP / USD: during the European session, the pair fell to $ 1.6765

USD / JPY: during the European session, the pair fell to Y101.41 and stepped

At 12:30 GMT , Canada will release the housing price index on the primary market in February. In the U.S. at 12:30 GMT will import price index for March, at 18:00 GMT - monthly budget execution report for March. At 23:50 GMT the meeting minutes will be published on the Bank of Japan's monetary policy in March .

EUR/USD

Offers $1.4000, $1.3970, $1.3950, $1.3930, $1.3890-900, $1.3875/85

Bids $1.3825/15, $1.3800, $1.3780, $1.3750

GBP/USD

Offers $1.6900, $1.6880, $1.6840/50, $1.6825

Bids $1.6730/25, $1.6710/00, $1.6685/80, $1.6660/50

AUD/USD

Offers $0.9600, $0.9550, $0.9500

Bids $0.9420/00, $0.9350, $0.9310/00, $0.9250

EUR/JPY

Offers Y142.00, Y141.45/50, Y141.20

Bids Y140.50, Y140.25/20, Y139.50

USD/JPY

Offers Y103.00, Y102.80/85, Y102.50, Y102.20/25, Y101.75/80

Bids Y101.20, Y101.00, Y100.50

EUR/GBP

Offers stg0.8320/25, stg0.8300

Bids stg0.8200, stg0.8190-80

European stocks retreated as mining companies fell after a report showed Chinese imports unexpectedly slumped last month. U.S. index futures also dropped, while Asian shares climbed.

The Stoxx Europe 600 Index dropped 0.4 percent to 333.89 at 10:31 a.m. in London, erasing a gain of as much as 0.6 percent. The benchmark has fallen 1.6 percent from a six-year high on April 4 as investors sold technology stocks and the shares with the highest valuations. Standard & Poor’s 500 Index futures also slipped 0.3 percent today. The MSCI Asia Pacific Index climbed 0.6 percent.

In China, a report showed that imports slid 11 percent in March. The median economist estimate had called for a gain of 3.9 percent, according to data compiled by Bloomberg.

In the U.S., a Labor Department report at 8:30 a.m. in Washington will probably show that jobless claims in the world’s biggest economy in the week ended April 5 fell to 320,000, according to the median estimate of economists.

A gauge of commodity producers declined 0.9 percent.

Tryg A/S lost 4.5 percent after reporting first-quarter net income that missed analysts’ estimates.

LVMH Moet Hennessy Louis Vuitton SA added 3.4 percent as the world’s largest luxury-goods company posted the fastest growth in fashion and leather-goods sales in two years.

FTSE 100 6,637.38 +1.77 +0.03%

CAC 40 4,424.25 -18.43 -0.41%

DAX 9,470.75 -35.60 -0.37%

USD/JPY Y102.00, Y102.20, Y102.50, Y102.95, Y103.00, Y103.05, Y103.20-25

EUR/USD $1.3700, $1.3715, $1.3760, $1.3795, $1.3800, $1.3900

GBP/USD $1.6700

EUR/GBP stg.0.8225, stg0.8240, stg0.8315, stg0.8340

USD/CHF Chf0.8930

GBP/CHF Chf1.4600, Chf1.4700

EUR/CHF Chf1.2180, Chf1.2230, Chf1.2240

AUD/USD $0.9300, $0.9350, $0.9455

AUD/JPY Y94.70

USD/CAD C$1.0965, C$1.0970, C$1.0980

Asian stocks rose as brokerages trading in Hong Kong climbed after China announced plans to link the Hong Kong and Shanghai bourses, outweighing an unexpected fall in exports from the region’s biggest economy. China’s customs administration said shipments from the nation declined 6.6 percent from a year earlier, compared with the median estimate for a 4.8 percent increase in a Bloomberg News survey of 47 economists. Imports fell 11.3 percent, leaving a trade surplus of $7.71 billion.

Nikkei 225 14,300.12 +0.43 0.00%

S&P/ASX 200 5,480.8 +17.02 +0.31%

Shanghai Composite 2,134.23 +28.99 +1.38%

Citic Securities Co. surged 11 percent in Hong Kong, pushing a gauge of Chinese shares listed in the city to a three-month high.

NSK Ltd. gained 3.6 percent in Tokyo after Goldman Sachs Group Inc. advised buying shares of the bearings maker.

01:00 Australia Consumer Inflation Expectation April +2.1% +2.4%

01:30 Australia Unemployment rate March 6.0% 6.0% 5.8%

01:30 Australia Changing the number of employed March 47.3 14.3 18.1

02:00 China Trade Balance, bln March -23.0 -0.9 +7.7

The yen strengthened against most counterparts while the Australian dollar pared gains after China reported an unexpected drop in imports and exports, fueling concern about demand for commodities. China’s overseas shipments declined 6.6 percent from a year earlier, the customs administration said today, attributing the drop partly to distortions from inflated data in early 2013. Imports fell 11.3 percent, leaving a trade surplus of $7.71 billion.

The U.S. dollar slid to a five-month low versus a basket of peers before a Federal Reserve policy maker speaks after central-bank minutes undercut prospects for an increase in interest rates. Janet Yellen said following the March meeting that the bank may start to increase interest rates “around six months” after ending its asset-buying program. The U.S. central bank cut monthly bond purchases by $10 billion to $55 billion last month. The Fed is winding down stimulus it has used to support the economy, while keeping its target for overnight lending between banks in a range of zero to 0.25 percent since 2008.

Chicago Fed President Charles Evans will participate in a panel discussion in Washington today.

The Aussie rose after employers added more than seven times as many jobs as forecast. The nation’s statistics bureau said employers added 18,100 jobs compared with the forecast for 2,500 additions. The jobless rate fell to 5.8 percent, the lowest level since November and the first decline in six months.

New Zealand’s dollar touched its highest level since 2011. The nation’s manufacturing expanded last month to the highest level since July, according to the Performance of Manufacturing Index compiled by the Bank of New Zealand Ltd. and Business NZ.

EUR / USD: during the Asian session, the pair rose to $ 1.3870

GBP / USD: during the Asian session, the pair rose to $ 1.6820

USD / JPY: during the Asian session, the pair rose fell below Y102.00

BOE rate announcement at 1100GMT the domestic interest, though no change widely expected.

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.