- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

European stocks gained the most since November as demand increased at a Spanish debt sale, German investor confidence topped forecasts and the International Monetary Fund boosted its global growth outlook.

Spain sold 3.18 billion euros of bills today, compared with a maximum target of 3 billion euros the Treasury set for the sale. The average 12-month yield was 2.623 percent, compared with 1.418 percent at the last auction on March 20, the Bank of Spain said. The Treasury also sold 18-month bills at 3.11 percent, compared with 1.71 percent last month.

German investor confidence unexpectedly rose for a fifth month in April to the highest in almost two years, suggesting Europe’s largest economy can weather the resurgent debt crisis in the euro region’s periphery. The ZEW Center for European Economic Research’s index of investor and analyst expectations, which aims to predict economic developments six months in advance, climbed to 23.4 from 22.3 in March.

The world economy will expand 3.5 percent this year and 4.1 percent in 2013, the Washington-based IMF said today in its World Economic Outlook, raising forecasts made in January from 3.3 percent for 2012 and 4 percent for next year.

National benchmark indexes advanced in all of the 18 western European markets. France’s CAC 40 Index climbed 2.6 percent, while Germany’s DAX rose 2.5 percent. The U.K.’s FTSE 100 (UKX) added 1.8 percent.

A gauge of bank shares gained 4 percent today as Banco Popolare, Italy’s fifth-largest lender, increased 8.9 percent to 1.15 euros. Barclays, the U.K.’s second-biggest bank by assets, increased 4.9 percent to 221.2 pence. BNP Paribas SA, France’s largest bank, rallied 6.7 percent to 30.94 euros and Societe Generale SA, the country’s second-biggest lender, rose 8.2 percent to 18.52 euros.

Greek banks jumped amid optimism the government is close to completing its plans to restructure the country’s banks. EFG Eurobank Ergasias SA surged 7.3 percent to 71.9 euro cents and National Bank of Greece SA climbed 1.1 percent to 1.88 euros.

Danone advanced 2.8 percent to 53 euros after reporting higher first-quarter sales, led by bottled water and baby food. Revenue rose to 5.12 billion euros from 4.76 billion euros a year earlier, the company said. That beat the 5.05 billion-euro average estimate of 11 analysts.

Marks & Spencer Group Plc slid 2.5 percent to 358.5 pence. The U.K.’s largest clothing retailer said sales of general merchandise at U.K. stores open at least a year fell 2.8 percent in the 13 weeks ended March 31. The average estimate of 10 analysts was for an unchanged performance.

The yen fell versus all of its 16 most-traded peers as a report showing German investor confidence rose to a two-year high fueled appetite for riskier assets. The ZEW Center for European Economic Research in Mannheim said its index of investor and analyst expectations, which is designed to predict economic developments six months in advance, increased to 23.4 from 22.3 in March. That’s the highest since June 2010.

Canada’s dollar gained the most in four months against the greenback as the central bank said higher borrowing costs “may become appropriate” because economic growth will be faster than forecast. The Bank of Canada said the nation’s economy will reach full output in the first half of next year, sooner than a January forecast for the third quarter of 2013, while predicting that Europe will emerge from recession later this year and the U.S. recovery will be stronger than policy makers expected. The BOC kept its key interest rate unchanged today at 1 percent.

The euro was buoyed against the yen as increased demand at Spanish debt sales eased concern Europe’s sovereign- debt crisis is worsening. The euro gained versus the yen as the Frankfurt-based Bundesbank said the German economy, Europe’s largest, is in “remarkably good shape.” Growth should gather pace as unemployment at a two-decade low fuels domestic demand, it said in a statement today. The International Monetary Fund raised its economic growth estimates. Its World Economic Outlook forecast the global economy will expand 3.5 percent this year and 4.1 percent in 2013, an increase from its January projections of 3.3 percent growth in 2012 and 4 percent next year.

The pound climbed after U.K. consumer prices climbed 3.5 percent from a year earlier, after rising 3.4 percent in February, the Office for National Statistics said in London. The reading was higher than the 3.4 percent median estimate of economists, and above the central bank’s target of 2 percent.

U.S. stocks rose, following a two- day drop in the Standard & Poor’s 500 Index, after the International Monetary Fund raised its global growth forecast and concern about Europe’s crisis eased as Spain’s bonds gained.

Equities rallied as the IMF raised its forecast for global growth in 2012 to 3.5 percent from 3.3 percent and said the U.S. will expand 2.1 percent. German investor confidence unexpectedly rose and Spain sold 12-month and 18-month bills a day after borrowing costs climbed to the highest this year.

Dow 13,116.11 +194.70 +1.51%, Nasdaq 3,046.86 +58.46 +1.96%, S&P 500 1,390.54 +20.97 +1.53%

Coca-Cola (КО) gained 2.7 percent to $74.40. Chief Executive Officer Muhtar Kent has introduced smaller package sizes to attract price-conscious consumers as part of an effort to spur sales in North America.

First Solar surged 12 percent, the most in the S&P 500, to $23.36. The company will cut about 2,000 jobs in response to a deteriorating European market. Most of the jobs to be eliminated will be at a factory it’s closing in Germany and in Malaysia, where it’s idling four production lines.

Goldman Sachs Group Inc. swung between gains and losses, recently rising 0.7 percent to $118.59. The fifth-biggest U.S. bank by assets reported a 23 percent decline in first-quarter profit, beating analysts’ estimates. The company boosted the dividend 31 percent. Revenue from trading bonds, currencies and commodities lagged behind JPMorgan Chase & Co.

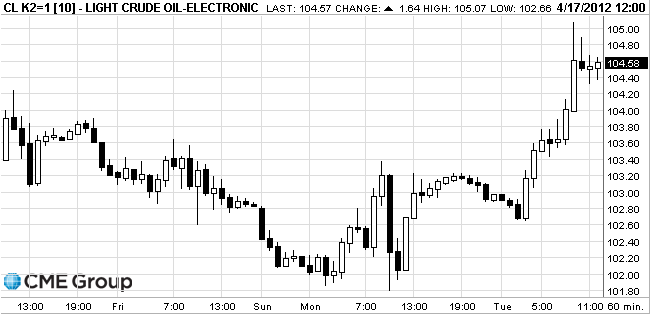

Oil climbed to a two-week high in New York as Spain raised more than its maximum target at a debt auction and the International Monetary Fund bolstered its global growth forecast.

Futures gained as much as 2.1 percent after Spain sold 3.18 billion euros of bills today, easing concern the credit crisis will spread. The IMF raised its outlook for 2012 and 2013 today.

The world economy will expand 3.5 percent this year and 4.1 percent in 2013, the Washington-based IMF said today in its World Economic Outlook, raising forecasts made in January from 3.3 percent for 2012 and 4.0 percent for next year. The U.S. will grow 2.1 percent this year and 2.4 percent in 2013, up from 1.8 percent and 2.2 percent in the lender’s January projections.

Crude oil for May delivery advanced to $105.07, the highest intraday price since April 3. Crude is up 5.8 percent this year.

Brent oil for June settlement rose 11 cents to $118.79 a barrel on the London-based ICE Futures Europe exchange.

Gold prices adjusted in early trading after falling to the weekly wage on the eve on the background of strong statistical data on retail sales in the U.S.

The fall of the value of gold due to the eve of which turned out better than analysts' expectations of macroeconomic statistics from the U.S., which led to an increase in investor interest in U.S. currency as a safe asset. On Monday it was reported that retail sales in March in the country grew by 0.8% compared with February. The analysts were expecting sales growth of 0.3%.

At the same time, investors remained concerned about the economic situation in the euro area, particularly in Spain. On the eve of the rate of return on ten-year government bonds of the country exceeded the psychologically important level of 6%. So on Tuesday the attention of bidders is focused on the placement of the Spanish Treasury bills with maturities of 12 and 18 months worth of 3 billion euros. Spain's Ministry of Finance sold on Tuesday the 12 - and 18-month bonds worth 3.2 billion euros, slightly exceeding the target amount of 2.3 billion euros. In addition, the economic expectations in Germany improved in April compared with March, according to research institute ZEW.

May futures on the COMEX for gold today rose to $ 1655.8 an ounce and then dropped to $ 1635.0 an ounce.

Resistance 3:1397 (Apr 5 high)

Resistance 2:1388 (Apr 13 high)

Resistance 1:1378 (resistance line from Apr 2)

Current price: 1378,50

Support 1:1375 (МА (200) for Н1)

Support 2:1360 (area of session low and Apr 16 low)

Support 2:1356/52 (support line from Mar 6, Apr 10 low)

Bids at C$0.9880/85, with talk of layered stops below. Further bids C$0.9860/50 with stops below. Larger support seen ahead of the March 1 low at

$0.9835-40.

EUR/USD $1.3000, $1.3090, $1.3125

USD/JPY Y80.75, Y81.00, Y81.10

EUR/GBP stg0.8250, stg0.8200

GBP/USD $1.5815, $1.5800

USD/CHF Chf0.9265

AUD/USD $1.0220, $1.0285, $1.0300, $1.0310, $1.0400

U.S. stock-index futures maintained gains even after housing starts unexpectedly declined as declines in Spanish and Italian bond yields eased concern about Europe’s debt crisis.

Global Stocks:

Nikkei 9,464.71 -5.93 -0.06%

Hang Seng 20,562.31 -48.33 -0.23%

Shanghai Composite 2,334.98 -22.04 -0.94%

FTSE 5,727.71 +61.43 +1.08%

CAC 3,261.42 +56.14 +1.75%

DAX 6,721.49 +96.30 +1.45%

Crude oil: $104.17 (+1.20%).

Gold: $1653.60 (+0.24%).

Data:

08:30 United Kingdom HICP, m/m March +0.6% +0.3% +0.3%

08:30 United Kingdom HICP, Y/Y March +3.4% +3.5% +3.5%

08:30 United Kingdom HICP ex EFAT, Y/Y March +2.4% +2.4% +2.5%

08:30 United Kingdom Retail Price Index, m/m March +0.8% +0.4% +0.4%

08:30 United Kingdom Retail prices, Y/Y March +3.7% +3.6% +3.6%

08:30 United Kingdom RPI-X, Y/Y March +3.8% +3.7% +3.6%

09:00 Germany ZEW Survey - Economic Sentiment April 22.3 20.2 23.4

09:00 Eurozone ZEW Economic Sentiment April 11.0 10.7 13.1

09:00 Eurozone Harmonized CPI March +0.5% +1.2% +1.3%

09:00 Eurozone Harmonized CPI, Y/Y (finally) March +2.7% +2.6% +2.7%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y March +1.5% +1.5% +1.6%

The euro strengthened as Spain sold more than its maximum target at a bill auction and German investor confidence unexpectedly rose for a fifth month in April.

The yen fell as stocks rose and before reports that may show the U.S. economy is improving.

The euro rebounded after Spain sold 3.18 billion euros of 364- and 546-day securities, compared with a maximum target of 3 billion euros.

The ZEW Center for European Economic Research in Mannheim said its index of investor and analyst expectations, which aims to predict economic developments six months in advance, increased to 23.4 from 22.3 in March. That’s the highest since June 2010. Economists forecast a drop to 19, according to the median of estimates.

The inflation rate in the 17-nation euro region held at 2.7% for a fourth month, the European Union’s statistics office in Luxembourg said in an e-mailed statement today.

EUR/USD: the pair showed high in $1,3170 area then receded in $1,3130 area.

GBP/USD: the pair grown in $1,5950 area.

USD/JPY: pair showed high at Y80,70 area then slightly receded.

EUR/USD

Offers $1.3240/50, $1.3215, $1.3200, $1.3175/80

Bids $1.3125/20, $1.3075/70, $1.3060/50, $1.3030

USD/JPY

Offers Y81.60/65, Y81.45/50, Y81.25, Y81.00, Y80.80/85, Y80.70/75

Bids Y80.30, Y80.10/00, Y79.80/75, Y79.50, Y79.40/35

AUD/USD

Offers $1.0490/00, $1.0460/65, $1.0450/55, $1.0425/30, $1.0400/10, $1.0385/90

Bids $1.0300, $1.0275/70, $1.0255/50, $1.0225, $1.0200

EUR/JPY

Offers Y107.45/50, Y107.10, Y106.95/00, Y106.45/50

Bids Y105.70/65, Y105.10/00, Y104.65/60,

EUR/GBP

Offers stg0.8320/25, stg0.8300, stg0.8275/80, stg0.8265/70

Bids stg0.8210, stg0.8200, stg0.8180/75

Resistance 3: Y82.55 (Apr 6 high)

Resistance 2: Y81.90 (Apr 10 high)

Resistance 1: Y81.20/30 (Apr 13 high, МА (200) for Н1, the top border of down channel from Apr 2)

Current price: Y80.68

Support 1: Y80.20 (Feb 29 low)

Support 2: Y80.00 (Feb 28 low)

Support 3: Y79.80 (border of down channel from Apr 2)

Resistance 3: Chf0.9340 (high of March)

Resistance 2: Chf0.9250 (Apr 16 and Mar 16 highs)

Resistance 1: Chf0.9170/80 (session high, МА (200) for Н1)

Сurrent price: Chf0.9147

Support 1: Chf0.9120 (support line from Apr 3, session low)

Support 2: Chf0.9090 (Apr 12 low)

Support 3: Chf0.9000 (low of April)

Resistance 3 : $1.6170 (high of October)

Resistance 2 : $1.6060 (high of April)

Resistance 1 : $1.5980 (area of Apr 12 high)

Current price: $1.5958

Support 1 : $1.5910 (Apr 16 high, 38,2 % FIBO $1,5820-$ 1,5970)

Support 2 : $1.5880 (МА(200) for Н1)

Support 3 : $1.5860 (session low)

Комментарии: пара торгуется в области линии сопротивления от 2 апреля, закрепление выше которой откроет дорогу в область апрельских максимумов $1,6060.

Resistance 3 : $1.3250 (Mar 29 low)

Resistance 2 : $1.3210 (Apr 12 high)

Resistance 1 : $1.3165/70 (session high, resistance line from Apr 3)

Current price: $1.3137

Support 1 : $1.3100/090 (session low, МА (200) for Н1)

Support 2 : $1.3000 (Apr 16 low, low of March, psychological level)

Support 3 : $1.2975 (low of February)

Italian growth recovery this year depends on financial markets, sovereign bond yields.

EUR/USD $1.3000, $1.3090, $1.3125

USD/JPY Y80.75, Y81.00, Y81.10

EUR/GBP stg0.8250, stg0.8200

GBP/USD $1.5815, $1.5800

USD/CHF Chf0.9265

AUD/USD $1.0220, $1.0285, $1.0300, $1.0310, $1.0400

Asian stocks fell for a second day as foreign direct investment into China dropped for a fifth month, and Spanish borrowing costs climbed to the highest level this year ahead of a debt auction by the nation today.

China Construction Bank Corp. retreated 2.6 percent in Hong Kong even as investment slipped at about half the rate forecast by economists.

Nikkei 225 9,464.71 -5.93 -0.06%

Hang Seng 20,554.15 -56.49 -0.27%

S&P/ASX 200 4,288.79 -13.55 -0.31%

Shanghai Composite 2,334.98 -22.04 -0.94%

Esprit Holdings Ltd., which depends on Europe for about 80 percent of its sales, retreated 3.6 percent as Spain prepares to sell bonds later today. Apple Inc. suppliers fell amid concern demand for the company’s products will slow.

Gree Inc., a Japanese social-network game operator, rose 9.1 percent in Tokyo after Bank of America Merrill Lynch said its domestic revenue growth is accelerating.

01:30 Australia RBA Meeting's Minutes -

01:30 Australia New Motor Vehicle Sales (MoM) March 0.0% 4.0%

01:30 Australia New Motor Vehicle Sales (YoY) March +1.7% 4.0%

04:30 Japan Industrial Production (MoM) (finally) February +1.9% -1.2% -1.6%

04:30 Japan Industrial Production (YoY) (finally) February -1.3% +1.5% +1.5%

05:00 Japan Consumer Confidence March 39.5 40.1 40.3

The euro fell versus most of its 16 major counterparts before Spain sells securities after borrowing costs climbed to the highest level this year, boosting concern Europe’s debt crisis is spreading. Yields on the nation’s 10-year notes soared as much as 18 basis points, or 0.18 percentage point, to 6.16 percent yesterday. That’s the highest level since Dec. 1 and is edging toward the 7 percent level that pushed Greece, Ireland and Portugal into rescues. The cost of insuring against a Spanish default rose eight basis points to 511 yesterday, the highest on record, according to CMA.

The 17-nation currency weakened against the greenback before reports that may show confidence among investors in Germany, The ZEW Center for European Economic Research in Mannheim will probably report today its index of investor and analyst expectations, which aims to predict economic developments six months in advance, fell to 19 in April from 22.3 in March, according to the median estimate in a Bloomberg News survey. Last month’s figure was the highest reading since June 2010.

Australia’s dollar declined for a third day versus its U.S. counterpart after the Reserve Bank said slower inflation would increase the prospects of an interest-rate reduction. Minutes released today of the RBA’s April 3 meeting, when officials held the benchmark interest rate unchanged at 4.25 percent, reaffirmed that the next rate reduction h¼inges on an April 24 report on first-quarter inflation. Governor Glenn Stevens said in a statement after this month’s gathering that the board “judged the pace of output growth to be somewhat lower than earlier estimated.”

EUR/USD: during the Asian session the pair lowered below $1.3100.

GBP/USD: during the Asian session the pair fell, receded from yesterday's high.

USD/JPY: during the Asian session the pair traded in range Y80.30-Y80.55.

Today the European Commission President Jose Manuel Barroso meets German President Joachim Gauck, in Brussels. European data starts at 0600GMT with the release of ACEA new car registrations data. The main core-European releases come at 0900GMT with the German ZEW survey and final EMU HICP data. UK data at 0830GMT sees inflation data. In its February Inflation Report the Bank of England forecast CPI would average 3.35% in Q1. In Europe at 1230GMT, ECB President Mario Draghi is due to give an introductory speech at the Sixth ECB Statistics Conference, in Frankfurt. US data starts at 1230GMT, Housing Starts and Building Permits data are due. Weekly Johnson Redbook chain store sales data is due at 1255GMT. The IMF World Economic Outlook is also due at 1300GMT. At 1315GMT, US industrial production is expected to rise 0.2% in March after holding steady in Feb.

Yesterday the euro touched the lowest level against the yen since February as Spanish bond yields touched a 2012 high after a minister called on the European Central Bank to do more to stem debt-market turmoil. The euro slid against the yen after the cost of insuring Spain’s debt reached a record and Jaime Garcia-Legaz, the nation’s deputy economy minister, said in an interview on April 13 that the ECB should “step up purchases of bonds.”

The dollar rose earlier versus most major counterparts as data showed U.S. consumer purchases rose last month, damping speculation the Federal Reserve will add to monetary easing. Retail sales increased 0.8 percent, following a revised 1 percent advance in February, Commerce Department figures showed today in Washington.

China’s yuan tumbled against the dollar as the central bank doubled the daily trading band, reflecting declines in emerging- market currencies. Effective today the People’s Bank of China is allowing 1 percent moves from its daily fixing, after keeping the limit at 0.5 percent since May 2007.

EUR/USD: yesterday the pair gain, fixed above $1.3100.

GBP/USD: yesterday the pair rose, restored after Friday’s decrease.

USD/JPY: yesterday the pair fell, closed day below Y80.50.

Today the European Commission President Jose Manuel Barroso meets German President Joachim Gauck, in Brussels. European data starts at 0600GMT with the release of ACEA new car registrations data. The main core-European releases come at 0900GMT with the German ZEW survey and final EMU HICP data. UK data at 0830GMT sees inflation data. In its February Inflation Report the Bank of England forecast CPI would average 3.35% in Q1. In Europe at 1230GMT, ECB President Mario Draghi is due to give an introductory speech at the Sixth ECB Statistics Conference, in Frankfurt. US data starts at 1230GMT, Housing Starts and Building Permits data are due. Weekly Johnson Redbook chain store sales data is due at 1255GMT. The IMF World Economic Outlook is also due at 1300GMT. At 1315GMT, US industrial production is expected to rise 0.2% in March after holding steady in Feb.

Asian stocks fell, with a regional benchmark index headed for its biggest drop in almost two weeks, after the cost of insuring against a Spanish default climbed and U.S. consumer confidence dropped, clouding the earnings outlook for Asia’s exporters.

Nikkei 225 9,470.64 -167.35 -1.74%

Hang Seng 20,600.46 -100.58 -0.49%

S&P/ASX 200 4,302.3 -21.01 -0.49%

Shanghai Composite 2,357.03 -2.13 -0.09%

Nintendo Co. a manufacturer of game consoles that gets a third of its sales in Europe, fell 3.2 percent in Osaka.

James Hardie Industries SE, an Australian supplier of building materials that gets more than half of its sales from the U.S., dropped 1.2 percent in Sydney.

Industrial & Commercial Bank of China Ltd. declined 1 percent in Hong Kong after Goldman Sachs Group Inc. was said to sell a $2.5 billion stake at a discount.

European stocks rebounded from their longest stretch of weekly losses since August as companies from International Power Plc to Royal KPN NV rallied amid an increase in takeover activity.

The benchmark Stoxx 600 has risen 4 percent this year as the European Central Bank disbursed more than 1 trillion euros ($1.3 trillion) to the region’s lenders and as U.S. economic reports topped forecasts. The number of shares changing hands on gauge today was 4.8 percent greater than the average over 30 days.

National benchmark indexes climbed in 12 of the 17 western- European markets that were open today. The U.K.’s FTSE 100 advanced 0.3 percent and Germany’s DAX rose 0.6 percent. France’s CAC 40 increased 0.5 percent. Greece’s stock market was closed for the Orthodox Easter holiday.

International Power added 3.2 percent to 416.8 pence after GDF Suez agreed to buy the 30 percent stake at a revised price of 418 pence a share. That’s 7 percent more than an earlier offer of 390 pence that the U.K. utility rejected as too low. GDF increased 5 percent to 18.86 euros as Europe’s biggest utility by market value confirmed that it will raise its 2012 targets if the deal goes through.

KPN rose 0.9 percent to 7.12 euros after the Netherlands’ largest phone company said it has started a review of Belgian mobile-phone unit, BASE. The business will probably attract interest from private-equity firms such as Apax Partners LLP, according to people familiar with the situation. BASE may fetch 1.8 billion euros in a sale.

Vestas Wind Systems A/S surged 13 percent to 55.55 kroner for the biggest gain on the Stoxx 600. Jyllands-Posten reported that Sinovel Wind Group Co. and Xinjiang Goldwind Science & Technology Co. are considering bidding for the Danish company.

Most U.S. stocks advanced, following the biggest weekly loss for the Standard & Poor’s 500 Index in 2012, as a stronger-than-forecast increase in retail sales bolstered optimism about the world’s largest economy.

The S&P 500 swung between gains and losses as banks rallied, while technology shares slumped. Retail sales rose 0.8 percent in March, almost three times as large as projected. Investors also watched earnings reports.

Dow 12,921.41 +71.82 +0.56%, Nasdaq 2,988.40 -22.93 -0.76%, S&P 500 1,369.57 -0.69 -0.05%

Citigroup gained 1.8 percent to $34. Fixed-income trading revenue jumped to $4.74 billion from $1.72 billion in the last three months of 2011 and $3.98 billion a year earlier, the New York-based company said today in a statement. David Trone, an analyst in New York with JMP Securities LLC, predicted fixed- income revenue of $2.78 billion.

Procter & Gamble (PG) rallied 1.5 percent, the second-biggest gain in the Dow, to $66.78. The Cincinnati-based company lifted its quarterly dividend to 56.2 cents a share from 52.5 cents.

Apple, which soared 43 percent in 2012, dropped 4.2 percent to $580.13 today. Verizon Wireless, a U.S. partner of Apple, said last week that it will begin charging customers $30 to upgrade to a new phone. The move suggests mobile-phone service providers may take other steps, including trimming subsidies, to keep sales of the iPhone from eating into their margins, said Walter Piecyk, an analyst at BTIG LLC in New York.

Mattel slumped 9.1 percent, the most in the S&P 500, to $31.01. North American retailers kept inventories of toys and dolls tight, causing first-quarter sales to trail analysts’ estimates.

Gannett Co. tumbled 7.7 percent to $13.89. The owner of 82 daily newspapers including USA Today reported a 25 percent drop in first-quarter prof.

Resistance 3: Y81.85 (Apr 10 high)

Resistance 2: Y81.20 (Apr 13 high)

Resistance 1: Y80.55 (session high)

The current price: Y80.42

Support 1: Y80.25 (Apr 16 low)

Support 2: Y80.00 (Feb 28 low)

Support 3: Y79.35 (Feb 20 low)

Resistance 3: Chf0.9250 (Apr 16 high)

Resistance 2: Chf0.9200 (Apr 13 high)

Resistance 1: Chf0.9170 (session high)

The current price: Chf0.9159

Support 1: Chf0.9140 (Apr 16 low)

Support 2: Chf0.9110 (low of the European session on Apr 13)

Support 3: Chf0.9090 (Apr 12 low)

Resistance 3 : $1.5985 (Apr 12 high)

Resistance 2 : $1.5965 (Apr 13 high)

Resistance 1 : $1.5910 (Apr 16 high)

The current price: $1.5884

Support 1 : $1.5880 (session low)

Support 2 : $1.5855 (high of the European session on Apr 16)

Support 3 : $1.5815 (Apr 16 low)

Resistance 3 : $1.3215 (Apr 12 high)

Resistance 2 : $1.3185 (123.6% FIBO $1.2995-$1.3150)

Resistance 1 : $1.3150 (Apr 16 high)

The current price: $1.3120

Support 1 : $1.3105 (session low)

Support 2 : $1.3070 (Apr 13 low)

Support 3 : $1.3030 (Apr 9 low)

Change % Change Last

Oil $103.10 +0.17 +0.17%

Gold $1,652.40 +2.70 +0.16%

Change % Change Last

Nikkei 225 9,470.64 -167.35 -1.74%

Hang Seng 20,600.46 -100.58 -0.49%

S&P/ASX 200 4,302.3 -21.01 -0.49%

Shanghai Composite 2,357.03 -2.13 -0.09%

FTSE 100 5,666.28 +14.49 +0.26%

CAC 40 3,205.28 +16.19 +0.51%

DAX 6,625.19 +41.29 +0.63%

Dow 12,921.41 +71.82 +0.56%

Nasdaq 2,988.40 -22.93 -0.76%

S&P 500 1,369.57 -0.69 -0.05%

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,3132 +0,42%

GBP/USD $1,5896 +0,32%

USD/CHF Chf0,9151 -0,46%

USD/JPY Y80,44 -0,58%

EUR/JPY Y105,63 -0,18%

GBP/JPY Y127,85 -0,30%

AUD/USD $1,0354 -0,16%

NZD/USD $0,8199 -0,37%

USD/CAD C$0,9998 +0,03%

01:30 Australia RBA Meeting's Minutes -

01:30 Australia New Motor Vehicle Sales (MoM) March 0.0%

01:30 Australia New Motor Vehicle Sales (YoY) March +1.7%

04:30 Japan Industrial Production (MoM) (finally) February +1.9% -1.2%

04:30 Japan Industrial Production (YoY) (finally) February -1.3% +1.5%

05:00 Japan Consumer Confidence March 39.5 40.1

08:30 United Kingdom HICP, m/m March +0.6% +0.3%

08:30 United Kingdom HICP, Y/Y March +3.4% +3.5%

08:30 United Kingdom HICP ex EFAT, Y/Y March +2.4% +2.4%

08:30 United Kingdom Retail Price Index, m/m March +0.8% +0.4%

08:30 United Kingdom Retail prices, Y/Y March +3.7% +3.6%

08:30 United Kingdom RPI-X, Y/Y March +3.8% +3.7%

09:00 Germany ZEW Survey - Economic Sentiment April 22.3 20.2

09:00 Eurozone ZEW Economic Sentiment April 11.0 10.7

09:00 Eurozone Harmonized CPI March +0.5% +1.2%

09:00 Eurozone Harmonized CPI, Y/Y (finally) March +2.7% +2.6%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y March +1.5% +1.5%

12:30 Canada Manufacturing Shipments (MoM) February -0.9% -0.1%

12:30 U.S. Building Permits, mln March 0.717 0.715

12:30 U.S. Housing Starts, mln March 0.698 0.705

13:00 Canada Bank of Canada Rate - 1.00% 1.00%

13:00 Canada BOC Rate Statement -

13:15 U.S. Industrial Production (MoM) March 0.0% +0.4%

13:15 U.S. Capacity Utilization March 78.7% 78.6%

13:30 Eurozone ECB President Mario Draghi Speaks -

14:30 United Kingdom MPC Member Posen Speaks

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.