- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

European stocks fell for a second day as reports showed that sales of previously owned houses dropped and more Americans than forecast filed claims for unemployment benefits.

Stocks initially rallied after Spain sold 2.54 billion euros of two- and 10-year bonds at an auction, meeting the government’s maximum target of 2.5 billion euros. France also raised 10.5 billion euros of debt out of a planned 11 billion euros today as risks linked to the country’s presidential election drove up yields.

Both countries have come under increased scrutiny from investors as the effect of the European Central Bank’s longer- term refinancing operation fades. The ECB has injected 1 trillion euros of liquidity into the region’s financial system.

The yield on Spain’s benchmark 10-year bond has jumped as much as 1 percentage point since the beginning of March, while the yield on the equivalent French security has gained about 10 basis points.

National benchmark indexes fell in 14 of the 17 western- European markets that were open today. France’s CAC 40 Index declined 2.1 percent and Germany’s DAX Index declined 0.9 percent. The U.K.’s FTSE 100 Index lost less than 0.1 percent. Spain’s IBEX 35 Index retreated 2.4 percent to extend a three- year low.

Publicis sank 4.1 percent to 38.48 euros in Paris. The company said sales growth will slow after it lost a contract for General Motors Co. and as some clients cut spending. First- quarter sales rose 13 percent to 1.45 billion euros from a year earlier, Publicis said. Excluding acquisitions, sales grew 4.1 percent.

Nokia declined 3.6 percent to 2.92 euros, its lowest price since 1997, after the company reported a first-quarter operating loss, burdened by costs at the unprofitable equipment venture with Siemens AG.

Ladbrokes Plc, the second-biggest U.K. betting group, soared 6.5 percent to 173.4 pence after predicting profit growth in its digital offering in the second half of 2012.

The yen fell against most of its major counterparts as Bank of Japan officials signaled they’ll keep acting to stem its strength to spur economic growth. The Bank of Japan is “committed” to monetary easing, Governor Masaaki Shirakawa said yesterday in a speech in New York. Deputy Governor Kiyohiko Nishimura said the central bank is ready to implement additional easing if necessary. Japan had a trade deficit of 82.6 billion yen ($1 billion) in March, versus a revised surplus of 29.4 billion yen in the previous month, data showed today. The prediction was for a 223.2 billion-yen shortfall.

Europe’s shared currency fluctuated versus the dollar after yields on Spanish 10-year benchmark bonds and French five-year debt increased at auctions. Spain sold 2.54 billion euros ($3.33 billion) of two- and 10-year securities today and France raised 10.5 billion euros in debt out of an 11 billion-euro goal. The yield on the 10-year Spanish note was 5.743 percent, compared with 5.403 percent when it was last sold in January. France’s five-year notes yielded 1.83 percent, up from 1.78 percent on March 15.

U.S. stocks swung between gains and losses as better-than-forecast earnings offset disappointing economic data and concern over Europe’s debt crisis.

The S&P 500 fell earlier after reports showed sales of previously owned U.S. homes in March unexpectedly fell, while more Americans than forecast filed applications for unemployment benefits last week. Another report showed manufacturing in the Philadelphia region expanded at a slower pace in April as orders and sales cooled.

Global equities also fell as yields on French and Spanish 10-year bonds climbed at least six basis points, reviving concern about the sovereign debt crisis. Spain sold 2.54 billion euros ($3.3 billion) of two-year and 10-year debt today, compared with a maximum target of 2.5 billion euros. France auctioned 8 billion euros.

Dow 12,977.65 -55.10 -0.42%, Nasdaq 3,019.59 -11.86 -0.39%, S&P 500 1,379.70 -5.44 -0.39%

Bank of America (ВАС) rose 0.4 percent to $8.96. The second- largest U.S. lender said first-quarter profit rose amid a rebound in trading and better credit quality. Profit excluding certain one-time items increased about 40 percent to $3.7 billion, or 31 cents a diluted share, from $2.6 billion, or 23 cents, a year earlier. That beat the average per-share estimate of 27 analysts.

Morgan Stanley climbed 1.9 percent to $18. Stock- and bond- trading revenue rose more than at any other major U.S. bank. Profit was 71 cents a share excluding accounting charges, topping the 44-cent average estimate of 17 analysts surveyed by Bloomberg. The KBW Bank Index advanced 0.1 percent.

Travelers (TRV) added 4.8 percent to $62.34. First-quarter operating profit, which excludes some investment results, was $2.01 a share. That compares with the $1.52 average estimate of 22 analysts.

Oil fluctuated in New York after more Americans than forecast filed applications for unemployment benefits and the index of U.S. leading indicators rose for a sixth month in March.

Futures traded in a $1.18-a-barrel range after the Labor Department reported jobless claims fell by 2,000 to 386,000 last week. The Conference Board’s gauge of the outlook for the next three to six months climbed 0.3 percent, the New York-based group said today.

Crude oil for May delivery traded in range of $102.03 - $103.21 a barrel on the New York Mercantile Exchange. Prices are up 4.1 percent this year.

Brent oil for June settlement rose 48 cents, or 0.4 percent, to $118.45 a barrel on the London-based ICE Futures Europe exchange.

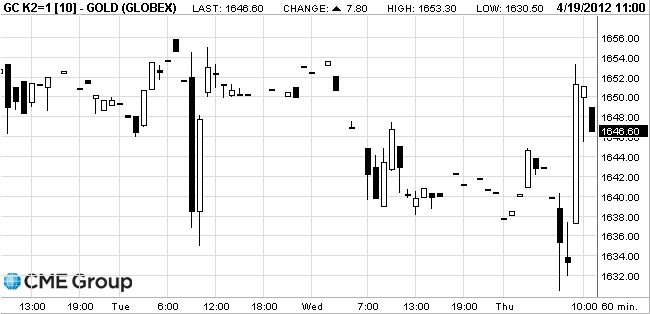

The price of gold rising after the fall of the previous day, due to weak demand for physical precious metals. Investors remained concerned about the decline in demand for gold from the main consumers of this precious metal - India and China, although the price of gold does not exceed the level recorded at the beginning of the year.

On Thursday, it was reported that as of April 18 the amount of precious metal stocks the world's largest gold fund SPDR Gold Shares ETF has not been changed six consecutive sessions and remained at 1.28 tons.

At the same time, investors' attention on Thursday focused on the auction two-year and ten-year government bonds in Spain totaling 2.5 billion euros. The increased interest in this location due to the fact that earlier this week, ten-year government bond yield of the country exceeded the psychological mark of 6%.

It was learned that the Spanish Government has successfully placed two-year and ten-year government bonds worth 2.541 billion euros - a little above the target range.Spain's Ministry of Finance planned to sell the government bonds of 1.5-2.5 billion euros.

In particular, it has a decade of debt securities to 1.425 billion euros. Yield was 5.743%, demand exceeded supply by 2.42 times. At the previous auction of ten-year government bonds interest rate was at around 5.403%, demand exceeded supply by 2.17 times.

The authorities also offered debt securities to investors with a maturity of two years amounting to 1.116 billion euros. Yield was 3.463%, demand exceeded supply by 3.28 times.

May futures on the COMEX for gold today rose to $ 1653.3 an ounce.

Resistance 3:1420 (4 years high)

Resistance 2:1397 (Apr 5 high)

Resistance 1:1388 (Apr 13 and 17 highs, session high)

Current price: 1377,25

Support 1:1374/70 (МА (200) for Н1, resistance line from Apr 2 broken earlier)

Support 2:1357/60 (area of Apr 16-17 lows and support line from Mar 6)

Support 3:1352 (Apr 10 low)

EUR/USD $1.2950, $1.2985, $1.3025, $1.3070, $1.3100, $1.3210

USD/JPY Y81.00, Y81.15, Y81.25, Y81.50

USD/CHF Chf0.9150, Chf0.9250

GBP/USD $1.6000, $1.5990, $1.5960, $1.5900

EUR/JPY Y106.25, Y105.00

AUD/USD $1.0300, $1.0415, $1.0435, $1.0450

EUR/GBP stg0.8175, stg0.8200

U.S. stock futures were little changed, paring earlier gains, as higher-than-forecast jobless claims and concern over Europe’s debt crisis offset better-than- expected earnings from Bank of America Corp. (BAC) and Morgan Stanley.

Global Stocks:

Nikkei 9,588.38 -78.88 -0.82%

Hang Seng 20,995.01 +214.28 +1.03%

Shanghai Composite 2,378.63 -2.21 -0.09%

FTSE 5,763.52 +18.23 +0.32%

CAC 3,214.01 -26.28 -0.81%

DAX 6,714.04 -17.99 -0.27%

Crude oil: $102.50 (-0.17%).

Gold: $1643.40 (+0.23%).

Bank of America (BAC): Q1 EPS of $0.31 vs cons $0.11. Revenue of $22.5B (-10% Y/Y) misses by $500M. Shares of BAC +3.36% premarket.

DuPont (DD): Q1 EPS of $1.61 vs cons $1.55. Revenue of $11.2B (+11.9% Y/Y) in-line. Shares of DD +0.13% premarket.

Verizon (VZ): Q1 EPS of $0.59 vs cons $0.58. Revenue of $28.2B (+4.6% Y/Y) in-line. Shares +0.90% premarket.

The euro fell against the dollar as concern European nation’s ability to fund debt damped demand for the shared currency.

The euro fell as yields on Spanish 10-year benchmark bonds and French five-year debt rose at auctions.

The pound rose against the euro amid speculation the Bank of England will pause its stimulus program next month.

EUR/USD: the pair showed high in $1,3170 area then decreased below $1,3100.

GBP/USD: the pair tested resistance in $1.6060 area then receded in $1,6020 area.

USD/JPY: the pair grown in Y81,50 area.

There is a raft of US data due at 1400GMT, including NAR existing home sales, the latest leading indicators and also the Philadelphia Fed Survey. Late US data then sees the 2030GMT release of M2 money supply data.

GBP/USD

Offers $1.6150, $1.6120/30, $1.6095/100, $1.6080/85

Bids $1.6015/00, $1.5980, $1.5965/60, $1.5950/40, $1.5920

USD/JPY

Offers Y82.50/60, Y82.30/35, Y81.90/00, Y81.74/75

Bids Y81.30/10, Y80.75/70, Y80.55/50, Y80.30

AUD/USD

Offers $1.0555/60, $1.0490/00, $1.0460/65, $1.0450/55, $1.0430/35, $1.0400

Bids $1.0340/35, $1.0300, $1.0275/70, $1.0255/50

EUR/JPY

Offers Y108.60/65, Y108.35/40, Y107.80/85, Y107.45/50

Bids Y106.55/50, Y106.20/10, Y106.00, Y105.80

EUR/GBP

Offers stg0.8320/25, stg0.8300, stg0.8275/80, stg0.8265/70, stg0.8255/60, stg0.8220, stg0.8200

Bids stg0.8155/50, stg0.8145/40, stg0.8120

Resistance 3: Y82.55 (Apr 6 high)

Resistance 2: Y82.15 (МА (200) for Н4)

Resistance 1: Y81.90 (Apr 10 high)

Current price: Y81.63

Support 1: Y81.55 (earlier resistance, Apr 18 high)

Support 2: Y81.10/00 (resistance line from Apr 2 broken earlier, МА (200) for Н1)

Support 3: Y80.30/20 (area of Feb 29, Apr 16-17 lows)

Resistance 3: Chf0.9340 (high of March)

Resistance 2: Chf0.9250 (Apr 16 and Mar 16 highs)

Resistance 1: Chf0.9210 (Apr 18 high)

Current price: Chf0.9192

Support 1: Chf0.9170 (МА (200) for Н1)

Support 2: Chf0.9130 (area of session low and Apr 17 low)

Support 3: Chf0.9090 (Apr 12 low)

Resistance 3 : $1.6280 (resistance line from Apr’2011)

Resistance 2 : $1.6170 (high of October)

Resistance 1 : $1.6060/80 (area of highs of April)

Current price: $1.6030

Support 1 : $1.6000 (earlier resistance, psychological level)

Support 2 : $1.5940 (resistance line from Apr 2 broken earlier)

Support 3 : $1.5890 (Apr 18 low)

Resistance 3 : $1.3250 (Mar 29 low)

Resistance 2 : $1.3210 (Apr 12 high)

Resistance 1 : $1.3170 (session high, Apr 17 high)

Current price: $1.3120

Support 1 : $1.3110/00 (session low, МА (200) for Н1)

Support 2 : $1.3060 (Apr 18 low)

Support 3 : $1.3000 (Apr 16 low, low of March, psychological level)

EUR/USD $1.2950, $1.2985, $1.3025, $1.3070, $1.3100, $1.3210

USD/JPY Y81.00, Y81.15, Y81.25, Y81.50

USD/CHF Chf0.9150, Chf0.9250

GBP/USD $1.6000, $1.5990, $1.5960, $1.5900

EUR/JPY Y106.25, Y105.00

AUD/USD $1.0300, $1.0415, $1.0435, $1.0450

EUR/GBP stg0.8175, stg0.8200

Most Asian stocks fell as bad loans held by Spanish banks surged ahead of European bond sales today, damping investor confidence. Losses were limited amid speculation China will ease its monetary policy to spur growth.

Nikkei 225 9,588.38 -78.88 -0.82%

Hang Seng 20,962.95 +182.22 +0.88%

S&P/ASX 200 4,362.73 +14.07 +0.32%

Shanghai Composite 2,378.63 -2.21 -0.09%

Esprit Holdings Ltd., a clothier that depends on Europe for about 80 percent of its sales, declined 3.3 percent in Hong Kong.

Nippon Sheet Glass Co. headed for its lowest close since 1976 in Tokyo after Chief Executive Officer Craig Naylor quit over a disagreement with the Japanese company’s board.

OCI Co. fell 2.2 percent in Seoul after operating profit at the chemicals maker declined.

Wynn Macau Ltd. gained 3.4 percent in Hong Kong after a report the casino operator may sign a land contract to build a second resort in Macau.

Sold E1.12bln of 3.30% Oct 2014; bid-to-cover 3.29

Sold E1.425bln of 5.85% Jan 2022 , bid-to-cover 2.42.

22:00 New Zealand ANZ Job Advertisements (MoM) March +5.3% -1.0%

22:30 Japan BOJ Governor Shirakawa Speaks -

22:45 New Zealand CPI, q/q Quarter I -0.3% +0.6% +0.5%

22:45 New Zealand CPI, y/y Quarter I +1.8% +1.6% +1.6%

23:50 Japan Adjusted Merchandise Trade Balance, bln March -313.2 -446.3 -621.3

01:30 Australia NAB Quarterly Business Confidence Quarter I 1 -1

The yen declined versus most of its 16 major counterparts as Bank of Japan officials signaled they’ll add to easing efforts to weaken the currency and help return the nation to an export surplus. The yen fell for a third day against the dollar as a report showed Japan had a trade deficit last month after an unexpected surplus in February. Japan reported a trade shortfall of 82.6 billion yen ($1 billion) in March from a revised surplus of 29.4 billion yen in the previous month. The prediction in a Bloomberg News survey was for a 223.2 billion yen deficit.

The euro held losses versus the greenback before Spain, the currency union’s fourth-biggest economy, sells bonds amid debt contagion concerns. Spain and France plan to raise as much as 13.5 billion euros ($17.6 billion) in debt today as Prime Minister Mariano Rajoy’s struggles to meet deficit targets and the French presidential elections drive up yields. Spain is issuing as much as 2.5 billion euros in two- and 10-year bonds, while France has set a maximum target of 11 billion euros for securities including 2017 notes and 2018 inflation-linked debt. Spain’s borrowing costs rose at a sale of one-year and 18-month bills for the first time since November on April 17.

The so-called Aussie and kiwi dollars rose against the yen after Xinhua News Agency said China will boost liquidity by cutting reserve requirements if necessary, citing an unidentified central bank official. China is Australia’s biggest trading partner and New Zealand’s second-largest export market.

EUR/USD: during the Asian session the pair traded in a range $1.3105-$1.3130.

GBP/USD: during the Asian session the pair traded in a range $1.6010-$1.6035.

USD/JPY: during the Asian session the pair gain to a yesterday's high.

In Europe at 1400GMT, the Eurozone flash consumer climate data for April is also due. US data starts at 1230GMT when weekly jobless claims are expected to fall 10,000 to 366,000 in the April 14 employment survey week. There is a raft of US data due at 1400GMT, including NAR existing home sales, the latest leading indicators and also the Philadelphia Fed Survey. Late US data then sees the 2030GMT release of M2 money supply data.

Yesterday the yen weakened for a second day against all of its 16 most-traded counterparts after the Bank of Japan suggested more stimulus may be needed even as global economic growth accelerates. The dollar gained to a one-week high versus the yen as Bank of Japan Deputy Governor Kiyohiko Nishimura said the central bank is ready to implement additional easing. The Japanese currency dropped the most against the pound after Nishimura said it’s vital to make efforts to support upward momentum toward an economic recovery. The BOJ is “committed to implementing additional easing measures, if deemed necessary,” he said in a speech in Okayama, western Japan.

Euro fell against the dollar amid growing profitability of peripheral bonds. Thus, the yield on 10-year bond 5.87% Spain 5.71% against the previous. A yield of 10-year bonds of Italy 5.52% against 5.40% earlier. Also, pressure on the single currency was the fact that Italy has revised forecast for growth. According to the statement, the growth in 2012 will decrease by 1.2% against the previous estimate of -0.5%. In 2013 the economic growth of 0.5% against the previous forecast of 0.3%.

The pound rose after Bank of England minutes showed policy maker Adam Posen ended a push for more stimulus. The pound advanced for a second day versus the euro after minutes of the Bank of England’s April 4-5 meeting published today showed Posen joined the majority of the nine-member Monetary Policy Committee in seeking no change to the 325 billion-pound ($517 billion) asset-purchase target. While officials said the U.K. may face a recession in the first half of this year, they also said inflation might pose more of a danger than previously anticipated.

EUR/USD: yesterday in first half of day the pair decreased, however could will be restored later.

GBP/USD: yesterday the pair gain, fixed above $1.6000.

USD/JPY: yesterday the pair rose to Y81.50.

In Europe at 1400GMT, the Eurozone flash consumer climate data for April is also due. US data starts at 1230GMT when weekly jobless claims are expected to fall 10,000 to 366,000 in the April 14 employment survey week. There is a raft of US data due at 1400GMT, including NAR existing home sales, the latest leading indicators and also the Philadelphia Fed Survey. Late US data then sees the 2030GMT release of M2 money supply data.

Asian stocks rose, with the regional benchmark index headed for its biggest gain this month, after the International Monetary Fund raised global economic forecasts and Spain sold more debt than targeted, boosting the earnings outlook for exporters.

Nikkei 225 9,667.26 +202.55 +2.14%

Hang Seng 20,777.39 +215.08 +1.05%

S&P/ASX 200 4,348.66 +59.88 +1.40%

Shanghai Composite 2,380.88 +45.86 +1.96%

Toyota Motor Corp., Asia’s biggest carmaker by market value, gained 2.8 percent in Tokyo. OCI Co., a maker of materials used in solar panels, advanced 4.7 percent in Seoul on speculation oversupply in the industry may ease as companies consolidate and restructure.

BHP Billiton Ltd. rose 2.5 percent in Sydney after commodity prices gained and the miner’s iron-ore production rose.

CSR Corp., a Chinese trainmaker, increased 4.6 percent in Hong Kong after a report it won orders from Hong Kong.

European stocks declined as Bank of England policy maker Adam Posen ended his support for more stimulus and bad loans surged in Spain.

Posen ended his push for further Bank of England stimulus, joining the majority of the nine-member Monetary Policy Committee in seeking no change to the 325 billion-pound ($517 billion) asset-purchase target, according to minutes of their April 4-5 meeting published today in London.

Non-performing loans for Spanish banks as a proportion of total lending jumped to 8.16 percent in February, the highest level since 1994, from less than 1 percent in 2007, according to Bank of Spain data. The total credit in the economy that the regulator lists as “doubtful” reached 143.8 billion euros.

National benchmark indexes fell in 15 of the 18 western- European markets. France’s CAC 40 Index declined 1.6 percent and the U.K.’s FTSE 100 Index slid 0.4 percent. Germany’s DAX Index lost 1 percent. Spain’s IBEX 35 Index retreated 4 percent to its lowest since March 2009.

Santander, Spain’s largest bank, dropped 4 percent to 4.81 euros. Banco Popular Espanol SA fell 3.2 percent to 2.39 euros. CaixaBank slid 3.5 percent to 2.60 euros. A gauge of European bank shares was the second-worst performer of the 19 industry groups on the Stoxx 600.

Repsol dropped 6.2 percent to 15.40 euros. Argentina rejected its demand for $10.5 billion in compensation after President Cristina Fernandez de Kirchner seized its YPF SA unit, saying it hasn’t invested enough in the South American country.

Iberdrola dropped 7.9 percent to 3.59 euros, its lowest since November 2003, after Actividades de Construccion & Servicios SA sold a 3.7 percent stake in Spain’s biggest power company to cut debt. ACS tumbled 6.1 percent to 16.45 euros as it said the stake sale will reduce its earnings by 540 million euros.

Statoil Fuel & Retail soared 51 percent to 52.60 kroner. Alimentation Couche-Tard offered to buy the company for 53 kroner per share, valuing it at 15.9 billion kroner ($2.8 billion). The offer represents a 53 percent premium for Scandinavia’s biggest gas-station operator, the Laval, Canada- based company said in a statement today. Statoil ASA (STL), Norway’s biggest oil producer, has agreed to sell its 54 percent stake in the company.

BHP Billiton added 0.9 percent to 1,943 pence, gaining for a third day. The world’s largest mining company said third- quarter iron ore production rose 14 percent as it expands its mines and port in Australia.

Heineken NV advanced 2.5 percent to 43.35 euros after reporting first-quarter revenue of 3.83 billion euros, beating analysts’ estimates of 3.74 billion euros.

U.S. stocks fell, after the biggest advance in more than a month for the Standard & Poor’s 500 Index, as Intel Corp. and International Business Machines Corp. drove a slump in technology shares after reporting results.

Stocks fell as Intel forecast gross margin that was lower than some analysts predicted and IBM’s sales missed forecasts. The S&P 500 had risen 11 percent in 2012 through yesterday on better-than-estimated economic and corporate data. Equities also dropped as Bank of England policy makers said inflation may be higher than forecast. Spain will auction 3.3 percent two-year notes and 5.85 percent 10-year debt tomorrow.

Intel (INTC) slumped 1.8 percent to $27.95, while IBM retreated 3.5 percent to $200.13. IBM’s revenue climbed 0.3 percent to $24.7 billion in the period, while Intel sales rose 0.5 percent to $12.9 billion. That was the smallest increase for either company since the third quarter of 2009, when the U.S. economy was just emerging from recession. Even so, Intel predicted a pickup in sales for the current quarter.

Berkshire Hathaway Class A shares lost 1.3 percent to $119,750 even after Buffett said his condition is “not remotely life threatening.” The 81-year-old billionaire will begin a two-month treatment of daily radiation in July, he said. The regimen will restrict his travel during the period and not otherwise change his daily routine, said Buffett, who is chief executive officer of the Omaha, Nebraska-based company.

Genworth Financial Inc. tumbled 24 percent, the most since November 2008, to $5.87. The IPO is now planned for early 2013, after the company previously targeted the offering for the second quarter of this year, the insurer said late yesterday in a statement. Genworth has said it plans to sell as much as 40 percent of the unit.

Yahoo! Inc. advanced 3.2 percent to $15.49 after reporting first-quarter sales that topped estimates, fueling optimism that a turnaround effort by Chief Executive Officer Scott Thompson may take hold.

Halliburton Co. added 4.6 percent to $34.17. The world’s largest provider of hydraulic fracturing services said first- quarter profit increased as rising crude prices drove producers to expand drilling in North America.

Resistance 3: Y82.55 (Apr 6 high)

Resistance 2: Y81.85 (Apr 10 high)

Resistance 1: Y81.55 (session high)

The current price: Y81.35

Support 1: Y81.15 (session low)

Support 2: Y80.85 (Apr 18 low)

Support 3: Y80.30 (Apr 16 low)

Resistance 3: Chf0.9250 (Apr 16 high)

Resistance 2: Chf0.9210 (Apr 18 high)

Resistance 1: Chf0.9180 (Apr 17 high)

The current price: Chf0.9166

Support 1: Chf0.9150 (low of the American session on Apr 18)

Support 2: Chf0.9120 (Apr 17 low)

Support 3: Chf0.9090 (Apr 12 low)

Resistance 3 : $1.6130 (Nov 8 high)

Resistance 2 : $1.6090 (Nov 11-14 high)

Resistance 1 : $1.6040 (Apr 18 high)

The current price: $1.6022

Support 1 : $1.6010 (session low)

Support 2 : $1.5960/70 (area of Apr 13-17 highs)

Support 3 : $1.5910 (Apr 16 high)

Resistance 3 : $1.3215 (Apr 12 high)

Resistance 2 : $1.3175 (Apr 17 high)

Resistance 1 : $1.3135 (high of the American session on Apr 18)

The current price: $1.3113

Support 1 : $1.3105 (low of the American session on Apr 17)

Support 2 : $1.3055 (Apr 18 low)

Support 3 : $1.3030 (Apr 9 low)

Change % Change Last

Oil $102.71 +0.04 +0.04%

Gold $1,642.70 +3.10 +0.19%

Change % Change Last

Nikkei 225 9,667.26 +202.55 +2.14%

Hang Seng 20,777.39 +215.08 +1.05%

S&P/ASX 200 4,348.66 +59.88 +1.40%

Shanghai Composite 2,380.88 +45.86 +1.96%

FTSE 100 5,745.29 -21.66 -0.38%

CAC 40 3,240.29 -52.22 -1.59%

DAX 6,732.03 -68.97 -1.01%

Dow 13,032.75 -82.79 -0.63%

Nasdaq 3,031.45 -11.37 -0.37%

S&P 500 1,385.14 -5.64 -0.41%

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,3118 -0,07%

GBP/USD $1,6016 +0,57%

USD/CHF Chf0,9160 +0,10%

USD/JPY Y81,28 +0,49%

EUR/JPY Y106,62 +0,42%

GBP/JPY Y130,17 +1,04%

AUD/USD $1,0355 -0,40%

NZD/USD $0,8156 -0,71%

USD/CAD C$0,9910 +0,11%

01:30 Australia NAB Quarterly Business Confidence Quarter I 1

12:30 U.S. Initial Jobless Claims 14.04.2012 380 370

14:00 Eurozone Consumer Confidence April -19.1 -19.0

14:00 U.S. Existing Home Sales March 4.59 4.62

14:00 U.S. Philadelphia Fed Manufacturing Survey April 12.5 12.1

14:00 U.S. Leading Indicators March +0.7% +0.2%

18:00 United Kingdom MPC Member Posen Speaks -

23:50 Japan Tertiary Industry Index February -1.7% +0.8%

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.