- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

European stocks fell to a three- month low as manufacturing contracted in the euro area and China and as Dutch Prime Minister Mark Rutte offered to resign after struggling to clinch an austerity deal.

Euro-area services and manufacturing contracted more than estimated in April, to a five-month low. A composite index based on a survey of purchasing managers in both industries fell to 47.4 from 49.1 in March, London-based Markit Economics said in an initial estimate. Chinese manufacturing also shrank for a sixth month in April, according to a survey of companies. The 49.1 preliminary reading of the purchasing managers’ index from HSBC Holdings Plc and Markit today compared with a final 48.3 the previous month.

In the Netherlands, Rutte offered his Cabinet’s resignation after one of the parties in his minority coalition withdrew support. Queen Beatrix will consider the resignation, the government’s information service said. Elsewhere, French President Nicolas Sarkozy became the first incumbent since 1958 not to win the first round of the nation’s election.

National benchmark indexes dropped in all of 18 western European markets except Iceland. The Netherlands’ AEX declined 2.6 percent to the lowest level this year. France’s CAC 40 lost 2.8 percent, the U.K.’s FTSE 100 slid 1.9 percent and Germany’s DAX retreated 3.4 percent. Sweden’s OMX tumbled 4.6 percent, the biggest drop since September.

A gauge of auto-industry companies was the second-worst performer among the 19 industry groups in the Stoxx 600, tumbling 3.7 percent. Daimler AG lost 4.2 percent to 39.50 euros, Bayerische Motoren Werke AG, which today said it expects the pace of sales growth in China to ease, fell 4.1 percent to 67 euros and Renault SA sank 5.1 percent to 33.70 euros.

Basic-resource companies also retreated. ArcelorMittal, the world’s largest steelmaker, dropped 5.3 percent to 12.25 euros. Vedanta Resources Plc declined 5.7 percent to 1,167 pence and Antofagasta Plc slid 3.2 percent to 1,140 pence.

Philips limited losses in Amsterdam, rallying 3.3 percent to 14.82 euros, after the world’s biggest light-bulb maker reported profit that beat analysts’ estimates after cutting costs and selling assets.

Cable & Wireless Worldwide Plc jumped 12 percent to 35.9 pence after Vodafone Group Plc agreed to buy the U.K. company for 1.04 billion pounds ($1.7 billion). The world’s largest wireless operator offered 38 pence a share after India’s Tata Communications Ltd. last week failed to agree on a price.

The euro fell for the first time in five days against the yen amid concern French presidential elections and Dutch government turmoil will disrupt efforts to stem the region’s sovereign-debt crisis. In France, Hollande won 28.6 percent of the vote yesterday, versus 27.2 percent for Sarkozy, the interior ministry said in Paris. The anti-euro National Front, led by Marine Le Pen, got 18.1 percent of the vote. The second ballot is on May 6. Netherlands Prime Minister Mark Rutte offered to quit, a move that would trigger early elections, after losing the support of Geert Wilders’s Freedom Party over a disagreement on budget cuts needed to steer the nation clear of the debt crisis. Queen Beatrix will consider the offer, the government information service said. The 17-nation currency stayed weaker after London-based Markit Economics said today a euro-area composite index based on a survey of manufacturing and services purchasing managers dropped to 47.4 in April from 49.1 in March. A reading below 50 indicates contraction.

The yen rose against all of its 16 most-traded peers as France’s Socialist challenger Francois Hollande, who has called for more European Central Bank action, captured more of the first-round presidential ballot than incumbent Nicolas Sarkozy, boosting demand for haven assets.

The U.S. dollar gained versus most major peers on bets that data tomorrow will show the U.S. economy is growing, reducing chances the Federal Reserve will expand monetary easing. The government may say new-home purchases rose 1.6 percent in March.

U.S. stocks fell, joining a global slump, as Dutch Prime Minister Mark Rutte offered to quit after lawmakers split over austerity plans and French President Nicolas Sarkozy lost the first round of his re-election bid.

Equities from Hong Kong to Paris and Sao Paulo slumped as the Dutch prime minister offered his cabinet’s resignation today after losing the Freedom Party’s support over the weekend on disagreements about an austerity package. French President Sarkozy and challenger Francois Hollande threw themselves into the second round of election, vying to lead a country split over tackling immigration and ending a sovereign debt crisis.

Concern about the global economy grew as euro-area services and manufacturing declined more than estimated, while data indicated China’s production will contract for a sixth month.

Dow 12,892.16 -137.10 -1.05%, Nasdaq 2,965.88 -34.57 -1.15%, S&P 500 1,364.68 -13.85 -1.00%

American banks joined a 3 percent drop in a gauge of European lenders. Bank of America (ВАС) declined 2 percent to $8.19. Citigroup decrease 2.3 percent to $33.11.

Wal-Mart (WMT) slumped 4.9 percent, the most in the Dow, to $59.38. Its probe of possible bribery in Mexico may prompt executive departures and steep U.S. government fines if it reveals senior managers knew about the payments and didn’t take strong enough action, corporate governance experts said.

Kellogg tumbled 5.4 percent to $51.08. Earnings per share, including the impact of its acquisition of Pringles potato chips, will be $3.18 to $3.30 for the year, the Battle Creek, Michigan-based company said today in a statement. Kellogg previously predicted $3.25 to $3.37 a share. Analysts projected $3.48, the average of estimates compiled by Bloomberg.

Apple Inc., which reports results tomorrow, dropped 0.6 percent to $569.69. On average, the analysts estimate fiscal second-quarter earnings of $9.96 a share.

Xerox Corp. added 1.9 percent to $8.02. The provider of printers and business services reported first-quarter earnings that exceeded analysts’ estimates after businesses and governments farmed out more tasks to cut costs.

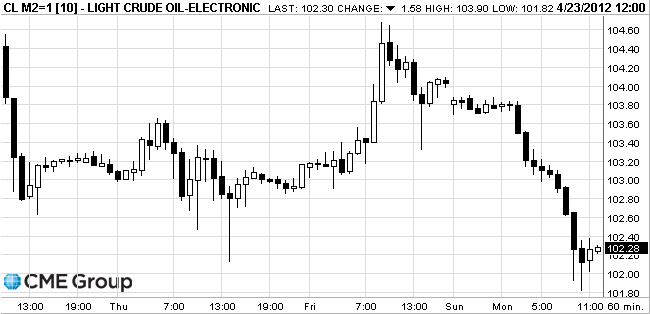

Oil declined the most in two weeks as manufacturing shrank in China and the euro-area, bolstering concern that fuel consumption will diminish.

Futures fell as much as 2 percent after China’s economy contracted for a sixth month in April, according to a preliminary reading of a purchasing managers’ index. Euro-area services and manufacturing output slipped.

Chinese manufacturing may contract this month, according to a preliminary reading of the purchasing managers index for China by HSBC Holdings Plc and Markit Economics. It came in at 49.1 for April, compared with a final 48.3 in March. A number below 50 points to a contraction.

A euro-area composite index based on a survey of purchasing managers in services and manufacturing fell to 47.4, a five- month low, from 49.1 in March, London-based Markit Economics said in an initial estimate today.

Crude oil for June delivery decreased to $101.82 a barrel on the New York Mercantile Exchange. Futures have declined 9 percent in the past year.

Brent oil for June settlement dropped 94 cents, or 0.8 percent, to $117.82 a barrel on the London-based ICE exchange. The European benchmark contract was at a premium of $15.61 to New York futures, up from $14.88 on April 20.

Gold prices on Monday is reduced considerably after the strengthening of the dollar against most world currencies caused a reduction in demand for the metal as an investment alternative.

The dollar to a basket of six currencies of countries - major trade partners of the U.S. grew by 0.44% to 79.66 points on the background of weak macroeconomic data in Europe and China, which have increased concerns about global economic outlook.

On Monday, it became known that the PMI index in China's industry, calculated by HSBC, according to the original estimate, rose in April to 49.1 points from 48.3 points in March. Despite the positive trend, the indicator for six consecutive months is below 50, which means a decline in the sector.

Investors remained concerned about the unstable economic situation in the euro area.On Monday, fears of bidders increased after it became known that the composite index of business activity in the industrial and service sectors for the 17 euro zone countries, according to preliminary estimates, in April fell to their lowest in five months in the value of 47.4 points from 49.1 points in March. These differed from the forecasts of analysts who had expected growth rate to 49.3 points.

At the same time, the appreciation of the dollar affects the political instability in some countries in Europe. Thus, the Prime Minister of the Netherlands Mark Rutte on Monday resigned after unsuccessful negotiations with the opposition on the budget in 2013 and possible measures to overcome the crisis.

Investors also continue to monitor the presidential elections in France. In the first round of the representative of the Socialist Party, Francois Hollande and the current president, the leader of the ruling "Union for a Popular Movement," Nicolas Sarkozy in the second round with 28.63% and 27.18% of the vote respectively.

However, a little optimism in the market on Monday brought news that the resulting increase in reserves of the International Monetary Fund has managed to attract an additional 430 billion dollars.

May gold futures on the COMEX fell today to $ 1624.4 an ounce.

Resistance 3:1373 (МА (200) for Н1, session high)

Resistance 2:1365 (Apr 19 low)

Resistance 1:1360 (earlier support, area Apr 16-17 lows)

Current price: 1355,75

Support 1:1352 (Apr 10 low)

Support 2:1338 (low of March)

Support 3:1334 (Feb 10 and 16 lows)

EUR/USD $1.3200, $1.3100, $1.2900

USD/JPY Y80.00, Y81.50, Y82.00

GBP/USD $1.6200, $1.6000

EUR/JPY Y106.00

AUD/USD $1.0400

EUR/GBP stg0.8200, stg0.8175

U.S. stock futures fell after data showed that manufacturing shrank in the euro-area and China while concern grew about Europe’s sovereign debt crisis.

Global Stocks:

Nikkei 9,542.17 -19.19 -0.20%

Hang Seng 20,624.39 -386.25 -1.84%

Shanghai Composite 2,388.59 -18.28 -0.76%

FTSE 5,673.79 -98.36 -1.70%

CAC 3,118.74 -69.84 -2.19%

DAX 6,559.92 -190.20 -2.82%

Crude oil: $102.66 (-1.17%)

Gold: $1628.50 (-0.87%)

EUR/USD

Offers $1.3300/15, $1.3280, $1.3230/50

Bids $1.3130/20, $1.3100, $1.3085/80, $1.3050

GBP/USD

Offers $1.6220/25, $1.6200, $1.6175, $1.6150, $1.6100/10

Bids $1.6075, $1.6050/40, $1.6010/00

AUD/USD

Offers $1.0430/35, $1.0400, $1.0380/90, $1.0345/50

Bids $1.0275/70, $1.0255/50, $1.0225, $1.0200, $1.0150

EUR/JPY

Offers Y108.35/40, Y107.75/80, Y107.40/45, Y107.25/30, Y106.85/90

Bids Y106.20/00, Y105.90/85, Y105.70/65, Y105.50, Y105.30/25, Y105.00

USD/JPY

Offers Y82.30/35, Y81.90/00, Y81.65/70, Y81.30/35

Bids Y80.80, Y80.55/50, Y80.30, Y80.00

EUR/GBP

Offers stg0.8300, stg0.8275/80, stg0.8265/70, stg0.8255/60, stg0.8220, stg0.8200/10

Bids stg0.8155/50, stg0.8145/40, stg0.8120, stg0.8050

Resistance 3: Y82.55 (Apr 6 high)

Resistance 2: Y81.80/90 (Apr 10 and 20 highs)

Resistance 1: Y81.40 (intraday high)

Current price: Y81.09

Support 1: Y81.00 (session low)

Support 2: Y80.85 (61,8 % FIBO Y80,30-Y81,80)

Support 3: Y80.30/20 (area of Febr 29, Apr 16-17 lows)

Resistance 3: Chf0.9250 (high of April)

Resistance 1: Chf0.9210 (Apr 18 high)

Resistance 1: Chf0.91500 (session high, МА (200) for Н1)

Current price: Chf0.9143

Support 1: Chf0.9080 (Apr 20 low)

Support 2: Chf0.9000 (area of April and March lows, psychological level)

Support 3: Chf0.8930 (low of February)

Resistance 3 : $1.6200 (area of Sep 6 high)

Resistance 2 : $1.6170 (high of October)

Resistance 1 : $1.6100 (intraday low)

Current price: $1.6084

Support 1 : $1.6080 (area of session low and Apr 19 high)

Support 2 : $1.6000 (Apr 20 low)

Support 3 : $1.6000 (area of Apr 19 low)

Resistance 3 : $1.3250 (Mar 29 low)

Resistance 2 : $1.3210/30 (Apr 12 and 20 highs)

Resistance 1 : $1.3160 (intraday high)

Current price: $1.3148

Support 1 : $1.3130 (session low, МА (200) for Н1, support line from Apr 16)

Support 2 : $1.3060 (area of Apr 18-19 lows)

Support 3 : $1.3000 (Mar 15 and Apr 16 lows)

EUR/USD $1.3200, $1.3100, $1.2900

USD/JPY Y80.00, Y81.50, Y82.00

GBP/USD $1.6200, $1.6000

EUR/JPY Y106.00

AUD/USD $1.0400

EUR/GBP stg0.8200, stg0.8175

Asian stocks fell, with the regional benchmark index heading for a third straight daily decline, after companies from Daewoo Engineering & Construction Co. to Tokyo Steel Manufacturing Co. posted weaker earnings and a report China’s manufacturing may shrink for a sixth month.

Nikkei 225 9,542.17 -19.19 -0.20%

Hang Seng 20,728.51 -282.13 -1.34%

S&P/ASX 200 4,352.4 -14.10 -0.32%

Shanghai Composite 2,388.59 -18.28 -0.76%

Daewoo Engineering dropped 4.4 percent in Seoul after the construction company posted a 38 percent drop in first-quarter operating profit. Tokyo Steel slumped 7.6 percent as the steelmaker’s full-year loss widened. China Mobile Ltd., the world’s biggest carrier by subscribers, fell 2.2 percent in Hong Kong after posting first-quarter net income that missed analysts’ estimates.

01:30 Australia Producer price index, q / q Quarter I +0.3% +0.6% -0.3%

01:30 Australia Producer price index, y/y Quarter I +2.9% +2.2% +1.4%

02:30 China HSBC Manufacturing PMI (preliminary) April 48.3 49.1

The yen rose as incumbent Nicolas Sarkozy and Socialist challenger Francois Hollande made it to the final round of France’s presidential elections amid concern Europe is failing to contain the region’s debt crisis.

Demand for the dollar was supported on the prospect reports tomorrow will show the U.S. economy is gaining momentum, reducing the likelihood the Federal Reserve will expand monetary easing. The Fed will release a statement on monetary policy along with its projections for growth, unemployment and inflation on April 25. All 76 economists surveyed by Bloomberg predict the central bank will keep its benchmark rate in a range of zero to 0.25 percent at the meeting.

The so-called Aussie dollar declined against all 16 of its major peers after Australia’s producer price index dropped 0.3 percent in the January-to-March period from the prior quarter, when it gained 0.3 percent, the Bureau of Statistics said in Sydney today. The index was forecast to climb 0.4 percent, according to the median estimate in a Bloomberg News survey.

A Credit Suisse Group AG index based on swaps indicates traders are betting the Reserve Bank of Australia will lower rates by 98 basis points over the next 12 months. That compares with 38 basis points indicated on March 20.

EUR/USD: during the Asian session the pair decreased.

GBP/USD: during the Asian session the pair fell.

USD/JPY: during the Asian session the pair receded from week's high.

European data starts at 0600GMT with German Construction Orders, while this morning also sees the flash Manufacturing/services PMI

releases for the core-European states, including France at 0658GMT,Germany at 0728GMT and the main EMU release at 0758GMT. UK data at 0830GMT sees Bank of England Trends in Lending and CML Gross Mortgage Lending data. At 1745GMT, Treasury Secretary Tim

Geithner and other the other five Social Security trustees issue the annual report with updated projections of Trust Fund benefits schedule. US data at 1900GMT then sees Treasury Allotments by Class data.

On Monday the euro touched the lowest level against the yen since February as Spanish bond yields touched a 2012 high after a minister called on the European Central Bank to do more to stem debt-market turmoil. The euro slid against the yen after the cost of insuring Spain’s debt reached a record and Jaime Garcia-Legaz, the nation’s deputy economy minister, said in an interview on April 13 that the ECB should “step up purchases of bonds.” The dollar rose earlier versus most major counterparts as data showed U.S. consumer purchases rose last month, damping speculation the Federal Reserve will add to monetary easing.

On Tuesday the yen fell versus all of its 16 most-traded peers as a report showing German investor confidence rose to a two-year high fueled appetite for riskier assets. The ZEW Center for European Economic Research in Mannheim said its index of investor and analyst expectations, which is designed to predict economic developments six months in advance, increased to 23.4 from 22.3 in March. That’s the highest since June 2010. The euro was buoyed against the yen as increased demand at Spanish debt sales eased concern Europe’s sovereign- debt crisis is worsening.

On Wednesday the pound rose after Bank of England minutes showed policy maker Adam Posen ended a push for more stimulus. Euro fell against the dollar amid growing profitability of peripheral bonds. Thus, the yield on 10-year bond 5.87% Spain 5.71% against the previous.

On Thursday the yen fell against most of its major counterparts as Bank of Japan officials signaled they’ll keep acting to stem its strength to spur economic growth. The Bank of Japan is “committed” to monetary easing, Governor Masaaki Shirakawa said yesterday in a speech in New York. Europe’s shared currency fluctuated versus the dollar after yields on Spanish 10-year benchmark bonds and French five-year debt increased at auctions. Spain sold 2.54 billion euros ($3.33 billion) of two- and 10-year securities and France raised 10.5 billion euros in debt out of an 11 billion-euro goal.

On Friday the euro touched its strongest level in two weeks versus the dollar after German business confidence unexpectedly increased to a nine-month high, fueling investor appetite for risk. The Munich-based Ifo institute said today its business climate index, based on a survey of 7,000 executives, rose to 109.9 this month from 109.8 in March. The 17-nation currency gained for a fourth day versus the yen amid bets the International Monetary Fund will increase its lending capacity to help keep Europe’s debt crisis contained. Governments are leaning toward committing more than $400 billion in fresh funding for the IMF to help it protect the world economy against more fiscal turmoil in Europe. The U.K., Australia and Singapore joined Japan, Denmark and Switzerland among the countries to rally this week to Managing Director Lagarde’s call for capacity beyond the current $380 billion. She told reporters she expected the IMF’s firepower to be “significantly” increased.

Stocks: Weekly’s review

Asian stocks fell for the fourth day this week, as the Group of 20 nations warned Europe’s debt crisis still threatens global growth, and as U.S. economic data signaled the recovery in the world’s largest economy is slowing.

Nikkei 225 9,561.36 -27.02 -0.28%

Hang Seng 20,982.61 -12.40 -0.06%

S&P/ASX 200 4,366.5 +3.77 +0.09%

Shanghai Composite 2,406.86 +28.23 +1.19%

Esprit Holdings Ltd., a clothier that depends on Europe for about 80 percent of its sales, fell 1 percent in Hong Kong.

James Hardie Industries SE, an Australian supplier of building materials that gets more than half of its sales from the U.S., slid 1.1 percent in Sydney.

LG Chem Ltd. sank 9.2 percent in Seoul after the chemical maker’s profit slumped.

JFE Holdings, Inc., the No. 2 Japanese steelmaker, slid 3.3 percent in Tokyo after a report it may increase borrowing for investment.

European stocks rose as German business confidence unexpectedly gained and U.S. companies from General Electric Co. to Schlumberger Ltd. reported earnings that beat estimates, offsetting higher yields on Spanish bonds.

In Germany, a report showed that business confidence unexpectedly rose to a nine-month high in April. The Ifo institute’s business climate index, based on a survey of 7,000 executives, increased to 109.9 from 109.8 in March. Economists had forecast a drop to 109.5, according to the median of 40 economists.

IMF Managing Director Christine Lagarde is seeking more than $400 billion in new reserves to increase a lending capacity of about $380 billion and this week won promises of support from Japan to Denmark.

FTSE 100 5,772.15 +27.60 +0.48%, CAC 40 3,188.58 +14.56 +0.46%, DAX 6,750.12 +78.90 +1.18%

A gauge of European banks was among the best performers of the 19 industry groups in the Stoxx 600. Deutsche Bank AG and Commerzbank AG, Germany’s largest lenders, gained 2 percent to 34.56 euros, and 2 percent to 1.63 euros, respectively.

BNP Paribas, France’s largest bank, gained 3.7 percent to 29.60 euros after Bank of America Corp. raised the stock to neutral, the equivalent of hold, from underperform. Societe Generale SA, the country’s second-biggest, also added 3.6 percent to 17.33 euros. It was upgraded to buy from neutral.

William Hill increased 4.4 percent to 278.5 pence, its highest price since May 2008. First-quarter net revenue jumped 12 percent from a year earlier, adding it remains “confident” in its expectations for the full year.

Home Retail Group Plc advanced 4.2 percent to 103.8 pence as U.K. retail sales rose more than forecast last month. Marks & Spencer Group Plc (MKS) gained 1.6 percent to 361.3 pence.

Waertsilae Oyj, the world’s biggest maker of ship motors and power plants, rose 3.1 percent to 28.90 euros as its service business reached record sales in the first quarter.

A gauge of technology shares was the worst-performing group in the Stoxx 600. Infineon Technologies AG lost 1 percent to 7.60 euros and Alcatel-Lucent retreated 1.7 percent to 1.42 euros. Logitech International SA, the world’s largest maker of computer mice, dropped 1.8 percent to 7.21 Swiss francs.

U.S. stocks rose, snapping a two- day decline for the Standard & Poor’s 500 Index, as profits from companies including Microsoft (MSFT) Corp. and General Electric Co. (GE) beat estimates and German business confidence improved.

A report today showed German business confidence unexpectedly increased for a sixth month in April, adding to evidence that Europe’s largest economy can weather the sovereign-debt crisis.

Seven out of 10 industries in the S&P 500 advanced today as utilities and consumer-staples companies gained the most.

Dow 13,029.26 +65.16 +0.50%, Nasdaq 3,000.45 -7.11 -0.24%, S&P 500 1,378.53 +1.61 +0.12%

Microsoft (MSFT)rose 4.6 percent, the most in three months, to $32.42. The software maker reported fiscal third-quarter profit that topped estimates on better-than-expected sales of Windows and Office software for businesses. Corporate demand for Windows computers made up for tepid interest from consumers opting for tablet machines.

GE rose 1.2 percent to $19.36. Chief Executive Officer Jeffrey Immelt is increasing the focus on divisions that make gas turbines, jet engines and diesel locomotives while shrinking GE Capital’s balance sheet. He has pledged to boost industrial income this year by 5 percent to 10 percent, excluding the effect of acquisitions, while expanding margins.

Schlumberger Ltd. gained 2.7 percent to $71.70. The world’s largest oilfield-services provider reported first-quarter profit rose 38 percent as customers increased higher margin deep-water drilling around the globe in response to climbing crude prices.

McDonald’s Corp. (MCD) added 0.7 percent to $95.94. The world’s largest restaurant chain reported a 4.8 percent gain in first- quarter profit as new menu items such as Chicken McBites attracted U.S. consumers.

SanDisk, which makes memory chips used in mobile devices, declined 11 percent, the most in the S&P 500, to $35.91 after giving a second-quarter sales forecast that fell short of some analysts’ estimates. Chip production at SanDisk and its rivals is outpacing demand, causing prices to fall, Chief Executive Officer Sanjay Mehrotra said on a conference call with analysts yesterday. Some of the company’s customers also ordered fewer chips for mobile phones than SanDisk had predicted, he said.

Resistance 3: Y83.00 (Apr 3 high)

Resistance 2: Y82.55 (Apr 6 high)

Resistance 1: Y81.85 (Apr 10 high)

The current price: Y81.31

Support 1: Y81.15 (Apr 19 low)

Support 2: Y80.85 (Apr 18 low)

Support 3: Y80.30 (Apr 16 low)

Resistance 3: Chf0.9195 (Apr 19 high)

Resistance 2: Chf0.9155 (Apr 20 high)

Resistance 1: Chf0.9120/25 (area of Apr 17-19 low)

The current price: Chf0.9103

Support 1: Chf0.9080 (Apr 20 low)

Support 2: Chf0.9070 (Apr 2 high)

Support 3: Chf0.9000 (Apr 2 low)

Resistance 3 : $1.6200 (Sep 6 high)

Resistance 2 : $1.6165 (Oct 31 high)

Resistance 1 : $1.6145 (Apr 20 high)

The current price: $1.6121

Support 1 : $1.6075 (Apr 19 high)

Support 2 : $1.6005 (Apr 19 low)

Support 3 : $1.5960/70 (area of Apr 13-17 highs)

Resistance 3 : $1.3300 (psychological level)

Resistance 2 : $1.3240 (Apr 4 high)

Resistance 1 : $1.3230 (Apr 20 high)

The current price: $1.3193

Support 1 : $1.3165/75 (area of Apr 17-19 high)

Support 2 : $1.3125 (Apr 20 low)

Support 3 : $1.3055/65 (area of Apr 18-19 lows)

01:30 Australia Producer price index, q / q Quarter I +0.3% +0.6%

01:30 Australia Producer price index, y/y Quarter I +2.9% +2.2%

02:30 China HSBC Manufacturing PMI (preliminary) April 48.3

07:00 France Manufacturing PMI (preliminary) April 46.7 47.3

07:00 France Services PMI (preliminary) April 50.1 50.3

07:30 Germany Manufacturing PMI (preliminary) April 48.4 49.1

07:30 Germany Services PMI (preliminary) April 52.1 52.4

08:00 Eurozone Manufacturing PMI April 47.7 48.2

08:00 Eurozone Services PMI (preliminary) April 49.2 49.4

12:30 Canada Wholesale Sales, m/m February -1.0% 0.0%

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.