- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

(raw materials / closing price /% change)

Oil 51.41 +0.08%

Gold 1,204.30 +0.23%

(index / closing price / change items /% change)

Nikkei +177.88 19072.25 +0.94%

TOPIX +14.29 1528.15 +0.94%

Hang Seng -48.30 23049.96 -0.21%

CSI 300 -10.08 3329.29 -0.30%

Nikkei +177.88 19072.25 +0.94%

TOPIX +14.29 1528.15 +0.94%

Hang Seng -48.30 23049.96 -0.21%

CSI 300 -10.08 3329.29 -0.30%

DJIA -72.32 19732.40 -0.37%

S&P 500 -8.20 2263.69 -0.36%

NASDAQ -15.57 5540.08 -0.28%

S&P/TSX +11.96 15409.81 +0.08%

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0664 +0,33%

GBP/USD $1,2340 +0,65%

USD/CHF Chf1,006 -0,13%

USD/JPY Y114,86 +0,19%

EUR/JPY Y122,48 +0,51%

GBP/JPY Y141,74 +0,86%

AUD/USD $0,7559 + 0,74%

NZD/USD $0,7188 +0,92%

USD/CAD C$1,3316 +0,37%

00:00 Australia HIA New Home Sales, m/m November -8.5%

01:00 U.S. Fed Chairman Janet Yellen Speaks

02:00 China Industrial Production y/y December 6.2% 6.1%

02:00 China Retail Sales y/y December 10.8% 10.7%

02:00 China Fixed Asset Investment December 8.3% 8.3%

02:00 China GDP y/y Quarter IV 6.7% 6.7%

07:00 Germany Producer Price Index (MoM) December 0.3% 0.4%

07:00 Germany Producer Price Index (YoY) December 0.1% 1%

09:00 Switzerland World Economic Forum Annual Meetings

09:30 United Kingdom Retail Sales (MoM) December 0.2% -0.1%

09:30 United Kingdom Retail Sales (YoY) December 5.9% 7.2%

13:30 Canada Retail Sales, m/m November 1.1% 0.5%

13:30 Canada Retail Sales YoY November 3.8%

13:30 Canada Retail Sales ex Autos, m/m November 1.4% 0.1%

13:30 Canada Consumer Price Index m / m December -0.4% -0.1%

13:30 Canada Consumer price index, y/y December 1.2% 1.7%

13:30 Canada Bank of Canada Consumer Price Index Core, y/y December 1.5% 1.7%

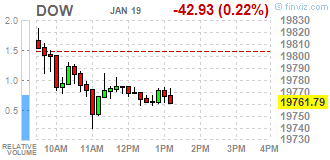

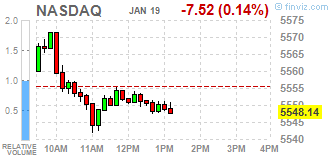

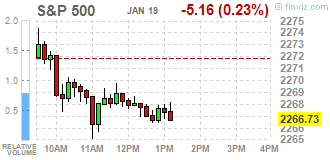

Major US stock indexes fell slightly, with the Dow recorded its fifth consecutive fall-session as investors stayed away from risky trades before the deposition of Donald Trump as president on Friday.

As revealed today the report submitted by the Philadelphia Fed business activity index in the manufacturing sector rose in January, reaching 23.6 points compared to 21.5 points in December. Economists had expected a decline of this indicator to 15.8 points. Recall, the index represents the results of a survey of manufacturers in Philadelphia for their attitude to the current economic situation. The indicator is published just before the ISM index of purchasing managers, and may give an idea of how will an indicator of business activity at the national level. Readings above zero indicate expansion in the sector.

In addition, after reporting a sharp drop in US housing starts in the previous month, the Commerce Department released a report on Thursday, reflecting that the tabs of new homes showed significant recovery in December. The Commerce Department reported that the establishment of new homes rose by 11.3 percent to an annual rate of 1.226 million in December from a revised level of 1.102 million in November.

However, initial applications for unemployment benefits unexpectedly fell for the week of 14 January, according to a report published by the Department of Labor. The number of initial applications for unemployment benefits dropped to 234,000, down 15,000 from a revised level of the previous week's 249,000.

DOW index components closed mostly in the red (23 of 30). Most remaining shares fell Exxon Mobil Corporation (XOM, -1.94%). leaders of growth were shares of The Boeing Company (BA, + 0.77%).

Sector S & P index ended the session mostly in the red. Most utilities sector fell (-1.0%). The leader turned conglomerates sector (+ 0.5%).

At the close:

Dow -0.37% 19,731.99 -72.73

Nasdaq -0.28% 5,540.08 -15.58

S & P -0.36% 2,263.69 -8.20

Major U.S. stock-indexes slightly fell on Thursday, with the Dow on track to mark its fifth day of losses as investors stayed away from making risky bets ahead of Donald Trump's swearing-in as president on Friday. The markets are also digesting a clutch of information including the European Central Bank's decision to maintain its monetary policy, while awaiting a speech by Federal Reserve Chair Janet Yellen. After hitting a series of record highs in a post-election rally, Wall Street has been trading in a tight range as investors look for more details on Trump's policies.

Most of Dow stocks in negative area (18 of 30). Top gainer - Exxon Mobil Corporation (XOM, -1.56%). Top loser - UnitedHealth Group Incorporated (UNH, +1.01%).

Most of S&P sectors in negative area. Top loser - Conglomerates (+1.0%). Top loser - Basic Materials (-0.7%).

At the moment:

Dow 19704.00 -31.00 -0.16%

S&P 500 2262.75 -3.75 -0.17%

Nasdaq 100 5056.25 +1.75 +0.03%

Oil 52.00 +0.11 +0.21%

Gold 1199.80 -12.30 -1.01%

U.S. 10yr 2.49 +0.10

Polish equity market closed higher on Thursday. The broad market measure, the WIG Index, surged by 0.42%. The WIG sub-sector indices were mainly higher with media stocks (+1.24%) outperforming.

The large-cap stocks' measure, the WIG30 Index, rose 0.52%. 2/3 of all index components returned gains, with the way up led by coking coal miner JSW (WSE: JSW), which rose 2.88%, partly erasing a 6% drop recorded in the first two sessions of the week. It was reported that stockpile of coal at Polish mines fell to around 1 mln tonnes as of end of December compared to almost 6 mln tonnes in 2015 on the back of mines shutdowns, geological problems and increased demand due to freezing temperatures. Other major advancers were videogame developer CD PROJEKT (WSE: CDR), chemical producer GRUPA AZOTY (WSE: ATT) and three banking names BZ WBK (WSE: BZW), MBANK (WSE: MBK) and ALIOR (WSE: ALR), which added between 1.77% and 2.37%. On the other side of the ledger, IT-company ASSECO POLAND (WSE: ACP) and genco TAURON PE (WSE: TPE) topped the decliners' list, falling by 2.04%, and 1.78% respectively.

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 2.3 million barrels from the previous week. At 485.5 million barrels, U.S. crude oil inventories are near the upper limit of the average range for this time of year.

Total motor gasoline inventories increased by 6.0 million barrels last week, and are above the upper limit of the average range. Both finished gasoline inventories and blending components inventories increased last week.

Distillate fuel inventories decreased by 1.0 million barrels last week but are above the upper limit of the average range for this time of year. Propane/propylene inventories fell 7.4 million barrels last week but are in the upper half of the average range. Total commercial petroleum inventories decreased by 2.0 million barrels last week.

The market in the US began the listing on cosmetic pros. During the last few sessions the supply can not takes advantage and the market is in consolidation with limited volatility and with generating medium-term positive signals. Such signals can come along with the first action of Donald Trump as president.

An hour before the close of trading the WIG20 index was at the level of 2,014 points (+ 0.43%).

U.S. stock-index futures were little changed as investors prefered to be cautious ahead of Donald Trump's inauguration, scheduled to be held on Friday. Market participants also assessed a raft of economic data, including statistics on US housing market and initial jobless claims.

Global Stocks:

Nikkei 19,072.25 +177.88 +0.94%

Hang Seng 23,049.96 -48.30 -0.21%

Shanghai 3,101.70 -11.31 -0.36%

FTSE 7,217.66 -29.95 -0.41%

CAC 4,855.46 +2.06 +0.04%

DAX 11,600.83 +1.44 +0.01%

Crude $51.50 з(+0.82%)

Gold $1,200.90 (-0.92%)

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 34.42 | -0.39(-1.1204%) | 2010 |

| ALTRIA GROUP INC. | MO | 69.04 | -0.12(-0.1735%) | 1309 |

| Amazon.com Inc., NASDAQ | AMZN | 809.55 | 2.07(0.2564%) | 11460 |

| American Express Co | AXP | 77.79 | 0.30(0.3871%) | 12220 |

| Apple Inc. | AAPL | 119.51 | -0.48(-0.40%) | 174289 |

| Barrick Gold Corporation, NYSE | ABX | 16.72 | -0.10(-0.5945%) | 36722 |

| Caterpillar Inc | CAT | 93.25 | -0.08(-0.0857%) | 2110 |

| Citigroup Inc., NYSE | C | 57.45 | 0.06(0.1045%) | 14226 |

| Exxon Mobil Corp | XOM | 85.87 | -0.41(-0.4752%) | 6912 |

| Facebook, Inc. | FB | 128.18 | 0.26(0.2032%) | 69985 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 15.11 | -0.13(-0.853%) | 15008 |

| Goldman Sachs | GS | 234.2 | -0.09(-0.0384%) | 4283 |

| Hewlett-Packard Co. | HPQ | 14.8 | 0.22(1.5089%) | 6504 |

| International Business Machines Co... | IBM | 166.6 | -0.20(-0.1199%) | 2116 |

| JPMorgan Chase and Co | JPM | 83.9 | -0.04(-0.0477%) | 14125 |

| McDonald's Corp | MCD | 122.44 | -0.27(-0.22%) | 238 |

| Microsoft Corp | MSFT | 62.31 | -0.19(-0.304%) | 1152 |

| Nike | NKE | 53.4 | 0.13(0.244%) | 13572 |

| Pfizer Inc | PFE | 32 | -0.03(-0.0937%) | 781 |

| Procter & Gamble Co | PG | 84.89 | -0.04(-0.0471%) | 461 |

| Tesla Motors, Inc., NASDAQ | TSLA | 248 | 9.64(4.0443%) | 185938 |

| The Coca-Cola Co | KO | 41.05 | -0.24(-0.5813%) | 23002 |

| UnitedHealth Group Inc | UNH | 157.13 | -0.61(-0.3867%) | 482 |

| Verizon Communications Inc | VZ | 52.5 | 0.25(0.4785%) | 11425 |

| Wal-Mart Stores Inc | WMT | 68 | -0.11(-0.1615%) | 164 |

| Walt Disney Co | DIS | 107.95 | -0.21(-0.1942%) | 1046 |

| Yahoo! Inc., NASDAQ | YHOO | 42.13 | 0.10(0.2379%) | 621 |

| Yandex N.V., NASDAQ | YNDX | 21.91 | -0.05(-0.2277%) | 544 |

-

Too Early to Comment on Brexit Outcomes

-

Final Outcome of Brexit Negotiations Will be Very Important

-

We Stand Ready to Upgrade, Revise Strategy As Needed

-

Buying Below Deposit Rate Greatly Enlarges Purchase 'Universe'

-

Increasingly Clear That Policy Stance Successful

-

Risks Coming from Global Uncertainty

-

Inflation Mostly Driven By Energy, Underlying Pressure Subdued

-

Germans Have Benefitted from Recovery

Upgrades:

HP (HPQ) upgraded to Buy from Neutral at UBS

Tesla Motors (TSLA) upgraded to Overweight from Equal Weight at Morgan Stanley; target $305

Downgrades:

Coca-Cola (KO) downgraded to Market Perform from Outperform at Wells Fargo

Exxon Mobil (XOM) downgraded to Sell from Neutral at UBS

Other:

Apple (AAPL) target raised to $140 from $125 at BofA/Merrill

NIKE (NKE) initiated with a Underperform at CLSA

Verizon (VZ) initiated with a Buy at HSBC Securities

Privately-owned housing units authorized by building permits in December were at a seasonally adjusted annual rate of 1,210,000. This is 0.2 percent below the revised November rate of 1,212,000, but is 0.7 percent above the December 2015 estimate of 1,201,000.

Single-family authorizations in December were at a rate of 817,000; this is 4.7 percent above the revised November figure of 780,000. Authorizations of units in buildings with five units or more were at a rate of 355,000 in December. An estimated 1,186,900 housing units were authorized by building permits in 2016. This is 0.4 percent above the 2015 figure of 1,182,600.

Privately-owned housing starts in December were at a seasonally adjusted annual rate of 1,226,000. This is 11.3 percent (±10.4%) above the revised November rate of 1,102,000 and is 5.7 percent above the December 2015 rate of 1,160,000.

Single-family housing starts in December were at a rate of 795,000; this is 4.0 percent below the revised November figure of 828,000. The December rate for units in buildings with five units or more was 417,000. An estimated 1,166,400 housing units were started in 2016. This is 4.9 percent above the 2015 figure of 1,111,800.

Canadian investors reduced their holdings of foreign securities by $7.9 billion in November, largely through sales of US instruments. At the same time, foreign acquisitions of Canadian securities slowed to $7.2 billion, following a $15.8 billion investment in October.

As a result, international transactions in securities generated a net inflow of funds of $15.1 billion into the Canadian economy in the month. From January to November, foreign investment in Canadian securities has exceeded Canadian investment in foreign securities by $142.3 billion.

-

Draghi: Headline Inflation has Increased Lately, Due to Base Effects

-

Very Substantial Degree of Monetary Accommodation Is Needed

-

If Outlook Less Favorable, We Stand Ready to Increase Asset Purchases

-

Decisions on Purchases Below Deposit Rate Published at 3:30pm CET

-

Borrowing Conditions for Firms and Households Benefit from Policies

EUR/USD

Offers: 1.0660 1.0685 1.0700 1.0720-25 1.0750 1.0785 1.0800

Bids: 1.0625-30 1.0600 1.0580 1.0565 1.0550 1.0520 1.0500

GBP/USD

Offers: 1.2325-30 1.2360 1.2380 1.2400 1.2420 1.2450 1.2475-80 1.2500

Bids: 1.2280 1.2250 1.2230 1.2200 1.2185 1.2150 1.2100

EUR/GBP

Offers: 0.8680 0.8700 0.8730 0.8750 0.8780 0.8800

Bids: 0.8650 0.8620-25 0.8600 0.8585 0.8550 0.8530 0.8500

EUR/JPY

Offers: 122.50 122.80 123.00 123.30 124.00

Bids: 122.00 121.80 121.50 121.00 120.80 120.50 120.00

USD/JPY

Offers: 115.00 115.20 115.35 115.50 115.80 116.00 116.30 116.50

Bids: 114.50 114.20 114.00 113.85 113.55-60 113.20 113.00 112.80 112.65 112.50

AUD/USD

Offers: 0.7560 0.7580 0.7600 0.7630 0.7650 0.7675 0.7700

Bids: 0.7520 0.7500 0.7480-850.7450 0.7430 0.7400

Информационно-аналитический отдел TeleTrade

At today's meeting the Governing Council of the ECB decided that the interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility will remain unchanged at 0.00%, 0.25% and -0.40% respectively. The Governing Council continues to expect the key ECB interest rates to remain at present or lower levels for an extended period of time, and well past the horizon of the net asset purchases.

The first half of the session on the Warsaw Stock Exchange was uneventful and the level of variation is small. On the European markets are beginning to dominate correction mood. It is clear that investors are waiting for the 14:30 hour (Warsaw time) when will start a press conference after the ECB meeting. The most important is the rhetoric of the president as a major change in politics itself no one expects.

"We get a likely uneventful ECB meeting on Thursday, but it is still likely to be a combination of renewed widening in yield differentials and a ramping-up of nervousness ahead of the French elections which will be the catalyst for renewed Euro weakness when that happens.The choppiness of the most heavily traded pairs, like EUR/USD, USD/JPY and GBP/USD, not to mention the recent moves in equities and bonds, is making life difficult for anyone who doesn't just put positions in place and walk away. Those who do just walk away are probably the ones still long dollars, short Treasuries and waiting for President Trump to begin his first hundred days in office".

"In line with an overwhelming consensus, we do not expect any changes to the ECB's monetary policy programme at tomorrow's meeting. Instead, we expect the focus to be on the Governing Council's assessment of macro-economic developments in light of some positive dataflow over the past few weeks. Thanks in part to that dataflow, we now believe the risks to the ECB's (and consensus) forecasts for the growth and inflation outlook have shifted to the upside. During the post-meeting press conference, President Draghi will nevertheless probably re-emphasise the ECB's strong commitment to the existing monetary policy programme by stressing some of the numerous downside risks that could generate further instability for the region in the months ahead. In terms of trades: we enter 10yr OLO vs short 10yr RFGB at 20bp targeting 10bp (stop 25bp), but also a tactical long 15yr BTP Mar-32 vs 10yr and 20yr at 10.5bp with a target at 0bp stop at 15b".

This morning, the New York futures for Brent increased by 1.35% to $ 54.65 and WTI rose by + 1.19% to $ 51.69. Thus, the black gold traded in positive territory after the release of data from the American Petroleum Institute. The volume of oil reserves in the United States declined slightly more than 5 million barrels for the week to 479,225 mln. Earlier, OPEC agreed to reduce output by 1.2 million barrels per day to 32.5 million barrels per day in order to restore balance in the global market and maintain prices.

The current account of the euro area recorded a surplus of €36.1 billion in November 2016 (see Table 1). This reflected surpluses for goods (€30.9 billion), primary income (€12.1 billion) and services (€4.8 billion), which were partly offset by a deficit for secondary income (€11.7 billion).

The 12-month cumulated current account for the period ending in November 2016 recorded a surplus of €358.1 billion (3.4% of euro area GDP), compared with one of €319.9 billion (3.1% of euro area GDP) for the 12 months to November 2015 (see Table 1 and Chart 1). This was due to increases in the surpluses for goods (from €344.3 billion to €370.2 billion) and services (from €59.2 billion to €68.4 billion), as well as a decrease in the deficit for secondary income (from €132.7 billion to €127.6 billion). These were offset to a limited extent by a decrease in the surplus for primary income (from €49.1 billion to €47.1 billion).

"We used the recent rally in EURUSD to add a short position to our portfolio. Our arguments for a weaker EUR have not changed. In the absence of further political integration, the ECB may have to remain accommodative to support the struggling periphery even as the core overheats. As EMU inflation shows signs of rising, real yields may decline to weaken the EUR. The risk of rising populism with the upcoming elections in the Netherlands, France and Germany will also be an undertone for the currency. We'll pay particular attention to the ECB's rhetoric on the recent upside surprise in inflation".

The total index of producer and import prices rose by 0.2 percent in December 2016 compared with the previous month, reaching 100.0 points (December 2015 = 100 basis). Compared to December 2015, the rate of inflation thus amounted to 0.0 percent. The average annual tax rate in 2016 was -1.8 percent. This is evident from the figures of the Federal Statistical Office (FSO).

The average annual taxation 2016 corresponds to the rate of change between the 2016 annual average and the 2015 annual average. The annual average is calculated as the arithmetic average of the 12 month indices of the calendar year.

WIG20 index opened at 2005.60 points (0.00%)*

WIG 53505.27 0.14%

WIG30 2325.22 0.12%

mWIG40 4410.74 0.19%

*/ - change to previous close

The cash market (the WIG20 index) started the day almost at the point of yesterday's close, with the turnover concentrated on the shares of KGHM and PZU. The German DAX gaining cosmetically. The beginning of trading looks therefore very quiet.

After fifteen minutes ot the session, the WIG20 index was at level of 2,007 points (+ 0.10%).

EUR/USD

Resistance levels (open interest**, contracts)

$1.0783 (2411)

$1.0751 (2226)

$1.0716 (254)

Price at time of writing this review: $1.0640

Support levels (open interest**, contracts):

$1.0610 (1377)

$1.0566 (1384)

$1.0509 (2686)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 54458 contracts, with the maximum number of contracts with strike price $1,0750 (3362);

- Overall open interest on the PUT options with the expiration date March, 13 is 65663 contracts, with the maximum number of contracts with strike price $1,0000 (4886);

- The ratio of PUT/CALL was 1.21 versus 1.17 from the previous trading day according to data from January, 18

GBP/USD

Resistance levels (open interest**, contracts)

$1.2510 (1380)

$1.2413 (399)

$1.2318 (668)

Price at time of writing this review: $1.2258

Support levels (open interest**, contracts):

$1.2186 (1033)

$1.2090 (519)

$1.1992 (2275)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 17322 contracts, with the maximum number of contracts with strike price $1,2800 (1462);

- Overall open interest on the PUT options with the expiration date March, 13 is 21350 contracts, with the maximum number of contracts with strike price $1,1500 (3230);

- The ratio of PUT/CALL was 1.23 versus 1.19 from the previous trading day according to data from January, 18

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

The major US stock indexes ended Wednesday's without significant changes. The Dow Jones Industrial dropped at the closing of 0.11 percent, the S&P 500 rose by 0.18 percent and the Nasdaq Composite gained 0.31 percent. The focus of investors were on the results of companies. Despite the higher-than-expected earnings in the fourth quarter of Goldman Sachs and Citigroup, their quotations were below the line. Yesterday's evening speech by Janet Yellen, who confirmed the intention of further rate hikes in the US, strengthened the dollar. In Asia, the mood is mixed, the Japanese Nikkei rose nearly 1 percent after the strengthening of the dollar. In Europe we wait for a calm start of trading with a certain expectation for an afternoon conference of the ECB. Investors do not expect a deeper content, although the last speech of Mario Draghi weaken the euro.

"The ECB's Governing Council will meet on Thursday, January 19. In line with the broad market consensus, we expect little action at the meeting, based on the lack of market news since December. Specifically, we expect key policy rates to be left unchanged, and no changes to the Asset Purchase Programme (APP). We expect the introductory statement to continue to describe risks to the growth outlook as skewed to the downside, and that Mr. Draghi will resist any suggestion that recent inflation data warrant the withdrawal of monetary accommodation".

-

Monetary Policy Has Little Influence Over Structural Unemployment

-

Monetary Policy Cannot, by Itself, Create a Health Economy

-

Waiting Too Long to Raise Rates Could Risk 'Nasty Surprise' of High Inflation, Instability

-

Makes Sense to Ease Monetary Policy as Economy Approaches Fed Goals

-

Wage Growth Remains Fairly Low, Only Begun to Pick Up Recently

The seasonally adjusted number of new dwellings consented fell 9.2 percent in November 2016 compared with October 2016. This followed a 2.0 percent rise in October. The trend is showing signs of decreasing after reaching a 12-year high in mid-2016.

In the year ended November 2016, 30,303 new dwellings were consented - up 13 percent from the November 2015 year.

Expectations of consumer price inflation in Australia, published by the Institute of Melbourne, was 4.3%, which is higher than the previous value of 3.4%. This indicator reflects the expectations of consumers about inflation for the next 12 months. However, the increase in interest rates by the Australian central bank is unlikely in the near future, as many other economic data from Australia, less positive than expected.

-

Employment increased 13,500 to 11,985,900. Full-time employment increased 9,300 to 8,176,500 and part-time employment increased 4,200 to 3,809,500.

-

Unemployment increased 14,700 to 741,100. The number of unemployed persons looking for full-time work increased 15,000 to 528,900 and the number of unemployed persons only looking for part-time work decreased 300 to 212,200.

-

Unemployment rate increased 0.1 pts to 5.8%.

-

Participation rate increased 0.1 pts to 64.7%.

European stocks on Wednesday wrapped up trading with a tepid gain during a up-and-down session, as investors sifted through corporate updates, including better-than-anticipated results from ASML Holding NV.

U.S. stocks rose moderately on Wednesday as gains in financials offset weakness in telecommunications shares but the Dow Jones Industrial Average bucked the trend to close at its lowest of 2017. The S&P 500 SPX, +0.18% gained 4 points, or 0.2%, to close at 2,271. The Dow Jones Industrial Average DJIA, -0.11% shed 22 points, or 0.1%, to end at 19,804 while the Nasdaq Composite Index COMP, +0.31% rose 16 points, or 0.3%, to close at 5,555. Major indexes traded within a tight range as sentiment remained subdued ahead of President-elect Donald Trump's inauguration on Friday.

Investors in Asian stocks broadly maintained caution ahead of President-elect Donald Trump's inauguration, though Japanese equities rallied Thursday as the dollar strengthened overnight amid comments from Federal Reserve Chairwoman Janet Yellen that were interpreted hawkishly.

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.