- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

(raw materials / closing price /% change)

Oil 52.85 +0.19%

Gold 1,217.80 +0.18%

(index / closing price / change items /% change)

Nikkei -246.88 18891.03 -1.29%

TOPIX -18.83 1514.63 -1.23%

Hang Seng +12.61 22898.52 +0.06%

CSI 300 +9.19 3364.08 +0.27%

Euro Stoxx 50 -26.40 3273.04 -0.80%

FTSE 100 -47.26 7151.18 -0.66%

DAX -84.38 11545.75 -0.73%

CAC 40 -29.26 4821.41 -0.60%

DJIA -27.40 19799.85 -0.14%

S&P 500 -6.11 2265.20 -0.27%

NASDAQ -2.39 5552.95 -0.04%

S&P/TSX -67.75 15480.13 -0.44%

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0764 +0,64%

GBP/USD $1,2533 +1,40%

USD/CHF Chf0,9963 -0,58%

USD/JPY Y112,79 -1,50%

EUR/JPY Y121,31 -0,93%

GBP/JPY Y141,24 -0,16%

AUD/USD $0,7582 +0,42%

NZD/USD $0,7331 +2,29%

USD/CAD C$1,3236 -0,67%

00:30 Japan Manufacturing PMI (Preliminary) January 52.4

08:00 France Manufacturing PMI (Preliminary) January 53.5 53.3

08:00 France Services PMI (Preliminary) January 52.9 53.2

08:30 Germany Manufacturing PMI (Preliminary) January 55.6 55.4

08:30 Germany Services PMI (Preliminary) January 54.3 54.5

09:00 Eurozone Manufacturing PMI (Preliminary) January 54.9 54.8

09:00 Eurozone Services PMI (Preliminary) January 53.7 53.9

09:30 United Kingdom PSNB, bln December -12.21 -7.2

09:30 United Kingdom EU Membership Court Ruling

14:45 U.S. Manufacturing PMI (Preliminary) January 54.3 54

15:00 U.S. Richmond Fed Manufacturing Index January 8

15:00 U.S. Existing Home Sales December 5.61 5.56

23:30 Australia Leading Index December 0%

23:50 Japan Trade Balance Total, bln December 153 270

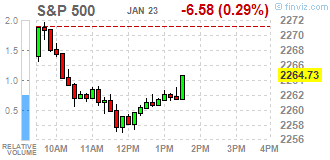

Major U.S. stock-indexes fell on Monday as President Donald Trump's protectionist stance on trade sent investors scurrying for safe-haven assets on Monday. In his latest executive order, Trump signed to formally withdraw the United States from the 12-nation Trans-Pacific partnership trade deal.Earlier in the day, Trump met with a dozen prominent American manufacturers at the White House and said he would slash regulations and cut corporate taxes to boost the economy.

Most of Dow stocks in negative area (23 of 30). Top gainer - General Electric Company (GE, -3.06%). Top loser - The Home Depot, Inc. (HD, +1.77%).

Most of S&P sectors in negative area. Top loser - Consumer goods (+0.1%). Top gainer - Industrial goods (-0.9%).

At the moment:

Dow 19699.00 -46.00 -0.23%

S&P 500 2257.00 -9.00 -0.40%

Nasdaq 100 5054.50 -3.75 -0.07%

Oil 53.04 -0.18 -0.34%

Gold 1215.20 +10.30 +0.85%

U.S. 10yr 2.40 -0.07

Polish equity market plunged on Monday. The broad market measure, the WIG Index, declined by 0.28%. The WIG sub-sector indices closed mixed. The WIG Clothes (-1.56%) fell the most, while WIG-Pharmaceuticals (+1.32%) outpaced.

The large-cap stocks' measure, the WIG30 Index, fell by 0.59%. Almost 2/3 of the index components recorded losses. Footwear retailer CCC (WSE: CCC) topped the decliners' list, dropping by 4.04%, weight down by an analyst downgrade. Among other largest decliners were three banking sector stocks MBANK (WSE: MBK), BZ WBK (WSE: BZW) and PKO BP (WSE: PKO), and coking coal miner JSW (WSE: JSW), which slumped between 2.11% and 2.83%. At the same time, property developer GTC (WSE: GTC) led the gainers with a 3.01% advance, followed by railway freight transport operator PKP CARGO (WSE: PKP), oil and gas producer PGNIG (WSE: PGN) and videogame developer CD PROJEKT (WSE: CDR), which added 2.86%, 1.87% and 1.21% respectively.

"The instinctive reaction of markets to a more isolationist/protectionist world is to favour the currencies of countries with large current account surpluses, as these are the winners if capital stays at home. That may be too simplistic, but the yen and Euro are natural initial winners. FX positions are much less stretched than bond ones but a further final flush of Euro and Yen shorts is a risk here.

The first round of the French Socialist Primaries shows a clear shift to the left, with Benoit Hamon gaining most votes and heading into the second round with Manuel Valls this weekend. A Hamon win would leave a big gap in the centre ground, to the benefit of Emmanuel Macron. In many ways, it is easier for a centrist candidate to galvanise cross-party support in the Presidential election and so, this result may well be seen in FX=-terms as Euro-friendly. There are far too many twists and turns ahead in this election us to alter a view that at some point, political nerves will drag the euro down but today or tomorrow we may well see a break back above EUR/USD 1.08".

Copyright © 2017 Societe Generale, eFXnews™

In January 2017, the DG ECFIN flash estimate of the consumer confidence indicator was broadly unchanged in both the euro area (+0.2 points to -4.9) and the EU (+0.3 points to -4.3) compared to December 2016.

U.S. stock-index futures fell, as investors preferred safe-haven assets such as gold and the U.S. Treasuries in response protectionist sentiment in Trump inauguration speech. Focus also is on quarterly earnings reports; around 20 percent of the S&P 500 components is scheduled to report between today and Friday.

Global Stocks:

Nikkei 18,891.03 -246.88 -1.29%

Hang Seng 22,898.52 +12.61 +0.06%

Shanghai 3,136.64 +13.50 +0.43%

FTSE 7,151.49 -46.95 -0.65%

CAC 4,827.25 -23.42 -0.48%

DAX 11,573.49 -56.64 -0.49%

Crude $52.51 (-1.33%)

Gold $1,210.20 (+0.44%)

(company / ticker / price / change ($/%) / volume)

| ALTRIA GROUP INC. | MO | 70 | -0.01(-0.0143%) | 1083 |

| Amazon.com Inc., NASDAQ | AMZN | 806.5 | -1.83(-0.2264%) | 4396 |

| AMERICAN INTERNATIONAL GROUP | AIG | 66.47 | -0.07(-0.1052%) | 400 |

| Apple Inc. | AAPL | 119.8 | -0.20(-0.1667%) | 85817 |

| AT&T Inc | T | 41.4 | -0.05(-0.1206%) | 1449 |

| Barrick Gold Corporation, NYSE | ABX | 17.38 | 0.27(1.578%) | 126591 |

| Boeing Co | BA | 159.5 | -0.03(-0.0188%) | 6198 |

| Chevron Corp | CVX | 115.22 | -0.38(-0.3287%) | 1243 |

| Citigroup Inc., NYSE | C | 55.91 | -0.20(-0.3564%) | 11187 |

| Deere & Company, NYSE | DE | 106.68 | -0.06(-0.0562%) | 481 |

| Exxon Mobil Corp | XOM | 85.6 | -0.29(-0.3376%) | 1696 |

| Ford Motor Co. | F | 170.15 | -0.40(-0.2345%) | 7472 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 15.62 | 0.11(0.7092%) | 64480 |

| Google Inc. | GOOG | 804.99 | -0.03(-0.0037%) | 1372 |

| International Business Machines Co... | IBM | 170.15 | -0.40(-0.2345%) | 7472 |

| JPMorgan Chase and Co | JPM | 83.38 | -0.29(-0.3466%) | 3795 |

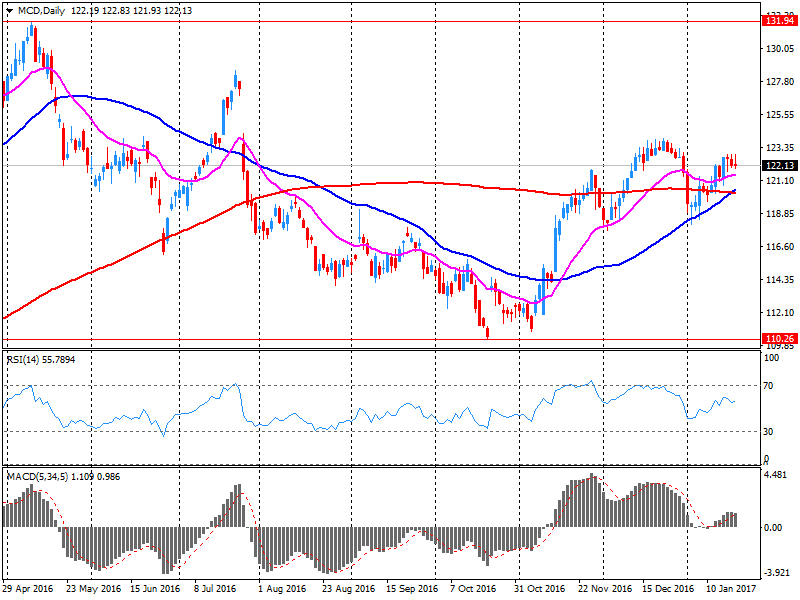

| McDonald's Corp | MCD | 121.6 | -0.66(-0.5398%) | 122507 |

| Merck & Co Inc | MRK | 62.12 | -0.41(-0.6557%) | 682 |

| Microsoft Corp | MSFT | 62.8 | 0.06(0.0956%) | 8589 |

| Nike | NKE | 53.4 | 0.20(0.3759%) | 1375 |

| Pfizer Inc | PFE | 31.86 | 0.09(0.2833%) | 683 |

| Procter & Gamble Co | PG | 87.17 | -0.28(-0.3202%) | 1556 |

| Starbucks Corporation, NASDAQ | SBUX | 57.62 | -0.04(-0.0694%) | 2957 |

| Tesla Motors, Inc., NASDAQ | TSLA | 245 | 0.27(0.1103%) | 4372 |

| The Coca-Cola Co | KO | 41.56 | 0.24(0.5808%) | 1367 |

| Twitter, Inc., NYSE | TWTR | 16.51 | -0.07(-0.4222%) | 40953 |

| Verizon Communications Inc | VZ | 170.15 | -0.40(-0.2345%) | 7472 |

| Wal-Mart Stores Inc | WMT | 67.05 | -0.13(-0.1935%) | 483 |

| Walt Disney Co | DIS | 107.25 | -0.41(-0.3808%) | 3139 |

| Yahoo! Inc., NASDAQ | YHOO | 41.88 | -0.17(-0.4043%) | 652 |

EURUSD 1.0500 (EUR 1.33bln) 1.0600 (815m) 1.0700 (535m)

USDJPY 112.00 (USD 525m) 114.00 (426m) 115.00 (586m) 115.50 (516m) 116.00 (1.25bln) 116.50 (536m) 117.15 (407m)

GBPUSD 1.2060 (GBP 464m) 1.2300 (628m)

AUDUSD 0.7500 (AUD 363m)

USDCAD 1.3550 (USD 410m)

Upgrades:

Downgrades:

Verizon (VZ) downgraded to Market Perform from Outperform at Wells Fargo

Other:

Higher sales in four subsectors were partially offset by lower sales in two subsectors. The motor vehicle and parts subsector posted the largest decline, while the miscellaneous subsector, which includes wholesalers of agricultural supplies, chemicals and allied products, and paper, paper product and disposable plastic products, posted the largest increase.

In volume terms, wholesale sales edged down 0.1%.

McDonald's reported Q4 FY 2016 earnings of $1.44 per share (versus $1.31 in Q4 FY 2015), beating analysts' consensus estimate of $1.41.

The company's quarterly revenues amounted to $6.029 bln (-4.9% y/y), generally in-line with analysts' consensus estimate of $5.997 bln.

MCD fell to $122.05 (-0.17%) in pre-market trading.

January 23

Before the Open:

McDonald's (MCD). Consensus EPS $1.41, Consensus Revenues $5997.30 mln.

After the Close:

Yahoo! (YHOO). Consensus EPS $0.21, Consensus Revenues $907.72 mln.

January 24

Before the Open:

3M (MMM). Consensus EPS $1.87, Consensus Revenues $7338.29 mln.

DuPont (DD). Consensus EPS $0.42, Consensus Revenues $5265.34 mln.

Johnson & Johnson (JNJ). Consensus EPS $1.56, Consensus Revenues $18259.82 mln.

Travelers (TRV). Consensus EPS $2.81, Consensus Revenues $6176.97 mln.

Verizon (VZ). Consensus EPS $0.89, Consensus Revenues $32123.16 mln.

After the Close:

Alcoa (AA). Consensus EPS $0.24, Consensus Revenues $2365.54 mln.

January 25

Before the Open:

Boeing (BA). Consensus EPS $2.33, Consensus Revenues $23129.14 mln.

Freeport-McMoRan (FCX). Consensus EPS $0.33, Consensus Revenues $4335.63 mln.

United Tech (UTX). Consensus EPS $1.56, Consensus Revenues $14709.58 mln.

After the Close:

AT&T (T). Consensus EPS $0.66, Consensus Revenues $42181.09 mln.

January 26

Before the Open:

Caterpillar (CAT). Consensus EPS $0.67, Consensus Revenues $9811.58 mln.

Ford Motor (F). Consensus EPS $0.32, Consensus Revenues $34892.87 mln.

After the Close:

Alphabet (GOOG). Consensus EPS $9.62, Consensus Revenues $25140.11 mln.

Intel (INTC). Consensus EPS $0.75, Consensus Revenues $15749.89 mln.

Microsoft (MSFT). Consensus EPS $0.79, Consensus Revenues $25286.75 mln.

Starbucks (SBUX). Consensus EPS $0.52, Consensus Revenues $5850.89 mln.

January 27

Before the Open:

Chevron (CVX). Consensus EPS $0.68, Consensus Revenues $32961.41 mln.

Honeywell (HON). Consensus EPS $1.74, Consensus Revenues $10149.17 mln.

EUR/USD

Offers 1.0760 1.0785 1.0800 1.0830 1.0850-55 1.0880 1.0900

Bids 1.0720 1.0700 1.0680 1.0650 1.0625-30 1.0600 1.0580 1.0565 1.0550

GBP/USD

Offers 1.2480 1.2500 1.2520 1.2550 1.2585 1.2600

Bids 1.2420 1.2400 1.2375-80 1.2350 1.2320-25 1.2300 1.2280 1.2250

EUR/GBP

Offers 0.8650 0.8665 0.8680 0.8700 0.8730 0.8750 0.8780 0.8800

Bids 0.8620 0.8600 0.8585 0.8550 0.8530 0.8500

EUR/JPY

Offers 122.30 122.50 122.80 123.00 123.50 124.00

Bids 121.50 121.00 120.80 120.50 120.00

USD/JPY

Offers 113.65 113.80 114.00 114.20 114.50 114.80 115.00 115.20 115.35 115.55-60115.80 116.00

Bids 113.20 113.00 112.80 112.65 112.50 112.30 112.00

AUD/USD

Offers 0.7580-85 0.7600 0.7630 0.7650 0.7675 0.7700

Bids 0.7545-50 0.7525-30 0.7500 0.7480-85 0.7450

"While there has been significant pullback in the USD/JPY, it still remains significantly above where rates and other short-term fundamentals suggest it should be. USD/JPY remains vulnerable given extended short positioning in the JPY.

So it remains up to President Trump and US economic data to start pushing US rates higher again to justify the level of the USD/JPY. The weaker JPY should help push Japan's trade balance and inflation higher. Inflation data will be the main focus locally, but it is unlikely to accelerate enough to jeopardise any change in the BoJ's current stance.

The JGB yield curve has been steepening in 2017 relative to the UST curve, which is weighing on the USD/JPY. So, the outcome of the JGB 40Y auction this coming week could also be of some interest for the USD/JPY".

Copyright © 2017 Credit Agricole CIB, eFXnews™

During his presentation Coeure said that the recent rise in inflation rates was associated with an increase in oil prices. According to the banker, the ECB would be ready to raise interest rates only in the case of higher salaries. "At the moment this is not happening".

EUR/USD 1.0500 (EUR 1.33bln) 1.0600 (815m) 1.0700 (535m)

USD/JPY 112.00 (USD 525m) 114.00 (426m) 115.00 (586m) 115.50 (516m) 116.00 (1.25bln), 116.50 (536m) 117.15 (407m)

GBP/USD 1.2060 (GBP 464m) 1.2300 (628m)

AUD/USD 0.7500 (AUD 363m)

USD/CAD 1.3550 (USD 410m)

Информационно-аналитический отдел TeleTrade

This morning, the New York futures for Brent fell 0.41% to $ 55.26 and WTI is down 0.56% to $ 52.92. Thus, the black gold prices traded lower in anticipation of projections for US oil production. The recent pressure on prices put data on the growth of drilling rigs in the United States. During the last week drilling increased to 551, which is a 4 years high.

-

At 11:00 GMT the Bundesbank Monthly Report

-

At 11:30 GMT ECB president Mario Draghi will deliver a speech

-

At 13:15 GMT ECB Board Member Peter Praet will make a speech

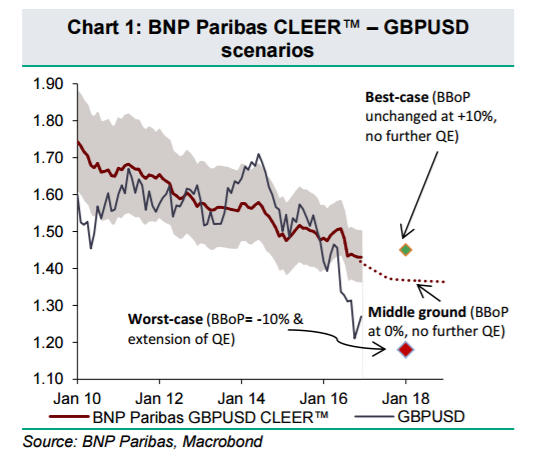

"The GBP will remain in focus heading into the ruling on Brexit from the Supreme Court, expected on Monday.

The government is generally not expected to win this appeal, but we think the significance of this ruling has diminished since last month's parliamentary resolution supporting the Q1 timeline for Article 50.

We continue to believe the GBP is trading near levels reflecting a worst-case scenario for trade and capital flows, and therefore expect long-term-oriented investors to be buyers below GBPUSD 1.20".

Copyright © 2017 BNP Paribas™, eFXnews™

According to data released today by the Ministry of Economy, Trade and Industry of Japan, the index of business activity in all sectors of the Japanese economy increased in November by 0.3% compared with October, better than the previous value. However, the October data was revised downward from 0.2% to 0.0%. The indicator measures the activity in all sectors of Japanese industry and allows to estimate the overall trend in services and production.

Japan's leading index climbed more than initially estimated in November and remained at the highest level in fifteen months, latest figures from from the Cabinet Office showed Monday, cited by rttnews.

The leading index, which measures the future economic activity, rose to 102.8 in November from 100.8 in October. The November reading was revised up slightly from 102.7.

Moreover, the latest score was the highest since August 2015, when it marked 103.4.

The coincident index that reflects the current economic activity, climbed to 115.0 in November from 113.5 a month earlier. The score was slightly below the preliminary estimate of 115.1.

Europe's main stock benchmark closed down modestly Friday, snapping a weekly run of gains, as investors remained largely on the sidelines before Donald Trump delivers his inauguration speech as the 45th president of the United States.

U.S. stocks closed higher Friday after coming off intraday highs as Donald Trump was sworn in as the 45th president of the U.S. In his inauguration speech, the new president reiterated his protectionist stance but did not offer details on how he would go about pursuing his agenda.

After some initial softness, Asian stocks are broadly higher as investors continue to digest what Donald Trump means to their holdings. But Japanese equities are a noted laggard as the yen leads broad currency gains in the dollar, rising nearly a full yen from late-Friday levels in the U.S.

EUR/USD

Resistance levels (open interest**, contracts)

$1.0842 (2720)

$1.0805 (2454)

$1.0778 (2226)

Price at time of writing this review: $1.0749

Support levels (open interest**, contracts):

$1.0636 (1395)

$1.0588 (1492)

$1.0525 (2877)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 57617 contracts, with the maximum number of contracts with strike price $1,0800 (3628);

- Overall open interest on the PUT options with the expiration date March, 13 is 66859 contracts, with the maximum number of contracts with strike price $1,0000 (4928);

- The ratio of PUT/CALL was 1.16 versus 1.20 from the previous trading day according to data from January, 20

GBP/USD

Resistance levels (open interest**, contracts)

$1.2706 (1060)

$1.2609 (1367)

$1.2512 (1376)

Price at time of writing this review: $1.2431

Support levels (open interest**, contracts):

$1.2286 (1238)

$1.2190 (1076)

$1.2093 (560)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 18400 contracts, with the maximum number of contracts with strike price $1,2800 (1520);

- Overall open interest on the PUT options with the expiration date March, 13 is 22683 contracts, with the maximum number of contracts with strike price $1,1500 (3228);

- The ratio of PUT/CALL was 1.23 versus 1.22 from the previous trading day according to data from January, 20

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.