- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

(raw materials / closing price /% change)

Oil 52.93 -0.47%

Gold 1,208.30 -0.21%

(index / closing price / change items /% change)

Nikkei -103.04 18787.99 -0.55%

TOPIX -8.30 1506.33 -0.55%

Hang Seng +51.34 22949.86 +0.22%

CSI 300 +0.37 3364.45 +0.01%

Euro Stoxx 50 +8.49 3281.53 +0.26%

FTSE 100 -0.84 7150.34 -0.01%

DAX +49.19 11594.94 +0.43%

CAC 40 +8.62 4830.03 +0.18%

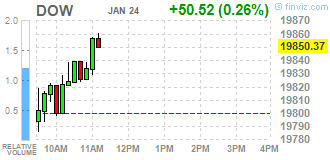

DJIA +112.86 19912.71 +0.57%

S&P 500 +14.87 2280.07 +0.66%

NASDAQ +48.01 5600.96 +0.86%

S&P/TSX +130.56 15610.69 +0.84%

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0731 -0,31%

GBP/USD $1,2519 -0,11%

USD/CHF Chf1,0007 +0,44%

USD/JPY Y113,78 +0,87%

EUR/JPY Y122,09 +0,64%

GBP/JPY Y142,43 +0,84%

AUD/USD $0,7580 -0,03%

NZD/USD $0,7245 -1,19%

USD/CAD C$1,3157 -0,60%

00:30 Australia CPI, q/q Quarter IV 0.7% 0.7%

00:30 Australia CPI, y/y Quarter IV 1.3% 1.6%

00:30 Australia Trimmed Mean CPI q/q Quarter IV 0.4% 0.5%

00:30 Australia Trimmed Mean CPI y/y Quarter IV 1.7% 1.4%

07:00 Switzerland UBS Consumption Indicator December 1.43

09:00 Germany IFO - Business Climate January 111 111.2

09:00 Germany IFO - Current Assessment January 116.6 116.9

09:00 Germany IFO - Expectations January 105.6 105.8

11:00 United Kingdom CBI industrial order books balance January 0 5

14:00 Belgium Business Climate January -0.2 0.5

14:00 U.S. Housing Price Index, m/m November 0.4% 0.4%

15:30 U.S. Crude Oil Inventories January 2.347 -1.25

21:45 New Zealand CPI, q/q Quarter IV 0.2% 0.3%

21:45 New Zealand CPI, y/y Quarter IV 0.2% 1.2%

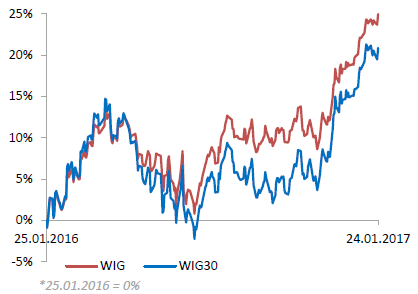

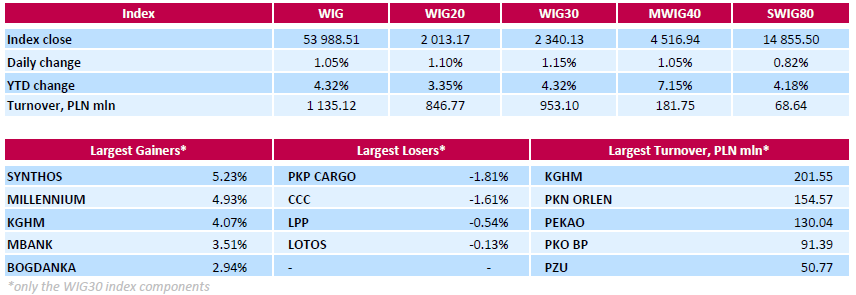

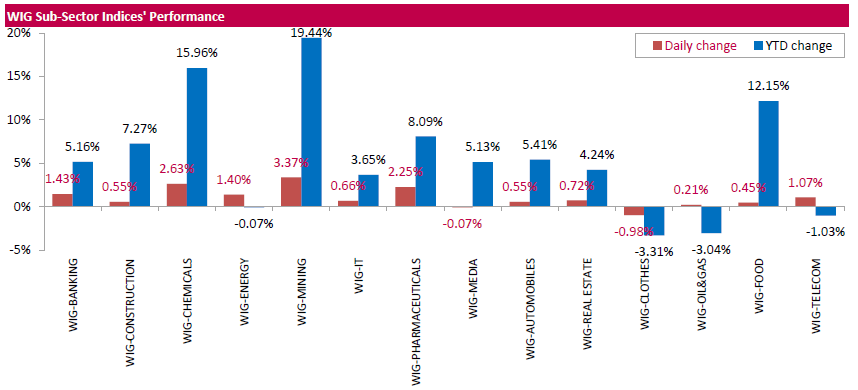

Polish equity market closed higher on Monday. The broad market measure, the WIG Index, surged by 1.05%. Except for clothes (-0.98%) and media (-0.07%), every sector in the WIG Index rose, with mining (+3.37%) outperforming.

The large-cap stocks' measure, the WIG30 Index, rose by 1.15%. There were only four decliners among the index components. Railway freight transport operator PKP CARGO (WSE: PKP) was the worst-performing name, tumbling by 1.81%. Other laggards were oil refiner LOTOS (WSE: LTS) and two retailers LPP (WSE: LPP) and CCC (WSE: CCC), losing between 0.13% and 1.61%. At the same time, chemical producer SYNTHOS (WSE: SNS) became the strongest performer with a 5.23% gain, supported by a target price hike by analysts of a regional investment bank. It was followed by copper producer KGHM (WSE: KGH), jumping by 4.07% as well as two banks MILLENNIUM (WSE: MIL) and MBANK (WSE: MBK), advancing by 4.93% and 2.94% respectively, as the both banks announced they saw no need to seek fresh capital despite authorities recommendation for banks to put more capital aside if they hold foreign exchange-denominated mortgages. Among other major outperformers were also thermal coal miner BOGDANKA (WSE: LWB) and genco TAURON PE (WSE: TPE), gaining 2.94% and 2.87% respectively. The former was helped by the announcement that the company's coal production reached 9 mln tons in 2016, that was at the upper end of the planned range of 8.5-9 mln tonnes. Elsewhere, it was reported that agricultural producer KERNEL (WSE: KER) had set final guidance for a benchmark five-year US dollar bond at 9% (+/-12.5bp), to price in range. Thus, the Ukrainian holding, rated B+/B, began marketing the notes at 9.25-9.50%. Order books are over $2 bln on the 144A/Reg S deal, which will price today via lead managers ING and JP Morgan. The KER stock added 0.36% on the back of this announcement.

Major U.S. stock-indexes higher on Tuesday as investors assessed quarterly earnings, while seeking clarity on President Donald Trump's economic policies. With earnings gathering pace, investors are hoping that corporate performance can justify market valuations, given the recent rally that drove Wall Street to record highs.

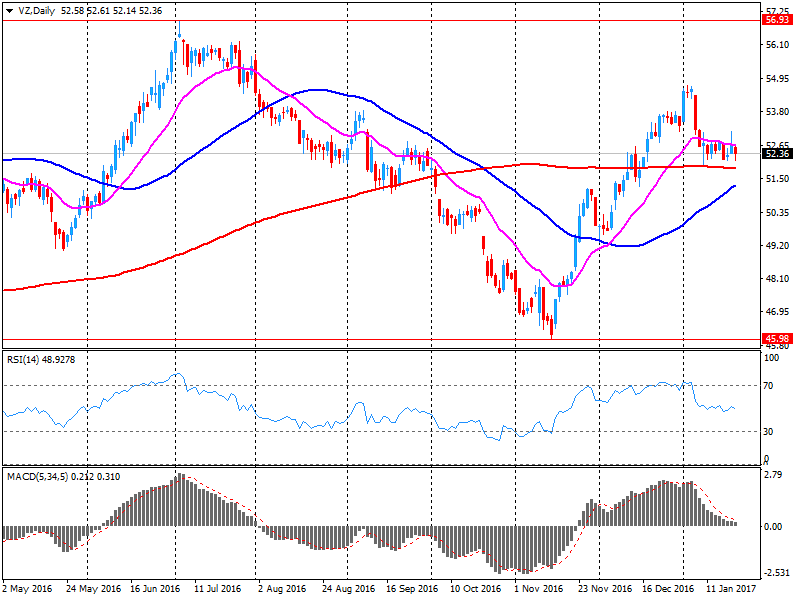

Most of Dow stocks in positive area (20 of 30). Top gainer - E. I. du Pont de Nemours and Company (DD, +3.29%). Top loser - Verizon Communications Inc. (VZ, -4.37%).

Almost all of S&P sectors in positive area. Top gainer - Basic Materials (+1.1%). Top loser - Healthcare (-1.0%).

At the moment:

Dow 19764.00 +29.00 +0.15%

S&P 500 2265.50 +3.50 +0.15%

Nasdaq 100 5072.50 +9.00 +0.18%

Oil 53.36 +0.61 +1.16%

Gold 1214.20 -1.40 -0.12%

U.S. 10yr 2.43 +0.03

U.S. stock-index futures were flat, as investors assessed quarterly earnings reports of a batch of high-profile companies.

Global Stocks:

Nikkei 18,787.99 -103.04 -0.55%

Hang Seng 22,949.86 +51.34 +0.22%

Shanghai 3,143.09 +6.32 +0.20%

FTSE 7,163.23 +12.05 +0.17%

CAC4,822.84 +1.43 +0.03%

DAX 11,572.30 +26.55 +0.23%

Crude $53.16 (+0.78%)

Gold $1,213.30 (-0.19%)

(company / ticker / price / change ($/%) / volume)

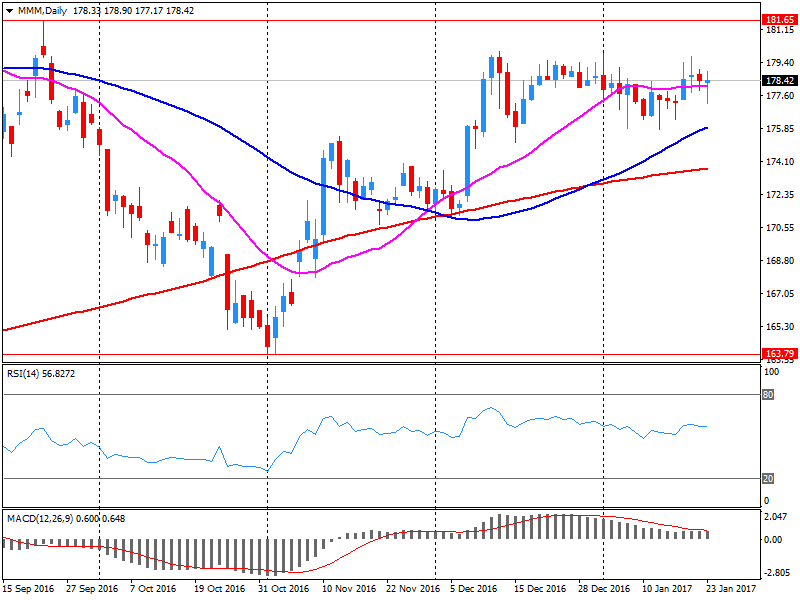

| 3M Co | MMM | 176.7 | -1.81(-1.014%) | 15137 |

| ALCOA INC. | AA | 36.85 | 0.56(1.5431%) | 42516 |

| ALTRIA GROUP INC. | MO | 70.65 | 0.10(0.1417%) | 980 |

| Amazon.com Inc., NASDAQ | AMZN | 820.05 | 2.17(0.2653%) | 13245 |

| American Express Co | AXP | 76.13 | 0.16(0.2106%) | 1399 |

| Apple Inc. | AAPL | 119.46 | -0.62(-0.5163%) | 162520 |

| AT&T Inc | T | 41.4 | -0.60(-1.4286%) | 105678 |

| Barrick Gold Corporation, NYSE | ABX | 17.78 | -0.04(-0.2245%) | 67855 |

| Boeing Co | BA | 157.59 | -0.25(-0.1584%) | 5017 |

| Caterpillar Inc | CAT | 94.71 | 0.25(0.2647%) | 3131 |

| Chevron Corp | CVX | 115 | -0.39(-0.338%) | 315 |

| Cisco Systems Inc | CSCO | 30.34 | 0.07(0.2313%) | 2742 |

| Citigroup Inc., NYSE | C | 55.95 | 0.27(0.4849%) | 10551 |

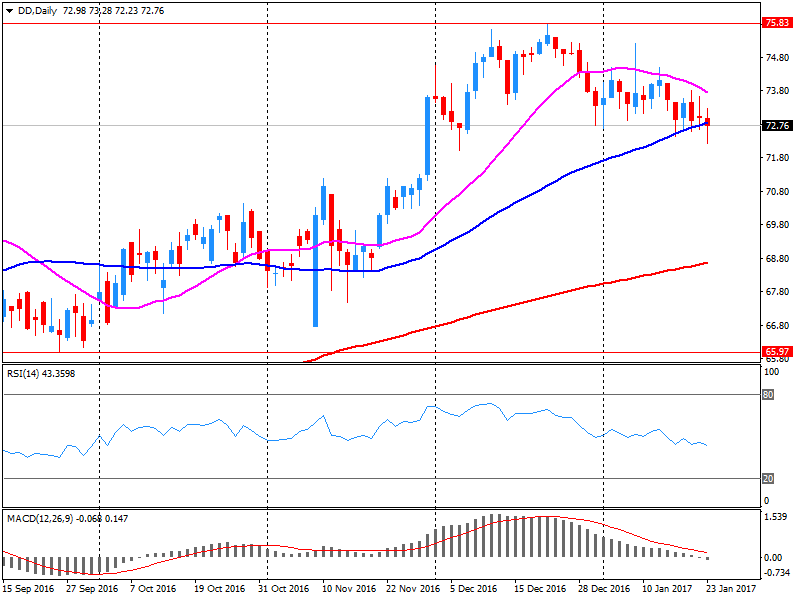

| E. I. du Pont de Nemours and Co | DD | 72.28 | -0.50(-0.687%) | 5786 |

| Exxon Mobil Corp | XOM | 85.15 | 0.18(0.2118%) | 5166 |

| Facebook, Inc. | FB | 129.26 | 0.33(0.2559%) | 78841 |

| Ford Motor Co. | F | 12.35 | 0.04(0.3249%) | 66707 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 16.23 | 0.51(3.2443%) | 327665 |

| General Electric Co | GE | 29.83 | 0.08(0.2689%) | 21051 |

| General Motors Company, NYSE | GM | 36.87 | 0.22(0.6003%) | 6216 |

| Goldman Sachs | GS | 233.37 | 0.70(0.3009%) | 2279 |

| Google Inc. | GOOG | 821.29 | 1.98(0.2417%) | 2846 |

| Home Depot Inc | HD | 138.54 | 0.47(0.3404%) | 2445 |

| Intel Corp | INTC | 36.83 | 0.06(0.1632%) | 2429 |

| International Business Machines Co... | IBM | 171.22 | 0.19(0.1111%) | 1987 |

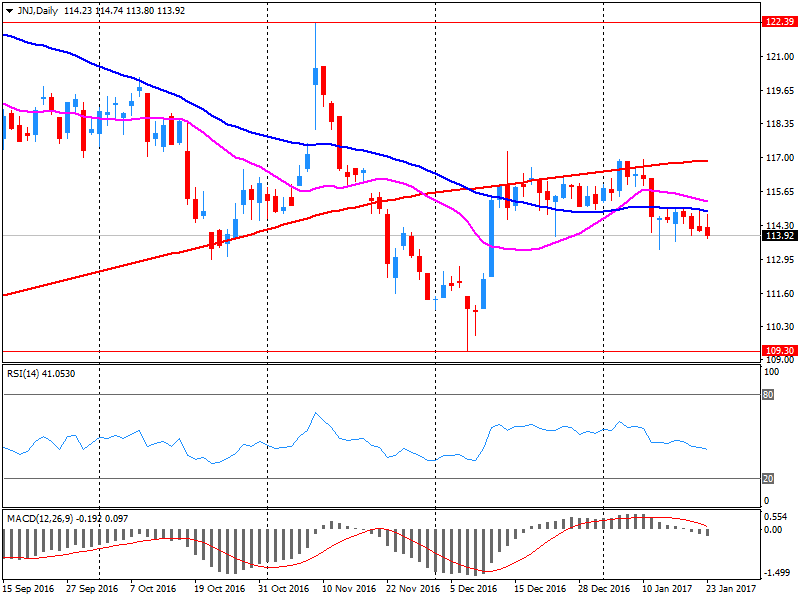

| Johnson & Johnson | JNJ | 112.38 | -1.53(-1.3432%) | 70051 |

| JPMorgan Chase and Co | JPM | 83.91 | 0.20(0.2389%) | 4936 |

| McDonald's Corp | MCD | 121.47 | 0.09(0.0741%) | 358 |

| Merck & Co Inc | MRK | 62.1 | 0.29(0.4692%) | 892 |

| Microsoft Corp | MSFT | 63.1 | 0.14(0.2224%) | 8570 |

| Pfizer Inc | PFE | 31.54 | 0.08(0.2543%) | 5500 |

| Procter & Gamble Co | PG | 87.3 | 0.34(0.391%) | 1728 |

| Starbucks Corporation, NASDAQ | SBUX | 57.9 | 0.14(0.2424%) | 1456 |

| Tesla Motors, Inc., NASDAQ | TSLA | 249.8 | 0.88(0.3535%) | 14179 |

| The Coca-Cola Co | KO | 41.44 | 0.01(0.0241%) | 3772 |

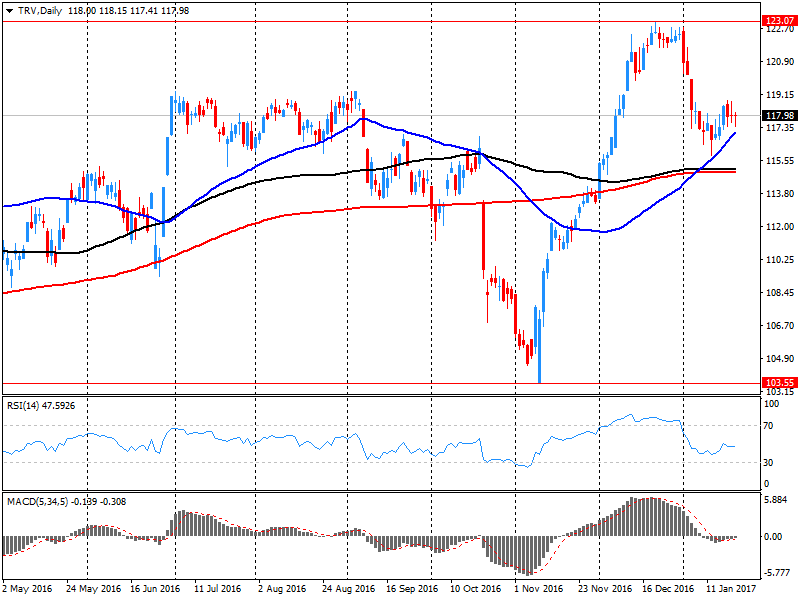

| Travelers Companies Inc | TRV | 118.58 | 0.54(0.4575%) | 16442 |

| Twitter, Inc., NYSE | TWTR | 16.65 | 0.04(0.2408%) | 3254 |

| United Technologies Corp | UTX | 110.16 | -0.18(-0.1631%) | 885 |

| Verizon Communications Inc | VZ | 50.7 | -1.71(-3.2627%) | 600819 |

| Wal-Mart Stores Inc | WMT | 66.71 | 0.06(0.09%) | 510 |

| Walt Disney Co | DIS | 107.19 | 0.07(0.0653%) | 1530 |

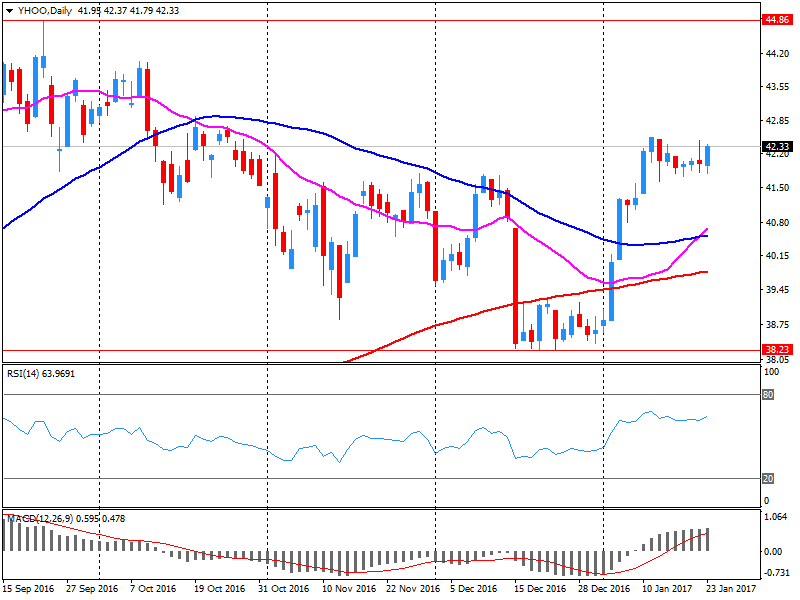

| Yahoo! Inc., NASDAQ | YHOO | 43.65 | 1.25(2.9481%) | 847487 |

| Yandex N.V., NASDAQ | YNDX | 22.28 | 0.19(0.8601%) | 100 |

Upgrades:

Downgrades:

Apple (AAPL) downgraded to Equal Weight from Overweight at Barclays; target to $117 from $119

Other:

Deere (DE) initiated with a Sell at Berenberg; target $90

Yahoo! (YHOO) target lowered to $43 from $45 at RBC Capital

EURUSD 1.0700 (1.7bln) 1.0725 (579m)

USDJPY 112.00 (USD 795m) 113.00 (641m) 113.60 (335m) 114.00 (916m)

EURGBP 0.8790-0.8800 (EUR 1.1bln)

AUDUSD 0.7500 (AUD 353m) 0.7600-10 (447m) 0.7635 (298m)

USDCAD 1.3400 (USD 290m)

Verizon reported Q4 FY 2016 earnings of $0.86 per share (versus $0.89 in Q4 FY 2015), missing analysts' consensus estimate of $0.89.

The company's quarterly revenues amounted to $32.340 bln (-5.6% y/y), generally in-line with analysts' consensus estimate of $32.123 bln.

VZ fell to $51.00 (-2.69%) in pre-market trading.

Travelers reported Q4 FY 2016 earnings of $3.20 per share (versus $2.90 in Q4 FY 2015), beating analysts' consensus estimate of $2.81.

The company's quarterly revenues amounted to $7.193 bln (+7.7% y/y), beating analysts' consensus estimate of $6.177 bln.

TRV fell to $118.00 (-0.03%) in pre-market trading.

Johnson & Johnson reported Q4 FY 2016 earnings of $1.58 per share (versus $1.44 in Q4 FY 2015), beating analysts' consensus estimate of $1.56.

The company's quarterly revenues amounted to $18.106 bln (+1.7% y/y), generally in-line with analysts' consensus estimate of $18.260 bln.

The company also issued downside guidance for FY 2017, projecting EPS of $6.93-7.08 (versus analysts' consensus estimate of $7.12) and revenues of $74.1-74.8 bln (versus analysts' consensus estimate of $75.13 bln).

JNJ fell to $112.28 (-1.43%) in pre-market trading.

DuPont reported Q4 FY 2016 earnings of $0.51 per share (versus $0.27 in Q4 FY 2015), beating analysts' consensus estimate of $0.42.

The company's quarterly revenues amounted to $5.211 bln (-1.7% y/y), slightly missing analysts' consensus estimate of $5.265 bln.

The company also issued guidance for Q1, projecting EPS of $1.36 (+8% y/y), while analysts forecast Q1 EPS of $1.41.

DD fell to $72.50 (-0.38%)in pre-market trading.

3M reported Q4 FY 2016 earnings of $1.88 per share (versus $1.80 in Q4 FY 2015), beating analysts' consensus estimate of $1.87.

The company's quarterly revenues amounted to $7.329 bln (+0.4% y/y), generally in-line with analysts' consensus estimate of $7.338 bln.

The company also reaffirmed guidance for FY 2017, projecting EPS of $8.45-8.80 (versus analysts' consensus estimate of $8.62) and organic sales growth at +1-3%.

MMM rose to $179.00 (+0.27%) in pre-market trading.

EUR/USD

Offers 1.0760 1.0780 1.0800 1.0830 1.0850-55 1.0880 1.0900

Bids 1.0720 1.0700 1.0680 1.0650 1.0625-30 1.0600 1.05801.0565 1.0550

GBP/USD

Offers 1.2500 1.2520 1.2550 1.2585 1.2600 1.2630 1.2650 1.2675-80 1.2700

Bids 1.2450 1.2420 1.2400 1.2375-80 1.2350 1.2320-25 1.2300 1.22801 .2250

EUR/GBP

Offers 0.8625-30 0.8650 0.8665 0.8680 0.8700 0.8730 0.8750 0.8780 0.8800

Bids 0.8600 0.8580-85 0.8550 0.8530 0.8500 0.8485 0.8450 0.8400

EUR/JPY

Offers 122.00 122.30 122.50 122.80 123.00 123.50 124.00

Bids 121.50 121.20 121.00 120.80 120.50 120.00

USD/JPY

Offers 113.50 113.65 113.80 114.00 114.20 114.50 114.80 115.00 115.20 115.35 115.55-60

Bids 113.00 112.80 112.65 112.50 112.30 112.00 111.80 111.50

AUD/USD

Offers 0.7585 0.7600 0.7630 0.7650 0.7675 0.7700

Bids 0.7545-50 0.7525-30 0.7500 0.7480-85 0.7450

Yahoo! reported Q4 FY 2016 earnings of $0.25 per share (versus $0.13 in Q4 FY 2015), beating analysts' consensus estimate of $0.21.

The company's quarterly revenues amounted to $0.960 bln (-4.2% y/y), beating analysts' consensus estimate of $0.908 bln.

YHOO rose to $43.95 (+3.66%) in pre-market trading.

EUR/USD 1.0700 (1.7bln) 1.0725 (579m)

USD/JPY 112.00 (USD 795m) 113.00 (641m) 113.60 (335m) 114.00 (916m)

EUR/GBP 0.8790-0.8800 (EUR 1.1bln)

AUD/USD 0.7500 (AUD 353m) 0.7600-10 (447m) 0.7635 (298m)

USD/CAD 1.3400 (USD 290m)

Информационно-аналитический отдел TeleTrade

EUR/USD

Resistance levels (open interest**, contracts)

$1.0859 (2718)

$1.0826 (2420)

$1.0804 (2223)

Price at time of writing this review: $1.0743

Support levels (open interest**, contracts):

$1.0663 (1349)

$1.0609 (1627)

$1.0542 (2964)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 57574 contracts, with the maximum number of contracts with strike price $1,0750 (3677);

- Overall open interest on the PUT options with the expiration date March, 13 is 66916 contracts, with the maximum number of contracts with strike price $1,0000 (4929);

- The ratio of PUT/CALL was 1.16 versus 1.16 from the previous trading day according to data from January, 23

GBP/USD

Resistance levels (open interest**, contracts)

$1.2806 (1580)

$1.2709 (1106)

$1.2613 (1381)

Price at time of writing this review: $1.2470

Support levels (open interest**, contracts):

$1.2388 (247)

$1.2291 (1243)

$1.2194 (1066)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 19718 contracts, with the maximum number of contracts with strike price $1,2800 (2351);

- Overall open interest on the PUT options with the expiration date March, 13 is 22799 contracts, with the maximum number of contracts with strike price $1,1500 (3237);

- The ratio of PUT/CALL was 1.16 versus 1.23 from the previous trading day according to data from January, 23

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

European stocks closed in the red Monday as equity investors got their first chance to react to President Donald Trump's inauguration speech, seen as taking a protectionist tone.

U.S. stocks closed down Monday, but off session lows of the day as investors wrestled with uncertainty over the policies of President Donald Trump and as a batch of corporate quarterly results came out mixed.

Asian shares were lacking direction early Tuesday, as the overnight decision by the U.S. to pull out of a regional trade pact, as well as increased protectionist rhetoric, have largely been priced in by the market.

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.