- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

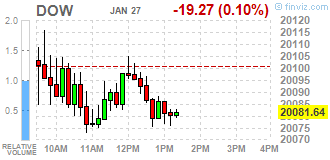

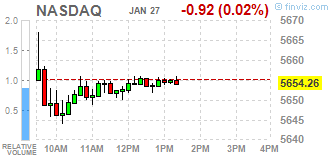

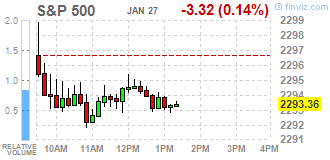

Major U.S. stock-indexes little changed on Friday as investors paused after a recent rally following underwhelming corporate earnings and gross domestic product data. U.S. economic growth slowed more than expected in the fourth quarter, with GDP rising at a 1,9% annual rate, below the 2,2% rise expected by economists and the 3,5% growth pace logged in the third quarter.

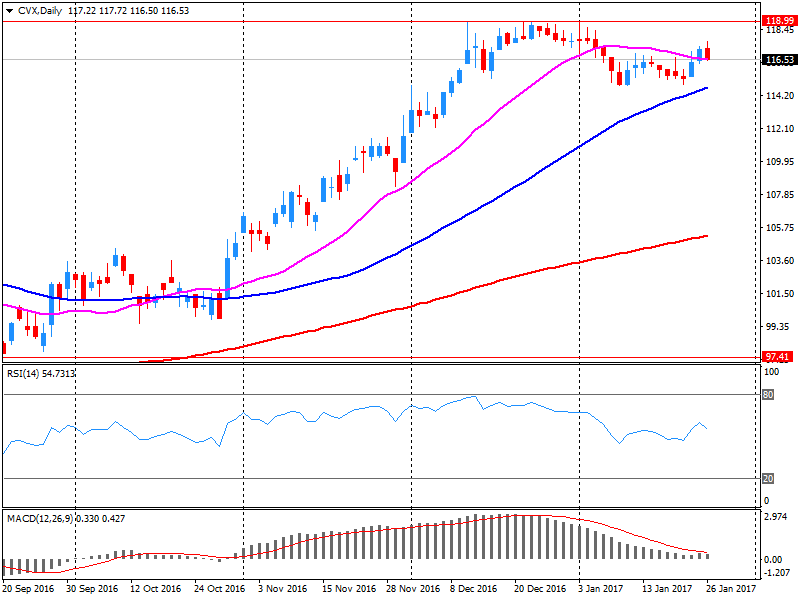

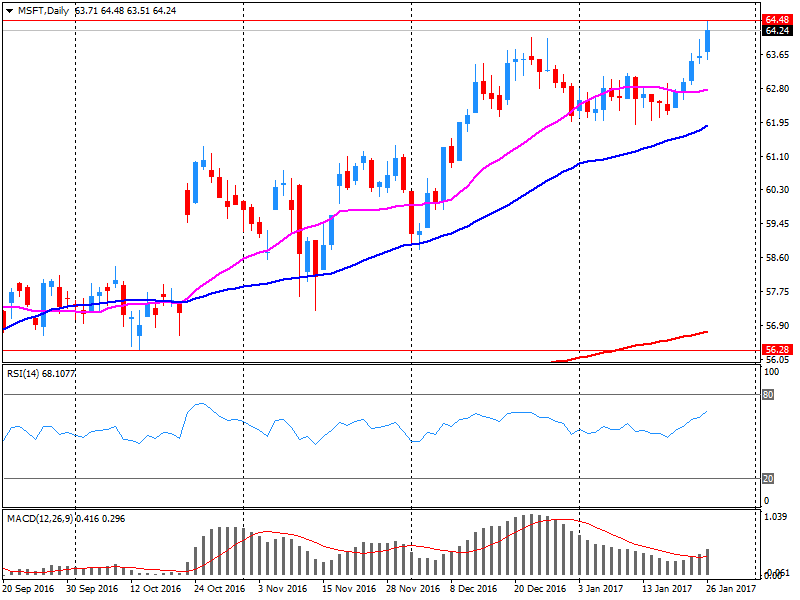

Dow stocks mixed (15 vs 15). Top loser - Chevron Corporation (CVX, -2.47%). Top gainer - Microsoft Corporation (MSFT, +2.25%).

Most of S&P sectors in negative area. Top gainer - Healthcare (+0.6%). Top loser - Basic Materials (-1.0%).

At the moment:

Dow 20012.00 -39.00 -0.19%

S&P 500 2288.75 -5.25 -0.23%

Nasdaq 100 5160.75 +13.00 +0.25%

Oil 52.84 -0.94 -1.75%

Gold 1188.90 -0.90 -0.08%

U.S. 10yr 2.49 -0.01

Polish equity market closed higher on Friday. The broad market measure, the WIG Index, added 0.18%. Sector-wise, food stocks (+2.50%) outperformed, while clothes sector names (-0.81%) lagged behind.

The large-cap stocks' measure, the WIG30 Index, rose by 0.13%. Within the index components, agricultural producer KERNEL (WSE: KER) led the gainers, jumping by 4.22 % as the stock continued to benefit from the announcement the company has successfully placed Eurobonds worth $500 mln this week. It was the first Ukraine's corporate bond issuance since a 2013-14 uprising and separatist conflict plunged the country into economic crisis. Other largest advancers were bank MBANK (WSE: MBK), copper producer KGHM (WSE: KGH), oil refiner PKN ORLEN (WSE: PKN), IT-company ASSECO POLAND (WSE: ACP) and genco PGE (WSE: PGE), adding between 1% and 2.77%. On the other side of the ledger, coking coal miner JSW (WSE: JSW) was the biggest loser, tumbling by 2.94% after significant gains earlier this week. It was followed by bank BZ WBK (WSE: BZW), genco ENEA (WSE: ENA) and thermal coal miner BOGDANKA (WSE: LWB), which fell by 2.49%, 2.26% and 2.09% respectively.

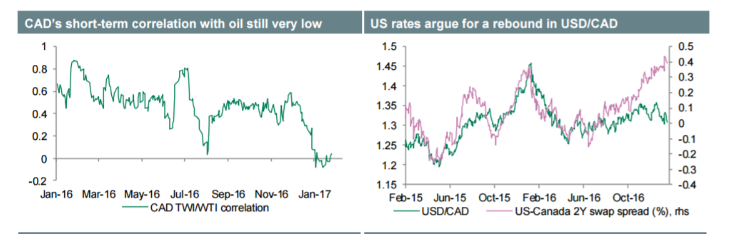

"The CAD has recouped its post-BoC losses. Markets were probably encouraged by President Trump's approval of the Keystone XL oil pipeline, previously blocked by President Barack Obama on environmental concerns.

However, we do not see this as an immediate negative for USD/CAD: although this would facilitate the delivery of oil from Western Canada to US refineries in several years' time, the immediate impact will mostly be via increased US hiring during the construction of the project. Markets were also likely to have been encouraged by the relatively constructive tone from Prime Minister Justin Trudeau and other Canadian politicians with respect to potentially re-negotiating the NAFTA terms, suggesting that the close US-Canada trade relationship will most likely largely survive the protectionist leanings of the new US administration.

However, from a valuation perspective, the CAD is starting to look expensive again, as oil prices remain in their current USD51-55/bl range and 2Y rate differentials with the US continue to widen.

We expect USD/CAD to rise to 1.37 by the end of Q1 and 1.40 by Q3.

In the week ahead, we are watching the November GDP report. BoC Governor Stephen Poloz speaks on Tuesday, 31 January, when he gets a chance to clarify his comment at the press conference that a rate cut remains "on the table".

"Consumers expressed a higher level of confidence January than any other time in the last dozen years. The post-election surge in confidence was driven by a more optimistic outlook for the economy and job growth during the year ahead as well as more favorable economic prospects over the next five years. Consumers also reported much more positive assessments of their current financial situation due to gains in both incomes and household wealth, and anticipated the most positive outlook for their personal finances in more than a decade", says Surveys of Consumers chief economist, Richard Curtin.

U.S. stock-index futures were flat as investors assessed a slew of important macroeconomic data and the latest earnings reports.

demonstrated caution after the major indices closed at record highs yesterday.

Global Stocks:

Nikkei 19,467.40 +65.01 +0.34%

Hang Seng 23,360.78 -13.39 -0.06%

Shanghai Closed

FTSE 7,169.31 +7.82 +0.11%

CAC 4,843.32 -23.92 -0.49%

DAX 11,822.76 -25.87 -0.22%

Crude $53.61 (-0.32%)

Gold $1,180.70 (-0.78%)

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 36.4 | 0.10(0.2755%) | 251 |

| ALTRIA GROUP INC. | MO | 70.72 | -0.13(-0.1835%) | 1300 |

| AMERICAN INTERNATIONAL GROUP | AIG | 65.55 | -0.47(-0.7119%) | 400 |

| Apple Inc. | AAPL | 122.06 | 0.12(0.0984%) | 21176 |

| AT&T Inc | T | 41.78 | 0.01(0.0239%) | 2737 |

| Barrick Gold Corporation, NYSE | ABX | 83.52 | 0.28(0.3364%) | 685 |

| Boeing Co | BA | 83.52 | 0.28(0.3364%) | 685 |

| Caterpillar Inc | CAT | 97.37 | 0.15(0.1543%) | 8805 |

| Chevron Corp | CVX | 113.63 | -2.92(-2.5054%) | 137400 |

| Cisco Systems Inc | CSCO | 30.72 | -0.02(-0.0651%) | 2349 |

| Citigroup Inc., NYSE | C | 57.29 | -0.07(-0.122%) | 5710 |

| Exxon Mobil Corp | XOM | 83.52 | 0.28(0.3364%) | 685 |

| Facebook, Inc. | FB | 132.34 | -0.44(-0.3314%) | 108315 |

| Ford Motor Co. | F | 83.52 | 0.28(0.3364%) | 685 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 83.52 | 0.28(0.3364%) | 685 |

| General Electric Co | GE | 30.38 | 0.06(0.1979%) | 14406 |

| General Motors Company, NYSE | GM | 83.52 | 0.28(0.3364%) | 685 |

| Goldman Sachs | GS | 238.67 | -0.91(-0.3798%) | 8401 |

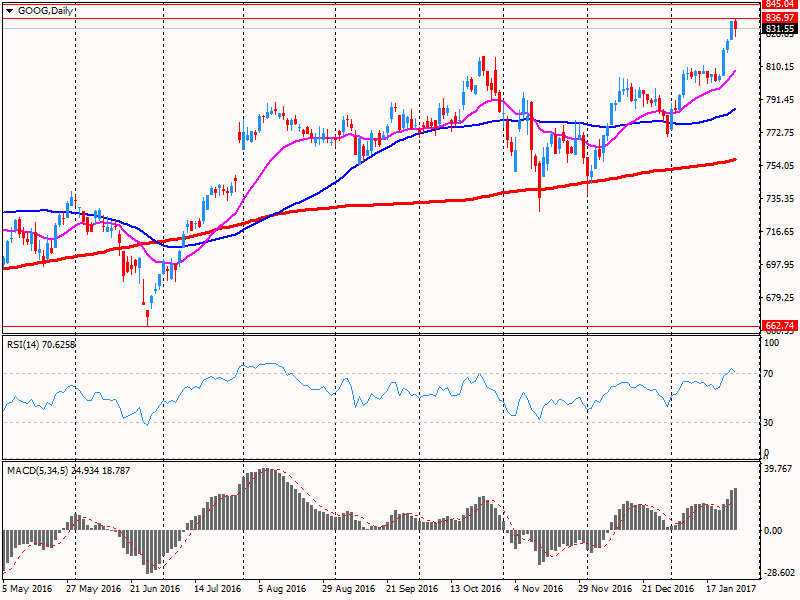

| Google Inc. | GOOG | 826.79 | -5.36(-0.6441%) | 91050 |

| HONEYWELL INTERNATIONAL INC. | HON | 117.11 | -0.86(-0.729%) | 9193 |

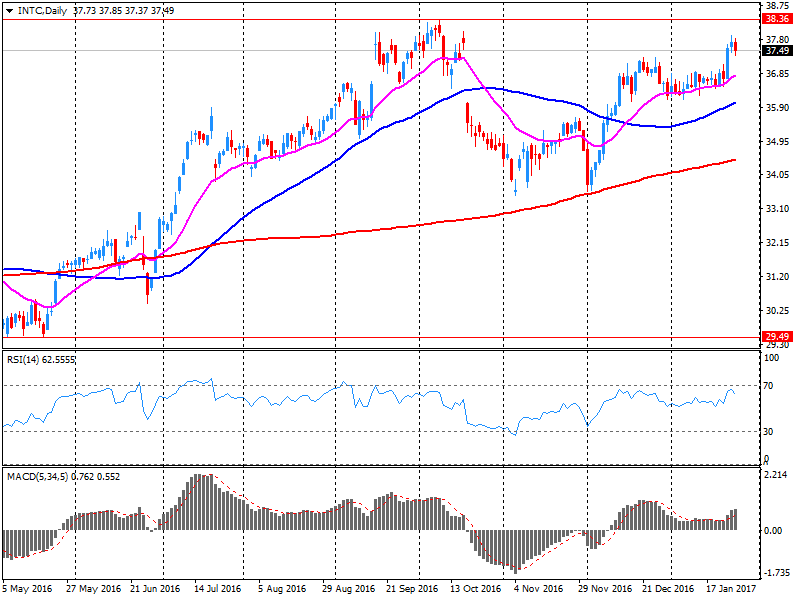

| Intel Corp | INTC | 37.94 | 0.38(1.0117%) | 143127 |

| International Business Machines Co... | IBM | 178.16 | -0.50(-0.2799%) | 59066 |

| Johnson & Johnson | JNJ | 112.16 | 0.32(0.2861%) | 1323 |

| JPMorgan Chase and Co | JPM | 86.69 | -0.06(-0.0692%) | 6232 |

| Microsoft Corp | MSFT | 65.09 | 0.82(1.2759%) | 600951 |

| Pfizer Inc | PFE | 31.37 | 0.09(0.2877%) | 2628 |

| Procter & Gamble Co | PG | 86.17 | -0.43(-0.4965%) | 4076 |

| Starbucks Corporation, NASDAQ | SBUX | 30.38 | 0.06(0.1979%) | 14406 |

| Tesla Motors, Inc., NASDAQ | TSLA | 251.65 | -0.86(-0.3406%) | 12377 |

| Twitter, Inc., NYSE | TWTR | 16.96 | 0.15(0.8923%) | 18970 |

| Verizon Communications Inc | VZ | 49.19 | 0.07(0.1425%) | 17571 |

| Visa | V | 83.52 | 0.28(0.3364%) | 685 |

| Wal-Mart Stores Inc | WMT | 67 | 0.27(0.4046%) | 2781 |

| Yahoo! Inc., NASDAQ | YHOO | 122.06 | 0.12(0.0984%) | 21176 |

| Yandex N.V., NASDAQ | YNDX | 23.5 | 0.22(0.945%) | 1127 |

Upgrades:

Microsoft (MSFT) upgraded to Neutral from Sell at Citigroup; target $65

Intel (INTC) upgraded to Equal-Weight from Underweight at Morgan Stanley

Caterpillar (CAT) upgraded to Outperform from Market Perform at Wells Fargo

Ford Motor (F) upgraded to Outperform at RBC Capital Mkts; target raised to $14

Downgrades:

Other:

Microsoft (MSFT) target raised to $71 from $69 at BMO Capital Markets

Microsoft (MSFT) target raised to $71 from $65 at RBC Capital Mkts

Microsoft (MSFT) target raised to $68 from $66 at Stifel

Intel (INTC) target raised to $43 from $42 at Needham

Caterpillar (CAT) target raised to $85 at RBC Capital Mkts

EURUSD 1.0495-1.0500 (EUR 831m) 1.0630 (307m) 1.0645-55 (543m) 1.0750 (485m)1.0900 (423m) 1.0650 (271m) 1.0750 (256m)

USDJPY 113.20-25 (610m) 114.00 (722m) 114.85 (300m) Y115.00 (575m) 115.40-50(775m) 116.00 (358m)

GBPUSD: 1.2970 (GBP 700m)

AUDUSD: 0.7350 (AUD 724m) 0.7575 (333m) 0.7600 (244m)

USDCAD: 1.3145 (USD 520m) 1.3400 (2.69bln)

Chevron reported Q4 FY 2016 earnings of $0.22 per share (versus -$0.31 in Q4 FY 2015), missing analysts' consensus estimate of $0.68.

The company's quarterly revenues amounted to $31.497 bln (+7.7% y/y), missing analysts' consensus estimate of $32.962 bln.

CVX fell to $113.13 (-2.93%) in pre-market trading.

New orders for manufactured durable goods in December decreased $1.0 billion or 0.4 percent to $227.0 billion, the U.S. Census Bureau announced today. This decrease, down two consecutive months, followed a 4.8 percent November decrease. Excluding transportation, new orders increased 0.5 percent. Excluding defense, new orders increased 1.7 percent. Transportation equipment, also down two consecutive months, drove the decrease, $1.7 billion or 2.2 percent to $73.7 billion.

Nondefense new orders for capital goods in December increased $2.4 billion or 3.8 percent to $66.6 billion. Shipments increased $1.2 billion or 1.8 percent to $71.7 billion. Unfilled orders decreased $5.1 billion or 0.7 percent to $691.8 billion. Inventories increased $0.6 billion or 0.3 percent to $171.1 billion.

Real gross domestic product (GDP) increased at an annual rate of 1.9 percent in the fourth quarter of 2016, according to the "advance" estimate released by the Bureau of Economic Analysis. In the third quarter, real GDP increased 3.5 percent.

The increase in real GDP in the fourth quarter reflected positive contributions from personal consumption expenditures (PCE), private inventory investment, residential fixed investment, nonresidential fixed investment, and state and local government spending that were partly offset by negative contributions from exports and federal government spending. Imports, which are a subtraction in the calculation of GDP, increased

EUR/USD

Offers 1.0700 1.0730 1.0765 1.0780 1.0800 1.0830 1.0850-55

Bids 1.0655-60 1.0625-30 1.0600 1.0580 1.0565 1.0550 1.0520 1.0500

GBP/USD

Offers 1.2560 1.2580 1.2600 1.2630 1.2660 1.2680 1.2700 1.2730 1.2750

Bids 1.2525-30 1.2500 1.2480-85 1.2450 1.2430 1.2400

EUR/GBP

Offers 0.8530-35 0.8550 0.8580-85 0.8600 0.8620 0.8650

Bids 0.8470-75 0.8450 0.8430 0.8400 0.8385 0.8350

EUR/JPY

Offers 123.30 123.50 123.80 124.00 124.20 124.50 124.80 125.00

Bids 122.80 122.60 122.30 122.00 121.80 121.60 121.20 121.00

USD/JPY

Offers 115.35 115.50 115.65 115.80 116.00 116.20 116.50 116.80 117.00

Bids 115.00 114.80-85 114.50 114.30 114.00 113.80 113.50 113.30 113.00

AUD/USD

Offers 0.7550-55 0.7580-85 0.7600 0.7630 0.7650 0.7675 0.7700

Bids 0.7500 0.7480-85 0.7450 0.7430 0.7400

Honeywell reported Q4 FY 2016 earnings of $1.74 per share (versus $1.58 in Q4 FY 2015), in-line with analysts' consensus estimate.

The company's quarterly revenues amounted to $9.985 bln (0% y/y), missing analysts' consensus estimate of $10.149 bln.

HON fell to $116.95 (-0.86%) in pre-market trading.

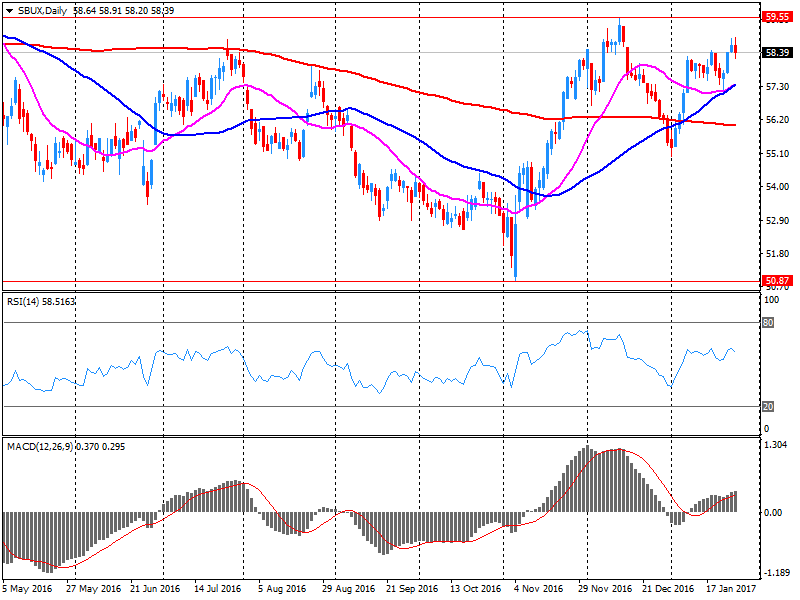

Starbucks reported Q1 FY 2017 earnings of $0.52 per share (versus $0.46 in Q1 FY 2016), in-line with analysts' consensus estimate.

The company's quarterly revenues amounted to $5.733 bln (+6.7% y/y), missing analysts' consensus estimate of $5.851 bln.

SBUX fell to $55.70 (-4.72%) in pre-market trading.

Microsoft reported Q2 FY 2017 earnings of $0.83 per share (versus $0.78 in Q2 FY 2016), beating analysts' consensus estimate of $0.79.

The company's quarterly revenues amounted to $26.066 bln (+1.5% y/y), beating analysts' consensus estimate of $25.287 bln.

MSFT rose to $65.55 (+1.99%) in pre-market trading.

Intel reported Q4 FY 2016 earnings of $0.79 per share (versus $0.74 in Q4 FY 2015), beating analysts' consensus estimate of $0.75.

The company's quarterly revenues amounted to $16.400 bln (+10.1% y/y), beating analysts' consensus estimate of $15.750 bln.

The company also issued upside guidance for Q1, projecting EPS of $0.65 (versus analysts' consensus estimate of $0.61) and revenues of $14.8 bln (versus analysts' consensus estimate of $14.51 bln). For FY 2017, it forecast EPS of $2.80 (versus analysts' consensus estimate of $2.81) and revenues of $59.5 bln (versus analysts' consensus estimate of $60.85 bln).

INTC rose to $38.00 (+1.17%) in pre-market trading.

Alphabet reported Q4 FY 2016 earnings of $9.36 per share (versus $8.67 in Q4 FY 2015), missing analysts' consensus estimate of $9.62.

The company's quarterly revenues amounted to $26.064 bln (+22.2% y/y), beating analysts' consensus estimate of $25.140 bln.

GOOG fell to $820.99 (-1.34%) in pre-market trading.

European stocks traded mostly in the red zone correcting after strong growth in the previous session. Investors analyzed corporate reports and follow the fluctuations in the currency markets.

Certain influence had statistical data for the euro area. The ECB said that the euro zone's money supply increased significantly in December, accelerating relative to November and exceeded the estimates of experts. At the same time, private sector credit growth also improved, confirming expectations. December monetary aggregate M3 grew by 5.0 percent year on year, after increasing by 4.8 percent in November. Analysts had expected growth to accelerate to 4.9 per cent. In addition, the report showed that, on average over the past three months (to December) M3 monetary aggregate grew by 4.8 per cent, as in the previous 3-month period. Private sector credit volume increased by 2.5% in December after rising 2.4% in November. Adjusted lending to the private sector rose in December by 2.3% compared to 2.2% in November. The annual rate of growth in adjusted lending to households was 2.0% compared to 1.9% in November. Last change coincided with the forecast. At the same time, lending to non-financial corporations expanded by 2.3% compared with an increase of 2.1% in November.

Market participants are also awaiting the outcome of the talks between US President Donald Trump and British Prime Minister Theresa May. Leaders of the two countries should discuss a trade agreement between the United States and Britain. May stated that some of the barriers in trade between the United Kingdom and the United States may be withdrawn. In the case of the United States, with which Britain has close political and economic relations, there is a clear understanding and a desire to conclude an agreement on free trade.

The composite index of the largest companies in the region Stoxx Europe 600 was down 0.45%, to 365.84. However, the index is ready to complete the current week with an increase of 0.90%. The biggest decline demonstrates the banking sector - about 1%.

The capitalization of the Italian bank UniCredit fell 4.4% after the Italian media said that the vice-chairman confirmed that the bank did not sell its stake in Mediobanca. The lender will also launch its capital increase earlier than planned, on February 6, according to reports.

Wartsila shares - Finnish engineering company - rose by 7.2%, following statements on a higher than expected amount of profit and new orders in the last quarter.

At the moment:

FTSE 100 +13.03 7174.52 + 0.18%

DAX -30.43 11818.20 -0.26%

CAC 40 4842.56 -24.68 -0.51%

EUR/USD 1.0650 (EUR 271m) 1.0750 (256m)

USD/JPY 112.70-75 (626m) 112.95-113.00 (429m) 114.00 (2.1bln)

GBP/USD: 1.2260 (328m)

EUR/GBP: 0.8750 (379m)

USD/CHF: 1.000 (594m) 1.0250 (1.1bln)

AUD/USD: 0.7375 (813m) 0.7460 (250m)

Информационно-аналитический отдел TeleTrade

This morning, the New York futures for Brent fell 0.25% to $ 56.1 and WTI fell 0.07% to $ 53.74. Thus, the black gold prices little changed after the rapid growth in the past couple of sessions. Doubts about the effectiveness of market participants to reduce the oversupply not in focus anymore. According to the Ministry of Energy US analysts, the price of black gold will remain below $ 60 a barrel before the end of 2018.

"In the short run, we continue to expect EURUSD and GBPUSD to test major resistance levels, which is consistent with our roadmap from 1999, before turning again later.

Looking back to 1999, as the DXY started turning higher in October of 1999, it did not rally against JPY. The rally was against European currencies and it is these crosses - largely EURUSD and GBPUSD - that we believe will trend in favor of the USD over the months ahead.

A month after the June 1999 Fed hike, EURUSD posted a bullish monthly reversal (July 1999) and the DXY Index posted a bearish one. We may well see the same again this month. The monthly close levels to watch this month are

- EURUSD: 1.0875 - A monthly close above would result in a bullish monthly reversal targeting a decent gap to the 200 day which currently stands at 1.1017.

- USD-Index: 99.43 - A monthly close below would result in a bearish monthly reversal

If seen, we it would add to the short term bias of USD weakness. Beyond this short term bounce the overall picture still looks bearish for EURUSD just as we saw in the last cycle.

GBP/USD: Taken out the reverse head and shoulders neckline, 55 day moving average and previous falling trendline which all converged between 1.2406-1.2415

This break suggests a rally to 1.2842 which would be the reverse head and shoulders target.

Good resistance levels are at 1.2775-1.2798".

Copyright © 2017 CitiFX, eFXnews™

The annual growth rate of the broad monetary aggregate M3 increased to 5.0% in December 2016, from 4.8% in November.

• The annual growth rate of the narrower aggregate M1, which includes currency in circulation and overnight deposits, increased to 8.8% in December, from 8.5% in November.

• The annual growth rate of adjusted loans to households stood at 2.0% in December, compared with 1.9% in November.

• The annual growth rate of adjusted loans to non-financial corporations increased to 2.3% in December, from 2.1% in November.

EUR/USD

Resistance levels (open interest**, contracts)

$1.0782 (2520)

$1.0757 (2240)

$1.0741 (449)

Price at time of writing this review: $1.0668

Support levels (open interest**, contracts):

$1.0622 (1373)

$1.0597 (2047)

$1.0568 (1757)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 59258 contracts, with the maximum number of contracts with strike price $1,0800 (3762);

- Overall open interest on the PUT options with the expiration date March, 13 is 70852 contracts, with the maximum number of contracts with strike price $1,0000 (5001);

- The ratio of PUT/CALL was 1.20 versus 1.17 from the previous trading day according to data from January, 26

GBP/USD

Resistance levels (open interest**, contracts)

$1.2808 (1712)

$1.2712 (1623)

$1.2617 (1643)

Price at time of writing this review: $1.2546

Support levels (open interest**, contracts):

$1.2589 (14396)

$1.2492 (911)

$1.2394 (1451)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 22815 contracts, with the maximum number of contracts with strike price $1,2500 (2589);

- Overall open interest on the PUT options with the expiration date March, 13 is 25551 contracts, with the maximum number of contracts with strike price $1,1500 (3231);

- The ratio of PUT/CALL was 1.12 versus 1.06 from the previous trading day according to data from January, 26

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

"EURCAD is currently consolidating the sharp fall experienced from November till December 2016.

However, with a major top still in place we remain bearish and look for an eventual break below 1.3820 to turn the core trend lower again for the 61.8% retracement of the 2012/16 rise and potential trend support 1.3648/25 next.

We would expect a renewed basing effort here. However, below it would then aim at 1.3520, potentially the April 2015 major low at 1.3024.

Resistance shows first at 1.4368/94 with "neckline" and 200-day average barriers at 1.4441/47 ideally capping to keep the overall trend still bearish".

Copyright © 2017 Credit Suisse, eFXnews™

Consumer prices in Japan were up 0.3 percent on year in December, the Ministry of Internal Affairs and Communications said, cited by rttnews.

That topped expectations for 0.2 percent but was down from 0.5 percent in November.

Core consumer prices, which exclude food, sank an annual 0.2 percent. That also beat forecasts for a decline of 0.3 percent following the 0.4 percent contraction a month earlier.

Overall inflation for the Tokyo region, considered a leading indicator for the nationwide trend, added 0.1 percent on year in January versus expectations for a flat reading - which would have been unchanged.

Today, after the publication of weak data on inflation Japanese Prime Minister Shinzo Abe said Japan is still facing deflationary pressure. However, the politician added that he is waiting for the situation to improve in the near future.

This morning, the Bank of Japan increased its purchases of Japanese government bonds with a maturity of 5-10 years. The Central Bank took such measures in order to curb the rise of Japanese government bond yields. After this decision the 10-year Japanese government bonds yield fell to 0.07% compared to yesterday's value of 0.09% (the highest level since December 16).

USD / JPY rose, breaking the psychological level of Y115.00, and continues to trade around this level.

The Import Price Index rose 0.2% in the December quarter 2016. Through the year to the December quarter 2016, the Import Price Index fell 4.6%.

The Export Price Index rose 12.4% in the December quarter 2016. Through the year to the December quarter 2016, the Export Price Index rose 12.4%.

European stocks on Thursday finished at their highest level in nearly 13 months, supported by a surge in biotech firm Actelion Ltd. and gains for bank stocks. The Stoxx Europe 600 index SXXP, +0.25% rose 0.3% to 367.50, rising for a third straight day and representing the highest close for the pan-European benchmark since Dec. 30, 2015, according to FactSet data.

The Dow Jones Industrial Average on Thursday extended its run into the record books, but the broader market meandered as gains in industrials and consumer-discretionary shares were offset by losses in health-care and consumer-staples.

Investors' renewed enthusiasm for risk continued into Asia-Pacific trading on Friday morning, as equities continued to build on recent gains and the dollar crept upward, breaching 115 yen for the first time this week. The shifts in asset prices have come as investors have had different interpretations of what Trump administration policies will mean in the U.S. and worldwide.

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.