- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

(raw materials / closing price /% change)

Oil 53.71 -0.13%

Gold 1,188.10 -0.14%

(index / closing price / change items /% change)

Nikkei +344.89 19402.39 +1.81%

TOPIX +23.43 1545.01 +1.54%

Hang Seng +325.05 23374.17 +1.41%

CSI 300 +12.06 3387.96 +0.36%

Euro Stoxx 50 -7.02 3319.13 -0.21%

FTSE 100 -2.94 7161.49 -0.04%

DAX +42.58 11848.63 +0.36%

CAC 40 -10.43 4867.24 -0.21%

DJIA +32.40 20100.91 +0.16%

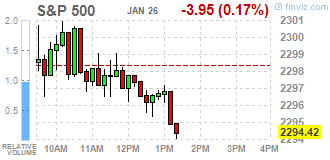

S&P 500 -1.69 2296.68 -0.07%

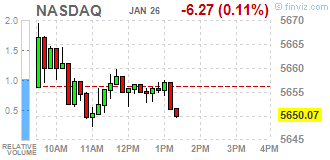

NASDAQ -1.16 5655.18 -0.02%

S&P/TSX -28.32 15615.52 -0.18%

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0681 -0,63%

GBP/USD $1,2592 -0,31%

USD/CHF Chf0,9996 +0,03%

USD/JPY Y114,51 +1,08%

EUR/JPY Y122,32 +0,47%

GBP/JPY Y144,2 +0,78%

AUD/USD $0,7533 -0,49%

NZD/USD $0,7244 -0,72%

USD/CAD C$1,3088 +0,15%

00:30 Australia Producer price index, q / q Quarter IV 0.3% 0.2%

00:30 Australia Producer price index, y/y Quarter IV 0.5%

00:30 Australia Export Price Index, q/q Quarter IV 3.5% 11%

00:30 Australia Import Price Index, q/q Quarter IV -1% -0.5%

09:00 Eurozone Private Loans, Y/Y December 1.9% 2%

09:00 Eurozone M3 money supply, adjusted y/y December 4.8% 4.9%

13:30 U.S. Durable Goods Orders December -4.6% 2.6%

13:30 U.S. Durable Goods Orders ex Transportation December 0.5% 0.5%

13:30 U.S. Durable goods orders ex defense November -6.6%

13:30 U.S. PCE price index ex food, energy, q/q (Preliminary) Quarter IV 1.7% 1.7%

13:30 U.S. PCE price index, q/q (Preliminary) Quarter IV 1.5%

13:30 U.S. GDP, q/q (Preliminary) Quarter IV 3.5% 2.2%

15:00 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) December 98.2 98.1

Major U.S. stock indexes little changed on Thursday, after breaching the milestone a day earlier, while losses in tech stocks weighed on the S&P 500 and the Nasdaq Composite indexes. The post-election rally roared back to life this week following optimism over U.S. President Donald Trump's pro-growth initiatives and solid earnings, catapulting the Dow above the historic mark.

Dow stocks mixed (15 vs 15). Top loser - Verizon Communications Inc. (VZ, -1.35%). Top gainer - UnitedHealth Group Incorporated (UNH, +1.31%).

Most of S&P sectors in negative area. Top gainer - Conglomerates (+1.5%). Top loser - Consumer goods (-0.7%).

At the moment:

Dow 20023.00 +20.00 +0.10%

S&P 500 2292.00 -2.00 -0.09%

Nasdaq 100 5154.50 +8.00 +0.16%

Oil 53.70 +0.95 +1.80%

Gold 1189.50 -8.30 -0.69%

U.S. 10yr 2.51 -0.01

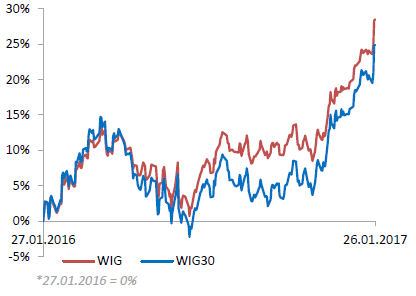

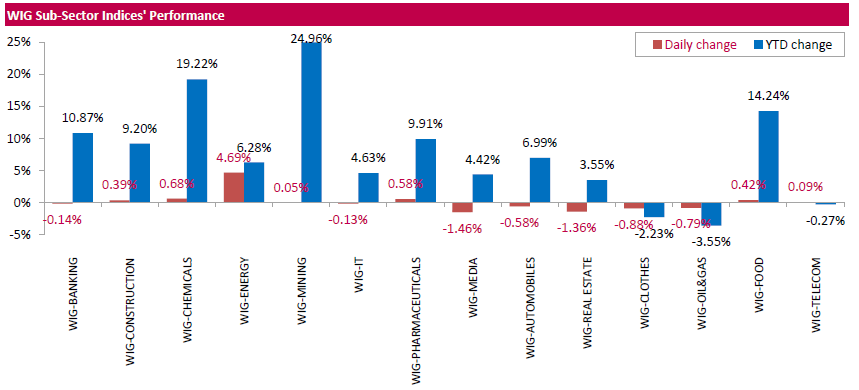

Polish equity market closed slightly higher on Thursday. The broad market measure, the WIG index, added 0.14%. Sector performance within the WIG Index was mixed. Utilities stocks (+4.69%) were the strongest group, while media names (-1.46%) lagged behind.

The large-cap stocks' measure, the WIG30 Index, edged up 0.07%. In the index basket, coking coal producer JSW (WSE: JSW) and four energy generating sector's names ENERGA (WSE: ENG), ENEA (WSE: ENA), PGE (WSE: PGE) and TAURON (WSE: TPE) posted the largest gains, climbing by 2.41%-9.21%. At the same time, bank ING BSK (WSE: ING) was biggest loser, dropping by 3.43%. Other major laggards were footwear retailer CCC (WSE: CCC), bank MBANK (WSE: MBK) and oil refiner PKN ORLEN (WSE: PKN), falling by 1.87%, 1.12% and 1.1% respectively. It should be noted that PKN ORLEN reported that its net profit amounted to PLN 5.261 bln in 2016, up 85.4% y/y. Its total sales volume rose by 2 percent to a record 10 bln liters of fuel. But its revenues fell by 9.9% y/y to PLN 79.553 bln. As a result, its net margin stood at 12.1%, down 5.5 p.p. y/y. The company also said that it expected that its downstream margin might slightly decrease in 2017 compared to the 2016 average.

Sales of new single-family houses in December 2016 were at a seasonally adjusted annual rate of 536,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 10.4 percent below the revised November rate of 598,000 and is 0.4 percent below the December 2015 estimate of 538,000.

The median sales price of new houses sold in December 2016 was $322,500; the average sales price was $384,000. The seasonally adjusted estimate of new houses for sale at the end of December was 259,000. This represents a supply of 5.8 months at the current sales rate.

The latest survey revealed a robust expansion of business activity and another strong increase in incoming new work. Meanwhile, service providers were more upbeat about the business outlook than at any time since May 2015.

Inflationary pressures eased since December, but were still among the highest seen over the past year-and-a-half. Adjusted for seasonal influences, the Markit Flash U.S. Services PMI Business Activity Index picked up to 55.1 in January, from 53.9.

U.S. stock-index futures were flat as investors demonstraded caution after the major indices closed at record highs yesterday.

Global Stocks:

Nikkei 19,402.39 +344.89 +1.81%

Hang Seng 23,374.17 +325.05 +1.41%

Shanghai 3,159.17 +9.61 +0.31%

FTSE 7,176.48 +12.05 +0.17%

CAC 4,878.65 +0.98 +0.02%

DAX 11,846.34 +40.29 +0.34%

Crude $53.11 (-0.13%)

Gold $1,188.00 (-0.82%)

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 36.26 | -0.27(-0.7391%) | 4154 |

| ALTRIA GROUP INC. | MO | 71.05 | 0.09(0.1268%) | 817 |

| AMERICAN INTERNATIONAL GROUP | AIG | 60.83 | -0.25(-0.4093%) | 660 |

| Apple Inc. | AAPL | 121.8 | -0.08(-0.0656%) | 31310 |

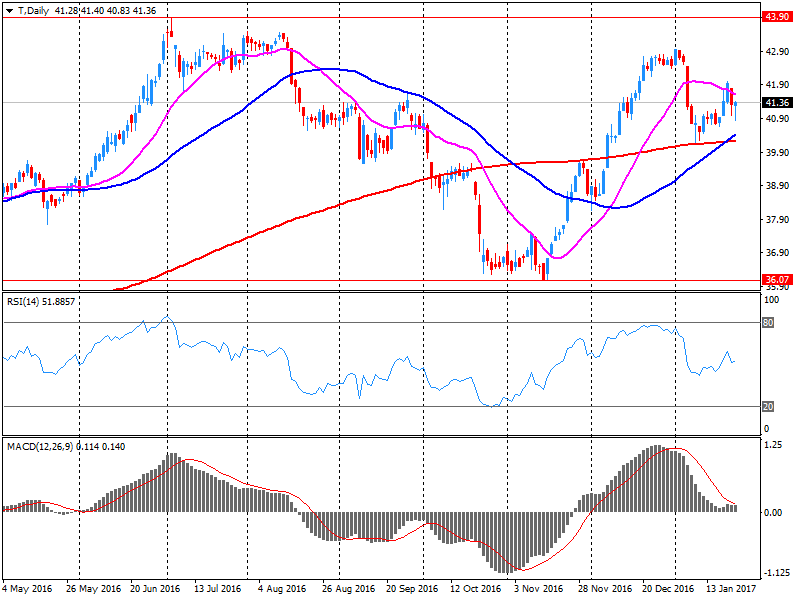

| AT&T Inc | T | 41.25 | -0.14(-0.3382%) | 79178 |

| Barrick Gold Corporation, NYSE | ABX | 87.15 | -0.01(-0.0115%) | 2714 |

| Boeing Co | BA | 167.52 | 0.16(0.0956%) | 1896 |

| Caterpillar Inc | CAT | 97.2 | -0.95(-0.9679%) | 252781 |

| Cisco Systems Inc | CSCO | 30.73 | 0.03(0.0977%) | 1942 |

| Citigroup Inc., NYSE | C | 57.77 | 0.08(0.1387%) | 23388 |

| E. I. du Pont de Nemours and Co | DD | 76.85 | 0.18(0.2348%) | 3890 |

| Exxon Mobil Corp | XOM | 85.62 | 0.28(0.3281%) | 5710 |

| Facebook, Inc. | FB | 131.54 | 0.06(0.0456%) | 88657 |

| FedEx Corporation, NYSE | FDX | 60.83 | -0.25(-0.4093%) | 660 |

| Ford Motor Co. | F | 87.15 | -0.01(-0.0115%) | 2714 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 16.37 | -0.13(-0.7879%) | 253996 |

| General Motors Company, NYSE | GM | 38.41 | 0.13(0.3396%) | 9039 |

| Google Inc. | GOOG | 838.03 | 2.36(0.2824%) | 8491 |

| Home Depot Inc | HD | 139.1 | 1.62(1.1784%) | 610 |

| HONEYWELL INTERNATIONAL INC. | HON | 87.15 | -0.01(-0.0115%) | 2714 |

| Intel Corp | INTC | 37.93 | 0.13(0.3439%) | 73641 |

| International Business Machines Co... | IBM | 178.44 | 0.15(0.0841%) | 1706 |

| Johnson & Johnson | JNJ | 112.25 | -0.55(-0.4876%) | 252223 |

| JPMorgan Chase and Co | JPM | 86.15 | 0.12(0.1395%) | 17237 |

| McDonald's Corp | MCD | 121.51 | -0.28(-0.2299%) | 603 |

| Merck & Co Inc | MRK | 60.83 | -0.25(-0.4093%) | 660 |

| Microsoft Corp | MSFT | 60.83 | -0.25(-0.4093%) | 660 |

| Nike | NKE | 53.89 | 0.03(0.0557%) | 211 |

| Pfizer Inc | PFE | 31.4 | 0.11(0.3515%) | 16978 |

| Procter & Gamble Co | PG | 87.15 | -0.01(-0.0115%) | 2714 |

| Tesla Motors, Inc., NASDAQ | TSLA | 254.3 | -0.17(-0.0668%) | 5939 |

| The Coca-Cola Co | KO | 60.83 | -0.25(-0.4093%) | 660 |

| Travelers Companies Inc | TRV | 60.83 | -0.25(-0.4093%) | 660 |

| Twitter, Inc., NYSE | TWTR | 87.15 | -0.01(-0.0115%) | 2714 |

| United Technologies Corp | UTX | 109.68 | -1.28(-1.1536%) | 296 |

| Visa | V | 84.05 | 0.15(0.1788%) | 221 |

| Yahoo! Inc., NASDAQ | YHOO | 45.06 | 0.12(0.267%) | 2451 |

| Yandex N.V., NASDAQ | YNDX | 23.45 | -0.25(-1.0548%) | 850 |

EURUSD 1.0650 (EUR 271m) 1.0750 (256m)

USDJPY 112.70-75 (626m) 112.95-113.00 (429m) 114.00 (2.1bln)

GBPUSD: 1.2260 (328m)

EURGBP: 0.8750 (379m)

USDCHF: 1.000 (594m) 1.0250 (1.1bln)

AUDUSD: 0.7375 (813m) 0.7460 (250m)

Upgrades:

Intl Paper (IP) upgraded to Buy from Neutral at Citigroup

Downgrades:

United Tech (UTX) downgraded to a Hold from Buy at Argus

Johnson & Johnson (JNJ) downgraded to Market Perform from Outperform at Wells Fargo

Other:

AT&T (T) target raised to $42 from $39 at RBC Capital Mkts; Sector Perform

AT&T (T) target raised to $44 from $42 at FBR & Co.; Market Perform

The international trade deficit of US was $65.0 billion in December, down $0.3 billion from $65.3 billion in November. Exports of goods for December were $125.5 billion, $3.7 billion more than November exports. Imports of goods for December were $190.5 billion, $3.4 billion more than November imports.

Total inventories of merchant wholesalers, except manufacturers' sales branches and offices, after adjustment for seasonal variations but not for price changes, were $595.3 billion at the end of November, up 1.0 percent from the revised October level. Total inventories are up 1.4 percent from the revised November 2015 level. The October 2016 to November 2016 percent change was revised from the advance estimate of up 0.9 percent to up 1.0 percent.

In the week ending January 21, the advance figure for seasonally adjusted initial claims was 259,000, an increase of 22,000 from the previous week's revised level. The previous week's level was revised up by 3,000 from 234,000 to 237,000.

The 4-week moving average was 245,500, a decrease of 2,000 from the previous week's revised average. This is the lowest level for this average since November 3, 1973 when it was 244,000. The previous week's average was revised up by 750 from 246,750 to 247,500.

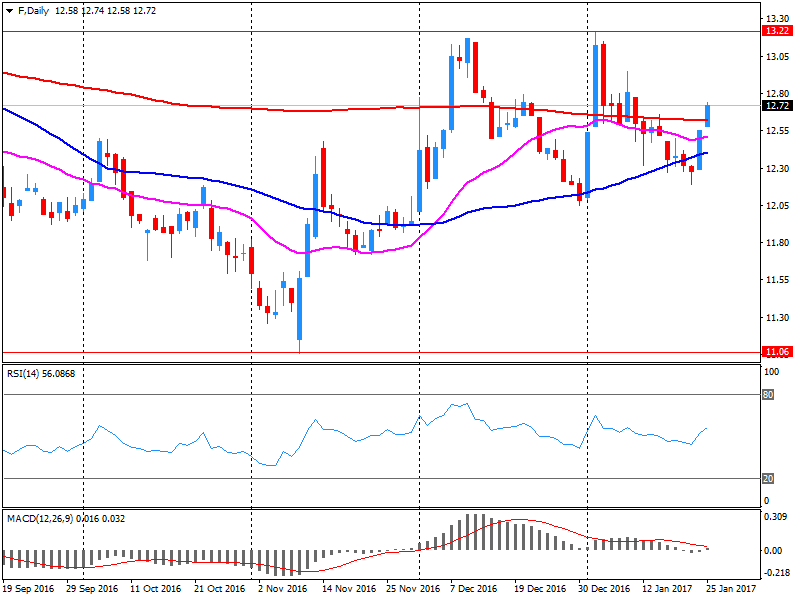

Ford Motor reported Q4 FY 2016 earnings of $0.30 per share (versus $0.58 in Q4 FY 2015), slightly missing analysts' consensus estimate of $0.32.

The company's quarterly revenues amounted to $38.700 bln (+2.10% y/y), beating analysts' consensus estimate of $34.893 bln.

F fell to $12.75 (-0.31%) in pre-market trading.

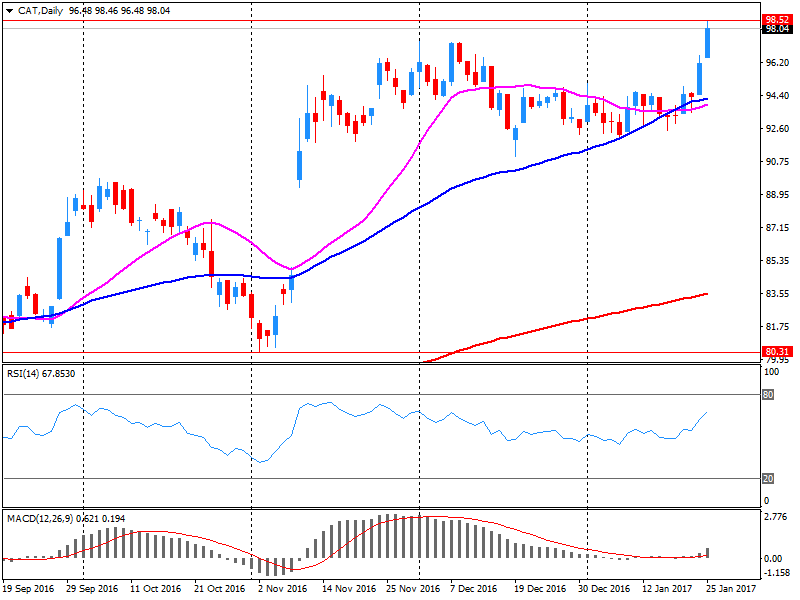

Caterpillar reported Q4 FY 2016 earnings of $0.83 per share (versus $0.74 in Q4 FY 2015), beating analysts' consensus estimate of $0.67.

The company's quarterly revenues amounted to $9.574 bln (-13.2% y/y), missing analysts' consensus estimate of $9.812 bln.

The company also said it slightly lowered its guidance for FY 2017. It now projects EPS of $2.90 (versus analysts' consensus estimate of $3.07) and revenues in a range of $36-39 bln (versus analysts' consensus estimate of $38.3 bln).

CAT fell to $97.19 (-0.98%) in pre-market trading.

EUR/USD

Offers 1.0765 1.0780 1.0800 1.0830 1.0850-55 1.0880 1.0900

Bids 1.0720 1.0700 1.0680 1.0650 1.0625-30 1.0600 1.0580 1.0565 1.0550

GBP/USD

Offers 1.2660 1.2680 1.2700 1.2730 1.2750 1.2775 1.2800 1.2860 1.2900

Bids 1.2620 1.2600 1.2585 1.2550 1.2530 1.2500 1.2480-85 1.2450

EUR/GBP

Offers 0.8520 0.8535 0.8550 0.8580-85 0.8600

Bids 0.8480 0.8450 0.8430 0.8400 0.8385 0.8350

EUR/JPY

Offers 122.30 122.50 122.80 123.00 123.50 124.00

Bids 121.80 121.60 121.20 121.00 120.80 120.50 120.00

USD/JPY

Offers 113.80-85 114.00 114.20 114.50 114.80 115.00 115.50 115.80 116.00

Bids 113.50 113.30 113.00 112.80 112.65 112.50 112.30 112.00 111.80 111.50

AUD/USD

Offers 0.7580-85 0.7600 0.7630 0.7650 0.7675 0.7700

Bids 0.7550 0.7520 0.7500 0.7480-85 0.7450 0.7430 0.7400

AT&T reported Q4 FY 2016 earnings of $0.66 per share (versus $0.63 in Q4 FY 2015), in-line with analysts' consensus estimate.

The company's quarterly revenues amounted to $41.841 bln (-0.7% y/y), generally in-line with analysts' consensus estimate of $42.011 bln.

T rose to $41.40 (+0.02%) in pre-market trading.

The survey of 113 firms, consisting of 52 retailers, showed that sales fell modestly at the start of this year. Looking ahead, volumes are set to grow in the year to February.

Sales volumes were considered to be broadly in line with the average for the time of year, having been above seasonal norms at the end of 2016. Orders placed on suppliers were broadly unchanged over the year, and are expected to fall marginally next month.

The moderate decline in retail sales volumes was driven by grocers, where sales fell at the fastest pace since August 2004. However, continually healthy growth was reported elsewhere, particularly among clothing retailers and department stores.

This morning, the New York futures for Brent rose 0.96% to $ 55.61 and WTI rose 0.72% to $ 53.13. Thus, the black gold prices traded in positive territory on the background of the weakening dollar. According to the US Energy Information Administration oil stocks rose last week by 2.84 million barrels to 488.3 million barrels. Thus, oil production in the US rose more than 6.3% since the middle of last year to 8.96 million barrels per day.

UK gross domestic product (GDP) was estimated to have increased by 0.6% during Quarter 4 (Oct to Dec) 2016, the same rate of growth as in the previous 2 quarters.

Growth during Quarter 4 was dominated by services, with a strong contribution from consumer-focused industries such as retail sales and travel agency services.

Following falls in Quarter 3 (July to Sept) 2016, construction and production provided negligible positive contributions to GDP growth in Quarter 4 2016.

UK GDP was estimated to have increased by 2.0% during 2016, slowing slightly from 2.2% in 2015 and from 3.1% in 2014.

In November 2016 the seasonally adjusted retail trade index decreased by 0.7% with respect to October 2016 (-1.2% for food goods and -0.5% for non-food goods). The average of the last three months decreased with respect to the previous three months (-0.1%). The unadjusted index increased by 0.8% with respect to November 2015.

The number of employed is reduced by 19,400 people in the fourth quarter of 2016 Compared to the previous quarter (-0.10%) and stands at 18,508,100. In terms Seasonally adjusted, the quarterly variation is 0.41%. Employment has grown in 413,900 people in the last 12 months.

The annual rate is 2.29%. The decline in employment is concentrated this quarter in the public sector (17,800 Employed), while employment in the private sector declined by 1,600. In the last 12 months employment has increased by 428,500 people in the sector Private and has been reduced by 14,600 in the public.

Moody's Investors Service says that China's property market -- after posting a record high in 2016 -- will show nationally a slower pace of sales growth in 2017 on the back of the government's tightened controls to curb property price growth.

"We expect nationwide contracted sales in 2017 will be largely flat or will see a slight decline from 2016, after buoyant growth that year," says Chris Wong, a Moody's Analyst.

Overall, national contracted sales (on a sales value basis) grew by 36.2% year-on-year to a record high of RMB9.9 trillion in 2016, driven by growth in both sales volumes and average selling prices.

"However, the growth pace in December 2016 slowed from that seen in the first three quarters of 2016 after the government implemented tightening measures to cool the sector from late September," adds Wong.

The future head of the Ministry of Finance said that the Fed has "sufficient independence" in order to carry out its policies. Mnuchin spoke about the actions of the Fed and endorsed the recent efforts to improve the transparency of the regulator.

Steven Turner Mnuchin - American businessman, former member of Goldman Sachs.

In the December 2016 quarter compared with the September 2016 quarter:

-

The consumers price index (CPI) rose 0.4 percent (up 0.7 with seasonal adjustment).

-

Transport prices rose 3.7 percent, influenced by higher petrol and air transport prices.

-

Housing-related prices rose - purchase of new housing, excluding land, was up 1.4 percent.

-

Vegetable prices fell 15 percent (up 3.0 percent after seasonal adjustment).

From the December 2015 quarter to the December 2016 quarter:

The CPI inflation rate was 1.3 percent.

-

Housing and household utilities increased 3.3 percent.

-

Transport prices decreased 1.0 percent.

-

Tradable prices decreased 0.1 percent, while prices for non-tradables increased 2.4 percent.

The average price of 1 litre of 91 octane petrol was $1.82 in the December 2016 quarter, up from $1.75 in the September 2016 quarter.

EUR/USD

Resistance levels (open interest**, contracts)

$1.0844 (2816)

$1.0812 (2390)

$1.0791 (2238)

Price at time of writing this review: $1.0743

Support levels (open interest**, contracts):

$1.0671 (1377)

$1.0646 (1253)

$1.0617 (1984)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 58466 contracts, with the maximum number of contracts with strike price $1,0800 (3727);

- Overall open interest on the PUT options with the expiration date March, 13 is 68313 contracts, with the maximum number of contracts with strike price $1,0000 (4951);

- The ratio of PUT/CALL was 1.17 versus 1.17 from the previous trading day according to data from January, 25

GBP/USD

Resistance levels (open interest**, contracts)

$1.2906 (1391)

$1.2809 (1755)

$1.2713 (1623)

Price at time of writing this review: $1.2642

Support levels (open interest**, contracts):

$1.2586 (826)

$1.2490 (720)

$1.2393 (294)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 22421 contracts, with the maximum number of contracts with strike price $1,2500 (2600);

- Overall open interest on the PUT options with the expiration date March, 13 is 23776 contracts, with the maximum number of contracts with strike price $1,1500 (3231);

- The ratio of PUT/CALL was 1.06 versus 1.15 from the previous trading day according to data from January, 25

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

After a decline in the previous year, foreign trade grew again in 2016, with the development of chemical-pharmaceutical products. Exports rose by 3.8% (real: - 0.8%) to a record high of CHF 210.7 billion. However, the two other major divisions - machines and electronics as well as watches - were unable to participate in the growth. Imports increased by 4.1% (real: + 1.2%) to CHF 173.2 billion. The surplus in the trade balance reached a new record (37.5 billion francs). Exports expanded by 3.8% (real: - 0.8%) to CHF 210.7 billion in 2016, which means that, they reached a new peak.

Both economic and income expectations as well as propensity to buy have improved. The overall consumer climate indicator is forecasting 10.2 points for February 2017, following 9.9 points in January.

At the beginning of 2017, consumer mood, which was already at a good level, improved even further. For example, economic expectation climbed for the fourth time in a row to their highest point in one and a half years. As a result of better income prospects, propensity to buy grew significantly in January. As such, the start of 2017 was, in the view of consumers, a resounding success.

European stocks leapt Wednesday, pushed to their highest in more than a year by optimism over fresh records in the U.S. markets and a rally in bank shares. The Stoxx Europe 600 index SXXP, +1.29% climbed 1.3% to end at 366.59, its highest close since December 2015. The jump also marked the strongest one-day percentage gain since Nov. 9 last year.

The Dow Jones Industrial Average on Wednesday both crossed and closed above the 20,000 level for the first time, while the S&P 500 and Nasdaq Composite also cruised to records after upbeat earnings releases from heavyweights such as Boeing Co. and optimism over the economy.

Asian stock markets were broadly higher early Thursday, tracking overnight gains on Wall Street, with the Dow Jones Industrial Average closing above 20,000 points for the first time ever. The post-election equities rally in the U.S. has been spurred by hopes of fiscal spending, tax cuts and regulation rollback under the administration of President Donald Trump.

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.