- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

Major U.S. stock-indexes slightly fells on Friday as a renewed slide in oil prices weighed on energy and materials stocks and prospects of a rate hike this year were rekindled by data pointing to firmer inflation trends. Crude prices, which have moved in lockstep with the stock market for much of the year, slid more than 4% after a record increase in U.S. stockpiles.

Report showed core consumer price index rose by a bigger-than-expected 0.3% in January, signs of an uptick in price pressures that could allow the Federal Reserve to gradually raise interest rates this year.

Most of Dow stocks in negative area (20 of 30). Top looser - Chevron Corporation (CVX, -2,02%). Top gainer - American Express Company (AXP, +0,96%).

Most of all S&P sectors in negative area. Top looser - Basic Materials (-1,5%). Top gainer - Conglomerates (+0,9%).

At the moment:

Dow 16332.00 -59.00 -0.36%

S&P 500 1911.50 -5.00 -0.26%

Nasdaq 100 4164.75 +9.75 +0.23%

Oil 31.71 -1.22 -3.70%

Gold 1232.20 +5.90 +0.48%

U.S. 10yr 1.75 -0.01

Stock indices closed lower as oil prices declined on concerns over the global oil oversupply.

The European Central Bank (ECB) Vice President Vitor Constancio said on Friday that the central bank could add further stimulus measures in March if it takes longer to reach 2% inflation target.

Constancio noted that inflation could turn negative in the short terms but it should rise in the second half of the year.

European Central Bank (ECB) Governing Council member Ignazio Visco said in an interview on Friday that there were no taboos to reach the price stability.

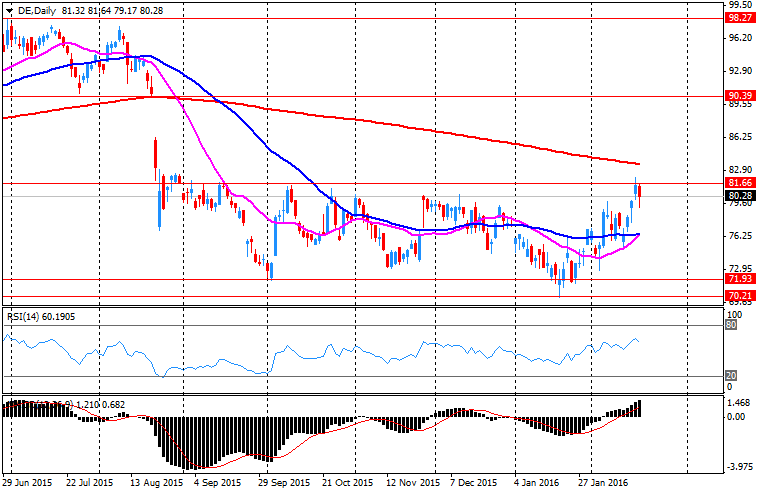

Market participants also eyed the economic data from the Eurozone. Destatis released its producer price index (PPI) for Germany on Friday. German PPI producer prices declined 0.7% in January, missing expectations for a 0.3% fall, after a 0.5% drop in December.

On a yearly basis, German PPI dropped 2.4% in January, missing expectations for a 2.0% decrease, after a 2.3% fall in December.

The decline was mainly driven by a drop in energy prices.

The Office for National Statistics released its retail sales data for the U.K. on Friday. Retail sales in the U.K. climbed 2.3% in January, exceeding expectations for a 0.8% gain, after a 1.4% drop in December. December's figure was revised down from a 1.0% decrease.

The increase was driven by lower demand for clothing and computer.

On a yearly basis, retail sales in the U.K. jumped 5.2% in January, beating forecasts of 3.6% increase, after a 2.3% rise in December. December's figure was revised down from a 2.6% gain.

Public sector net borrowing excluding banks rose to £11.2 billion in January from £10.2 billion in January last year. It was the biggest surplus since 2008.

The increase was driven by the high level of tax receipts.

Indexes on the close:

Name Price Change Change %

FTSE 100 5,950.23 -21.72 -0.36 %

DAX 9,388.05 -75.59 -0.80 %

CAC 40 4,223.04 -16.72 -0.39 %

Polish equity market closed lower on Friday. The broad market measure, the WIG Index, fell by 0.83%. Sector-wise, chemicals (-1.67%) fared the worst, while media sector (+1.24%) was the best-performer.

The large-cap stocks' measure, the WIG30 Index, dropped by 0.79%. Within the WIG30 Index components, clothing retailer LPP (WSE: LPP) recorded the biggest decline, down 5.45%, after reporting worse-than-expected bottom line result for Q4 FY2015 (the company posted net profit of PLN 170 mln, whereas the analysts forecasted PLN 194 mln). Other major laggards were genco ENERGA (WSE: ENG), chemical producer GRUPA AZOTY (WSE: ATT) and two banking names ING BSK (WSE: ING) and MBANK (WSE: MBK), which quotations slid down 3.03%-3.96%. On the other side of the ledger, media- and telecom-group CYFROWY POLSAT (WSE: CPS) led a handful of gainers with a 1.39% advance, followed by oil refiner PKN ORLEN (WSE: PKN), adding 1.32%.

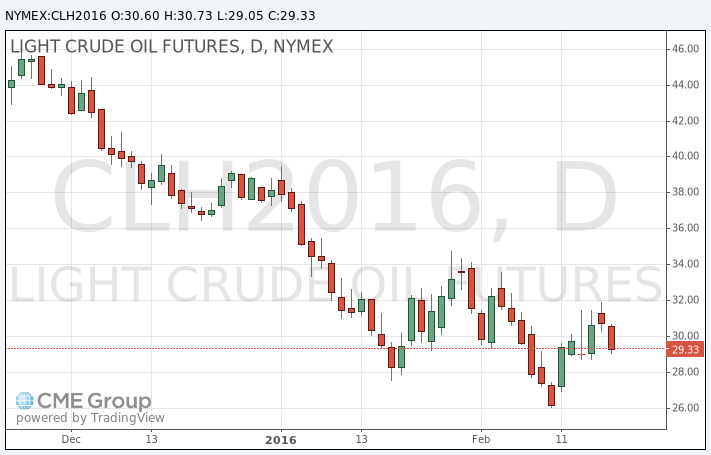

Oil prices continued to decline on concerns over the global oil oversupply. Earlier this week, oil prices rose on news that Russia and Saudi Arabia agreed to freeze the oil production at the level of January if other oil producers join. But it is unclear if other oil producers will join. Especially, Iran plans to boost its exports.

Yesterday's U.S. crude oil inventories data also added to concerns over the global oil oversupply. According to the U.S. Energy Information Administration (EIA), U.S. crude inventories rose by 2.15 million barrels to 504.1 million in the week to February 12. Analysts had expected U.S. crude oil inventories to rise by 4.0 million barrels.

Market participants are also awaiting the release of the number of active U.S. rigs later in the day. The oil driller Baker Hughes reported on last Friday that the number of active U.S. rigs declined by 28 rigs to 439 last week. It was the lowest level since January 2010.

WTI crude oil for April delivery declined to $29.05 a barrel on the New York Mercantile Exchange.

Brent crude oil for April fell to $33.48 a barrel on ICE Futures Europe.

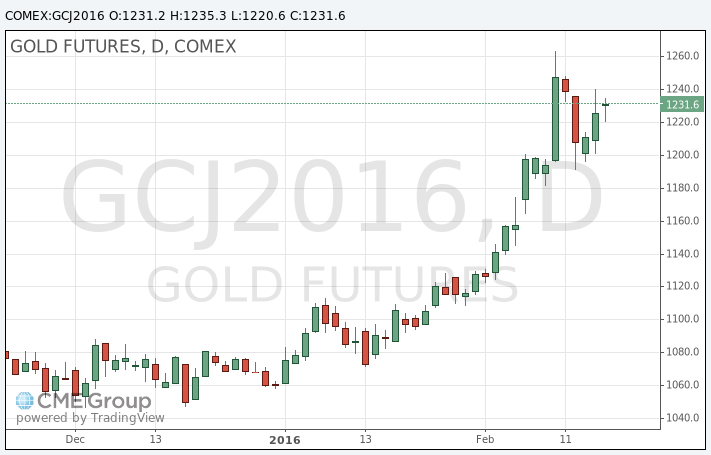

Gold price rose on a weaker U.S. dollar. The U.S. dollar fell against other currencies despite the better-than-expected U.S. consumer price inflation data. The U.S. Labor Department released consumer price inflation data on Friday. The U.S. consumer price inflation was flat in January, beating expectations for a 0.1% decline, after a 0.1% fall in December.

The index was mainly driven by higher prices of rents and medical care, and higher shelter costs.

On a yearly basis, the U.S. consumer price index increased to 1.4% in January from 0.7% in December, exceeding expectations for a rise to 1.3%. It was the biggest increase since October 2014.

The U.S. consumer price inflation excluding food and energy gained 0.3% in January, exceeding expectations for a 0.2% rise, after a 0.2% increase in December.

On a yearly basis, the U.S. consumer price index excluding food and energy increased to 2.2% in January from 2.1% in December, beating expectations for a 2.1% rise.

The consumer price index is not preferred Fed's inflation measure.

April futures for gold on the COMEX today increased to 1235.30 dollars per ounce.

The Bank of England's (BoE) Monetary Policy Committee (MPC) member Martin Weale said in an interview with the Irish Newson Monday that the central bank could hike its interest rate sooner than expected by markets.

"I would be surprised if people had to wait as long as markets are currently implying," he said.

"But markets may well turn out to be right," Weale added.

He noted that inflation remained below the central bank's target longer than expected.

"There is a longer waiting period than we had expected but if we look at core measures of inflation, those are closer to the target but still below the target," MPC member said.

Britain's Prime Minister David Cameron said on Friday that there was "some progress" but no deal in talks between Britain and the European Union (EU).

"We've made some progress but there's still no deal," he said.

"I'll only do a deal if we get what Britain needs," Cameron added.

The EU and Britain discussed conditions to keep Britain in the EU.

European Central Bank (ECB) Governing Council member Ignazio Visco said in an interview on Friday that there were no taboos to reach the price stability.

He also said that the central bank should act before inflation will decline strongly.

"Acting pre-emptively and aggressively may mean having to act less than you would have done, had you acted too late," ECB Governing Council member noted.

Visco said that he saw the second-round effect of the oil price drop.

"I see that the risk of second-round effects is materializing. For example we already see wage contracts which include the possibility of a revision if inflation is lower than expected," he pointed out.

The European Commission released its preliminary consumer confidence figures for the Eurozone on Friday. Eurozone's preliminary consumer confidence index fell to -8.8 in February from -6.3 in January. Analysts had expected the index to decline to -6.7.

European Union's consumer confidence index decreased by 2.4 points to -6.6 in February.

The European Central Bank (ECB) Vice President Vitor Constancio said on Friday that the central bank could add further stimulus measures in March if it takes longer to reach 2% inflation target.

"The main thing for us discussing our decisions is the prospect for inflation going forward. We don't expect to reach our goal in a short time, but to go in that direction. If the conclusion of the Governing Council is that path is at stake and that the delay in normalizing may get bigger...it may decide to act," he said.

Constancio noted that inflation could turn negative in the short terms but it should rise in the second half of the year.

Cleveland Fed President Loretta Mester said in a speech on Friday that she expected the U.S. economy to grow.

"My current expectation is that the U.S. economy will work through this episode of market turbulence and the soft patch of economic data to regain its footing for moderate growth, even as the energy and manufacturing sectors remain challenged," she said.

Mester noted that ties between the U.S. and the Chinese economies were "not very strong".

She pointed out that she expected the Fed to continue raising its interest rate gradually.

Mester is a voting member of the Federal Open Markets Committee this year.

Saudi Arabian Foreign Minister Adel Al Jubeir said in an interview on Thursday that Saudi Arabia was not ready to lower its oil output.

"If other producers want to limit or agree to a freeze in terms of additional production that may have an impact on the market but Saudi Arabia is not prepared to cut production," he said.

"The oil issue will be determined by supply and demand and by market forces. The kingdom of Saudi Arabia will protect its market share and we have said so," he added.

The U.S. Labor Department released its real earnings data on Wednesday. Average weekly earnings rose 0.7% in January, after a 0.1% increase in December.

The increase was driven by rises in in average hourly earnings.

Average hourly earnings climbed 0.4% in January, after a 0.2% rise in December.

On a yearly basis, real average weekly earnings increased 1.2% in January, while hourly earnings rose 1.1%.

U.S. stock-index futures declined.

Global Stocks:

Nikkei 15,967.17 -229.63 -1.42%

Hang Seng 19,285.5 -77.58 -0.40%

Shanghai Composite 2,861.38 -1.51 -0.05%

FTSE 5,940.11 -31.84 -0.53%

CAC 4,196.28 -43.48 -1.03%

DAX 9,371.94 -91.70 -0.97%

Crude oil $29.97 (-2.60%)

Gold $1226.00 (-0.02%)

The U.S. Labor Department released consumer price inflation data on Friday. The U.S. consumer price inflation was flat in January, beating expectations for a 0.1% decline, after a 0.1% fall in December.

The index was mainly driven by higher prices of rents and medical care, and higher shelter costs. Rents rose 0.5% in January, while both medical care and shelter costs were up 0.3%.

Gasoline prices fell 4.8% in January, while food prices were flat.

On a yearly basis, the U.S. consumer price index increased to 1.4% in January from 0.7% in December, exceeding expectations for a rise to 1.3%. It was the biggest increase since October 2014.

The U.S. consumer price inflation excluding food and energy gained 0.3% in January, exceeding expectations for a 0.2% rise, after a 0.2% increase in December.

On a yearly basis, the U.S. consumer price index excluding food and energy increased to 2.2% in January from 2.1% in December, beating expectations for a 2.1% rise.

The consumer price index is not preferred Fed's inflation measure.

Statistics Canada released consumer price inflation data on Friday. Canadian consumer price inflation rose 0.2% in January, beating expectations for a 0.1% decline, after a 0.5% fall in December.

The monthly rise was mainly driven by an increase in food prices, which climbed 1.5% in January.

On a yearly basis, the consumer price index rose to 2.0% in January from 1.6% in December, exceeding expectations for a gain to 1.7%.

The consumer price index was mainly driven by higher food, and alcoholic beverages and tobacco products prices. Food prices climbed 4.0% year-on-year in January, while alcoholic beverages and tobacco products prices increased 3.1%.

The index for recreation, education and reading climbed by 2.2% in January from the same month a year earlier, the shelter index gained 1.1%, while energy prices dropped 0.4%.

The Canadian core consumer price index, which excludes some volatile goods, increased 0.3% in January, after a 0.4% fall in December.

On a yearly basis, core consumer price index in Canada climbed to 2.0% in January from 1.9% in December. Analysts had expected the index to remain unchanged at 1.9%.

The Bank of Canada's inflation target is 2.0%.

(company / ticker / price / change, % / volume)

| Yahoo! Inc., NASDAQ | YHOO | 30.16 | 2.52% | 48.0K |

| McDonald's Corp | MCD | 117.55 | 0.32% | 0.7K |

| Procter & Gamble Co | PG | 82.03 | 0.06% | 0.1K |

| JPMorgan Chase and Co | JPM | 57.82 | 0.02% | 27.4K |

| Johnson & Johnson | JNJ | 103.49 | 0.00% | 21.0K |

| Merck & Co Inc | MRK | 50.32 | 0.00% | 667.4K |

| Facebook, Inc. | FB | 103.38 | -0.09% | 21.9K |

| Intel Corp | INTC | 29.39 | -0.10% | 1.2M |

| General Motors Company, NYSE | GM | 29 | -0.10% | 6.5K |

| Starbucks Corporation, NASDAQ | SBUX | 56.9 | -0.11% | 1.2K |

| International Business Machines Co... | IBM | 132.28 | -0.13% | 9.6K |

| Pfizer Inc | PFE | 29.51 | -0.14% | 0.6K |

| Apple Inc. | AAPL | 96.1 | -0.17% | 278.8K |

| Google Inc. | GOOG | 696.03 | -0.19% | 2.8K |

| Cisco Systems Inc | CSCO | 26.37 | -0.23% | 395.1K |

| The Coca-Cola Co | KO | 43.5 | -0.25% | 4.2K |

| Tesla Motors, Inc., NASDAQ | TSLA | 166.3 | -0.28% | 5.3K |

| Verizon Communications Inc | VZ | 50.79 | -0.29% | 24.1K |

| Home Depot Inc | HD | 119.61 | -0.30% | 0.2K |

| Microsoft Corp | MSFT | 52.01 | -0.34% | 2.1K |

| ALCOA INC. | AA | 8.09 | -0.37% | 2.3K |

| Citigroup Inc., NYSE | C | 38.77 | -0.39% | 3.2K |

| Goldman Sachs | GS | 147.12 | -0.41% | 0.9K |

| Wal-Mart Stores Inc | WMT | 63.85 | -0.42% | 562.3K |

| General Electric Co | GE | 28.95 | -0.45% | 2.2K |

| Amazon.com Inc., NASDAQ | AMZN | 522.51 | -0.47% | 2.8K |

| Boeing Co | BA | 117 | -0.48% | 0.2K |

| AT&T Inc | T | 36.8 | -0.51% | 3.1K |

| Nike | NKE | 58.2 | -0.68% | 0.3K |

| Chevron Corp | CVX | 86.13 | -0.69% | 0.3K |

| Exxon Mobil Corp | XOM | 81.88 | -0.69% | 2.7K |

| American Express Co | AXP | 53.75 | -0.74% | 0.1K |

| Yandex N.V., NASDAQ | YNDX | 12.98 | -0.76% | 2.0K |

| Caterpillar Inc | CAT | 65.53 | -0.89% | 1.5K |

| Ford Motor Co. | F | 12.15 | -0.90% | 27.2K |

| Barrick Gold Corporation, NYSE | ABX | 12.48 | -1.19% | 15.9K |

| Twitter, Inc., NYSE | TWTR | 18.17 | -1.41% | 12.9K |

| Visa | V | 70.2 | -1.46% | 0.9K |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 7 | -2.10% | 51.4K |

| Deere & Company, NYSE | DE | 77.79 | -3.16% | 13.7K |

Upgrades:

Downgrades:

Other:

Starbucks (SBUX) initiated with a Buy at Nomura; target $70

Statistics Canada released retail sales data on Friday. Canadian retail sales dropped by 2.2% in December, missing expectations for a 0.6% fall, after a 1.7% increase in November.

The decline was mainly driven by lower sales at motor vehicle and parts dealers, which slid by 3.9% in December.

Sales at gasoline stations declined 1.1% in December, while sales at food and beverage stores were down 1.2%.

Motor vehicle and parts sales increased 3.5% in November, while sales at furniture and home furnishings stores rose 0.5%.

Canadian retail sales excluding automobiles declined 1.6% in December, missing expectations for a 0.5% decline, after a 1.0% rise in November. November's figure was revised down from a 1.1% gain.

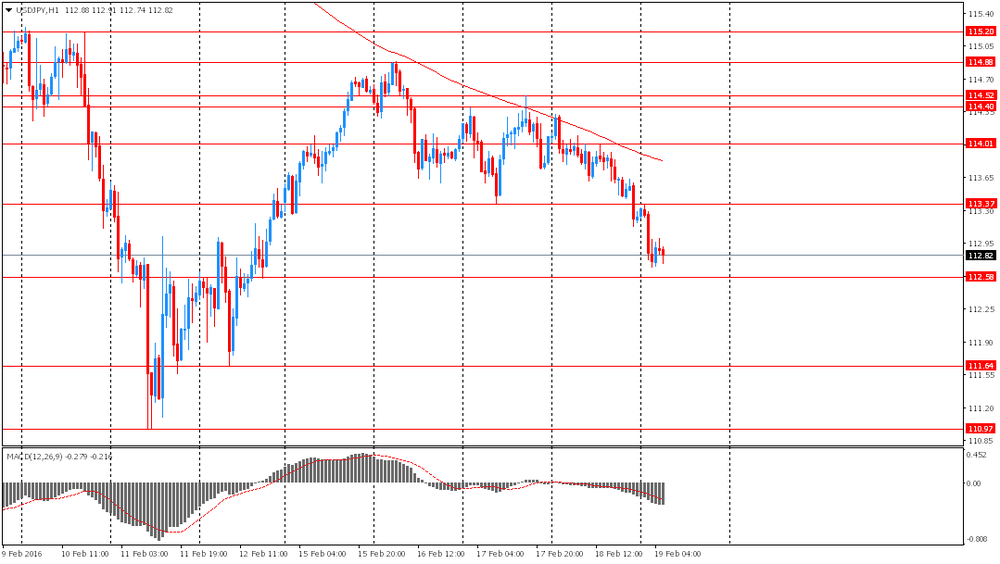

USDJPY: 112.70-75 (376m) 115.00 (227m)

EURUSD: 1.0800 (EUR 570m) 1.0950 (261m) 1.1150 (259m) 1.1200 (336m) 1.1275(255m) 1.1300 (289m)

GBPUSD: 1.4400(GBP 293m)

EURGBP: 0.7500 (310m) 0.7700 (350m)

AUDUSD: 0.6950 (AUD 288m) 0.7050 (246m) 0.7110 (149m) 0.7155 (140m) 0.7325(152m)

USDCAD: 1.3500 (USD 300m) 1.3700 (442m) 1.3800-05 (874m) 1.3900 (440m) 1.4000 (2.39bn)

The Organization for Economic Cooperation and Development (OECD) released its preliminary real gross domestic product (GDP) growth figures on Friday. Real GDP of 20 OECD member countries fell to 0.2% in the fourth quarter from 0.5% in the third quarter.

Real GDP of the United States was down to 0.2% in the fourth quarter from 0.5% in the third quarter, real GDP of Germany remained unchanged at 0.3%, while Britain's economy increased to 0.5% from 0.4%.

GDP of France decreased to 0.2% from 0.3%, while Japan's GDP dropped to -0.4% from 0.3%.

Eurozone's economy expanded at 0.3% in the fourth quarter, after a 0.4% rise in the third quarter.

On a yearly basis, GDP of 20 OECD member countries was up 1.8% in the fourth quarter, after a 2.1% gain in the previous quarter.

In 2015 as whole, GDP of 20 OECD member countries increased 2.0%, after a 1.8% growth in 2014.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

04:30 Japan All Industry Activity Index, m/m December -1.1% Revised From -1.0% -0.3% -0.9%

07:00 Germany Producer Price Index (MoM) January -0.5% -0.3% -0.7%

07:00 Germany Producer Price Index (YoY) January -2.3% -2% -2.4%

09:30 United Kingdom PSNB, bln January -7.49 Revised From 7.49 13.95 11.81

09:30 United Kingdom Retail Sales (MoM) January -1.4% Revised From -1% 0.8% 2.3%

09:30 United Kingdom Retail Sales (YoY) January 2.3% Revised From 2.6% 3.6% 5.2%

13:00 U.S. FOMC Member Mester Speaks

The U.S. dollar traded mixed to higher against the most major currencies ahead of the release of the U.S. consumer price inflation data. The U.S. consumer price inflation is expected to rise to 1.3% year-on-year in January from 0.7% in December.

The U.S. consumer price index excluding food and energy is expected to remain unchanged at 2.1% year-on-year in January.

The euro traded lower against the U.S. dollar in the absence of any major economic reports from the Eurozone.

Destatis released its producer price index (PPI) for Germany on Friday. German PPI producer prices declined 0.7% in January, missing expectations for a 0.3% fall, after a 0.5% drop in December.

On a yearly basis, German PPI dropped 2.4% in January, missing expectations for a 2.0% decrease, after a 2.3% fall in December.

The decline was mainly driven by a drop in energy prices.

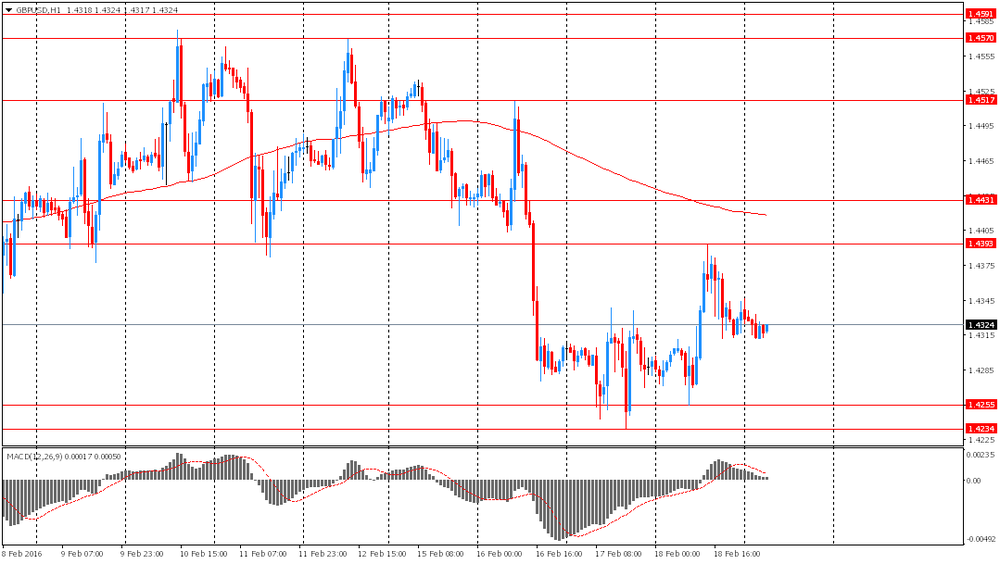

The British pound traded lower against the U.S. dollar despite the better-than-expected U.K. retail sales data. The Office for National Statistics released its retail sales data for the U.K. on Friday. Retail sales in the U.K. climbed 2.3% in January, exceeding expectations for a 0.8% gain, after a 1.4% drop in December. December's figure was revised down from a 1.0% decrease.

The increase was driven by lower demand for clothing and computer.

On a yearly basis, retail sales in the U.K. jumped 5.2% in January, beating forecasts of 3.6% increase, after a 2.3% rise in December. December's figure was revised down from a 2.6% gain.

Public sector net borrowing excluding banks rose to £11.2 billion in January from £10.2 billion in January last year. It was the biggest surplus since 2008.

The increase was driven by the high level of tax receipts.

The Canadian dollar traded lower against the U.S. dollar ahead of the release of the Canadian economic data. The consumer price index in Canada is expected to climb 1.7% year-on-year in January from 1.6% in December.

The core consumer price index in Canada is expected to remain unchanged at 1.9% year-on-year in January.

Canadian retail sales are expected to decrease 0.6% in December, after a 1.7% rise in November.

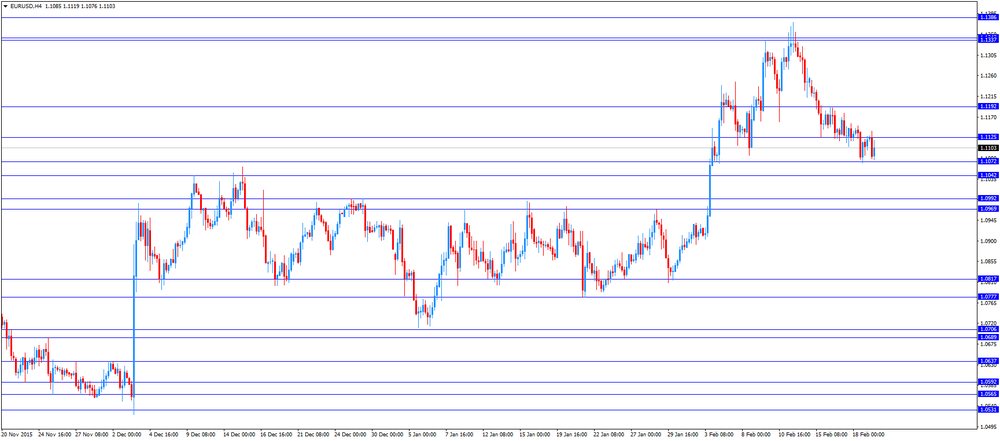

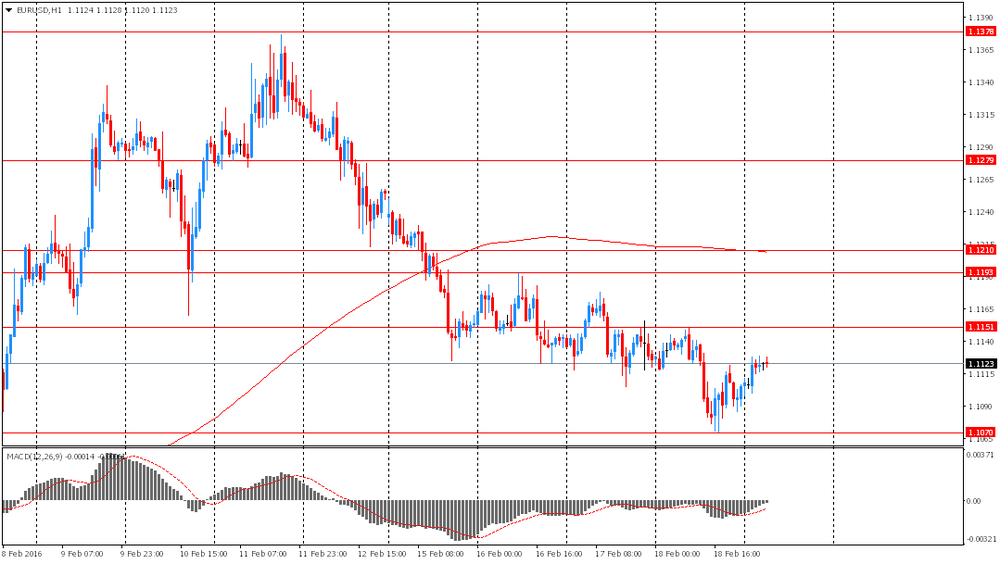

EUR/USD: the currency pair decreased to $1.1076

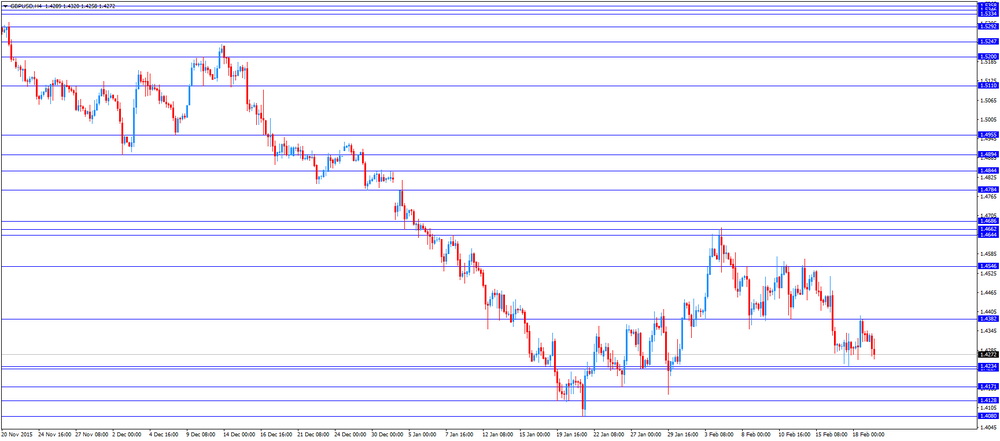

GBP/USD: the currency pair fell to $1.4258

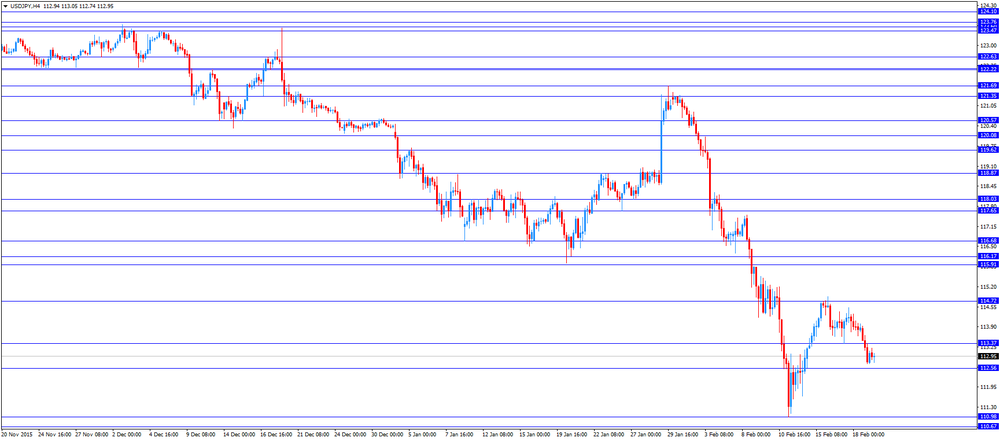

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

13:30 Canada Retail Sales, m/m December 1.7% -0.6%

13:30 Canada Retail Sales YoY December 3.2%

13:30 Canada Retail Sales ex Autos, m/m December 1.1% -0.5%

13:30 Canada Consumer Price Index m / m January -0.5% -0.1%

13:30 Canada Consumer price index, y/y January 1.6% 1.7%

13:30 Canada Bank of Canada Consumer Price Index Core, y/y January 1.9% 1.9%

13:30 U.S. CPI, m/m January -0.1% -0.1%

13:30 U.S. CPI, Y/Y January 0.7% 1.3%

13:30 U.S. CPI excluding food and energy, m/m January 0.2% 0.2%

13:30 U.S. CPI excluding food and energy, Y/Y January 2.1% 2.1%

15:00 Eurozone Consumer Confidence (Preliminary) February -6.3 -6.7

EUR/USD

Offers 1.1135 1.1150 1.1165 1.1185 1.1200 1.1220 1.1235 1.1250

Bids 1.1100 1.1080 1.1065 1.1050 1.1030 1.1000 1.0985 1.0965 1.0950

GBP/USD

Offers 1.4325 1.4350 1.4365 1.4385 1.4400 1.4420 1.4435-40 1.4460

Bids 1.4280-85 1.4250-55 1.4230 1.4200 1.4185 1.4150

EUR/JPY

Offers 126.00 126.30 126.50 126.80 127.00 127.25 127.50

Bids 125.30 125.00 124.80 124.50 124.00

EUR/GBP

Offers 0.7780 0.7800 0.7820-25 0.7850-55 0.7875 0.7884 0.7900

Bids 0.7750 0.7730 0.7700 0.7680 0.7665 0.7650

USD/JPY

Offers 113.25 113.40 113.65 113.85 114.00 114.20-25 114.50 114.75-80 115.00

Bids 112.75-80 112.50 112.20 112.00 111.85 111.50

AUD/USD

Offers 0.7130 0.7150 0.7165 0.7180-85 0.7200 0.7220 0.7235 0.7250

Bids 0.7100 0.7080 0.7065 0.7050 0.7030 0.7000 0.6980 0.6950

Deere reported Q1 FY 2016 earnings of $0.80 per share (versus $1.12 in Q1 FY 2015), beating analysts' consensus of $0.70.

The company's quarterly revenues amounted to $4.769 bln (-14.9% y/y), missing consensus estimate of $4.862 bln.

Deere issued downside guidance for FY 2016, lowering revenues to -10% to $23.2 bln from -7% (versus analysts' consensus of $23.56 bln) and net income to $1.3 bln from $1.4 bln.

DE fell to $78.25 (-2.59%) in pre-market trading.

Stock indices traded lower as oil prices declined on concerns over the global oil oversupply.

Market participants also eyed the economic data from the Eurozone. Destatis released its producer price index (PPI) for Germany on Friday. German PPI producer prices declined 0.7% in January, missing expectations for a 0.3% fall, after a 0.5% drop in December.

On a yearly basis, German PPI dropped 2.4% in January, missing expectations for a 2.0% decrease, after a 2.3% fall in December.

The decline was mainly driven by a drop in energy prices.

The Office for National Statistics released its retail sales data for the U.K. on Friday. Retail sales in the U.K. climbed 2.3% in January, exceeding expectations for a 0.8% gain, after a 1.4% drop in December. December's figure was revised down from a 1.0% decrease.

The increase was driven by lower demand for clothing and computer.

On a yearly basis, retail sales in the U.K. jumped 5.2% in January, beating forecasts of 3.6% increase, after a 2.3% rise in December. December's figure was revised down from a 2.6% gain.

Public sector net borrowing excluding banks rose to £11.2 billion in January from £10.2 billion in January last year. It was the biggest surplus since 2008.

The increase was driven by the high level of tax receipts.

Current figures:

Name Price Change Change %

FTSE 100 5,959.52 -12.43 -0.21 %

DAX 9,405.95 -57.69 -0.61 %

CAC 40 4,221.88 -17.88 -0.42 %

The Office for National Statistics released public sector net borrowing for the U.K. on Friday. Public sector net borrowing excluding banks rose to £11.2 billion in January from £10.2 billion in January last year. It was the biggest surplus since 2008.

The increase was driven by the high level of tax receipts.

The debt-to-gross domestic product ratio declined to 82.8% in January, the first annual decline since September 2002.

Japan's Ministry of Economy, Trade and Industry (METI) released its all industry activity index on Friday. The index slid 0.9% in December, missing expectations for a 0.3% fall, after a 1.1% drop in November. November's figure was revised down from a 1.0% decrease.

Construction industry activity index dropped 2.1% in December, industrial production index fell 1.7%, while tertiary industry activity declined 0.6%.

The Bank of Greece released its current account data on Friday. Greece's current account deficit fell to €0.78 billion in December from €1.87 billion in December last year.

The Greek deficit on trade in goods declined to €1.49 billion in December from €2.04 billion in December last year, while the services surplus fell to €348 million from €521 million.

The primary income deficit turned into a surplus of €323 million in December from a deficit of €42 million in December last year, while the deficit on secondary income turned into a surplus of €43.5 million from a deficit of €309.5 million last year.

The capital account surplus decreased to €136.7 million in December from 245.3 million last year.

Destatis released its producer price index (PPI) for Germany on Friday. German PPI producer prices declined 0.7% in January, missing expectations for a 0.3% fall, after a 0.5% drop in December.

On a yearly basis, German PPI dropped 2.4% in January, missing expectations for a 2.0% decrease, after a 2.3% fall in December.

PPI excluding energy sector fell by 0.6% year-on-year in January.

Energy prices were down 7.3% year-on-year in January.

Consumer non-durable goods prices rose 0.6% year-on-year in January, intermediate goods sector prices decreased by 2.2%, while capital goods prices increased 0.6% and durable consumer goods sector prices gained 1.4%.

The Office for National Statistics released its retail sales data for the U.K. on Friday. Retail sales in the U.K. climbed 2.3% in January, exceeding expectations for a 0.8% gain, after a 1.4% drop in December. December's figure was revised down from a 1.0% decrease.

The increase was driven by lower demand for clothing and computer.

On a yearly basis, retail sales in the U.K. jumped 5.2% in January, beating forecasts of 3.6% increase, after a 2.3% rise in December. December's figure was revised down from a 2.6% gain.

The Reserve Bank of Australia (RBA) board member John Edwards said on Friday that the Australian dollar was still too high.

"I guess I would say I still think it is a bit too high. If it was driven entirely by commodity prices, it certainly should be lower," he said, adding that he would be more comfortable if the Australian dollar was trading at around $0.65.

Edwards pointed out that if major central banks keep their negative interest rates, the Australian dollar could rise.

His comments could mean that the central bank is likely to ease its monetary policy further.

Statistics Canada released its number of new and renewal claims for unemployment insurance benefits on Thursday. The number of new and renewal claims for unemployment insurance benefits increased 3.4% in December.

On a yearly basis, the number of new and renewal claims for unemployment insurance benefits climbed 7.8% in December.

The number of people receiving regular jobless benefits fell 0.5% in December.

On a yearly basis, the total number of people receiving jobless benefits jumped 7.3%.

French President Francois Hollande said on Thursday that a deal between the European Union (EU) and the U.K. was "possible".

"A deal is possible if certain conditions are met. A deal is possible because it is necessary that Britain should remain in the EU," he said.

"But no country can have the right to a veto, no country can withdraw from the common rules... otherwise another country will demand exceptions," Hollande added.

The rating agency Moody's said on Thursday that the downside risks to the global economy increased as the slowdown in the Chinese economy, lower commodity prices and tighter financing conditions in some countries weigh on the global economy. The G20 economies are expected to expand 2.6% in 2016 and 2.9% in 2017.

The Chinese economy is expected to grow 6.3% in 2016 and 6.1% in 2017. "China's slowdown will be concentrated in heavy industry sectors that are significant importers," Marie Diron, a Moody's Senior Vice President, said.

The U.S. GDP growth is expected to be 2.3% in 2016 and 2.5% in 2017. Moody's noted that the Fed will continue to raise its interest rate gradually, with the Fed's interest rate at around 1.75% by the end of 2017.

Japan's economy is expected to expand below 1% in 2016 and 2017. The agency noted that the Bank of Japan's (BoJ) 2% inflation target will remain elusive.

According to data from the Bloomberg Consumer Comfort Index, consumers' expectations for U.S. economy decreased to 42.5 in February from 47.0 in January. January's reading was the highest level since June 2015.

The decline was driven by a less favourable assessment of the measure of views of the economy.

According to data from the Bloomberg Consumer Comfort Index, consumers' expectations for U.S. economy fell to 44.3 in in the week ended February 14 from 44.5 the prior week.

The weekly drop was driven by declines in all sub-indexes. The measure of views of the economy declined to 35.4 from 35.5, the buying climate index was down to 41.6 from 41.9, while the personal finances index fell to 55.8 from 56.1.

San Francisco Fed President John Williams said in a speech on Thursday that the U.S. economic growth remained strong.

"If we look at the domestic market in isolation, it shows strong growth. We're just contending with outside forces," he said.

Williams added that the effect of falling oil prices and a stronger U.S. dollar will dissipate.

San Francisco Fed president expects the inflation in the U.S. to rise toward the 2% target "over the next two years".

He also said that he was not concerned about the slowdown in the Chinese economy.

Williams pointed out that further interest rate hikes will be gradual and will depend on the incoming economic data.

EUR / USD

Resistance levels (open interest**, contracts)

$1.1252 (5094)

$1.1193 (3103)

$1.1152 (5217)

Price at time of writing this review: $1.1118

Support levels (open interest**, contracts):

$1.1052 (2815)

$1.1010 (5165)

$1.0951 (9279)

Comments:

- Overall open interest on the CALL options with the expiration date March, 4 is 64762 contracts, with the maximum number of contracts with strike price $1,1000 (5217);

- Overall open interest on the PUT options with the expiration date March, 4 is 91692 contracts, with the maximum number of contracts with strike price $1,1000 (9279);

- The ratio of PUT/CALL was 1.42 versus 1.44 from the previous trading day according to data from February, 18

GBP/USD

Resistance levels (open interest**, contracts)

$1.4604 (1233)

$1.4506 (1289)

$1.4409 (705)

Price at time of writing this review: $1.4321

Support levels (open interest**, contracts):

$1.4288 (1999)

$1.4192 (2064)

$1.4095 (1409)

Comments:

- Overall open interest on the CALL options with the expiration date March, 4 is 26972 contracts, with the maximum number of contracts with strike price $1,4650 (1643);

- Overall open interest on the PUT options with the expiration date March, 4 is 25377 contracts, with the maximum number of contracts with strike price $1,4350 (2928);

- The ratio of PUT/CALL was 0.94 versus 0.95 from the previous trading day according to data from February, 18

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

04:30 Japan All Industry Activity Index, m/m December -1.0% -0.3% -0.9%

The euro climbed ahead of consumer confidence data due later today. Analysts expect the index to come in at -6.7 points in February compared to -6.3 in the previous month. The survey is based on answers from about 2,300 respondents from all euro zone states.

The yen rose against most major currencies amid greater safe-haven demand. Lower oil prices and a selloff in Japanese stocks persuaded investors to secure their funds and turn to the yen.

The Australian dollar fell after Reserve Bank of Australia Board member John Edwards said the national currency was "a bit too high". According to the Wall Street Journal, the policymaker also said he would be more comfortable with a level around 65 U.S. cents, though he's not sure the AUD would drop so much. The Australian economy depends on exports and a stronger national currency could undermine exporters' interests.

EUR/USD: the pair rose to $1.1130 in Asian trade

USD/JPY: the pair fell to Y112.70

GBP/USD: the pair traded within $1.4310-40

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:00 Germany Producer Price Index (MoM) January -0.5% -0.3%

07:00 Germany Producer Price Index (YoY) January -2.3% -2%

09:30 United Kingdom PSNB, bln January -6.87 13.95

09:30 United Kingdom Retail Sales (MoM) January -1% 0.8%

09:30 United Kingdom Retail Sales (YoY) January 2.6% 3.6%

13:00 U.S. FOMC Member Mester Speaks

13:30 Canada Retail Sales, m/m December 1.7% -0.6%

13:30 Canada Retail Sales YoY December 3.2%

13:30 Canada Retail Sales ex Autos, m/m December 1.1% -0.5%

13:30 Canada Consumer Price Index m / m January -0.5% -0.1%

13:30 Canada Consumer price index, y/y January 1.6% 1.7%

13:30 Canada Bank of Canada Consumer Price Index Core, y/y January 1.9% 1.9%

13:30 U.S. CPI, m/m January -0.1% -0.1%

13:30 U.S. CPI, Y/Y January 0.7% 1.3%

13:30 U.S. CPI excluding food and energy, m/m January 0.2% 0.2%

13:30 U.S. CPI excluding food and energy, Y/Y January 2.1% 2.1%

15:00 Eurozone Consumer Confidence (Preliminary) February -6.3 -6.7

West Texas Intermediate futures for March delivery declined to $32.77 (-0.49%), while Brent crude fell to $34.10 (-0.53%) as concerns over the global supply glut outweighed optimism about the latest deal between Russia, Saudi Arabia, Venezuela and Qatar.

Renewed concerns were driven by data from the Energy Information Administration. Last week U.S. crude oil inventories rose by 2.1 million barrels to 504.1 million barrels marking the third week of record highs.

On Thursday Iraqi oil minister said that OPEC and non-OPEC members will continue searching for a way to improve conditions in the market. However most analysts point to Iran, because its officials made clear multiple statements that Tehran wants return to its pre-sanctions output level.

Gold is currently at $1,226.60 (+0.02%) holding above the key $1,200 an ounce level amid declines in stocks. Concerns over the global economy and a global equity selloff allowed gold price to gain 16% since the beginning of 2016. However many analysts say that the recent rally was overdone and bullion may lose more. Concerns over Federal Reserve's plan to continue raising rates support the precious metal too.

Holdings of SPDR Gold Trust, the largest gold-backed exchange-traded-fund, rose by 0.38% to 713.63 tonnes on Thursday.

U.S. stock indices declined on Thursday with Wal-Mart stocks leading declines amid a weaker-than-expected quarterly report. Lower oil prices weighed on stocks too.

The Dow Jones Industrial Average declined 40.40 points, or 0.3%, to 16,413.43. The S&P 500 lost 8.99 points, or 0.5%, to 1,917.83 (eight out of its ten sectors declined). The Nasdaq Composite fell 46.53 points, or 1%, to 4,487.54.

Philadelphia Fed Manufacturing Survey showed that business activity improved in the region in February. The corresponding index rose to -2.8 points from -3.5 in January. Economists had expected the index to climb to -3.0.

The U.S. leading indicators index from the Conference Board fell by 0.2% to 123.2 (2010=100) in January after a 0.3% decline in December and 0.5% rise in November. The latest reading was in line with forecasts.

This morning in Asia Hong Kong Hang Seng fell 0.35%, or 67.75 points, to 19,295.33. China Shanghai Composite Index declined 0.17%, or 4.74 points, to 2,858.15. Meanwhile the Nikkei fell 1.43%, or 231.89 points, to 15,964.91.

Asian stock indices fell following declines in U.S. equities. A stronger yen put additional pressure on stocks of Japanese exporters. The yen rose by almost 10% against the dollar in the past three weeks.

(raw materials / closing price /% change)

Oil 30.62 -0.49%

Gold 1,232.00 +0.46%

(index / closing price / change items /% change)

S&P/ASX 200 4,992 +109.90 +2.25%

TOPIX 1,311.2 +28.80 +2.25%

Hang Seng 19,363.08 +438.51 +2.32 %

Shanghai Composite 2,862.89 -4.45 -0.16 %

FTSE 100 5,971.95 -58.37 -0.97 %

CAC 40 4,239.76 +6.29 +0.15 %

Xetra DAX 9,463.64 +86.43 +0.92 %

S&P 500 1,917.83 -8.99 -0.47 %

NASDAQ Composite 4,487.54 -46.53 -1.03 %

Dow Jones 16,413.43 -40.40 -0.25 %

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1105 -0,19%

GBP/USD $1,4334 +0,29%

USD/CHF Chf0,9928 +0,06%

USD/JPY Y113,23 -0,76%

EUR/JPY Y125,77 -0,92%

GBP/JPY Y162,31 -0,44%

AUD/USD $0,7155 -0,38%

NZD/USD $0,6642 +0,15%

USD/CAD C$1,3725 +0,40%

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.