- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 | Japan | Manufacturing PMI | August | 49.4 | |

| 04:30 | Japan | All Industry Activity Index, m/m | June | 0.3% | -0.7% |

| 07:15 | France | Services PMI | August | 52.6 | 52.5 |

| 07:15 | France | Manufacturing PMI | August | 49.7 | 49.5 |

| 07:30 | Germany | Services PMI | August | 54.5 | 54 |

| 07:30 | Germany | Manufacturing PMI | August | 43.2 | 43 |

| 08:00 | Eurozone | Manufacturing PMI | August | 46.5 | 46.2 |

| 08:00 | Eurozone | Services PMI | August | 53.2 | 53 |

| 10:00 | United Kingdom | CBI retail sales volume balance | August | -16 | -11 |

| 11:30 | Eurozone | ECB Monetary Policy Meeting Accounts | |||

| 12:30 | Canada | Wholesale Sales, m/m | June | -1.8% | 0.3% |

| 12:30 | U.S. | Continuing Jobless Claims | 1726 | 1700 | |

| 12:30 | U.S. | Initial Jobless Claims | 220 | 216 | |

| 13:45 | U.S. | Manufacturing PMI | August | 50.4 | 50.5 |

| 13:45 | U.S. | Services PMI | August | 53 | 52.8 |

| 14:00 | Eurozone | Consumer Confidence | August | -6.6 | -7 |

| 14:00 | U.S. | Leading Indicators | July | -0.3% | 0.2% |

| 14:00 | U.S. | Jackson Hole Symposium | |||

| 22:45 | New Zealand | Retail Sales YoY | Quarter II | 3.3% | |

| 22:45 | New Zealand | Retail Sales, q/q | Quarter II | 0.7% | 0.1% |

| 23:30 | Japan | National CPI Ex-Fresh Food, y/y | July | 0.6% | 0.6% |

| 23:30 | Japan | National Consumer Price Index, y/y | July | 0.7% | 0.5% |

Major US stock indices recorded solid gains, as strong quarterly reporting by retailers such as Lowe's (LOW) and Target (TGT) contributed to the growth of optimism among investors. In addition, the focus was on the minutes of the July meeting of the Fed.

Target shares (TGT) soared 19.86% to record levels after the company announced it received adjusted quarterly earnings of $ 1.82 per share, which was $ 0.20 higher than analysts' average forecast. The retailer’s revenue also exceeded Wall Street forecasts. Comparable sales of the company grew by 3.4%, while the forecast of analysts surveyed by Refinitiv suggested an increase of 2.9%. Target also raised its full-year earnings forecast.

Shares of Lowe's (LOW) jumped 10.41%, as the company showed adjusted quarterly earnings of $ 2.15 per share against the average forecast of analysts at $ 2.00. Its revenue also exceeded market expectations. Lowe's comparable sales rose 2.3%, which was higher than the consensus estimate of + 1.9%.

Exceeding the quarterly results of these two retailers indicated strong consumer demand, which helped ease some concerns about a slowdown in US economic growth.

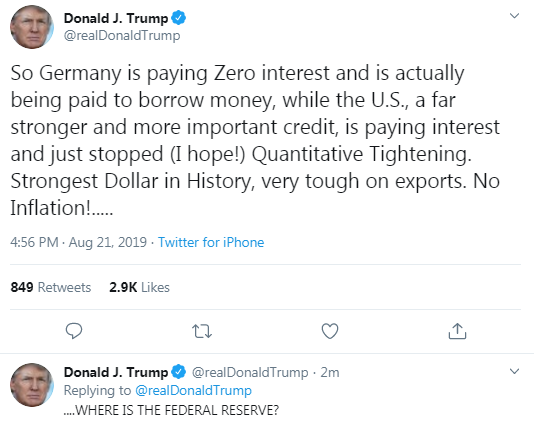

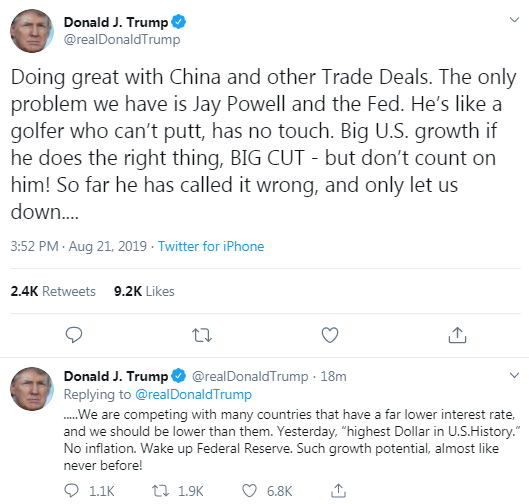

Meanwhile, US President Trump today again wrote several critical messages about the Fed and its chairman on Twitter. Including he said that the only problem for the US is “Jay Powell and the Fed.” “If he decides to significantly reduce the rate, the US economy will grow strongly, but you can’t count on him. Until now, he has only let us down, ”Trump added.

Regarding the minutes of the Fed meeting, the document said that most Fed leaders considered the rate cuts in July to be a recalibration of policies and not the beginning of a more aggressive cycle of easing them, and at the last FOMC meeting, they were reluctant to predict the future path of rates. The protocol indicated that Fed leaders expect the uncertainty surrounding the Trump administration’s trade policy to continue, which will have a “lasting negative impact” on the prospects for the US economy. The opinions of FOMC members on the need to lower rates in July were divided. Several executives thought that rates should be left unchanged, because "the real economy remains in good shape," the protocol says. Two leaders, on the contrary, called for lowering rates in July by 0.5%, which, in their opinion, would be more effective in solving the problem of "persistently low" inflation.

Almost all DOW components completed trading in positive territory (29 out of 30). The biggest gainers were NIKE, Inc. (NKE, + 2.78%). Only Walmart Inc. shares fell in price (WMT, -0.08%).

All S&P sectors recorded an increase. The conglomerate sector grew the most (+ 2.0%).

At the time of closing:

Dow 26,202.73 +240.29 +0.93%

S&P 500 2,924.43 +23.92 +0.82%

Nasdaq 100 8,020.21 +71.65 +0.90%

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 | Japan | Manufacturing PMI | August | 49.4 | |

| 04:30 | Japan | All Industry Activity Index, m/m | June | 0.3% | -0.7% |

| 07:15 | France | Services PMI | August | 52.6 | 52.5 |

| 07:15 | France | Manufacturing PMI | August | 49.7 | 49.5 |

| 07:30 | Germany | Services PMI | August | 54.5 | 54 |

| 07:30 | Germany | Manufacturing PMI | August | 43.2 | 43 |

| 08:00 | Eurozone | Manufacturing PMI | August | 46.5 | 46.2 |

| 08:00 | Eurozone | Services PMI | August | 53.2 | 53 |

| 10:00 | United Kingdom | CBI retail sales volume balance | August | -16 | -11 |

| 11:30 | Eurozone | ECB Monetary Policy Meeting Accounts | |||

| 12:30 | Canada | Wholesale Sales, m/m | June | -1.8% | 0.3% |

| 12:30 | U.S. | Continuing Jobless Claims | 1726 | 1700 | |

| 12:30 | U.S. | Initial Jobless Claims | 220 | 216 | |

| 13:45 | U.S. | Manufacturing PMI | August | 50.4 | 50.5 |

| 13:45 | U.S. | Services PMI | August | 53 | 52.8 |

| 14:00 | Eurozone | Consumer Confidence | August | -6.6 | -7 |

| 14:00 | U.S. | Leading Indicators | July | -0.3% | 0.2% |

| 14:00 | U.S. | Jackson Hole Symposium | |||

| 22:45 | New Zealand | Retail Sales YoY | Quarter II | 3.3% | |

| 22:45 | New Zealand | Retail Sales, q/q | Quarter II | 0.7% | 0.1% |

| 23:30 | Japan | National CPI Ex-Fresh Food, y/y | July | 0.6% | 0.6% |

| 23:30 | Japan | National Consumer Price Index, y/y | July | 0.7% | 0.5% |

- EU would probably accept to grant UK a delay on Brexit to hold new elections

- Britain should have no doubt France, Germany and other EU countries are totally united

The U.S. Energy

Information Administration (EIA) revealed on Wednesday that crude inventories fell

by 2.732 million barrels in the week ended August 16. Economists had forecast a

drop of 1.500 million barrels.

At the same

time, gasoline stocks rose by 0.312 million barrels, while analysts had

expected a decline of 0.200 million barrels. Distillate stocks surged by 2.610

million barrels, while analysts had forecast a decrease of 0.300 million

barrels.

Meanwhile, oil

production in the U.S. was unchanged at 12.300 million barrels a day.

U.S. crude oil

imports averaged 7.2 million barrels per day last week, down by 497,000 barrels

per day from the previous week.

The National

Association of Realtors (NAR) announced on Wednesday that the U.S. existing

home sales jumped 2.5 percent m-o-m to a seasonally adjusted rate of 5.42

million in July from a revised 5.29 million in June (originally 5.27 million).

Economists had

forecast home resales increasing to a 5.39 million-unit pace last month.

In y-o-y terms,

existing-home sales rose 0.6 percent in July.

According to

the report, single-family home sales stood at a seasonally adjusted annual rate

of 4.84 million in July, up from 4.71 million in June and up 1.0 percent from a

year ago. The median existing single-family home price was $284,000 in July

2019, an increase of 4.5 percent from July 2018. Meanwhile, existing

condominium and co-op sales were recorded at a seasonally adjusted annual rate of

580,000 units in July, unchanged from the prior month and down 3.3 percent from

a year ago. The median existing condo price was $254,300 in July, which is up

2.5 percent from a year ago.

The NAR’s chief

economist Lawrence Yun noted that falling mortgage rates were improving housing

affordability and nudging buyers into the market. However, he added that the

supply of affordable housing is severely low. “The shortage of lower-priced

homes have markedly pushed up home prices,” he said.

Mazen Issa, the senior FX strategist at TD Securities, notes that the Fed's July minutes will take center stage today and TD expects that a policy divide over the future path of policy will surface.

- “We would not be surprised either that the minutes also reveal a debate among some participants who do not believe that the Fed should be cutting at all. We are sympathetic to both sides of the debate, as Powell and co are between a rock and a hard place as far as facing external pressures to ease; both from Trump and the bond market. To this end, we are more circumspect that the bond market will show much sympathy to a division in the Minutes, particularly with so much focus on Powell's appearance at Jackson Hole later this week.

- We expect the USD, on the other hand, to show more deference to this division, however, and at the expense of EUR and JPY, as neither offers a compelling positive offset at the moment.”

Nathan Janzen, the senior economist at Royal Bank of Canada (RBC), notes that Canada’s headline inflation increased 0.5% m/m in July and 2.0% y/y.

- “A surge in July airfares (a 14% increase from June) was to blame for a big chunk of what was a stronger-than-expected month-over-month headline price increase. But airfares jumped a similar amount last year in July as well. The gains have more to do with a new methodology for the component implemented more than a year ago than an underlying change in price growth.

- Looking through monthly wiggles, underlying inflation trends still look pretty solidly anchored around the Bank of Canada’s 2% target rate. The headline index was up 2.0% year-over-year. Excluding food & energy products, prices were up 2.2% from a year ago. Probably most importantly for future Bank of Canada policy decisions, the central bank’s preferred ‘core’ measures averaged 2.0% once again – extending the tight 1.9%-2.1% range since February 2018 for another month.”

U.S. stock-index futures surged on Wednesday as solid earnings reports from retailers Lowe’s (LOW) and Target (TGT) pointed to robust consumer demand, helping ease some concerns over slowing economic growth..

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 20,618.57 | -58.65 | -0.28% |

Hang Seng | 26,270.04 | +38.50 | +0.15% |

Shanghai | 2,880.33 | +0.3295 | +0.01% |

S&P/ASX | 6,483.30 | -61.70 | -0.94% |

FTSE | 7,211.85 | +86.85 | +1.22% |

CAC | 5,435.77 | +91.13 | +1.71% |

DAX | 11,817.17 | +165.99 | +1.42% |

Crude oil | $56.52 | +0.69% | |

Gold | $1,510.8 | -0.32% |

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 162.01 | 1.00(0.62%) | 875 |

ALCOA INC. | AA | 18.32 | 0.01(0.05%) | 4400 |

ALTRIA GROUP INC. | MO | 46.32 | 0.29(0.63%) | 2241 |

Amazon.com Inc., NASDAQ | AMZN | 1,816.25 | 14.87(0.83%) | 30089 |

American Express Co | AXP | 122.3 | 0.88(0.72%) | 490 |

Apple Inc. | AAPL | 212.44 | 2.08(0.99%) | 139224 |

AT&T Inc | T | 35.13 | 0.15(0.43%) | 27058 |

Boeing Co | BA | 334.6 | 2.85(0.86%) | 5503 |

Caterpillar Inc | CAT | 117.69 | 1.02(0.87%) | 1365 |

Chevron Corp | CVX | 117.17 | 1.04(0.90%) | 2866 |

Cisco Systems Inc | CSCO | 48.39 | 0.46(0.96%) | 18133 |

Citigroup Inc., NYSE | C | 64.06 | 0.64(1.01%) | 9879 |

Exxon Mobil Corp | XOM | 69.5 | 0.47(0.68%) | 8409 |

Facebook, Inc. | FB | 185.45 | 1.64(0.89%) | 35826 |

FedEx Corporation, NYSE | FDX | 157.98 | 2.14(1.37%) | 303 |

Ford Motor Co. | F | 9.02 | 0.06(0.67%) | 34771 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 9.26 | 0.07(0.76%) | 16346 |

General Electric Co | GE | 8.42 | 0.04(0.48%) | 365325 |

General Motors Company, NYSE | GM | 37.25 | 0.29(0.78%) | 1133 |

Goldman Sachs | GS | 201.62 | 1.64(0.82%) | 5374 |

Google Inc. | GOOG | 1,192.45 | 9.76(0.83%) | 2463 |

Home Depot Inc | HD | 218.75 | 1.66(0.76%) | 19422 |

Intel Corp | INTC | 46.93 | 0.33(0.71%) | 20916 |

International Business Machines Co... | IBM | 133.99 | 0.99(0.74%) | 2319 |

Johnson & Johnson | JNJ | 131.3 | 0.70(0.54%) | 4849 |

JPMorgan Chase and Co | JPM | 108.11 | 0.80(0.75%) | 13586 |

McDonald's Corp | MCD | 219.14 | 0.67(0.31%) | 457 |

Merck & Co Inc | MRK | 85.75 | 0.10(0.12%) | 351 |

Microsoft Corp | MSFT | 138.33 | 1.07(0.78%) | 73874 |

Nike | NKE | 81.2 | 0.67(0.83%) | 2472 |

Pfizer Inc | PFE | 34.81 | 0.20(0.58%) | 10956 |

Procter & Gamble Co | PG | 119.26 | 0.36(0.30%) | 1538 |

Starbucks Corporation, NASDAQ | SBUX | 96.15 | 0.52(0.54%) | 2126 |

Tesla Motors, Inc., NASDAQ | TSLA | 221.76 | -4.10(-1.82%) | 187830 |

The Coca-Cola Co | KO | 54.1 | 0.22(0.41%) | 5584 |

Twitter, Inc., NYSE | TWTR | 42.75 | 0.46(1.09%) | 55992 |

Verizon Communications Inc | VZ | 56.49 | 0.22(0.39%) | 3381 |

Visa | V | 180.3 | 1.06(0.59%) | 11480 |

Wal-Mart Stores Inc | WMT | 113.5 | 1.45(1.29%) | 37548 |

Walt Disney Co | DIS | 134.8 | -0.33(-0.24%) | 18622 |

Yandex N.V., NASDAQ | YNDX | 36.89 | 0.41(1.12%) | 1535 |

Chevron (CVX) initiated with Outperform at BMO Capital Markets

Exxon Mobil (XOM) initiated with Market Perform at BMO Capital Markets; target $86

Statistics

Canada reported on Wednesday the country’s consumer price index (CPI) rose 0.5

percent m-o-m in July, following a 0.2 percent m-o-m drop in the previous

month.

On the y-o-y

basis, Canada’s inflation rate increased 2.0 percent last month, matching the gain

in June.

Economists had

predicted inflation would decrease 0.2 percent m-o-m but gain 1.7 percent y-o-y

in July.

According to

the report, growth in the services index slowed to 2.4 percent y-o-y in July compared

with a 2.8 percent y-o-y advance in June. This slowdown, however, was offset by a 1.3

percent y-o-y gain in the goods index, as the decline in gasoline prices slowed, and price growth accelerated for durable goods and food.

Meanwhile, the

closely watched the Bank of Canada's core index rose 2.0 percent y-o-y in July,

the same pace as in the previous month. Economists had forecast an advance of

2.3 percent y-o-y.

Analysts at Standard Chartered note that China’s August SME survey showed early signs of stabilization in the economy.

- “The headline SMEI (Bloomberg: SCCNSMEI <index>) edged up to 54.5 in August from 53.8 in July, with the growth momentum indicator (new orders minus finished-goods inventory) picking up again after dropping for three consecutive months. The services sector showed an improvement in performance, while the manufacturing sector disappointed. Domestically-focused SMEs outperformed exporters.

- Both the ‘current performance’ and the ‘expectations’ sub-indices edged higher versus July, though they remained relatively low.

- SMEs’ expectations of real activity turned benign, pointing to a possible mild recovery later this year.

- SMEs’ credit conditions remain a concern, with the ‘credit’ sub-index easing in August after improving in July.

- The recent loan prime rate (LPR) reform, making it the new reference rate for loans, should improve interest rate transmission. However, to consistently lower financing costs for SMEs, we think the authorities will need to offer cheaper funding to the banking system.”

Target (TGT) reported Q2 FY 2019 earnings of $1.82 per share (versus $1.47 in Q2 FY 2018), beating analysts’ consensus estimate of $1.62.

The company’s quarterly revenues amounted to $18.422 bln (+3.6% y/y), generally in line with analysts’ consensus estimate of $18.320 bln.

The company issued in-line guidance for Q3, projecting EPS of $1.04-1.24 versus analysts’ consensus estimate of $1.17.

It also raised guidance for FY 2019, projecting EPS of $5.90-6.20 versus its prior guidance of $5.75-6.05 and analysts’ consensus estimate of $5.94.

TGT rose to $100.40 (+17.39%) in pre-market trading.

Lowe's (LOW) reported Q2 FY 2019 earnings of $2.15 per share (versus $2.07 in Q2 FY 2018), beating analysts’ consensus estimate of $2.00.

The company’s quarterly revenues amounted to $20.992 bln (+0.5% y/y), generally in line with analysts’ consensus estimate of $20.958 bln.

The company also reaffirmed guidance for FY 2019, projecting EPS of $5.45-5.65 (versus analysts’ consensus estimate of $5.57) and revenues of ~$72.74 bln or+2% y/y (versus analysts’ consensus estimate of $72.53 bln).

LOW rose to $110.00 (+12.39%) in pre-market trading.

Analysts at TD Securities are expecting Canada’s CPI inflation to fall from 2.0% to 1.7% y/y in July as a 0.2% m/m increase is overshadowed by base-effects from last year.

- “Gasoline prices will provide a significant driver to the monthly increase on a 3.4% increase in the price at the pump alongside a modest increase in food prices. Core measures are also expected to edge lower on a 0.1pp decline the trimmed-mean and weighted-median measures, pushing the average of the three to 1.97% from 2.03% y/y in June.”

Analysts at TD Securities are expecting the minutes of the Fed meeting in July to attempt to clarify the path forward after Chair Jerome Powell remained non-committal on guidance for future rate movements at his July press conference.

- “Powell painted the Fed's action as a "mid-cycle adjustment" and not necessarily one cut or the "beginning of a long series of cuts." The minutes should support our view that soft global growth, trade uncertainty, and persistent below-target inflation should keep the Fed on a dovish footing.”

The Mortgage

Bankers Association (MBA) reported on Wednesday the mortgage application volume

in the U.S. fell 0.9 percent in the week ended August 16, following a 21.7

percent surge in the previous week.

According to

the report, applications to purchase a home fell 4 percent, while refinance

applications rose 0.4 percent.

Meanwhile, the

average fixed 30-year mortgage rate decreased to 3.90 percent from 3.93

percent.

“In a week

where worries over global economic growth drove U.S. Treasury yields 13 basis

points lower, the 30-year fixed mortgage rate decreased just 3 basis points. As

a result, the refinance index saw only a slight increase but remained at its

highest level since July 2016,” said Joel Kan, MBA’s associate vice president

of economic and industry forecasting. “The small moves in rates and refinancing

are potentially signs that lenders may be approaching capacity constraints as

they continue to deal with the largest wave of refinance activity in three

years.”

- Argues the Fed should cut the federal funds rate in September and should also use forward guidance to provide even more of a boost to the economy than a rate cut alone can deliver

- The Fed can influence long-term rates by giving guidance about the future path of short-term equivalents

Analysts at TD Securities note that the UK’s Public Sector Net Borrowing (PSNB) data for July showed a surplus of £1.3bn, compared to consensus of £2.9bn and £3.6bn in July 2018.

- “After a couple of years of the fiscal data generally surprising to the upside, the YTD fiscal deficit is now 60% higher than a year ago, suggesting that the rapid improvement that we had seen recently is likely behind us now.”

- unlikely that negotiations on backstop will get going again

David Mann, global chief economist at Standard Chartered, expects the global economy to slow further, but not to fall into recession.

“We see a protracted slowdown, driven largely by structural factors including slowing workforce growth in economies such as China and the US. Whether the global economy falls into recession will depend on fundamentals, policy and confidence. Fundamentals are softening; there are pockets of excessive leverage, including in China. Policy is now aimed at countering the slowdown, in line with our dovish wave theme since earlier this year, but confidence is being damaged nevertheless. Markets seem to expect little (or no) progress on US-China trade negotiations in the coming months; this leaves room for a positive surprise. But even if the two sides settle their economic dispute relatively soon, the long-term damage to investor sentiment is already done. Any deal that might be reached is unlikely to be the end of the story.”

Prime Minister Boris Johnson is set to tell German Chancellor Angela Merkel on Wednesday that unless she agrees to change the Brexit deal, Britain will leave the European Union on Oct. 31 without a deal.

More than three years after the United Kingdom voted to leave the EU, it is still unclear on what terms - or indeed whether - the bloc’s second largest economy will leave the club it joined in 1973.

Johnson, a Brexiteer who won the premiership a month ago, is betting that the threat of ‘no-deal’ Brexit turmoil will convince Merkel and French President Emmanuel Macron that the EU should do a last-minute divorce deal to suit his demands.

But with just over 10 weeks left until the United Kingdom is due to leave, the EU has repeatedly said it will not renegotiate the Withdrawal Agreement struck by Johnson’s predecessor, Theresa May, and that it will stand behind member state Ireland.

Merkel on Tuesday said she was open to “practical solutions” to the Irish border insurance policy or ‘backstop’ that Johnson says is unacceptable - but that the Withdrawal Agreement was not to be reopened.

Societe Generale Research flags a scope for EUR/USD and GBP/JPY to edge lower lower over the coming weeks.

"We don't think the market is short enough of euros to prevent yet another new, marginal low in this move and it's worth re-emphasising that thanks to the weakness of the yuan and sterling this summer, the trade-weighted euro is reached its best level of the year a week ago. Given recent economic data and likely ECB moves, it seems likely, in fact,that we will see EUR/USD edge lower in the weeks ahead, unless we get clear signals of further Fed easing or clear signals of European fiscal easing. And if we get the former, we w much rather be long the yen than the euro, thanks," SocGen notes. More Brexit noise is likely too as Europe ‘responds' to PM Johnson's demands. GBP/JPY looks more likely to fall to 125 than rise to 130," SocGen adds.

Karen Jones, analyst at Commerzbank, suggests that the USD/JPY continues to creep slowly higher, its recent new low of 105.05 was not been confirmed by the daily RSI.

“We suspect that the market may have based just ahead of the 104.48/10 January low and the 2013-2019 uptrend. This support is reinforced by the 200 month ma at 104.44. Interim resistance is the 107.21 18th July low and the market remains capped here, as such we remain unable to rule out another stab down towards the 104.50 region prior to recovery. A negative bias remains entrenched while capped by the 108.99/109.32 recent highs. Failure at 104.10 would target 99.00 the 2016 low, but for now we would allow for consolidation and look for the market to hold circa 104.50/10.”

According to the report from Office for National Statistics, UK posted a smaller-than-expected budget surplus in July as government expenditure rose, underlining budget constraints on new Prime Minister Johnson as he promises to boost spending ahead of Brexit.

The surplus, excluding state-owned banks, stood at 1.319 billion pounds, compared with 3.562 billion pounds in July 2018. This was well below the median forecast of 2.7 billion pounds.

While most tax receipts were up a little compared with a year ago, government spending was 2.6 billion pounds higher, a 4.2% annual increase. Purchases of goods and services and staff costs drove most of the rise.

For the first four months of the financial year starting in April, Britain has borrowed 16.0 billion pounds, up 60% compared with a year ago although the deficit as a share of the economy remains small compared with a decade ago.

FX Strategists at UOB Group believe there is still scope for NZD/USD to slip back to the mid-0.6300s in the next weeks.

24-hour view: “Expectation for “further NZD weakness” did not materialize as NZD traded in a muted manner between 0.6404 and 0.6430. The quiet price action offers no fresh clues and NZD could continue to trade sideways, likely between 0.6400 and 0.6435”.

Next 1-3 weeks: “While the overall outlook for NZD still appears to be ‘soft’, it has not been able to make much headway on the downside as it failed to crack 0.6400 over the past two days (low of 0.6404 on both Monday and Tuesday). For now, we continue to hold the view that there is chance for NZD to weaken further to 0.6350. However, in view of the waning downward momentum, a break of 0.6470 (level previously at 0.6500) would indicate that the current downward pressure has eased. To look at it another way, a break of 0.6470 would suggest NZD could trade sideways for up to a few weeks”.

Sonia Meskin, US economist at Standard Chartered, suggests that they have lowered their Fed funds target rate (FFTR) call for year-end 2019 to 1.75% (from 2.00%) by adding a 25bps cut in September.

“We continue to forecast a cut in December, as well. We believe that heightened trade uncertainty, coupled with ongoing deterioration in global growth, will worry the Committee. The extent to which global growth deterioration will hurt the domestic economy is uncertain, and there is little precedent on which the Fed can confidently rely. US economic fundamentals remain solid, for now, supported by a strong labour market and consumer spending. However, both coincident and leading indicators from the goods sector have been deteriorating. The stronger USD, rising unit labour costs, supply-chain disruptions and weaker revenue from abroad may soon combine to squeeze corporate margins and sap hiring. Meanwhile, core inflation remains below the FOMC’s medium-term 2% objective.Against this backdrop, we believe the FOMC will ease further in H2-2019, and we expect the policy stance to remain dovish until either trade and growth concerns abate, core inflation tops 2% or wage growth tops 3.5% y/y, roughly the latest cycle’s peak.”

The U.S. economy isn’t headed for recession right now, San Francisco Fed President Mary Daly said.

“When I look at the data coming in, I see solid domestic momentum that points to a continued economic expansion,” Daly said.

Daly said that there are “considerable headwinds” facing the economy and she was worried that they are contributing to a fear that a downturn is right around the corner.

“So one thing I’m looking closely at is whether the mood gets so out of sync with the data that the fear of recession becomes a self-fulfilling prophecy,” she added.

Daly said she supported the Fed’s interest-rate cut in July as “an appropriate recalibration of policy” in response to the headwinds facing the economy. She stressed her support for the rate cut was not based on her seeing “an impending downturn on the horizon.”

Asked if the U.S. was “doomed” to low inflation, Daly replied no. She said the Fed has tools it can use once it better understands what is driving low inflation.

France’s borrowing costs are set to have been reduced by around 2 billion euros, compared to earlier forecasts, due to the low interest rates currently circulating within world financial markets, said French budget minister Gerald Darmanin.

“The state is borrowing at extremely low, even negative rates.....Over the course of the year, we’re looking at around two billion euros worth of savings generated with regards to what had been forecast in the budget,” Darmanin said in a tweet.

There is no sign of a looming euro zone crisis due to political upheaval in Italy, German Finance Minister Olaf Scholz said on Wednesday.

Asked if he feared a new euro zone crisis, Scholz told German television: “No, there is no sign of that.”

Agreement had been reached with Italy on developing the European stability criteria even with the current government in Rome, he said. “And it looks as if a new government, perhaps with a different composition, will emerge.”

Danske Research discusses EUR/CHF outlook and flags a scope for further dips in the near-term.

"EUR/CHF edged higher yesterday after the weekly sight-deposit numbers underlined that the SNB curbed CHF strength last week. We still expect the SNB to stay in the market to mitigate large moves in EUR/CHF, but given its revealed distaste for balance sheet expansion, it is unlikely to have any clear red lines for the cross now that 1.10 has been crossed. The risk remains for a further dip as SNB will likely be forced to enter new territory on policy rates," Danske adds.

China’s overseas investment growth will likely slow or even decline in the next few years, as geopolitical and economic risks around the world increase, according to credit rating agency, Moody’s Investors Service.

Moody’s said that Chinese infrastructure companies will be more selective when investing in projects outside the country.

“Overseas investments will remain at a solid level, but companies will take a more cautious approach to these investments, especially in emerging and frontier markets,” wrote the authors of the report.

That’s due to an “increased awareness” of the risks, they said.

“This awareness stems from the lessons — sometimes difficult ones — companies are learning from the sector’s rapid expansion into emerging and frontier markets during the past few years,” according to the report.

For years, Chinese overseas direct investments grew, boosted by government policy programs such as the Belt and Road Initiative.

Overseas direct investment in China jumped 49.3% in 2016, followed by two consecutive years of decline. It fell 23% year-on-year in 2017, and dropped 13.6% in 2018 compared to the previous year, Moody’s said, citing Chinese government data.

After its peak in 2016, growth started to slow as a result of regulatory controls and tighter liquidity conditions in China, according to Moody’s.

According to Danske Bank analysts, the main data release today is the FOMC minutes from the July meeting, which we get tonight.

“A lot has happened since the last meeting so the minutes may seem hawkish in the current context. Today, PM Boris Johnson is meeting with German chancellor Angela Merkel to, among other things, discuss Brexit. In his letter Monday, Johnson made it clear that the backstop needs to be removed for the withdrawal deal to pass the House of Commons but the EU has repeatedly rejected this, as it sees it as a necessary insurance policy to avoid a hard border. The swift refusal yesterday led to a depreciation of GBP.”

According to Karen Jones, analyst at Commerzbank, EUR/USD pair remains on the defensive as the intraday Elliott wave counts suggests that intraday bounces should struggle circa 1.1150.

“It came under increasing downside pressure last week and attention has reverted to the 1.1027 recent low and the base of its down channel at 1.0955. Below here lies the 78.6% retracement at 1.0814/78.6% retracement. Nearby resistance is the 200 day ma at 1.1287, but key resistance is 1.1343/65, the 2018-2019 down channel and the 55 week ma. A weekly close above this latter level is needed for us to adopt an outright bullish stance. The market will need to regain the 55 week ma and channel at 1.1343/65 to generate upside interest.”

EUR/USD

Resistance levels (open interest**, contracts)

$1.1219 (2669)

$1.1184 (2145)

$1.1159 (855)

Price at time of writing this review: $1.1093

Support levels (open interest**, contracts):

$1.1060 (4545)

$1.1027 (4094)

$1.0987 (7283)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date September, 6 is 105035 contracts (according to data from August, 20) with the maximum number of contracts with strike price $1,1400 (8871);

GBP/USD

Resistance levels (open interest**, contracts)

$1.2281 (1206)

$1.2236 (913)

$1.2210 (164)

Price at time of writing this review: $1.2153

Support levels (open interest**, contracts):

$1.2120 (1548)

$1.2099 (966)

$1.2044 (2074)

Comments:

- Overall open interest on the CALL options with the expiration date September, 6 is 30054 contracts, with the maximum number of contracts with strike price $1,2750 (4128);

- Overall open interest on the PUT options with the expiration date September, 6 is 24278 contracts, with the maximum number of contracts with strike price $1,2100 (2074);

- The ratio of PUT/CALL was 0.81 versus 0.78 from the previous trading day according to data from August, 20

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 59.67 | 0.67 |

| WTI | 55.99 | 0.04 |

| Silver | 17.14 | 1.72 |

| Gold | 1507.238 | 0.77 |

| Palladium | 1486.87 | 0.71 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | 114.06 | 20677.22 | 0.55 |

| Hang Seng | -60.3 | 26231.54 | -0.23 |

| KOSPI | 20.35 | 1960.25 | 1.05 |

| ASX 200 | 77.6 | 6545 | 1.2 |

| FTSE 100 | -64.65 | 7125 | -0.9 |

| DAX | -64.19 | 11651.18 | -0.55 |

| Dow Jones | -173.35 | 25962.44 | -0.66 |

| S&P 500 | -23.14 | 2900.51 | -0.79 |

| NASDAQ Composite | -54.25 | 7948.56 | -0.68 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.67746 | 0.15 |

| EURJPY | 117.856 | -0.21 |

| EURUSD | 1.10974 | 0.17 |

| GBPJPY | 129.249 | -0.01 |

| GBPUSD | 1.2166 | 0.33 |

| NZDUSD | 0.64107 | 0.07 |

| USDCAD | 1.33172 | -0.05 |

| USDCHF | 0.97736 | -0.41 |

| USDJPY | 106.232 | -0.34 |

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.