- Analytics

- News and Tools

- Market News

- EU session review: Dollar reaches 4-month low before U.S. jobs data release

EU session review: Dollar reaches 4-month low before U.S. jobs data release

Data released

08:00 UK Halifax house price index (February) -0.9% -0.6% 0.8%

08:00 UK Halifax house price index (February) 3m Y/Y -2.8% -2.5% -2.4%

The dollar fell to its weakest level in four months against the euro as stock markets rose before a report that may show U.S. employers added the most jobs since May, curbing demand for the currency as a haven.

The euro headed for a third straight weekly increase against the greenback, the longest run of gains since October, after European Central Bank President Jean-Claude Trichet said yesterday the ECB may increase interest rates at its next meeting.

The euro has jumped 1.3% since Feb. 25 against a basket of developed nations’ currencies as investors increased wagers the ECB would raise it key rate, which is already 0.75% higher than the upper end of the Federal Reserve target range.

An “increase of interest rates in the next meeting is possible,” Trichet said yesterday. Trichet and board member Lorenzo Bini Smaghi are among the ECB policy makers scheduled to speak in Paris and Cape Town today.

“It’s absolutely clear that the ECB will raise rates in April, with some now expecting 75 basis points worth of hikes this year,” said Yuji Saito at Credit Agricole Corporate & Investment Bank. “The euro will likely strengthen further, initially targeting $1.4080,” the Nov. 8 high, he said.

Sterling declined against the dollar after house prices fell in February, fueling concern that the economic recovery won’t be sustained.

U.K. house prices fell 0.9% from January, when they rose 0.8%. Britain’s economy shrank 0.6% in the fourth quarter.

EUR/USD holds within the $1.3950/80 range.

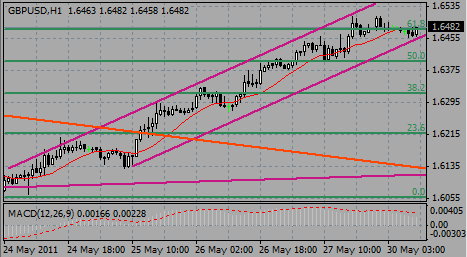

GBP/USD initially fell to session lows around $1.6232 before it recovered to $1.6306. Rate failed to hold above and was back under Y1.6300.

USD/JPY rose from Y82.30 to current Y82.75.

U.S. nonfarm payrolls report is due to come at 13:30 GMT. Analysts expect the report to show a rise of 185,000, following a tepid 36,000 increase previously.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.