- Analytics

- News and Tools

- Market News

- European session: The euro rose

European session: The euro rose

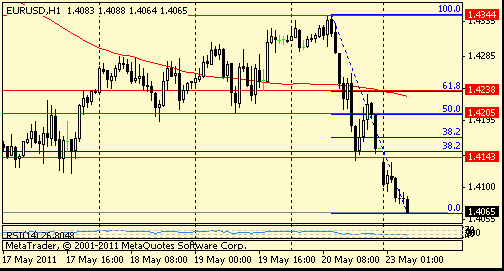

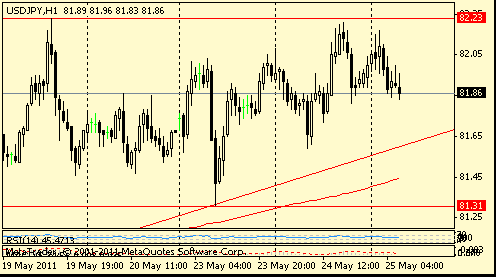

The euro rose as the U.S. debt deal struck overnight gave investors a much-needed confidence boost, but lingering uncertainties kept the gains in check, sustaining demand for safe-haven currencies like the Swiss franc and yen.

Although U.S. political leaders thrashed out a deal over the weekend, this still has to be passed by both the Senate and the House of Representatives later Monday, with the latter expected to be tight. Currency traders are also worried that the deal might not be sufficient to placate the rating agencies.

Manufacturing purchasing managers' indexes across Europe suggested the euro-zone economy got off to a weak start in the third quarter. The data showed that activity at euro-zone factories slowed to a near standstill in July, with even Germany recording slower growth than expected.

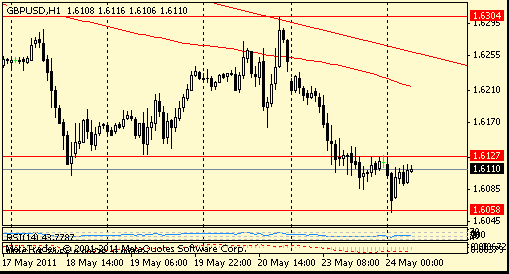

The economic situation looked worse in the U.K., however. The PMI showed that U.K. manufacturing activity unexpectedly contracted last month for the first time in two years. That saw sterling fall more than half a cent against the dollar to dip briefly below $1.64 and the euro climb to GBP0.8795 against the pound. But the weaker dollar helped sterling to rebound.

The pound has benefited in recent weeks from the market's focus on euro-zone and U.S. fiscal concerns but with a semblance of resolution to both crises, sterling may start to underperform, some strategists say.

US construction specding and ISM manuf index are in schedule at 14:00 GMT.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.