- Analytics

- News and Tools

- Market News

- Asian session: Yen collapced after BoJ intervention

Asian session: Yen collapced after BoJ intervention

Data released:

05:00 Japan BoJ meeting announcement 0.00-0.10% 0.00-0.10%

The yen weakened against all its major counterparts after Japan sold its currency in the foreign- exchange market for the first time since March to stem gains that threaten the nation’s economic recovery.

The yen slumped more than 3% against the dollar, the biggest intraday drop since March, after the Bank of Japan followed its Swiss counterpart in easing monetary policy.

Japanese Finance Minister Yoshihiko Noda said today’s intervention was one-side.

“Intervention will be more effective if it comes with monetary easing,” said Kazuo Kitazawa at Credit Suisse Group AG. “I can’t say intervention is successful until the yen depreciates beyond 80 against the dollar.”

The Bank of Japan expanded its asset-purchase fund to 15 trillion yen ($189 billion) from 10 trillion yen, according to a statement. Policy makers also kept the benchmark interest rate near zero. They ended their meeting a day earlier than scheduled on request of the government.

The franc fell for a second day after the Swiss National Bank cut interest rates to zero yesterday.

The Swiss National Bank yesterday lowered its target from 0.25%.

The franc has gained 9.2% over the past month. The yen has risen 0.9% and the dollar has fallen 0.9%, the indexes show.

Meanwhile, gains in the dollar were tempered before U.S. reports today and tomorrow that economists said will show initial jobless claims rose and the unemployment rate stayed above 9%.

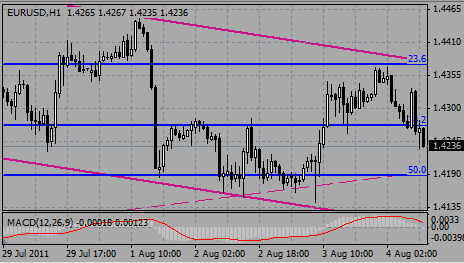

EUR/USD rose to $1.4344 after it earlier tested lows on $1.4140. Later rate recovered decline and weakened to $1.4245/50.

USD/JPY eased from Y77.40 to Y76.80 before BOJ intervention lifted it to Y80.00. Currenty rate retreats.

Germany's Factory Orders are scheduled at 10:00 GMT.

The BoE and ECB rate decisions will be the main focus for today with announcement comes at 11:00 GMT and 11:45 GMT respectively.

Later the main attention will be on ECB's head Trichet's traditional press-conference at 12:30 GMT.

US Jobless claims report also due to come at 12:30 GMT.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.