- Analytics

- News and Tools

- Market News

- European session: The euro rose

European session: The euro rose

08:00 EU(17) M3 money supply (September) adjusted Y/Y 3.1%

08:00 EU(17) M3 money supply (3 months to September) adjusted Y/Y 2.6%

09:00 EU(17) Economic sentiment index (October) 94.8

09:00 EU(17) Business climate indicator (October) -0.18

10:00 UK CBI retail sales volume balance (October) -11%

The euro strengthened after European leaders agreed to expand a rescue fund for indebted nations and reached an accord with lenders on writedowns for Greek debt.

The 17-nation currency rose on speculation the deal reached in Brussels points the way out of the debt crisis even if key details are lacking.

The dollar weakened as stocks rallied, damping demand for safer assets.

European leaders meeting yesterday for the second time in four days persuaded bondholders to take 50 percent losses on Greek debt and boosted the firepower of a rescue fund for indebted nations to 1 trillion euros, responding to global pressure to step up the fight against the financial crisis.

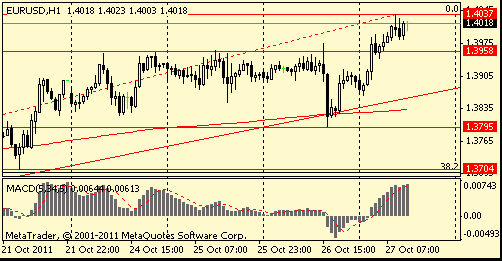

EUR/USD: the pair grown in $1,4040 area.

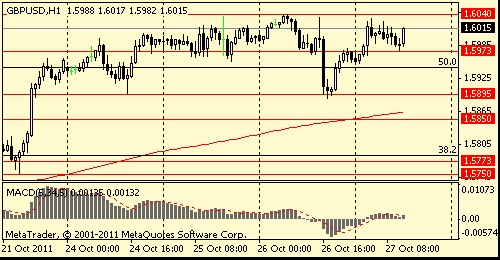

GBP/USD: the pair holds $1,5970-$ 1,6030.

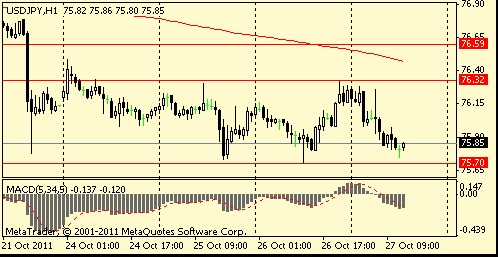

USD/JPY: the pair fell in Y75,80 area.

US data starts at 1200GMT with the September release of the Building Permits Revision. US data continues at 1230GMT with the weekly Jobless Claims and also Q3 GDP and Chain Price Index data. Initial jobless claims are expected to rise to 405,000 in the October 22 week after falling slightly in the previous week. The advance estimate for third quarter GDP is for a 2.5% rate of growth, up from 1.3% in the previous quarter. PCE is expected to post a stronger increase than in the previous quarter, while nonresidential fixed investment is forecast to be post another solid gain. The trade gap is expected to narrow,

while residential fixed investment is expected to improve slightly. Government spending, however, is expected to post another soft reading in the quarter. The chain price index is forecast to rise 2.4% in the quarter, down slightly from 2.5% in the previous two quarters.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.