- Analytics

- News and Tools

- Market News

- European session: the euro fell

European session: the euro fell

08:15 Switzerland Consumer Price Index (MoM) January -0.2% -0.2% -0.3%

08:15 Switzerland Consumer Price Index (YoY) January +0.1% +0.1% +0.1%

10:00 Eurozone Industrial production, (MoM) December +1.6% Revised From +1.8% -0.2% -0.7%

10:00 Eurozone Industrial Production (YoY) December +2.8% Revised From +3.0% +1.8% +0.5%

10:30 United Kingdom Bank of England Quarterly Inflation Report Quarter I

10:30 United Kingdom BOE Gov Mark Carney Speaks

Тhe euro fell sharply against major currencies on the comments of the ECB representative Coeur introducing negative rates. ECB Coeur , said today that the Central Bank is "very seriously" considering the introduction of negative rates. His comments collapses the euro, which has lost more than 50 pips . against the dollar in a matter of minutes .

Previously, the pressure on the single currency had a report on industrial production in the eurozone. As shown by recent data on Wednesday statistical office Eurostat, industrial production in the euro area grew considerably slower pace in December , the growth rate fell short of economists' expectations .

Industrial production growth fell to 0.5 percent in December from a revised down 2.8 percent in the previous month . Economists forecast that growth will weaken to 1.8 percent from November 3 percent initially announced .

Production of energy fell by 1.9 percent compared to December 2012 . Consumer non-durable goods and durable consumer goods fell by 0.9 percent and 1.2 percent respectively. Meanwhile, the production of intermediate goods increased by 3.6 percent .

Among the EU Member States the largest increase was registered in Portugal , Romania , the Czech Republic and Slovenia. The largest decrease was recorded in Malta, Ireland, Estonia and Finland.

On a monthly measurement of industrial production fell by 0.7 percent in late 2013 , after a gain of 1.6 percent in November , which was revised downward from 1.8 percent . Production is projected should have been reduced by 0.2 percent.

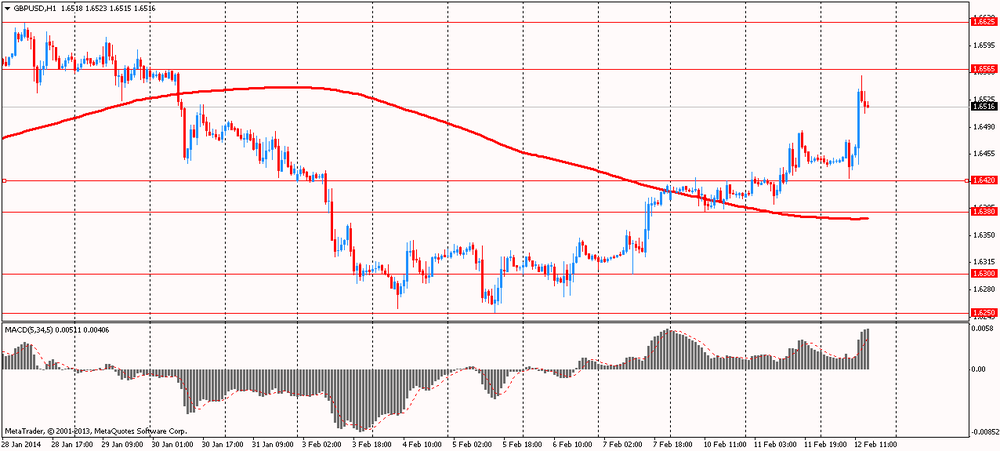

The British pound appreciated sharply against the U.S. dollar on a background of the quarterly report of the Bank of England and the speech of the Central Bank of Carney . According to the Bank of England inflation report , published today , the Central Bank is going to keep rates at a record - low of 0.5 % , at least for another year, even if the unemployment rate / p fall to 7% threshold that, according to expectations occur in Q1 2014 . Bank of England pointed out that the British economy will grow even before the Bank to raise rates . But it is worth noting that the increase will be gradual and not to such a high level , which was celebrated before the crisis.

"The consequences of the financial crisis and the availability of economic obstacles indicate that some time rates should be kept at a low level , - the report says . - Even when the economy returns to a normal level of production capacity , and inflation closer to the target level , the bank rate will be significantly lower than 5 % ( level set before the crisis ) . "

MPC predicts that in the last quarter of 2013 Britain's GDP to grow by 0.9 % against the previous estimate of 0.7 %. As for the remainder of 2014 , the Central Bank expects to rise by 3.4 % versus 2.8 % November forecast .

As for inflation , according to expectations, in the 2nd quarter of 2015 its growth will slow to 1.7% , and then accelerate again in 2016 and will reach 1.9%.

Bank of England Governor Mark Carney , speaking at a press conference after the release of the report , noted that Britain's economic recovery is underway, but it "still is neither stable nor balanced ." He defended the policy of transparency , noting that it has helped reduce the rate hike expectations .

Carney also commented on the rapid drop in rates b / d to reach 7% , explaining the reduction of the total number of those citizens who do not have full employment. At the same time , he pointed out that the number of citizens with underemployment rose to historic highs .

Thus, under the policy of transparency , the Bank of England will consider a number of indicators , such as an index of manufacturing activity , working hours , labor productivity and wages . Size asset purchase program will continue to be £ 375 billion , at least until the first rate increase.

EUR / USD: during the European session, the pair fell to $ 1.3563

GBP / USD: during the European session, the pair rose to $ 1.6556

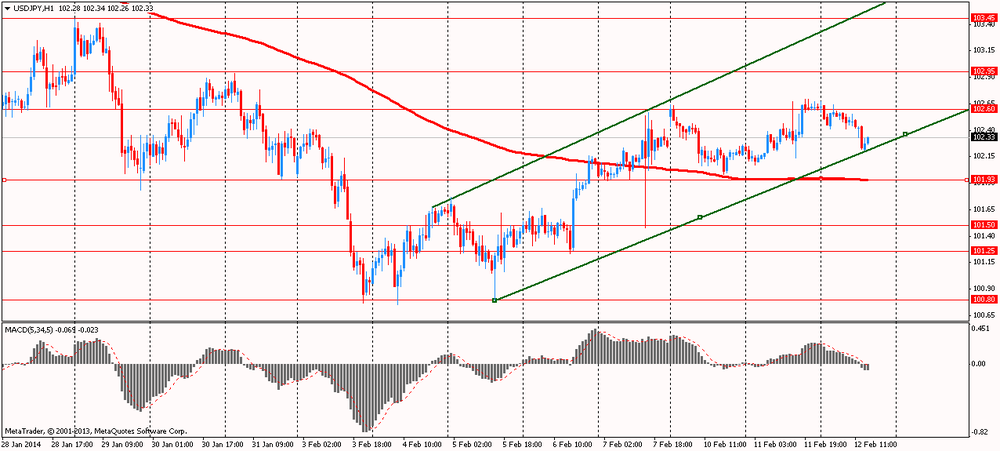

USD / JPY: during the European session, the pair dropped to Y102.21

At 18:00 GMT the U.S. is deploying 10 - year bonds . At 19:00 GMT the United States will submit a monthly report on the budget . At 21:30 GMT New Zealand will release the index of business activity in the manufacturing sector of Business NZ in January .

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.