- Analytics

- News and Tools

- Market News

- Gold Price Forecast: XAU/USD stays on the way to $1,810 hurdle ahead of ECB, US GDP

Gold Price Forecast: XAU/USD stays on the way to $1,810 hurdle ahead of ECB, US GDP

- Gold consolidates weekly losses during two-day uptrend, eases from daily high of late.

- US dollar differs from firmer Treasury yields, helps gold buyers amid market’s indecision, central bank moves.

- US GDP, ECB and US stimulus updates are the key for fresh impulse.

- Gold Price Forecast: Bulls trying to recover the 1,800 mark

Gold (XAU/USD) flirts with the $1,800 threshold, keeps the previous day’s rebound amid softer USD during early Thursday.

The yellow metal recovered the previous day from the weekly bottom as the US dollar faded the bounce off a one-month low, tracking the US Treasury yields. The latest run-up in the gold prices, however, could be linked to the market’s fears of an end to the easy money policies introduced during the pandemic. It’s worth noting that the hopes of US stimulus and Sino-American tussles are extra catalysts that helped the gold buyers at the latest.

The US 10-year Treasury yields consolidate the heaviest daily fall since mid-August, recently picking up bids to 1.55%, up 2.6 basis points (bps). The reason could be linked to the expectations that the US Federal Reserve (Fed) and the European Central Bank (ECB) will track their global counterparts and tighten the strings of monetary policies. The market consensus takes clues from the firmer inflation expectations and recently firmer data from the developed economies, as well as receding fears of the coronavirus.

On Wednesday, the Bank of Canada (BOC) announced the end of bond purchases and the UK also cuts bond issuance. Further, Australia’s strong prints of the RBA Trimmed Mean CPI also push the Reserve Bank of Australia (RBA) towards a rate hike.

Talking about the data, a lower-than-expected US Good Trade Balance and improvement in Durable Goods Orders probed the US dollar bulls ahead of the key Q3 GDP, indirectly helping gold buyers.

Elsewhere, the White House’s (WH) push for faster progress over the budget talks ahead of the December deadline for the debt ceiling extension keeps the gold buyers hopeful. The news joins the Democratic Party members’ scheduling of an additional meeting for President Joe Biden to sort out some last issues with expectations of a deal on the much-awaited stimulus.

Furthermore, the US-China tussles regain momentum, recently over telecom and Taiwan whereas the Evergrande fears aren’t off the table, which in turn underpin the gold’s safe-haven demand.

Against this backdrop, the US stock futures ignore the firmer Treasury yields and the US Dollar Index (DXY) stays on the back foot ahead of the key data/events.

Looking forward, firmer-than-expected preliminary prints of the US Q3 GDP will help the Fed hawks and weigh on the market sentiment, helping the US dollar to regain upside momentum. However, the ECB’s likely hawkish performance may challenge the greenback and help the gold buyers to keep the reins.

Read: US Third Quarter GDP Preview: A most uncertain estimate

Technical analysis

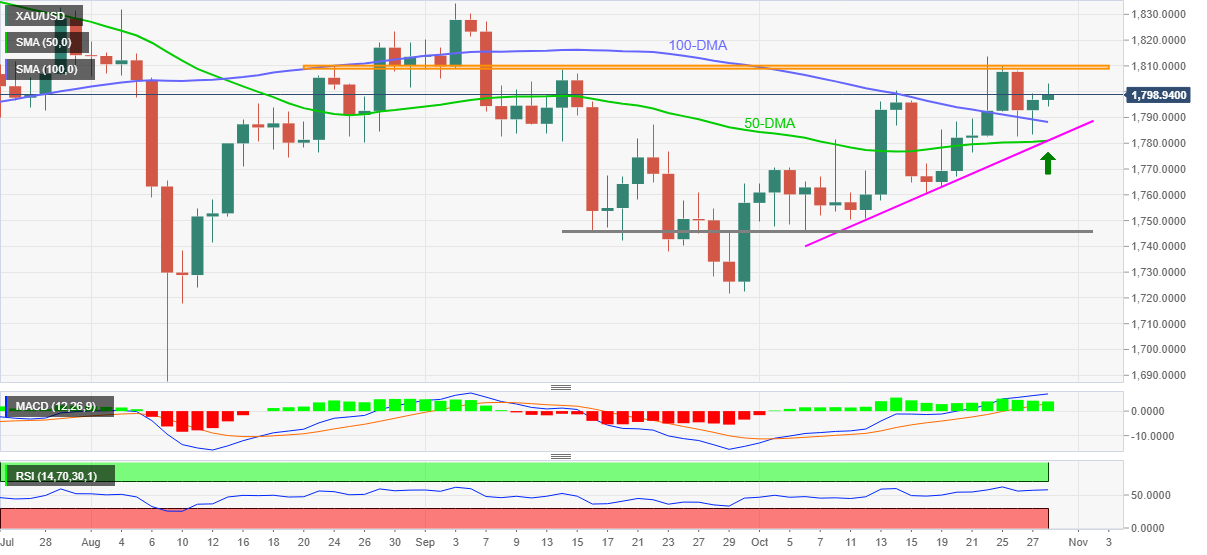

Gold’s failure to cross a two-month-old horizontal hurdle doesn’t allow sellers to sneak in as a convergence of 50-DMA and a fortnight-long rising trend line restricts short-term downside.

Hence, bullish MACD and firmer RSI line, not overbought, keeps gold buyers hopeful to cross the key resistance area surrounding $1,810-11 until staying beyond $1,780 support confluence.

During the quote’s upside past $1,811, the double tops marked in July and September close to $1,834 will be crucial to watch.

On the contrary, a sustained downside below $1,780 may aim for the latest swing low around $1,760 before directing gold sellers to the horizontal line comprising multiple levels marked since September 16, near $1,745.

To sum up, gold remains in a bullish consolidation phase but has tough barriers to the north.

Gold: Daily chart

Trend: Further upside expected

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.