- Analytics

- News and Tools

- Market News

- Gold Price Forecast: XAU/USD could be on the way to $1,830s

Gold Price Forecast: XAU/USD could be on the way to $1,830s

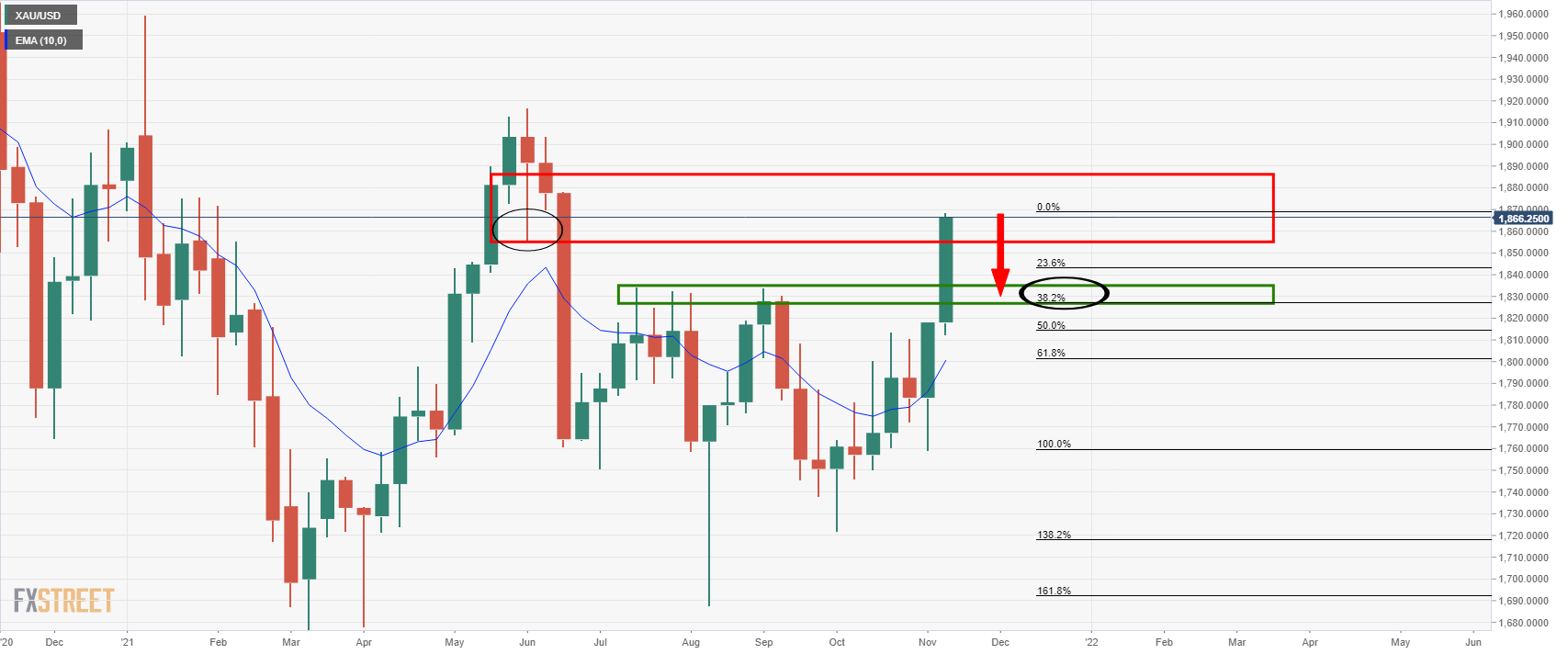

- Gold is on the verge of a 38.2% Fibonacci correction to test prior daily highs.

- The US dollar is on fire as US data impress and Fed rate hike expectations resurface.

The price of gold sank by over 0.6% on Tuesday and printed a low of $1,849.77 following a big move in the US dollar. XAU/USD fell from a high of $1,877.14 after the greenback rallied to the highest levels since June 2020, reaching as high as 95.899.

The US dollar rallied to a fresh 16-month high as US yields took off on the back of impressive data and hawkish Federal Reserve speakers. US data showed US consumers looked past rising prices and drove Retail Sales higher than expected last month. US Retail Sales rose 1.7% in October, topping consensus expectations of a 1.4% rise.

The US dollar has been better bid ever since US inflation data last week surprised to the upside and showed consumer prices surged to their highest rate since 1990. Investors now expected that the Federal Reserve will taper their QE programme at a faster pace. More hawkishly, some observers even expect that the Fed could potentially hike interest rates sooner than first anticipated in the markets.

Fed speakers spur on the USD bulls

Also spurring up-the US dollar bulls was the well-known hawk, St. Louis Federal Reserve bank president James Bullard. "If inflation happens to go away we are in great shape for that. If inflation doesn't go away as quickly as many are currently anticipating it is going to be up to the (Federal Open Market Committee) to keep inflation under control," Bullard said on Bloomberg Television.

"The inflation rate is quite high," Bullard said. "It behoves the committee to tack in a more hawkish direction in the next couple of meetings so that we are managing the risk of inflation appropriately."

He also said that the Fed could also play up the idea that it does not have to wait to end the taper in order to raise rates.

This follows previous comments from Bill Dudley – former New York Fed President – who said “they’re going to have to get the taper done quicker”. The Fed has already said it could change the pace of tapering if warranted and thus far the inflation data supports the need to slow stimulus.

US stocks cheer positive data

Meanwhile, US stocks were boosted by the strong Retail Sales data, also alongside strong manufacturing and home-build data. However, US equity markets took little notice of comments from Federal Reserve members that monetary stimulus should be curbed more quickly to combat inflation. The S&P 500 lifted 0.6% into the close on Wall Street.

Overall, it was a setback for the price of gold despite the prospects of higher inflation and lower real US yields. Analysts at TD Securities' have forecasted slowing growth and inflation next year and that to them suggests that market pricing remains far too hawkish. However, they note that gold prices have managed to break out nonetheless as global markets scour for inflation hedges. This leaves a bullish bias on the fundamental side, but there could be a meanwhile correction left to play out still as follows:

Gold technical analysis

As per the prior analysis, Gold Price Forecast: Bulls could be throwing in the towel here, the price is correcting from a weekly resistance that was illustrated as follows:

The following is an update with the price action and market structure drawn on the daily chart in confluence with the above prior analysis:

The bears could be on the verge of a test of prior resistance structure in the $1,830s.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.