- Analytics

- News and Tools

- Market News

- NZD/USD Price Analysis: Key levels to watch into the RBNZ's Survey of Expectations

NZD/USD Price Analysis: Key levels to watch into the RBNZ's Survey of Expectations

- NZD/USD is trying to correct the bearish impulse.

- NZD/USD traders start to roll up their sleeves for RBNZ's Survey of Expectations

- Bears are looking for a downside extension while bulls are banking on a hawkish RBNZ hike.

NZD/USD is in a precarious position on the charts as we head into the key event today, RBNZ's Survey of Expectations and before the forthcoming interest rate meeting. Today's event is watched closely for signs that expectations are drifting away from the 2% target.

''Market pricing is sitting at roughly 60/40 in favour of a 25bp hike vs 50bp, and we’re expecting a 25bp hike as well. We can’t rule out a 50bp move,'' analysts at ANZ Bank explained.

''But risks to employment and growth are at best balanced and at worst to the downside, and the construction sector is facing a lot of headwinds. Moving in well-signalled 25bp increments can achieve a similar tightening in financial conditions compared with a 50bp hike, but without jolting the economy as much.''

The following is a breakdown of the market structure ahead of these events.

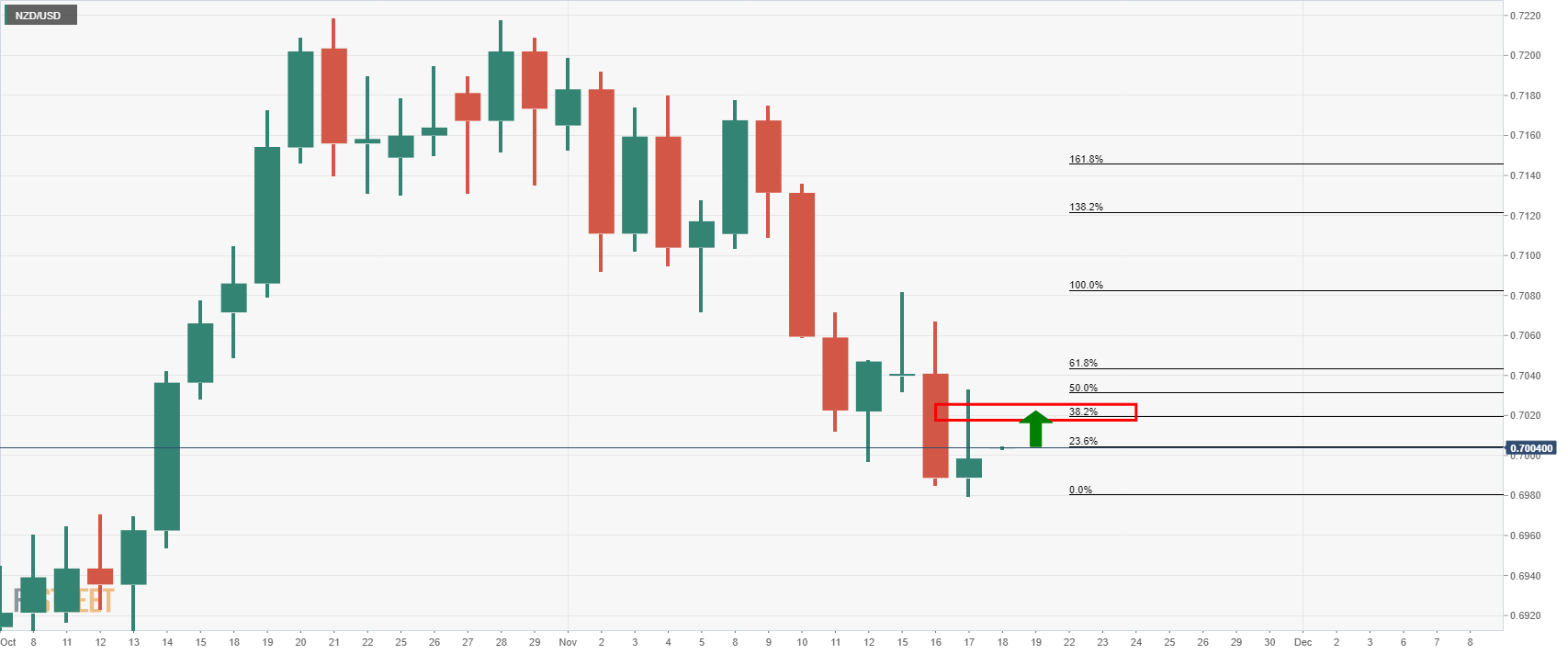

NZD/USD daily chart

NZD/USD is on the verge of a deeper correction to test the 38.2% Fibonacci retracement level near 0.7020 which could be the last stop ahead of a downside continuation. A break of the current lows opens risk to the 0.6950's at least:

However, should there be renewed speculation that the RBNZ is about to hike by 50bps, then the upside will most definitely be to play for in the kiwi. With that being said there could be better places to go and trade the kiwi against, such as AUD for the divergence of central banks.

In such a scenario, 0.7100 will be eyed vs the greenback:

For the upcoming event, we have two areas of resistance at 0.7040 and 0.7020:

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.