- Analytics

- News and Tools

- Market News

- EUR/USD looks offered, visits daily lows near 1.1320

EUR/USD looks offered, visits daily lows near 1.1320

- EUR/USD loses some upside momentum and recedes to 1.1320.

- The greenback looks bid following poor Payrolls results in December.

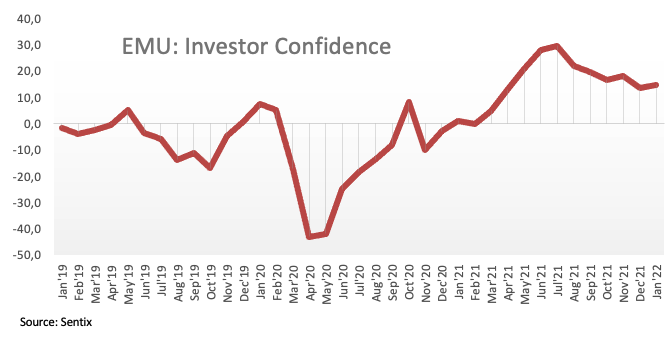

- The Sentix Index in the euro area improved to 14.9 in January.

Sellers appear to have returned to the single currency and now drag EUR/USD back to the 1.1320 region, or daily lows, on Monday.

EUR/USD weaker on dollar’s rebound, yields

EUR/USD fades part of Friday’s strong advance in response to the renewed buying interest in the greenback, which so far manages to lift the US Dollar Index (DXY) back to the 96.00 neighbourhood following last week’s lows around 95.70.

The rebound in the dollar and the consequent knee-jerk in spot came against the backdrop of the relentless uptick in US yields, with the 10y reference note edging higher to the 1.80% region for the first time in nearly two years. In the same direction, yields of the German 10y Bund move to the vicinity of -0.02%, area last visited in May 2019.

In the domestic calendar, the Investor Confidence tracked by the Sentix Index improved to 14.9 for the current month, while the Unemployment Rate in the euro bloc ticked a tad lower to 7.2% (from 7.3%) in November.

Across the pond, the only data release scheduled for Monday will be the Wholesale Inventories during November.

What to look for around EUR

EUR/USD remains in a consolidation mode since late November, with gains capped by the proximity of the 1.1400 mark and the lower end offering contention around 1.1220. In the meantime, the pair’s price action continues to track the performance of the greenback as well as the policy divergence between the ECB vs. the Federal Reserve and the response to the persistent elevated inflation on both sides of the Atlantic. On another front, the unabated progress of the coronavirus pandemic remains as the exclusive factor to look at when it comes to the economic growth prospects and investors’ morale.

Key events in the euro area this week: EMU Unemployment Rate, Sentix Index (Monday) - ECB C.Lagarde (Tuesday) - EMU Industrial Production (Wednesday) - Germany Full Year GDP Growth 2021, ECB C.Lagarde (Friday).

Eminent issues on the back boiler: Asymmetric economic recovery post-pandemic in the euro area. ECB stance/potential reaction to the persistent elevated inflation in the region. ECB tapering speculation/rate path. Presidential elections in France.

EUR/USD levels to watch

So far, spot is losing 0.26% at 1.1331 and faces the next up barrier at 11369 (55-day SMA) seconded by 1.1386 (monthly high November 30) and finally 1.1464 (weekly high Nov.15). On the other hand, a break below 1.1272 (weekly low Jan.4) would target 1.1221 (weekly low Dec.15) en route to 1.1186 (2021 low Nov.24).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.