- Analytics

- News and Tools

- Market News

- USD/TRY Price Analysis: Bears eye 12.00 as US dollar crumbles

USD/TRY Price Analysis: Bears eye 12.00 as US dollar crumbles

- USD/TRY bears move in as bulls take profits on weaker US dollar.

- Bears eye 12.00/20 territories on a break of the critical support structure.

A combination of Turkish politics and a weaker US dollar is sending USD/TRY lower as bulls begin to take profits in what has been a strong correction in a 50% mean reversion of the prior bearish impulse as follows:

USD/TRY weekly chart

-637776066746182412.png)

As illustrated, the price fell heavily and corrected in volatile price action owing to the unprecedented course of action by Turkish officials combatting the highest levels of inflation since 2002, (Turkey's consumer price inflation jumped to 36.08 per cent year-on-year in December 2021, up from 21.31 per cent in the previous month).

USD/TRY daily chart

-637776066992128223.png)

The daily chart shows that the price has attempted to base near 12.90 from where it moved in on the 50% reversion level. However, renewed US dollar weakness has enabled the bears to take back control this week.

USD/TRY H4 chart

-637776067274315009.png)

From a 4-hour perspective, the price is moving in on the 200-EMA. This would be expected to hold initial tests and the current resistance, old support, near the 21 EMA could see the bears moving in at a discount. This would force the price lower and potentially lead to a significant break of support and the 200 EMA.

USD/TRY H1 chart

-637776067526525011.png)

There is still room for the price to move lower according to the hourly chart. Nevertheless, the support is eyed and a meanwhile correction could evolve to test the various significant Fibonacci retracement levels along the way.

Turkish politics and a weaker US dollar

From a political front, the lira could find further stability as we approach planned elections scheduled for no later than mid-2023. The economic turmoil has already started to hit President Erdogan's opinion poll ratings as Erdogan's scheme to curb the lira's weakness has been seen to fail.

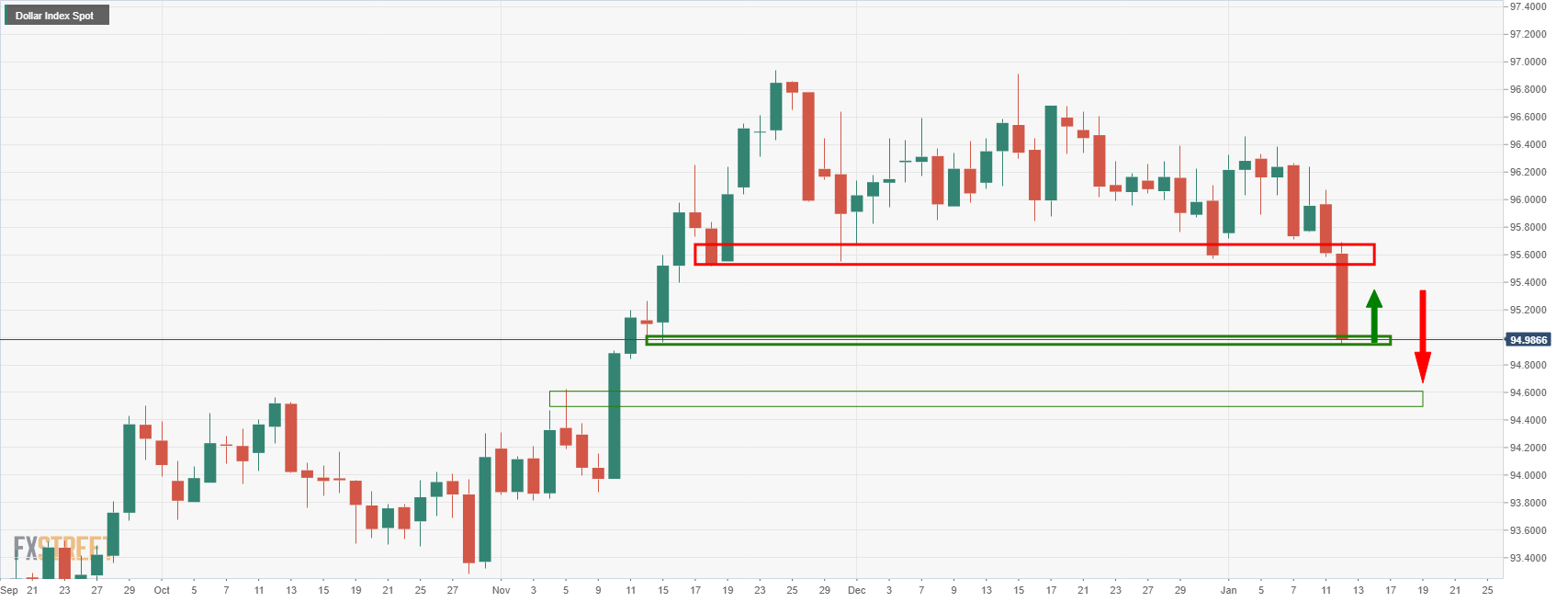

The US dollar is a major driving force of emerging market currency performances. As it stands, the greenback is an overcrowded trade that is starting to unwind given the Federal Reserve's hawkish sentiment is a fact that is now being sold off:

DXY daily chart

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.