- Analytics

- News and Tools

- Market News

- AUD/USD steady after China trade balance, holds around the base of sell-off

AUD/USD steady after China trade balance, holds around the base of sell-off

- AUD/USD bears remain in charge and target 0.72 the figure.

- Fed expectations continue to favour a strong US dollar.

AUD/USD has been stabilising in recent trade following a sell-off overnight into the lows of the Asian session near 0.7264. At the time of writing, AUD/USD is down some 0.12% around 0.7270 after sliding from 0.7283 on the session so far.

There has been little in the way of a catalyst out there on the economic calendar but China reported its trade balance in recent trade. A surplus of US$94.46bn was reported with exports +20.9% YoY and imports +19.5% YoY.

Meanwhile, the data failed to move the needle and instead, the US dollar is has been attempting to correct which has weighed on the Aussie. A slightly risk-off environment has also played its role with US equity markets softening overnight and reversing the recent upward trend.

The hawks continue to circle over the Federal Reserve and Lael Brainard said the Fed could raise rates as soon as asset purchases are terminated, which is due to occur in March.

We now look ahead to the Fed interest rate decision later this month, with New York Fed president, John Williams, the only speaker slated before the blackout period officials start this weekend. There could be some price action in the greenback centred around his comments that would potentially see the stock markets and the Aussie reacting in kind. US Retail Sales is also on the cards as a potential market mover.

AUD/USD technical analysis

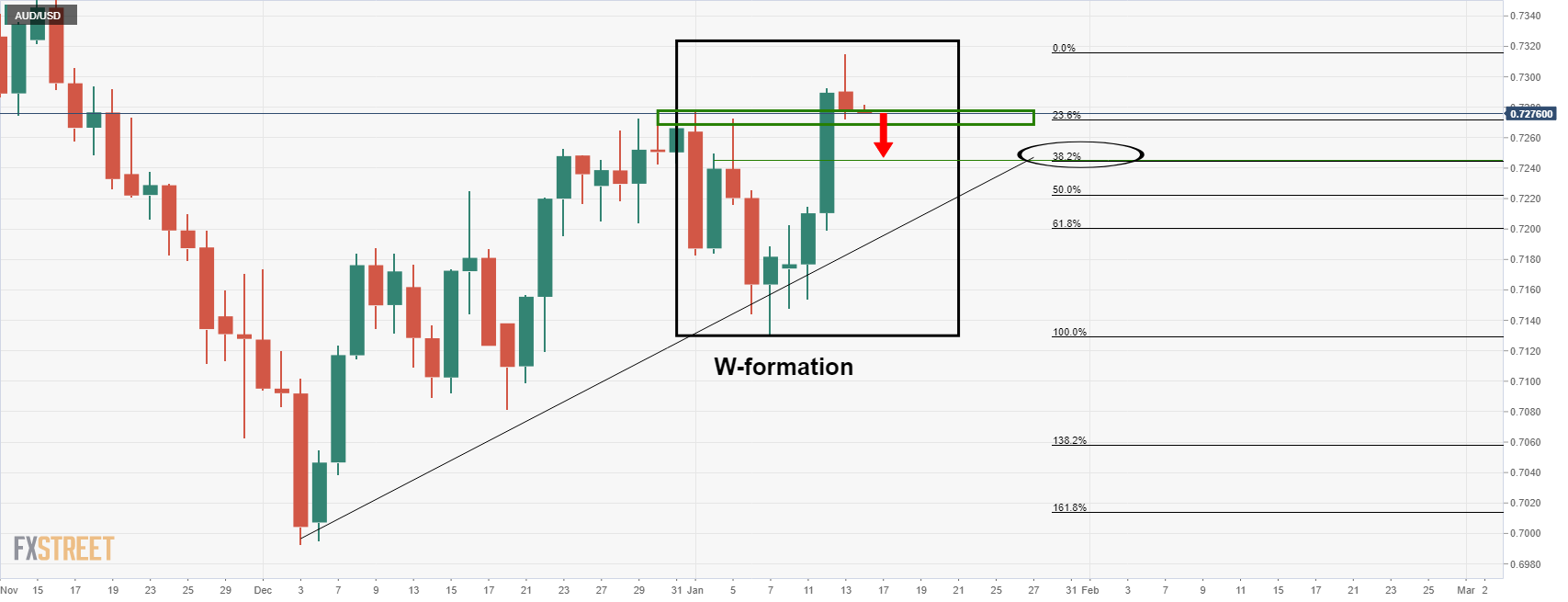

Meanwhile, from a technical outlook, the price action since the prior analysis has moved in on the old resistance and a break there opens risk to the 38.2% Fibonacci and the neckline of the W-formation near 0.7250:

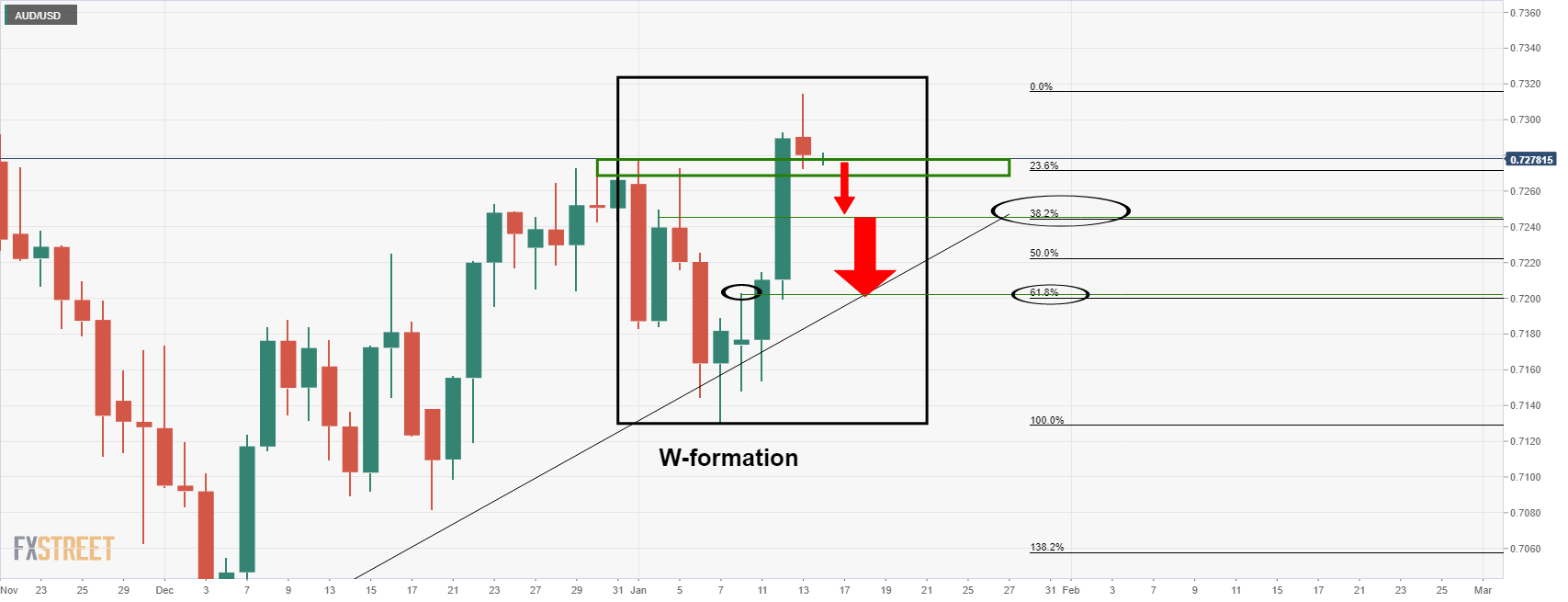

Below there, it can be argued that there is another W-formation, depending on the broker and close of the candle. However, it is a compelling level nonetheless as it meets the 0.72 figure and a confluence of the 61.8% Fibonacci level as follows:

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.