- Analytics

- News and Tools

- Market News

- NZD/USD bulls stepping in at daily support as full markets return

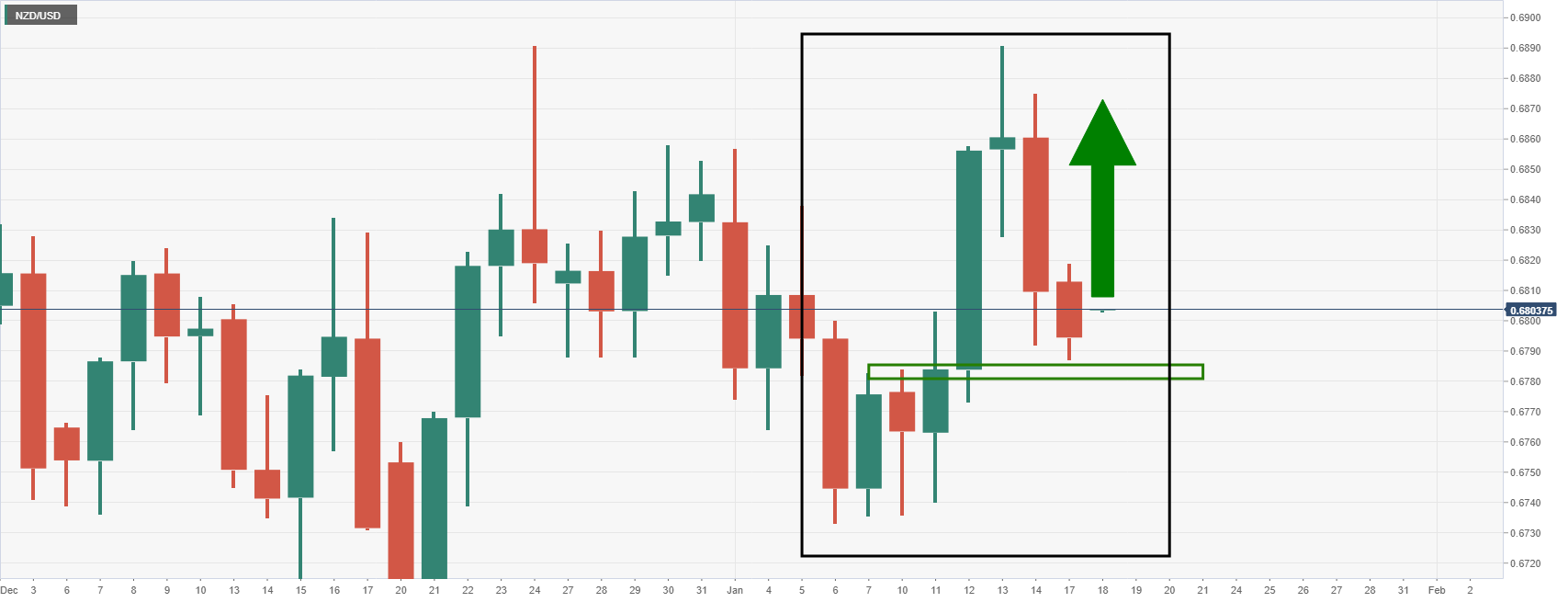

NZD/USD bulls stepping in at daily support as full markets return

- NZD/USD bears are being beaten back by bulls near the daily support.

- A pick up in price activity is underway as traders return to markets for Tuesday.

At 0.6804, NZD/USD is higher on Tuesday by 0.17% following a rally from a low of 0.6783 to a high of 0.6808. It is a relief for traders following a very quiet end to Monday's trade with the US on holiday for Martin Luther King Jr Day and no headline data releases in Europe.

''With 2022 well underway, the main sense we get is that it could be a bumpy ride as global central banks transition from easing to tightening, and as markets look for slower growth (or a decline in) liquidity as QT supplants QE,'' analysts at ANZ Bank said.

''Locally, Omicron remains a proximate threat (to activity and inflation), but going the other way, it’s not difficult to envisage inflation and jobs data surprising to the upside over coming quarters, and that could provide a leg of support. Plenty to think about.''

Meanwhile, traders continue to hold on to US dollars as per the latest positing data but there is a major segment of the market that expect that the Federal Reserve tightening plans are largely priced in. This is weighing on the greenback, while the euro eased from Friday’s two-month high. The US dollar index (DXY), which declined sharply last week until Friday's leap, is dripping pips by some 11% ton the day so far.

NZD/USD technical analysis

The bulls are moving in around daily support following a test at the neckline support of the W-formation. If this were to hold, the bulls will be looking to run the show back towards 0.6900. A break of support below 0.6780 will otherwise open prospects of a test to the daily lows near 0.6735.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.